🔬The S&P 500 Is A Lie!

Plus: The 'goldilocks' scenario in the labor market; Tesla gambles on robotaxi; and much more.

"A fool with a plan can outsmart a genius with no plan"

- T. Boone Pickens

"I’m just a surfer who rode the wave of interest rates down"

- Jeffrey Gundlach

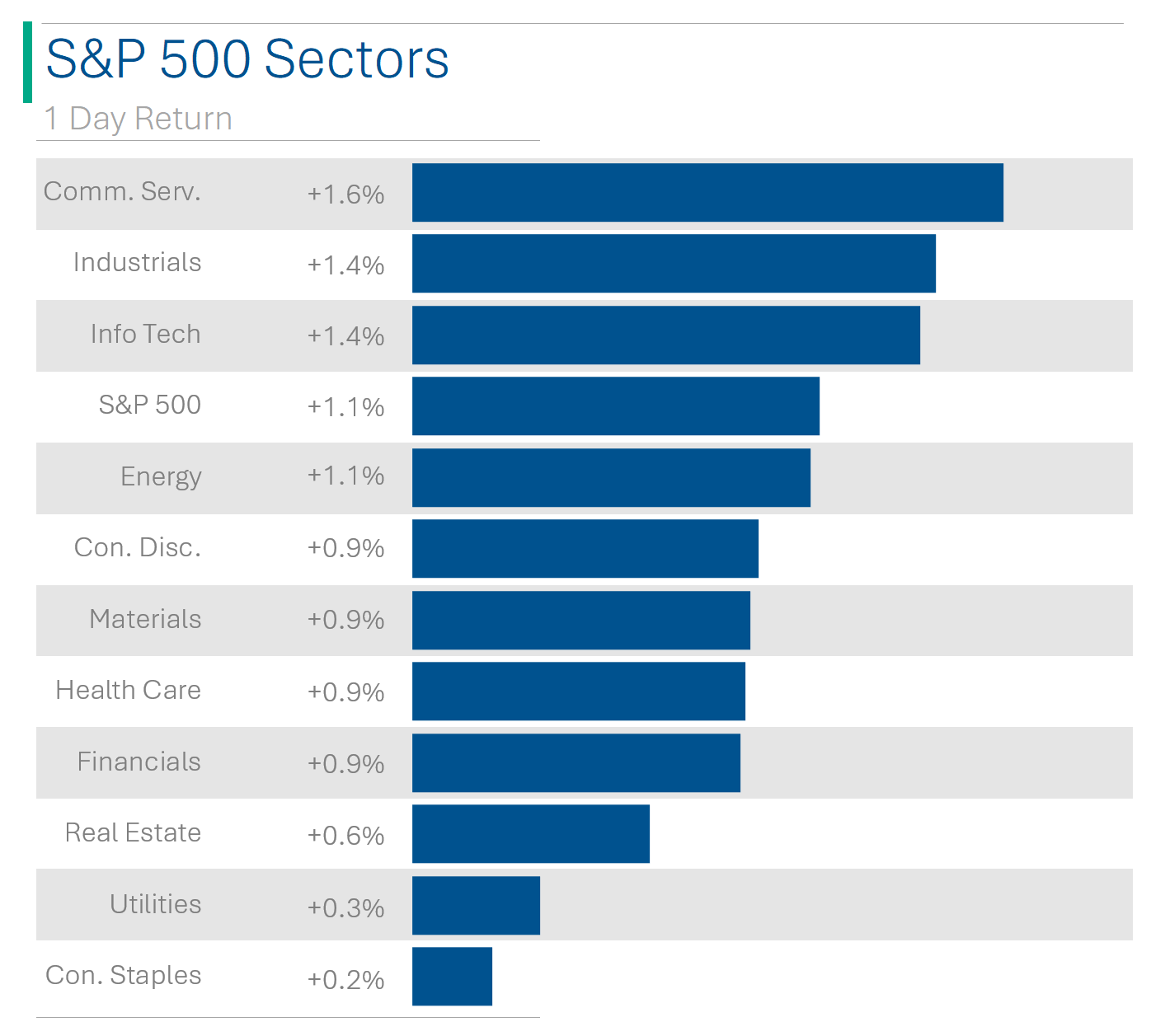

The big US markets had a strong Friday to end the week (S&P 500 +1.1%, Nasdaq +1.2%) but it wasn’t enough to turn the week around with the S&P 500 down 1.0% and Nasdaq -0.8%.

While all 11 sectors finished higher Friday, only two sectors were positive on the week, Energy (+3.9%) and Communication Services (+2.5%). The former driven by continued strength in the oil price.

The big story Friday was the strength of the labor market, as Non-Farm payrolls came in at +303k vs. Wall Street consensus estimate for 205k (more below).

South Carolina completes the perfect season by beating Iowa in the Women’s NCAA Basketball Final. Men’s final tonight (fun fact: Bill Murray’s son as Assistant Coach for UConn).

Street Stories

The S&P 500 Is A Lie

If you’ve been reading StreetSmarts for a while you’d know by now my ire for the Dow Jones (see ‘What is the Down (and why I hate it)’), as it’s just a subjective, non-expansive, price-weighted piece of garbage with little indicative value.

The S&P 500? That’s a real index! Diverse, Market Cap-weighted, and reflective of the top 500 or so companies in the US. Well… sorta. See the S&P 500 has it’s own problems. And while it’s the best, it is far from perfect.

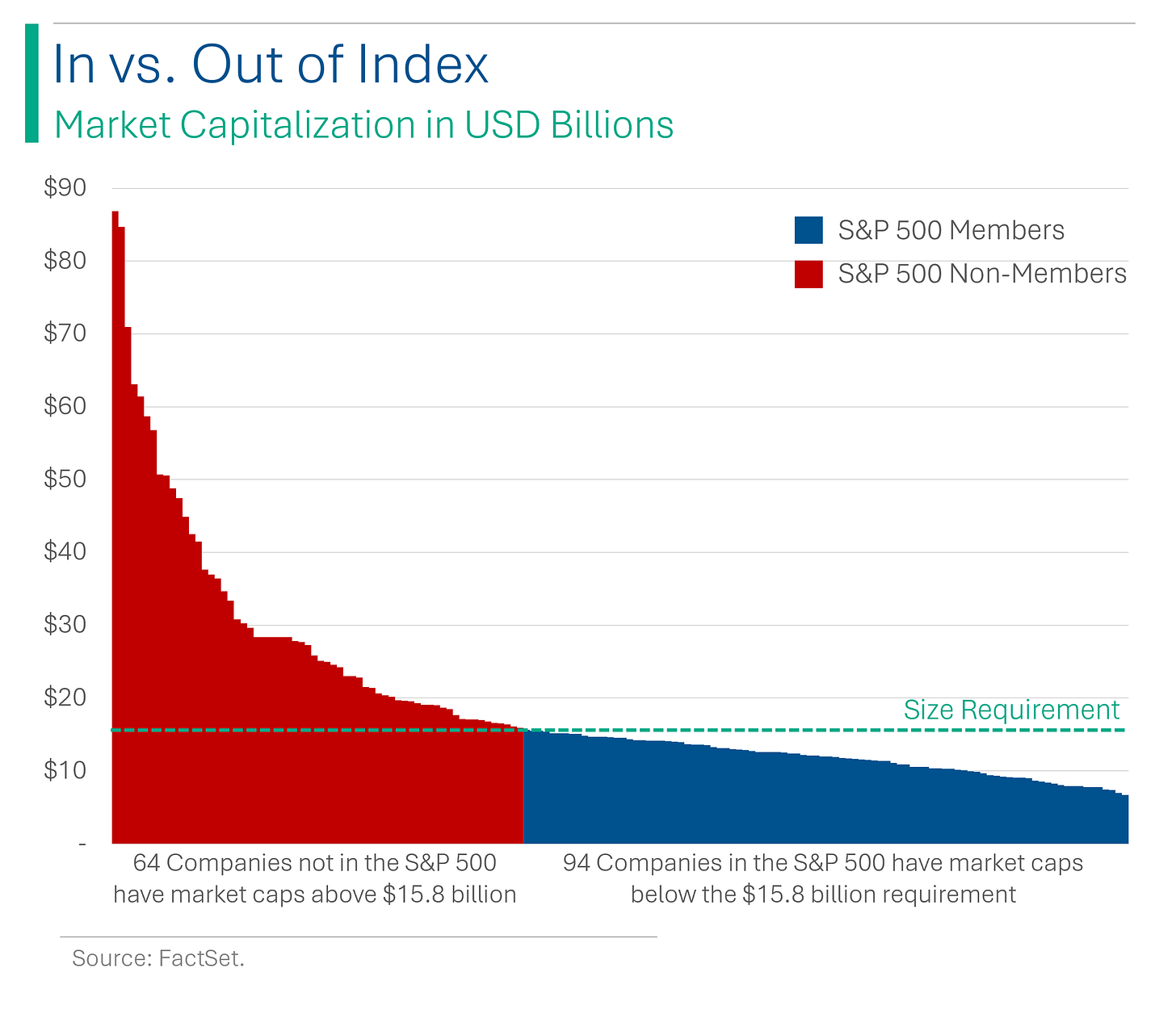

See, the common misconception is that the S&P 500 is ‘the largest 500 companies in the US’ - which is actually pretty far from the truth. Moreover, the selection criteria can be pretty subjective. For example, private equity giant KKR ($87 billion market cap) isn’t in the index but PE peer Blackstone ($90 billion) is for some reason. So much for the common belief about only the biggest companies make in on the S&P 500.

The S&P does have some requirements that need to be met for inclusion, with the big ones including:

The company needs to be US-based, although there are some exceptions to this rule (just ask NXP Semiconductors or TE Connectivity).

The shares must be highly liquid, and at least 50% be available for public trading. Also, the shares have to be common stock or from a Real Estate Investment Trust (REIT) - so no business development companies (BDCs), master limited partnerships (MLPs), and limited liability companies (LLCs) allowed!

The company must be profitable over its last quarter and net positive over the last 4 quarters. This can be a bit wishy-washy, for example when Moderna was added in summer 2021 it only had 2 straight profitable quarters, but because they were monsters from Covid vax sales they cancelled out the the others.

Lastly, as of the most recent rules, a company must have a market cap greater than $15.8 billion.

What’s interesting about the last point is that currently there are 94 companies (19% of the S&P 500) that have market caps below this threshold. Hell, Microstrategy, which I talked about last week, has a Bitcoin pile worth $15.4 billion - and they are nowhere near getting listed on the S&P 500. Essentially, it’s hard to get added to the S&P 500 but once you’re in, it’s pretty hard to get kicked out.

Non-Farm and Unemployment

March Non-Farm Payrolls data came out Friday, and looked incredibly strong: The 303k print was well ahead of Wall Street’s consensus estimate of 205k. February and January figures were also revised upward a total of 22k. Neato!

The unemployment rate also dipped from 3.9% to 3.8%, matching expectations from economists.

While not as talked about as the above two, something quite important was that hourly wage growth actually ticked down from 4.6% to 4.2% YoY. Wage growth is one of the biggest drivers of overall inflation and has been quite sticky as of late. A decline here supports the ‘Goldilocks’ scenario, whereby the labour market has remained strong but the potential economic drag from persistent inflation has shown an important sign of further cooling - hopefully helping support that elusive first interest rate cut from the Fed.

Elon’s ‘Robotaxi’ Gambit

Tesla shares have been on a terrible streak as of late, down around 31% since the start of the year, amid increasing investor concerns around competition and a period of slowing growth for the company. However, the shares got a bit of a lift Friday after market close, as CEO Elon Musk announced their Robotaxi product reveal for August 8, with shares rising over 3% after the announcement.

Despite previous ambitious claims about achieving full autonomy, Tesla has yet to deliver a robotaxi or level 3 autonomous vehicle, instead offering advanced driver assistance systems that still require human supervision. Competition in the autonomous vehicle space is fierce, with companies like Waymo and Didi operating commercial services, while others like Apple's self-driving unit (now scrapped) and GM's Cruise have faced setbacks. Good luck!

Joke Of The Day

One of the oddities of Wall Street is that it is the dealer and not the customer who is called broker.

Hot Headlines

Reuters / Investors in talks to help Elon Musk's xAI raise $3 billion. The deal would value the company at $18 billion, with reported potential backers including VC firm Gigafund and Steve Jurvetson. Musk currently runs 284 companies.

Reuters / Paramount could acquire Skydance in $5 billion all-stock deal. The merger would provide a valuable cash infusion to struggling Paramount. This deal keeps getting weirder - as Paramount reportedly prefers a deal with the independent studio over the reported $26 billion offer on the table from Apollo.

WSJ / With the S&P 500 up 9.1% this year, the upcoming earning season will determine if the ongoing rally breaks down. Put-up or shut-up time for growth.

Axios / Airbnb bookings illustrate the path of solar eclipse totality for today’s

The Verge / Apple opens the App Store to retro game emulators. Apple says those games must comply with “all applicable laws,” though - an indication it will ban apps that provide pirated titles. Can’t wait to play Brick Breaker on my iPhone and pretend it’s a Blackberry.

Yahoo Finance / Serena Williams’ VC Fund has invested in 14 companies that have gone on to reach unicorn status, a value of $1 billion or more. Damn, she’s even a better investor than me? 🙃

Trivia

Today’s trivia is on Tesla.

When was Tesla founded?

A) 1997

B) 1999

C) 2003

D) 2007Who were the founders of Tesla?

A) Elon Musk and JB Straubel

B) Martin Eberhard and Marc Tarpenning

C) Larry Page and Sergey Brin

D) Elon Musk and Larry EllisonTesla's first vehicle, the Roadster, was built on the chassis of which other car?

A) Chevrolet Corvette

B) Lotus Elise

C) Porsche Boxster

D) Ford MustangIn what year did Tesla acquire SolarCity?

A) 2014

B) 2015

C) 2016

D) 2017

(answers at bottom)

Market Movers

Winners!

Krispy Kreme (DNUT) [+7.3%] upgraded to overweight from neutral by Piper Sandler, due to a McDonald’s partnership and an improving narrative.

Kura Sushi USA (KRUS) [+6.0%] reported a FQ2 revenue beat with slightly light comp growth, possibly affected by weather; noted strong traffic growth and restaurant margins above consensus, raising FY revenue guidance again, with analysts optimistic about unit growth.

Cinemark Holdings (CNK) [+5.4%] upgraded to overweight from underweight by Wells Fargo, highlighting a promising movie release slate and recent box office success indicating strong consumer demand.

Western Digital (WDC) [+3.6%] upgraded to buy from neutral at Rosenblatt Securities, with strengthening NAND prices driven by increased demand and low inventories.

Losers!

Enphase Energy (ENPH) [-7.1%] downgraded to neutral from buy by Citi, due to weakening solar trends and slower US inventory reduction.

Altice USA (ATUS) [-5.1%] downgraded to underweight from equal weight by Wells Fargo Securities, with concerns the market is overestimating M&A potential.

Tesla (TSLA) [-3.6%] saw its shares fall after Reuters reported it is scrapping its low-cost EV plan due to strong competition in China, a claim Elon Musk denied on X.

Market Update

Trivia Answers

C) Tesla was founded in 2003.

B) Martin Eberhard and Marc Tarpenning founded Tesla. Yep, Elon didn’t join until 2004.

B) The Roadster was built on a Lotus Elise chassis.

C) Tesla acquired SolarCity in 2016.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

3/4 on the trivia and I don’t even like Tesla lmao