The Bull Market in Charts

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap). The intelligent investor is a realist who sells to optimists and buys from pessimists.”

- Benjamin Graham

“If you can't be kind, at least be vague."

- Judith Martin

Street Stories

The Bull Market

The market’s run since bottoming out in late 2022 after the ‘Everything Bubble’ popped has felt like something other worldly. Maybe it’s because every step has seemed fraught with fear (wars, sticky inflation, overextended valuations) and euphoria (AI, Crypto, resilient consumers, Trump-trades).

However, in the grand scheme of things, this Bull Market isn’t particularly exceptional.

Lemme explain…

Since the late ‘70s, the US market has actually been in a Bull Market 86% of the time. The COVID blip and 2022’s meltdown were actually pretty minor in both their drawdown and duration.

The run we are currently in has actually been relatively minor: The S&P 500 is *only* +71% since the October 2022 lows.

The caveat to this is of course that the two Bear Markets we’ve experienced in recent memory (2020, 2022) were minor events. A case can be made that we’ve been in a secular Bull Market since as the end of the Great Financial Crisis back in 2009.

What should have investors concerned, isn’t the run that the market’s had or it’s persistence, but rather how steeply stock valuations have risen.

As you can see above, on a forward P/E basis, the S&P 500 has only been more expensive in the Tech Bubble and during Covid’s ‘Everything Bubble’ - and much of the former had to do with temporarily suppressed EPS estimates which skew the multiple upward.

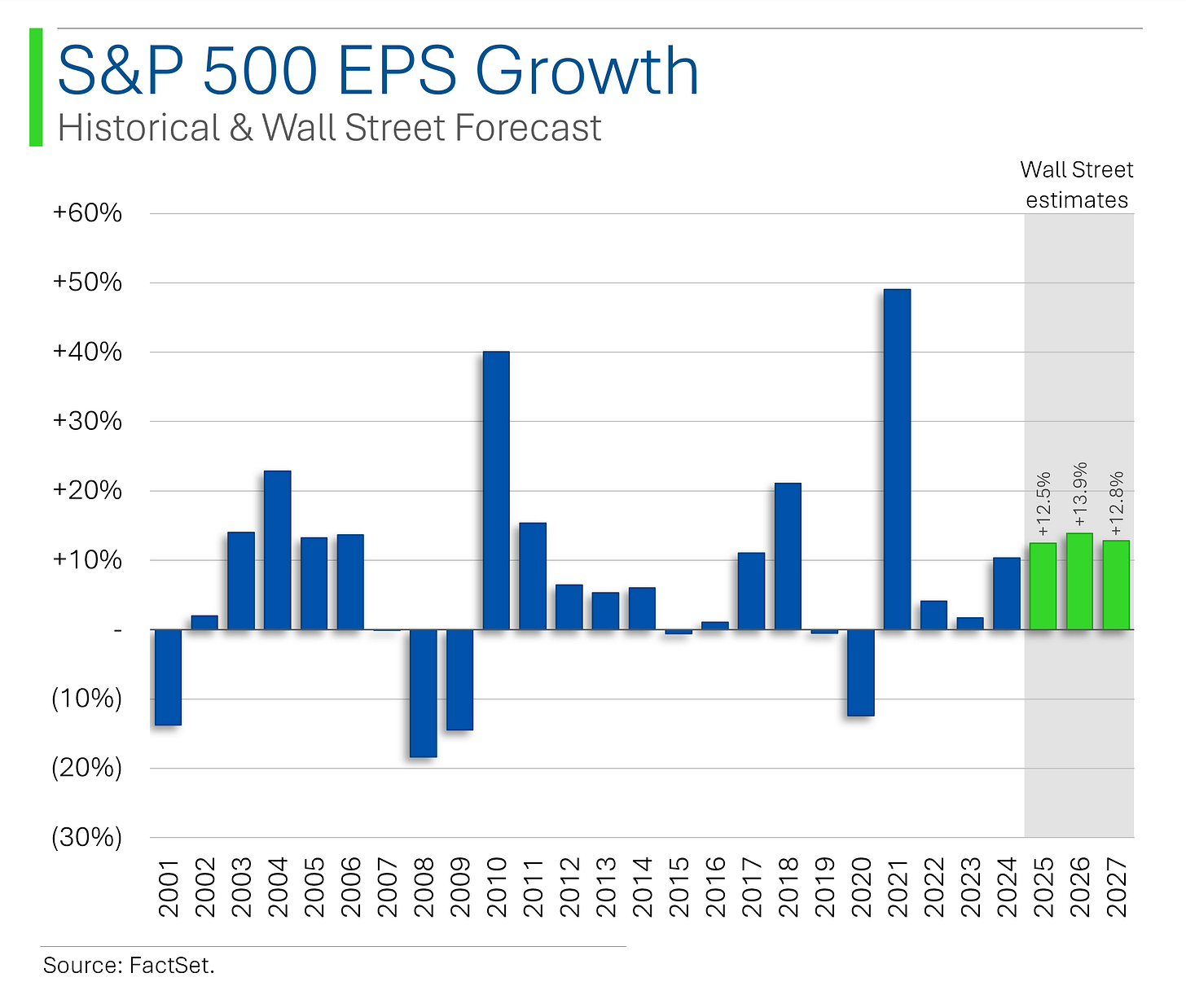

High growth should be rewarded with a higher multiple and the companies that make up the S&P 500 are clearly expected to deliver. Whether or not that growth is realizable or is sufficient to warrant the current market premium remains to be seen. 🙃

What is clear is that going back to the mid-'70s, the current Bull Market is pretty nascent in comparison with its predecessors.

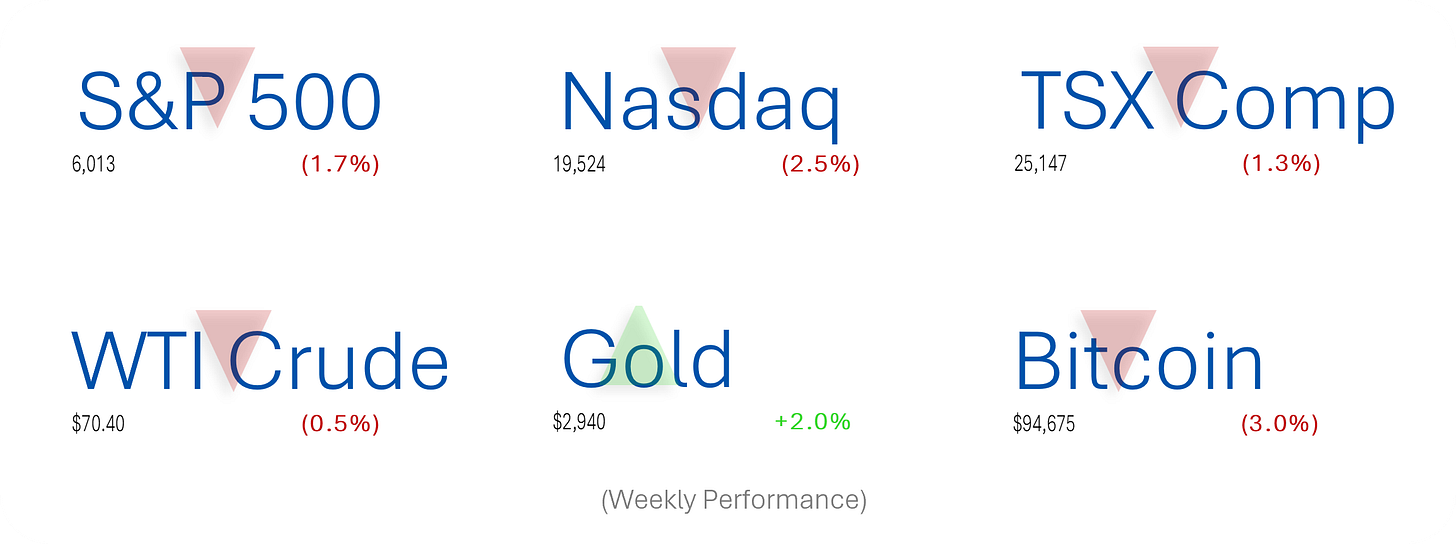

Focusing in on the current situation, the market has been a bit wobbly as of late but being up +3.6% so far in 2025 shows that investors aren’t panicking.

The high-flying, techy Nasdaq has looked even stronger recently.

This is important as this index is more concentrated towards the techy names like Nvidia, Meta and Apple which are the most responsible for this Bull Market’s success - and will likely be harbingers for it’s retrograde.

Expanding on this (in something of a concerning manner), I’d highlight that these Tech mega-caps weren’t just the biggest contributors in 2024 (due to their market cap influence) but the best overall performers.

This trend has continued in 2025, with size being the biggest determinant of performance. To shocking degree.

As a result, I’m a bit mixed on my outlook for the future. Growth is expected to be strong but it will need to be in order to warrant the steep valuations. Narrow market leadership by a handful of mega-caps poses serious risk should the fan favorites start to lose their luster - particularly since every company in the Mag7 is heavily invested/dependent on mass adoption and profitability in AI.

None of this is to say that the current Bull Market is in jeopardy: As multiples and factor risks get digested and normalize, we may not see anything implode but could just find the market sitting on its hands or trading sideways until things start making sense again.

Joke Of The Day

What’s ET short for? He’s only got little legs.

I have not slept for ten day - because that would be too many. (RIP Mitch Hedberg)

Macro Update

February Preliminary PMI Composite (Friday)

The Preliminary February PMI composite dropped to 50.4, its lowest in 17 months and below the consensus of 53.0.

Manufacturing PMI rose to 51.6, ahead of the 50.5 consensus, marking its second consecutive month of improvement, while Services PMI fell to 49.7, missing the 53.0 consensus and signaling its first contraction in over two years.

January Existing Home Sales (Friday)

January existing home sales declined 4.9% month-over-month to 4.080M, falling short of the 4.113M consensus, with sales down in all regions except the Midwest.

The median existing-home price rose 4.8% year-over-year to $396,900, while February's final consumer sentiment came in at 64.7, below the 67.5 consensus, with 1-year inflation expectations at 4.3% and 5-year expectations ticking up to 3.5%.

Trivia

Today’s trivia is on Bull and Bear Markets.

What is the traditional definition of a bear market?

A) A market decline of 10% from recent highs

B) A market decline of 15% from recent highs

C) A market decline of 20% from recent highs

D) A market decline of 25% from recent highsWhich bull market was known for the “irrational exuberance” speech by Alan Greenspan?

A) 1982-1987

B) 1990-2000

C) 2009-2020

D) 1949-1956How much did the S&P 500 fall during the Dot-com bubble burst?

A) 35%

B) 49%

C) 42%

D) 55%Which stock index is considered the most volatile during bear markets?

A) S&P 500

B) Dow Jones

C) Nasdaq

D) Russell 1000Which company was the first to reach a $1 trillion market cap, contributing to the 2009-2020 bull market?

A) Amazon

B) Apple

C) Microsoft

D) Google

(answers at bottom)

This Week In History

Fidel Castro Becomes Prime Minister of Cuba (February 16, 1959)

Event: After leading a successful revolution that ousted dictator Fulgencio Batista,

Fidel Castro was sworn in as the Prime Minister of Cuba.Significance: Castro's rise to power marked the beginning of communist rule in Cuba, significantly impacting U.S.-Cuba relations and Cold War dynamics.

Volkswagen Beetle Becomes Best-Selling Car (February 17, 1972)

Event: The Volkswagen Beetle surpassed the Ford Model T's record for the most units sold, with the 15,007,034th Beetle produced on this day.

Significance: This milestone highlighted the Beetle's global popularity and symbolized post-war economic recovery in Germany.

Assassination of Malcolm X (February 21, 1965)

Event: Civil rights leader Malcolm X was assassinated while delivering a speech in New York City.

Significance: His death was a significant loss for the civil rights movement, and his ideas continue to influence discussions on race and equality.

Raising the Flag on Iwo Jima (February 23, 1945)

Event: U.S. Marines raised the American flag on Mount Suribachi during the Battle of Iwo Jima.

Significance: This iconic moment, captured in a famous photograph, symbolized hope and determination during World War II.

Market Update

Market Movers

Friday

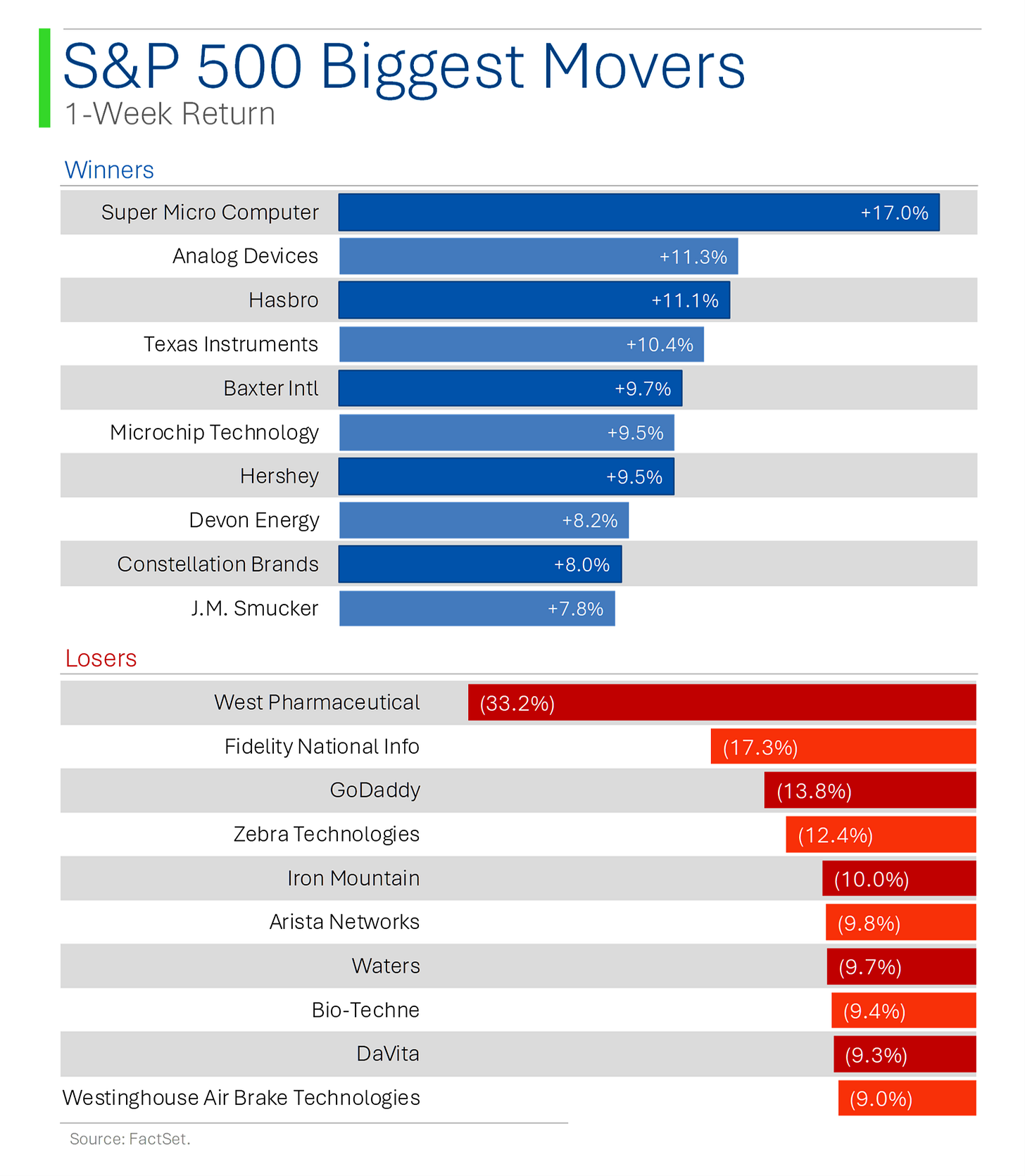

UNH (UnitedHealth Group) [-7.2%]: DoJ is reportedly probing UnitedHealth over billing practices tied to Medicare Advantage plans, but the company slammed the claims as "outrageous and false."

CELH (Celsius Holdings) [+27.8%]: Celsius crushed Q4 estimates, announced a $1.8B deal to acquire Alani Nu, and got analyst love for the growth potential.

MELI (MercadoLibre) [+7.1%]: MercadoLibre posted a strong Q4, with big growth in Brazil and Argentina, better margins, and solid credit performance.

XYZ (Block, Inc.) [-17.7%]: Despite an EBITDA beat, Block missed on revenue and gave weaker gross profit guidance, making analysts cautious despite solid go-to-market efforts.

HIMS (Hims & Hers Health) [-25.8%]: Shares tanked after the FDA reported the semaglutide injection shortage is now resolved.

Thursday

WMT (Walmart) [-6.5%]: Walmart beat on Q4 numbers, but the FY26 guide and leap year/VIZIO deal headwinds had investors underwhelmed despite strong market share gains.

HAS (Hasbro) [+13.0%]: Hasbro beat Q4 expectations, especially in Wizards/Digital Gaming, and rolled out a strategic plan aiming for $1B in savings over the next three years.

SHAK (Shake Shack) [+11.1%]: Shake Shack delivered in-line Q4 results but impressed with better margins thanks to new labor scheduling, and gave upbeat guidance for Q1 and FY25.

RCL (Royal Caribbean Group) [-7.6%]: Shares dipped after Commerce Secretary Lutnick claimed cruise lines dodge US taxes.

Wednesday

HIMS (Hims & Hers Health) [+17.5%]: Hims & Hers stock jumped after buying an at-home lab testing facility, though deal terms stayed under wraps.

GRMN (Garmin) [+12.6%]: Garmin had a strong Q4 beat, driven by Fitness and Outdoor demand, plus it announced a 20% bump to its annual dividend.

BMBL (Bumble) [-30.3%]: Bumble tumbled after soft guidance and concerns about declining paying users, despite beating Q4 revenue and EBITDA estimates.

ETSY (Etsy) [-10.1%]: Etsy missed across the board in Q4, citing Marketplace weakness and flagging further GMS declines with lower active buyers and sellers.

Tuesday

INTC (Intel) [+16.1%]: Intel spiked on reports that TSM and AVGO are in early talks about deals that could split the US chipmaker into two.

NKE (Nike) [+6.2%]: Nike announced a new women's line, NikeSKIMS, in collaboration with Kim Kardashian’s SKIMS brand.

WBA (Walgreens Boots Alliance) [+13.9%]: Walgreens shares jumped as reports hinted the Sycamore buyout deal might still be alive after being presumed dead in January.

BIDU (Baidu) [-7.5%]: Baidu beat Q4 estimates, but weak ad spending and scrutiny over its AI Cloud adoption dragged the stock down.

HOOD (Robinhood Markets) [-7.4%]: Robinhood dropped after Wolfe Research downgraded it, citing rising competitive risks and limited upside left in the stock.

(Market closed on Monday for Washington’s BDay)

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

C) A Bear Market is generally a market decline of 20% from recent highs.

B) The 1990-2000 Bull Market was referenced in the ‘Irrational Exuberance’ speech.

B) The S&P fell 49% after the DotCom bubble burst.

C) Nasdaq is considered the most volatile during Bear Markets.

B) Apple was the first to reach a $1 trillion market cap.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.