🔬The Rise & F-Up of WeWork, The Fed Isn't Dovish - Just Less Hawkish, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

"The investor's chief problem – and even his worst enemy – is likely to be himself."

- Benjamin Graham

"When you get in the end zone, act like you've been there before."

- Julian Robertson

Table of Contents

A.M. Allocations: Summaries of important news and investing events

The Rise & Fall of WeWork

Rate Hike Hiatus: Powell’s Fed Hints at Less Aggressive Rate Policy

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

The Rise & Fall of WeWork

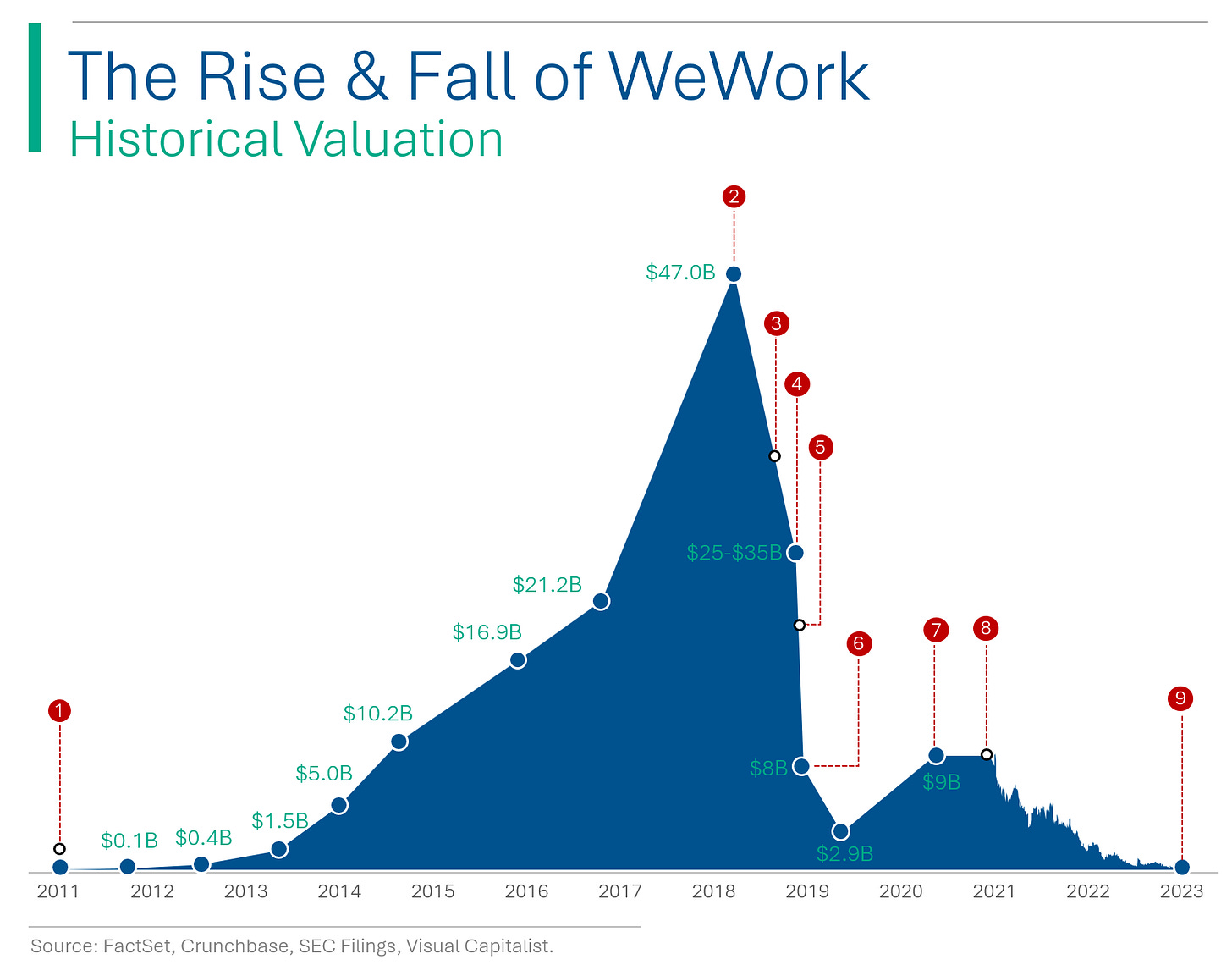

(1) October 25, 2011 - WeWork raises a $1 million Seed Round. Subsequent funding rounds will see the valuation balloon to $47 billion, with 779 locations as of 2022.

(2) January 9, 2019 - Scrambling for a cash infusion to bridge them to their IPO, they receive $5 billion in funding at a staggering $47 billion valuation, with $2 billion coming from Softbank.

(3) August 14, 2019 - The Company files its IPO prospectus featuring hilarious made up stats - like a $3 trillion addressable market - and BS metrics like ‘Community Adjusted EBITDA’. What really stands out to potential investors, however, is the $900 million loss in only the first six months of 2019.

(4) September 5, 2019 - WeWork begins testing the waters ahead of its IPO roadshow. Due to backlash from its financial losses, they only circle a target valuation of $25 to $35 billion. And subsequently get laughed out of the room.

(5) September 25, 2019 - With the IPO ‘temporarily delayed’ and talk of massive headcount cuts of up to 1/3rd of its workforce, Co-Founder and CEO Adam Neumann resigns in disgrace.

(6) October 22, 2019 - Talk has officially transitioned from the IPO to whether or not WeWork is financially viable as a going concern. Softbank steps in with a $5 billion bailout. Within two months Softbank will write-down $9.2 billion of its total $10.3 billion invested in WeWork

(7) March 26, 2021 - Not one to miss out on a bubble, WeWork announces a merger with a SPAC called BowX. The deal brings in around $1.3 billion into the still-loss-making company.

(8) October 21, 2021 - SPAC deal officially closes and WeWork begins trading on the Nasdaq under the ticker symbol WE. Shares even pop 13.5% on its first day.

(9) October 31, 2023 - News leaks to the media that WeWork is in the process of filing for Chapter 11 bankruptcy, with an announcement expected as early as next week.

Take-Aways: No happy ending here. Adam Neumann walked away with +$2 billion and has somehow convinced people to give him more money for his next

scamcompany, Flow.The only positive is just how ridiculous their IPO prospectus was - check it out: WeWork S1 Filing. Some highlights below.

Rate Hike Hiatus: Powell’s Fed Hints at Less Aggressive Rate Policy

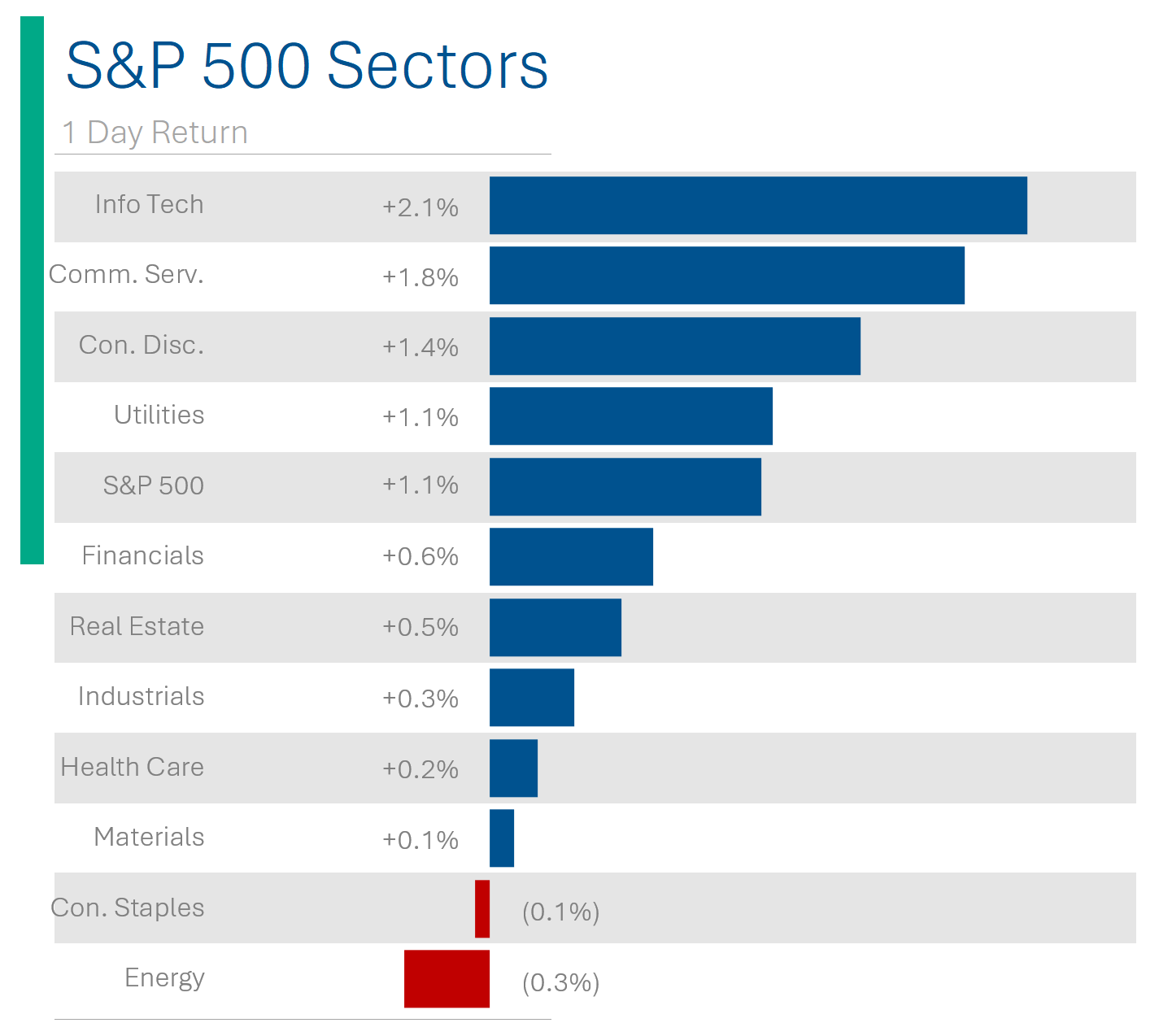

As expected, the Federal Reserve maintained its benchmark interest rate at 5.25%-5.50%, as Chair Jerome Powell acknowledged uncertainties in determining if current financial conditions are sufficiently restrictive to control inflation, which remains above their 2% target (currently 3.4%).

Powell highlighted the recent market-driven increase in Treasury bond yields and mortgage rates, acknowledging their potential impact on the economy, and expressed a need to observe how job and price data evolve before the next policy meeting in December.

Despite market speculation about the end of rate hikes, Powell emphasized the possibility of a slowdown and softening labor market as necessary for achieving price stability, with the Fed's future decisions to be influenced by upcoming employment and inflation data.

Take-Aways: The tone of today’s meeting probably can’t be construed as ‘Dovish’ (that the Fed is willing to be less aggressive with interest rates to quash inflation) but perhaps ‘Less Hawkish’ is more apt. The Fed is acknowledging that there are forces at work helping to slow inflation, like high mortgage rates, and seems willing to take a wait-and-see approach. This is a net positive for the many people - myself included - that have concerns that an overly aggressive policy might end up being more damaging to the economy and helping to trigger a recession in the US.

Joke Of The Day

Interviewer: What are your thoughts about nepotism in a workplace environment?

Candidate: Well, that’s a really good question, Dad.

Why was the vampire removed as CEO? He couldn’t appeal to the stakeholders.

Hot Headlines

(Axios) WeWork reportedly prepares for bankruptcy - WeWork is on the brink of bankruptcy, potentially filing as soon as next week in New Jersey, amid missed bond interest payments and a 30-day grace period to avoid default. The company is struggling with a fundamental shift in the office real-estate market, substantial lease obligations, and a dwindling cash reserve, marking a sharp downturn from its once $47 billion valuation and venture-capital darling status. Shares were down 47% Wednesday, leaving its market cap at $65 million.

(Reuters) Boeing says 'cyber incident' hit parts business after ransom threat - The incident comes after the Lockbit cybercrime gang claimed responsibility for stealing a significant amount of data from Boeing, threatening to release it if a ransom isn't paid by Nov. 2. Lockbit has apparently hacked 1,700 US organizations since 2020. Jerks.

(Axios) What the heck is happening at Disney - The article highlights that Bob Iger’s first tenure CEO was about big deals, like LucasFilm, Marvel and Pixar, but that his current second term might be known for his cutting, such as rumored sales of FX and ABC, and their hunt for a ‘strategic partner’ for ESPN.

(Reuters) Unlike Pfizer, Moderna can meet 2023 COVID forecast, analysts say - Sales needed to hit their guidance looks a bit punchy.

(CNBC) Space Force awards $2.5 billion in rocket contracts to SpaceX and ULA for 21 launches - still can’t believe they actually called it Space Force.

(CNN) Interest rates are high. These are the best places to park your cash - The article provides some options for exploring high-yield online savings accounts, money market accounts and funds, certificates of deposit, and Treasury bills as low-risk options for getting the best yields on funds needed within two to five years, while also considering convenience and accessibility.

(CNBC) Kyiv tries to rally troops, urging them to resist burnout as Russian attacks intensify

Trivia

Following the fiasco at WeWork mentioned above, Softbank’s Vision Fund recorded a $17.7 billion loss in 2020. Other than WeWork, what was the other main driver for the loss?

Uber

Theranos

Bad accounting

FTX

A major criticism of WeWork's business model was:

It only catered to left-handed people

Long-term leases vs. short-term rentals

Offices lacked feng shui

More people working from home

In addition to his shares and other benefits, how much was Adam Neumann reportedly paid to leave WeWork?

$1 million

$10 million

$185 million

A lifetime supply of kombucha

(answers at bottom)

Market Movers

Winners

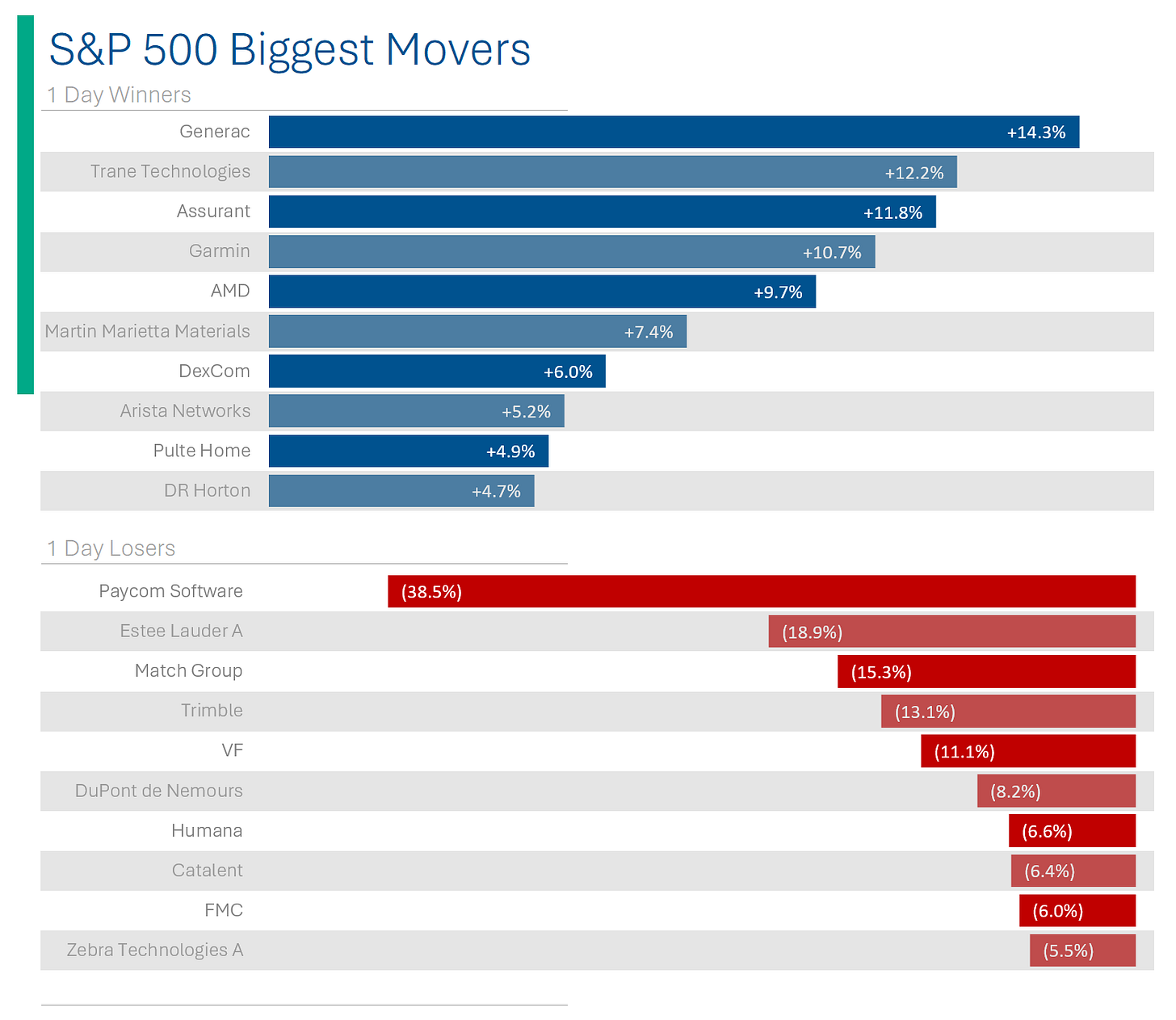

Advanced Micro Devices (AMD): [+9.7%] Q3 EPS and revenue exceeded expectations, but Q4 guidance for revenue and GM fell short due to weaker Gaming and Embedded trends. Positive outlook for AI, particularly MI300X GPU, expected to generate $2B by 2024.

Losers

Paycom Software (PAYC): [-38.5%] Q3 revenue underperformed, impacted by BETI cannibalization and macro challenges. Q4 and 2024 revenue projections significantly below expectations, resulting in multiple downgrades.

Estée Lauder (EL) :[-18.9%] FQ1 EPS surpassed estimates, revenue matched. FY24 EPS and revenue growth guidance lowered, citing potential disruptions in Israel/Middle East and pressures in Asia travel retail, especially slow recovery in China's prestige beauty market.

Canada Goose (GOOS): [-8.7%] Fiscal Q2 results better than expected, driven by DTC performance. However, Q3 guidance well below expectations and FY guidance reduced, noting a September slowdown and challenging macroeconomic and geopolitical factors affecting consumer spending decisions.

Market Update

Trivia Answers

Uber.

Long-term leases vs. short-term rentals. How could that ever fail?

$185. In addition to selling his shares Adam was given $185 million over 4 years to be a ‘consultant’ to WeWork. Pretty sure they didn’t ask him a single damn question.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.

x