“Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.”

- Seth Klarman

“The reason I talk to myself is because I’m the only one whose answers I accept.”

- George Carlin

US equities closed higher despite a quiet Monday session: The S&P 500 hit a new closing high, with the Nasdaq now less than 1% below its July 10th peak. Outperformers included Nvidia, semiconductors, homebuilders, banks, and airlines, while energy, retail, China tech, and machinery stocks lagged.

Bond market holiday slowed activity, but key data awaits later this week: Markets are in wait-and-see mode ahead of retail sales, manufacturing, and housing data on Thursday. Valuation concerns, Fed policy uncertainties, and volatility (VIX) remain in focus, with favorable earnings seasonality providing some support.

Corporate and macro news highlights a few movers: Boeing made headlines with a Q3 revenue miss and workforce reduction, and Elliott Management is pushing for a board shake-up at Southwest Airlines. Meanwhile, Longboard Pharmaceuticals will be acquired for $60/share, and B. Riley Financial surged on its Great American unit sale to Oaktree Capital.

Notable Companies:

Canada Goose (GOOS) [-5.2%]: Wells Fargo downgraded it, saying the brand’s buzz is fading, social media chatter is lagging peers, and China’s economic struggles are hurting margins.

Adobe (ADBE) [+2.9%]: Announced deeper partnerships with Google, Meta, Microsoft, Snap, and TikTok to strengthen its ad game.

VF Corp (VFC) [-4.8%]: Got an underweight rating from Wells Fargo, warning that optimism about a turnaround might be too rosy.

More below in ‘Market Movers’.

Short note today as I’m horrendously ill.

Street Stories

Tesla's Stock Takes the Exit Ramp After Robotaxi Reveal

Tesla’s “We, Robot” robotaxi event on Thursday was actually pretty cool. They debuted the much anticipated Cybercab - which I’m pretty sure was just a Model 3 with some Cybertruck panels - and the Robovan - which I can’t really describe in words.

Diehard Tesla fans got to take short rides in the aforementioned autonomous vehicles, while Tesla’s humanoid robot, Optimus, mixed drinks.

Definitely neat.

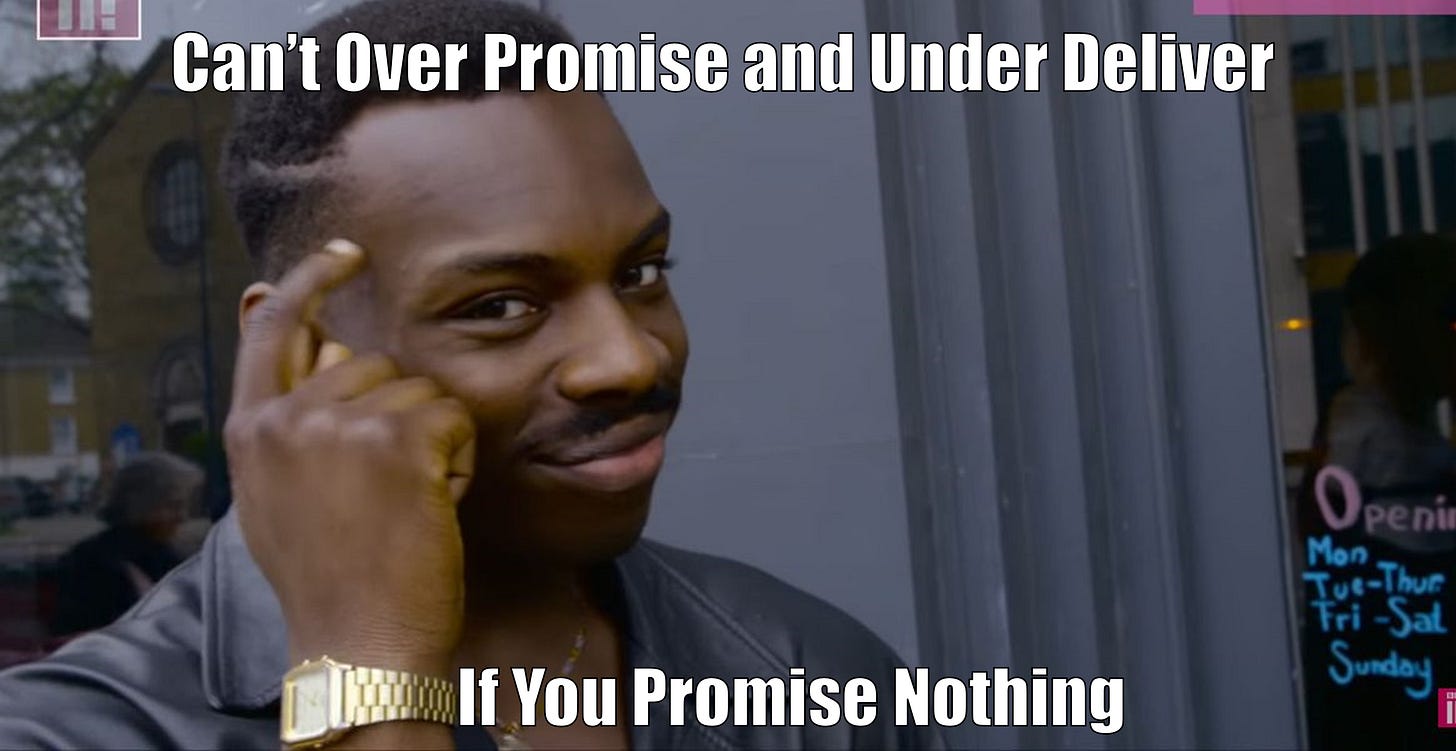

The problem was that the event was what one analyst called 'stunningly absent on detail.' Ooof.

With the shares up ~70% since April, investors wanted concrete evidence that the company wasn’t falling further behind Waymo and Cruise in the autonomous taxi space.

And, as no evidence was forthcoming, the shares dropped 9% on Friday.

It was almost like Elon knew that Wall Street was tired of hearing the same unfulfilled promises and decided to take a different tack. It didn’t work.

And it’s not like the rest of the business has been going gangbusters either. Sales are steadily recovering from the Q1 meltdown in the EV market, but the growth story seems to have run out of batteries.

And while expectations for the long-term are a bit more rosy, Tesla’s margins are growing concerning. For example, despite a meaningful increase in sales, 2024 EBITDA is expected to come in 28% lower than 2022.

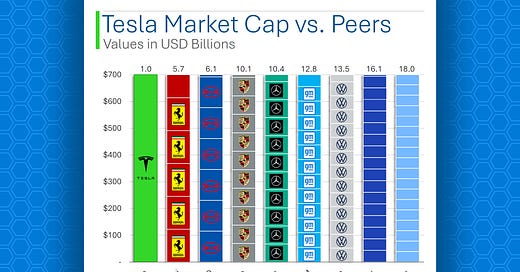

In case you were feeling sympathetic for Tesla, it’s worth pointing out that it’s valued at more than all of it’s competitors combined. At a valuation like that, there’s little room for excuses.

Joke Of The Day

My wife accused me of being immature.

I told her to get out of my fort.

Hot Headlines

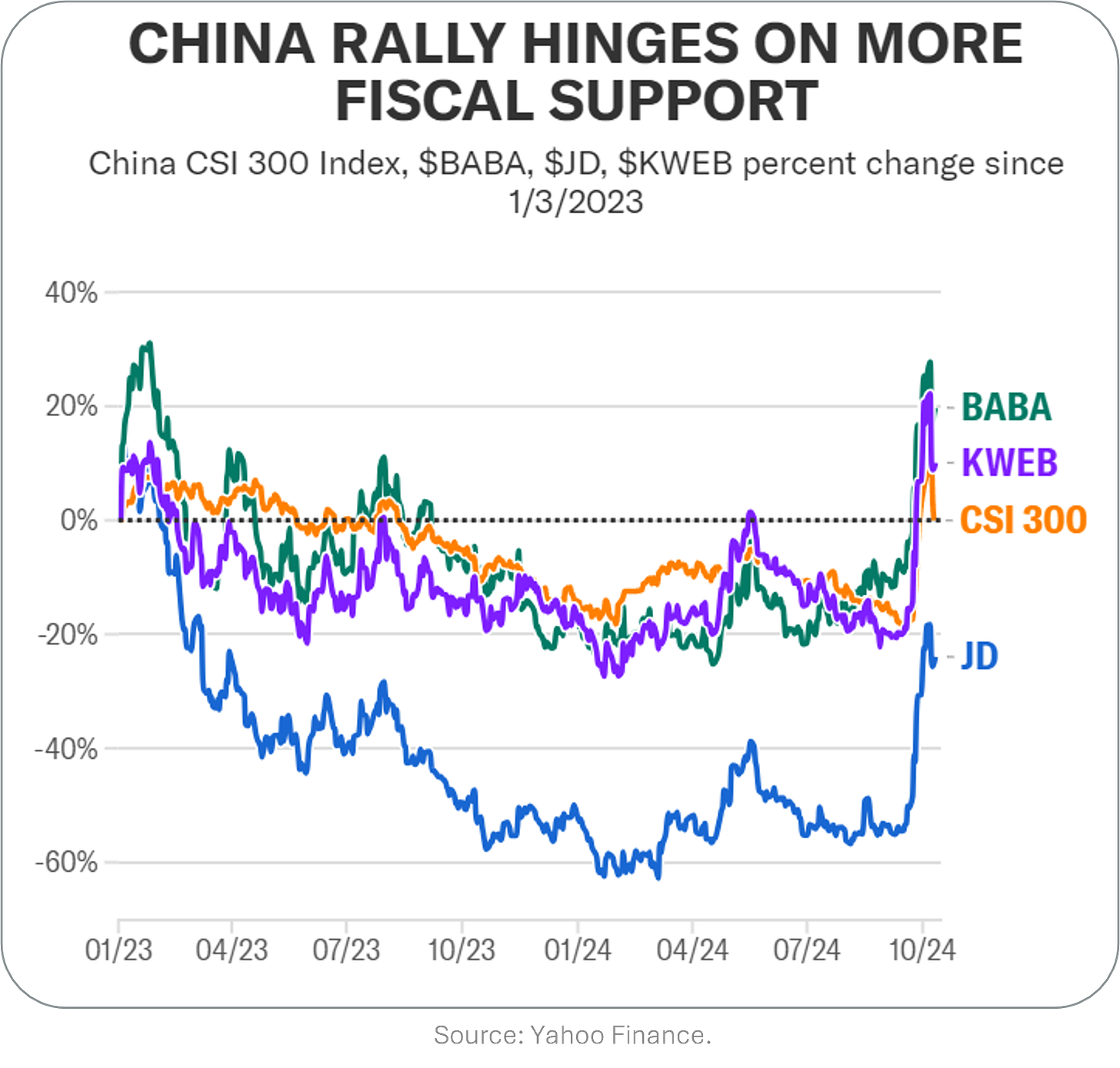

The Wall Street Journal / Xi Jinping’s mixed messaging on china stimulus leaves investors confused. After resisting strong stimulus measures for two years, Xi Jinping finally ordered a series of interest-rate cuts in late September to stabilize China’s economy.

Reuters / US warns Iran to stop plotting against Trump, says US official.

The United States has issued a stern warning to Iran, stating that any attempt on Donald Trump's life would be considered an act of war, following reports of Iranian plots against the former president

Yahoo Finance / China growth forecast upgraded at Goldman Sachs amid stimulus efforts. Goldman Sachs increased its 2024 China GDP forecast from 4.7% to 4.9%

Bloomberg / Ericsson shares surge as AT&T deal delivers strong US growth. Ericsson’s stock jumped 7.5% after a third-quarter earnings report showed strong growth, boosted by a major contract with AT&T and a 55% increase in North American sales.

Yahoo Finance / The bull market is 2 years old. Here's where Wall Street thinks stocks go next.Two years into the bull market, the S&P 500 has surged over 60%, with Wall Street optimistic that earnings growth and the resilient U.S. economy will keep the momentum going.

Bloomberg / OPEC cuts global oil demand growth forecasts for the third consecutive month. OPEC reduced its oil demand growth forecasts for 2024 by 106,000 barrels per day, marking the third consecutive monthly downgrade as the group adjusts.

CNBC / Boeing to cut 17,000 jobs as losses deepen during factory strike. Boeing plans to slash 10% of its workforce as a machinist strike enters its fifth week, delaying the launch of its 777X.

CNBC / From swimming cars to rectangular steering wheels, here’s what’s going on at the Paris auto show. This included Peugeot’s Hypersquare steering wheel, set for production in 2026, and BYD’s Yangwang U8, a plug-in hybrid SUV capable of "swimming" for 30 minutes.

CNBC / Walgreens says it will close 1,200 stores by 2027, as earnings top estimates. Walgreens plans to shutter 1,200 stores by 2027, with 500 closures in fiscal 2025 alone, as it aims to slash costs.

CNBC / Tom Brady expected to become part owner of NFL’s Las Vegas Raiders.

NFL owners are set to approve Tom Brady's purchase of a 10% stake in the Las Vegas Raiders, marking Brady's second sports ownership role after his stake in the WNBA's Las Vegas Aces.

Trivia

Today’s trivia takes a ride through the fascinating history of cars!

Which year did Henry Ford introduce the Model T, revolutionizing the automobile industry?

A) 1903

B) 1908

C) 1913

D) 1918What was the first mass-produced car in the United States?

A) Oldsmobile Curved Dash

B) Ford Model A

C) Chrysler Six

D) Cadillac Model ThirtyWhich car manufacturer was the first to introduce seat belts as a standard feature?

A) Ford

B) Volvo

C) Mercedes-Benz

D) General MotorsIn 1934, which iconic French car was introduced that featured the first mass-produced front-wheel-drive system?

A) Renault 4CV

B) Citroën Traction Avant

C) Peugeot 203

D) Simca ArondeWhich luxury car brand was initially known for manufacturing airplane engines during World War I?

A) Rolls-Royce

B) Bentley

C) Bugatti

D) Aston Martin

(answers at bottom)

Market Movers

Winners!

Longboard Pharmaceuticals (LBPH) [+51.7%]: Getting scooped up by H. Lundbeck A/S for $2.6B cash, with a sweet $60/share offer that’s 54% higher than last week’s close.

SoFi Technologies (SOFI) [+11.4%]: Announced a $2B loan platform deal with Fortress, expanding its lending game.

Hims & Hers Health (HIMS) [+9.7%]: Reuters says the FDA may rethink rules that could allow selling cheaper copies of Eli Lilly's drugs.

Sirius XM Holdings (SIRI) [+7.9%]: Berkshire Hathaway bought another 3.6M shares, boosting its total to nearly 109M shares.

Flutter Entertainment (FLUT) [+4.8%]: Wells Fargo upgraded it, saying the market already baked in the worst-case UK gambling tax scenario.

Affirm Holdings (AFRM) [+4.6%]: Wedbush upgraded it, citing better credit quality, lower funding costs, and GMV growth with low rates.

Adobe (ADBE) [+2.9%]: Announced deeper partnerships with Google, Meta, Microsoft, Snap, and TikTok to strengthen its ad game.

SentinelOne (S) [+2.7%]: Piper Sandler upgraded it, expecting it to steal market share from CrowdStrike and grow with AI and automation tools.

Losers!

Canada Goose (GOOS) [-5.2%]: Wells Fargo downgraded it, saying the brand’s buzz is fading, social media chatter is lagging peers, and China’s economic struggles are hurting margins.

VF Corp (VFC) [-4.8%]: Got an underweight rating from Wells Fargo, warning that optimism about a turnaround might be too rosy.

Caterpillar (CAT) [-2.0%]: Morgan Stanley downgraded it, concerned about excess inventory and stiff competition in its Construction Industries segment.

Triumph Group (TGI) [-1.3%]: JPMorgan dropped it to underweight, citing Boeing dependency and doubts about a potential buyout, despite rumors the company might be up for sale.

Boeing (BA) [-1.3%]: After hours on Friday, it warned Q3 revenue will miss expectations, postponed the 777X launch, and announced 17,000 job cuts.

Amgen (AMGN) [-1.1%]: Truist downgraded it to hold, saying the stock’s price is high and competition is fierce despite optimism for its atopic dermatitis drug, rocatinlimab.

Market Update

Trivia Answers

B) 1908 – Henry Ford introduced the Model T in 1908, making cars affordable for the average American family.

A) Oldsmobile Curved Dash – Introduced in 1901, the Oldsmobile Curved Dash is credited as the first mass-produced car in the U.S.

B) Volvo – In 1959, Volvo became the first car manufacturer to offer seat belts as a standard feature.

B) Citroën Traction Avant – Introduced in 1934, the Citroën Traction Avant was groundbreaking with its front-wheel-drive design.

A) Rolls-Royce – Rolls-Royce initially manufactured airplane engines during WWI, before becoming a symbol of luxury in the automotive world.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.