🔬 The S&P 500 Club: Fame & The Walk of Shame

Plus: Chinese inflation walks the plank; and much more!

“Success is 99 percent failure.”

- Soichiro Honda

"I'm in a glass case of emotion."

- Ron Burgundy

US equities bounced back on Monday after last week's tech and semiconductor selloff, with outperformance in sectors like semiconductors, airlines, banks, and copper, while underperformers included department stores, China tech, and media.

Treasury yields saw mixed movements with the 2-year yield hitting its lowest since September 2022, while market focus remains on the upcoming September 18th FOMC meeting, where the debate over a 25 vs. 50 basis point rate cut remains unsettled.

Economic data included a 1.2% increase in the August Manheim used car index and steady inflation expectations according to the NY Fed, while China’s weaker-than-expected inflation and deflation data continued to stir growth concerns.

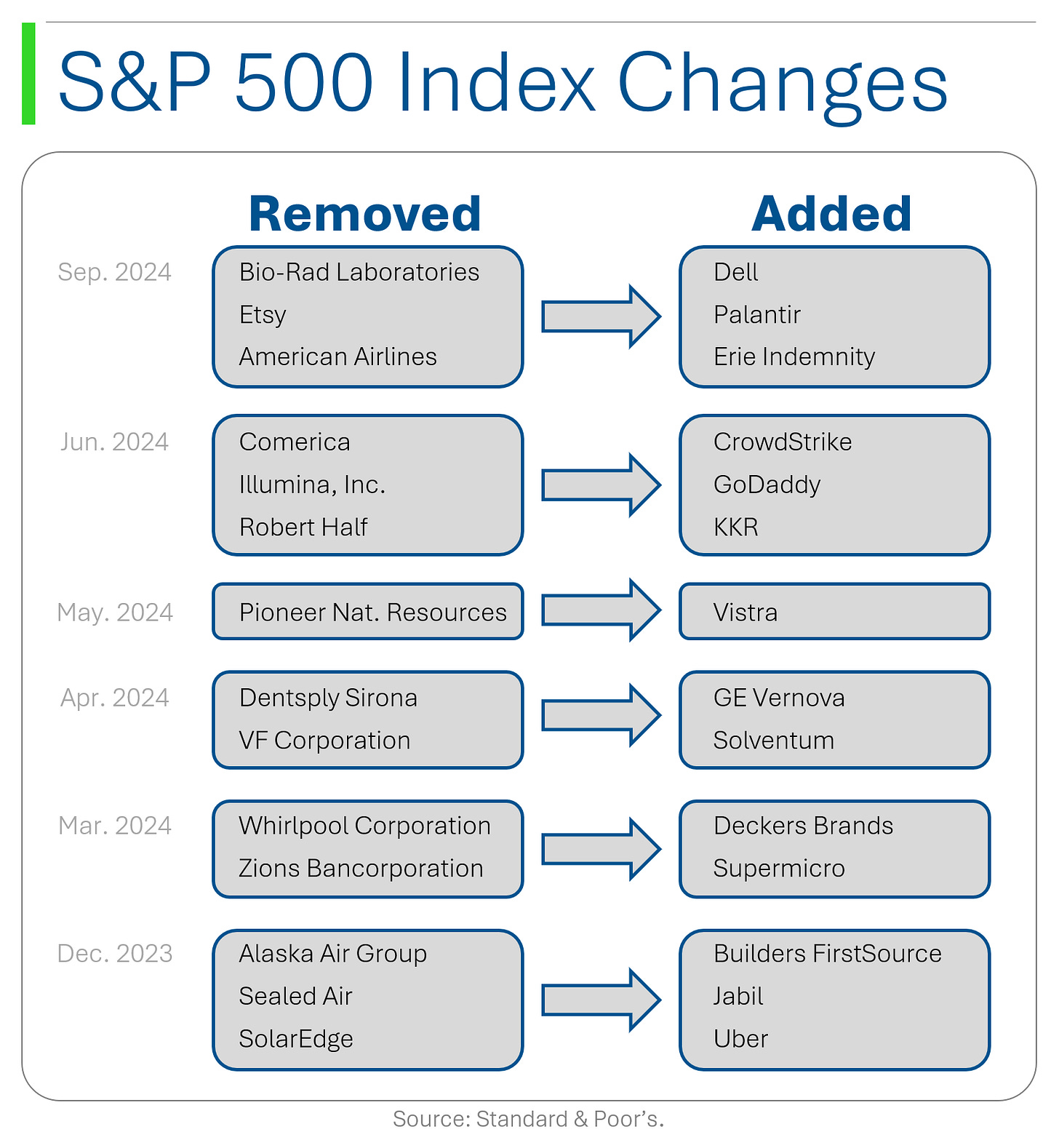

Notable company developments include Apple’s iPhone event showcasing new features and chip upgrades, Tesla’s strong China sales, Boeing’s labor deal, and Dell, Palantir, and Erie joining the S&P 500 on September 23rd.

Notable companies:

Boeing (BA) [+3.4%]: Boeing reached a deal with over 32,000 union workers, including a 25% pay raise and plans for a new airplane in Seattle.

Tesla (TSLA) [+2.6%]: Tesla hit its best China sales month of 2024 in August, with over 86,000 units sold.

JetBlue Airways (JBLU) [+7.2%]: Bank of America upgraded JetBlue after seeing fuel prices drop and steady travel demand.

Street Stories

The S&P 500 Club: Fame & The Walk of Shame

Palantir, Dell and something called ‘Erie Indemnity’ were announced as new additions to the S&P 500 on Monday, taking effect on September 23rd.

Sometimes new adds take the place of companies that no longer trade, such as Lululemon replacing Activision Blizzard after the latter’s acquisition by Microsoft. More often, however, it’s because a company decided to start being lame and lost their hood pass.

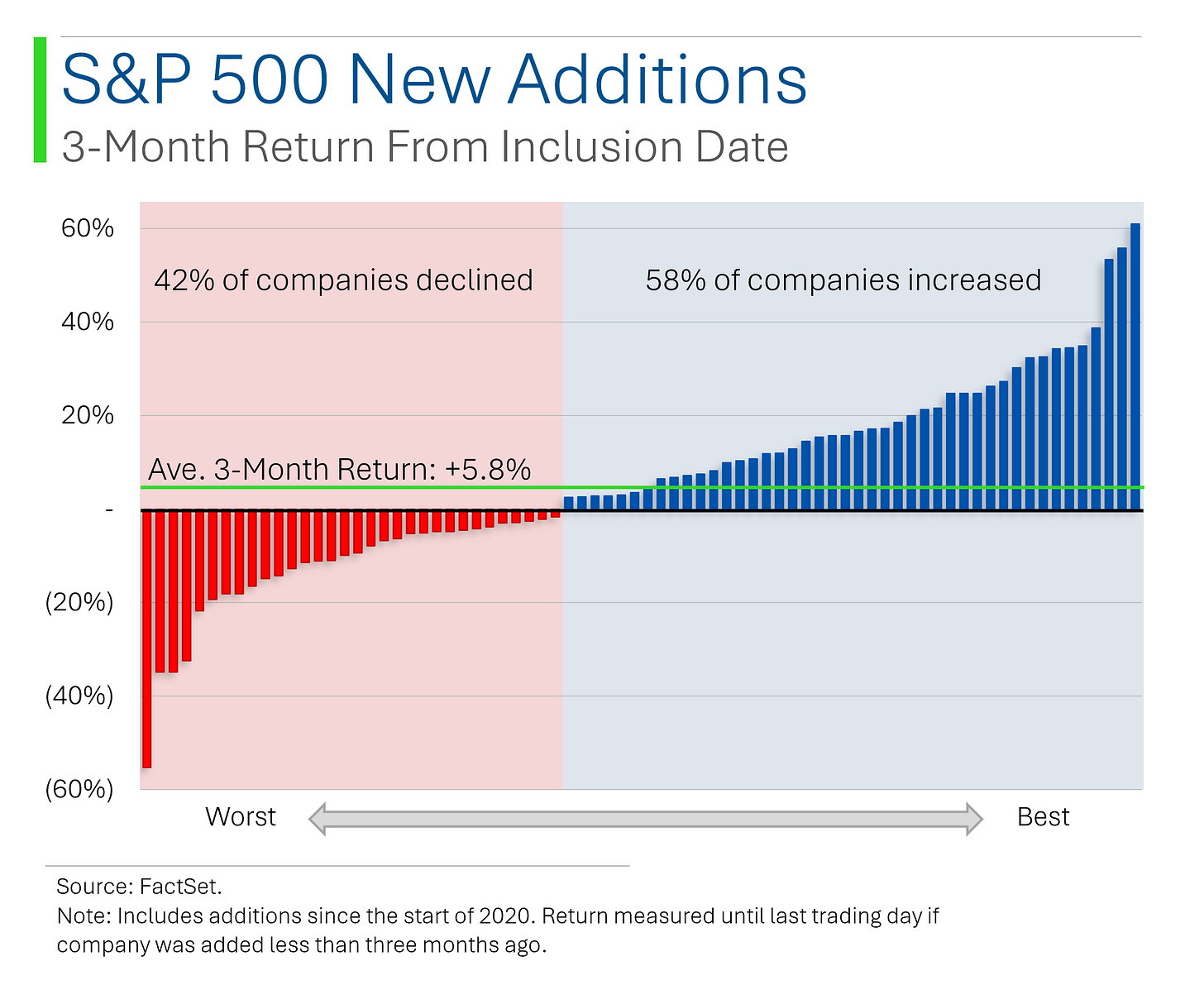

Making it into the S&P means that a company has shown strong growth for many years - and there’s even a pretty limp requirement for earnings. This momentum translates modestly into the performance of companies once they make the cut.

As you can see below, companies that were added to the S&P since 2020 posted an average gain of +5.8% in the first three months of being listed in the index. That’s actually pretty huge.

Moreover, in their first three months in the index, 68% of companies outperform the S&P 500. Not impressed?

Well the average new company beats the S&P 500 by 11.5% in those three months. Ya. Damnnn.

So we’ve established that it’s good to be a winner and make the cut, but what happens to the poor sods that fall from grace?

Well, it’s not too pretty: There’s the expected bankruptcies and the few ‘success stories’ (Kohl’s, Coty, Arconic) mostly have to do with to the companies going from insolvent to mostly insolvent.

You don’t want to be one of them. Or do you?

Ya see, weirdly 59% of companies that were dropped from the S&P 500 since 2020 actually went on to outperform the index, with the average company posting +6.2% relative outperformance.

Yes, correct: It’s better to be added to or dropped from the S&P than it is to just hang-out in the index.

Now there’s actually some decent logic to why a company can outperform in the period following their deletion. Investors are given a heads-up about companies being removed from the the index and there is often a bit of a fire sale ahead of the de-indexing event.

Some of this is investor preference; some is fund managers wanting stuff off their books to avoid nagging questions by LPs or advisors; and some is actually structural, such as funds with mandates that only allow the manager to hold securities on certain indices.

And not to mention all the voodoo that happens at those mega S&P 500 ETFs like the SPY, VOO or IVV.

Anywhoo, the companies getting added this time are much bigger than the ones they are replacing, holding a combined market cap of $164 billion at close before the announcement. That compares to the $22 billion of combined market cap of the companies they are replacing!

And as you can see below, Dell and Palantir took the scenic route to get here.

And interestingly, of the three companies being removed, two had only been included since 2020.

*cough* Pandemic stocks! *cough*

To wrap this up, companies getting added to the index have done well and so have companies that get dropped. I’d consider buying the latter but I worry that would make me a Value Investor. Eww.

China’s CPI and PPI: The Prices are Right... for Trouble

China’s consumer inflation rose in August, but mostly thanks to extreme weather driving up food prices rather than any real recovery in domestic demand. Despite the CPI uptick, producer price deflation worsened, leaving the economy stuck in a rut with falling car sales, housing struggles, and a job market that needs a pep talk.

The government's $41 billion plan to boost confidence through equipment upgrades and consumer trade-ins hasn’t exactly sparked joy. In short, while nature’s wreaking havoc on food prices, China’s economy is still waiting for a real comeback, but fiscal spending might just make things messier.

Joke Of The Day

A wife calls her husband and said "be careful driving home, some complete moron is driving down the wrong side of the motorway."

The husband replies "there's not just one, there's bloody hundreds of them!"

Hot Headlines

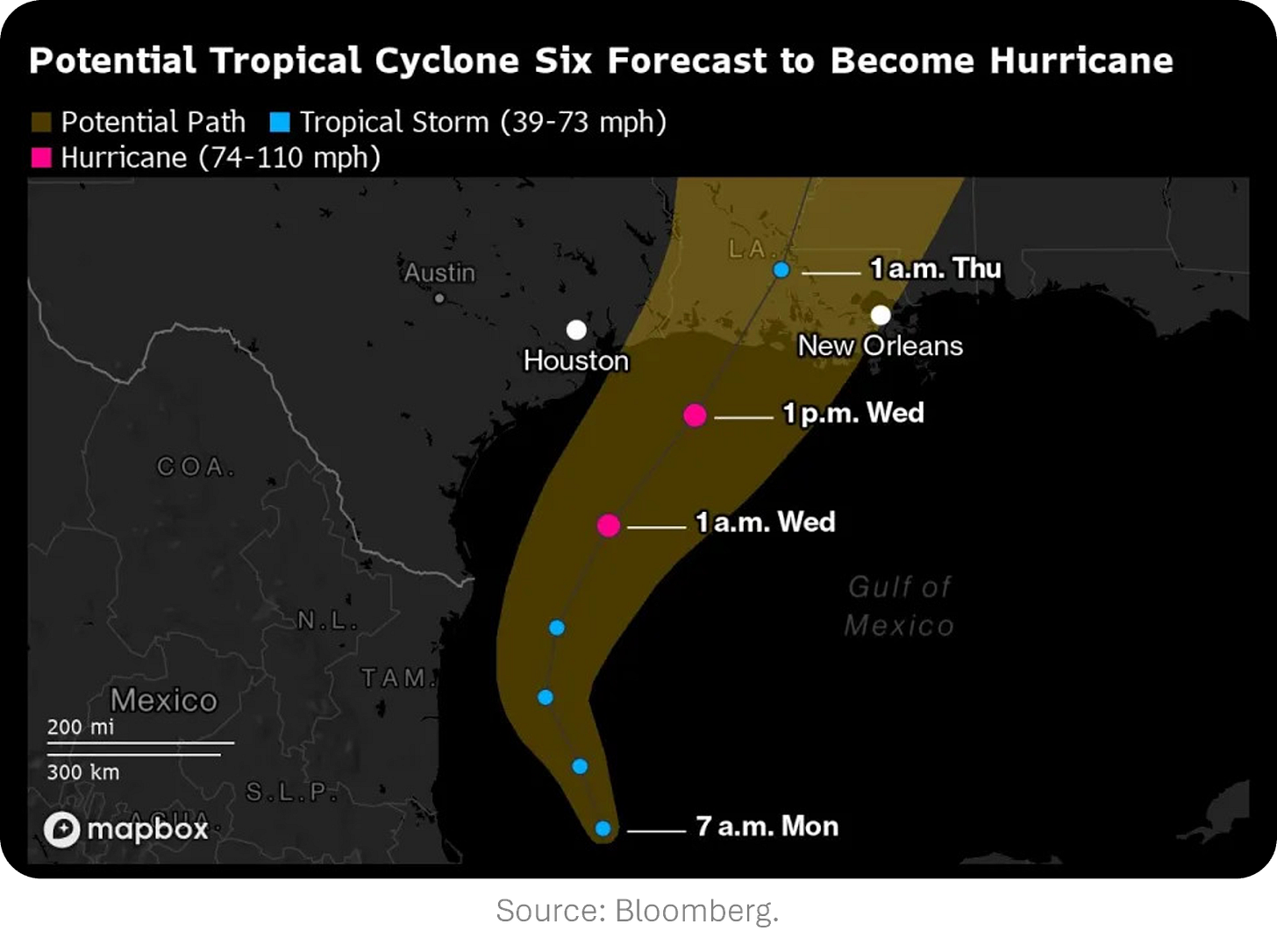

Yahoo Finance / Tropical storm Francine strengthens, spurring oil shutdowns. With 60 mph winds, oil giants like Chevron, ExxonMobil, and Shell have evacuated crews and shut down offshore production. The storm’s projected path intersects fields producing 125jk barrels of crude and 300 million cubic feet of natural gas daily. While damage to overall output is expected to be minimal, Francine could hit the Gulf Coast as a Category 1 hurricane by Wednesday, bringing storm surges up to 10 feet.

Yahoo Finance / Americans lost $5.6 billion last year in cryptocurrency fraud scams according to FBI. This represented a staggering 45% increase from 2022, with the majority of the losses ($3.96 billion) coming from investment fraud…particularly through dating apps.

Bloomberg / Couche-Tard pushes for Seven & I deal talks after rejection. Well folks, it looks like Couche-Tard is going to have to offer a higher number than the $40B on the table previously. This would create a global giant with 100k stores and mark the biggest foreign takeover in Japan’s history.

CNBC / Judge blocks Biden’s new student loan forgiveness plan before it rolls out. Millions of borrowers thought student loan relief was just around the corner until this roadblock and now, with the courts tied up (again), student debt relief is now in limbo until at least mid-September.

CNBC / Here’s everything Apple just announced: iPhone 16, iPhone 16 Pro, Apple Watch Series 10, AirPods 4 and more. The tech giant also revealed new Apple Intelligence features and a faster A18 chip, with pre orders starting Friday and sales launching on Sept. 20. But does it really matter? You’ll buy it anyway.

Trivia

Today's Trivia Is On Financial Disasters!

In 1998, which major hedge fund's collapse nearly triggered a global financial meltdown, leading to a Federal Reserve-organized bailout?

A) Bridgewater Associates

B) Long-Term Capital Management (LTCM)

C) Renaissance Technologies

D) Tiger Global ManagementWhich 17th-century economic bubble involved the collapse of prices for a highly speculative asset, resulting in one of the first recorded financial bubbles?

A) Tulip Mania

B) South Sea Bubble

C) Mississippi Bubble

D) Dot-Com BubbleIn 2001, which major U.S. corporation’s bankruptcy became one of the largest in history, driven by accounting fraud and the failure of Arthur Andersen?

A) WorldCom

B) Enron

C) Tyco International

D) AIGWhat event in 1929 triggered the Great Depression, causing widespread economic devastation worldwide?

A) The Treaty of Versailles

B) The Stock Market Crash of 1929

C) The Panic of 1907

D) The 1930s Dust Bowl

(answers at bottom)

Market Movers

Winners!

Summit Therapeutics (SMMT) [+56%]: Ivonescimab monotherapy showed it cuts disease progression or death risk by 49% versus pembrolizumab for patients with PD-L1.

Palantir Technologies (PLTR) [+14.1%]: Palantir is getting added to the S&P 500 on September 23rd.

JetBlue Airways (JBLU) [+7.2%]: Bank of America upgraded JetBlue after seeing fuel prices drop and steady travel demand.

Arm Holdings (ARM) [+7.0%]: Apple is using Arm's new V9 chip tech, which comes with double the royalties of its previous version.

United States Steel (X) [+5.0%]: JP Morgan upgraded U.S. Steel thanks to lower spending and a good opportunity ahead of the Nippon deal.

Parsons (PSN) [+4.5%]: Parsons is getting added to the S&P MidCap 400, effective September 23rd.

Dell Technologies (DELL) [+3.8%]: Dell is getting added to the S&P 500 on September 23rd.

Western Alliance Bancorp (WAL) [+3.6%]: Western Alliance is getting added to the S&P MidCap 400 on September 23rd.

Boeing (BA) [+3.4%]: Boeing reached a deal with over 32k union workers, including a 25% pay raise and plans for a new airplane in Seattle.

Tesla (TSLA) [+2.6%]: Tesla hit its best China sales month of 2024 in August, with over 86,000 units sold.

Squarespace (SQSP) [+2%]: Permira raised its buyout offer for Squarespace to $46.50 per share, though a key investor opposes the deal.

Losers!

Methanex (MEOH) [-7.9%]: Methanex agreed to buy OCI’s methanol unit for $2.05 billion, with the deal closing in the first half of 2025.

Merck (MRK) [-2.1%]: Merck took a hit after Summit Therapeutics announced that its ivonescimab monotherapy beat out Merck’s pembrolizumab for reducing disease progression in PD-L1 patients.

Market Update

Trivia Answers

B) Long-Term Capital Management (LTCM) collapsed in 1998, nearly triggering a global financial crisis.

A) The financial disaster known as Tulip Mania involved the collapse of tulip prices in the 17th century.

B) Enron’s bankruptcy in 2001 was due to accounting fraud, marking one of the largest corporate scandals in history.

B) The Stock Market Crash of 1929 triggered the Great Depression, leading to a decade of economic hardship globally.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

New ETF comprised of companies dropped from indices:

https://www.etf.com/sections/news/arnotts-debut-etf-bets-index-rejects

You need to highlight the weird Alex Karp video about the Palantir addition. https://x.com/amitisinvesting/status/1833301593283780837