🔬The Golden Age of Momentum

Plus: Everyone seems to have stopped hating Tesla, and much more!

"The first step towards getting somewhere is to decide you’re not going to stay where you are"

- J.P. Morgan

“Never try to teach a pig to sing. It wastes your time and annoys the pig”

- George Bernard Shaw

Another solid day for the big US markets with the S&P 500 +0.6% and Nasdaq +0.8%.

9 of 11 sectors closed higher, led by Consumer Discretionary (+1.8%) and Financials (+1.1%). Health Care (-0.4%) and Energy (-0.2%) were at the bottom of the pile.

May job openings (JOLTS report) came in strong at +8.14m vs. Wall Street estimates for +7.91m, but April’s figure was revised downward by 140k to 7.92m - it’s lowest since February 2021. So like 🤷♂️

Notable companies:

Rivian (RIVN) [+7.0%] Media reports indicate company and Volkswagen exploring expanded partnership areas.

Paramount Global (PARA) [+5.7%] NY Times reported Barry Diller's IAC exploring a control bid; PARA also in talks to sell BET Network for ~$1.6B.

Novo Nordisk (NVO) [-1.7%] President Biden and Bernie Sanders criticized high prices for obesity medications in USA Today; White House plans to expand drug price negotiations.

Street Stories

The Golden Age of Momentum

The good people at Standard & Poor’s Global fill their days thinking up new and weirder ways to cut up the markets into data rich chunks.

One such way was the 1994 introduction of their ‘Momentum’ indices; the most important of which slices up the S&P 500 into the 100 companies that exhibit the strongest price performance over the 12 month period prior to the rebalancing reference date (ie: stocks that have gone up the most in the last year are included). If you’ve ran out of Ambien, here’s the index methodology document.

Punchline: We are currently going through one of the greatest periods of momentum in history.

As you can see above, historically the S&P 500 and the S&P 500 Momentum index have moved pretty much in lockstep. Generally it’s more than just the top quintile of companies that exhibit momentum traits, and often by the time a company gets included into the Momentum Index its outperformance can be a bit long in the tooth. Thus, its wanes or reverts to the mean.

What we’re seeing right now, however, is the names that crushed it in 2023 are continuing to crush it in 2024. To a near record amount at that.

Looking back over the last decade, you can see how tightly the S&P and the S&P Mo have moved.

But you can also see that in 2024 the S&P is up 15.3% while the S&P Momo has clocked in a blistering +34.4%. That’s massive or, as the French say, ‘gigantesque’.

This means that year-to-date, the Mo is beating the S&P 500 by +19.1%. At this point I should highlight that the only two other times in its history that the Mo has done better on a relative basis were in 1998 and 1999.

You know, right before the Tech Bubble burst. ☠️☠️

This brings me back to something I’ve written a lot about this year: the lack of breadth in the market. The S&P 500 is on pace for one of its best years in history but still 41% of companies are actually down for the year. And only 23% of companies are actually beating the index.

The winners keep winning, but that increasingly represents a smaller and smaller proportion of the market. What happens when the music stops for those few gilded stocks will certainly be noteworthy.

Tesla’s Back!

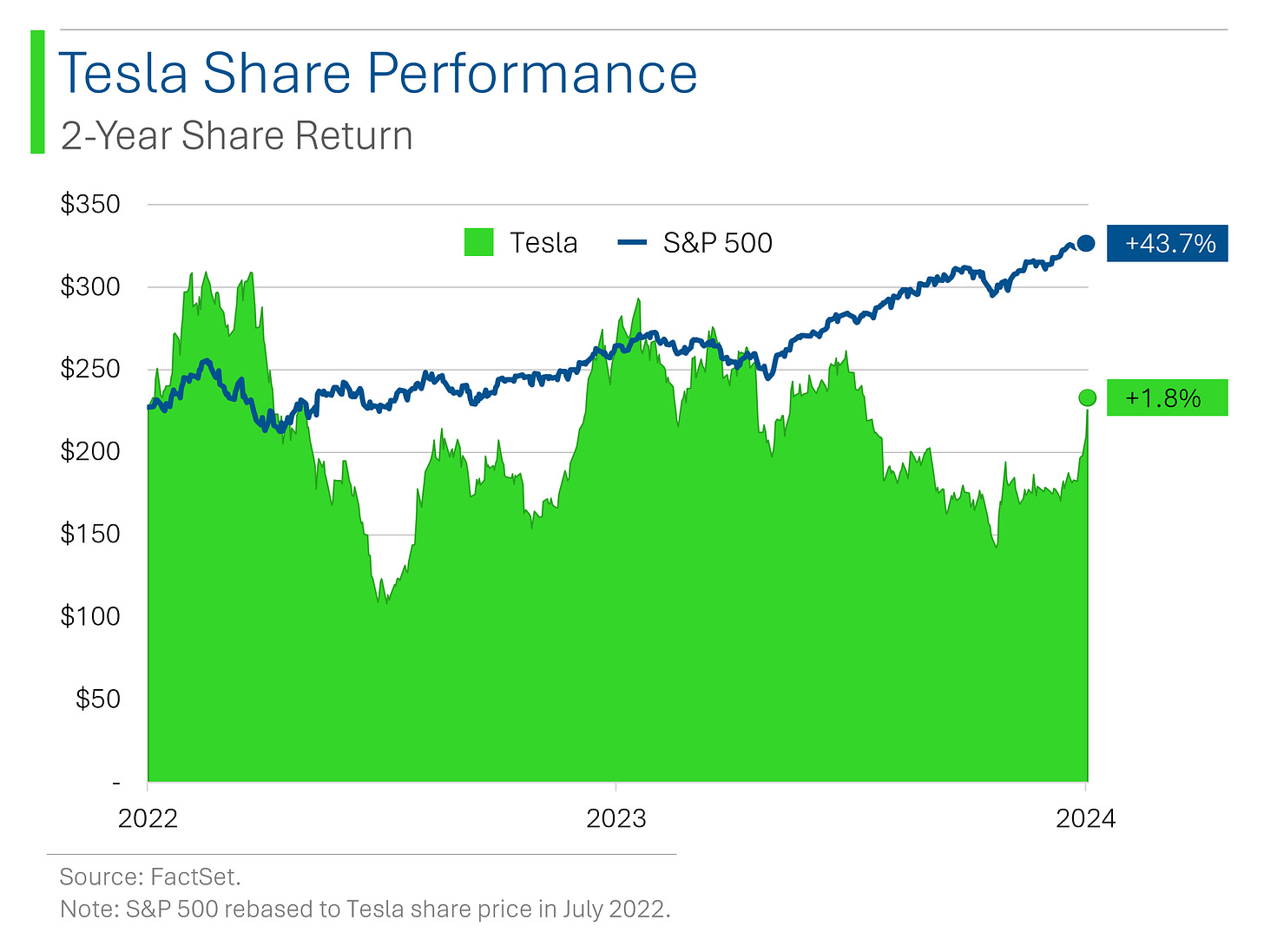

Tesla caught a bid on Monday (+6.1%) after it’s Chinese EV peers NIO, Li and XPeng posted strong Q2 delivery figures for their EVs - the implication being that Tesla caught some of that love too.

The company followed this up on Tuesday by publishing their own delivery figures which, though not great, were a lot less terrible than the market was forecasting.

Wall Street had a bogey of +438k deliveries for the quarter, and while Tesla’s +444k didn’t exactly blow the doors off, it was enough to impress upon investors that the worst of this EV winter may be in the rearview mirror.

The +10.2% Tesla added yesterday brings the company back into the green on a 2-year basis but still down 6.9% for the year.

Joke Of The Day

‘I have bad news and worse news …’ a financial adviser says to his client.

"Which would you like to hear first?"

"The bad news," the client says.

"All your money will be gone in 24 hours."

"Oh my gosh," the client says. "So what's the worse news then?"

"I should have made this call yesterday."

Hot Headlines

Bloomberg / Skydance Media reaches preliminary deal to acquire Paramount’s controlling shareholder National Amusements in $1.75 billion deal. I don’t care, but I am looking forward to not hearing about Sumner Redstone’s billionaire daughter Shari (National Amusements owner) bickering with Larry Ellison’s billionaire son David (Skydance owner) for another six months. Paramount’s shares popped 9% in hopes that those two brats are done whining.

Yahoo Finance / EV maker Polestar released it’s Q2 showing 80% growth in deliveries but net loss ballooning from $38 million to $274 million. Shares closed down 5.5%. How tf you can sell 80% more stuff, cut 15% of your workforce and still lose 6.2x more money is the kinda math that only makes sense in EV land.

They’re still in the top 7 though!

CNBC / Trump Media shares pop on $105 million raised from warrant exercise - but close down 4.1% once investors eventually did the dilution calculation. The Truth Social parent said it has more than $350 million in cash and no debt on its balance sheet.

Reuters / Novo Nordisk and Eli Lilly come under pressure following opinion piece by President Biden and Senator Bernie Sanders saying companies need to drastically reduce the price of weight-loss drugs. The pair recently bonded over shared passions for Werther’s Originals and calling Millennials whipper snappers.

Bloomberg / China’s investment bankers turn away from Wall Street as paychecks and morale sink. Increasingly the nation’s bankers are being pressured to join the Communist Party in order to advance their careers and the market for banking services shrinks across China.

Trivia

This week’s trivia is on corporate firsts.

The first publicly traded company in the world was?

A) East India Company

B) Dutch East India Company

C) British South Africa Company

D) Hudson's Bay CompanyWho developed the first silicon-based integrated circuit?

A) Intel

B) Texas Instruments

C) Fairchild Semiconductor

D) Bell LabsThe first company to build a gasoline-powered automobile was?

A) Ford

B) Mercedes-Benz

C) Fiat

D) Peugeot

(answers at bottom)

Market Movers

Winners!

Tesla (TSLA) [+10.2%] Delivered 443,956 vehicles in Q2, beating expectations; total Q2 production was 410,831.

Archer Aviation (ACHR) [+8.9%] Stellantis to invest an additional $55M after a recent flight test milestone.

Rivian (RIVN) [+7.0%] Media reports indicate company and Volkswagen exploring expanded partnership areas.

Paramount Global (PARA) [+5.7%] NY Times reported Barry Diller's IAC exploring a control bid; PARA also in talks to sell BET Network for ~$1.6B.

Atlassian (TEAM) [+2.3%] Upgraded to overweight from neutral at Piper Sandler; positive on improved cloud-growth dynamics and enterprise customer migrations.

PayPal (PYPL) [+2.0%] Upgraded to Positive from Neutral at Susquehanna; cited prioritizing profitable growth, increased OVAS in Braintree deals, and branded checkout improvements.

Losers!

R1 RCM (RCM) [-13.2%] Holder New Mountain Capital dropped joint bid with TCP-ASC for remaining company shares; offered solo take-private bid at $13.25/sh, down from $13.75/sh joint bid.

Pure Storage (PSTG) [-4.2%] Downgraded to sell from neutral at UBS; highlighted competition and slower than expected AI spending.

Fiverr International (FVRR) [-4.1%] Downgraded to neutral from buy at UBS; cited macro headwinds and a shift toward higher-spend buyers moderating revenue and GMV growth.

Incyte (INCY) [-3.0%] Downgraded to underperform from market perform at BMO Capital Markets; recent $2B Dutch auction seen as ineffective for increasing shareholder value, complicating acquisitions.

CrowdStrike (CRWD) [-1.8%] Downgraded to neutral from overweight at Piper Sandler; cited valuation concerns; remains positive on prospects but expects returns to lag behind others.

Shoals Technologies (SHLS) [-1.8%] Downgraded to sell from buy at Citi; patent infringement case against Voltage expected to go against Shoals, increasing competitive pressures and affecting margins.

Novo Nordisk (NVO) [-1.7%] President Biden and Bernie Sanders criticized high prices for obesity medications in USA Today; White House plans to expand drug price negotiations.

Market Update

Trivia Answers

B) The Dutch East India Company was the first publicly traded company, having started trading 1602.

B) Texas Instruments created the first silicon-based integrated circuit. No more Germanium!

B) Mercedes-Benz launched the Benz Patent Motor Car in 1886. Ok, technically it wasn’t ‘Mercedes’ back then.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Intrigued by your analysis of the spread between s&p 500 and s&p momo. Really makes one think doesnt it...