🔬The Apple Situation (in charts!)

Plus: GM thinks buying millions of shares will make their price go up (didn't work last time); Michael Dell is cashing out; and much more!

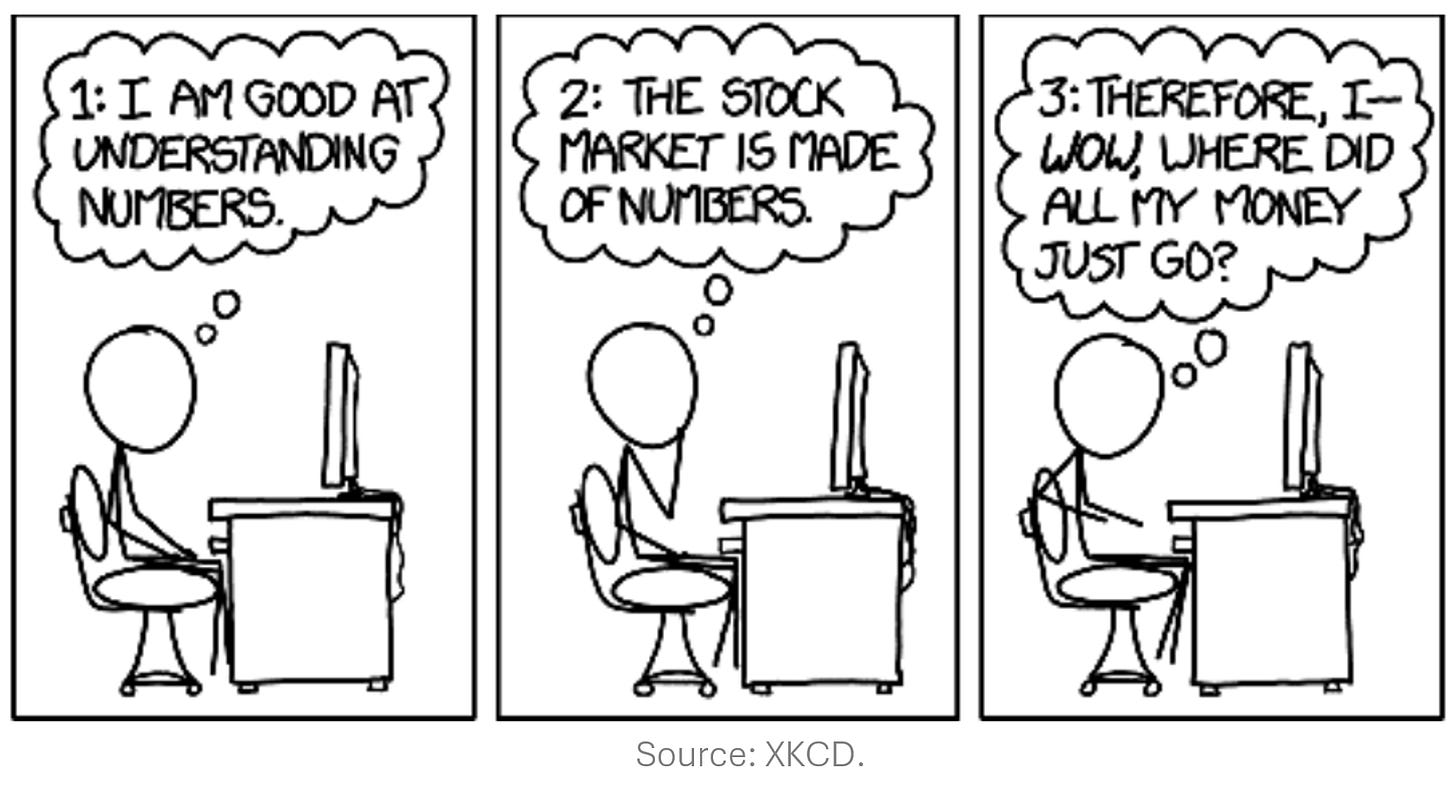

"The investor's chief problem – and even his worst enemy – is likely to be himself."

- Benjamin Graham

"When you get in the end zone, act like you've been there before."

- Julian Robertson

Another decent day for the big US markets with the S&P 500 +0.3% and Nasdaq +0.9%, with Apple pretty much pulling up the indices on a muted trading day ahead of CPI inflation and the Fed meeting today.

2 of 11 sectors closed higher with Tech (+1.7%) and techy Communication Services (+0.5%) the only positives. Financials had another bad day, finishing -1.2% and worst overall.

Notable companies:

Apple (AAPL) [+7.3%]: Analysts positive on the new "Apple Intelligence" AI platform and potential innovation-driven upgrade cycle.

General Motors (GM) [+1.4%]: Board approves new $6B share repurchase authorization; company cut 2024 EV production guidance.

Target Hospitality (TH) [-31.5%]: US Immigration and Customs Enforcement to close its Dilley, TX migrant facility due to high operating costs; this contract represents ~14% of revenue.

More in ‘Market Movers’ below.

Street Stories

The Apple Situation

Yesterday Apple (finally) got around to laying out a comprehensive AI strategy, which included a plan to bring Chat-GPT to iPhones and a new personalized AI system called ‘Apple Intelligence’ that will supposedly offer users a simpler way to navigate their devices. Get bent, Siri!

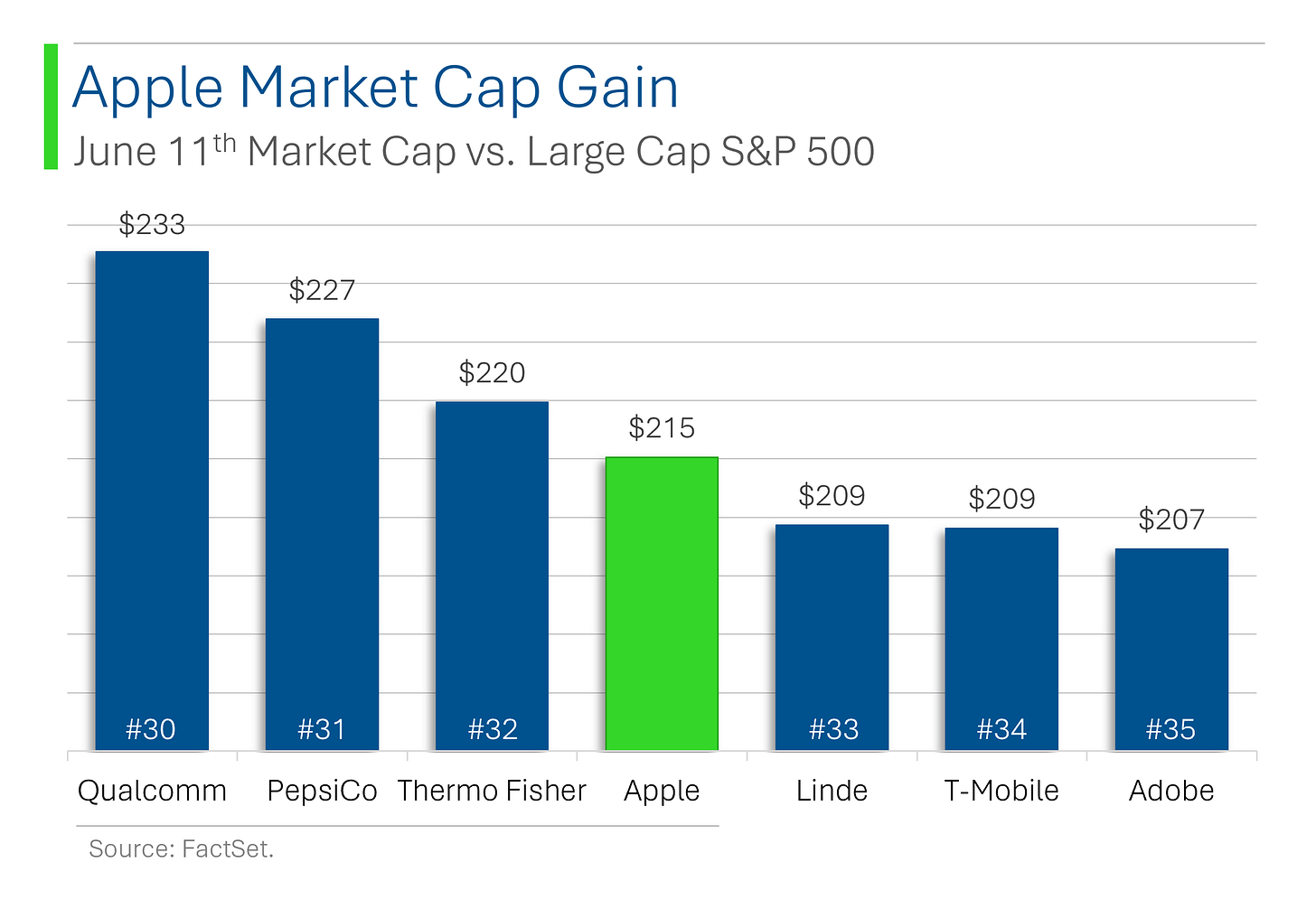

The result? Apple shares leapt +7.3% and added $215 billion to their market cap - their bigger gain ever and the third largest in history.

Since sometimes I feel like numbers this big can lose their meaning: if Apple’s one-day gain was a company, it would be the #33rd largest on the S&P 500, ahead of T-Mobile and Adobe. Saaaay what?

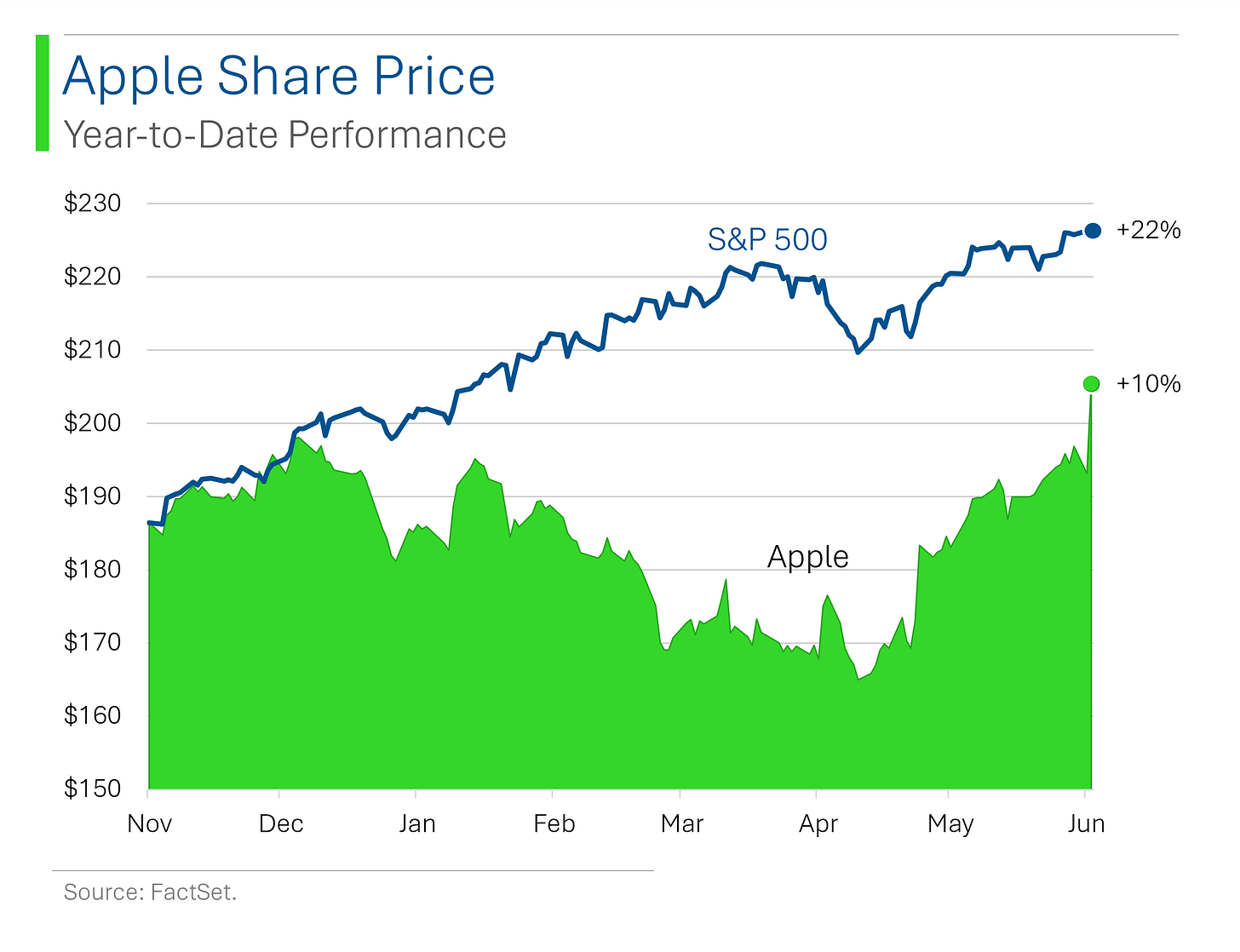

The move continues Apple’s rise out of the doldrums, as so far this year the company has massively underperformed the broader market.

Why, you ask, has Apple been so rocky lately?

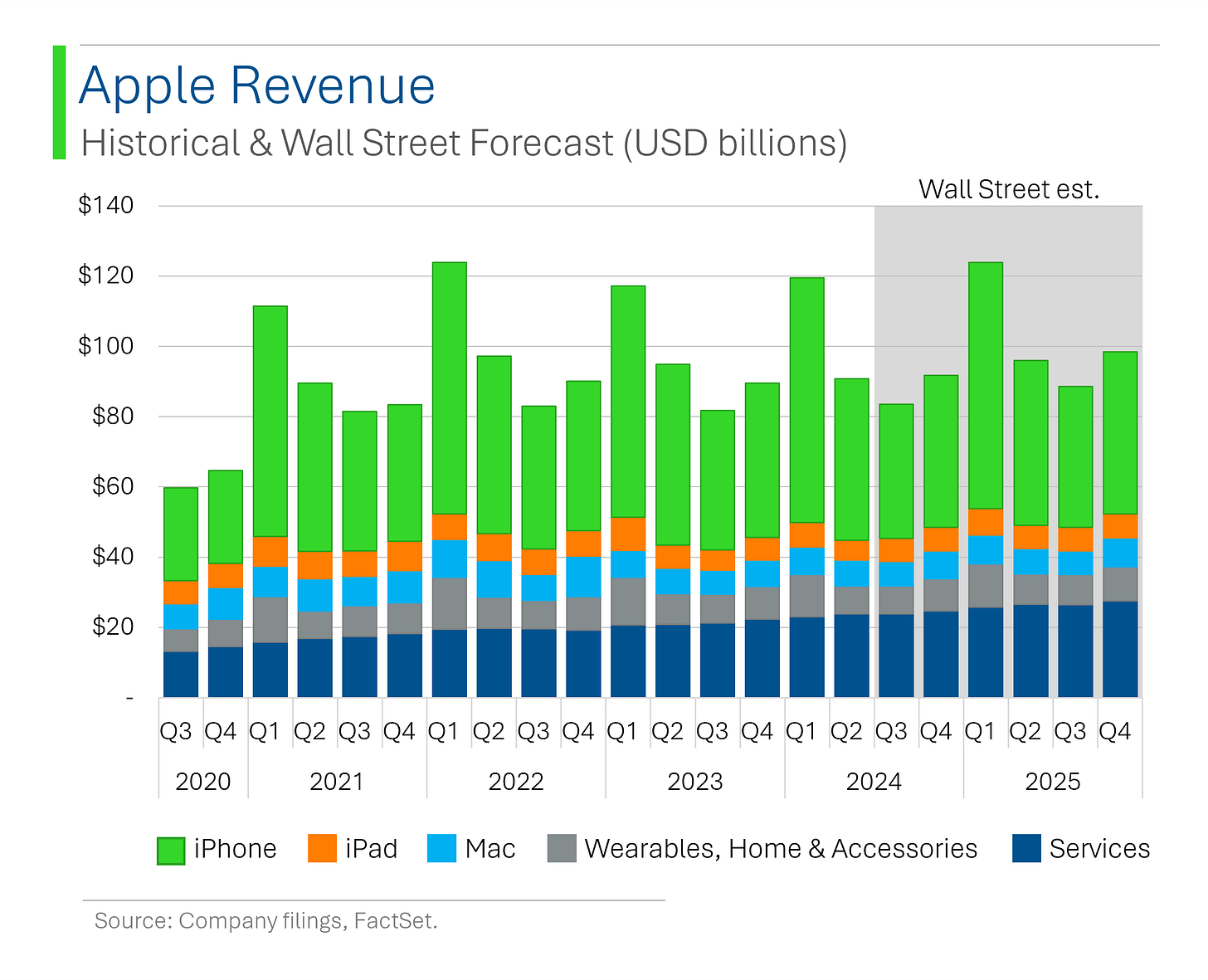

Investor and Wall Street sentiment has been souring over the last three years over a perceived lack of growth opportunities for the company. This is best seen in the evolution of Wall Street estimates. For example, the Street’s 2026 revenue estimate was once as high as $542 billion. Now it’s only sitting at $432 billion - a decrease of 20%.

The result is that Apple, once the great perpetual sales machine, has basically seen flat revenue growth over the past several years, with little improvement expected.

And this weakness has been pretty broad-based, with iPhone, iPad, Wearables all stagnating or in decline.

The only real growth engine for Apple has been its Services business, and if you’ve been following all the App store drama - from Spotify’s lawsuit to Epic Game’s lawsuit - you might be justified in having some question marks around the state of that business.

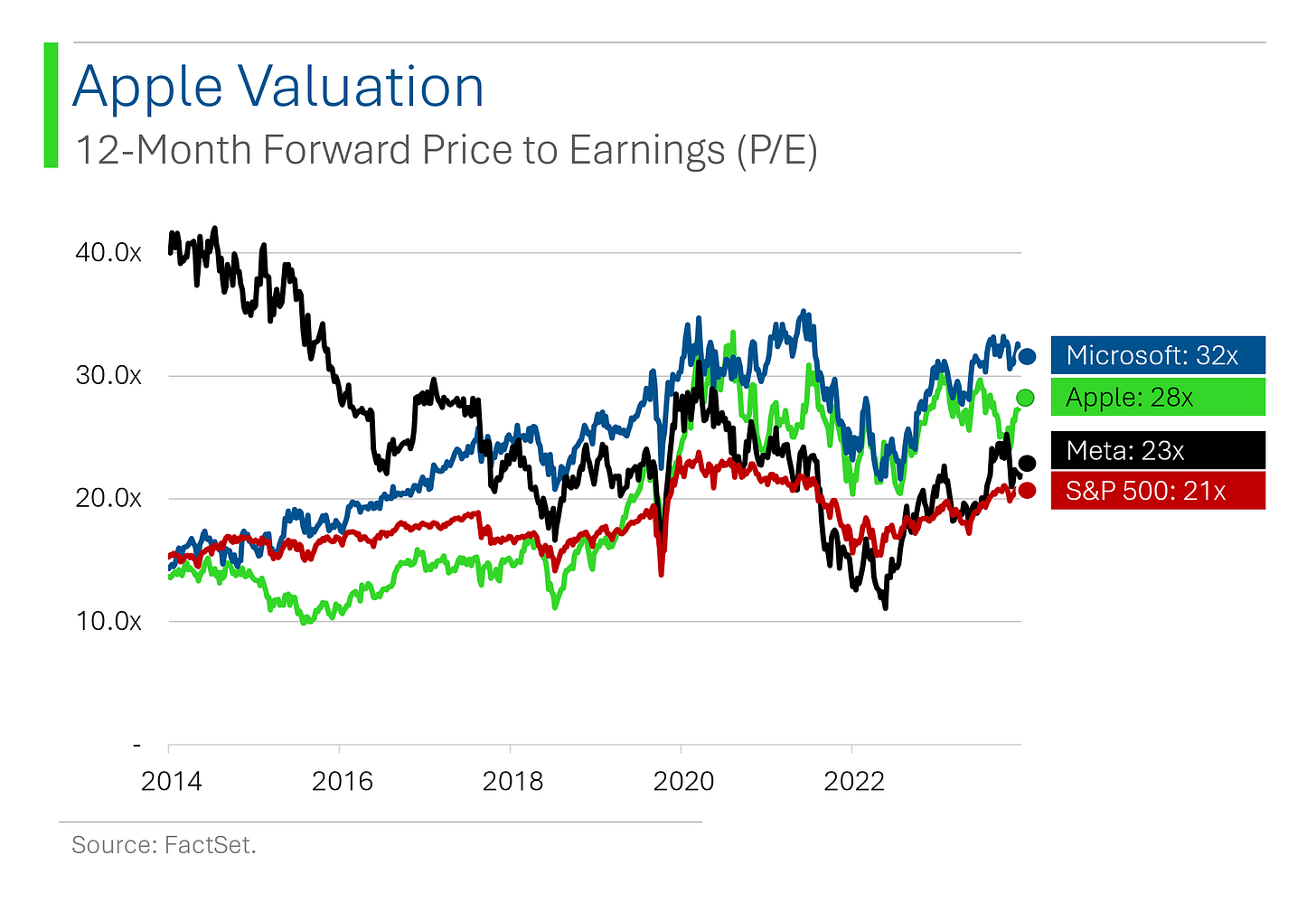

Despite cooling expectations for Apple, the valuation hasn’t exactly become cheap: At a 28.1x forward P/E, the company trades at a 35% premium to the market, and a 10% premium to the much faster growing Meta.

(Another) GM Mega Buy-Back

General Motors just approved another $6 billion stock buyback, because apparently, $10 billion last year wasn't juicy enough. CFO Paul Jacobson stated the move is about profitability and efficient capital deployment - as if cutting their EV production guidance the same day was a coincidence and not cloud cover.

I’m usually suspicious of companies with weak growth doing massive buy-backs (see: GE and Boeing) but with literally 53% of their market cap sitting in cash ($28.7 in cash vs. $54 billion market cap) I think I’ll let this one slide.

Also, someone tell the shares that when you do a massive buy-back, usually the price goes up. 🤦♂️

Michael Dell's Billion-Dollar Yard Sale

Michael Dell is on a selling spree, planning to offload another $1.3 billion worth of Dell Technologies shares this year, since the $1.6 billion earlier wasn't enough pocket change.

Even with these sales, he still owns nearly half of the company which has ballooned to a market cap of $95 billion, so might as well cash out of this ‘definitely not a bubble’.

Joke Of The Day

I saw a sign that said "watch for children" and I thought, "That sounds like a fair trade."

Hot Headlines

CNBC / Elon Musk drops suit against OpenAI and Sam Altman. Musk was one of the original founders of OpenAI but left acrimoniously due to a dispute over the strategic direction of the former non-profit, with the lawsuit claiming breach of contract and fiduciary duty.

World Bank / The latest edition of the WB’s (super dense) Global Economic Prospects reports sees global economic growth estimates increasing to +2.6% this year from a previous +2.4%. The gain is almost entirely due to a massive upgrade to the US, from +1.6% to +2.5% in 2024. Guess it can’t be all bad!

FT / OpenAI challenger Mistral secures €600mn funding as valuation soars to almost €6bn. The Paris-based, Nvidia and Microsoft-backed start-up has only been around a year. ‘Go into finance’ they said. ‘It’s good money’ they said. Blaa.

MarketWatch / Despite record high stock market, why are real people disillusioned with the economy? Turns out people like buying stuff, like food and shelter. Go figger!

CNBC / Computing firm Raspberry Pi pops +38% in rare London market debut. Hope is building that this could revive the UK as an IPO destination after decades of domestic migration.

Reuters / Boeing reports 24 commercial plane deliveries in May, a decrease of nearly 50% year-over-year.

Trivia

Today’s trivia is on famous investors.

Which investor is known for the 'Tiger Cubs', a group of hedge funds run by his former employees?

A) Julian Robertson

B) George Soros

C) Warren Buffett

D) Ray DalioWho is known for his contrarian investing approach and is the founder of Oaktree Capital Management?

A) Warren Buffett

B) Carl Icahn

C) Howard Marks

D) Ray DalioWhich investor is known for founding the Vanguard Group and popularizing index funds?

A) Warren Buffett

B) Carl Icahn

C) John C. Bogle

D) George Soros

(answers at bottom)

Market Movers

Winners!

Affirm Holdings (AFRM) [+11.0%]: Apple announced that Affirm products will be available to Apple Pay users in the US later this year, enabling buy-now/pay-later options.

Apple (AAPL) [+7.3%]: Reversed some weakness from Monday's WWDC keynote; analysts are positive on the new "Apple Intelligence" AI platform and potential innovation-driven upgrade cycle.

FMC Corp (FMC) [+4.0%]: Reappointed Chairman Bondreau as CEO; current President/CEO Douglas stepping down; reiterated Q2 guidance; market may be transitioning from correction to recovery; analysts concerned about H2 guidance cuts.

VF Corp (VFC) [+2.9%]: President Bracken Darrell purchased 75K shares; Darrell now beneficially owns 220K shares of common stock.

General Motors (GM) [+1.4%]: Board approves new $6B share repurchase authorization; company cut 2024 EV production guidance.

Shopify (SHOP) [+1.3%]: Initiated overweight at JP Morgan; cited competitive advantages including ease of use, product breadth, and scale.

Losers!

Target Hospitality (TH) [-31.5%]: US Immigration and Customs Enforcement to close its Dilley, TX migrant facility due to high operating costs; this contract represents ~14% of revenue and ~15% of gross profits.

CoreCivic (CXW) [-19.8%]: ICE to terminate service agreement at South Texas Family Residential Center; company suspends FY24 guidance and estimates EPS reduction of ~$0.38 to $0.41.

Paramount Global (PARA) [-7.9%]: National Amusements reportedly ended discussions with Skydance; Shari Redstone raised concerns about litigation risk from shareholders over the potential deal.

Array Technologies (ARRY) [-6.1%]: Announced CFO Kurt Wood will leave at the end of Q2 to pursue other interests; Wood had been in the role since November 2023.

Applovin (APP) [-3.8%]: Apple updated ad attribution technology at Developers Conference; new documentation prevents developers from using data to uniquely identify devices.

Cleveland-Cliffs (CLF) [-3.3%]: Downgraded to neutral from overweight at JP Morgan; noted negative sentiment due to diminishing auto tailwind, potentially weaker pricing, and higher capex.

Academy Sports & Outdoors (ASO) [-3.2%]: Q1 earnings, revenue, and EBITDA margin missed; comp decline wider than consensus; noted consumer pressure in current economic environment; raised FY EPS guidance to reflect buybacks but reaffirmed revenue and comp guides.

Market Update

Trivia Answers

A) Julian Robertson. The nickname derives from the name of his hedge fund, Tiger Management.

C) Howard Marks. Legend.

C) John C. Bogle. Still beloved by millions of (lazy) ‘Bogleheads’. jk.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Good thoughts on AAPL. Personally, I think consumers are going to love the new AI features. It’ll almost be like a brand new technology. Many of them haven’t even used Chat GPT before.