🔬The Relationship Between Growth & Valuation

Plus: Chip sorrows continue to compound; and much more!

"The only time I really ever lost money was when I broke my own rules"

- Jesse Livermore

“Money doesn’t change you. It reveals who you are when you no longer have to be nice”

- Tim Ferriss

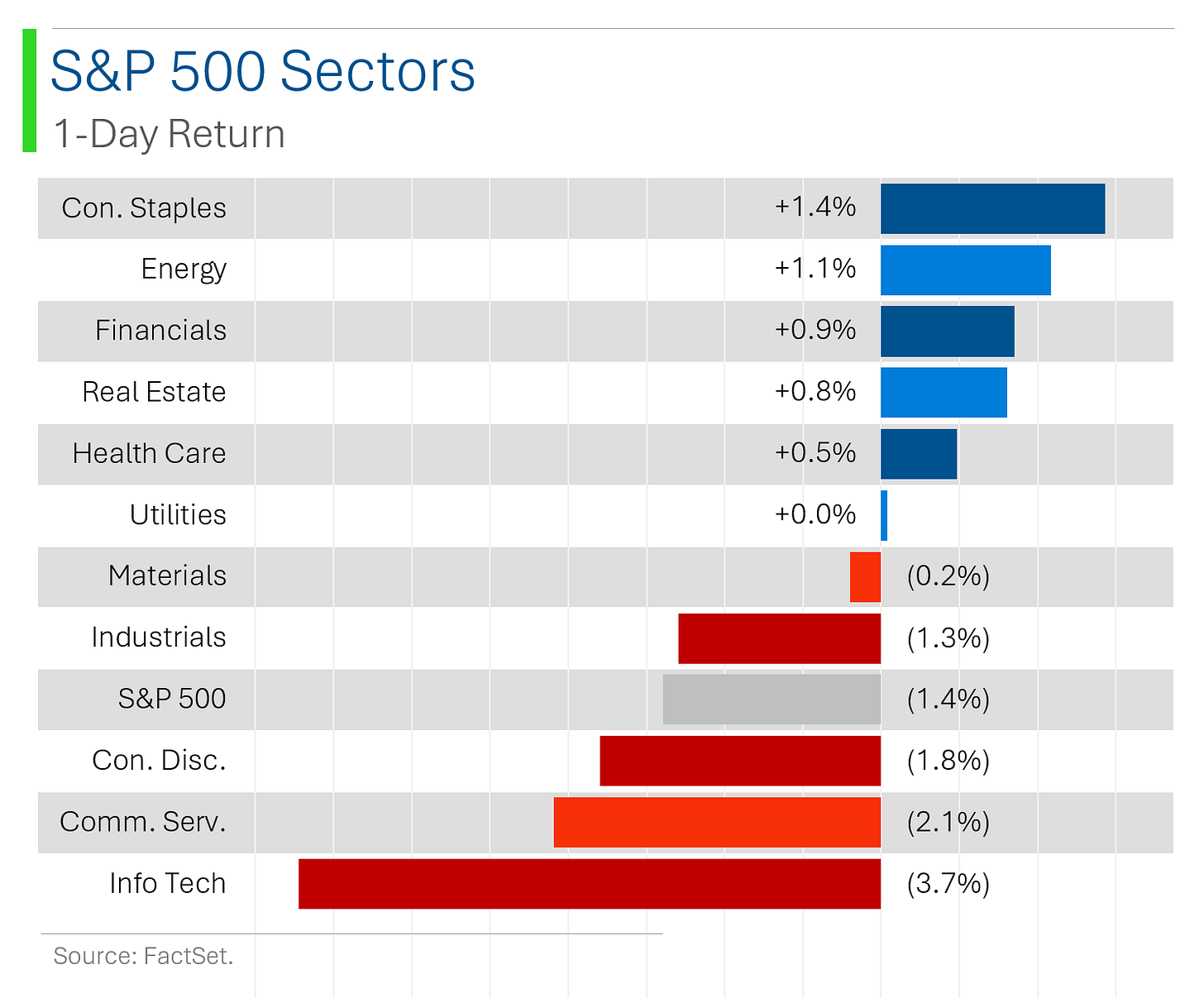

Bad day for the big US markets with the S&P 500 -1.4% and Nasdaq -2.77%, led by the ongoing sell-off in Tech which received new catalysts, such as Trump saying ‘Taiwan stole’ the US’s chip industry and potential fresh sanctions on chip sales to China.

6 of 11 sectors closed higher but when Tech (-3.7%) and techy bits of Consumer Discretionary (-1.8%) and Comm. Services (-2.1%) have a bad day, the market usually does as well. Staples (+1.4%) led the pack as defensives gain traction.

June Housing Starts came in +3% m/m at 1.35 million vs. Wall Street’s estimate for 1.30 million. While progress made month-over-month, starts are down 4.4% on an annualized basis.

Notable companies:

Gitlab (GTLB) [+9.3%] Reuters reported the company is considering selling itself after receiving interest from industry firms, including DDOG.

Taiwan Semiconductor (TSM) [-7.9%] Former President Trump said Taiwan "stole" US chip business and should pay for the security guarantee provided by US military.

Qualcomm (QCOM) [-8.6%] Downgraded to hold from buy at HSBC; flagged lack of catalysts and less bullish AI PC narrative; broader semi space weak on Bloomberg report US may ramp up chip crackdown on China.

Street Stories

Growth & Valuation

I was tinkering around with Excel, looking at companies’ growth rates and their valuations, when I thought it would be interesting to look at the relationship between the two.

As you’d expect, companies that grow faster tend to have higher multiples. This is common sense: Nvidia is forecast to grow revenue by 209% over the next three years and trades at 66x forward price to earnings (P/E). HP is only expected to grow revenue by 7% and thus trades at a much lower 11x P/E.

Nvidia is growing faster, so shareholders are willing to pay more of a premium for that growth in the expectation that the company will be more profitable in the future. Basic investing s***.

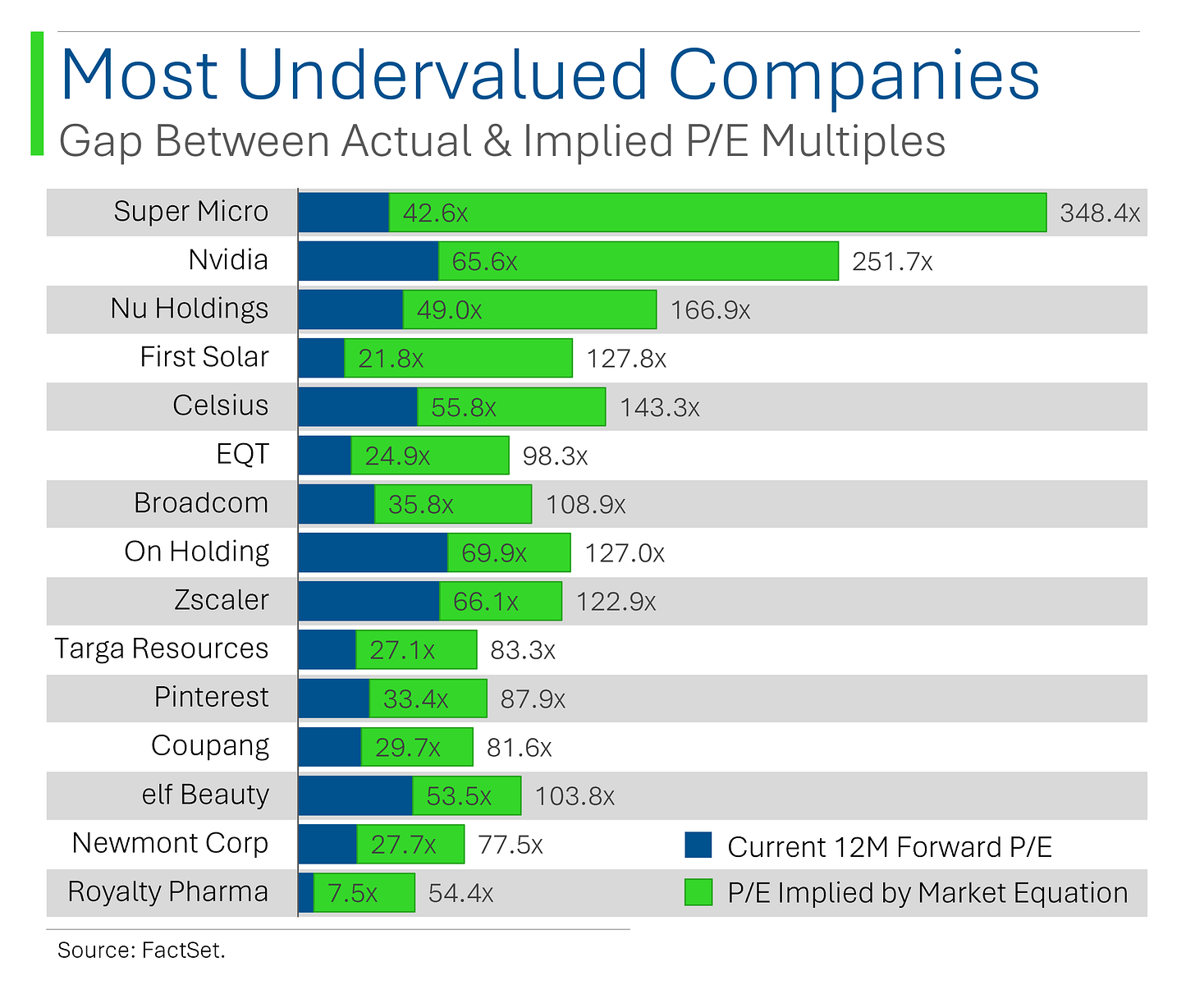

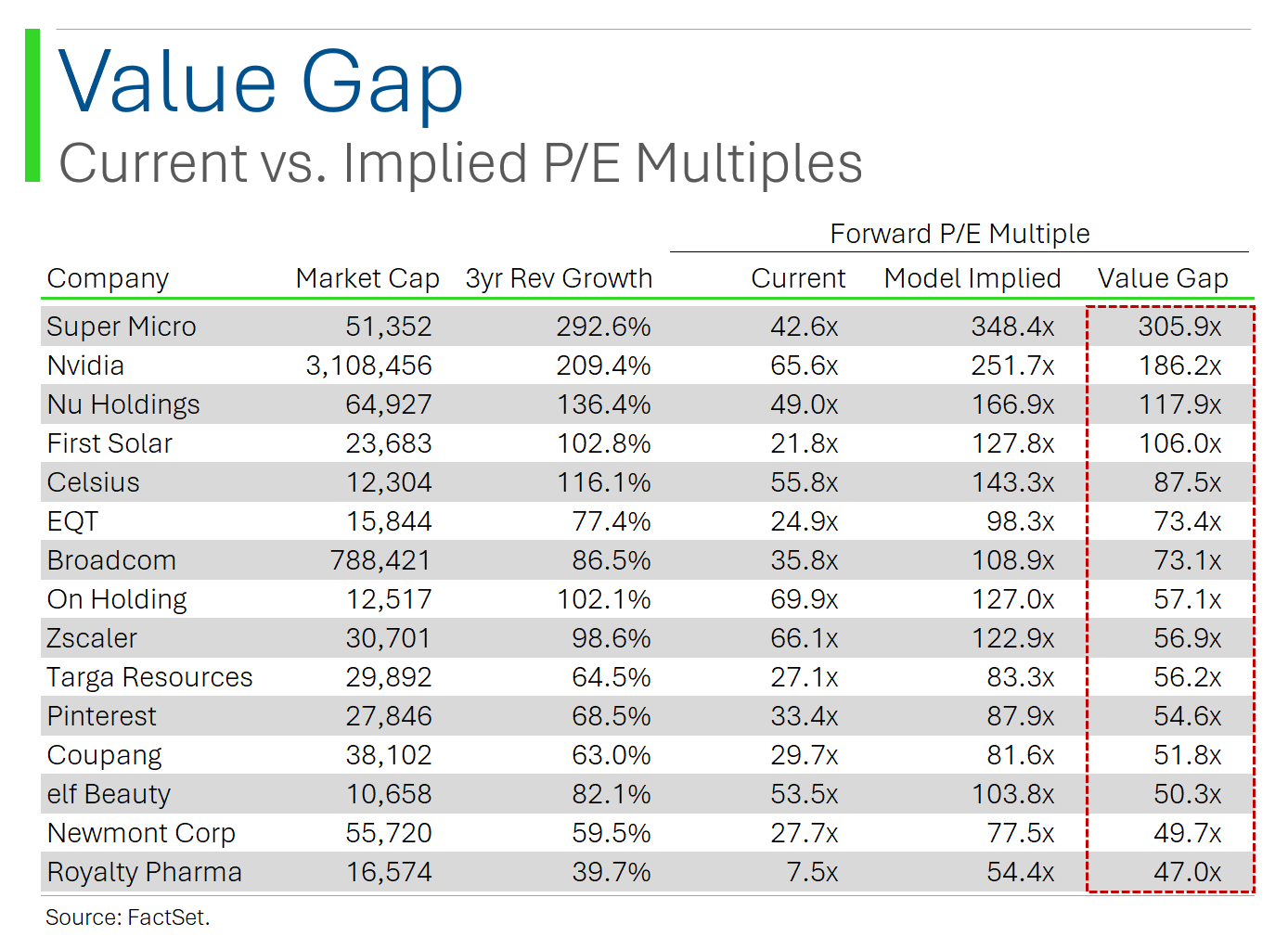

When you graph all this you see a definite trend. A linear regression of the two variables yields pretty reasonable equation for applying this: A company is worth 8.3x P/E plus ~1.16x for every 1% revenue growth expected over the next three years.

If a company is expected to grow revenue 10%, it’s worth 20.0x (8.3x just for existing, plus 11.6x for the growth). Cool.

Based on that equation, we can see the degree to which some companies are overvalued or undervalued. For example, Super Micro trades at 42.6x forward P/E but is forecast to grow revenue by 293% over the next three years. By this simplified formula, the stock looks super cheap.

However, that doesn’t necessarily tell the whole story. For example, Royalty Pharma is on the list. It trades at 7.5x P/E but, under the above equation, should trade at 54x. What gives?

The company mostly buys royalties on existing pharmaceutical drugs and clips a yield on their investment which shows up as revenue. What happens when the royalties expire or the drug goes generic and sells for pennies? Their royalties are virtually worthless.

See, medium-term revenue growth doesn’t tell the whole story. Barring the apocalypse, Microsoft has a machine that will generate revenue and profit growth well into the future (oligopolies tend to do that). Whereas three years from now Pinterest (33x P/E; 88x implied P/E) could still be growing well… or it could be bankrupt.

Stuff like this is fun to bang around with and find ideas, but investing is much more nuanced. It requires a measure of confidence in predicting the long-term and certainly doesn’t boil down to an equation I stumbled upon after a few beers.

Techxodus

(as in like, ‘Tech’ and ‘Exodus’. Ya, I’m lame)

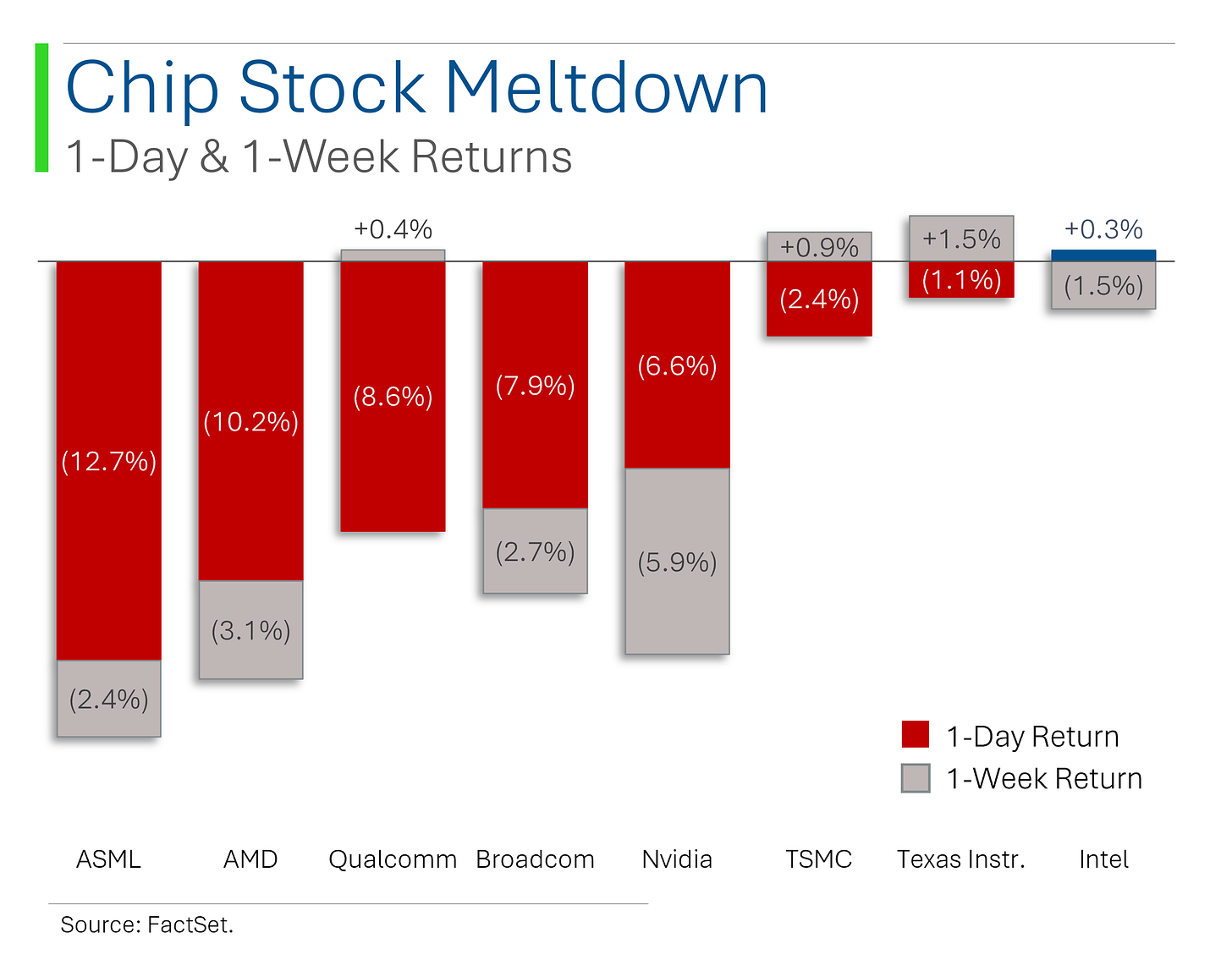

Amidst the general Tech retreat and a rotation into underperforming names (notably Small-Cap) another bundle of straw has been placed on the proverbial digital camel’s back: Additional chip regulation.

The US has floated the idea of a further chip crackdown, notably focused on Tokyo Electron and ASML following their ongoing sales to China. As you can see, the big semiconductor companies didn’t enjoy that much.

Joke Of The Day

You know you’ve gone to the wrong stockbroker when you ask him to buy 10,000 shares in IBM and he asks you how to spell it.

Hot Headlines

Reuters / Microsoft and Alphabet offer Nvidia chips to Chinese companies. While not selling the chips directly, which would breach new Biden sanctions, they are now offering data center services to Chinese companies to pursue AI products and research. Sounds like you could drive a supertanker through these loopholes.

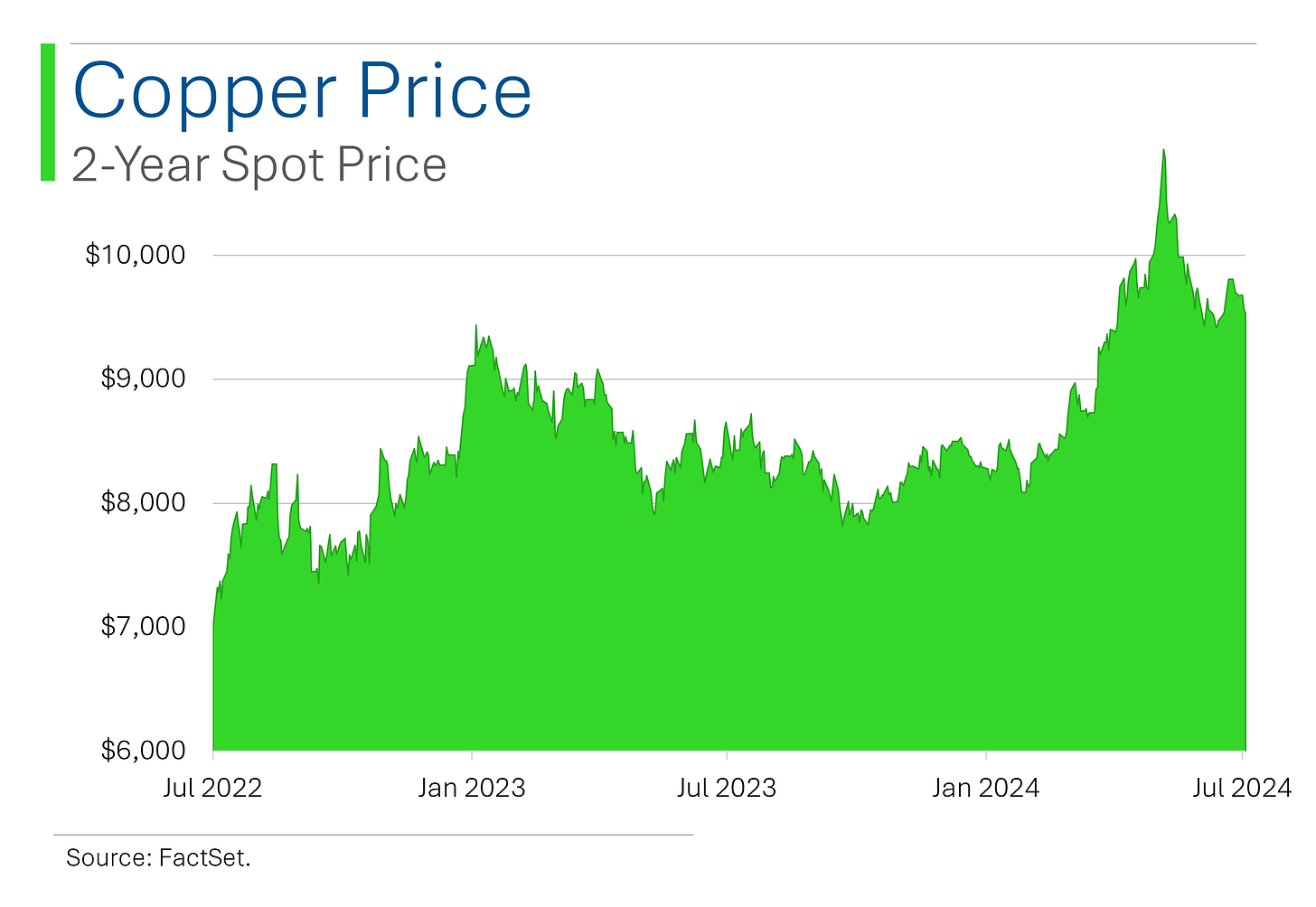

Yahoo Finance / Copper takes another nose dive over demand uncertainty, notable worries over the Chinese economy.

AP / Latest poll says 65% of Democrats want Biden to withdraw. Overall, seven in 10 Americans think Biden should drop out, with Democrats only slightly less likely than Republicans and independents to say that he should make way for a new nominee.

Reuters / Amazon Prime Day sees $7.2 billion in sales on first day of discounts. This sets it on pace for the best Prime Day (which is actually two days) following the $12.7 billion in 2023.

Reuters / Roche sees early trial success of obesity drug candidate. The Phase 1 trial saw once-daily pill CT-996 offering average weight loss of 6.1%.

Not a bad market to have success in…

Trivia

Today’s trivia is on financial crises and bubbles.

The 'Railway Mania' bubble occurred in which country during the 1840s?

A) United States

B) United Kingdom

C) Germany

D) FranceIn the movie "The Big Short," characters bet against the housing market using what financial instrument?

A) Bond Shorts

B) Stocks

C) Credit Default Swaps

D) Index OptionsThe 'Panic of 1907' was primarily alleviated by the actions of which influential banker?

A) Andrew Mellon

B) J.P. Morgan

C) John D. Rockefeller

D) George Soros

(answers at bottom)

Market Movers

Winners!

VF Corp (VFC) [+13.6%] Selling its Supreme brand to EssilorLuxottica (EL.FR) for ~$1.5B in cash; expected to close by year-end 2024; sale expected to be dilutive to EPS in FY25.

Gitlab (GTLB) [+9.3%] Reuters reported the company is considering selling itself after receiving interest from industry firms, including DDOG.

Progressive (PGR) [+5.4%] Upgraded to outperform from market perform at Keefe, Bruyette & Woods; expects lower core loss ratios, faster premium growth, offsetting higher cat loss and expense ratios.

US Bancorp (USB) [+4.6%] Q2 EPS and NII beat; highlighted improved NIM driven by deposit growth; reiterated FY24 guidance; flagged some credit cost and fees disappointment.

Johnson & Johnson (JNJ) [+3.7%] Q2 earnings and revenue beat; Innovative Medicine growth above consensus; strong results from Stelara, Tremfya, and Imbruvca; MedTech weaker amid macro and competitive pressures; trimmed FY24 adjusted EPS guide but increased operational sales guidance amid recent acquisitions.

Citizens Financial Group (CFG) [+3.4%] Q2 underlying EPS beat with revenue in line; NII/NIM slightly better with fee income above consensus; provision and net charge-offs above forecasts; reaffirmed FY guidance but expects a slight Q3 NII decline; generally positive analyst takes on deposits and costs.

Prologis (PLD) [+1.4%] Q2 core FFO slightly above consensus; slight raise to FY24 core FFO guidance midpoint; customer demand subdued but improving, with trend expected to continue as construction pipeline shrinks.

Bloom Energy (BE) [+1.4%] Announced a partnership with CoreWeave to deploy fuel cells for onsite power generation to cool AI datacenters.

Losers!

Five Below (FIVE) [-25.1%] Announced CEO transition; Kenneth Bull to assume CEO role immediately; updated Q2 guidance to include revenue of $820-826M; EPS expected in the range of $0.53-0.56.

ASML Holding (ASML) [-12.7%] Q2 results ahead; order book above consensus though some takeaways noted more in line with buyside; Q3 guide light but FY outlook reiterated; overhang from Bloomberg report US may ramp up chip crackdown on China.

Spirit Airlines (SAVE) [-10.9%] Cut Q2 revenue and RASM guidance, citing significant pressure on leisure ticket yields due to industry capacity increases; non-ticket revenue below initial estimates; downgraded to sell from hold at TD Cowen, citing downside risk on oversupply, weak lower income cohorts, utilization constraints.

Qualcomm (QCOM) [-8.6%] Downgraded to hold from buy at HSBC; flagged lack of catalysts and less bullish AI PC narrative; broader semi space weak on Bloomberg report US may ramp up chip crackdown on China.

Taiwan Semiconductor (TSM) [-7.9%] Former President Trump said Taiwan "stole" US chip business and should pay for the security guarantee provided by US military.

Datadog (DDOG) [-7.3%] Reuters reported GTLB is considering selling itself after receiving interest from industry firms, including DDOG.

J.B. Hunt Transport Services (JBHT) [-6.9%] Q4 operating income and EPS missed; softer performance in key Intermodal segment amid weak pricing and excess capacity; positive commentary on improving volumes in late June.

Omnicom Group (OMC) [-3.9%] Q2 earnings and revenue in line though OM light; organic growth above consensus; drag from Precision Marketing on client-spending delays; branding agency environment remains difficult; analysts noted disappointment with reiterated FY guidance.

Ally Financial (ALLY) [-2.3%] Q2 EPS well ahead (helped by taxes) but revenue a touch light; flagged higher net charge-offs and expenses in Auto Finance; guided FY24 NII to low end of prior range; lowered midpoints for consolidated NCOs and average earning assets.

American Airlines Group (AAL) [-1.6%] Downgraded to hold from buy at TD Cowen; concerns about aggressive discounting and need for significant investments.

Market Update

Trivia Answers

B) The 1840s ‘Railway Mania’ happened in the United Kingdom.

C) Credit default swaps were the main instrument used to short the U.S. housing market.

B) J.P. Morgan (the bloke) helped the US out of the ‘Panic of 1907’ by pledging his own money and forming a consortium of other bankers to shore up the banking system.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.