🔬Tesla Gets Recalled, Pirates Are Mean, and Much More

"Don’t invest in any idea you can’t illustrate with a crayon"

- Mohnish Pabrai

"History may not repeat, but it does rhyme"

- Mark Twain

Mixed day for the big markets on Friday following six straight days in the win column with the S&P 500 flat (-0.01%) and Nasdaq up smalls (+0.35%).

3 of 11 sectors closed in the green led by Tech (+0.7%) and Consumer Discretionary (+0.5%). Interest sensitive Utilities (-1.7%) and Real Estate (-1.2%) were the worst off.

Fedspeak: NY Fed's Williams said it looks like rates are near or at sufficiently restrictive levels, but that it’s too early to talk about interest rate cuts.

Treasuries ended weaker with the U.S. 10-Year Bond holding beyond 4%. Gold ended the week down 0.5% Friday but still up ~1% for the week.

Street Stories

TESLA RECALL - Tesla Inc. faces heightened legal challenges over its Autopilot system after recalling 2 million cars due to a safety regulator's finding that the driver-assistance program failed to ensure driver attentiveness. This recall, which acknowledges potential safety defects, strengthens the claims in several high-profile lawsuits alleging that Autopilot is defective and contributed to accidents, possibly leading to significant compensatory damages against the company. [Bloomberg has more]

ACTIVISION FINALLY ENDS LEGAL ROW - Activision Blizzard agreed to pay over $50 million to settle a lawsuit by California's Civil Rights Department, which had accused the company of ignoring employee complaints of sexual harassment, discrimination, and pay disparity since mid-2021. The settlement, which is the second-largest by the state agency, follows previous legal actions, including an $18 million settlement with the U.S. Equal Employment Opportunity Commission and a $35 million settlement with the SEC over related workplace misconduct allegations. This series of legal challenges significantly impacted Activision's reputation and operations, influencing Microsoft's decision to acquire the company for $75 billion in early 2022, and prompting internal reforms to improve workplace inclusivity. [The WSJ has more on this]

SHIPPING GIANT MAERSK TO AVOID RED SEA - A.P. Moller-Maersk, the world’s second largest shipping company, has halted all container shipments through the Red Sea due to security concerns, following a near-miss missile incident involving its vessel Maersk Gibraltar and another attack on a container ship. Despite Yemen's Houthi movement claiming an attack on a Maersk vessel, the company confirmed the vessel was not hit, expressing deep concern over the escalated security situation in the southern Red Sea and Gulf of Aden. [Reuters has the full story]

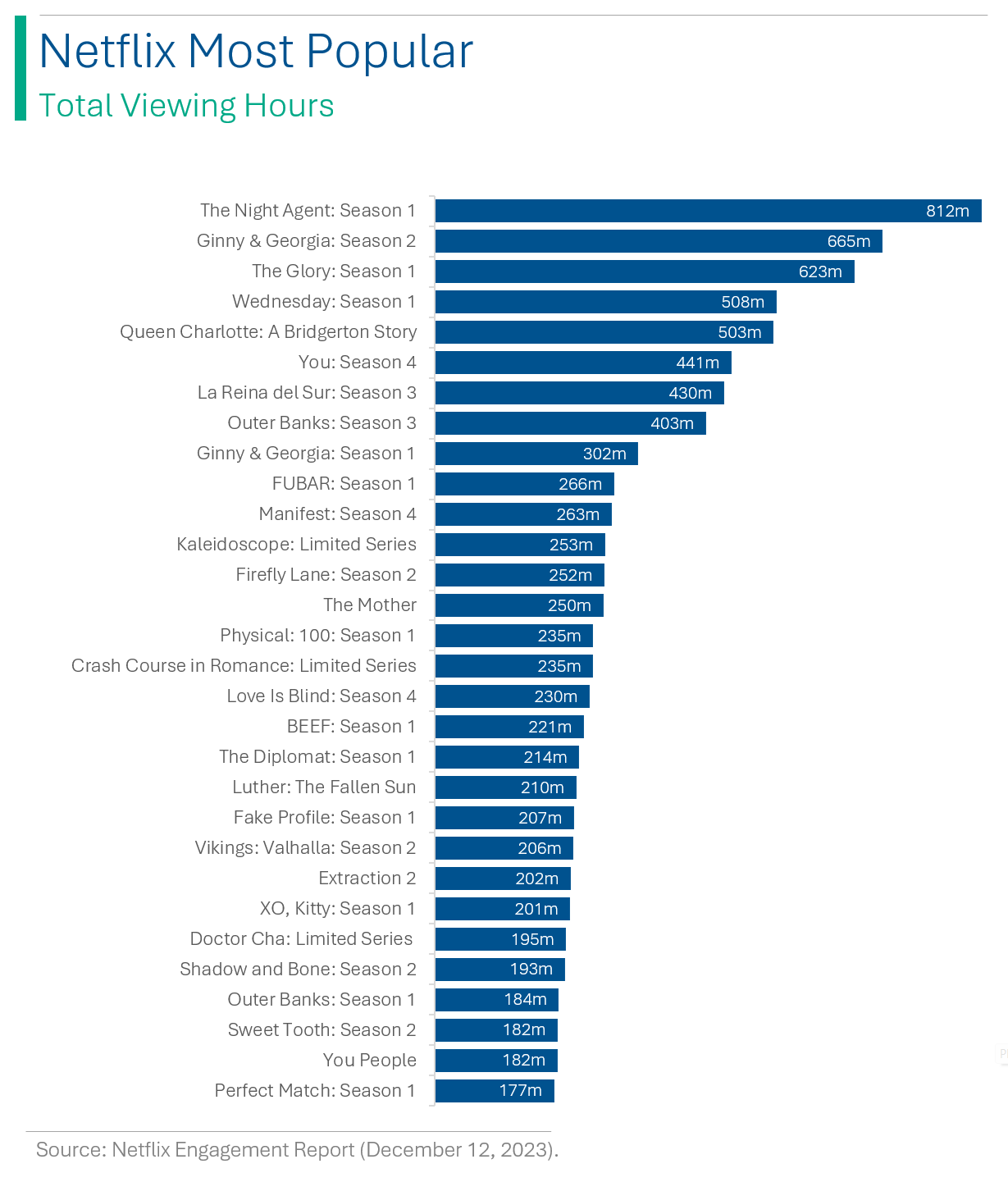

NETFLIX MOST WATCHED - The streaming video company just released it latest ‘Netflix Engagement Report’. Some interesting highlights are that the report covers +18 thousand titles which represents ~99% of all Netflix viewings, and covers nearly 100 BILLION hours viewed. Non-English content has also risen sharply, now consisting of ~30% of all viewings.

DOCUSIGN IS IN PLAY - DocuSign's shares soared like a paper airplane in a breeze, climbing up to +15% on rumors of a potential sale, even though their financial flight path has been less impressive than their tech peers, with only a 16% rise this year compared to the Nasdaq's 41%. The e-signature company, which blossomed in the pandemic but then hit some turbulence post-reopening, seems to be pondering a 'sign here' sticker on its own sale contract, amidst dwindling growth and stiff competition from the likes of Adobe and Dropbox. [More on this from CNBC]

Joke Of The Day

An economist walks into a pizzeria to order a pizza. The waiter asks him: “Should I cut it into 4 pieces or 6 pieces?” The economist replies: “I’m feeling hungry right now. You’d better cut it into 6 pieces.”

Hot Headlines

AP | Ukraine has reached another step closer to joining the EU.

Bloomberg | China’s iPhone ban accelerates across government and state firms. If you can’t beat ’em, ban ’em.

CNBC | The weight loss drug boom will pick up steam in 2024 with new drugs and improved supply chains. #fatprofits

Reuters | China critic Jimmy Lai’s trial to start on Monday despite calls from Britain against his charges of foreign collusion.

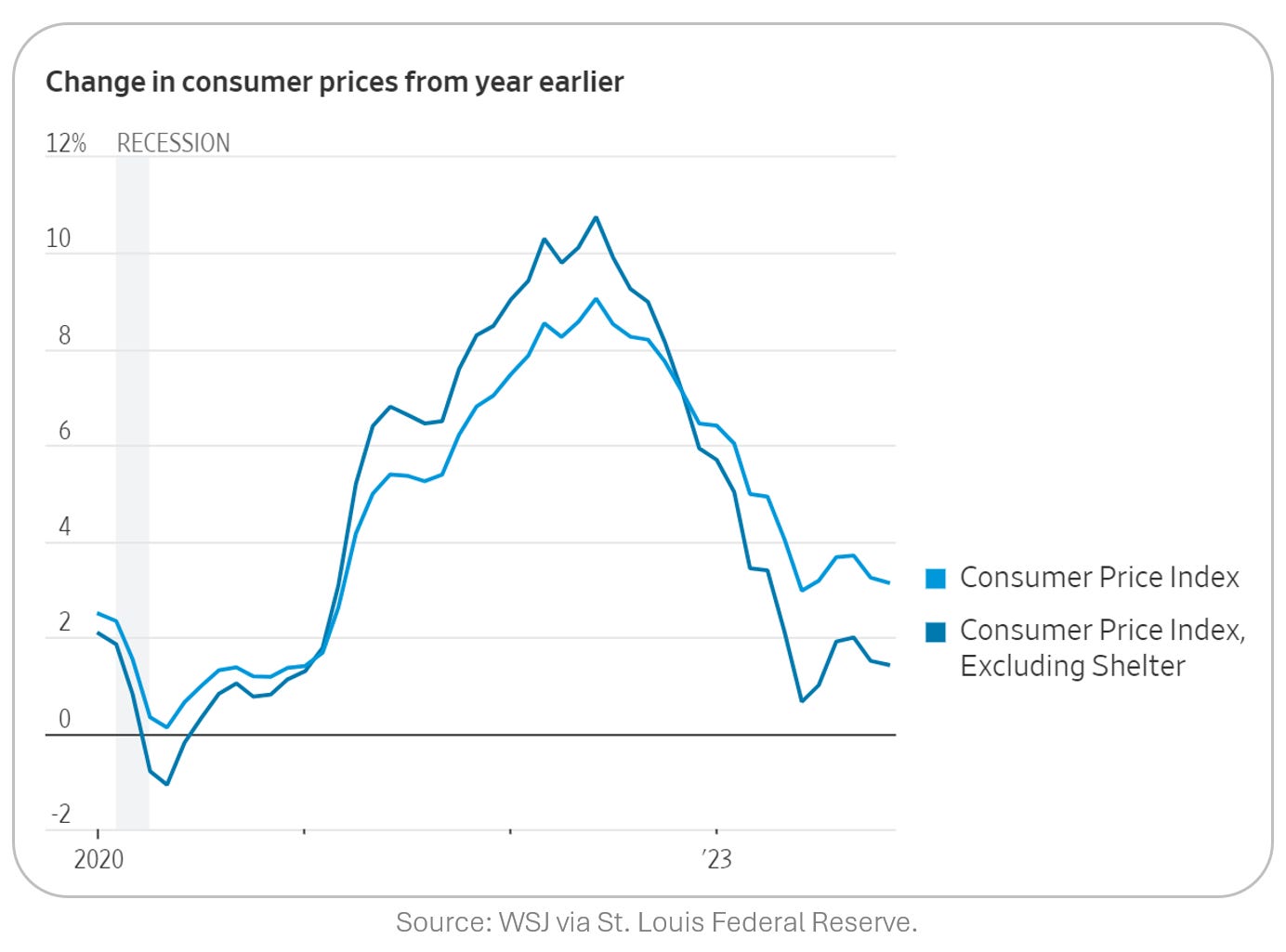

WSJ | Despite Record Home Prices, Housing Is About to Drag Inflation Down.

Axios | The IPO rebound faded just as quickly as it began. Why can’t we have nice things?

Blackstone - the big, mean kings of private equity - decided to show their warm and fuzzy side with a Taylor Swift themed holiday video. Because… why?

Beyond being terrible, this also reminds me of when hedge fund Galleon Group released their own rap song (also terrible) literally moments before they shut down on an insider trading wrap. Hope this isn’t a leading indicator.

Trivia

This week’s trivia is on ‘first year economics’.

The law of demand states that, other things equal, when the price of a good:

A) Increases, demand remains unchanged

B) Decreases, demand decreases

C) Increases, demand increases

D) Increases, demand decreasesIn Keynesian economics, which of the following is recommended during a recession?

A) Increase government spending

B) Decrease taxes

C) Both A and B

D) Sell all your stocks and panicA 'Giffen Good' is a product that:

A) Has inelastic demand

B) Has perfect substitutesC) Is a type of Scottish pastry

D) Has more demand as the price increases

(answers at bottom)

Market Movers

Winners!

DocuSign (DOCU) [+12.5%]: Reports suggest the company is considering a sale to private equity or a tech company.

Costco Wholesale (COST) [+4.5%]: Exceeded fiscal Q1 EBITDA and EPS expectations with improved gross margin; Black Friday and Cyber Monday sales surpassed forecasts, showing an uptick in discretionary sales. The company also announced a $15 per share special dividend.

Enphase Energy (ENPH) [+3.1%]: Received a buy initiation from Jefferies, driven by prospects of robust sector growth and anticipated federal rate cuts enhancing share values.

Losers!

Scholastic (SCHL) [-11.6%]: Reported lower than expected FQ2 earnings and revenue, with a year-over-year decline. Revised 2024 guidance to EBITDA of $165M to $175M, forecasting revenue to be level with or slightly below the previous year due to decreased participation and spending in the School Reading Events division.

Quanex Building Products (NX) [-10.9%]: Despite better Q4 earnings and revenue, the company faces softer market demand and lower North American pricing. They expressed a cautious outlook for the first half of 2024 due to macroeconomic challenges and seasonality, refraining from providing FY24 guidance amid ongoing uncertainties.

Roku (ROKU) [-6.8%]: Downgraded to sell from neutral by MoffettNathanson (who?). The downgrade was driven by valuation concerns and the expectation that sluggish growth in subscription video-on-demand services will slow revenues.

Market Update

Trivia Answers

D) The Law of Demand states that as price increases, demand decreases.

C) Keynesian economics recommends both A (increasing government spending) and B (decreasing taxes) in a recession.

D) A ‘Giffen Good’ has more demand as the price increases.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.