🔬The Rise of Temu: eCommerce Revolution or Marketing Mirage?

Plus: Russia's land grab in Ukraine is dangerous; and much more!

"A business that makes nothing but money is a poor business."

- Henry Ford

“If each day is a gift, then I'd like to know where I can return Mondays."

- John Wagner

Market Performance: US equities rose, with the S&P 500 and Nasdaq extending their four-day rally, driven by AI optimism and tech outperformance. Small-caps, energy equipment, and homebuilders also saw gains, while semiconductors, regional banks, and cosmetics lagged behind.

Economic Outlook: The market is pricing in rate cuts, with growing expectations for a 50 bp reduction amid soft landing optimism, supported by falling energy and food prices, rising corporate profits, and lower mortgage rates. Despite hotter-than-expected core PPI, revised data and moderate jobless claims helped ease concerns.

Company Stuff: Mastercard acquired Recorded Future for $2.65B, while McDonald's extended its $5 value meal promotion. Several companies like Alaska Air and Signet Jewelers raised their outlooks, while others like Caleres cut guidance due to weaker-than-expected performance.

Notable companies:

Warner Bros. Discovery (WBD) [+10.4%] announced an early renewal of its multi-year distribution deal with Charter Communications, though financial details were kept private.

23andMe (ME) [+6.9%] CEO Anne Wojcicki signaled she’s open to acquisition offers and had already proposed taking the company private at $0.40 a share.

Moderna (MRNA) [-12.4%] slashed its 2025 revenue forecast, increased 2024 R&D spending, and faced analyst concerns about the likelihood of a future equity issuance.

More below in ‘Market Movers’.

Street Stories

The Rise of Temu: E-Commerce Revolution or Marketing Mirage?

If you’re like me, your web browsers and social media have been flooded with Temu ads for months now. The company is seemingly everywhere, offering everything from clothing to car parts. But is this the eCommerce company of the future or a Made in China gimmick that will fizzle out as fast as it started?

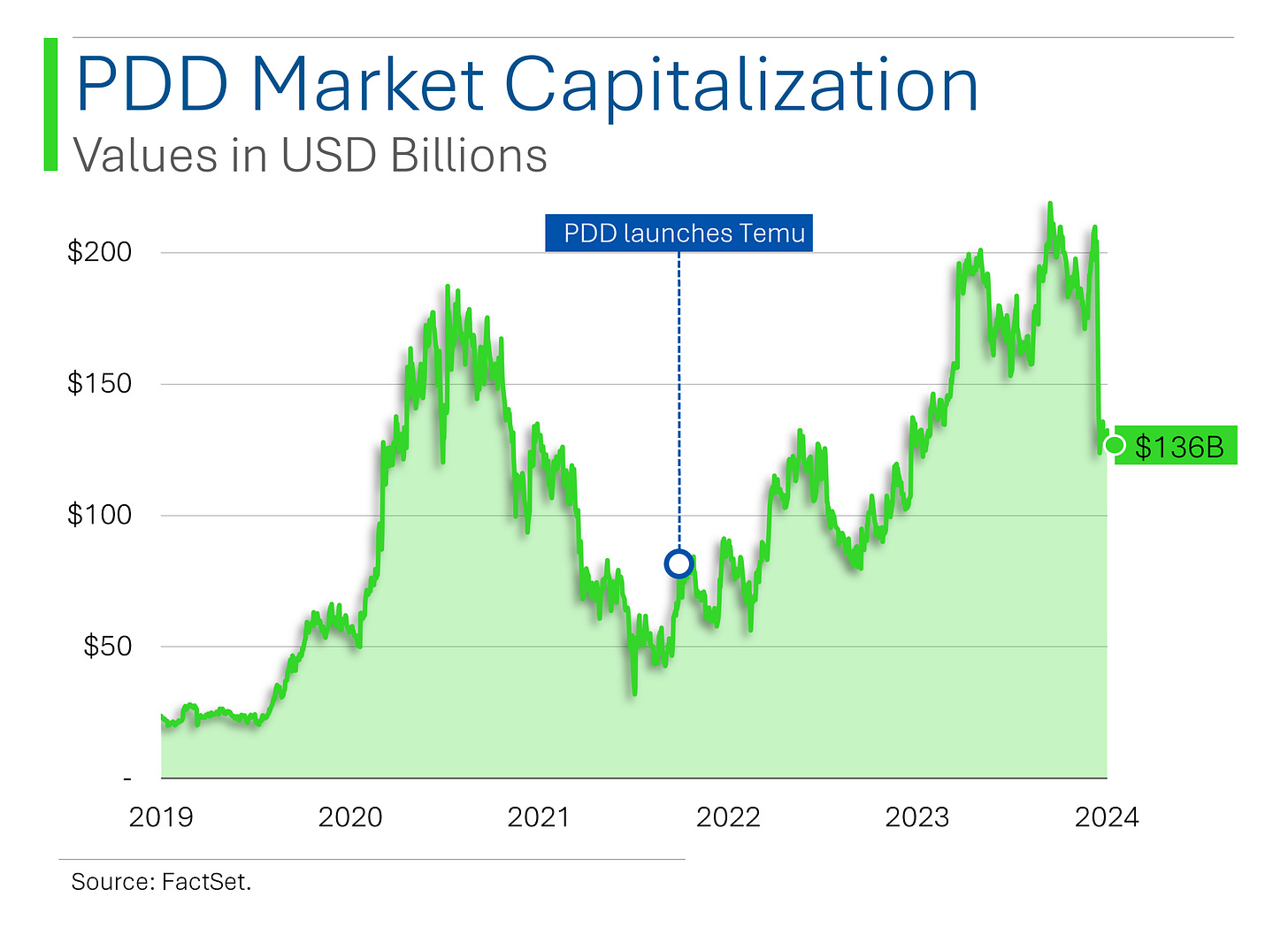

And while a lot of people still aren’t too familiar with Temu or it’s gamified shopping experience, the company has quickly become one of the largest players in the world of online shopping, with it’s parent company Pinduoduo (‘PDD’) worth nearly $140 billion.

To start there are a few caveats to today’s deep-dive:

Pinduoduo Financials: PDD doesn’t explicitly break-out Temu out separately in their financials and the company provides scant data and industry metrics so it’s not a particularly easy company to dig into. Basically this is a deep-dive on Pinduoduo with some Temu nuances.

‘Societal Concerns’: The company has faced MASSIVE criticism over its consumer experience, product quality, false advertisement, data privacy, forced labor (aka slavery), manipulative marketing, intellectual property theft, and work culture (they’re the poster child for China’s 9-9-6 working conditions). Hell, they’ve even been reprimanded for advertisements that were ‘graphically sexualizing of children’. Anyway, I don’t have the time or emotional bandwidth to get into that stuff so just assume that they’re a*******.

To start, before there was Temu there was Pinduoduo: A Chinese eCommerce marketplace that can best be looked at as the Amazon of China. It’s easy to think that Temu is just the international facing side of PDD but the business models are actually very different.

Below is my longwinded way to break-down the two businesses:

1. Target Markets:

Pinduoduo: Primarily focused on the Chinese domestic market. It is one of China's largest e-commerce platforms, catering mainly to price-sensitive consumers in smaller cities and rural areas.

Temu: Launched in 2022, Temu is focused on international markets, particularly in the U.S. and other Western countries.

2. Business Model:

Pinduoduo: Operates a social commerce model, where users can buy goods individually or participate in group purchasing to get discounts. The platform incentivizes users to share deals with friends and family via social media to increase volume and reduce prices.

Temu: Uses a direct-to-consumer (D2C) model, sourcing products directly from Chinese manufacturers and selling them to international consumers at very low prices. It focuses on offering a wide variety of inexpensive goods, similar to AliExpress, but with a more streamlined shopping experience tailored to Western consumers.

3. Logistics and Supply Chain:

Pinduoduo: Leverages its domestic supply chains and infrastructure in China, often working with local suppliers and farmers. Given its focus on China, logistics are optimized for local deliveries.

Temu: Relies on international shipping from Chinese manufacturers, meaning longer delivery times (often 1-2 weeks or more) for international buyers. Temu operates on a cross-border e-commerce model, where the platform acts as a marketplace, connecting manufacturers with overseas customers.

4. User Engagement:

Pinduoduo: Emphasizes social interaction to drive engagement, such as group buying and games that offer discounts or rewards. It also promotes customer engagement through gamification elements like daily sign-ins, virtual farms, and interactive features.

Temu: Less focused on social commerce. Instead, it aims to attract users through competitive pricing and flash sales, leveraging digital marketing strategies to expand its user base globally. It uses more traditional e-commerce engagement strategies like personalized recommendations and promotions.

5. Product Offering:

Pinduoduo: Offers a mix of branded and non-branded products, focusing on low-cost consumer goods, including fresh produce, electronics, and fashion.

Temu: Mainly features non-branded goods sourced from Chinese manufacturers, ranging from electronics, fashion, home goods, and other inexpensive items. The variety is similar to marketplaces like Wish or AliExpress but curated for international appeal.

6. Revenue Model:

Pinduoduo: Generates revenue primarily through advertising (from merchants paying for better visibility) and commissions on sales. The platform's success is built around a high-volume, low-margin strategy.

Temu: Also takes a commission from manufacturers and brands selling on the platform but operates at razor-thin margins to compete with local e-commerce giants in Western markets. It focuses heavily on customer acquisition and market penetration through low prices.

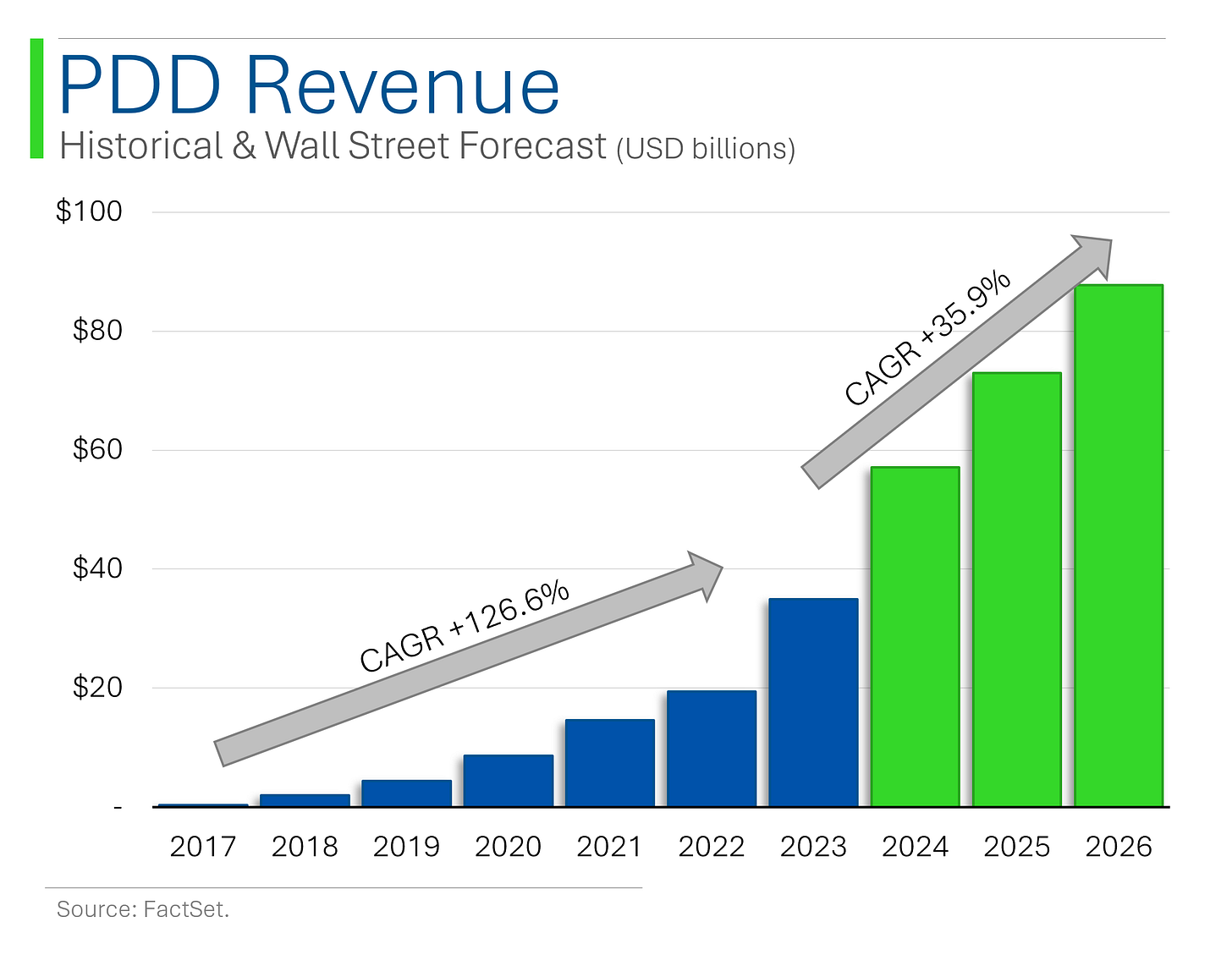

Above you can see the revenue by division of PDD. As mentioned above, Pinduoduo (Chinese domestic division) makes most of its money from online marketing, similar to the ‘sponsored’ items you see pop up in your Amazon search.

Temu, by contrast, makes it’s money through commissions on transactions; that’s why the category on the right has spiked since Temu was launched in 2022. It’s also clear that PDD was already a monster before Temu - hitting $14 billion in in revenue by 2021.

And if Wall Street is to be trusted, there is still a lot of growth left for both businesses. Currently, the consensus for revenue growth is +36% annually over the next three years. Which is a lot btw.

One of the biggest concerns about Temu specifically is that the marketing spend to attract users and their razor thin margins may leave the company walking away with very little profit.

While the company lacks the transparency to determine what is attributable to Pinduoduo or Temu, the company has shown incredible earnings per share growth and is forecast to continue to grow it at an astonishing rate.

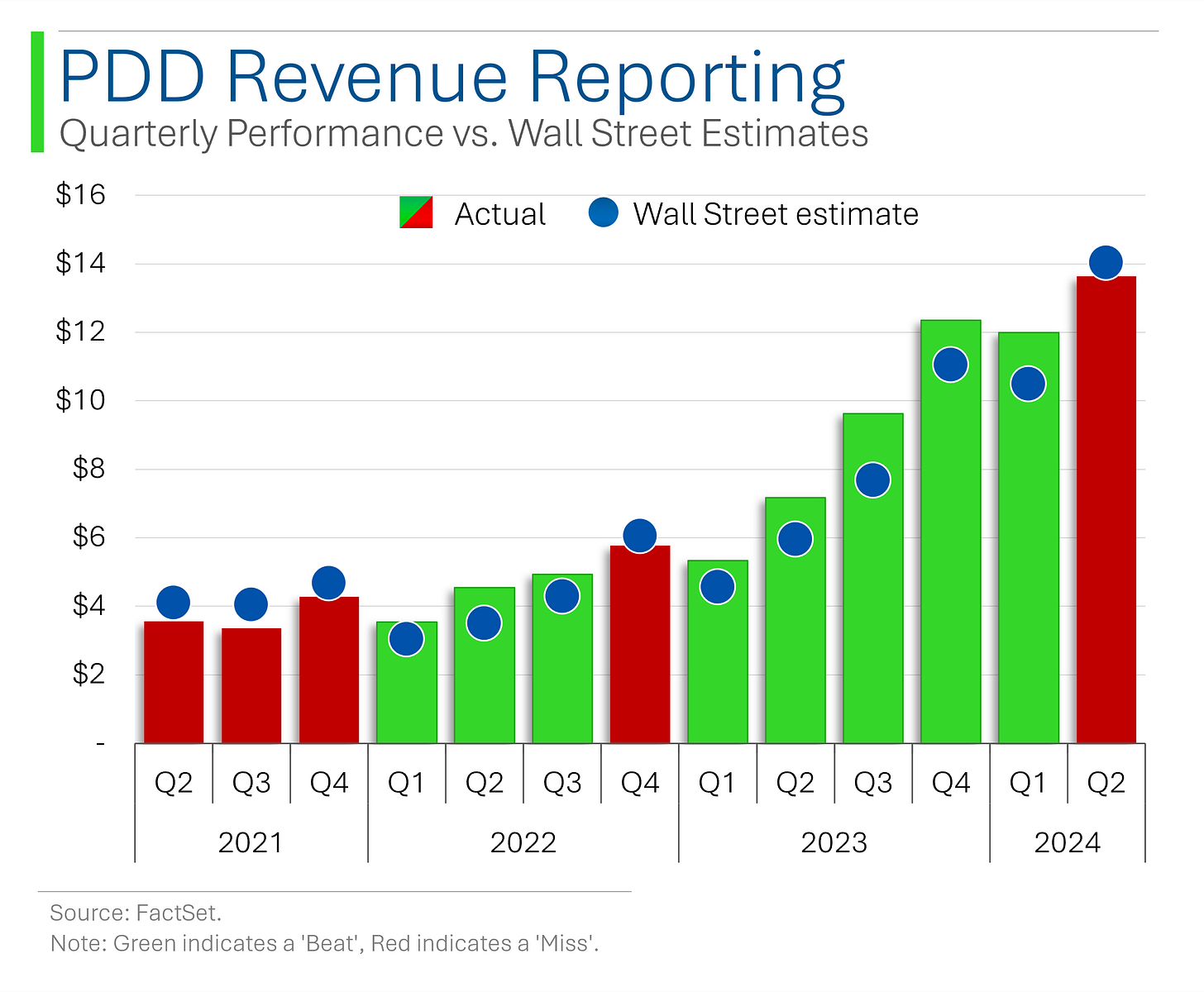

However, everything isn’t looking peachy for the company: They reported a few weeks back, posting a strong beat on EPS1 but a large miss on Revenue. More importantly management basically called for a very rough road ahead - subsequently collapsing the shares +30% in the fall-out.

1. Easy to manipulate, especially if you’re a Chinese company.

This is probably a good place to stop for today. Monday I’ll dig into the implosion of the stock; the expected impact to revenue and profitability; and see if - despite the moral reprehensibility of the company - it actually could be a decent investment.

Ukraine’s Red Hot Real Estate Market

Russia’s scaling up the pressure in Eastern Ukraine, with Pokrovsk and Chasiv Yar now in Moscow’s crosshairs. Taking these two cities could tip the scales in Russia’s favor in the Donetsk region.

Pokrovsk is a logistics hub that is facing a Russian assault and if it falls, Ukraine’s supply lines will take a major hit. Meanwhile, Russia’s aiming to seize Chasiv Yar, a small city perched on high ground. If Moscow grabs it, they get a major tactical advantage to push further into Donetsk.

It’s a race against time as winter approaches, threatening to freeze both the battle and military movements, with Ukraine holding out for crucial Western support amid Russia’s advances. 🤞

Joke Of The Day

I’ve been told by coworkers that I’m condescending…that means I talk down to people.

CEO 1: ‘Tell me, how many people work in your company?’

CEO 2: ‘About half.’

Hot Headlines

Reuters / ECB cuts interest rates as growth dwindles. This marked the second consecutive reduction, bringing the deposit rate to 3.5% as inflation nears its 2% target and eurozone growth slows. Lagarde emphasized that they’ll be following a wait and see agenda now, with more cuts unlikely until at least December.

CNBC / Microsoft hires former GE CFO Carolina Dybeck Happe as new operating chief. While Happe’s main mandate is to further the company’s AI efforts, she will also take over the commerce and ecosystems organization. Microsoft hasn’t had a COO since 2016 so I don’t think the bar was set too high.

CNBC / Interest payments on the national debt top $1 trillion as deficit swells. It’s official! After a 30% spike driven by the Fed’s highest interest rates in over 20 years, the U.S. Government is taking the words “fiscal irresponsibility” to the logical next level - trillions. All I’m going to say is that this is what a trillion dollars looks like: $1,000,000,000,000

Bloomberg / Steven Cohen’s Point72 plans to return billions in order to cap assets. Apparently all the big guys like Citadel and Millenium return capital and make an effort to stay a certain size - I’d say this is likely a result of constraints to their strategy or an effort to create perceived scarcity. That said, I can understand why he would try to protect what he’s got going on - he’s up a stellar 10% YTD while the S&P 500 is only up 18%...

Bloomberg / Couche-Tard discusses higher price for 7-Eleven owner. While Couche-Tard remains optimistic about finding a deal, the significant price gap between the two parties may make negotiations challenging…especially with Seven & I’s shares popping 7.3% on news of the buyout being rejected.

Bloomberg / Air Canada asks the government to step in as pilots threaten strike. With talks deadlocked over wages, Air Canada is seeking arbitration - warning the strike could cost the economy C$1.4 billion over two weeks. Business leaders are calling on the government to act swiftly to prevent further damage to the country’s supply chains and fragile economy.

Trivia

Today's Trivia Is On America’s very own Silicon Valley!

Which of these companies originated from a Stanford University research project and went on to revolutionize the field of data analytics?

A) Palantir Technologies

B) Oracle

C) Google

D) TableauWhat venture capital firm, founded in 1972, was instrumental in funding Silicon Valley startups like Google, Amazon, and Netscape?

A) Sequoia Capital

B) Andreessen Horowitz

C) Accel Partners

D) Benchmark CapitalWhich Silicon Valley company was one of the first to develop and commercialize the graphical user interface (GUI), changing the way people interacted with computers?

A) Apple

B) Xerox PARC

C) Sun Microsystems

D) Hewlett-PackardWhich researcher and entrepreneur is known as the "Father of Artificial Intelligence" for pioneering work in computer science and AI at Stanford?

A) John McCarthy

B) Alan Turing

C) Vinton Cerf

D) Ray Kurzweil

(answers at bottom)

Market Movers

Winners!

Medical Properties Trust (MPW) [+16.2%] announced a global settlement with its bankrupt tenant Steward Health Care, regaining control of 15 properties and setting up new lease agreements.

Signet Jewelers (SIG) [+11.3%] beat Q2 earnings expectations with better-than-expected comps and highlighted higher transaction values and cost-saving measures.

Warner Bros. Discovery (WBD) [+10.4%] announced an early renewal of its multi-year distribution deal with Charter Communications, though financial details were kept private.

23andMe (ME) [+6.9%] CEO Anne Wojcicki signaled she’s open to acquisition offers and had already proposed taking the company private at $0.40 a share.

Roku (ROKU) [+5.7%] got an upgrade from Wolfe Research for its focus on monetization and strong position in the connected TV market.

Navient (NAVI) [+5.5%] reached a settlement with the Consumer Financial Protection Bureau that aligns with its shift away from the student-loan business.

Carvana (CVNA) [+5.2%] was initiated with an overweight rating by Stephens, citing its superior economics and customer experience.

GE Vernova (GEV) [+2.9%] reaffirmed its FY24 outlook with strong results in Power and Electrification, offsetting challenges in Wind.

Gilead Sciences (GILD) [+2.7%] saw its HIV prevention treatment, Lenacapavir, reduce infections by 96% in a key Phase 3 trial, outperforming Truvada.

Belden (BDC) [+2%] rolled out a new long-term financial plan through 2028 and announced a $300M buyback ahead of its investor day.

Alaska Air Group (ALK) [+1.2%] raised its Q3 earnings guidance thanks to lower fuel costs and strong summer travel demand.

Losers!

Fulcrum Therapeutics (FULC) [-61.1%] announced that its phase 3 trial for losmapimod in treating muscular dystrophy failed to meet key endpoints, leading to the suspension of its development.

Caleres (CAL) [-18.9%] posted a big Q2 miss, cut FY guidance, and blamed system issues and weak seasonal demand for the disappointing results.

Moderna (MRNA) [-12.4%] slashed its 2025 revenue forecast, increased 2024 R&D spending, and faced analyst concerns about the likelihood of a future equity issuance.

Micron Technology (MU) [-3.8%] was downgraded due to concerns that the company is building memory chip capacity faster than demand, which could lead to an oversupply through 2027.

Interpublic Group (IPG) [-1.3%] was downgraded after analysts highlighted a loss of major accounts, including Amazon Media, with growth estimates still being too optimistic.

Market Update

Trivia Answers

A) Palantir Technologies originated from Stanford University and became a leader in data analytics.

A) Sequoia Capital is one of the most prominent venture capital firms, backing numerous Silicon Valley giants.

B) Xerox PARC developed the first GUI, which later inspired Apple’s Macintosh interface.

A) Hyperloop One aimed to transform transportation with maglev technology, but has faced challenges.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.