The Global Bond Sell-Off Explained, Yen Intervention, and Much More

StreetSmarts Morning Note

“Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.”

-Warren Buffett

“A bank is a place that will lend you money if you can prove that you don’t need it.”

-Bob Hope

Table of Contents

The Global Bond Sell-Off Explained: And Why It’s Bad For Governments

Japanese FX Intervention

Intel Gains On News It Is IPO-ing Its Programmable Chip Unit

US Job Market Remains Strong

US Speaker of the House McCarthy Is Out

SPAC IPOs On Pace For Lowest Level Since 2016

Trivia

Joke Of The Day

Fun Fact

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

The Global Bond Sell-Off Explained

And Why That’s Bad For Governments

A country’s 10-year bond is frequently referenced as it offers some insight into the financial health of a sovereign. A super high yield is concerning, as this can imply that a country is a potential default risk or that it is facing super-duper inflation. A super low yield - and Japan is the poster child for this - can imply stagnant economic growth, and even deflation.

Below I do my best to summarize the current sell-off in government bonds around the developed world, using the 10-year bond as my main point of reference, and will try to explain the longer-term ramifications. Let’s go!

The Rise In Bond Yields

To oversimplify things, the rise in yields (a bond’s yield is inversely related to its price) has been mostly tied to the jump inflation experienced around the world. Recall that higher interest rates help to lower inflation by slowing borrowing activity by companies and consumers, which in turn slows the pace of price increases for products and services. Governments have been raising sovereign interest rates to the extent that they can without causing undue damage to their economies over the last couple of years. The US has been one of the leaders in raising rates to quell the pace of inflation.

Global Bond Sell-Off

The FTSE World Government Bond Index tracks a selection of bonds from around the world and has turned negative in 2023, as interest returns fail to offset the sell-off in those bonds.

The US 10-year bond yields have exploded to 16-year highs, and German yields are at their highest since the Euro Zone Debt Crisis in 2011. Japan still has its policy rate below 0%, but its bond yields are back up to levels last seen in 2013.

In the States, the Fed is expected to continue raising its policy rate - the Federal Funds rate - which is currently at 5.5%. The Fed believes it can afford to do this because the US economy is relatively healthy (for instance, see my note on the US Jobs Market in Speed Round below). Outside the US is a different story, as other developed nations are mulling pausing their rate raising efforts to avoid risks to their nations facing an economic slowdown.

The Impact

Notwithstanding all those poor, long-only bond managers that are getting smacked, there are broader economic concerns. Corporate bonds, for example, are typically priced off of a spread against the relevant domestic bond of the same maturity. For example, a US company issuing a 10-year bond will lock-in interest payments equal to that of the US 10-year Treasury plus a spread based on their credit rating. For many companies, new debt they’ve issued has come with an interest expense more than double what they’ve been paying before, which hurts not only their profitability (or viability), but also their ability to grow and expand, which trickles into impacts for the broader economy.

Along a similar theme is that interest expense for governments has grown dramatically too. This is particularly felt as governments have been running burgeoning budget deficits that need to be paid for with greater levels of debt. As you can see in the above, significant levels of maturing debt in the US means locking in even higher interest rates which will be felt long into the future.

Opinion: Consensus is now rooted in the ‘higher for longer’ view of interest rates, in a world that hasn’t had any experience adapting to that in a decade and a half. I’m not worried about short-term ‘shocks’ to the global economy, as central banks and regulators have put infrastructure in place since the Great Financial Crisis, and Covid, to help stymie the impacts of unforeseen crises in the near term. However, I am concerned that we will be dealing with the impact of locked-in high interest rates for a long-time and in a multitude of ways we don’t yet appreciate.

TLDR: The bond sell-off is an affirmation that Wall Street expects interest rates to continue their march higher. That’s not good for anyone: companies, governments and regular Joes alike.

Speed Round

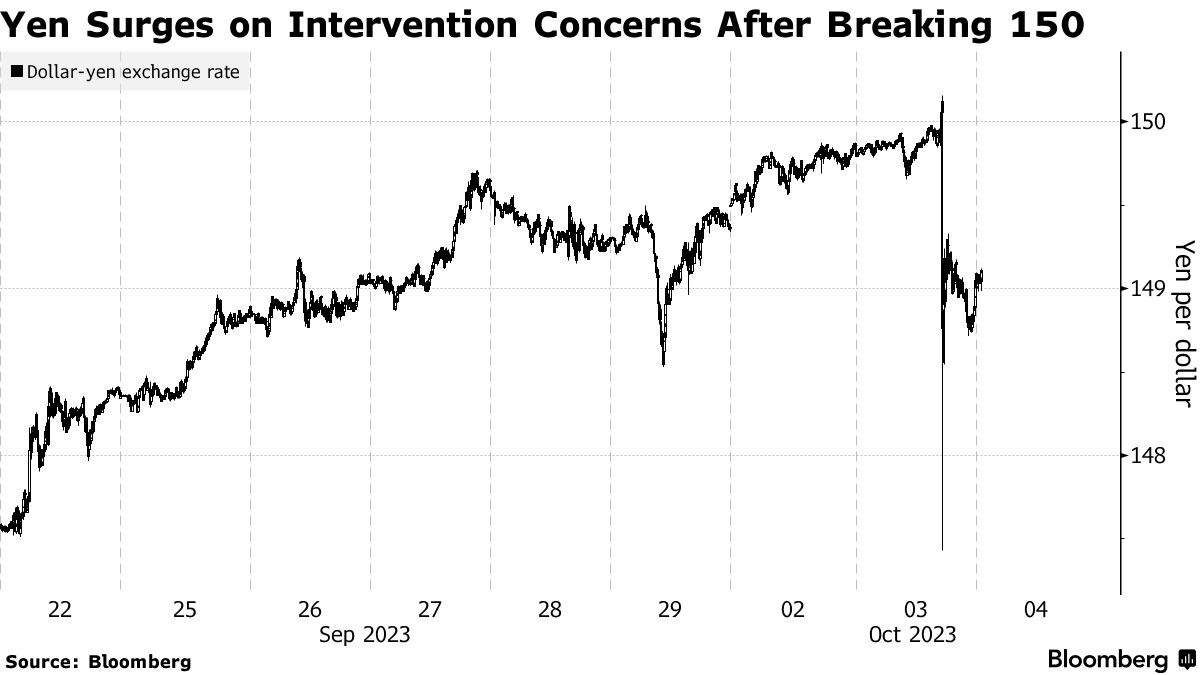

Japanese FX Intervention - While the Japanese Ministry of Finance’s response of ‘No Comment’ to the question of whether or not they intervened in currency markets to support the Yen, the press and Wall Street are convinced that they did. Back in October of last year, the Yen reached a multi-decade low against the USD of around 150 Yen to the Green (see graph below - a higher line means more JPY required per 1 USD, or a weaker/lower Yen value). The currency tipped over the 150 level again yesterday when the alleged intervention happened. The Yen has been depreciating against other major currencies in the world - particularly the USD - in part due to their interest rates, which are the lowest in the world (their version of the US Fed Funds rate - which stands at +5.5% - is currently -0.2%) and global demand for Japanese bonds (and thus Japanese Yen) has dried up. For the time being at least, it appears this 150 Yen level is a psychological barrier that the Japanese are willing to fight for; using their foreign currency reserves to buy Yen to support the price. Bloomberg Article.

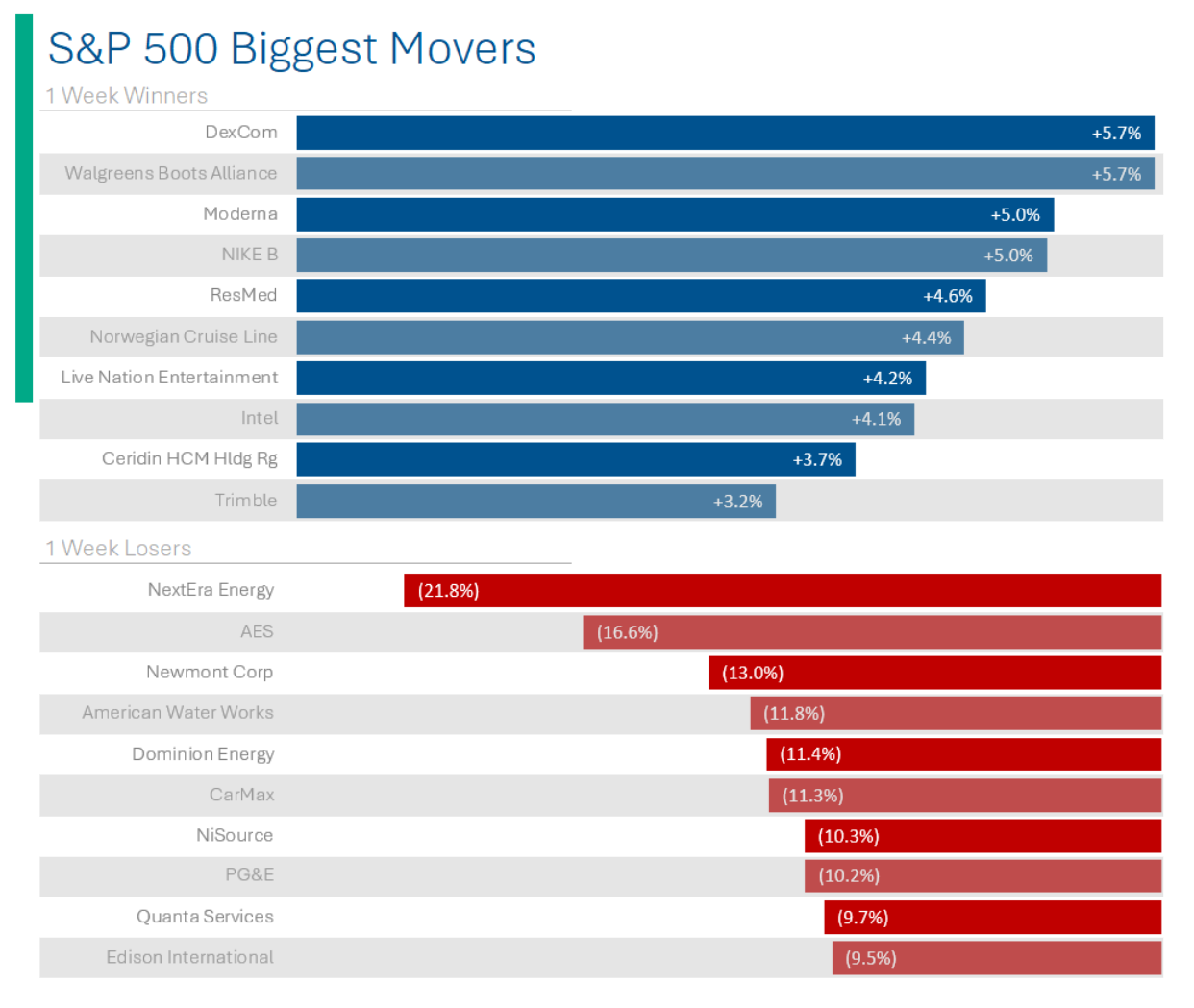

Intel Gains On News It Is IPO-ing Its Programmable Chip Unit - Intel’s programmable chip business (‘Programmable Solutions Group’) is to be spun out in an IPO. CEO Pat Gelsinger released a statement that “Our intention to establish PSG as a stand-alone business and pursue an IPO is another example of how we are consistently unlocking more value for our stakeholders.” Reuters Article.

US Job Market Remains Strong - The US Bureau of Labor Statistics (BLS) released their monthly ‘Job Openings and Labor Turnover Survey’ - which the cool kids call JOLTS - yesterday with the number of job openings in the States increasing to 9.6 million versus the Street’s estimate of 8.2 million. A strong jobs report is generally always good, but a caveat to today is that a tight labor market puts pressure on wages (gotta bribe people to work for you) which can contribute to inflation - which has been the overriding topic for quite some time now. Reuters Article.

***An even better gauge on the labor market will be the payrolls report coming out on Friday from BTS BLS which shows the US unemployment rate. Current Street expectations are for this number to drop from 3.8% to 3.7%, and it will be driving factor in the US Fed’s decision on future interest rate increases***

US Speaker of the House McCarthy Is Out - After some Republicans, led by Matt Gaetz, took action after alleging that he had betrayed the party by working towards a compromise deal with Democrats to avoid a shutdown, McCarthy got the boot. Given how heated relations are between parties, finding an acceptable replacement will be…complicated, given it took 15 rounds of votes to get McCarthy installed back in January. With only 44 days until the Shutdown will take effect, they could have made things even worse by kicking the can down the road. NBC News Article.

SPAC IPOs On Pace For Lowest Level Since 2016 - Good riddance. Bloomberg Article.

Grab Bag

Trivia:

The first mobile phone was made on April 3rd, 1973 by Martin Cooper, a researcher and executive for this company

Verizon

Motorola

Bell South

Vodaphone

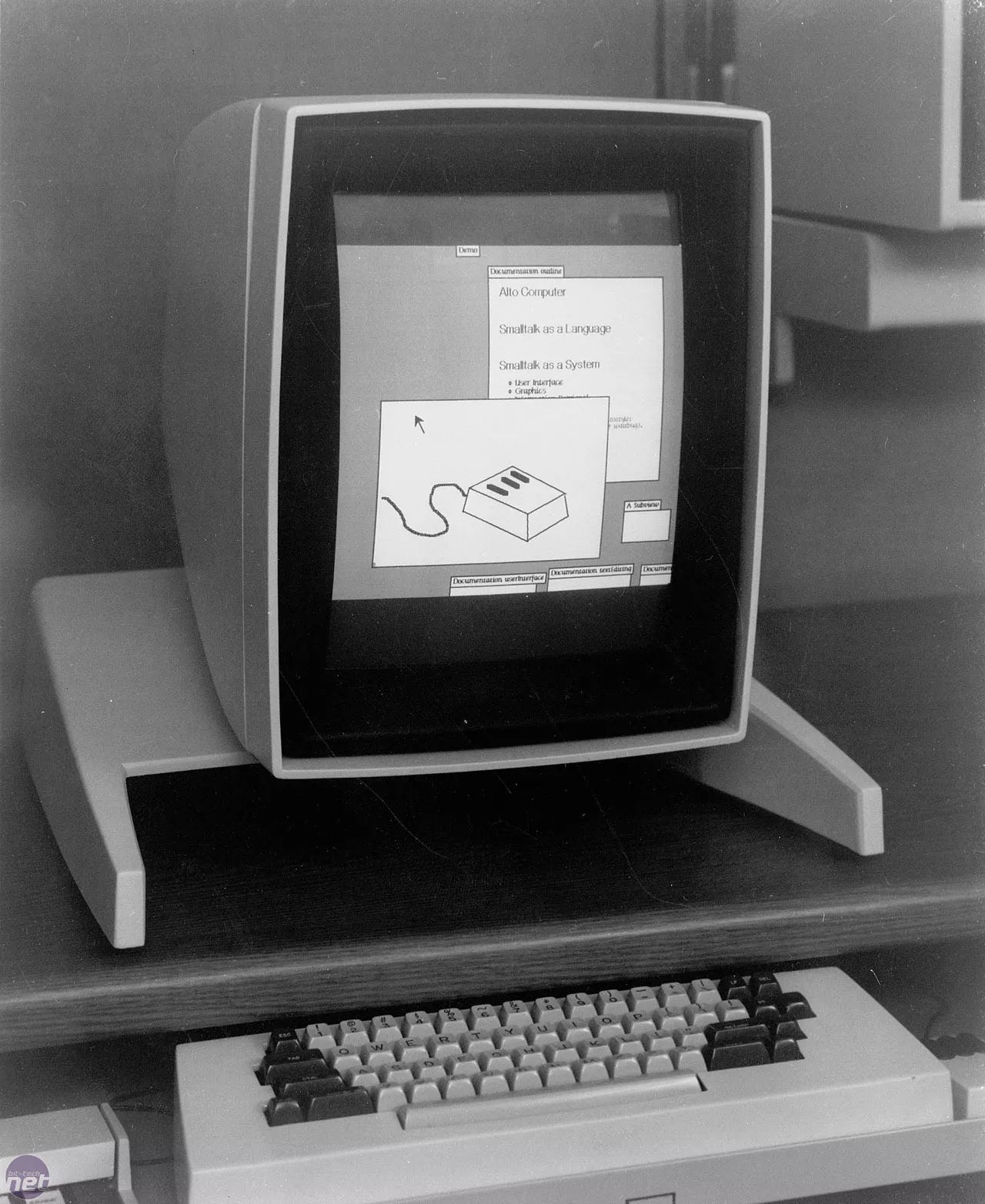

The Macintosh ‘Lisa’ was the first computer to be publicly sold with a graphical user interface (GUI) - Ie: being able to point and click at objects instead of typing into a command line. Which company did he get the idea from?

Xerox

General Electric

Bell Labs

Texas Instruments

(answers at bottom)

Joke Of The Day:

What did the accountant do when his caps lock stuck? He capitalized everything.

‘I have bad news and worse news …’ a financial adviser says to his client.

"Which would you like to hear first?"

"The bad news," the client says.

"All your money will be gone in 24 hours."

"Oh my gosh," the client says. "So what's the worse news then?"

"I should have made this call yesterday."

Market Update

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

Trivia Answers:

Motorola. In a bit of competitive fun, Cooper made the call to Joel Engel, head of their main competitor AT&T-owned Bell Labs.

Xerox. The technology was developed for its PARC computer. Before the copier business declined due to competition, Xerox was considered one of the leading technology companies in the world.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and Subscribe!