🔬The Post-Election Stock Market

"Wall Street is a street with a river at one end and a graveyard at the other."

- Fred Schwed Jr.

"The best things in life are free. The second best are very expensive."

- Coco Chanel

Short note today as I’m a bit under the weather. Back to normal on Monday!

Street Stories

The Post-Election Stock Market

A few weeks back I did a write-up on what happens to the stock market in election years (TLDR: The market does ok, and volatility starts to pick up around October).

This time I wanted to take a look at what the market reaction was following the most recent Presidential campaigns to see what worked and what didn’t.

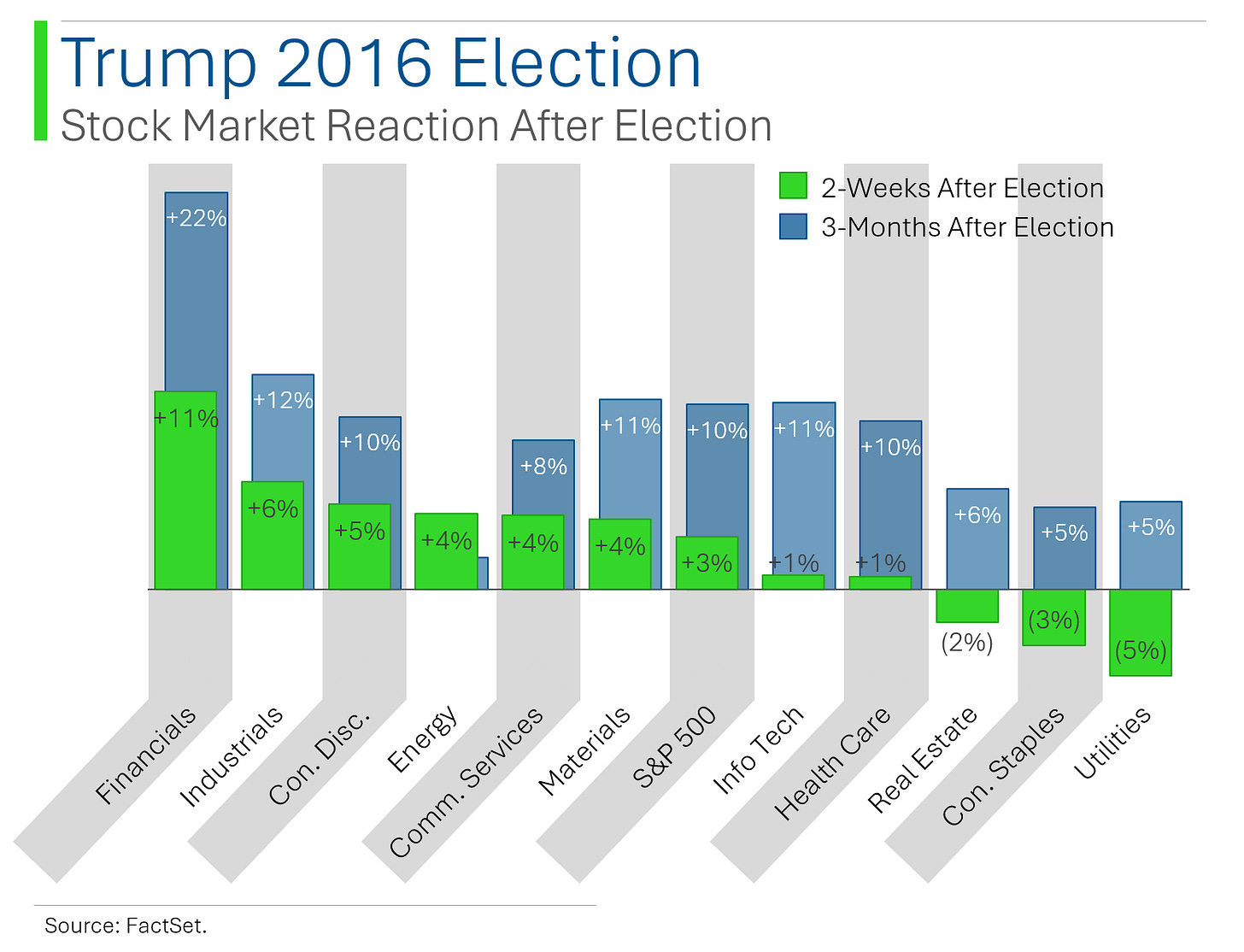

To start, Donald Trump’s election 2016 was pretty bullish for cyclical stocks as his economic policy appeared to lend itself to growth and support for American businesses. Defensive stuff, like Health Care, Staples and Utilities underperformed as a bit of a rotation took place.

Notably, his harsh words against some of the tech giants didn’t help out the sector.

Following Biden’s election in 2020 pretty much everything ripped but that also happened to coincide with the ‘Everything Bubble’ during the pandemic so take that with a grain of salt.

The biggest winner was Energy but that likely had less to do with policy implications and more that they had been crushed at the start of the pandemic.

A head-to-head isn’t too fair given the different states of the world in November 2016 vs. November 2020, but on a relative basis cyclical stocks did better after Trump, while Biden was perhaps better for Tech, Health Care and Real Estate.

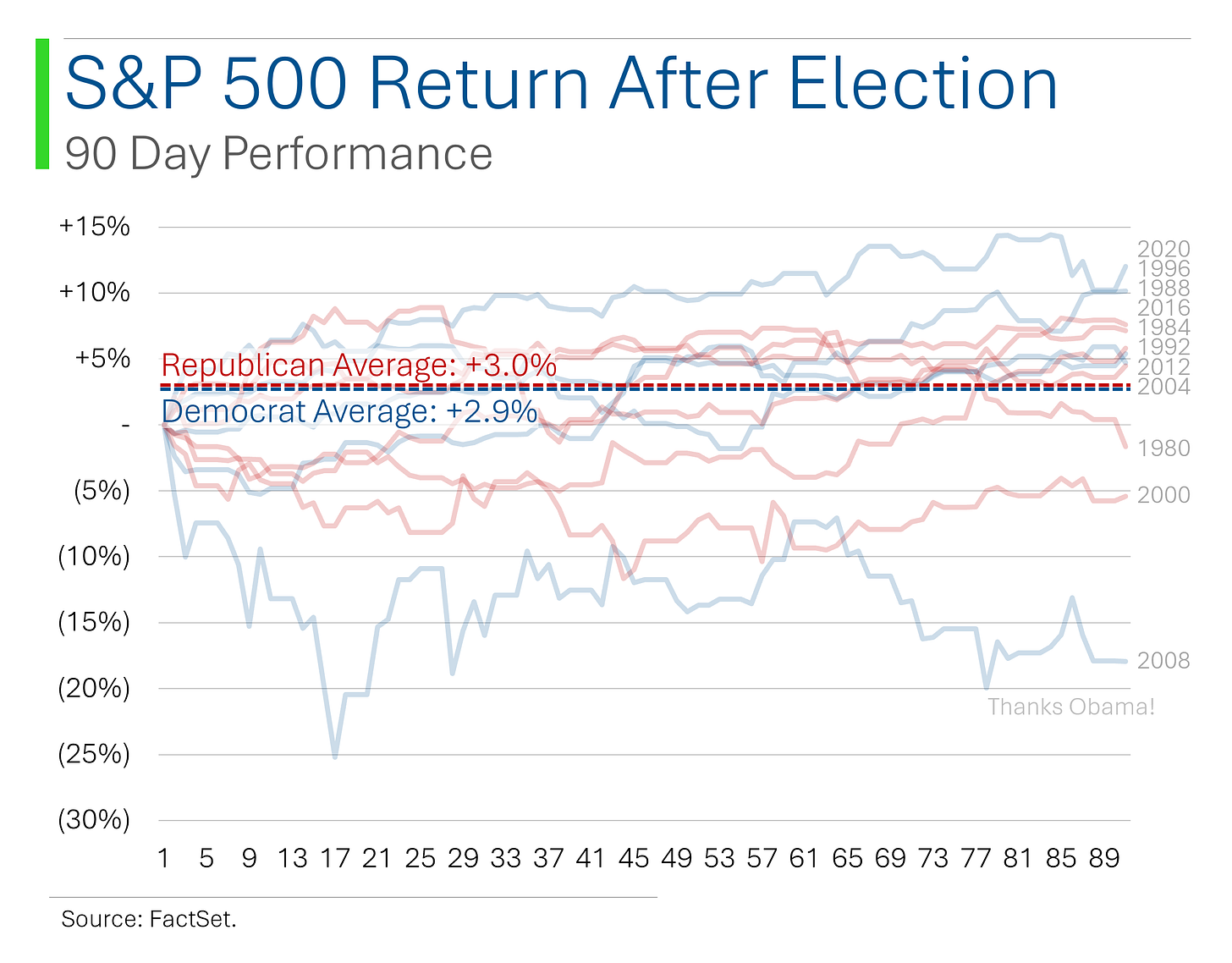

As far as benchmarking which party is better for the market, it’s actually been quite even since 1980 with the 90 day return of the S&P 500 being +3.0% for Republicans and +2.9% for Democrats.

The caveat being that Obama’s first win came smack-dab in the throws of the Great Financial Crisis which tanked the market, so the Dem figure might be a bit deflated.

If you’re like me, you too are dreading another four months of this constant election media cycle. The bright side is that regardless of who wins, the market seems to hang in there ok. ✌️🤞

Trivia

Today’s trivia is on Goldman Sachs.

What year was Goldman Sachs founded?

A) 1820

B) 1869C) 1941

D) 1977

Goldman was one of the last great Wall Street to be organized as a partnership. In what year did Goldman Sachs go public?

A) 1992

B) 1984

C) 2008

D) 1999

On the back of record investment banking advisory work, 2021 saw Goldman’s highest annual revenues to date. What were they?

A) $59 billion

B) $18 billion

C) $124 billion

D) $41 billion

(answers at bottom)

Joke Of The Day

I told my wife I got lost in her eyes. But I also get lost in most department stores, so I wouldn't read too much into it.

Trivia Answers

B) Goldman was founded in 1869.

D) The firm went public in 1999.

A) 2021 revenue was $59 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.