🔬The Bull That Refuses to Hibernate

Plus: The market loves China's stimulus; and much more!

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

- Peter Lynch

“I drink to make other people more interesting.”

- Ernest Hemingway

US equities rose on Monday, ending near record highs. The S&P 500 capped off another record close, with outperformance in sectors like China tech, energy, regional banks, and home improvement. Meanwhile, underperformers included semiconductors, telecoms, industrial metals, and travel.

Fed Chair Powell's hawkish comments did little to dampen the market's upside. Powell suggested that two 25 basis point rate cuts could be the base case if the economy performs as expected, pushing back on market hopes for deeper cuts. The market is now eyeing labor market updates later this week, including job openings and payroll data.

Corporate developments included Apple's pullout from OpenAI's investment round. Apple is shifting its focus to potentially cheaper Vision Pro headsets, while Microsoft is expected to continue investing in OpenAI. Stellantis downgraded its annual guidance, citing challenges in the global auto industry and competition from Chinese EVs.

Notable companies:

EchoStar (SATS) [-11.5%]: DirecTV will buy Dish TV and Sling TV, with SATS reducing its debt load by $11.7B and easing refinancing needs through 2026.

BlackLine (BL) [+4.3%]: Upgraded by Morgan Stanley to overweight, saying the market's not appreciating their margin growth.

Stellantis (STLA) [-12.5%]: Lowered FY24 guidance, blaming weak North American performance and competition from Chinese EVs, with margins expected to drop below double digits.

More below in ‘Market Movers’.

Street Stories

S&P 500: The Bull That Refuses to Hibernate

The S&P finished higher on Monday, notching a +2.0% performance in September. Despite the headline rollercoaster we’ve been on this year - from shooting wars, Chinese stagnation, sticky inflation, etc. - the market has only seen one down month since last November.

Pretty wild when you think about it….

With 8 months in the win column already this year, 2024 has a shot at tying the record for most ‘green’ months in the last 45 years at 11, which was set in 2017 and 2006.

Since at least 1978 (as far back as my data goes) no year has ever been able to bat 100% for months with a positive return, but at the same time, no year has seen less than 4 months of positive returns.

In fact, an incredible 80% of years since 1978 have seen 6 or more months of positive returns (ie: more than half). Stocks just want to go up…

Another way that 2024 has been a pretty historic year is it’s return thus far. At present, the index is up +20.8%, putting it firmly in the +20%-to-30% bucket with three months left in the year to spare!

The below also give you a good idea of why investing in the index has historically been a great place to put your money - and why the pros have such trouble beating the market consistently.

Since 1979 the market has had an average return of +10.3% before dividends, and only five of those years have been a loss above 10%: 2000-2002 (DotCom Bubble popped); 2008 (GFC); and 2022 (Covid ‘Everything Bubble’ popped).

To put it into perspective, on any given year in the last 45 you had an 11% chance of losing >10%, and a 60% chance of making >10%.

This is the greatest casino in the world.

It’s also worth noting that the September Curse seems to have been lifted, as the historically worst month for stocks saw it’s best return since 2013.

One day the bull market will end. It just doesn’t seem like it’s going to today.

Month of the Dragon

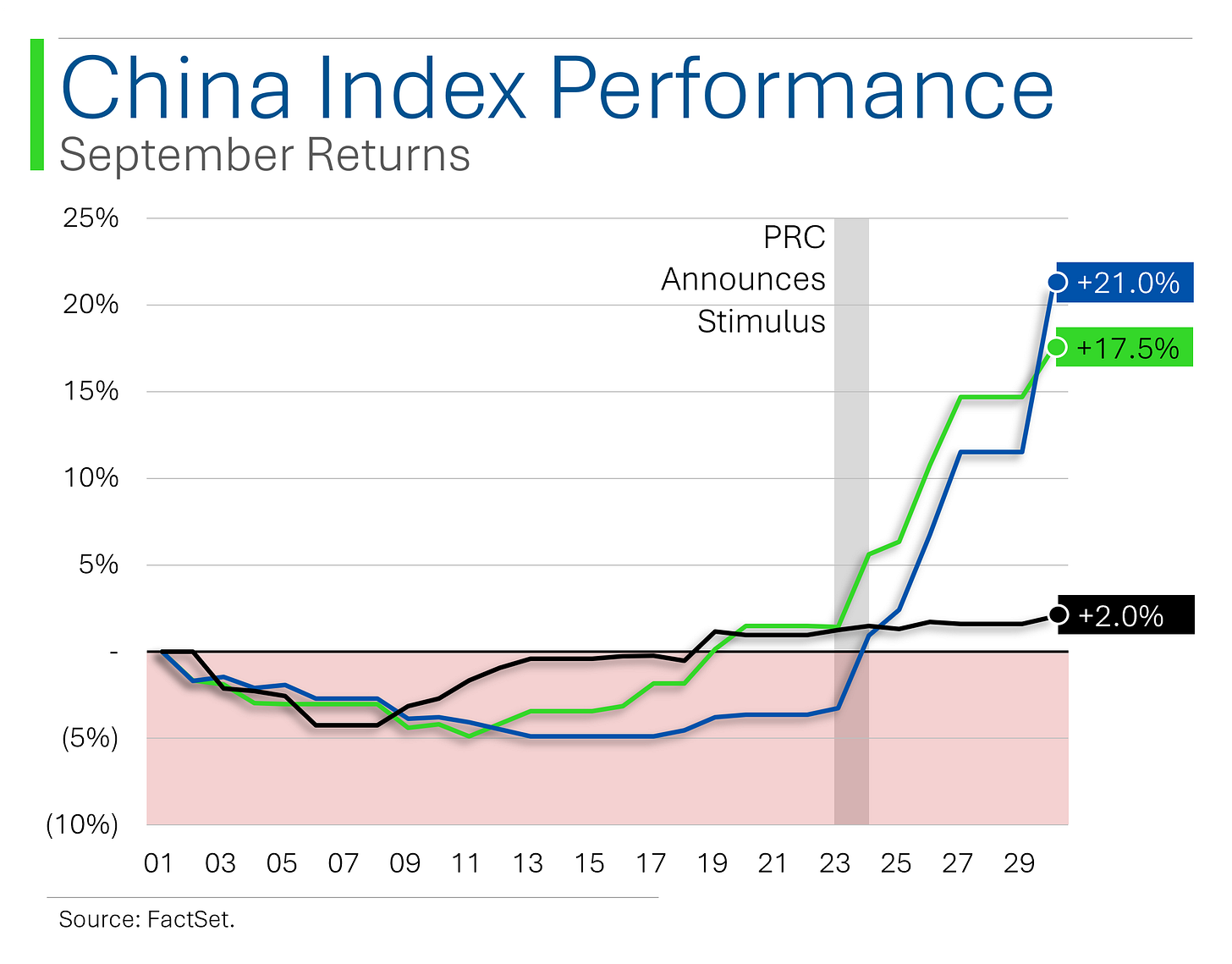

Not to be outdone, China’s major indices blew the doors off in September, following the announcement of the first big stimulus plan since the pandemic.

The September return was one of the few bright spots in recent years for the beleaguered Chinese market. Only surpassed by the last time they announced a stimulus in 2022, along with the removal of the extreme pandemic restrictions which severely crippled their economy.

In fact, those two ‘stimulus’ months are the best months the Hang Seng has experienced in the last 20 years. Pretty wild when you consider that in 2000, China had $1.1 trillion in GDP - bout the same as Italy at the time - and now it’s $17.7 trillion (2023).

I also just released this is basically a Chinese knock-off of my first story…

Joke Of The Day

Ladies, if I could describe you in one word, it would be sexist.

Hot Headlines

CNBC / Education Dept. extends deadline for defaulted student loan borrowers to get current. The Education Department has extended the deadline for the Fresh Start program for defaulted student loan borrowers until Wednesday morning. Borrowers who apply by 3 a.m. ET on Wednesday can return their loans to good standing, avoiding the negative consequences of delinquency and default. Thank god everyone can still pay.

CNBC / Michigan nuclear plant finalizes federal loan to support first reactor restart in U.S. history. After having secured this $1.5B dollar loan, Holtec International, the plant’s owner, aims to bring Palisades back online by late 2025, with plans to power 800,000 homes.

Bloomberg / Stellantis cuts forecasts in further blow to besieged carmakers. The automaker slashed revenue, cashflow and production estimates, and sunk -13% by the close as the company joins other European automakers feeling the pinch: Volkswagen and Mercedes-Benz are facing weak China sales, BMW has an expensive recall, and Volvo is impacted by rising EV tariffs.

Bloomberg / Treasury market closes in on historic five-month winning streak. Following Jerome Powell’s comments that the U.S. economy remains strong and that there is no immediate pressure to cut rates, short term treasuries rose sharply fueling the overall rally. While traders remain split on whether the Fed will implement a half-point or quarter-point cut in November - it will be the upcoming Friday jobs report that will be a large determinant in the market’s expectations.

Yahoo Finance / California enacts car data privacy law to curb domestic violence. The law requires automakers to provide a clear process for individuals to revoke the access of others to car features like location tracking and remote controls, ensuring compliance within two business days. While this law was aimed at supporting survivors of abuse, I have a feeling it will help a lot of kids sneak out at night without leaving a trace.

Trivia

Today's trivia is all about historic trades - the moves that rocked the markets and made headlines for years to come!

In 1995, which trader lost $1.3 billion, causing the collapse of Barings Bank, one of the oldest merchant banks in the world?

A) Nick Leeson

B) Michael Milken

C) Jerome Kerviel

D) Robert CitronIn 1997, the hedge fund Long-Term Capital Management (LTCM) lost $4.6 billion in just a few months after a highly leveraged bet on which event failed?

A) The Asian financial crisis

B) Russian government default

C) The Dot-com bubble

D) U.S. Treasury bond collapseIn 2008, John Paulson made one of the most legendary trades in history by betting against what type of financial product, earning him $20 billion?

A) Commodities

B) Mortgage-backed securities

C) Foreign exchange

D) Tech stocksWhich tech giant made a $1 billion investment in Netflix back in 2007, when the company was still transitioning from DVDs to streaming?

A) Amazon

B) Apple

C) Microsoft

D) Google

(answers at bottom)

Market Movers

Winners!

BlackLine (BL) [+4.3%]: Upgraded by Morgan Stanley to overweight, saying the market's not appreciating their margin growth.

CVS Health (CVS) [+2.4%]: Reports say Glenview Capital is meeting with CVS today to discuss ways to improve after they cut guidance and launched a cost-cutting plan.

Brown-Forman (BF.B) [+1.8%]: Barclays upgraded them, noting shares are coming out of a rough patch and their exposure to China is pretty minimal.

Losers!

Stellantis (STLA) [-12.5%]: Lowered FY24 guidance, blaming weak North American performance and competition from Chinese EVs, with margins expected to drop below double digits.

EchoStar (SATS) [-11.5%]: DirecTV will buy Dish TV and Sling TV, with SATS reducing its debt load by $11.7B and easing refinancing needs through 2026.

Baxter International (BAX) [-2.4%]: North Cove, NC facility was flooded by Hurricane Helene, temporarily shutting down production of key dialysis products, and they’re managing inventory to maintain patient care.

Bruker (BRKR) [-2.3%]: Downgraded by Wolfe Research due to concerns over slow demand recovery and long lead times for their major instruments.

Market Update

Trivia Answers

A) Nick Leeson – His unauthorized speculative trades led to the collapse of Barings Bank in 1995.

B) Russian government default – LTCM bet heavily on the stability of Russian bonds, but the 1998 default led to massive losses, nearly collapsing the global financial system.

B) Mortgage-backed securities – Paulson famously shorted mortgage-backed securities ahead of the 2008 financial crisis, earning billions.

C) Microsoft – Microsoft made an early bet on Netflix with a $1 billion investment during its streaming transition.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great charts about the positive months of the S&P 500 and how it wants to go up most of the time! So time in the market is better than timing the market!