🔬The Fed's Success at Dousing Rate Cut Dreams

Plus how 23andMe hopes to stop setting money on fire; the S&P 500 closes in on 5k barrier; and Energy returns +$100 billion to shareholders.

"The stock market is filled with individuals who know the price of everything, but the value of nothing"

- Philip Fisher

“Jesus, if this guy owned a funeral parlor nobody would die!”

- Gordon Gekko

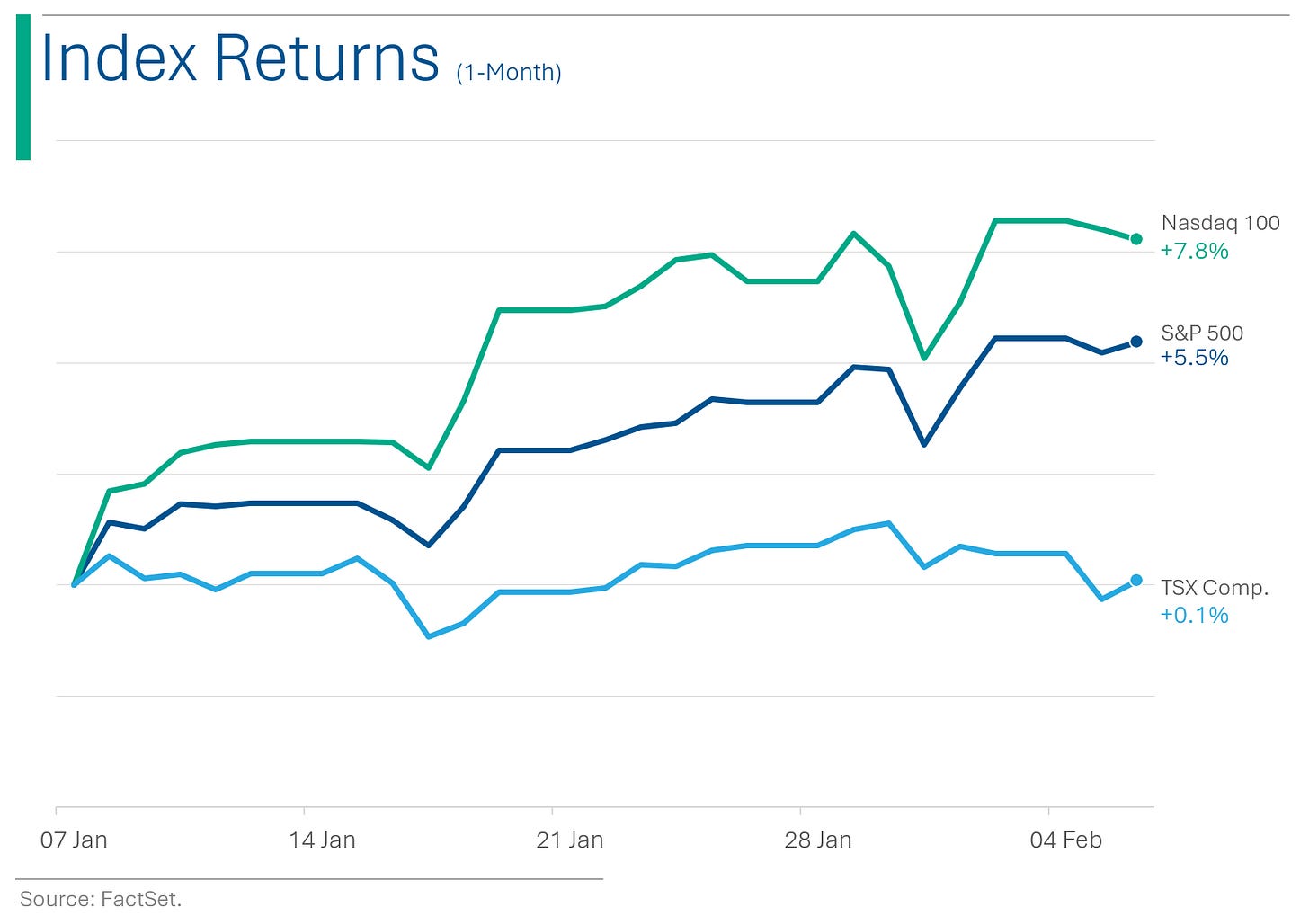

Strong day for the big US markets as the S&P 500 (+0.82%) nears its next milestone, closing at 4,999.89, a light breeze away from hitting the 5k mark for the first time. The Nasdaq was up +0.95 following a good day for tech.

9 of 11 sectors close up with the aforementioned Tech up +1.4% and leading the way. Staples was the worst down 0.1%.

Alibaba had a bla quarter and the shares were down 5.9% despite adding $25 billion to its share buyback program, bringing the total to a gargantuan (so rarely have an opportunity to use that in a sentence) $35.3 billion.

Snap Chat shares blew-up to close down 35% after their soft Q4 / I made fun of them yesterday. (i move marketz)

More earnings stuff at bottom.

Street Stories

Great (Interest Rate) Expectations

There was a whack of Fedspeak yesterday with several Fed members chiming in on where they see the interest rate trajectory headed this year, but it was essentially more of the ‘we’re not in a rush’ rhetoric we’ve become accustomed to. Governor Kugler said inflation has shown strong signs of slowing but she’s not ready to advocate lower rates just yet. Boston Fed President Collins said basically the same things. Barkin said it’s definitely looking like a soft-landing but advocated ‘patience’ rather than risk rocking the inflation boat. While Minneapolis Fed Pres. Kashkari cautioned risks from cutting too early, and said he’s banking on two to three cuts this year. Nothing too shocking here.

Anyway, the Fed’s mission to talk down market expectations for a March start to cutting season has been super successful. For example, at the end of December markets had priced in a 90% probability of one or more rates cuts by March, whereas now that number sits at only 22% - and is getting lower by the day (still not sure how that isn’t zero yet).

What I found interesting, though, is that while the Fed has successfully talked the Street away from high expectations in March, the outlook for later in the year has actually increased dramatically. Basically Wall Street thinks the Fed is gunna start later, but, when they do, they are going big.

23andMe Considers Split After Money Pit Runs Dry

When 23andMe went public via SPAC in 2021, the company carried with it a ~$3.5 billion valuation which would soon peak out at ~$6 billion. Since then, it’s been pretty much a straight shot downward, with the company now trading off 93% from its SPAC price. Baked into the astronomical valuation was the idea that the company wasn’t just a basic genetic testing service (although it’s pretty sweet and I did one in 2016) but rather that it was going to use this data to develop pharmaceutical drugs. The rub is that while the consumer product business pulls in cash, the drug discovery just chews it all up. Plus drug discovery takes years. Plus it’s basically a hit-or-miss sorta business. As for the investor base, not all consumer product investors want biotech risk, and not all biotech investors care for consumer products businesses.

So, after burning through much of the $1.2 billion the company raised in it’s SPAC, the company currently sits on just $258 million dollars in cash. Not ideal for a company that has burned through $155 million over the last four quarters. That’s why - after what I can only assume were some heated Board and investor meetings - the company is now ‘exploring’ spinning off the drug discovery business as a separate company.

Founder and CEO (and Google Founder Sergey Brin’s ex-wife) Anne Wojcicki has remained adamant that the mission of 23andMe is to continue to use its data for new genetic testing and drug development. However, a great vision might not be enough to offset the 18 years as a company they have spent burning billions.

(WSJ did a nice write-up on Anne Wojcicki and 23andMe last week before the split news came out)

S&P 5000 (almost)

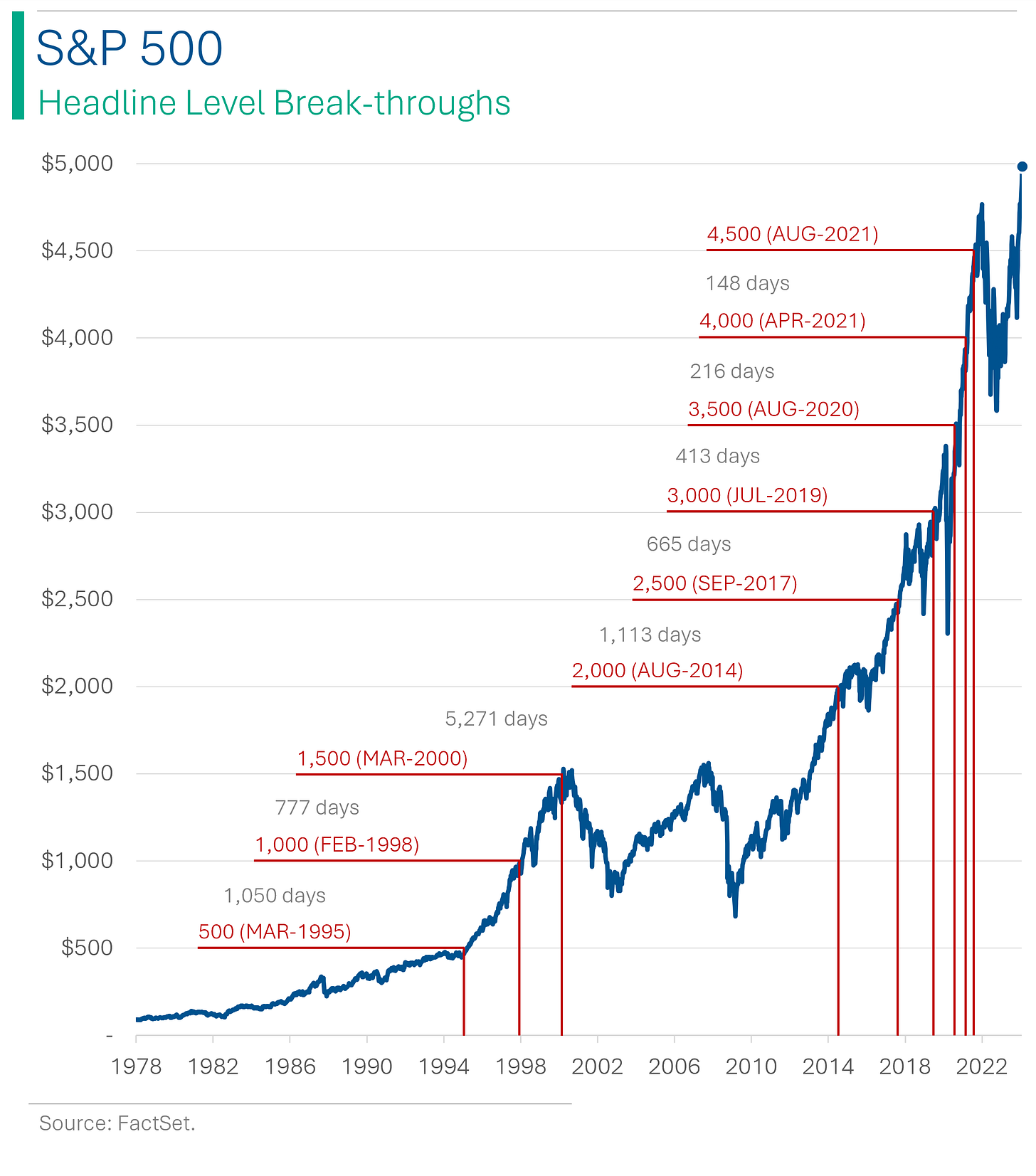

On Wednesday the S&P 500 closed at 4,999.89 so, if you round up, it’s there. If we’re able to break through tomorrow that will mark 894 days since we broke the 4,500 level, which will be the longest stretch between 500pt increments since it cracked the 2,500 barrier in 2017 after an 1,113 day slog. Still, nothing compares to the fall-out after the Tech Bubble, when it took 5,271 days to reach a new notch up the totem (+14 years).

***Note: I’m using weekly data so that my Excel doesn’t blow-up meaning the day increments may be off by a smidge***

Big Oil, Big Payday

In 2023, the top five Western oil and gas companies - BP, Chevron, Exxon Mobil, Shell, and TotalEnergies - returned over $111 billion to shareholders through dividends and share repurchases, slightly above the $110 billion in 2022, despite a drop in net profits from $196 billion to $123 billion amidst geopolitical and economic challenges. The interest in oil majors has waned due to the rise of the tech sector, previous excessive spending, oil price volatility, and environmental concerns, leading to the energy sector's reduced presence in the S&P 500 index from about 14% last decade to 4% by the end of January.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Question: How do you define optimism?

Answer: An investment banker who irons five shirts on a Sunday!

Hot Headlines

AP | Mexico overtakes China as the leading source of goods imported by US. First time in two decades Mexico ranks higher than China, as weak Washington-Beijing relations and a push to (semi) on-shore production makes gains.

CBO | Congressional Budget Office sees deficit growth shrinking in 2026-27 as revenues outstrip outlays. The deficit totals $1.6 trillion in fiscal year 2024, grows to $1.8 trillion in 2025, and then returns to $1.6 trillion by 2027. Shrinking is, I guess, relative.

CNBC | GM to spend $19 billion through 2035 to source EV battery materials from LG Chem. That plus better cars and they might have some here.

CNBC | Hedge fund billionaire Bill Ackman to launch a NYSE-listed fund for ‘regular’ investors. Plans to target 12 to 24 large-cap, investment grade, “durable growth” North American companies. And no 2-and-20 fees, it’s just 2. He’s still expected to be a douche tho.

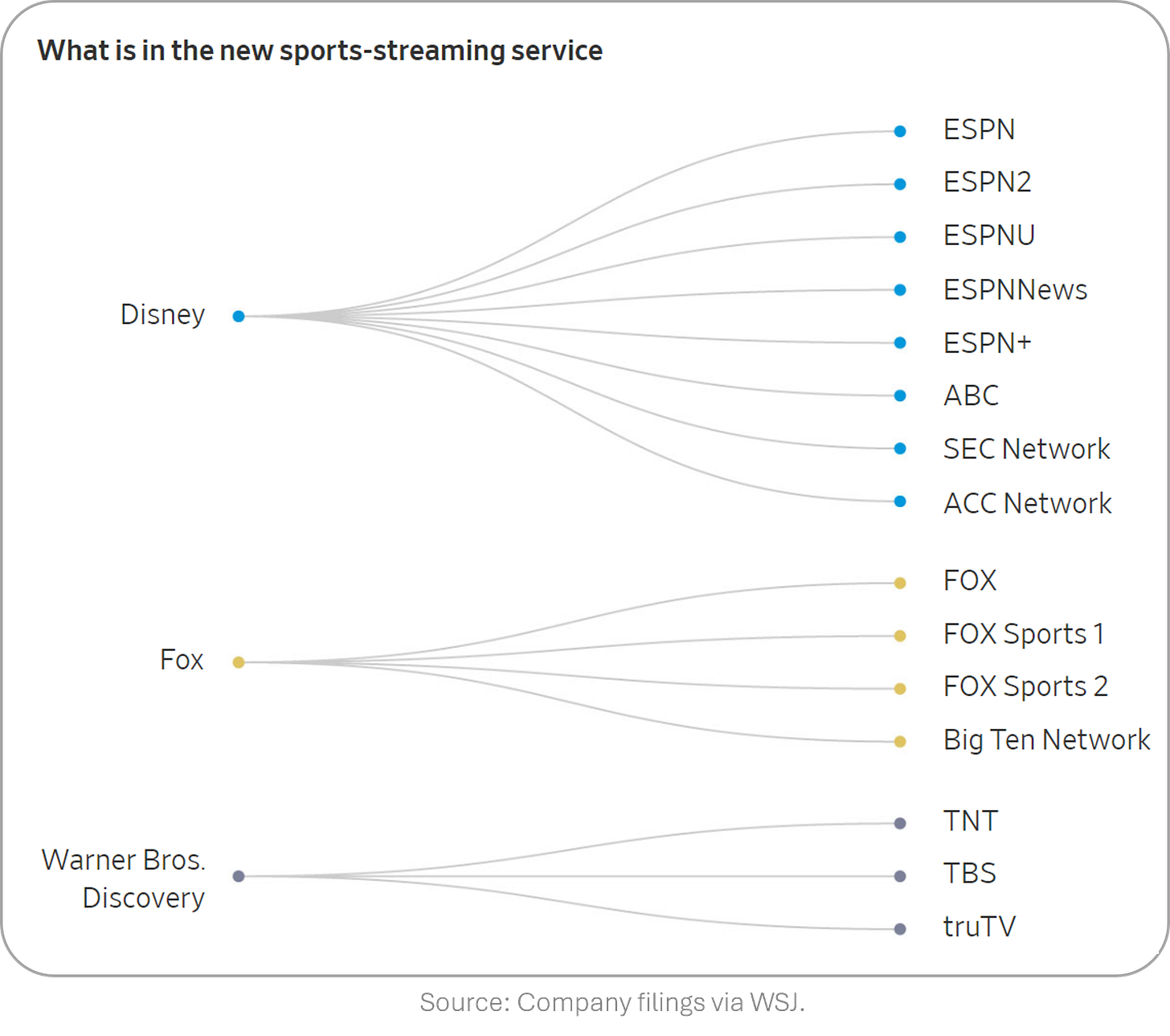

WSJ | How you stream sports is about to be transformed by the blockbuster media deal between ESPN (Disney), Fox and Warner Bros. Package isn’t a panacea though. For example, for football you’d still need Amazon for Thursday games, Paramount+ for Sunday afternoon games, and NBC’s Peacock for Sunday Night football. Also would be missing out on the Masters, British Open, Olympics, MLS and English Premier League.

Trivia

This week’s trivia is on Investing 101.

The ‘Black–Scholes’ model is used to value what type of securities?

A) Options

B) Mortgage bonds

C) Equity shares

D) Government bonds'The Glass-Steagall Act' was a law that:

A) Regulated the glass industry

B) Aims to limit financial institutions from becoming ‘too big to fail’

C) Established reporting standards for investment firms

D) Separated commercial banking from investment bankingIn accounting, 'GAAP' stands for:

A) Global Accounting and Auditing Principles

B) Generally Accepted Accounting Principles

C) General Assessment of Assets and Property

D) Governmental Audit and Approval Procedures

(answers at bottom)

Market Movers

Winners!

Sonos (SONO) [+17.1%]: Fiscal Q1 saw all metrics outperform; FY24 guidance reaffirmed. Strong streaming audio sales highlighted, with significant revenue expected from new products.

Enphase Energy (ENPH) [+16.9%]: Q4 earnings met expectations, with revenue slightly below; however, GM exceeded forecasts. Management noted a demand slowdown but anticipates a recovery, especially in Europe and the US.

Emerson Electric (EMR) [+10.4%]: FQ1 results exceeded forecasts; upgraded FY24 expectations. Analysts positive on T&M integration and cost synergies.

Carlyle Group (CG) [+8.6%]: Q4 EPS and revenue outperformed, with AUM up 11% q/q. FRE growth highlighted by analysts due to transaction fees and expense management.

Yum China Holdings (YUMC) [+7.9%]: Q4 EPS and EBIT above forecasts, with KFC and PH leading. Increased shareholder returns and effective cost management noted.

Chipotle Mexican Grill (CMG) [+7.2%]: Surpassed Q4 expectations; traffic growth and sales-per-unit targets emphasized. Weather impacts seen in January, but MSD comp growth expected in 2024.

Ford Motor (F) [+6.1%]: Q4 earnings and revenue topped estimates. FY24 guidance optimistic, with focus on cost savings and continued demand.

Losers!

Snap (SNAP) [-34.6%]: Q4 earnings matched expectations, but revenue fell short. Q1 sales guidance underwhelmed, partly blamed on Middle East conflict; brand advertising didn't meet forecasts, though user engagement was high.

VF Corp (VFC) [-9.7%]: Fiscal Q3 EPS significantly below expectations due to weak sales and higher expenses. Announced a strategic portfolio review; downgraded by Goldman Sachs.

Paramount Global (PARA) [-8.2%]: CNBC reported WBD's lack of interest in acquiring Paramount. This follows Paramount's consideration of strategic alternatives, including a $13.3B offer from Allen Media Group.

New York Times (NYT) [-7.3%]: Q4 EPS beat, but revenue missed. Added 300,000 digital-only subscribers, with a 3.5% increase in digital-only ARPU, though digital ad revenues fell more than anticipated.

Amgen (AMGN) [-6.4%]: Q4 EPS and revenue outperformed, driven by Neulasta. FY24 EPS guidance was slightly disappointing; mixed feelings on obesity drug AMG133 and misses in Tavneos and Tezspire sales.

Alibaba Group (BABA) [-5.9%]: Q3 EPS fell short, revenue was nearly on target. Approved a $25B increase in share repurchase program; Cloud Intelligence and Digital Media outperformed, but Core Commerce didn't meet expectations.

Market Update

Trivia Answers

A) Black-Scholes is used to value Options.

D) Glass-Steagall separated commercial banking from investment banking.

B) GAAP stands for Generally Accepted Accounting Principles. It’s the accounting compliance standard used in the US and governed by the Financial Accounting Standards Board (FASB).

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.