🔬 The S&P 500 Has Gotten Twice As Top Heavy Over The Last 10 Years.

Plus: I speak Investment Banker; Hedge Funds are too scared to short the Mag7; and much more.

"In the business world, the rearview mirror is always clearer than the windshield"

- Warren Buffett

"Money isn't everything but it sure keeps you in touch with your children"

- J. Paul Getty

After a huge Thursday following Nvidia’s earnings, the big US markets had a subdued end of the week with the S&P 500 +0.03% and Nasdaq -0.28%. The S&P was +1.7% for the week, while the Nasdaq was +1.4%.

7 of 11 sectors closed higher on Friday, led by the rebounding Utilities (+0.7%) and Materials (+0.6%) sectors. Energy was the worst, down -0.6%.

Crude oil closed down 2.7% on Friday, while Gold gained back a bit of its luster, +0.9%.

Retail punching bag Carvana popped +31% after reporting earnings with a strong outlook, despite missing Q4 revenue estimates. Intuitive Machines launched up 16% after its lunar lander safely landed on the moon.

Today is my birthday and a nice present would be if you could forward StreetSmarts to a friend. Or post it on your Facebook. Or get a tattoo on your belly with an arrow saying ‘beer goes here’ (unrelated but still cool).

Street Stories

The S&P Is Top Heavy. And Getting Heavier.

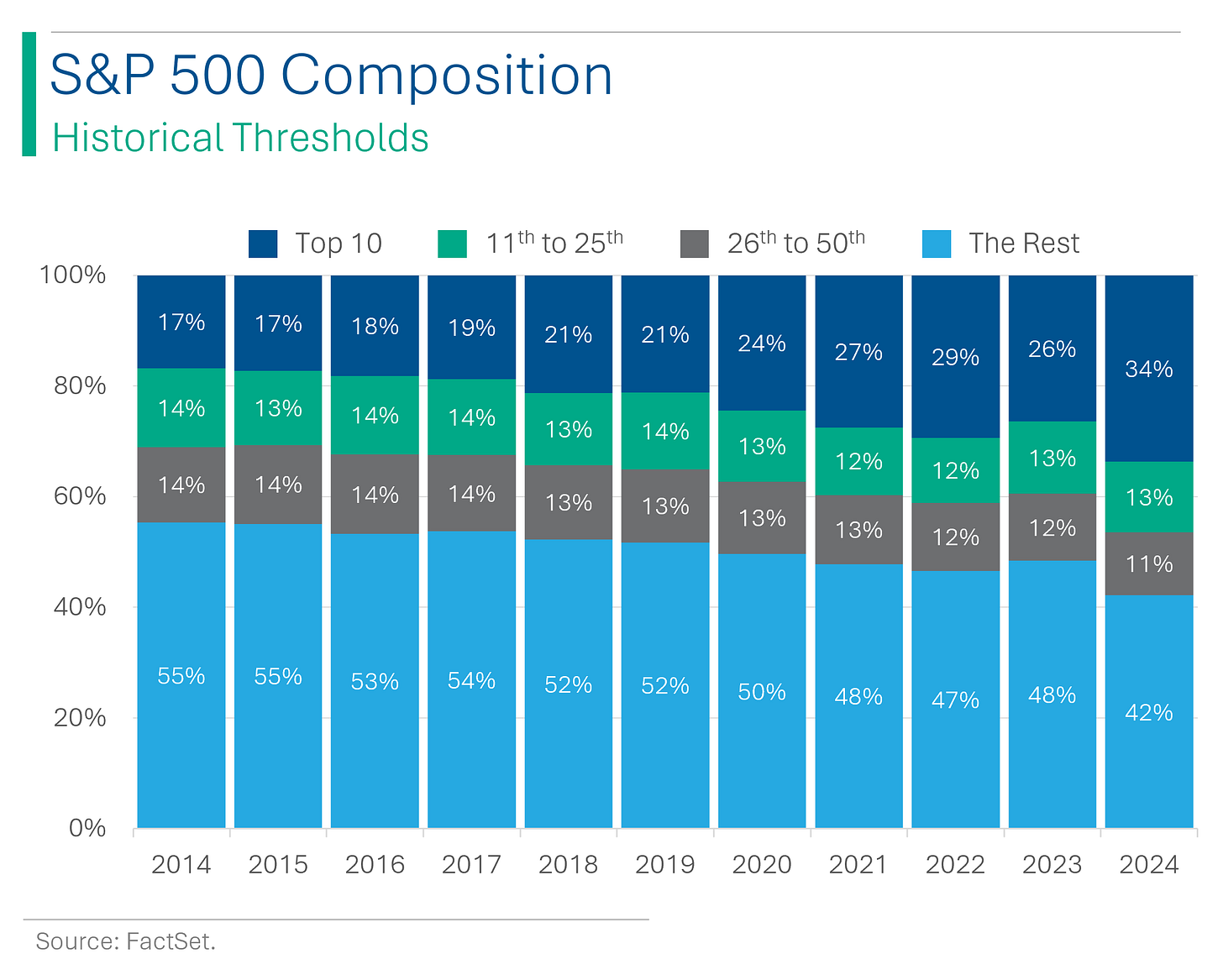

I’ve written in the past about how the S&P lives and dies based on how the big names perform. What I wanted to check out was just how that has changed over time. Turns out, a lot.

Going back just ten years, the biggest ten companies in the S&P 500 represented only 17% of the index. Now most of those names will be familiar; Apple was number one but also in there were Alphabet (still Google back then), Microsoft, Berkshire Hathaway, J&J, GE, and Walmart. There were also some unlikely ones - like how Exxon Mobil was #2, Wells Fargo #8 and Chevron #10. Today though, the top ten represents 34% of the index and only three of the companies from ten years ago are still there (Alphabet, Apple and Microsoft).

This growth in the top ten has come at the expense of the other groups, notably that ‘The Rest’ - the bottom 450 companies now represent 24% less.

Additionally, while all the groups have seen strong growth over the last decade, nothing can compare to the top ten, which went from $3.1 trillion in market capitalization to $15.2 trillion today. While the 40 companies that make up the 11th to 50th, only added $5.9 trillion. It seems the biggest have also been the best.

Hedge Funds Are Chicken

So a thing that often happens to stocks that massively outperform the market is that interest on the short side increases. Short-sellers (typically hedge funds) start making bets that the shares will go down, which can often lead to a self-fulfilling prophecy as the act of building a short position (selling shares you’ve borrowed) moves the price downward. So given the fact that the Magnificent 7 is up on average 546% over the last five years, you might expect that they would have seen a material increase in the number of shares sold short. But you’d be wrong.

As you can see below, the total short interest in the Mag7 has generally decreased over time, with only Microsoft (41 million shares sold short to 50 million) and Meta (20 million to 28 million) really the only ones seeing a relative increase. Moreover, short positions at Apple, Tesla and Nvidia have seen their short interest cut down by more than half. It’s been smart on the part of the hedgies to not get in front of this generational rise in the M7. Or maybe they’re just wimps. Either way, don’t stand on the tracks when the trains are coming through.

Investment Banker IPO Lingo

After writing about the Reddit IPO on Friday, I thought I’d take a minute to explain part of the IPO process from the investment banker perspective. Banks would have been wooing Reddit for years in the hopes of getting in on the action when they IPO. In this case, Morgan Stanley was selected as the top banker: Called a Syndicate Leader or Lead Bookrunner, on the Street they are just referred to as the ‘Lead Left’. That means that they are in control of running the process and have to do all the nitty gritty work with Reddit throughout the process, such as the IPO roadshow, SEC filings, babysitting the other banks, etc. They get the highest fee and the most prestige, but do a lot of work. The junior bankers on this team won’t be sleeping much over the next month.

The other book runners (‘active right's’) can chip in with some of stuff but this is generally a pretty chill job. Mostly they help ‘build the book’, meaning soliciting bids from their clients for how much stock they would want at what price. The structure is similar for things like M&A deals, but there the bank often has to put up risk capital (sell bonds, offer loans, etc.) so they actually earn their money.

The other underwriters are sorta just filler. They may have an allocation to the build part of the book but basically this is a job for their bank’s equity capital markets team and the real investment bankers don’t do much here. Basically free money.

Now, when banks ‘pitch’ for business they tout their credentials, and the roles they’ve played in prominent deals get factored into industry ‘league tables’ that rank a bank’s exposure to top transactions across industries and geographies. Any kid who did an internship in IB will recall with pain perpetually updating the ‘creds’ or ‘tombstone’ page of pitch decks that highlight important deals and rankings.

Because of the perceived importance, banks are EXTREMELY touchy about their placement in this pecking order: Higher and left is best. That’s why even amongst the spare underwriters, Citi (half decent bank) is top left, and whoever the f*** ‘Telsey Advisory Group’ is is bottom right.

Why I decided to bring this up are those tiny little asterisks beside Goldman Sachs and J.P. Morgan. Yes, in the pecking order JP is at the same ‘level’ as Goldman but just so no human ever assumes otherwise, JP made Morgan Stanley put it in writing. And no, I don’t miss banking.

*This was much longer than I expected and I apologize.

Nice post by Business Invest about why the Shiller PE ratio (also called Cyclically Adjusted Price-to-Earnings Ratio (CAPE)) and Warren Buffett’s favourite Stock Market/GDP Ratio are junk.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

I’ve started a business making boats in my attic. Sails are going through the roof.

Hot Headlines

Bloomberg | Japan to give extra $4.86 billion to expand TSMC Kumamoto Plant. This comes in addition to the $3.2 billion they’ve already pledged. Desperate much?

CNN | The hollowing out of Vice and BuzzFeed marks the end of the digital media revolution. Vice was great but BuzzFeed didn’t exactly push our collective consciousness forward.

Hollywood Reporter | OpenAI’s Sam Altman revealed as one of reddit’s biggest shareholders. Artificial intelligence meets natural stupidity.

WIRED | Tech job interviews are out of control. The power dynamic has shifted massively amidst industry layoffs, with firms now making outrageous demands, like building whole apps over the weekend as part of first round interviews.

ARS Technia | Darwin Online has virtually reassembled the famed naturalist’s personal library. The 18 year project released its complete 300-page online catalog—consisting of 7,400 titles across 13,000 volumes, with links to electronic copies of the works—to mark Darwin's 215th birthday on February 12. Oh, and 80% of it is porn. jk

Trivia

This week’s trivia is on early corporations. Today and tomorrow’s is on the Dutch East India Company (VOC) - the world’s first joint-stock company.

What year was the Dutch East India Company founded?

A) 1558

B) 1701

C) 1675

D) 1602

What was a major reason for the VOC's formation?

A) To explore uncharted territories

B) To carry out colonial activities and trade in the Indian Ocean

C) To compete in the spice trade with Britain

D) To promote Dutch culture globally

Around its peak, the VOC has around 150 merchant ships, 40 warships, 50k employees and its own army of around how many people?

A) 2,000

B) 5,000

C) 10,000

D) 30,000

(answers at bottom)

Market Movers

Winners!

Carvana (CVNA) [+31.4%]: Q4 revenue was below expectations, but EBITDA surpassed forecasts. The outlook is positive due to improved Q1 EBITDA guidance, better unit economics, and successful execution of its turnaround plan. The stock's rise was amplified by a high short interest.

Block, Inc. (SQ) [+16.1%]: Surpassed Q4 EBITDA and revenue forecasts with notable performance in CashApp revenues and Transaction margins. Guidance for Q1 and the full year exceeds analyst expectations, leading to multiple upgrades. The focus on profitability and CashApp and Square's growth is well-received.

Intuitive Machines (LUNR) [+15.8%]: Achieved a successful landing near the moon's south pole with its Odysseus vehicle. Analysts are optimistic about the technical achievement and the potential for high-margin space services revenue.

Nextdoor Holdings (KIND) [+15.7%]: Co-founder Nirav Tolia returns as CEO, with preliminary Q4 revenue exceeding forecasts and an additional $150M for share repurchases.

LegalZoom.com (LZ) [+14.3%]: Outperformed Q4 EPS and revenue expectations, with Q1 guidance on target. Subscription retention exceeded forecasts, offering better revenue visibility and sales and marketing efficiencies. Highlights include performance in LZ Books and LZ Tax.

Rocket Cos. (RKT) [+5.2%]: Q4 revenue and EPS beat expectations, with lower than anticipated expenses. Q1 revenue guidance is positive, with management optimistic about market share gains and margin stabilization.

Losers!

Fox Factory Holding (FOXF) [-26.8%]: Q4 EPS fell short, though revenue exceeded forecasts. Q1 and FY24 EPS and revenue guidance were significantly below expectations, with challenges in the OEM segment and impacts from UAW strikes despite a strong aftermarket.

Vicor (VICR) [-23.8%]: Missed Q4 earnings and revenue, with a 13% q/q drop in Advanced Products. Backlog declined 47.2% y/y and 8% q/q without forward guidance, raising concerns over the near-term outlook.

MercadoLibre (MELI) [-10.4%]: Q4 revenue and GMV/TPV surpassed expectations, but margins were below consensus due to cost pressures, potentially reversing in Q1. Analysts view the business and fintech initiatives positively despite the noisy report.

Booking Holdings (BKNG) [-10.1%]: Exceeded Q4 expectations, though the upside did not meet some forecasts. The outlook suggests a 10pp deceleration in GBV growth and EBITDA 4% below midpoint, with concerns over online travel trends normalization.

Warner Bros. Discovery (WBD) [-9.9%]: Q4 EBITDA and revenue missed, with Studios as the major revenue drag. DTC subscriber growth exceeded expectations, though ARPU was low. Analysts are wary of ad weakness and FCF strength reliant on reduced content investment.

Penumbra (PEN) [-9.3%]: Q4 earnings outperformed, but revenue fell short. Record thrombectomy results were noted, yet Neuro was underwhelming. FY revenue guidance below expectations led to a downgrade by JP Morgan over valuation concerns.

Universal Display (OLED) [-8.1%]: Q4 EPS exceeded expectations, but revenue did not meet forecasts. FY24 revenue guidance also missed, with operational expenses up and margin pressure due to volume pricing dynamics and material complexity as the industry expands.

Insulet (PODD) [-6.6%]: Surpassed Q4 earnings, revenue, and margins, highlighting strong Omnipod growth. However, Q1 and FY revenue growth guidance fell short, attributed to strong Q4 orders from pharmacy wholesalers, yet the long-term outlook remains positive.

Market Update

Trivia Answers

D) The company was founded in 1602.

B) The company was created to carry out colonial activities and trade in the Indian Ocean. Monopoly and subjugation were just ancillary perks I guess.

C) They had an army of about 10,000. Roughly 300x that of the current Canadian armed forces.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.