The Cult of Momentum

Plus: You're better off holding lava than EV stocks

"Geography has made us neighbors. History has made us friends. Economics has made us partners. And necessity has made us allies. Those whom nature hath so joined together, let no man put asunder.”

- President Kennedy, address to Canadian Parliament

“Never try to teach a pig to sing. It wastes your time and annoys the pig”

- George Bernard Shaw

Hey Readers,

The only thing I’m going to say about the US/Canada trade war is:

<1% of Fentanyl smuggled into the US passes through Canada.

Using that as a fake excuse for a trade war is playing brinksmanship with tens of millions of livelihoods on both sides of the border.

There is no way to cripple the Canadian economy to the point at which they will decide to become the 51st State.

Let’s hope we can go back to being friends again soon. 🍁🦅

Have a good weekend,

- Ryan

Street Stories

The Cult of Momentum

Maintaining index data is pretty boring so the good people at Standard & Poor’s Global spice up their day-to-day lives by thinking up new and weirder ways to cut up the markets into data rich chunks.

One such way was the 1994 introduction of their ‘Momentum’ indices; the most important of which slices up the S&P 500 into the 100 companies that exhibit the strongest price performance over the 12 month period prior to the rebalancing reference date (ie: stocks that have gone up the most in the last year are included).

[If you’ve ran out of Ambien, here’s the index methodology document]

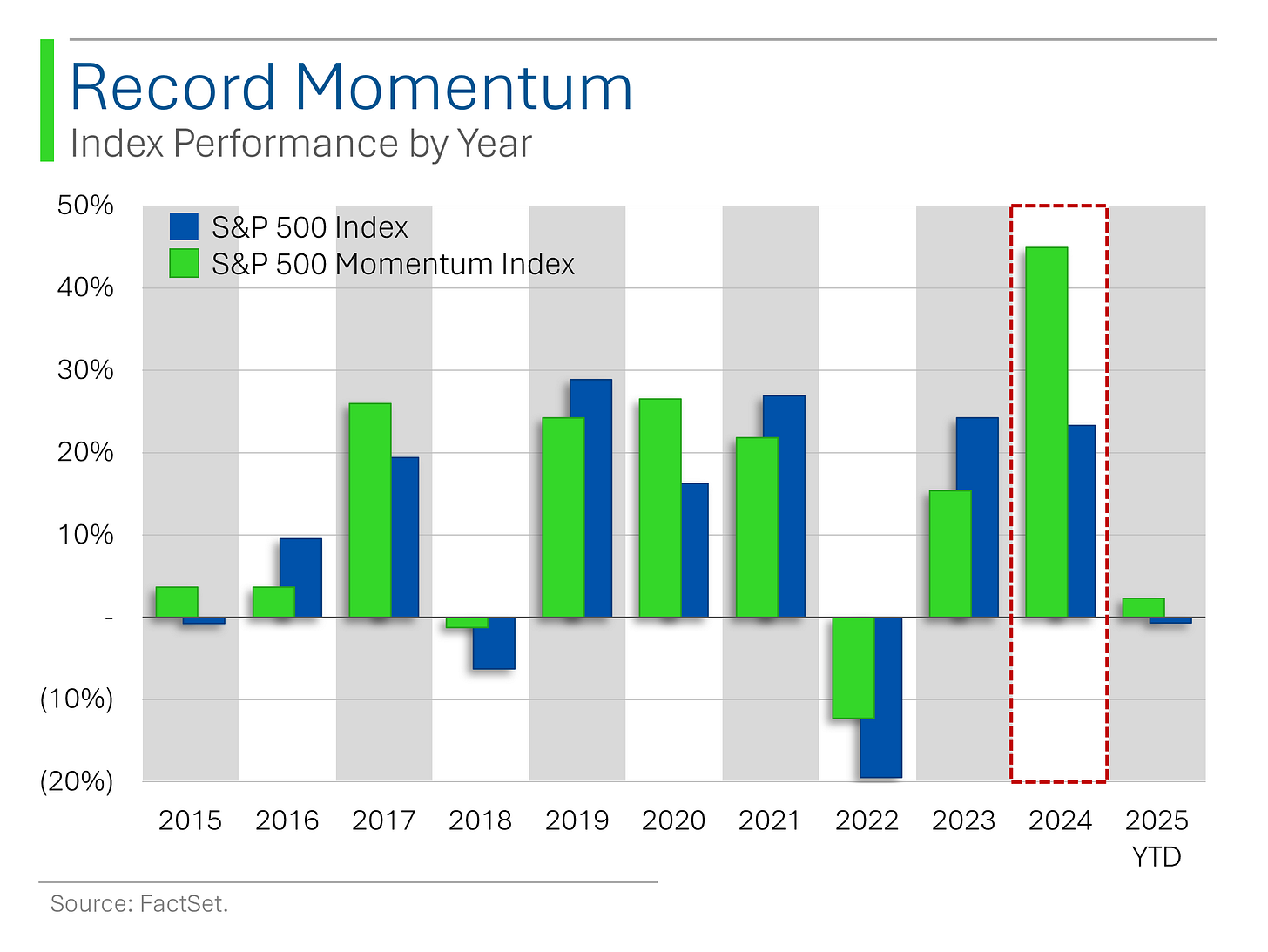

Spoiler Alert: We are currently going through one of the greatest periods of momentum in history.

As you can see above, historically the S&P 500 and the S&P 500 Momentum index have moved pretty much in lockstep. Generally it’s more than just the top quintile of companies that exhibit momentum traits, and often by the time a company gets included into the Momentum Index its outperformance can be a bit long in the tooth. Thus, it wanes or reverts to the mean.

What we’re seeing right now, however, is that the names that crushed it in 2023 also crushed it in 2024. And the names that crushed it in 2024, seem to be hanging in so far in 2025.

Looking back over the last decade, you can see how tightly the S&P and the S&P Mo have moved.

But you can also see that in 2024 the S&P finished up +22.3% while the S&P Momo clocked in a blistering +44.9%.

That’s massive or, as the French say, ‘gigantesque’.

This means that last year the Mo beat the S&P 500 by +21.6%.

At this point I should highlight that the only two other times in its history that the Mo has done better on a relative basis were in 1998 and 1999.

You know, right before the Tech Bubble burst. ☠️☠️

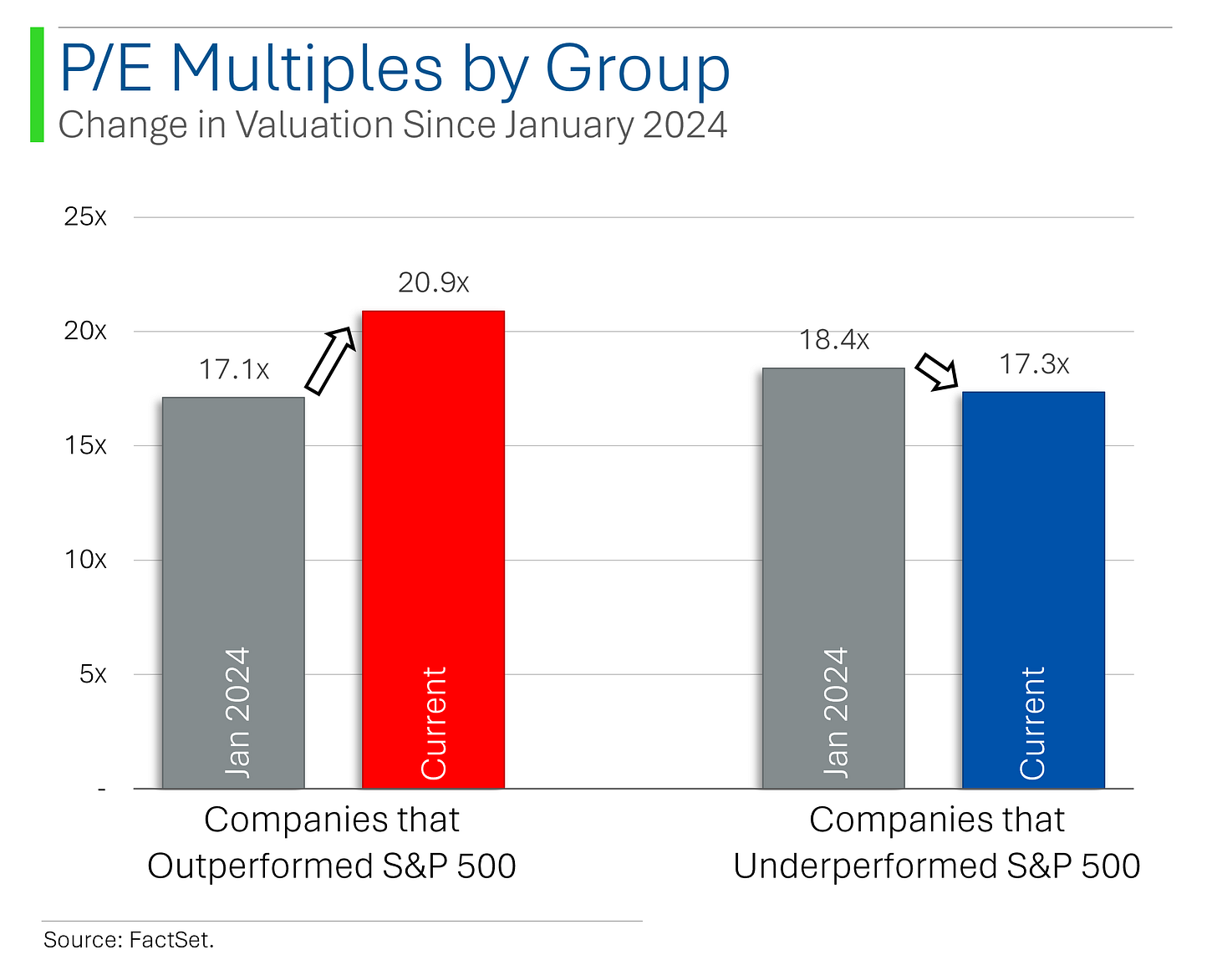

This brings me back to something I’ve written about quite a bit over the past year: the lack of breadth in the market. While 66% of companies in the S&P 500 are positive since the start of 2024, only 33% of them are actually outperforming the market.

As you would expect, the median 12-month forward P/E multiple for companies that have outperformed the market has increased materially since January 2024, while the multiple has actually declined for companies underperforming the market (EPS estimate increases > share price increases).

This really serves to skew the value proposition and makes those formerly unloved stocks that much more desirable.

To wrap this up, the winners keep winning, but that increasingly represents a smaller and smaller proportion of the market. So whatever happens when the music stops for those few gilded stocks, it will certainly be noteworthy.

EV Stocks Are Terrible

Ok, sure, Tesla has done great for shareholders brave enough to weather the triannual bloodbaths. And there’s a half decent case to be made that BYD is the best car company in the world (sadly).

But as an asset class: Terrible.

I updated the above chart from a July post to include the fact that Canoo (Jan 2025) and Nikola (Feb 2025) have joined the bankruptcy club.

My favorite has to be Mullen Automotive. Publicly traded since October 2012, they most recently did a 1-for-60 reverse stock split (world record?) in February to avoid being delisted from the Nasdaq for min bid price requirements (they are subsequently down 84% since then so expect another one shortly).

Meanwhile, Tesla shares have roundtripped (again). For a stock that has roughly matched the performance of the S&P over the last two years, it’s certainly taken the scenic route.

The 31% decline in the shares since the start of the year can be blamed on a plethora of reasons (never good when your bad stuff gets measured in plethorae).

In January, Tesla's sales in Europe dropped 45% year-over-year, while February sales of China-made Teslas plunged 49%, marking the lowest monthly sales since August 2022. Meanwhile, Chinese competitor BYD saw its sales surge 90.4% in China, further eroding Tesla’s market share.

Elon Musk’s involvement in politics has also sparked a backlash, leading to protests and a damaged brand image, particularly in Europe. Production delays, including downtime for the Model Y refresh, have contributed to Tesla missing delivery estimates, prompting analysts to lower their price targets. Tariff concerns and supply chain uncertainties have added to investor fears, putting further downward pressure on the stock.

Hell, even the Elon fanboys are annoyed he has spent <1% of this time this year CEOing.

Joke Of The Day

Question: How do you define optimism?

Answer: An investment banker who irons five shirts on a Sunday.

Trivia

Today’s trivia is on electric vehicles.

1. When was the first electric vehicle invented?

A) 1889

B) 1832

C) 1910

D) 1955

2. What was the best-selling electric vehicle of all time as of 2023?

A) Nissan Leaf

B) Chevrolet Bolt

C) Tesla Model Y

D) BYD Qin

3. Which country currently produces the most electric vehicles?

A) United States

B) Germany

C) Japan

D) China

4. The first Formula E (sorta electric Formula 1) race took place in:

A) 2014

B) 2016

C) 2018

D) 2020

5. What automaker introduced the first electric pickup truck to the U.S. market?A) Rivian (R1T)

B) Tesla (Cybertruck)

C) Ford (F-150 Lightning)

D) Chevrolet (Silverado EV)

(answers at bottom)

This Week In History

March 3, 1931 – "The Star-Spangled Banner" Becomes U.S. National Anthem

President Herbert Hoover signed a law designating the song as the national anthem, solidifying its place in American identity.

March 5, 1946 – Churchill's "Iron Curtain" Speech

Winston Churchill's speech in Fulton, Missouri, introduced the term "Iron Curtain," symbolizing the division between Western democracies and Eastern communist countries. Topical.

March 9, 1997 – The Notorious B.I.G. Murdered

Influential rapper Christopher Wallace, known as The Notorious B.I.G., was killed in a drive-by shooting in Los Angeles, intensifying the East Coast-West Coast hip-hop rivalry.

Market Update

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) The first electric vehicle was invented in 1832.

C) The Tesla Model Y is the best selling EV of all time.

D) China produces the most EVs.

A) The first Formula E race took place in 2014.

A) Rivian (R1T) was the first electric truck to enter the US market.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

"All truth goes through three stages. First, it is ridiculed. Then it is violently opposed. Finally, it is accepted as self-evident" - Arthur Schopenhauer. Very impressive content.

If you actually believe that <1% number for fentanyl I have some ocean front property in Arizona for you