🔬 The Market Chickens Out Ahead of Nvidia's Q4 Today

Plus: global inflation update; $LUNR shares go into orbit; hacker group LockBit...gets hacked, and much more.

"Successful investing requires a rare combination of just the right amount of arrogance and humility to imagine that you can see the future and the wherewithal to admit when you have made a mistake"

- Howard Marks

"I'm not a businessman—I'm a business, man"

- Jay-Z

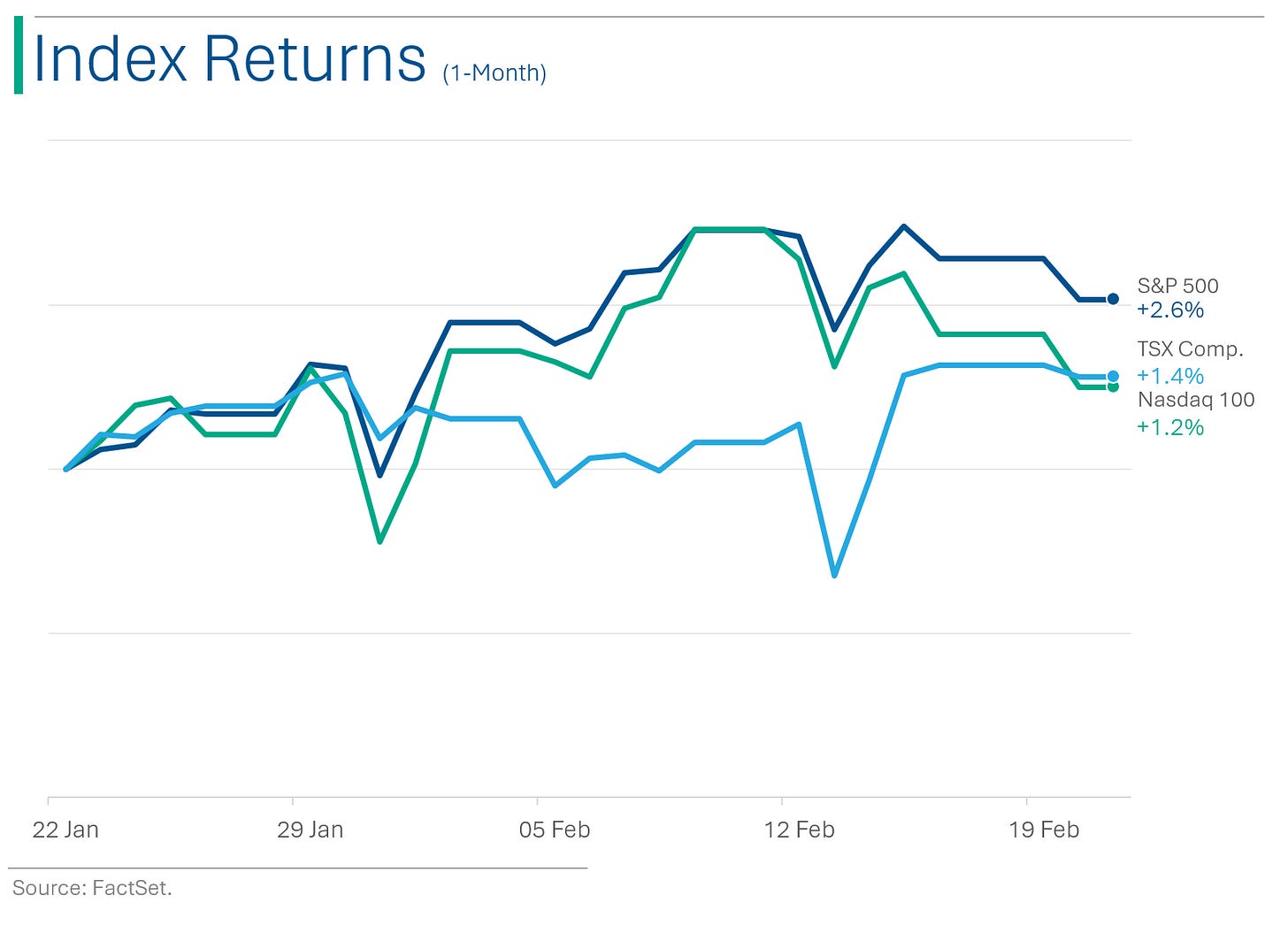

Sucky day for the big US markets with S&P 500 -0.6% and the Nasdaq -0.9%. Some cooling off possibly carried over from last week’s hot inflation print but mostly due to the much hyped Nvidia Q4 release coming out today after close.

Only 1 of the 11 sector closed up and it was defensive Consumer Staples (+1.1%), which makes sense given the shakiness out there.

The winners today were pretty much tied to M&A (Vizio +16.3%, Discover Financial +12.6%) or CHIPS Act subsidies (Intel +2.3%; GlobalFoundries +2.1%). (more on this in ‘Market Movers’ below)

Walmart (+3.2%) reported a strong quarter with beats on Revenue and EPS, and positive revenue guidance.

Street Stories

Nvidia Reports Today (and the Market is Nervous)

Nvidia shares took a bit of a nosedive in yesterday’s trading (-4.4%) ahead of its Q4 reporting today after market close. I can’t recall a more significant or hype-laden earnings release in recent memory as, not only is so much baked into the growth story, but potentially a lot of market euphoria is contingent upon the biggest growth story in a decade continuing to produce. Can’t blame some folks for chickening out at the wire.

Wall Street is estimating a full-year revenue number of ~$59.3 billion, which represents a massive leap from last year’s $27.0 billion figure.

Even crazier is the EPS estimate, which is expected to clock in at $12.39 - a whopping 611% increase over last year. With such gargantuan growth bogeys at play, no wonder everyone on the Street is holding their breath, as a bad print here will have ripples across the market.

In sorta related news, I think we can officially give Nvidia the new crown as the most actively traded stock in the world, ceasing the title from retail favourite Tesla, which has held it for the last few years.

$LUNR Shares Go Interplanetary

Shares of lunar lander company Intuitive Machines went parabolic over the last few days as the company’s first attempt to land on the moon enters its final stage. The company’s Odysseus lander, which hitched a ride on a SpaceX rocket, entered the moon’s lunar orbit last night. More than a nice science project, this is a for-profit enterprise with a payload of 12 government and commercial pieces of equipment, six of which are under a $118 million NASA contract.

The deal is part of NASA’s Commercial Lunar Payload Services initiative, a program to use low-cost private spacecraft and equipment to ship to the moon as part of the upcoming Artemis crewed program to the moon. And Intuitive isn’t the only name in the game; recall that last month I wrote about Astrobotics’ failed lunar mission that ended up with the craft breaking up over the South Pacific.

While the concept is pretty cool, one can’t help but think of it as a bit of a meme-stock at this point. While the shares are only up a modest 10% from their SPAC opening on the Nasdaq, the ride has been bumpy with the stock briefly up +1,000% before trading down to $2.11 before the recent build-up. Yeehaw!

Global Inflation

Canada reported its Consumer Price Index (CPI) for January yesterday, with a +2.9% Year-Over-Year figure that came in surprisingly below the Street’s estimate for +3.3%, versus +3.4% in December. While a pleasant surprise for my fellow Hosers, it must be said that the large declines experienced in 2023 seem to have mellowed across the West - with only Italy really able to crack the 2% inflation rate bogey (and that at the expense of a stagnating economy).

“We Have Hacked The Hackers”

Those were the words of Graeme Biggar, Director General of the UK’s National Crime Agency (NCA) in a press conference announcing the success of a global collaboration with the FBI, Europol, and an international law enforcement coalition, that seized control of the ransomware group LockBit's command and control infrastructure, leading to four arrests. LockBit has been the most prominent global hacker organization in recent memory, with significant attacks on several well known institutions and soliciting hundreds of millions in ransom payments.

The operation disrupted LockBit's operations by taking over its website and primary administrative environment, seizing its source code, and obtaining decryption keys to help victims. Authorities also froze over 200 cryptocurrency accounts linked to the group and recovered data from victims who had paid ransoms, debunking LockBit's promise to delete such data after payment. The effort represents a significant blow to LockBit, a group known for its "ransomware as a service" model for extorting businesses and individuals worldwide. Punks.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

China's stock market is down again. We should have seen it coming. The red flags were everywhere.

Hot Headlines

Reuters | The Conference Board’s monthly index of leading economic indicators fell for the 23rd straight month. Just one month shy of the record set during the Financial Crisis. The good news? It no longer forecasts a US recession in 2024.

CNBC | Adobe launches AI assistant that can search and summarize PDFs. Yes, officially everyone has an AI assistant now.

Axios | NYT plans to debut new generative AI ad tool later this year. Oops, nm, missed one.

CNBC | FuboTV sues Disney, Fox, Warner Bros. over sports joint venture. Suit cited what it calls “extreme suppression of competition in the U.S. sports-focused streaming market.”

Bloomberg | Ford slashes price of electric Mustang Mach-E after sales plunge. Price cuts of up to $8,100 after its sales tumbled 51% in January when the automaker had to stop offering tax incentives on the plug-in model. I’m sure the fact that it’s ugly had nothing to do with it.

Trivia

This week’s trivia is on the great financial dynasties. Today’s is on the Rothchilds.

The Rothschild banking dynasty originated from which country?

A) France

B) Germany

C) United Kingdom

D) ItalyWhat unique method did the Rothschilds use in the 19th century to communicate rapidly across Europe?

A) Smoke signals

B) Carrier pigeons

C) Semaphore lines

D) TelegraphIn what year did Nathan Mayer Rothschild allegedly use advanced knowledge of Napoleon's defeat at Waterloo to make a fortune on the stock market?

A) 1805

B) 1815

C) 1825

D) 1835In which century did the Rothschild banking dynasty begin to rise to prominence?

A) 16th Century

B) 17th Century

C) 18th Century

D) 19th Century

(answers at bottom)

Market Movers

Winners!

Vizio Holding (VZIO) [+16.3%]: Acquired by Walmart for about $2.3B in cash, at $11.50/share, a 21% premium to Friday's close. Media hinted at ongoing talks since 13-Feb.

Discover Financial (DFS) [+12.6%]: Capital One to acquire in an all-stock deal worth $35.3B, a 26.6% premium over Friday's closing. Deal expected to finalize by late 2024 or early 2025.

Walmart (WMT) [+3.2%]: Q4 results showed US comp growth, sales, GMs, and EPS above expectations; FY guidance seen as positive. Comp growth was driven by a 4.3% increase in transactions, offset by a slight decline in average ticket.

General Mills (GIS) [+2.6%]: Reaffirmed FY24 forecasts for organic net sales, adjusted operating profit, and free cash flow conversion.

Intel (INTC) [+2.3%]: Reported to be in discussions for over $10B in CHIPS Act subsidies, including loans and grants, according to Bloomberg.

GlobalFoundries (GFS) [+2.1%]: Set to receive around $1.5B in CHIPS Act funding to expand its Malta, NY fab and upgrade a Vermont fab.

Losers!

Fluor (FLR) [-12.8%]: Q4 EPS exceeded expectations, but revenue fell short, with FY24 earnings guidance slightly below consensus. Revenue miss attributed to weakness in Energy Solutions, though new bookings in Urban Solutions and operating cash flow were positives.

Enpro, Inc. (NPO) [-8.7%]: Q4 EPS and revenue underperformed due to soft Sealing sales and weak margins in Advanced Surface Technologies. FY24 revenue growth outlook disappointing, with noted softness in AST and weaker than expected margins.

Westlake (WLK) [-7.9%]: Q4 EPS, EBITDA, and revenue below expectations. Performance, Essential Materials segment ASPs fell 8% in Q4, sales volumes down 4% quarter-over-quarter. Despite management's optimism, analysts remain cautious about competitive pressures and price challenges.

Expeditors International (EXPD) [-6.9%]: Q4 earnings and revenue slightly missed, with Ocean Freight and Customs Brokerage segments showing weakness. Highlighted shipping uncertainties in the Mideast/Red Sea and noted high expenses.

Caterpillar (CAT) [-2.5%]: Downgraded to in line from outperform by Evercore ISI, citing a neutral outlook on the industrial sector and limited growth potential for the company's stock.

Market Update

Trivia Answers

B) The dynasty started in Germany.

B) Carrier pigeons were used by the bank to transport news and financial information.

B) Napoleon’s defeat was in 1815.

C) The family came into international prominence in the 18th Century.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.