🔬The Fed Makes Markets Sad, Weak Tech Earnings Makes Them Even Sadder, and Much More

"The obvious rarely happens, the unexpected constantly occurs"

- Bill Gross

“Sometimes that light at the end of the tunnel is a train”

- Charles Barkley

Bad day for the big US markets as the S&P 500 was down -1.61% and the Nasdaq down -2.23%, with soft tech earnings and a cautious Fed the main culprits.

All 11 sectors closed in the red. Healthcare sucked the least (-0.1%) with a mixed batch of earnings. Tech (-2.1%) had a bad day. Techy Communication Services (-3.9%) had a really bad day, with Alphabet (-7.8%) pulling the sector down after a soft quarter.

The Federal Reserve announced no change to interest rates as expected but the rhetoric from Chair Jerome Powell heavily implied that the ~50% chance of a rate cut priced in by the market is unlikely (which the market didn’t like).

Street Stories

Fed's Rate Roulette: Powell Plays it Cool, Market Temperatures Drop

As expected, yesterday the Federal Reserve kept interest rates unchanged, but the big news for markets was that Federal Reserve Chairman Jerome Powell indicated that the central bank is unlikely to cut interest rates by its March meeting, as they require more confidence in the inflation path. This stance caused a downturn in stock markets, with the Dow Jones quickly shedding 300 points. Powell emphasized that any future rate cuts would be data-dependent, with the Fed's next decision dates set for March 20 and May 1, and further economic data, including inflation and job reports, due before these meetings.

Fat Profits for Ozempic Maker Novo

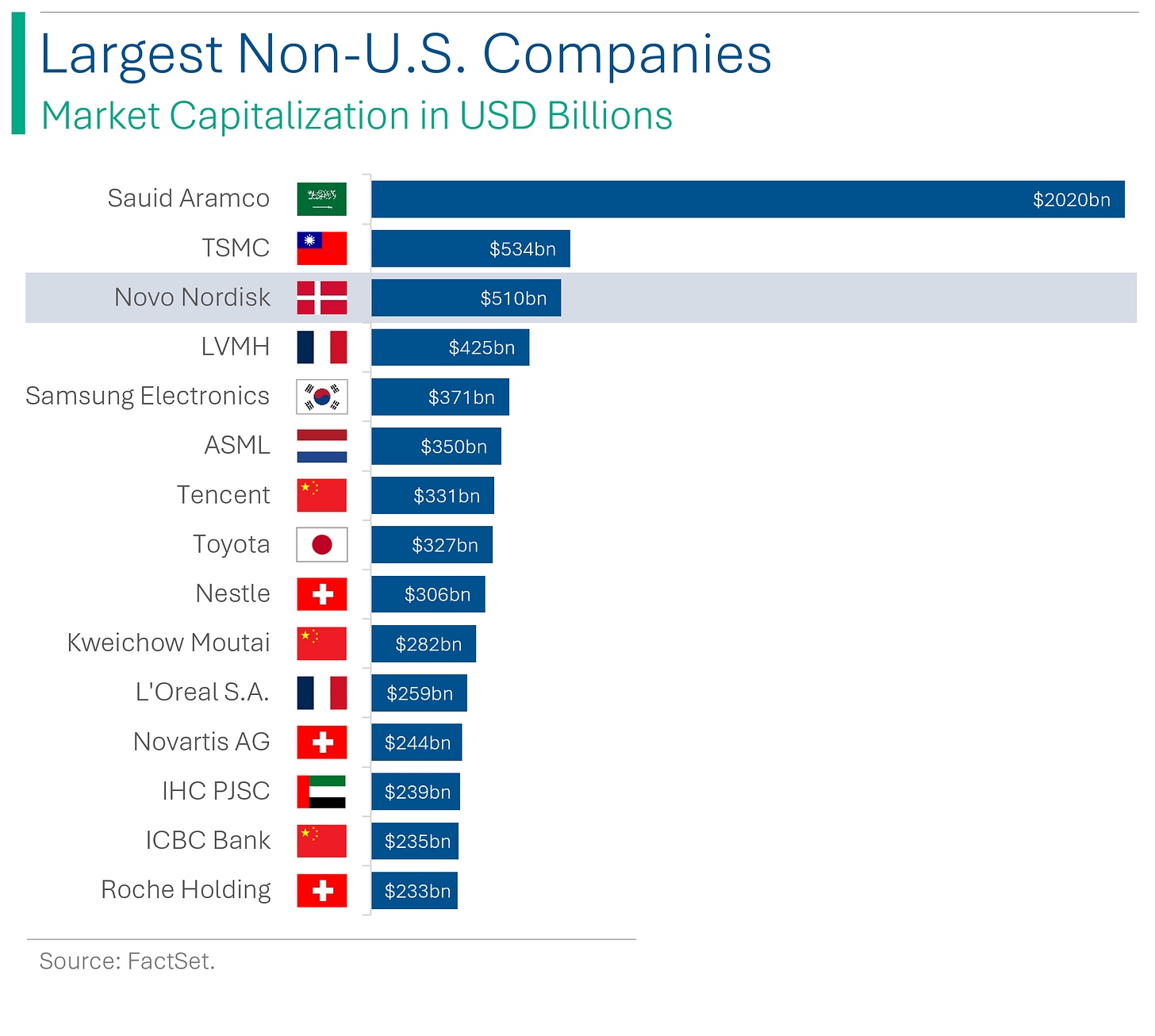

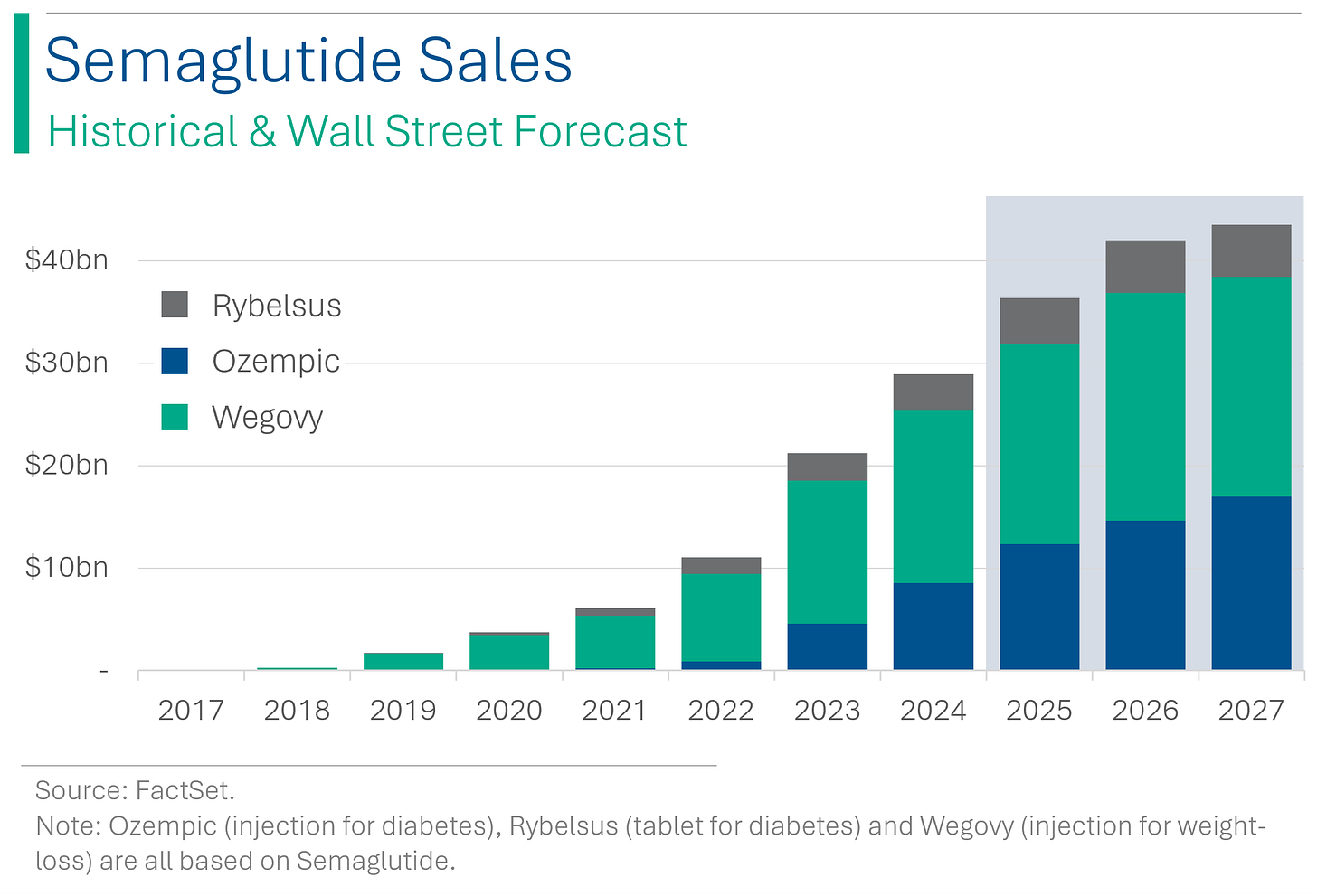

Novo Nordisk posted strong earnings driven by continued strength in its massive Semaglutide portfolio (Ozempic, Wegovy and Rybelsus are all semaglutide products). The shares closed up +5.3% yesterday and the company surpassed $500 billion market value, which made it the second European company to reach this milestone (LVMH briefly did), driven by high expectations for its obesity drugs. The company became the 3rd largest non-U.S. company in the world, behind Saudi Aramco and TSMC, in September of last year when it passed LVMH for its seat on the podium.

The company's optimistic financial outlook forecasts up to 26% revenue growth and 29% operating profit increase for 2024, despite facing challenges in meeting the demand for its drugs Wegovy and Ozempic. Novo Nordisk has significantly invested in manufacturing to support this growth but faces competition from Eli Lilly's Zepbound and concerns about the long-term usage of its treatments due to side effects and high costs.

While Novo's shares have surged by 60% over the past year, some analysts remain cautious, viewing the stock as overvalued and anticipating potential market challenges.

In case you’re curious, I did a bit of a deep-dive on Ozempic/Semaglutide last autumn and also one on about the potential competitor to Ozempic in Eli Lily’s Zepbound.

Door-Gate Doesn't Stop Boeing's Earnings from Taking Flight

Boeing managed to beat revenue forecasts in the fourth quarter, but decided to scrap its 2024 financial guidance, thanks to that pesky ‘door-opening demo mid-flight’ thing. Still, despite the hazy outlook, shares popped +5.3% due to the beat and also the news that all 737 MAX 9 are cleared to resume flying. CEO David Calhoun donned the hat of chief apologist, offering a mea culpa to the skies and pledging allegiance to the holy grails of quality and safety. However, concerns still linger as to potential order cancellations. TBD.

Big Day for Tech Earnings

Microsoft, Alphabet and AMD posted earnings today, and didn’t get a warm reception from the market. The two Mag7s and the chip giant all posted beats or in-line quarters for both revenue and earnings per share but nothing strong enough to warrant praise from the market, especially after mediocre outlooks for 2024. This comes after the names were up massively in 2023 and there are hints that sentiment is cooling.

Microsoft Highlights:

Revenue: $62.02B vs Wall Street estimate of $61.14B

Q2 EPS: $2.93 vs Wall Street’s $2.77

Management guided to Q3 Revenue of $60-61 billion, with the midpoint slightly ahead of Wall Street’s estimate, but Opex guidance came in below.

AMD Highlights:

Revenue: $6.17B vs Wall Street’s $6.13B

Q4 EPS: $0.77 ex-items vs Wall Street’s $0.77

Gaming was ahead of expectations on the top line while Client missed with Embedded and Data Center in-line. Ambitious estimates from Wall Street were lowered after the call (Q1 Revenues -4.6% to $5.46B, and EPS -8.8% to ($0.06) to $0.61.

Alphabet Highlights:

Revenue: $86.31B vs Wall Street’s $85.28B

Q4 EPS: $1.64 vs the Street’s $1.59

Higher than expected CapEx in the quarter was poorly received, as was uncertainty around management’s investment outlook in 2024. Ad revenue was also below expectations.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

Sadly, the man who invented autocorrect has passed away, restaurant in peace.

My wife tells me I talk in my sleep all the time. But I’m skeptical. Nobody at work ever mentions it.

Hot Headlines

Axios | The retail apocalypse never happened. Slow supply growth has helped. Ppl still go to ‘stores’?

Bloomberg | Disney lawsuit against DeSantis dismissed by Federal Judge. Sued over perceived retaliatory actions, including threats to void land-use contracts Disney holds, over the company’s criticism of a parental rights law DeSantis backed.

Axios | State Department reviewing options for possible recognition of Palestinian state. US has avoided granting such recognition in the past, urging the Palestinian Authority and Israel to figure it out (spoiler: it didn’t work). Now being pushed as possible solution to ongoing crisis.

CNBC | Biogen drops controversial Alzheimer’s drug Aduhelm to focus on Leqembi, experimental treatments. Most controversial drug approval in history (IMO) back in 2021. I remember two members of the FDA panel that approved the drug resigned in protest. Too bad, could have helped a lot of ppl if it worked.

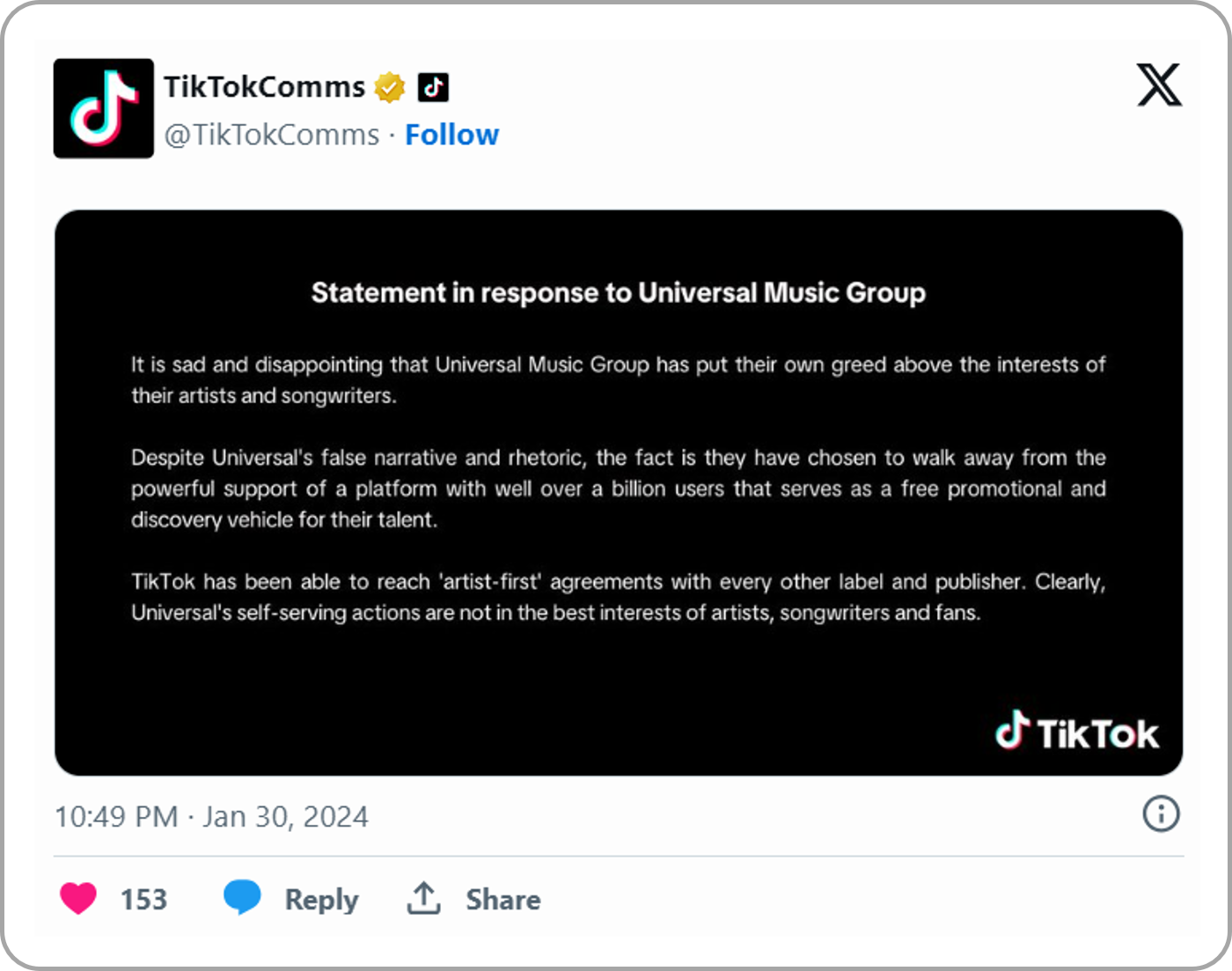

NDTV | Universal Music threatens to remove millions of songs from TikTok over licensing dispute. Sounds acrimonious (my word of the day), don’t expect a resolution any time soon.

Trivia

This week’s trivia is on Investing 101.

Beta in finance measures:

A) A company's profitability

B) A stock's volatility relative to the market

C) The CEO's performance

D) Interest rate riskWhat does WACC stand for?

A) Wide Asset Cost Control

B) Weighted Average Cost of Capital

C) Working and Consumable Cash

D) Wages, Assets, Costs and ContingenciesBond yield primarily represents:

A) The bond's weight in gold

B) The bond's maturity date

C) The return on investment for the bond

D) The coupon interest rate of a bond

(answers at bottom)

Market Movers

Winners!

Plug Power (PLUG) [+19.3%] Upgraded to buy from neutral by Roth MKM after a promising visit to its Georgia green hydrogen plant, indicating major technical challenges have been resolved. Green hydrogen delivery expected imminently.

Paramount Global (PARA) [+6.7%] Received a ~$30B offer from Byron Allen's Allen Media Group at $28.58 per share, significantly above Tuesday's close of $13.41, confirming market rumors report.

Stryker (SYK) [+5.9%] Surpassed Q4 earnings, revenue, and organic growth expectations, particularly strong in MedSurg/Neurotechnology. FY EPS and organic net sales growth guidance optimistic, with analysts positive on Spine results and new product growth. Still my favourite Medtech company.💘

Boeing (BA) [+5.3%] Beat Q4 EPS and revenue despite a profit loss, with better-than-expected FCF. Did not provide FY24 guidance.

Losers!

New York Community Bancorp (NYCB) [-37.6%] Q4 NII/NIM underwhelmed with better fee income; higher net charge-offs and nonperforming assets. Anticipates negative loan growth in FY24, increased provisions for financial standards, and reduced dividend to boost capital.

Rockwell Automation (ROK) [-17.7%] Missed FQ1 EPS and revenue but maintained FY24 outlook. Expects modest EPS growth, second-half heavy, amidst inventory and supply chain woes. Concerns include order delays/cancellations and weakness in ex-US sales.

Alphabet (GOOGL) [-7.5%] Surpassed Q4 revenue and EPS, but showed caution with softer Search growth and high Q4 capex. 2024 capex increase anticipated, mainly AI-related, yet Cloud and YouTube shine.

SoFi Technologies (SOFI) [-6.8%] Downgraded by Morgan Stanley due to slowing growth, execution risk, and excessive optimism. Was up 20% yesterday, yeesh.

Thermo Fisher Scientific (TMO) [-5%] Outperformed in Q4 earnings and revenue with stable OM; less severe organic growth decline. Analytical Instruments fared well, but Laboratory Products/Services underperformed due to vaccine/therapy revenue runoff. FY24 guidance below expectations.

Market Update

Trivia Answers

B) A stock's volatility relative to the market is measured by Beta.

B) WACC stands for Weighted Average Cost of Capital.

C) Yield is a measure of the return on investment for the bond.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.