🔬The Bullist Bull Market?

"You don't need to be a genius or a visionary or even a college graduate to be successful. You just need a framework and a dream."

– Michael Dell

If you can't be kind, at least be vague."

- Judith Martin

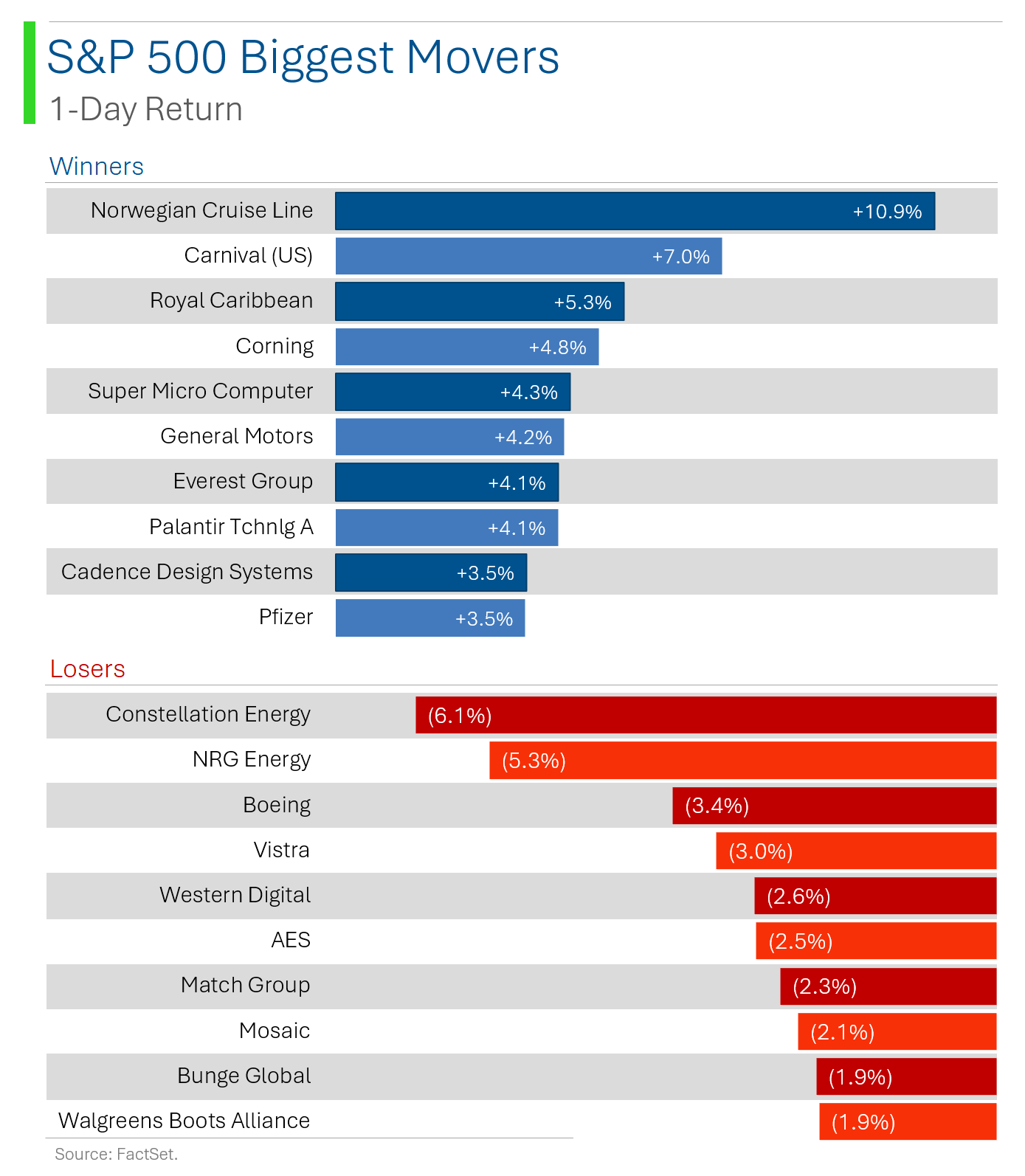

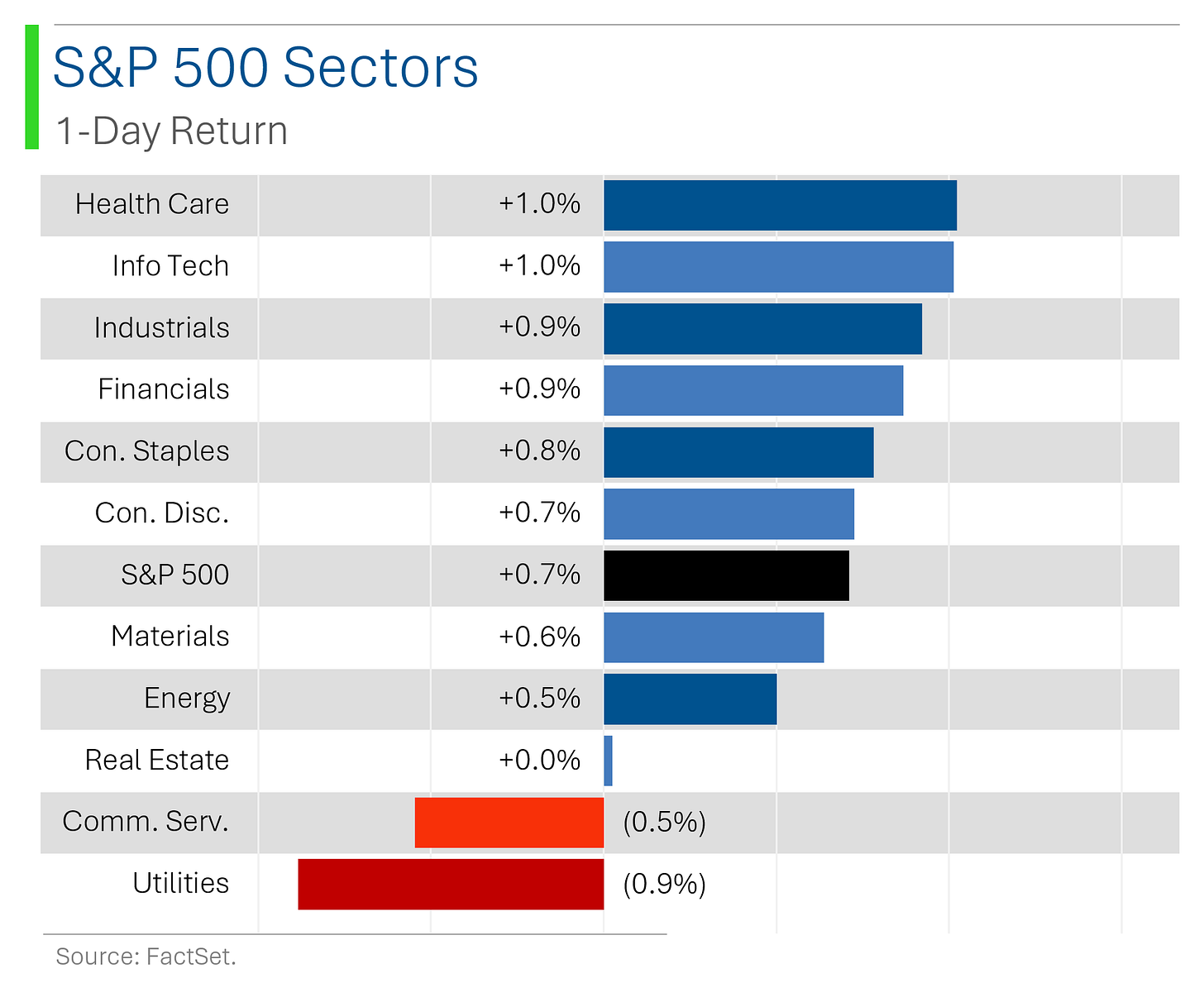

US equities finished higher on Wednesday: The S&P 500 hit a fresh record close, its 44th of the year, with strong performance in software, cruise lines, and home improvement. Underperformers included utilities, China tech, and energy sectors.

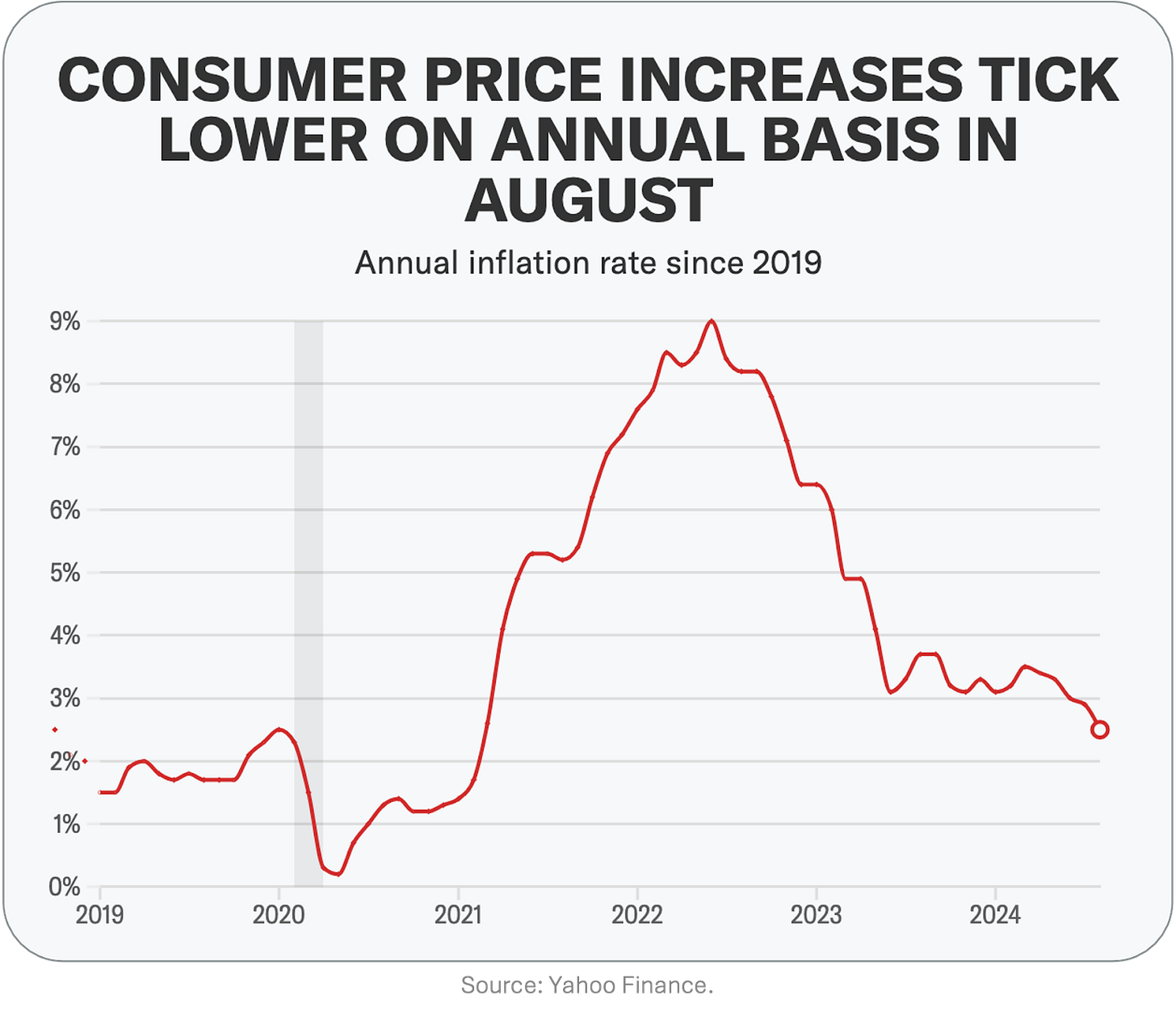

September FOMC minutes showed support for a rate cut: A majority favored a 50 bp rate cut, citing reduced inflation risks and increased employment risks. The market narrative is balanced between optimism over economic growth and bearish concerns like hawkish Fed moves and geopolitical tensions.

Corporate and global updates were light: Taiwan Semiconductor reported a 40% revenue jump, while Pfizer's CEO plans to meet with Starboard after their $1B investment. Boeing withdrew its union offer, and Rio Tinto announced plans to acquire Arcadium Lithium for $6.7B.

Notable companies:

Helen of Troy (HELE) [+17.9%]: Their earnings were better than expected, with good news from restructuring despite weak demand.

Astera Labs (ALAB) [+15.6%]: They launched a new product line aimed at boosting AI infrastructure.

Norwegian Cruise Line Holdings (NCLH) [+10.9%]: Citi upgraded them, citing a smart strategy shift to capture better pricing opportunities.

More below in ‘Market Movers’.

Street Stories

Bullist Bull Market

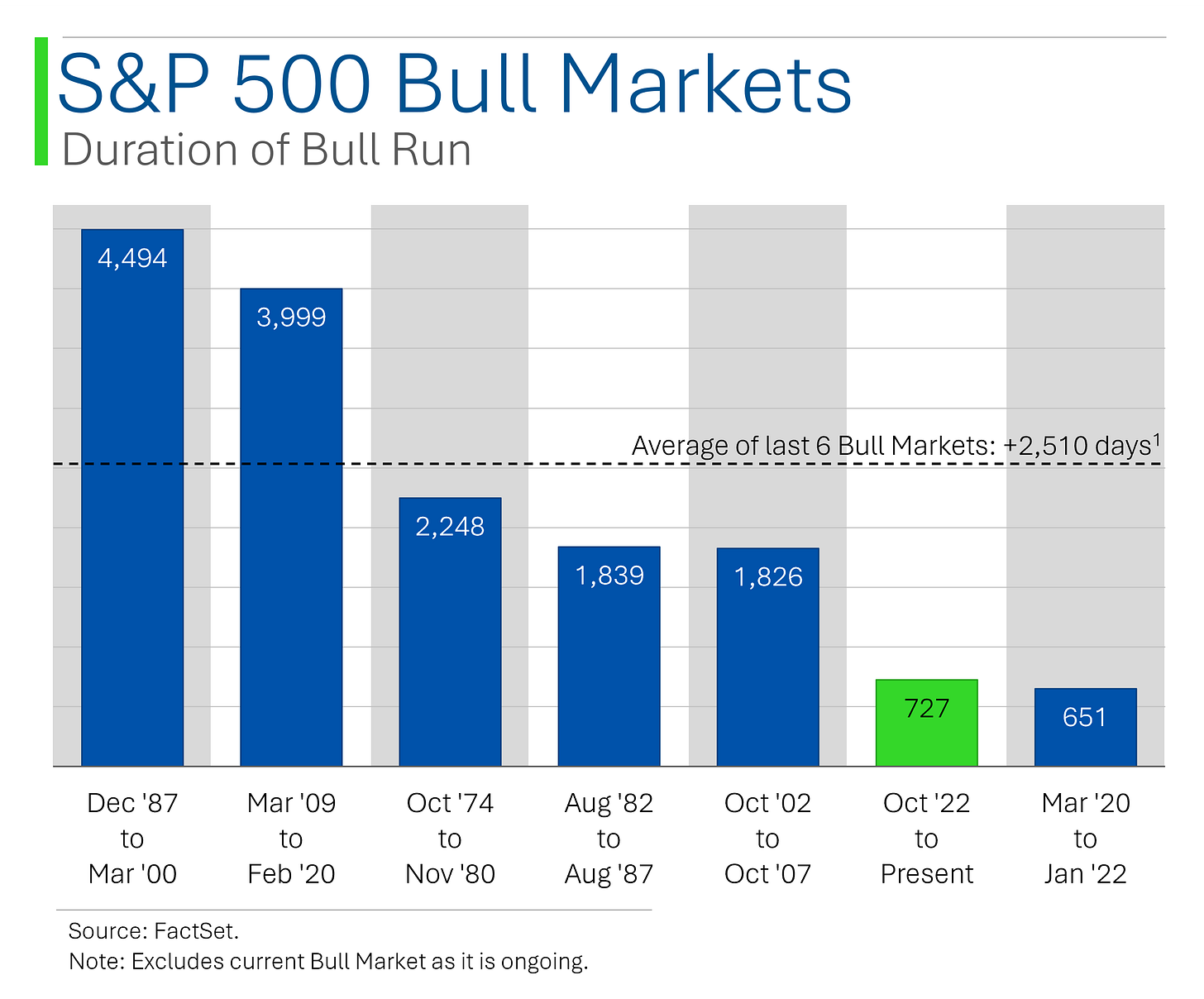

I talk a lot about how wild this rally has been since it kicked off in October 2022 but I think it’s worth while to add some context to Bull Markets of the past.

To start, I don’t think people appreciate that Bull Markets are the default setting. We’ve only seen six official Bear Markets since the late ‘70s and have represented only a tiny portion of the overall investment timeframe.

So for any bears or market timers out there, hopefully this reminds you not to be so negative - history has shown this to be an expensive mistake.

And while it might seem like we have been on some historic run, the current Bull Market has actually been quite modest by historical comparison. While the market may still a have ways to run, every Bull Market since the ‘70s has ended at least +40% higher than what we’ve currently hammered out.

However, as all financial advisor disclaimers read: Past performance is no guarantee for future returns. Ie: Things are looking a bit iffy right now so maybe tone it down with those triple levered ETFs and naked call options.

That said, the above gives a better indication as to how modest things have actually ben this go-around: The average Bull Market in the last 40+ years has returned +259%. Damnnn.

As far as duration, we are also in pretty early days compared to history. Thus far, we’ve only surpassed the short lived ‘Everything Bubble’ that took place during the pandemic.

To temper the hype a bit is the fact that the S&P 500 is trading at a 22x forward Price to Earnings multiple - rather dear compared to history.

In recent memory, only the peak of the DotCom Bubble and the Pandemic ‘Everything Bubble’ saw higher multiples, neither ended to well for anyone. And in the case of the latter, much of that had to do with the denominator (EPS) being temporarily depressed.

So while this Bull Market may be young compared to ones in the past, that doesn’t mean it won’t end early. Or in tears.

Betting $6.7B That Lithium’s Just Taking a Nap

Rio Tinto is dropping $6.7 billion to acquire Arcadium Lithium, making a bold move on the future of electric vehicles. With lithium prices down 80% from 2022 highs and EV sales slowing, Rio is betting that the slump won’t last long.

Let’s hope their shareholders agree…

CEO Jakob Stausholm calls it a “counter-cyclical expansion,” aiming to increase Rio's exposure to a key energy transition commodity at what he believes is the right moment.

The catch? Rio’s paying a 90% premium for Arcadium stock. Despite this, Rio is banking on long-term growth as global demand for EVs and clean energy heats up.

Catastrophe Bonds: Literally Weathering The Storm…

Hurricane Milton is shaping up to be one of the most destructive storms in years, with potential insured losses ranging from $15 billion to as much as $150 billion.

Furthermore, this has investors in catastrophe bonds (cat bonds) bracing for losses as Milton is expected to hit Florida’s coast, with Tampa in its potential crosshairs. Until recently, these exotic securities were outperforming many other asset classes since the mid 2000s.

If Milton delivers a direct blow, cat-bond market losses could range anywhere from 2% to 15%. For reference, Hurricane Ian caused a 10% hit to the Swiss Re Cat Bond Index in 2022.

A Category 5 storm like Milton could exceed the fallout from previous events, making this a defining moment for the insurance-linked securities market.

F*** around and find out right?

Joke Of The Day

How many Germans does it take to change a lightbulb?

One. We are efficient and don't have humor.

Hot Headlines

Bloomberg / Boeing withdraws contract offer. Yesterday’s S&P warning of their credit downgrade apparently led to the breakdown in talks.

Business Insider / Trump's close relationship with Putin could come back to haunt the US. Business Insider hit piece on Trump and his friend. Come on, where do we draw the line people?

Yahoo Finance / Inflation expected to slow in September but 'upside risks' loom amid start of Fed easing. It all comes down to this moment as to whether we can keep the good times rolling. Expectations are that it will print at 2.3%.

CNBC / Amazon cashierless tech competitor Grabango shutters after failing to secure funding. They burned through $73M and had plans to go public at a valuation higher than $10B not too long ago…

CNBC / Hard Rock chairman opens the door to a FanDuel or DraftKings partnership in Florida. Tickets booked for spring break, see you in Punta Cana!

Yahoo Finance / BlackRock is among suitors exploring purchase of credit firm HPS. This would further BlackRock’s ambitions in the liquid alts space for private credit. My question is who can outbid BlackRock?

Reuters / GM: EV unit to turn profitable by Q4, no plans of China pullback. They are also reducing inventory in China, despite their economic woes and do not think that they’ve maxed out margins on traditional gas-powered vehicles either.

CNBC / The Las Vegas Strip says goodbye to the iconic Tropicana property. The house always wins, unless you're the Tropicana - which tumbled to the ground this morning in a controlled demolition. Watch below!

Trivia

Today's trivia dives into the life and legacy of John D. Rockefeller, one of America's most famous industrialists!

In which year was John D. Rockefeller born?

A) 1829

B) 1839

C) 1849

D) 1859What was the name of the company John D. Rockefeller founded that became a monopoly in the oil industry?

A) Standard Oil

B) ExxonMobil

C) Chevron

D) BPWhich U.S. law was passed in 1890 in response to monopolies like Standard Oil?

A) The Interstate Commerce Act

B) The Clayton Antitrust Act

C) The Sherman Antitrust Act

D) The Glass-Steagall ActRockefeller was the first American to do what?

A) Found a major charity

B) Become a billionaire

C) Win a Nobel Prize

D) Launch a political campaign

(answers at bottom)

Market Movers

Winners!

Arcadium Lithium (ALTM) [+30.9%]: RIO is acquiring the company at a huge premium, sending shares skyrocketing.

Helen of Troy (HELE) [+17.9%]: Their earnings were better than expected, with good news from restructuring despite weak demand.

Astera Labs (ALAB) [+15.6%]: They launched a new product line aimed at boosting AI infrastructure.

Norwegian Cruise Line Holdings (NCLH) [+10.9%]: Citi upgraded them, citing a smart strategy shift to capture better pricing opportunities.

Gitlab (GTLB) [+7.7%]: Morgan Stanley gave them a thumbs-up, seeing them as a big player in DevOps and DevSecOps.

Affirm Holdings (AFRM) [+5.1%]: Morgan Stanley thinks they’re attracting higher-income customers and keeping younger ones hooked.

Zeta Global Holdings (ZETA) [+4.1%]: Their acquisition of LiveIntent is being well-received with big potential for cross-selling and growth.

G-III Apparel Group (GIII) [+2.7%]: Guggenheim is excited about their growth plans for brands like DNKY and Karl Lagerfeld.

Losers!

Boeing (BA) [-3.4%]: They pulled their pay offer for striking workers, saying the union's demands are non-negotiable, and now their debt might be downgraded to junk.

Alphabet (GOOGL) [-1.5%]: The DOJ is weighing options to break up Google over its search monopoly, with a final decision expected in November.

Market Update

Trivia Answers

B) 1839 – John D. Rockefeller was born on July 8, 1839, in Richford, New York.

A) Standard Oil – Rockefeller founded Standard Oil in 1870, which would grow to dominate the oil industry.

C) The Sherman Antitrust Act – Passed in 1890, this law was aimed at curbing monopolies like Standard Oil.

B) Become a billionaire – John D. Rockefeller became the first American billionaire in 1916.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.