The Fed Deep-Dive, Amazon Sued, and Much More

StreetSmarts Morning Note

“Price is what you pay. Value is what you get.”

-Warren Buffett

“A fool and his money are lucky enough to get together in the first place.”

-Gordon Gekko

Table of Contents

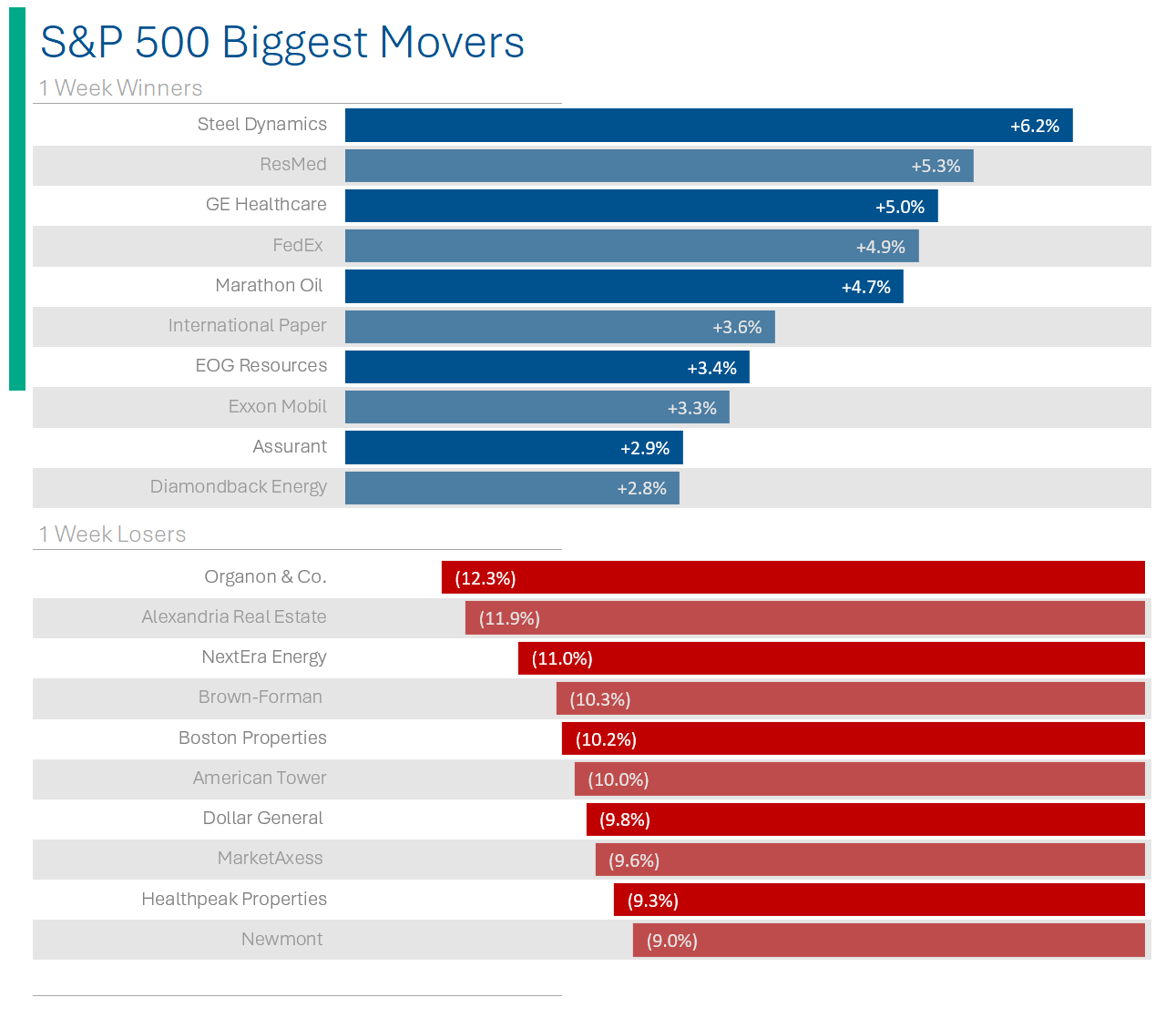

Oil Price Rally

OpenAI Considers Share Sale

Trump Found To Have Committed Fraud/Trial Next Week

UBS Stock Falls After D.O.J. Probe Into Sanctions Evasion

Trivia

Joke Of The Day

Fun Fact

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

The Fed Situation Explained

Economic Catch-22

The biggest news in the markets over the last week has been Federal Reserve Chairman Jerome Powell’s (from now on, JPow - as he likes to be called) comments coming out of the last Fed meeting last Thursday. At the meeting, the Fed kept rates unchanged (as expected) but the tone was perceived as ‘hawkish’ - bond nerd speak that he’s committed to raising rates to fight inflation; economy be damned! Below I’m going to outline some of the considerations weighing on future Fed decisions, discuss the potential impacts, and highlight some of the expectations from investors and Wall Street.

What’s the Fed’s Job?

First and foremost, the Federal Reserve has certain duties to uphold regarding the US economy. This is primarily referred to as the Fed’s ‘Dual Mandate’:

1) To keep price levels stable - this mostly comes in the form of raising interest rates to keep inflation below a target level of 2%; and

2) To maximize employment - you can ignore this one (at least during this crisis…)

What have they done?

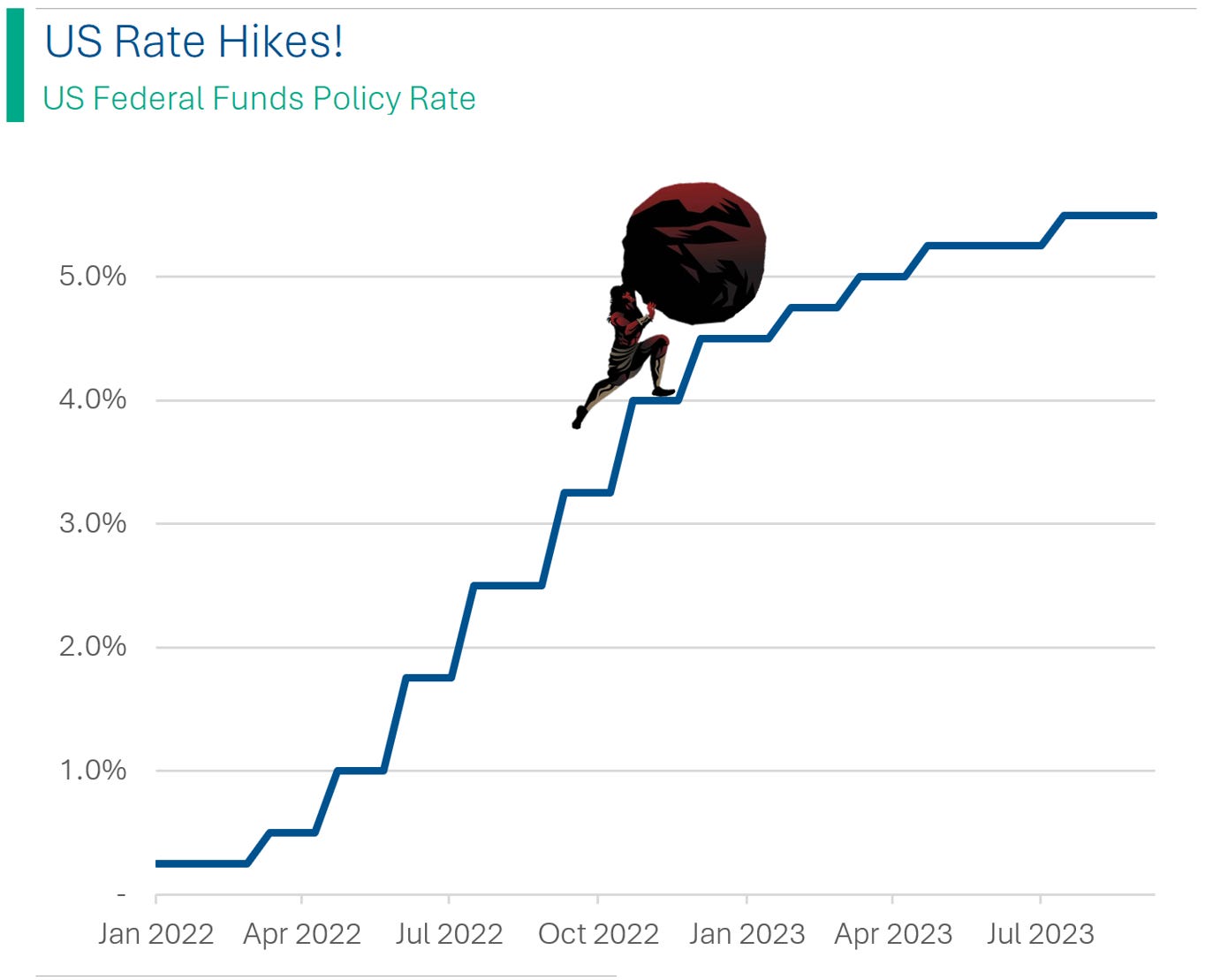

In light of the high inflation experienced since the pandemic - peaking at 9% in June 2022 - the Fed has raised rates aggressively to bring price levels down. This worked out reasonably well as inflation dropped substantially from its peak.

What’s the problem now?

While inflation has dropped significantly, it remains above the Fed’s 2% target level, currently sitting at 3.7%. What’s worse, is the figures for July and August actually showed a year-over-year increase.

Why is that so bad?

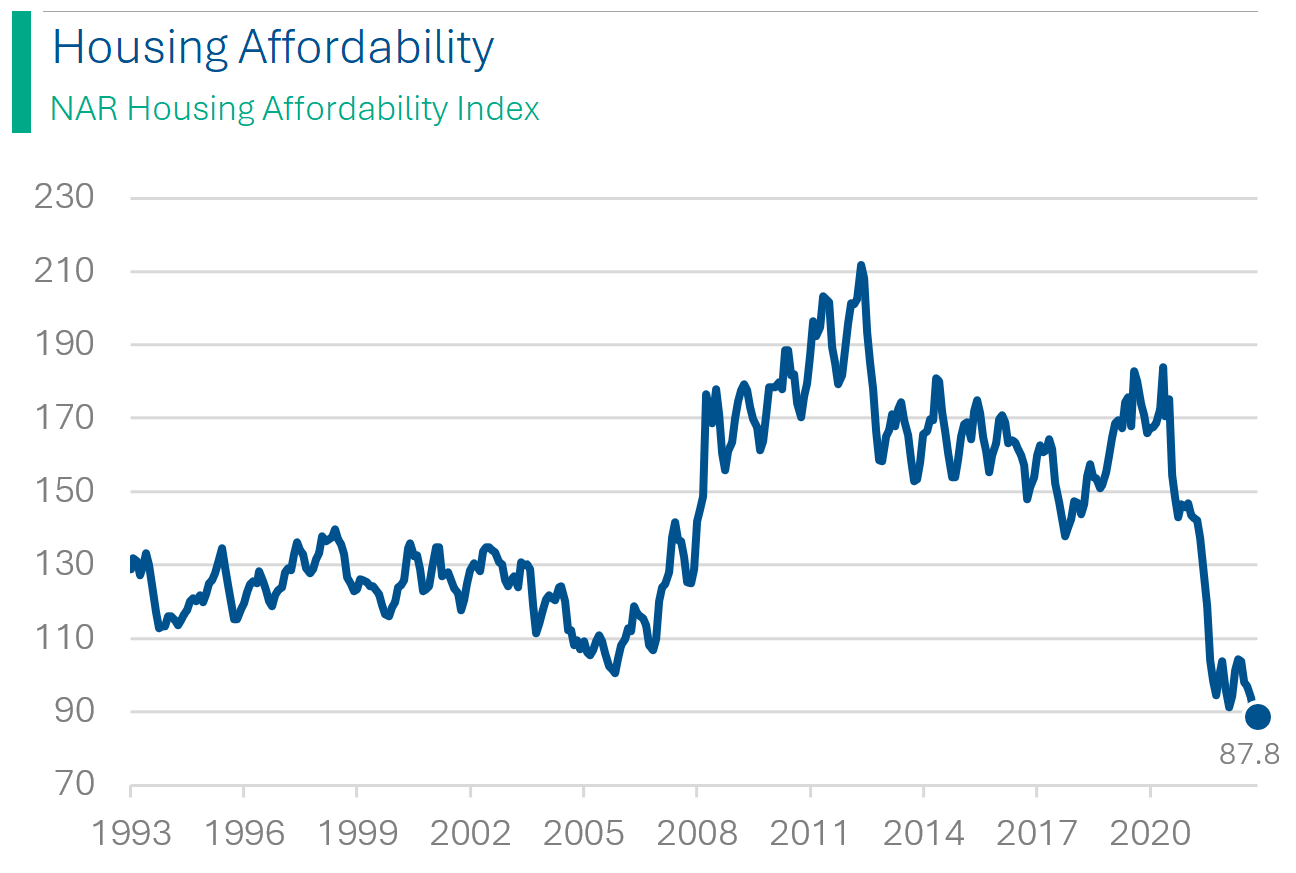

High interest rates have a negative impact on the broader economy. From businesses being charged more to borrow to expand their businesses, to regular people getting charged more for mortgages and car payments. Investors (and people looking to get a loan) were hoping that inflation would cool off more and that the Fed could begin to lower rates. Instead, it looks like they will take more action (raise rates higher) which will have an even greater negative impact on the economy.

So, how is the economy doing now?

By a lot of measures things look pretty good. And that’s part of why the Fed would even be considering raising rates: unemployment is still near record lows and economic growth, in the form of Gross Domestic Product, has actually been outperforming expectations. However, there are a lot of things behind the scenes that are building up. For example:

Housing affordability is at its lowest levels in over 30 years

Delinquencies on credit cards and personal loans are growing at a fast pace

Data shows that excess savings built up during the pandemic are now exhausted for the bottom 80% of Americans and credit card debt is building

44 million American’s have just started to resume payments on student loans with an average monthly payment of ~$500

The net result of all of that is that people will have less money to spend, which causes a recession, which leads to job losses, increases in personal debt, etc.

How has the Fed’s view changed?

The language during the press conference from JPow (also, Pow Dog) was increasingly hawkish and left on the table the potential for additional rate increases this year and next. He made statements about the Fed’s belief it can succeed lowering inflation without blowing up the economy (I’m paraphrasing here) and leading to significant job losses.

The Fed also provides the data from internal polling of is officials (when fully staffed this number is 19). These people are responsible for the famed ‘dot plot’ (seen above), which discloses the officials’ individual views on where they see rates shaking out in the future. Below, you can see the Dot Plot’s data aggregated into percent ranges. The key take away here is the that in the period since the June meeting (dotted line), Fed officials have increased their expectation of where interest rates will be over the next two years.

Additionally, the officials provide their personal projections for GDP growth (seen below), which have increased materially for 2023 and modestly for 2024.

Opinion/Take-Away: The way I interpret this is that the Fed sees GDP growth as strong (improved, actually) and as a result might be less hesitant to halt rate hikes if they believe the economy can endure them. The big question is ‘are they right?’ As mentioned above, there’s a lot of evidence that the US economy is deteriorating and they could end up making things much worse if they are wrong.

What does the Street think?

Expectations for interest rates in 2024 and 2025 have increased as expected (they expect interest rates to come down slower than previously). Lots of attention being paid to Personal Consumption Expenditures (PCE) which is going to be released on Friday. PCE is the Fed’s preferred gauge of inflation, over the more familiar Consumer Price Index (CPI). A high print for PCE on Friday could give the Fed extra impetus to raise rates.

Opinion: Personally, I think additional rate hikes are potentially quite dangerous. There is a lag between the time that you raise interest rates and that their impact trickles through the economy. So, the full force of +5% interest rates likely hasn’t really worked its way through the broader economy to cool inflation down to the Fed’s target 2% rate. And it’s not like the US has been on the back foot through all of this and needs to rush to play catch-up; they have the highest interest rates in the developed world!

From the other side, the person who’s seen their car payments go up $200 a month, or their mortgage payments go up by $500 doesn’t just go bankrupt tomorrow. They have to burn through savings and max out their HELOC and credit cards first. Just because we haven’t seen the economy fall apart yet doesn’t mean its immune to what’s happened, and what likely will continue to happen. High interest rates aren’t a knock-out punch, more like body shots.

TLDR: The Fed thinks the economy is sound and that it can probably raise interest rates higher to combat inflation. There is a risk that if the economy is in worse shape then they think, they could cause serious damage to the businesses and individuals already financially stretched.

Amazon Lawsuit

FTC Is Primed For A Fight

The US Federal Trade Commission and 17 States filed a lawsuit against Amazon for illegal trade practices. A statement released by the corporate fun police, claimed that Amazon uses ‘a set of interlocking anticompetitive and unfair strategies’ in its efforts to ‘illegally maintain its monopoly power’. ‘Monopoly’ might be a stretch in the purest sense as their are plenty of other online retailers (I’m currently on month two of my wait for my new iPhone case from AliExpress), but the lawsuit seems to have some merit in regards to the way sellers get locked into the platform, and stuck with high fees and barriers around the way they have to sell and price their wares. From the statement: ‘Amazon violates the law not because it is big, but because it engages in a course of exclusionary conduct that prevents current competitors from growing and new competitors from emerging.’

Some of the measures the suit claims include:

Anti-discounting - If you sell on Amazon you can’t sell products for cheaper elsewhere. If they catch you, they bury your products deep in the search results. And Jeff Bezos comes to your house and makes you sign up for Blue Origin.

Forcing Fulfillment Services - To be eligible for Prime - which is a virtual necessity for doing business on Amazon - sellers have to hand over their fulfillment services to Amazon. This is reportedly quite costly and makes it extremely difficult for them to offer their products on other platforms.

Costly Fees Once Locked In - Sellers face a range of fees the FTC deems exorbitant, such as monthly fees for each product, and that in order to get any traction, sellers must spend lavishly on advertising. The FTC says fees here can close in on 50% of the sellers revenue on the platform.

Some of the other claims around ‘user experience’ seem like a reach. For example:

‘Degrading’ the customer experience by replacing relevant search results with paid advertising. Ad money makes the internet move so not sure they win on this one. One day, years from now, I too hope for internet ad money.

‘Biasing’ search results to place Amazon products ahead of ones ‘Amazon knows’ are better quality. Sure. Imagine Bezos doing a snuggle test between assorted pillow cases, cackling manically at how low the thread count is on the Amazon Basics one.

Amazon attempted to fire back, with its General Council David Zapolsky telling Reuters that its actions actually “helped to spur competition and innovation across the retail industry” while producing “greater opportunity” for businesses to sell on Amazon’s platform. That’s awfully nice of them. Sounds kinda like Thanos’ argument about ‘helping’ the galaxy.

The charge, as always, is being led by FTC Chair Lina Khan, whose had a bone to pick with Amazon since she was a student at Yale. In 2017 she wrote an article for the Yale Law Journal called ‘Amazon's Antitrust Paradox’ which garnered a lot of attention (probably mostly among snobby Ivy Leaguers). Since taking over the reigns in 2021, she’s gotten a lot of press for her antitrust work and has become quite a polarizing figure for her attacks on big business, notably for trying to cancel Microsoft’s acquisition of video game maker Activision Blizzard. The deal passed legal scrutiny in July (sick burn) and Amazon appears to be her new white whale.

Opinion: Its probably too early to tell how the lawsuit will shape up but its hard to remember a large FTC lawsuit having a huge impact on a company’s operations. Most of the charges seem to only be resolvable across the broader eCommerce space, and singling Amazon out as the only perpetrator seems a bit slippery.

If you’ve read my note the last few days, you’ll know I’m growing pretty bearish on the US Consumer Discretionary sector (of which Amazon is the largest member), so this could be another negative catalyst for the space as investors search for reasons to keep holding. So far, Amazon isn’t getting hammered too hard - down 2.5% - but interestingly, if you go back a few weeks its significantly underperformed its peers and sector. A little bit of front running at the FTC?

TLDR: Lawsuit is probably nothing Amazon can’t handle but another negative catalyst for shaky Consumer Discretionary Sector. And Lina Khan is insider trading.

Speed Round

Oil Price Rally - Oil is up around 30% for the quarter and the highest its been in over a year. The 1.3m barrels a day cut from the Saudis and Russia is a leading contributor to the rally. Concern is starting about reserve inventories, such as the Cushing, OK storage facility. Forbes Article.

OpenAI Considers Share Sale - The poster child for all this AI hullabaloo is reportedly considering raising additional private market capital (no word on upcoming IPO) at a valuation between $80 - $90 billion. The valuation would be ~3x what they were reportedly worth when they last raised cash in January. A valuation like that would make them one of the most valuable private companies in the world and amongst the likes of SpaceX and TikTok owner ByteDance. Bloomberg Article.

I don’t know, it doesn’t seem that special to me, my 5yo knows this one…

Trump Found To Have Committed Fraud/Trial Next Week - The former President and his company go on trial next week in New York over alleged fraud associated with inflating the value of the company and its assets. The NY judge found that Trump’s company had committed fraud in order to obtain better business deals. If I end up writing a long form piece on this it will be called ‘Caught Orange Handed’. AP News Article.

UBS Stock Falls After D.O.J. Probe Into Sanctions Evasion - The former Credit Suisse IBanker in me chuckled, ‘Finally, a Swiss Bank in trouble and it wasn’t CS’. Nope. The US Department of Justice suspects Credit Suisse of helping Russians evade sanctions associated with the Russian invasion in Ukraine and potential compliance issues. UBS, which bought CS in a fire sale earlier this year for $3 billion, is just on the hook for it now. In a way its nice that some things never change. CNN Article.

Grab Bag

Trivia:

1. In 1980, the billionaire Hunt Brothers tried to corner the market for what commodity?

Aluminum

Silver

Crude oil

Pork Bellies

2. Since we’re at it lets do another ‘corner trade’. In the late 1950s, Chicago Mercantile Exchange traders Same Seigel and Vincent Kosuga attempted to corner the market for an agricultural product. Complaints led to the creation of a new law called:

The Potato Spot Act

The Orange Juice Act

The Onion Futures Act

The Wheat Leveraged Market Order Volatility Act

Joke Of The Day:

(this one is for my buddy David)

The First Law of Economics: For every economist, there exists an equal and opposite economist.

The Second Law of Economics: They're both wrong.

Fun Fact:

In the year 2000, the NYSE moved to decimalization - the ability to trade shares on an exchange at 1 cent increments. So how did they trade before? 1/16 of dollar of course. A weird feature of the US stock market was that shares had to move at $0.0625 increments. Since shares generally have a different price for buying and selling (the ‘bid-ask spread’) this made for chunky commissions and made investing in penny stocks quite expensive (as shares are typically traded on a per share commission). Thanks Obama Decimalization!

So where did the 1/16th thing come from? Apparently the Founders of the NYSE (see yesterday’s Fun Fact on the Buttonwood Agreement) based the structure of the exchange on the Spanish (you think they’d base it on the British but this was 1792 and only a few years after the American Revolution and they weren’t homies yet).

Anyway, the Spanish trading system was based on the Spanish dollar which was often cut into 8 pieces in order to exchange it for lesser priced goods (defacing money wasn’t a crime back then, I guess). Over time the Spanish dollar came to generally be referred to as the Spanish Piece of Eight (I thought they made that up for Pirates of the Caribbean but I guess it was a thing) and when the Americans started their stock exchange they used the Spanish system of 1/8th of a dollar - or $0.125. Once that became too cumbersome, they skipped the immediately obvious step of going to ‘cents’ and just cut the trading increments in half to $0.0625. Genius.

Market Update

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

Trivia Answers:

Answer: Silver.

This story is pretty crazy if you haven’t heard it. Two brothers with significant family money (oil, sugar, real estate) decided to try and corner the market for silver (essentially buy a significant share of the world’s silver so they could manipulate the price artificially high and make a killing). In 1979 before the attempted corner, the price of silver was around $6. Over the course of the next year, the price had increased to around $50 - up more than 700%!

That’s when ‘Silver Thursday’ happened (sounds so much better than Black Monday). March 27, 1980 saw the price of Silver collapse as the brothers ran out of (mostly borrowed) money and could no longer keep buying. This led to a panic in the commodities market and a consortium of banks arranged a bail-out of Bache Halsey Stuart Shields, the broker on the hook by the Hunt Brothers, in order to stop commodity markets from potentially collapsing globally.

My favorite part of the story is that jeweler Tiffany’s became so irate about having to pay massive price increases to buy silver, that they took out an ad in the NY Times publicly shaming the brothers who had already become well known for the trade.

The Onion Future Act…which is still in effect today.