🔬The Magnificent 7 Continue to Pull the Market Up

Plus: China's efforts to prop up ailing equity markets continue with 200 companies vowing share buybacks; Cocoa hits all-time high on weak crops and Red Sea mess; and IPOs just might be cool again.

"The four most expensive words in the English language are, 'This time it’s different'"

- Sir John Templeton

“Money and women are the most sought after and the least known about of any two things we have”

- Will Rogers

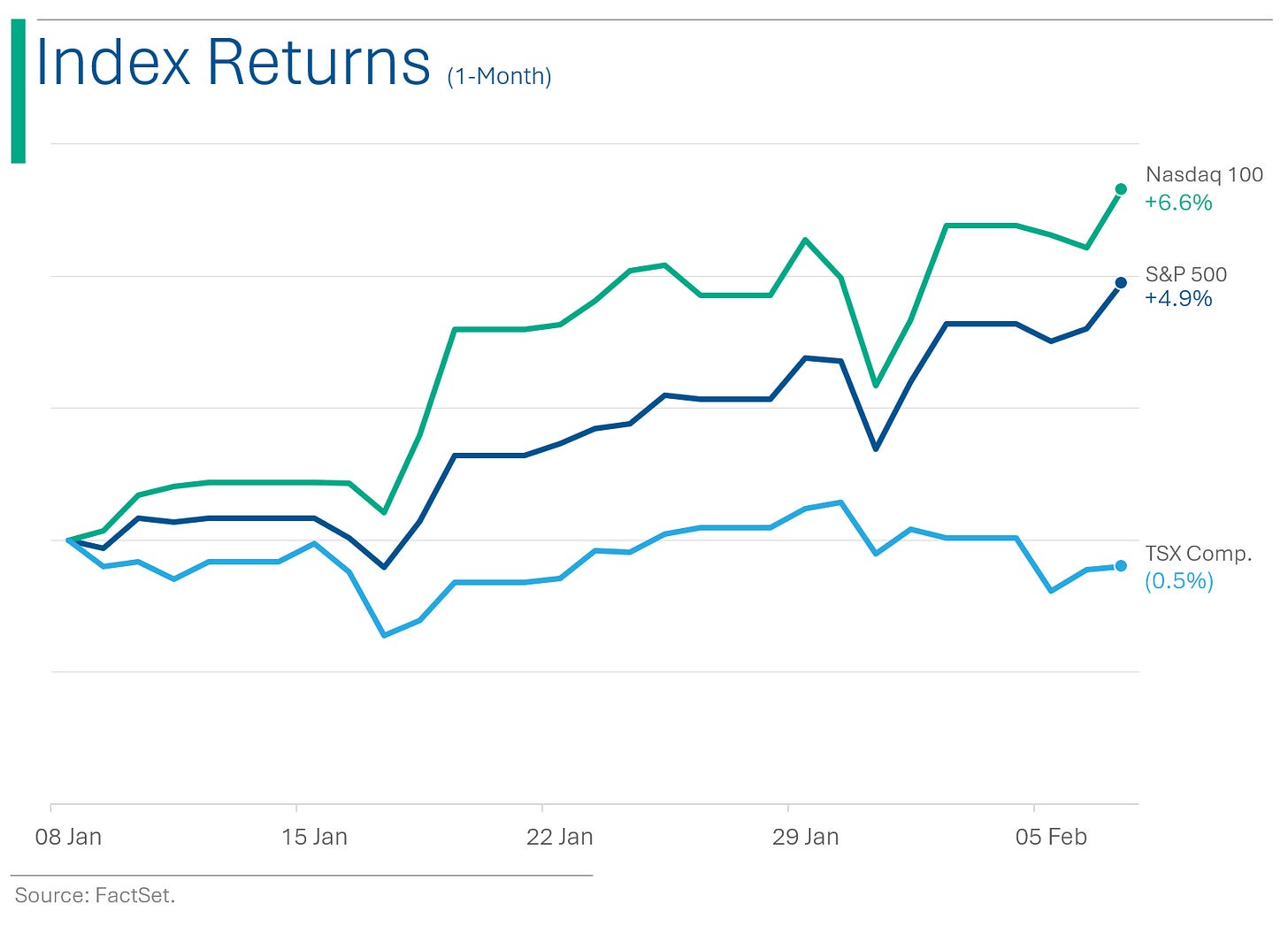

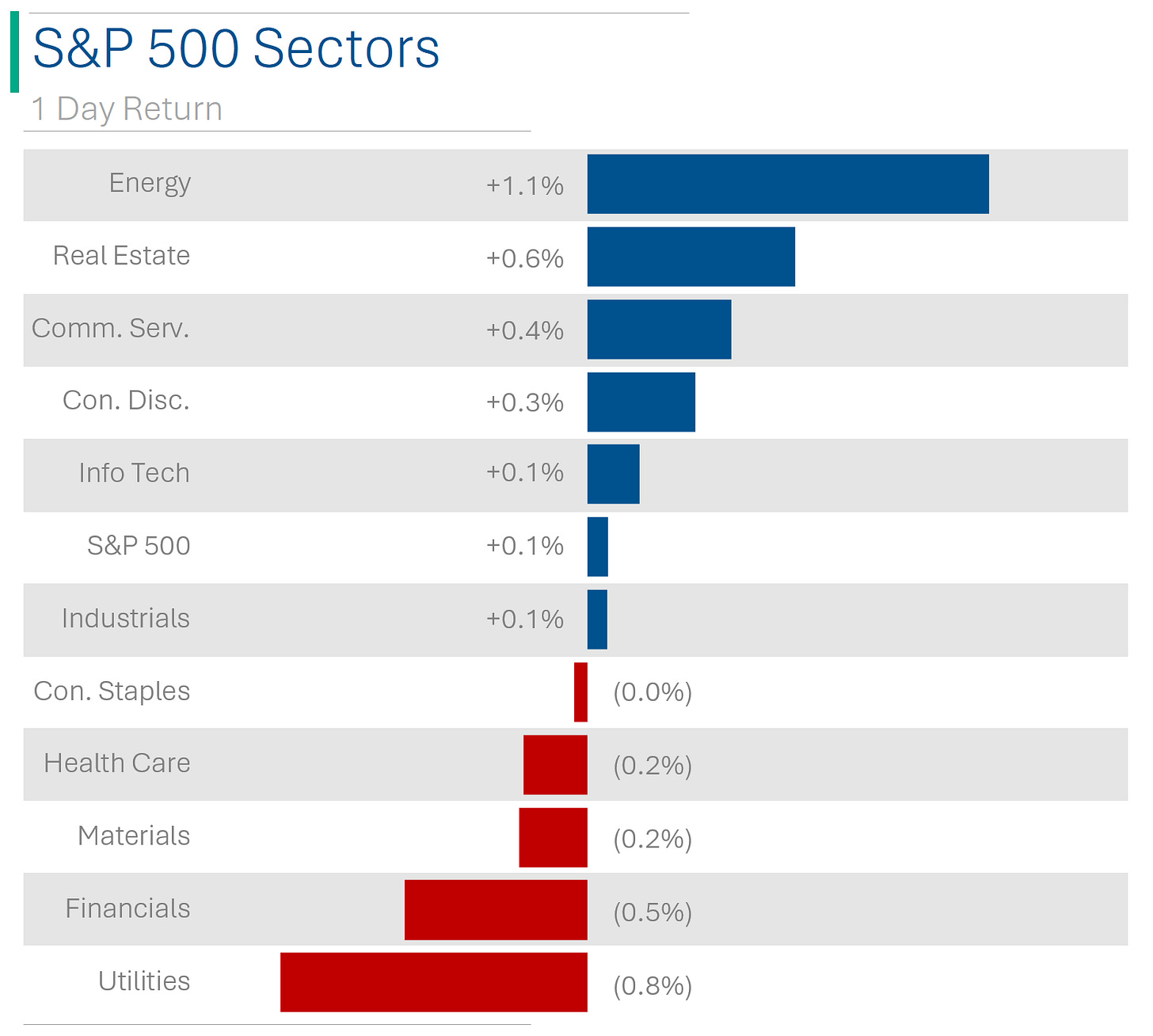

The big US markets closed slightly up (S&P 500 +0.06%, Nasdaq +0.24%) but not enough for the S&P to close above the 5k mark for the first time (4,997.91).

6 of 11 sectors were up with Energy leading the way (+1.1%) and Utilities (-0.8%) on the bottom shelf.

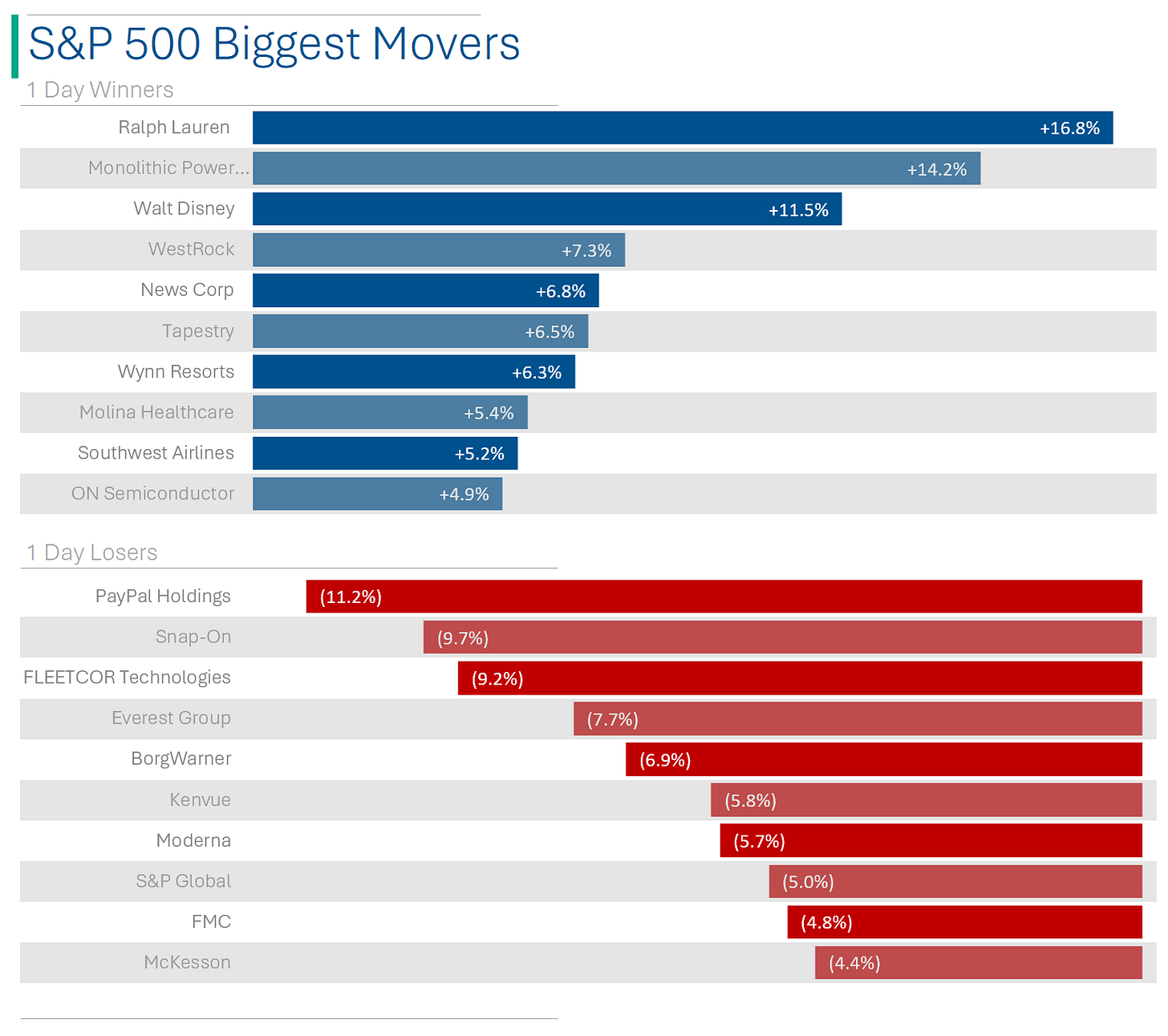

Another big day for earnings, with chip IP company ARM (+47.9%) the standout after fiscal Q3 revenue came in 8% ahead of the Street and Q4 guide that was 13% above where estimates sat. PayPal sucked (-11%), while Ralph Lauren (+16.8%), Disney (+11.5%) and News Corp (+6.5%) did not. More in ‘Market Movers’ below.

Pause for chocolate inflation as cocoa hits all-time high, while weekly initial jobless claims came in at 218k, better than consensus of 220k.

Street Stories

Magnificent 7 Continue to… Magnificate(?)

The big story of 2023 doesn’t seem to be losing steam as five of the seven have continued to outpace the broader market; some of them magnificently. With the S&P 500 up 4.8% so far this year (a great start), much of that has been the result of the big fellas continuing to pull the market up with them.

Perhaps a more succinct way to look at things, is to note that so far the Mag7 have added $1.0 trillion worth of market value this year. The other 493 companies? Well, they only added $917bn.

While some of that might just be market hype, tied to things like the US economy’s ‘soft landing’, much of it (if you can believe Wall Street analysts) is tied to continued strength as expectations for growth build. Sure, the Street can be fickle but upgrades have, for the most part (I’m lookin at you Tesla), been tied to things like positive financial guidance, cost cutting efforts and, in the case of Meta, a shiny new dividend.

For example, in just the month and a bit of 2024 we’ve seen, analysts have raised their 2024 earnings per share target for Amazon by 12.2% and 11.8% for Meta. Tesla has really been the only laggard here, as a soft EV outlook and potential supply chain issues (thanks Houthis!) have slashed Musk + Co.’s forecast.

Bitter Harvest: Climate and Conflict Stirring the Cocoa Pot

Cocoa prices have surged to a record high of $5,611 on the Intercontinental Exchange in New York, driven by disruptive weather conditions, including El Niño, and rising freight costs, with significant production in Ivory Coast and Ghana being heavily impacted. The Red Sea crisis has emerged as a new factor, further driving up freight rates and exacerbating already high cocoa prices. This spike in cocoa costs is affecting candy producers like Hershey, which has reported flat sales, warned of limited earnings growth due to these historic price levels, and announced a $300 million cost cutting program - mostly from layoffs.

Stock Shock Therapy: China's Corporate Crusade for Market Mojo

In the latest chapter of China trying to manipulate intervene in the plight of domestic stocks, over 200 companies listed on mainland China's stock exchanges have responded to the government's ‘initiative’ to support the stock market and economy by announcing plans for share buybacks and increasing stakeholder holdings, aiming to improve corporate quality and efficiency, and emphasize shareholder returns.

These actions, which gained momentum after Premier Li's speech on January 22, follow the short selling bans and efforts by Chinese State-Owned Enterprises (SOEs) to buy Chinese ETFs to support stock prices after $7 trillion in market cap evaporated (I got into this on Wednesday with ‘Shanghai Shuffle’). This collective move has sparked a market rebound, attracting foreign investors as net buyers, though the sustainability of this recovery is uncertain amidst ongoing economic challenges.

Are IPOs Back?

If you’re a long-time reader of StreetSmarts, you’d be aware of my negativity towards companies trying to go public of late. The ex-investment banker in me felt like conditions weren’t solid enough, and the ones that did attempt an IPO didn’t fare too well (I’m oddly proud I coined the phrase ‘Birken-flop’). And I blame a lot of bonus-hungry bankers for using voodoo on CEOs to get them to come to market. That said, I’m starting to change my tone. While I do hold some concerns that the market may be overbought, that is usually a good time to IPO. Investor appetite seems to be strong and a generally rosy outlook for the economy only adds to that.

Which (sorry for the delay) brings me to Kyverna, a decent enough gene-therapy play in immunology. The deal priced at $22 but - importantly - this was actually an increase from the $17-$19 price their bankers pitched in the pre-IPO roadshow (+22% from the mid-point is material). Last year we saw the opposite, which is a sign of weak investor demand, as companies ended up pricing lower than what they shopped the Street for or from where their latest venture funded rounds were priced. Also, a +36% pop in IPO is also a good indicator too (I guess). This compares to the big IPOs last year, which saw their shares generally trade down after launch.

Ryan Explains IPO Pricing: When companies decide to come to market, their investment bankers build nice financial models and Powerpoints (‘pitch decks’) to show groups of investors. Usually this is a multi-day process and involves dozens of meetings, with New York, Boston, LA, Toronto, and London being the most common stops for US-listings. They inform the potential investors of the price range that they think they can IPO at and, following the meetings, interested parties can submit bids to the bank (typically through the Equity Capital Markets team) of how much stock they would be interested in and at what price. This typically isn’t just one price but tiered. For example, I’ll take 4m shares at $25, 2m shares at $27, 1m shares at $28, and at $29 you can GFY. This is the ‘book building’ process.

A good IPO will be several times ‘oversubscribed’, meaning there is more demand at a given price than there are shares available. This helps provide support for the price after the IPO - and is also a nice way to help a bank’s top clients make some money. This ‘art more than science’ is often a bit nuanced, and can get legally murky, but that’s a whole ‘nother write up. The punch line is that if ‘retail investors’ are able to get an IPO allocation, that usually means the deal is a dud. For a bit more detail, check out what an over-allotment option for the banks is.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Stockbroker: What is a million years like to you?

God: Like one second.

Stockbroker: What is a million dollars like to you?

God: Like one penny.

Stockbroker: Can I have a penny?

God: Just a second…

Hot Headlines

Reuters | Google rebrands Bard chatbot as Gemini, rolls out $20 subscription. Subscribers will receive two terabytes of cloud storage that typically cost $9.99 monthly, and they will soon gain access to Gemini in Gmail and Google's productivity suite. Yeah, Bard sounded pretty lame.

Ars Technica | Disney invests $1.5B in Epic Games, plans new “games and entertainment universe”. Deal only represents a minority stake, likely in the 7% range.

CNN | FCC votes to ban scam robocalls that use AI-generated voices. Ban? Burn them. Burn them all.

Tech Crunch | GM hires ex-Tesla battery guru Kurt Kelty to beef up its battery efforts. In case you were wondering ‘Vice President of Batteries’ is a real job now.

Investing.com | JP Morgan predicts stocks will fall 20-30% from a 2024 peak. Buzzkills.

NBC News | Snoop Dogg is suing Post and Walmart after his cereal - cleverly named ‘Snoop Cereal’ - failed to generate sales. Lawsuit alleges that the innovative "Fruity Hoops with Marshmallows”, “Frosted Drizzlers” and “Cinnamon Toasteez” were intentionally hidden in stockrooms to depress sales.

Trivia

This week’s trivia is on Investing 101.

In finance, liquidity refers to:

A) The ease of converting assets to cash

B) The amount of liquid in a company's water cooler

C) The duration of investment assets

D) The change in net operating cash flow of a businessThe Capital Asset Pricing Model (CAPM) is used to:

A) Determine yield on a bond or annuity

B) Calculate expected return on an investment based on its risk

C) Price capital goods

D) Model the capital of a city

'Systemic Risk' refers to:

A) The risk that computer and technology failures pose to financial markets

B) The risk of collapse of an company, market or financial system

C) The risk associated with a particular operating system

D) The undiversifiable investment risk associated with the market

(answers at bottom)

Market Movers

Winners!

Arm Holdings (ARM) [+47.9%]: Fiscal Q3 revenue 8% ahead, Q4 guide 13% above consensus. Strength noted in royalties and licensing, with licensing boosted by AI adoption. Royalty growth from semi end-market/smartphone recovery, gains in Auto and Cloud, and swift transition to v9 chips.

Confluent (CFLT) [+34.1%]: Q4 earnings, revenue, and margins exceeded expectations, FCF well above consensus. FY24 revenue forecast surpasses expectations, driven by healthy customer trends and large-customer growth, rebounding from Q3 customer issues.

Ralph Lauren (RL) [+16.8%]: FQ3 EPS and revenue outperformed with strong holiday sales. Global inventories down 15% y/y. FY24 margins and revenue growth to expand, with capex below expectations.

Walt Disney (DIS) [+11.5%]: Q1 EBIT and EPS above expectations despite slightly light revenues. Focus on cost-savings, DTC loss reduction, and reiterated DTC profitability in Q4. FY24 EPS growth guidance of 20%+ with enhanced capital return.

News Corp. (NWSA) [+6.5%]: FQ2 EPS, EBITDA, and revenue beat expectations. Subs up 10% y/y, cost reductions including headcount lead to $3M savings. Potential for additional revenue from generative AI and licensing.

Wynn Resorts (WYNN) [+6.3%]: Q4 EBITDAR, revenue, and EPS beat estimates. Macau and Las Vegas results ahead of expectations, driven by China demand and Las Vegas F1 event. Strong 2024 Vegas event schedule anticipated to drive further upside.

Losers!

PayPal (PYPL) [-11.2%]: Q4 EPS and revenue exceeded forecasts, but Q1 and full-year guidance fell short. Slowing payment volume growth and weak transaction margin outlook noted. 2024 seen as a transition year with consistent consumer spending levels expected.

FLEETCOR Technologies (FLT) [-9.2%]: Missed Q4 earnings and revenue due to weak Lodging results and softness in workforce customers. Shift to higher-credit clients cut late fee revenue. Q1 and FY24 guidance below expectations, despite a $1B buyback boost.

BorgWarner (BWA) [-7.0%]: Q4 EBIT fell short due to weaker sales and margins. 2024 outlook underwhelms, with concerns over softer production and impacts from slower BEV transition and Eldor acquisition.

Kenvue (KVUE) [-5.8%]: Better Q4 earnings but disappointing revenue. Challenges include lower volumes from inventory reductions, tough comparisons, and weaker US Skin and Beauty, alongside ongoing China issues. FY24 EPS guidance below expectations.

S&P Global (SPGI) [-5.0%]: Q4 earnings below par, though revenue was stronger. FY24 EPS and revenue growth forecasts slightly conservative. Planned $500M accelerated buyback, with caution advised on Ratings performance and margins.

Market Update

Trivia Answers

A) Liquidity is the ease of converting assets to cash.

B) CAPM calculates expected return on an investment based on its risk (using Beta as the risk input).

B) Systemic Risk is the risk of collapse of a company, market or financial system. If you picked D, that’s ‘systematic risk’. muahaha

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.