🔬The Historical Duration of Peak Interest Rates

Plus: Tesla shares go up on s***** quarter (huh?); Copper is headed to the moon; PMIs are icky; and much more

"Time is your friend; impulse is your enemy."

- John Bogle

“Laugh it up, fuzzball!”

- Han Solo

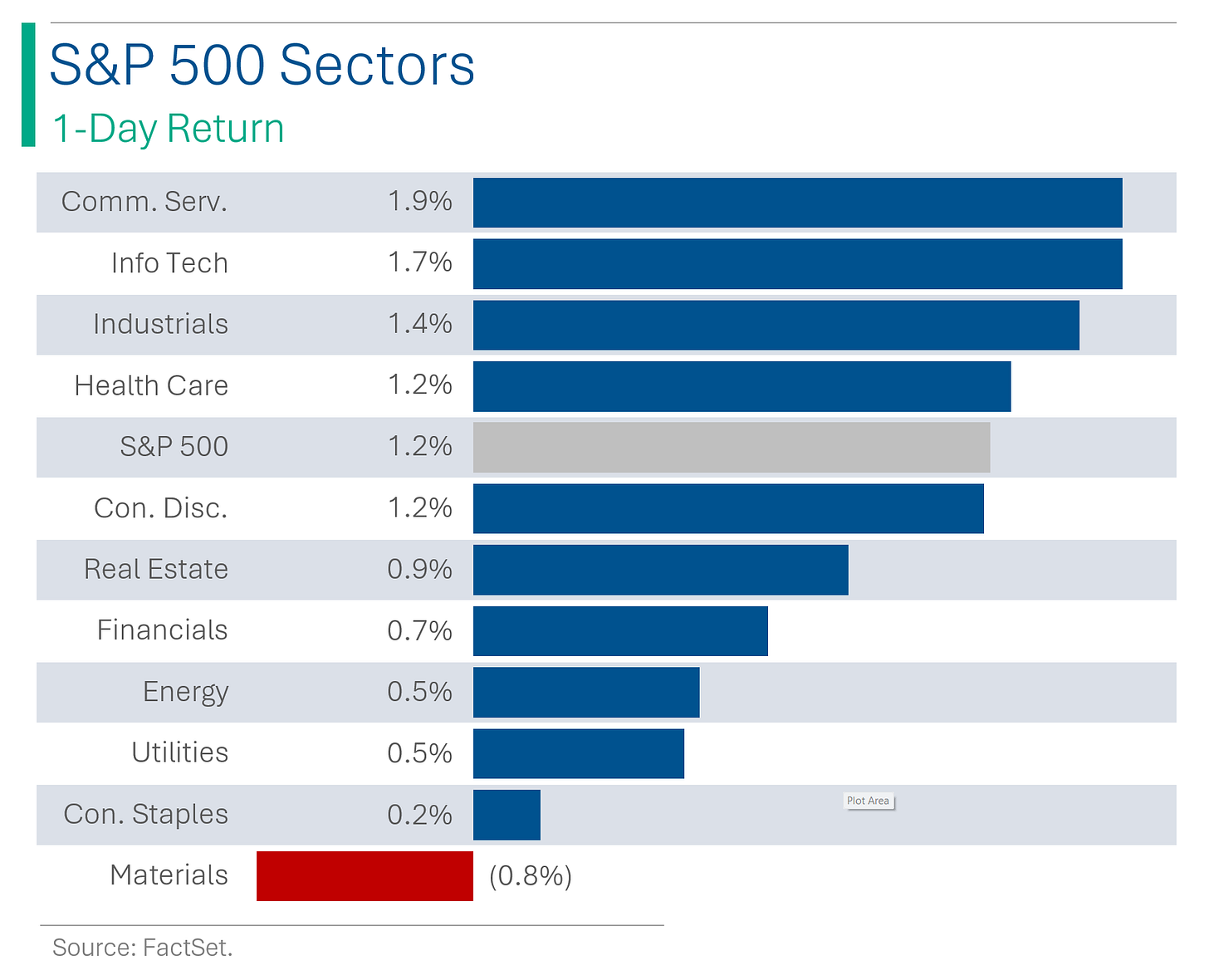

Strong day for the big US markets (S&P 500 +1.2%, Nasdaq +1.6%) as mixed earnings (and there was a ton of them) weren’t enough to derail the rally. That said, it was probably more of a ‘good news, is bad news’ as soft Flash PMI (more below) hinted at a modest slowing of growth, and thus inflation.

10 of 11 sectors closed higher, led by techy Communication Services (+1.9%) and (actual) Tech (+1.7%) following implosions last week. Materials (-0.8%) was the only sector in the red.

Street Stories

Peak Interest Rates

Starting in the mid-'90s, the Fed has been much less active in their use of Monetary Policy. This has in part been driven by a much more sobered inflationary environment, whereby policy directives have been moreso focused on stimulating the economy rather than combating transient bouts of inflation.

One measure of this is the duration at which the Fed has left rates at their peak before cutting. In the ‘70s and ‘80, these were generally for short periods but in recent memory have lasted much longer. For example, since 1971 the average duration of ‘peak rates’ has been 112 days. Since the mid-'90s this has grown to 322 days.

From a macro perspective, the biggest news of the year has been the persistent pushing back of rate cut expectations. At the end of December, odds of a March cut were nearly ~75%. Now the market is only pricing in a ~46% chance of one or more cuts by the July meeting.

I mention this since the last rate hike took place on July 26th, 2023 and the Fed’s July meeting will occur nearly a year later (July 30th-31st).

To us, it may seem like it was long coming. But in truth, that’s little more than the average duration since the ‘90s (371 vs. 322 average).

That said, it is still quite reasonable to gripe about the current situation (my mortgage is variable, after all). This time last year, expectations were for interest rates to be around 3.4% by the Fed’s June 2024 meeting. Clearly that has zero chance of happening.

For rates to drop, we either need to see the economy take a nosedive or see inflation cool off. For the latter, presently that doesn’t seem to be the case. As for the former, March GDP comes out on Thursday.

Tesla’s Icky Quarter

Tesla already announced vehicle deliveries data on April 3rd, so we knew it wasn’t going to be a pretty quarter (I made fun of it here) but the results were still a mess.

The company reported a significant 9% drop in first-quarter revenue, marking its largest decline since 2012, as it navigated the impacts of continued price reductions, softening demand and increased Chinese competition.

Deets:

- EPS: $0.45 vs. Wall Street estimate of $0.50 [9.1% MISS]

- Revenue: $21.3 billion vs. Wall Street estimate of $22.3 billion [4.3% MISS]

Musk tried to divert attention to the lackluster sales by suggesting that new, wallet-friendly electric vehicle models might hit production lines prematurely, possibly even before 2025 rolls around and also hyped up their futuristic robotaxi biz. As much of the awfulness was already baked into the quarter, this update helped lift the stock, which is up +13% in after hours trading.

Although the price meltdown makes it a bit hard to see on a chart…

Probably the best hot take on the situation.

Copper Shortages Key Price Trajectory

Copper prices have surged to nearly $10,000 a metric ton, driven by mine closures and anticipated shortages as well as expectations of robust demand linked to the energy transition, including uses in electric vehicles.

This upward trend - fueled by an increasingly less sucky outlook for manufacturing growth in China and pending global interest rate cuts - could help accelerate consumption.

Purchasing Managers' Index Cools Off

The Flash April PMI Composite index fell to 50.9, missing expectations and marking a decline from the previous month, with Services (50.9 vs. Wall Street estimate for 52.0) reaching a five-month low and Manufacturing (49.9 vs. est. 52.0) a four-month low.

Business activity in the U.S. continued to grow in April, though at a slowed pace due to weaker demand, while new orders decreased for the first time in six months. Despite a slight easing from the previous month, input prices remained high, and output prices also rose but at a reduced rate.

Explainer - The hell is PMI? PMI is put together by the Institute for Supply Management (ISM) and is a reliable, timely indicator of business conditions, aiding analysts and economists in predicting economic trends in GDP, industrial production, employment, inflation, etc. Since PMI data are often available months before comparable official data, PMI surveys are considered some of the most impactful economic data releases globally. 🤘

Joke Of The Day

Why didn’t Han Solo enjoy his steak dinner? It was Chewie.

Hot Headlines

Bloomberg / Boeing plan to buy Spirit complicated by airbus-linked factories. Kinda figured buying a company that makes parts for your archnemesis was going to add a wrinkle to the negotiations.

Yahoo Finance / Tesla to cut more than 6,000 jobs in Texas and California. Company snuck this in ahead of earnings, and the news follows an internal memo circulated on Monday that they plan to eliminate 10% of their workforce which stood at 140k at the end of last year.

Reuters / Amazon launches low-cost grocery delivery subscription plan in US. The subscription plan would allow Prime members to get unlimited grocery delivery at $9.99 per month on orders over $35 from Whole Foods Market, Amazon Fresh, and other retailers on the platform.

Yahoo Finance / JP Morgan CEO Jamie Dimon says that the economy is booming but that will weigh on persistent inflationary pressures. Additionally, he cast a cautious tone about the potential economic impact of geopolitical conflicts and the burgeoning national debt (love when I get to say ‘burgeoning’).

Yahoo Finance / Homebuilder PulteGroup’s CEO says the US has 'structural shortage' of millions of homes. The below ain’t helping either…

Trivia

Following Tesla’s reporting last night, here’s some trivia on the company.

When was Tesla founded?

A) 1995

B) 2003

C) 2008

D) 2010How many ‘Gigafactories’ does Tesla currently have?

A) 6

B) 2

C) 5

D) 11In what year did Tesla start selling the Model 3, its first mass-market electric car?

A) 2015

B) 2016

C) 2017

D) 2018Tesla’s market cap is currently $450 billion. What was it at it’s peak in November 2021?

A) $890 billion

B) $1.9 trillion

C) $621 billion

D) $1.2 trillion

(answers at bottom)

Market Movers

Winners!

Spotify Technology (SPOT) [+11.5%]: Q1 EPS, revenue, and GM all exceeded expectations with a strong Q2 outlook, though MAUs and premium subscriber forecasts were slightly lower after a record 2023, reflecting a reduction in marketing spend and lower revenue costs.

Danaher (DHR) [+7.2%]: Q1 earnings, revenue, and operating profit topped estimates with a narrower-than-expected core growth decline, improved bioprocessing order trends, and market-share gains in Cepheid; FY guidance remained steady despite some conservative analyst views.

SAP (SAP) [+5.6%]: Q1 Cloud revenue met expectations, Current Cloud Backlog growth accelerated, EBIT was slightly better excluding stock-based compensation; reiterated FY guidance amid positive management remarks on customer demand and cost savings.

Kimberly-Clark (KMB) [+5.5%]: Q1 EPS and revenue outperformed despite a 5% FX headwind, with organic growth exceeding forecasts across all segments, supported by a 4% price increase; GM improved from productivity gains; FY EPS and OI growth forecasts raised.

General Motors (GM) [+4.4%]: Q1 revenue and EBIT outperformed expectations by nearly 5% and 28% respectively, with stable core auto and GMF performance and lower Cruise expenses; FY EBIT and FCF guidance increased; highlighted truck and SUV market share gains and steady EV ramp-up.

Philip Morris International (PM) [+3.8%]: Q1 EPS, revenue, and operating income surpassed forecasts with stronger volume growth, including a smaller-than-expected cigarette decline; cut FY24 EPS guidance but raised EPS excluding currency impacts and FY organic net revenue growth.

United Parcel Service (UPS) [+2.4%]: Q1 revenue was slightly under expectations, but EPS exceeded forecasts by 10% due to improved margins; daily volume in the US strengthened through the quarter; reaffirmed FY guidance with expectations of volume and revenue recovery; noted a focus on a low bar with stock down ~7.5% YTD.

Losers!

JetBlue Airways (JBLU) [-18.8%]: Q1 earnings and OM better with revenue in line; PRASM/RASM below expectations; guidance for Q2 and FY revenue growth underwhelms, citing healthy demand during peak periods and solid premium demand but anticipating continued revenue pressure from high LatAm capacity.

MSCI Inc. (MSCI) [-13.4%]: Q1 EPS exceeded forecasts but revenue and adj. EBITDA fell short, the latter due to higher costs; reaffirmed FY24 Capex, FCF, and operating expenses guidance; highlighted weaker subscription run rate metrics.

Xerox Holdings (XRX) [-10.1%]: Significant Q1 earnings miss with flagged charges from structural changes; revenue also weaker, forecasting lower 2024 revenue due to backlog reduction and less focus on certain non-strategic revenue streams.

Hertz Global (HTZ) [-7.4%]: Filed to increase its First Lien covenants through Q1 2025; Goldman Sachs views this as negative due to implied downside to consensus estimates, operational restrictions, and potential equity funding needs.

Market Update

Trivia Answers

B) Tesla was founded in 2003.

A) Tesla has 6 Gigafactories: Four in the US (California, Nevada, Texas and New York) as well as China and Germany.

C) The Model 3 was launched in 2017.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.