The Consumer Discretionary Sector is Weird...In Charts!

Plus: January Sucks For Investors, And The Market is Top Heavy

“I skate to where the puck is going to be, not where it has been.”

- Wayne Gretzky

"Your margin is my opportunity."

- Jeff Bezos

Street Stories

Consumer Discretionary In A Nutshell

Going forward, you will see me periodically do a bit of a dive into the various sectors in the hopes of sharing something interesting.

Today I thought I’d start with Consumer Discretionary - a hodgepodge of random tech, manufacturers, fast food joints and even a few cruise lines. The connecting feature of which seems to be that they all share cyclicality to the spending decisions of end consumers.

Don’t hate me - I didn’t come up with this weird methodology…

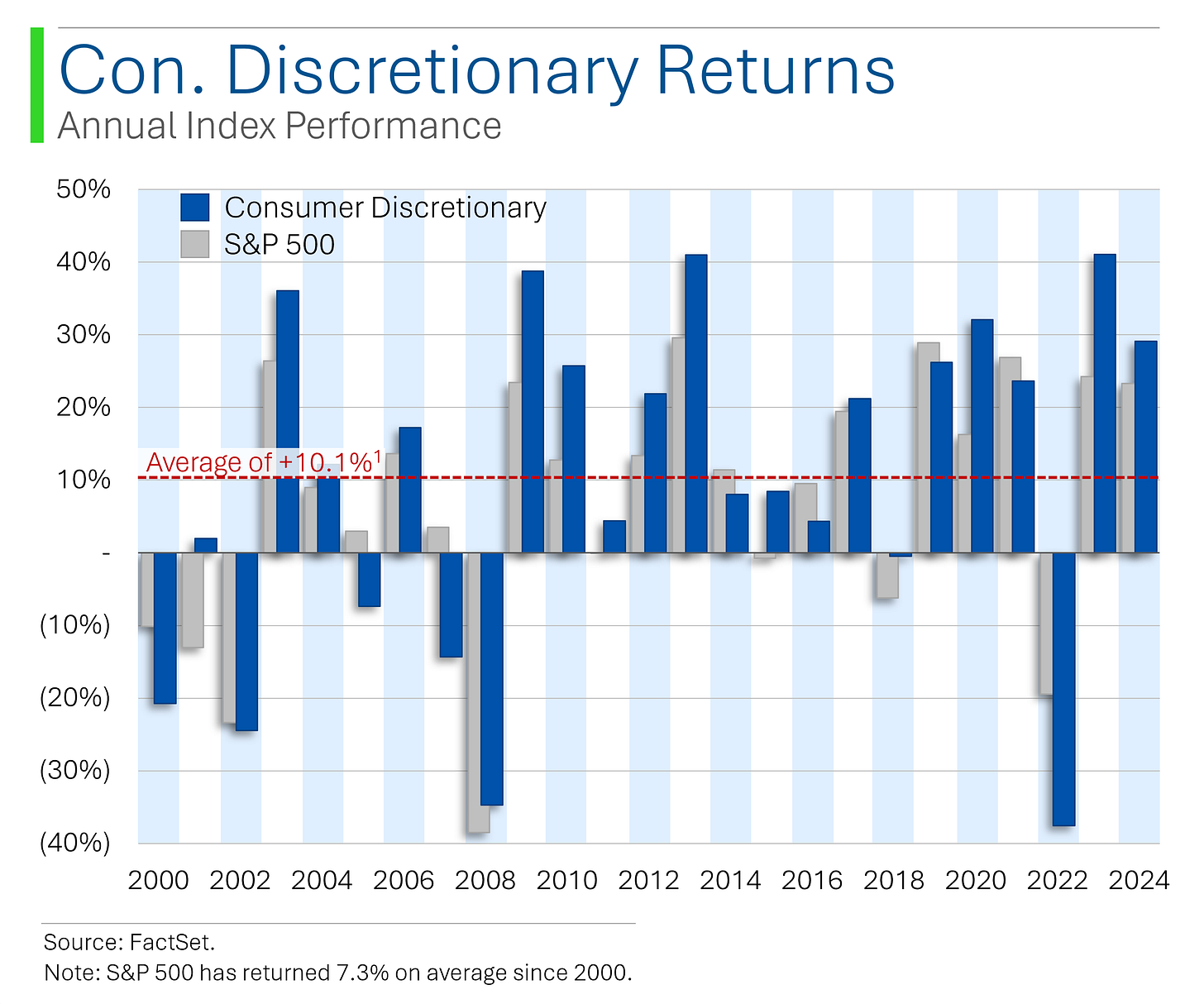

To start, Consumer Discretionary has been a great place to have some of your portfolio since the turn of the millennium. Since 2000, the sector has managed an average annual return of +10.1% - well ahead of the S&P 500 at +7.3%.

One of the cheat codes to investing has been to bet on an extremely resilient (and often spendthrift) US consumer, and Consumer Discretionary has been one of the best ways to capitalize on that.

More recently, Consumer Discretionary has kept up with the best performing sectors. Since the start of 2024, the sector is up a whopping +32% - just shy of it’s more hyped colleague, Tech, at +35%.

A look into the best and worst performing companies in the sector reveals what a mixed bag it is.

Something else pretty weird about Consumer Discretionary is just how top heavy it is. Like, super top heavy.

Of the $6.1 trillion in market cap included in the subindex, $3.6 trillion of that is the result of just Amazon and Tesla.

And while the index crushed it in 2024 - up a gargantuan +29% - a look under the hood makes the sector’s foundation seem a bit rickety. Tesla and Amazon contributed ~88% of the total market cap gain for the sector in 2024, and third place finisher Home Depot adding just 5.6% of what Amazon did ($42b vs. $737b).

If you are thinking about punting around a CD sector ETF, you better be pretty comfortable holding a big pile of Amazon and Tesla (or, like, just buy those two stocks).

My take away from all of this is that looking at Consumer Discretionary as indicator of the state of the US consumer really isn’t all that helpful. And as an investment tool via ETFs, you’d be better off just buying stock in Amazon and Tesla, and saving yourself the admin fee. An equal weight subindex might be though.

Investors love data - and I’m definitely on that list - but sometimes the numbers behind the numbers are just…well, weird.

January Sucks

The holidays are over. The snow is relentless. And it’s no longer socially acceptable to be continuously intoxicated. January sucks.

It’s also particularly terrible for the stock market.

The S&P 500 is already down 1.9% for the year, and January has been a negative month in 25 of the last 40 years (62.5% of the time). Ooof.

Fear not, there is a silver lining!

In years where January has ended negative, 80% of the time the index ended that respective year with a positive return. This is oddly higher than the odds of a year being positive following a positive January (73%).

(ok fine, no more Office memes this week)

Even More Top Heavy

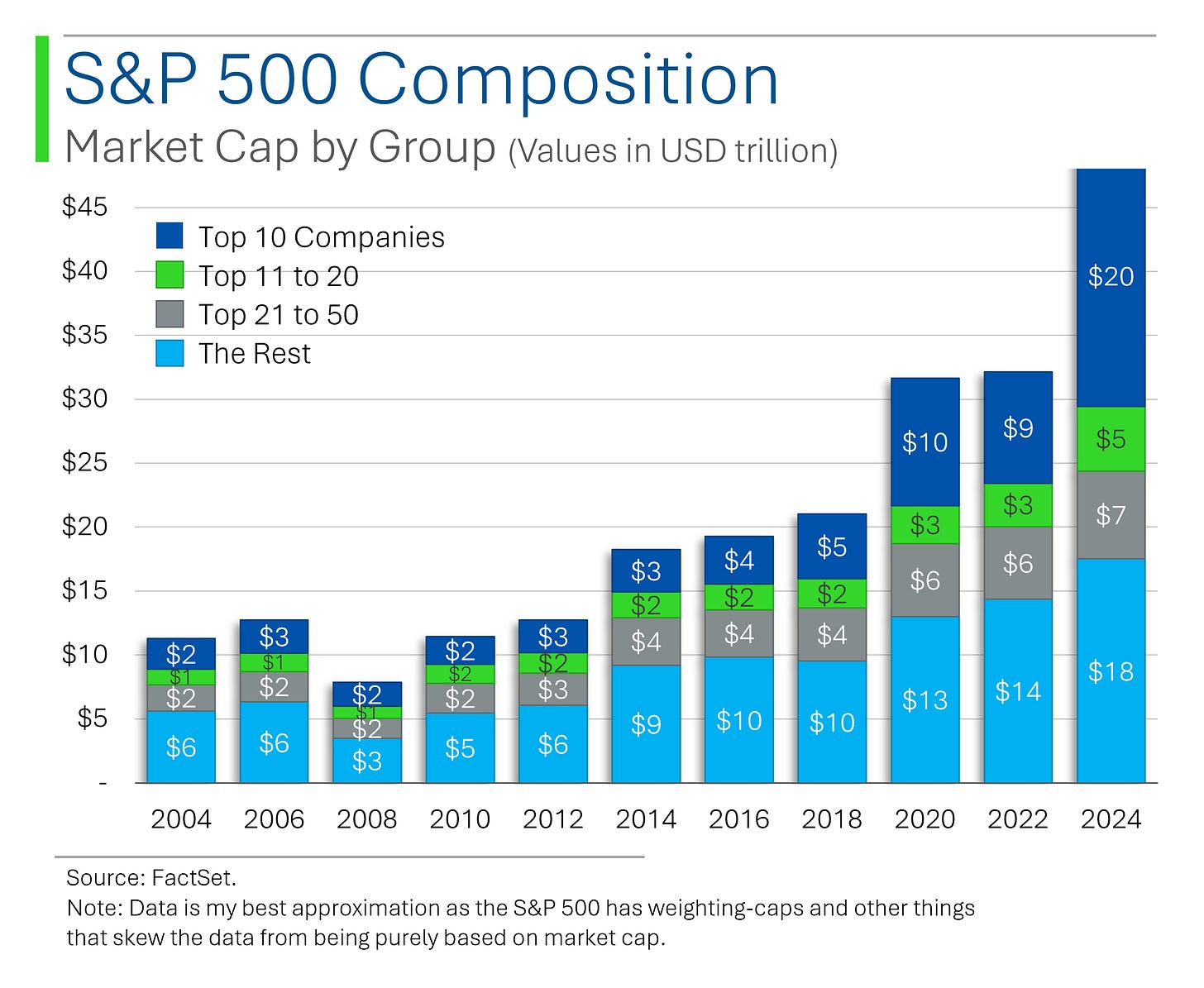

I ranted a few times last year about how the S&P is massively influenced by just a handful of stocks and that the Mag7 basically dictates the state of the market.

Well, it’s gotten even worse!

When I complained about it last February, the Top 10 largest stocks in the S&P 500 made up 34% of the S&P 500. Fast forward 11 months and that figure now sits at 41%!

As you can see below, the S&P has seen growth from all size buckets, but the increase in the Top 10 dwarfs the others.

For example, in the last 10 years, the Top Ten has increased in market cap by a factor of 8.5x.

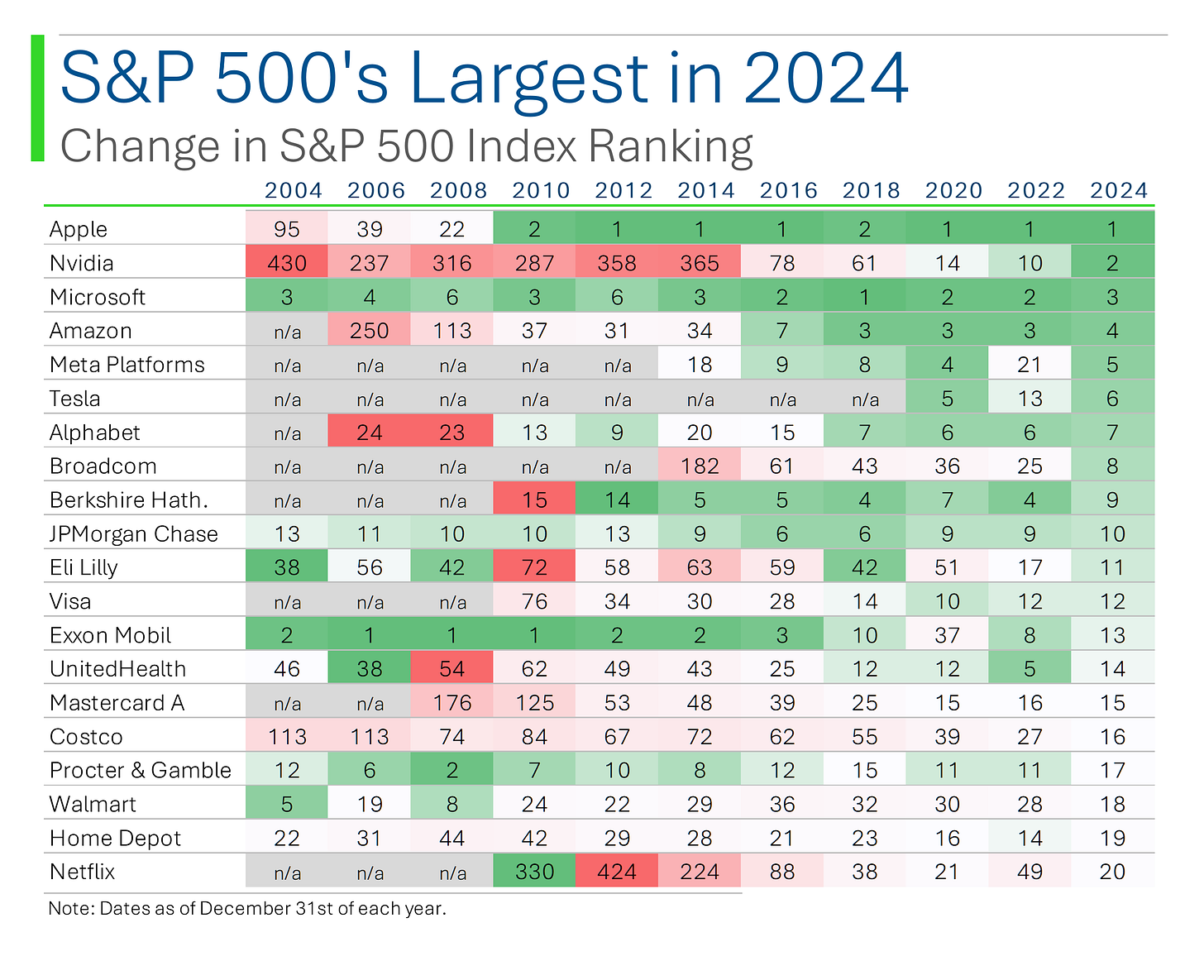

And while the Apple’s and Microsoft’s of the world may seem to have been gigantic forever, you might be interested to learn that most of the growth in the Top 10 has come from relative upstarts.

For example, only 3 companies in the current Top 10 were in that group back in 2004 (5 were in the Top 20). And only 5 were in the Top 10 as recently as 2012 (7 were in the Top 20).

Out with the old, eh?

And surprisingly, only one stock in the Top 20 back in 2004 is ranked higher in 2024 than it was back then: JPMorgan Chase (#13 in 2004, #10 in 2024).

Joke Of The Day

Did you hear about the first restaurant to open on the moon? Great food, but no atmosphere.

Macro Update

Consumer Price Index [Wednesday]

Core CPI inflation was +3.2% annually vs. consensus +3.3%, while annualized headline CPI at 2.9%, led by Energy and Food.

Analysts noted signs of inflation deceleration, particularly in shelter costs, as traders cross their fingers for the Fed to cut more than once this year. Bonds reactively quite strongly to the news, with a rally driven by the shorter dated treasuries.

Producer Price Index [Tuesday]

Headline PPI rose 0.2% m/m, slightly below the 0.3% consensus, with annualized PPI at 3.3% vs consensus 3.4%.

Core PPI was flat m/m, falling short of the 0.3% consensus, with annualized core PPI at 3.5%, below the expected 3.8%. The cooler-than-expected reading led to positive market reactions.

Trivia

Today’s trivia is on Amazon (ie: 38% of the Consumer Discretionary sector):

When was Amazon founded?

A) 1992

B) 1994

C) 1996

D) 1998

What is the name of Amazon's cloud computing service, launched in 2006?

A) Amazon Cloud Drive

B) Amazon Web Services (AWS)

C) Amazon CloudFront

D) Amazon Simple Storage Service (S3)

What was Amazon originally called when Jeff Bezos founded it?

A) Rainforest Retail

B) Cadabra

C) Bezos’ Bazaar

D) Prime TimeIn which city was Amazon's first headquarters located?

A) San Francisco, CA

B) Seattle, WA

C) New York, NY

D) Austin, TX

After surviving the dot-com bubble burst of the early 2000s, what year did Amazon first report a profit?

A) 1999

B) 2001

C) 2003

D) 2005

(answers at bottom)

This Week In History

Great Molasses Flood in Boston - January 15, 1919

A storage tank burst, releasing a deadly wave of molasses that killed 21 people and injured 150, prompting stricter building regulations.

Ratification of the Treaty of Paris - January 14, 1784

The Continental Congress formally ratified the treaty, officially ending the American Revolutionary War and securing independence from Britain.

Bank of England Established - January 14, 1694

The Bank of England was founded to fund war efforts against France, becoming a model for central banks worldwide.

Market Update

Market Movers

Friday:

Qorvo (QRVO) [+14.4%]: Starboard Value reportedly built a 7.7% stake in the company, sparking investor excitement.

Intel (INTC) [+9.2%]: Rumors surfaced that Intel is being eyed as an acquisition target.

Robinhood Markets (HOOD) [+4.5%]: Morgan Stanley named Robinhood a Top Pick, highlighting potential gains from a retail trading revival.

Novo Nordisk (NVO) [-5.3%]: Ozempic and Wegovy were listed for Medicare price negotiations, creating uncertainty for future revenue.

Vistra (VST) [-1.8%]: A lithium-ion battery fire at the Moss Landing facility in California led to evacuations and partial destruction of the building.

Thursday:

Symbotic (SYM) [+18.9%]: Walmart agreed to sell its robotics business to Symbotic in a $520M deal, boosting its future backlog by $5B.

Taiwan Semiconductor (TSM) [+3.9%]: TSM’s Q4 beat expectations, with strong AI revenue growth and ambitious future guidance.

Morgan Stanley (MS) [+4%]: Big Q4 beats in revenue and EPS highlighted strengths in equities trading and wealth management.

UnitedHealth Group (UNH) [-6%]: Revenue missed due to lower premiums and higher medical loss ratios, overshadowing cost savings.

Snap (SNAP) [-5.2%]: Reports indicated the Biden administration is exploring ways to keep TikTok operating in the U.S., adding pressure to Snap.

Wednesday:

D-Wave Quantum (QBTS) [+22.4%]: Quantum computing stocks rallied after Microsoft announced plans to accelerate quantum R&D.

Bank Earnings Strong: Major banks posted strong Q4 results, with earnings and revenue beats from Bank of New York Mellon (BK) [+8.0%], Wells Fargo (WFC) [+6.7%], Citigroup (C) [+6.5%], and Goldman Sachs (GS) [+6.0%], driven by higher net interest income, fee revenue, and robust wealth management performance. Analysts highlighted positive guidance for 2025 and strength across investment banking and asset management divisions.

Tuesday:

H&E Equipment Services (HEES) [+105.5%]: United Rentals announced a $3.4B cash acquisition of H&E, representing a 109% premium.

Signet Jewelers (SIG) [-21.7%]: Weak holiday sales and lowered Q4 guidance sent shares tumbling.

Eli Lilly (LLY) [-6.6%]: Revenue guidance fell short as incretin market growth lagged expectations and inventory levels remained low.

Monday:

Howard Hughes Holdings (HHH) [+9.5%]: Bill Ackman’s Pershing Square proposed buying the company at $85/share or an 18.4% premium.

United States Steel (X) [+6.1%]: The U.S. extended Nippon Steel’s acquisition deadline, with reports of a potential CLF and NUE bid in the works.

Moderna (MRNA) [-16.8%]: The company cut sales guidance and flagged challenges from rising Covid competition and declining vaccination rates.

NVIDIA (NVDA) [-2%]: Customers reportedly cut back on AI chip orders due to overheating and technical glitches in new rack shipments.

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) Amazon was founded in 1994.

B) Amazon Web Services (AWS) is the cloud computing arm.

B) Amazon was originally called Cadabra. Yup, I know. Terrible name.

B) Amazon’s first headquarters was in Seattle, WA.

C) They recorded their first profit in 2003.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Nice write-up. I like Academy Sports (ASO) in consumer discretionary. From your lists, I also own GPC and ULTA. Working on a write-up for ASO soon.

@The Science of Hitting has some good write-ups on ASO and DKS in this industry.

Your graphics are really sharp by the way. I like them.

Office / Dow meme rocked, Ryan! XLY is the answer to a truly bizarre investing question.