The 'Other' Chip Stocks & Is The Stock Market Actually Expensive?

"There are two classes of forecasters: those who don’t know, and those who don’t know they don’t know"

- John Kenneth Galbraith

"All this from a slice of gabagool?"

- Tony Soprano

Dear Reader,

Have a wonderful holiday season and a very Merry Christmas. And if you are in the giving spirit, the best gift of all for me would be to share StreetSmarts with someone who might enjoy it.

Wishing you and yours all the best,

- Ryan

Street Stories

The ‘Other’ Chip Stocks

Along with the US election and sticky inflation, AI and Chip stock euphoria has been one of the biggest themes of the year. But while we’ve been distracted elsewhere in recent months, things have turned pretty sour for all but a select few of the big semiconductor companies.

In fact, only three of the big chip names (Nvidia obviously, Broadcom and TSMC) are actually beating the S&P 500.

As you can see above, this wasn’t always the case - in fact at one point or another, all but Global Foundries and Intel were massively beating the index earlier in the year.

Just before the June sell-off, the average of this group was +30% on the year. But while the market quickly recovered in a few weeks, these companies continued to languish.

The lot of this has come from a bifurcation in investor preferences, as AI and data center exposure continues to reign, while the ‘other’ bucket - such as Qualcomm’s exposure to smartphones and automotive - has failed to impress.

Having said that, it’s not exactly like these ‘other’ markets are sinking. As you can see below, most of these players have seen double-digit revenue growth over the past year. It’s really only Texas Instruments that wet the bed.

One thing holding back share performance, however, has undoubtedly been valuation. While the growth prospects continue to impress, even the lowliest, non-‘datacenter’ chip players trade at healthy valuations.

And if you can explain why TI trades at a 33x P/E, you’re a smarter person than I.

So while the ‘other’ bucket will continue to post strong growth and innovate, in this market it might be too much to assume that they can impress investors still riding the AI hype trade.

Or, it could be a dip worth buying. 🫠

‘What We Need Is More Crypto Leverage’

Defiance ETFs has launched a 2.0x levered ETF with the shares of crypto piggybank/arbitrage anomaly Microstrategy as the underlier.

We are truly in the end game now.

[I did a neat explainer on how Microstrategy has been printing money a few weeks back in case you missed it: Link]

The P/E Problem: Index Math vs. Stock Reality

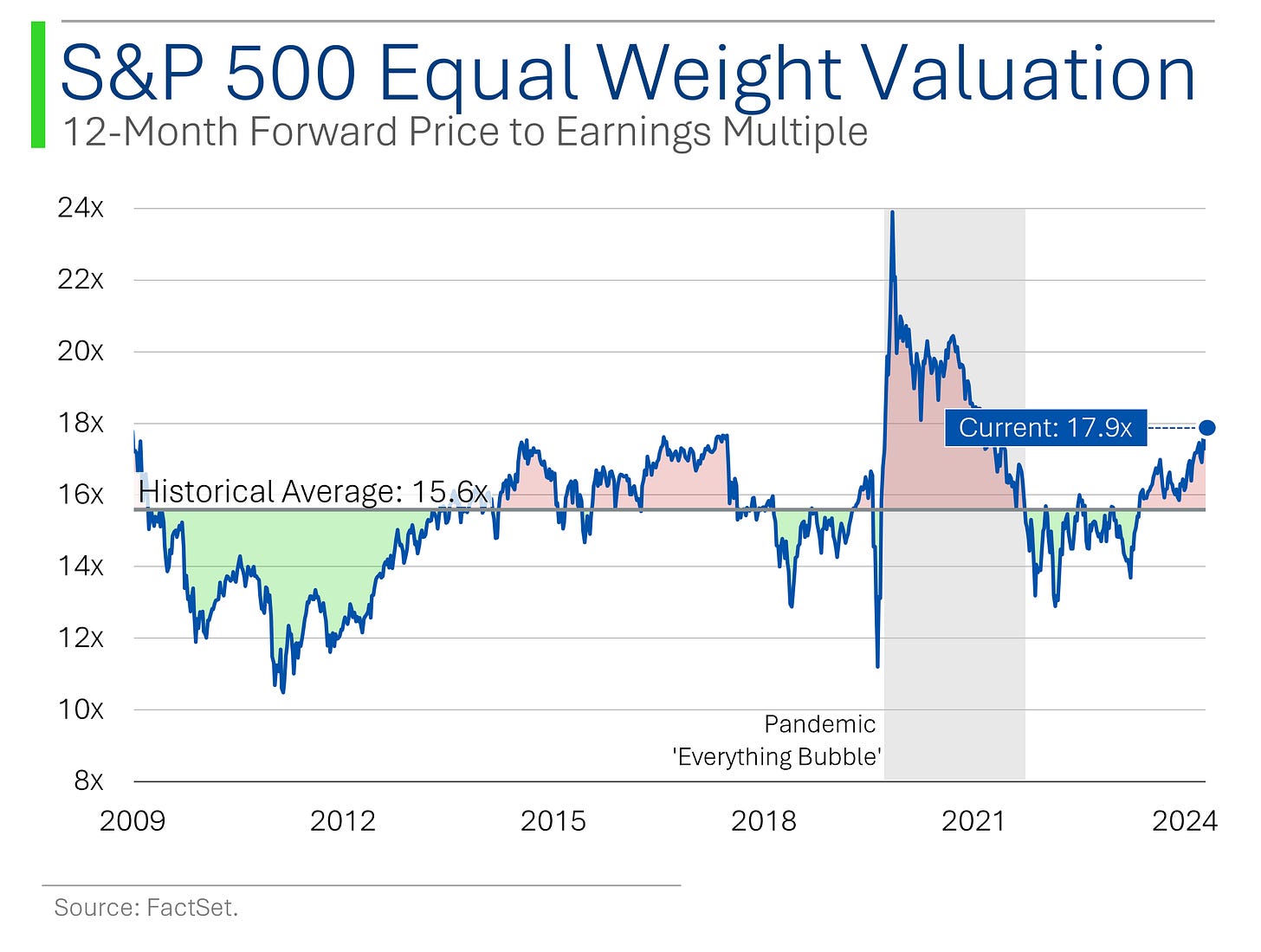

The S&P 500 is trading at a record valuation only seen this millennia in the DotCom bubble and the Pandemic’s ‘Everything Bubble’.

In the latter’s case, that had a lot to do with the denominator (earnings) shrinking. And right now, we don’t really have that excuse.

While that is obviously concerning (buying at the top isn’t a good investment strategy), there is some nuance that I think needs to be addressed: The index is increasingly top heavy, so the biggest companies - which also happen to be ones trading at steep multiples - add a level of bias to this whole way of looking at the market.

Looking at the S&P 500 Equal Weight Index, it’s actually only trading a smidge higher than its average over the last 15 years. Much less discouraging.

I dug in a bit further and compiled a list of the S&P 500 companies’ current forward P/E multiple and compared it to their ten year historical average (caveats: not all companies are included because some didn’t have market data that far back and some had silly multiples that distorted the data - like Boeing currently trading at a P/E of 1,907x).

Turns out that 45% (ie: nearly half) of companies in the S&P 500 are actually trading at multiples below their ten year average.

Now obviously this isn’t a perfect way to look at the world. For example, Netflix ten years ago was a super growth company trading at 77x but now trades at a ‘modest’ 39x, so it’s not exactly a the most representative (something like Survivorship Bias mixed with tapering earnings growth).

The point I’m trying to get at is that, while in aggregate the market ain’t exactly on the discount rack, for stock pickers there’s certainly plenty of great companies out there that aren’t trading at Birkin Bag valuations.🌈

Joke Of The Day

Nothing is foolproof to a sufficiently talented fool.

Macro Update

PCE Inflation (Friday)

November core and headline PCE rose 0.1% m/m, below the 0.2% consensus, with annualized core PCE at 2.8% (vs. 2.9% consensus) and headline at 2.4% (vs. 2.5% consensus).

Personal income grew 0.3% m/m, slightly missing the 0.4% expectation, while personal spending rose 0.4% m/m in line with October's increase but below the 0.5% forecast.

uMichigan Consumer Sentiment (Friday)

Final December UMich consumer sentiment hit 74.0, slightly below the 74.3 consensus, with a rise in the Current Economic Conditions Index (+11.2 points to 75.1) offset by a decline in the Consumer Expectations Index (-3.6 points to 73.3).

Inflation expectations eased, with one-year at 2.8% and five-year at 3.0%, signaling optimism about economic improvement and slowing inflation.

Fed Funds Rate (Wednesday)

The FOMC reduced the Fed funds rate by 25bps to 4.25%-4.50% as expected, with updated projections now forecasting a higher median year-end 2025 rate of 3.875%.

Powell emphasized caution in rate reductions given economic resilience, with futures now pricing only two 2025 cuts.

U.S. Housing Starts (Wednesday)

November housing starts fell 1.8% m/m to 1.289M SAAR, missing the 1.350M estimate, driven by a sharp drop in multiunit starts (-24.1% m/m).

However, permits rose 6.1% m/m to 1.505M SAAR, beating consensus, and builder sentiment remained mixed, with future sales expectations hitting a three-year high.

Trivia

Today’s trivia is on Nike.

When was Nike, Inc. originally founded?

A) 1971

B) 1954

C) 1964

D) 1980What was Nike's original name?

A) Mountain Footwear

B) Blue Ribbon Sports

C) Victory Sports

D) Athlete's FootWhat was the initial payment for the creation of the Nike Swoosh logo?

A) $35,000

B) $35

C) $350

D) $3,500What were Nike’s sales in fiscal 2023?

A) $7.1 billion

B) $51.2 billion

C) $104.8 billion

D) $87.4 billionWhat are Michael Jordan’s estimated earnings from the Jordan brand in 2024?

A) $20 millionB) $55 million

C) $164 millionD) $349 million

(answers at bottom)

This Week In History

Boston Tea Party (Dec. 16, 1773): American colonists, protesting the British Tea Act, boarded ships in Boston Harbor and dumped 342 chests of tea overboard. This act of defiance escalated tensions leading to the American Revolutionary War.

Wright Brothers' First Flight (Dec. 17, 1903): Orville and Wilbur Wright achieved the first powered, controlled airplane flight in Kitty Hawk, North Carolina. This event marked the dawn of modern aviation.

Apollo 17 Returns to Earth (Dec. 19, 1972): NASA's final Apollo moon mission safely returned, concluding the era of manned lunar exploration.

Market Update

Market Movers

Friday

BB (BlackBerry) [+23.8%]: Beat Q3 earnings and revenue estimates, showed strong IoT growth, and raised FY25 guidance midpoints despite light Q4 guidance.

LLY (Eli Lilly) [+1.4%]: Rose after competitor Novo Nordisk’s weight-loss drug underperformed expectations.

X (United States Steel) [-5%]: Gave weak Q4 EPS guidance as steel prices stayed low and Europe demand remained soft.

Thursday

TRIP (TripAdvisor) [+7.3%]: Announced a merger with Liberty TripAdvisor (LTRPA) in a $435M deal approved by both boards.

PLTR (Palantir Technologies) [+3.8%]: Secured a $619M AI contract extension with the U.S. Army.

MU (Micron Technology) [-16.2%]: Fell after Q1 results matched estimates but future guidance disappointed due to NAND oversupply and demand slowdown.

Wednesday

NSANY (Nissan Motor) [+17.1%]: Confirmed collaboration talks with Honda amid merger speculation in media reports.

RIVN (Rivian) [-11.2%]: Dropped after a downgrade, citing weaker EV demand and limited catalysts for 2025.

Tuesday

QUBT (Quantum Computing) [+51.5%]: Skyrocketed after winning a NASA contract for advanced radar data processing.

Monday

TSLA (Tesla) [+6.1%]: Gained as Wedbush raised its price target, citing AI opportunities and upcoming product launches like Cybertruck.

SMCI (Super Micro Computer) [-8.3%]: Declined on news it might raise equity and debt to bolster finances.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

C) Nike was founded in 1964.

B) Nike’s original name was Blue Ribbon Sports.

B) Nike paid $35 for the famous ‘Swoosh’ design.

B) 2023 revenues were $51.2 billion.

D) Jordan is estimated to have made $349 million in 2024 from the Jordan brand. Insane. In his 16 year playing career he only made $94 million.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Nicely done!