🔬Temu Part II: A Post-Implosion Look at Valuation

Plus: SpaceX is winning the new space race; and much more!

“You don’t have to be the biggest to beat the biggest.”

-Ross Perot

"There is no sunrise so beautiful that it is worth waking me up to see it."

-Mindy Kaling

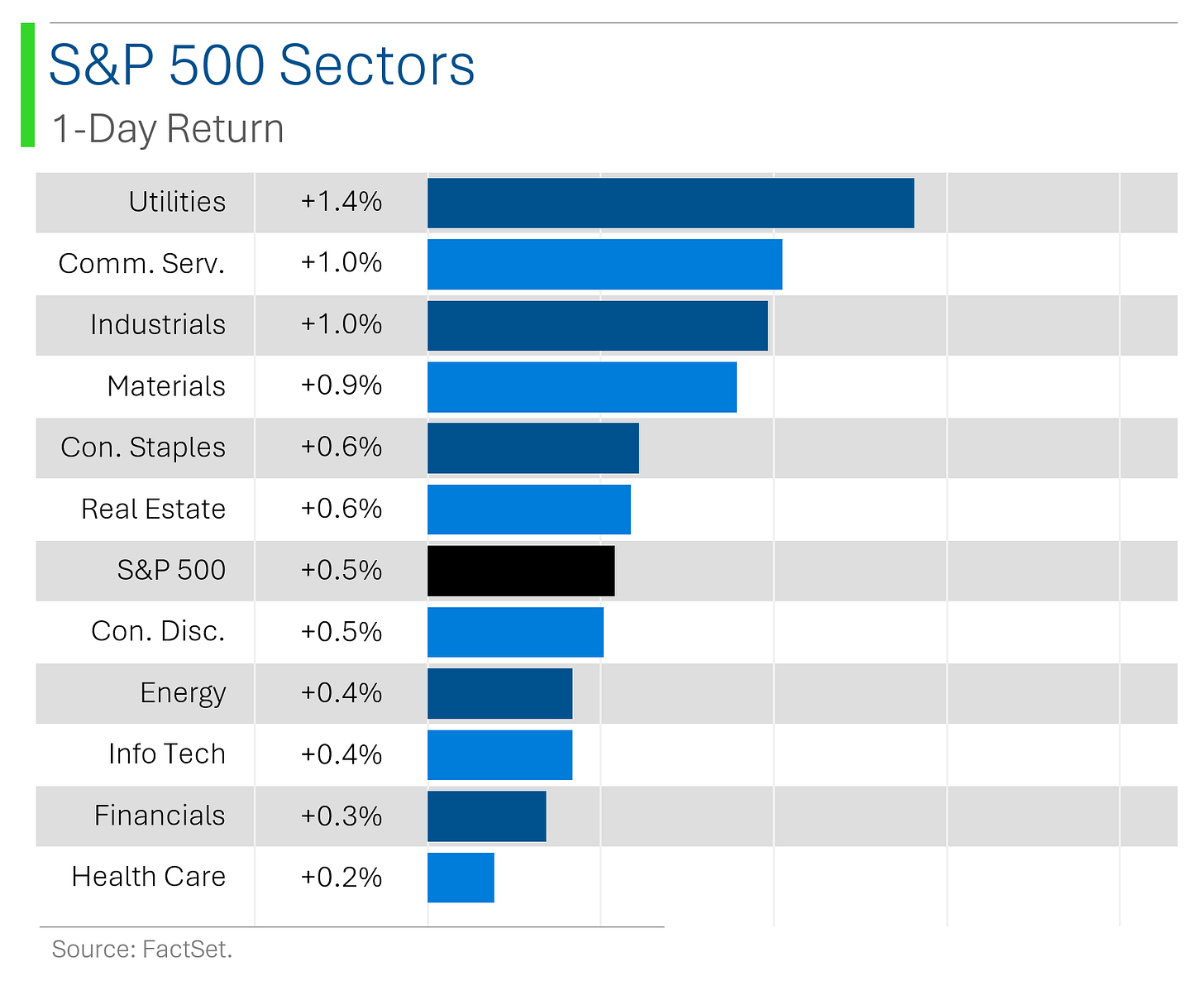

US stocks ended the week higher, with a fifth-straight day of gains Friday led by semis, homebuilders, energy, and retail. The Nasdaq had its best week since November 2023, while the S&P is nearing its July record high.

Optimism around a potential 50 bp Fed rate cut helped drive this week’s rally, along with AI enthusiasm and hopes of a soft landing after inflation expectations improved. Meanwhile, falling rates, energy, and food prices further bolstered market sentiment.

This week’s focus will be on retail sales and the Fed’s decision at the September FOMC meeting. Oracle surged on strong guidance, Adobe dipped on weak Q4 projections, and Boeing struggled with a workers' strike and potential credit downgrades.

Notable companies:

BA (Boeing) [ -3.7% ] Boeing workers in Seattle voted to strike, with some worried it could last longer than past ones, plus rumors of a potential debt rating downgrade.

ETSY (Etsy) [ +7.6% ] The White House is planning to close a trade loophole used by Shein and Temu, giving Etsy a boost.

UBER (Uber Technologies) [ +6.5% ] Uber's teaming up with Waymo to bring autonomous rides to Austin and Atlanta by early 2025.

ADBE (Adobe) [ -8.5% ] Adobe beat earnings for Q3 but gave a weak Q4 forecast, sparking concerns about future AI growth and slowing Creative Cloud momentum.

More below in ‘Market Movers’.

Street Stories

Temu Part II: A Post-Implosion Look at Valuation

I left things off Friday with parent company Pinduoduo’s ugly Q2 earnings report and even uglier guidance.

In it management called out a material increase in competition and external pressures to profitability, and also that ‘we see many challenges ahead… we are prepared to accept short-term sacrifices and potential decline in profitability’. Queue the 39% share meltdown.

The latest blow came within a few hours of Friday’s Part I as the White House said it will be putting forward a plan to close the ‘de minimis’ duty exemption for imported goods valued at $800 of less. Many consider this to be a loophole that is heavily exploited by Chinese eCommerce firms like Temu and Shein to not pay a dollar of import tax on the tens of billions in goods sent to the U.S..

As you can imagine, a business model that is heavily dependent on a tariff loophole between two nations with an increasingly hostile trading relationship isn’t what shareholders want to hear.

The impact of proposed changes to de minimis import duties is still pending as political support is being developed and the magnitude of tariffs is just speculation. However, it is worth noting that the news broke the same day the Biden administration signed off on a fresh new Chinese import tariff package so I can’t imagine they plan to be too accommodating1.

Even before this, Wall Street had been souring on future expectations as forward year revenue estimates reversed their multi-year trajectory of up and to the right with something more akin to a cliff dive.

1. 100% on EVs; 50% of chips; 25% on lithium-ion batteries, steel and aluminum, etc.

But I guess the good news is that Wall Street’s average target price didn’t decline nearly as much as the shares: a paltry 21% vs. pre-peak share collapse of 35%.

Ok, maybe that isn’t super encouraging…

Ok, so that’s the bad news…

The good news is that the stock is shockingly cheap relative to their eCommerce peers.

For context, the company trades at close to 1/5th the forward P/E multiple of Amazon but is forecast to grow revenue at more than 3x as much over the next three years.

The caveat is obviously that Amazon will be around long after WWIII and the zombie apocalypse, while Temu - and even potentially it’s core Pinduoduo domestic China business - have a lot of what MBAs call ‘stroke of a pen risk’ from the West and even at home in China.

To put a bow on this, if you have the stomach to put up with some serious investment risk (and can leave your moral scruples of owning a pretty evil company at the Schwab login screen) then Temu’s parent company Pinduoduo might just be right for you!

Just remember that your hard earned capital is like a package from Temu: There’s no returns.

Elon, We Have Splashdown

SpaceX’s Polaris Dawn mission, led by billionaire Jared Isaacman, splashed down safely off Florida’s coast early Sunday morning.

This five-day journey took the crew to an altitude of 870 miles, higher than anyone’s been since Apollo 17. A further testament to why Elon has built one of the most valuable private aerospace firm’s on the planet with reports of a most recent funding round being completed at a $210B valuation.

…which is more than 2x their space ‘rival’ Boeing.

The real showstopper? The first-ever all-civilian spacewalk, where Isaacman and SpaceX engineer Sarah Gillis braved the vacuum of space.

All part of testing new tech for future missions…Mars, anyone?

Joke Of The Day

Kid 1: “What kind of work does your Daddy do?”

Kid 2: “My Daddy’s a teacher. What does your Daddy do?”

Kid 1: “He’s a stockbroker.”

Kid 2: “Honest?”

Kid 1: “No, just the regular kind.”

Hot Headlines

Reuters / Houthi missile reaches central Israel for first time, no injuries reported. The missile was intercepted and only fragments of it that landed near key Israeli infrastructure. Netenyahu has already responded with a statement vowing to impose a "heavy price" on the Houthis. Poking the bear…

CNBC / Pfizer says its experimental drug for deadly condition that causes appetite and weight loss in cancer patients shows positive trial results. During trials the drug has significantly improved body weight and muscle mass in patients, potentially positioning it as the first approved treatment for this life-threatening condition.

CNBC / DirecTV and Disney reach deal to end blackout in time for college football.The deal ended a two-week blackout and allows DirectTV to stream Disney, ESPN and other key networks to their customers. While getting in between Americans and football might seem like a great way to gain leverage, in practice you’ll just make your user-base see red.

Bloomberg / Russia sharing nuclear secrets with Iran fuels US and UK worries. Apparently Russia’s getting ballistic missiles for sharing this info with Iran. Can you ever have too many of those?

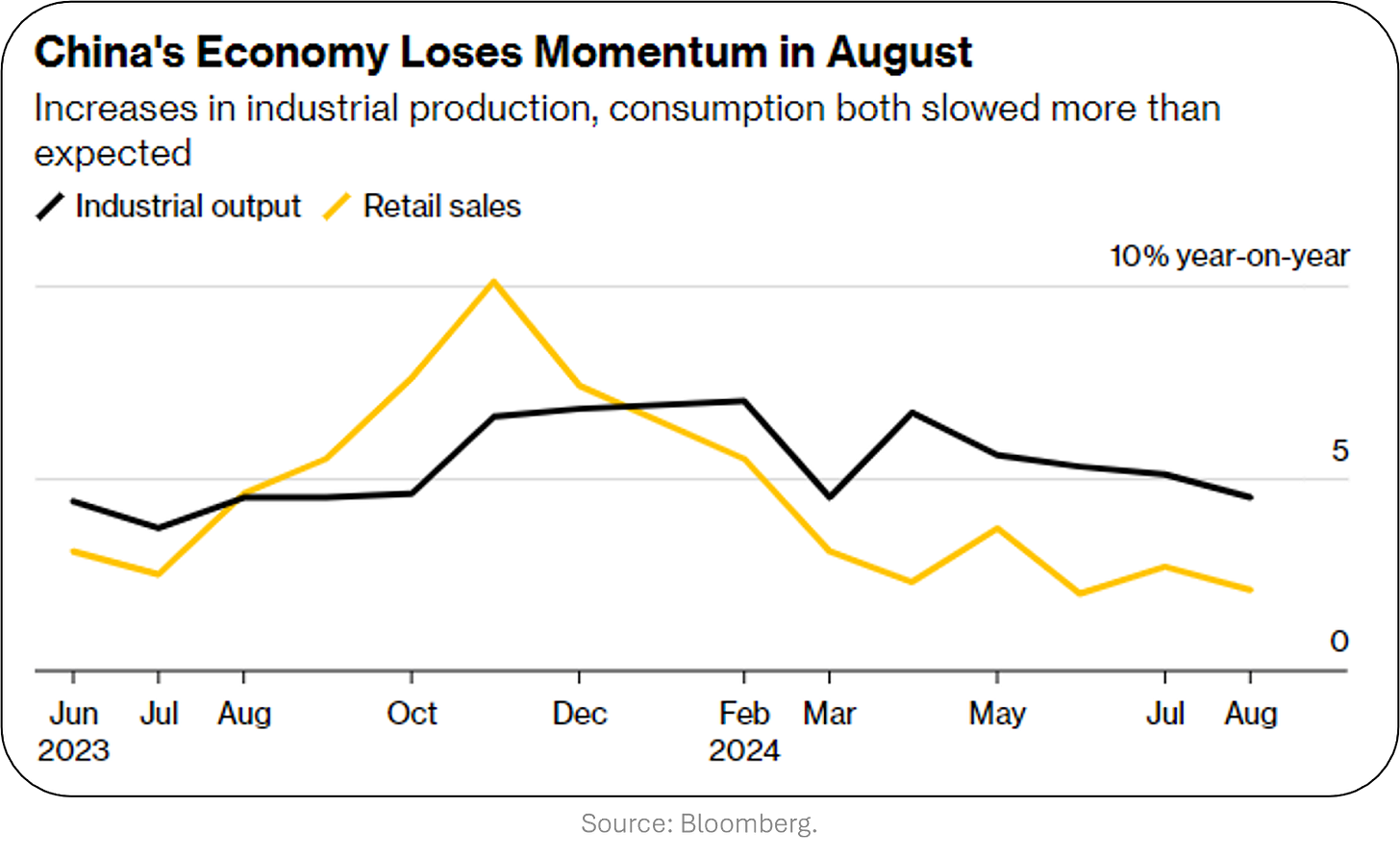

Bloomberg / China slowdown spurs calls for stimulus before it’s too late. China’s economy was plagued by weaker-than-expected industrial production, retail sales, and investment within the month of August. Moreover, with unemployment rising, the country’s 5% GDP target for 2024 is looking a little far out. That said, Beijing could always just fudge the numbers right?

Bloomberg / Air Canada offers 42% raise to pilots and averting strike. The agreement, which includes a 26% upfront pay boost, came after more than a year of negotiations and now awaits approval from the pilots' union members. The deal is set to cost the airline $1.9B…in monopoly money.

Trivia

Today's trivia is on America’s very own John Pierpont Morgan!

Which early event in J.P. Morgan’s career demonstrated his global financial influence when he orchestrated a bailout for a European nation?

A) Bailout of France

B) Bailout of England

C) Bailout of Russia

D) Bailout of GermanyWhich landmark deal did J.P. Morgan orchestrate in 1901, creating the world’s first billion-dollar corporation?

A) Standard Oil

B) U.S. Steel

C) General Electric

D) Carnegie SteelIn what year did J.P. Morgan famously step in to prevent a collapse of the U.S. financial system by organizing a group of bankers to support the New York Stock Exchange?

A) 1893

B) 1907

C) 1929

D) 1913

(answers at bottom)

Market Movers

Winners!

RH (Restoration Hardware) [ +25.5% ] Management says demand will pick up through FY24 and 2025, plus they beat on earnings and revenue with better-than-expected margins.

UPWK (Upwork) [ +10.0% ] Activist investor Engine Capital wants board changes and is pushing for a simpler platform, lower expenses, and better enterprise growth.

ETSY (Etsy) [ +7.6% ] The White House is planning to close a trade loophole used by Shein and Temu, giving Etsy a boost.

TLN (Talen Energy) [ +6.9% ] Jefferies started coverage with a buy, thanks to strong future growth from data center deals.

UBER (Uber Technologies) [ +6.5% ] Uber's teaming up with Waymo to bring autonomous rides to Austin and Atlanta by early 2025.

FNMA (Fannie Mae) [ +6.4% ] Rumor has it that Trump allies are exploring privatizing Fannie and Freddie, getting investors excited.

VST (Vistra) [ +6.3% ] Jefferies named Vistra their top pick, banking on data center deals to take off by 2025.

X (United States Steel) [ +3.8% ] The White House might delay a decision on U.S. Steel’s potential deal with Nippon Steel.

Losers!

VSAT (Viasat) [ -14.9% ] United Airlines teamed up with Starlink for free Wi-Fi on all flights starting in 2025, leaving Viasat behind.

ADBE (Adobe) [ -8.5% ] Adobe beat earnings for Q3 but gave a weak Q4 forecast, sparking concerns about future AI growth and slowing Creative Cloud momentum.

GRMN (Garmin) [ -5.1% ] Barclays downgraded Garmin due to a premium valuation and concerns about margins and the recent surge in stock price.

BA (Boeing) [ -3.7% ] Boeing workers in Seattle voted to strike, with some worried it could last longer than past ones, plus rumors of a potential debt rating downgrade.

PDD (PDD Holdings) [ -2.4% ] PDD slipped after reports that the White House plans to close a trade loophole affecting Shein and Temu.

MRNA (Moderna) [ -2.0% ] Moderna saw multiple downgrades after a lackluster R&D Day, with worries about FDA approval for their melanoma drug and potential need for an equity raise.

Market Update

Trivia Answers

A) Bailout of France - Early in his career, Morgan organized a gold loan to help stabilize France’s economy during the Franco-Prussian War.

B) U.S. Steel was created when J.P. Morgan merged Carnegie Steel and several other companies.

B) In 1907, J.P. Morgan intervened to stop the panic and saved the NYSE from collapse.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Monopoly money lol.