🔬The Fun Police Fed, IPOs Are Scary, and Much More

“The key to making money in stocks is not to get scared out of them”

- Peter Lynch“A fool and his money are lucky enough to get together in the first place”

- Gordon Gekko

Table of Contents

Hot Headlines

Joke Of The Day

A.M. Allocations: The Folly of Man (and Markets)

Trivia

Market Movers

Market Update

Hot Headlines

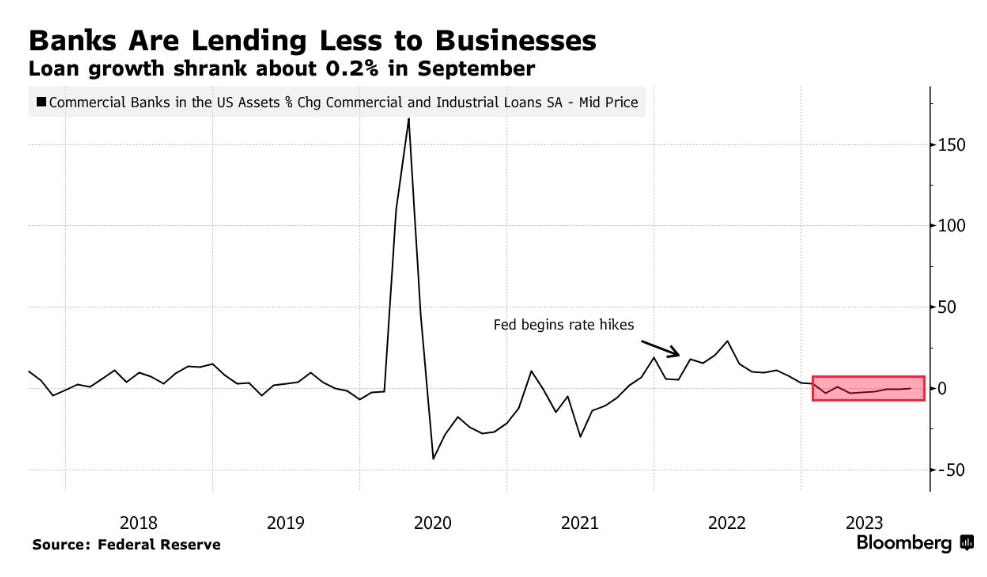

COMMERCIAL LENDING FREEZE - U.S. banks are reducing business loans as lending standards tighten and demand drops following 11 interest rate hikes by the Federal Reserve, raising concerns about economic growth slowing due to decreased business investment and hiring. This contraction in lending is occurring despite a resilient economy so far, but economists anticipate a significant economic downturn due to the combined impact of higher rates and reduced corporate borrowing. Countdown until they start using the ole phrase ‘Credit Crunch’? (Bloomberg)

FEDSPEAK - Fed Reserve officials, Thomas Barkin and Raphael Bostic, indicated that the full impact of past interest rate hikes has not yet materialized, suggesting further economic slowing, with ongoing debate among Fed members on the need for future rate increases amidst inflation concerns. Yes. Obviously. See yesterday’s update on Fedspeak for where the officials/governors are leaning. (Bloomberg)

CHINESE EV IPO - Zeekr, Geely's premium electric vehicle brand, is preparing to list shares in New York, with details to be revealed this week, led by underwriters Goldman Sachs and Morgan Stanley. Despite aiming to raise over $1 billion, the IPO may fetch less, marking a significant Chinese company listing in the U.S. for the first time in two years amid strained U.S.-China relations and a competitive EV market. Gotta be some ballsy bankers thinking they could hammer through a foreign IPO in an unloved sector when the IPO window has been slammed shut. Oh, nm, its Goldman.

THE DEAD IPO MARKET - The IPO market is unusually quiet before American Thanksgiving, with companies hesitant to go public due to poor stock performance in October, high interest rates, and lower valuations. Major IPOs like Waystar and Panera Bread are delaying their debuts, while others like Klarna and Shein are facing valuation challenges. This trend contrasts with previous years' robust IPO activity, and now, the focus has shifted to AI companies, leaving many tech unicorns in a challenging position. Someone send the memo to Geely. (CNBC)

CHINA’S BIGGEST LENDER HACKED - The U.S. arm of the Industrial and Commercial Bank of China (ICBC) was targeted by a ransomware attack, believed to be orchestrated by the cybercrime gang Lockbit, disrupting U.S. Treasury trades. Clorox, TSMC, Boeing, friggin Royal Mail - these guys are everywhere. (Reuters)

(Bloomberg) Mexico Signals Forthcoming Cut After Keeping Rate Unchanged - Didn’t think Mexico would be ahead of the curve on rates but at 11.25%, who cares about inflation?

(CNBC) McDonald’s and Krispy Kreme are in talks to expand partnership - Partnership with Ozempic pending.

(Reuters) MGM Resorts reaches historic labor deal with Las Vegas unions, averts strike - Still shocked that the Culinary Union and Bartenders Union are real things.

(CNBC) IRS announces new income tax brackets for 2024 - Brackets moved up by a little less than inflation. Obv.

(CNN) Vice to end several news shows and lay off dozens of staffers in hollowing out of news division - From trending to dumpster fire faster than you can say Allbirds.

Joke Of The Day

“Welcome to the accounting department, where everybody counts.”

How does Santa’s accountant value his sleigh? The Net Present Value.

A.M. Allocations

The Folly of Man (and Markets)

The market has been on a tear since the Federal Reserve meeting last week. It was expected that they would keep interest rates the same, but the thing that everyone jumped all over was this so-called ‘Peak Fed’ narrative: The idea that there was enough mischief going on in the economy to warrant the Fed staying their hand, which investors interpreted as a green light for the stock market.

To this I had my concerns. After the market ripped to a +5.9% gain last week - its highest in a year - I wrote about the potential of this being a ‘Bull Trap’. Basically a short-term rally amidst a broader market pullback that suckers in the overly optimistic. The big concern for me was that, as easily as the Fed can put the green flag on, they can just as easily reverse course and put up the red one.

Yesterday, Fed Chair Jerome Powell (Pow-Dog to his friends) stated that the Fed will not hesitate to tighten monetary policy further if needed to control inflation, despite recent indications of slowing inflation. He emphasized the importance of moving cautiously to avoid being misled by short-term data or the risk of overtightening, while still aiming to return inflation to the 2% target. The market didn’t like that.

Take-Aways: Yesterday was a red day, with all S&P 500 sectors closing in the no fun column. That comes after eight straight up-days for the S&P 500 (and nine for the punchy Nasdaq). I’m not going to make any statement on where things are headed (ok, probably down for a bit) but the big thing to pull out of this is the ephemeral nature of these hope/hate trades.

Times like these are annoying. Mostly because - as a fundamental equities guy - I want the stuff stocks do (good or bad) to be the determining factor in how their shares trade. When these macroeconomic hangovers dominate the focus, the market just seems to ignore what actually makes companies tick; which is what I like about investing. I could find a way to be cool with it if these trends were in any way predictable - but they aren’t.

I think the Bull-Trap (or Bear-Trap) analogy is a powerful lesson. Not just that you shouldn’t turn your strategy on its head to jump on the next momentum trade, but rather that your investing strategy should be fundamentally driven by a more holistic, long-term view of a company’s future growth and profitability. That old Chinese proverb of the farmer represents a powerful contrast to such emotional, foundationless chasing of returns.

A farmer and his son had a beloved horse who helped the family earn a living. One day, the horse ran away and their neighbours exclaimed, “Your horse ran away, what terrible luck!” The farmer replied, “Maybe so, maybe not.”

A few days later, the horse returned home, leading a few wild horses back to the farm as well. The neighbours shouted out, “Your horse has returned, and brought several horses home with him. What great luck!” The farmer replied, “Maybe so, maybe not.”

Later that week, the farmer’s son was trying to break one of the horses and she threw him to the ground, breaking his leg. The neighbours cried, “Your son broke his leg, what terrible luck!” The farmer replied, “Maybe so, maybe not.”

A few weeks later, soldiers from the national army marched through town, recruiting all boys for the army. They did not take the farmer’s son, because he had a broken leg. The neighbours shouted, “Your boy is spared, what tremendous luck!” To which the farmer replied, “Maybe so, maybe not. We’ll see.”

Trivia

Today’s trivia is about John Pierpont Morgan AKA Jupiter (best Wall Street soubriquet)

The predecessor to the current J.P. Morgan Chase has its roots in the company founded by Morgan and Philadelphia financier Anthony Joseph Drexel, called Drexel Morgan & Co. What year was this bank founded?

A. 1825

B. 1871

C. 1905

D. 1929In current USD, how much was J.P. Morgan worth at the time of this death?

A. $200 million

B. $510 million

C. $1.4 billion

D. $11 billionMorgan is credited with helping to stave off catastrophe during the 1907 Financial Crisis. What actions did he take?

A. He provided a significant personal loan to the U.S. Treasury

B. He organized a team of bankers to rescue the stock market

C. He shorted the failing banks and made a killing

D. He advocated for the end of the Gold StandardMorgan sought to create an effective monopoly in steel production with the creation of U.S. Steel through the acquisitions of varies steel companies. The largest of which was owned by what other Gilded Age tycoon?

A. Nathaniel Rothchild

B. Cornelius Vanderbilt

C. John Jacob Astor

D. Andrew Carnegie

(answers at bottom)

Market Movers

Winners!

Duolingo (DUOL) [+21.4%]: Exceeded Q3 EPS and revenue expectations, achieving unexpected profit and a 43% year-over-year revenue increase. Monthly active users grew to 83.1M, a 47% increase, with positive Q4 revenue outlook and a 60% rise in paid subscribers year-over-year. Me gusto!

Affirm Holdings (AFRM) [+14.1%]: Beat Q1 metrics and raised FY.

TransDigm Group (TDG) [+8.7%]: FQ4 EPS and revenue beat forecasts, with strong FY24 earnings and revenue guidance. Anticipates around 20% commercial OEM revenue growth, alongside a $1.39B acquisition and a $35 special dividend.

Bloom Energy (BE) [+8.4%]: Huge Q3 beat.

Walt Disney (DIS) [+6.9%]: FQ4 EPS outperformed despite slightly lower revenue. Disney+ core subscriptions and ARPU exceeded expectations, with optimism about cost-cutting measures and increased FY24 FCF forecasts, aiming for streaming profitability by year-end FY24.

Losers!

Cardlytics (CDLX) [-54.5%]: Just bad. Advert outlook worse.

Topgolf Callaway Brands (MODG) [-16.9%]: Beat on Q3 EPS and EBITDA but stroke and distance on guide.

AMC Entertainment (AMC) [-13.7%]: Surpassed Q3 EPS, EBITDA, and revenue expectations with positive FCF for the quarter. Management highlighted revenue boosts from films like Barbie and Oppenheimer and filed a $350M equity offering following a $325M offering in September.

Dillard's (DDS) [-5.4%]: Weak Q3, worse guide. Retail sucks.

Arm Holdings (ARM) [-5.2%]: Q2 results were mostly better with strong licensing, but Royalty revenue was only in line due to inventory absorption in Smartphone and IoT, and guidance for the December quarter was light with expected operational expense increases; positive notes included high demand in AI compute.

Market Update

Trivia Answers

B. 1871.

C. $1.4 billion. I know, I thought he’d be worth more too…

B. He organized a team of bankers to rescue the stock market.

D. Andrew Carnegie. After tense negotiations he bought Carnegie Steel Company for $480 million. The largest acquisition, in current USD, until the 1950s. U.S. Steel also resulted in the world’s first billion dollar corporation.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.