🔬Tech Bubble Flashbacks

Plus: Starbucks shareholders rejoice over activists; and much more!

"Life is 10% what happens to us and 90% how we react to it."

- Charles R. Swindoll

"Know what you own, and know why you own it."

- Peter Lynch

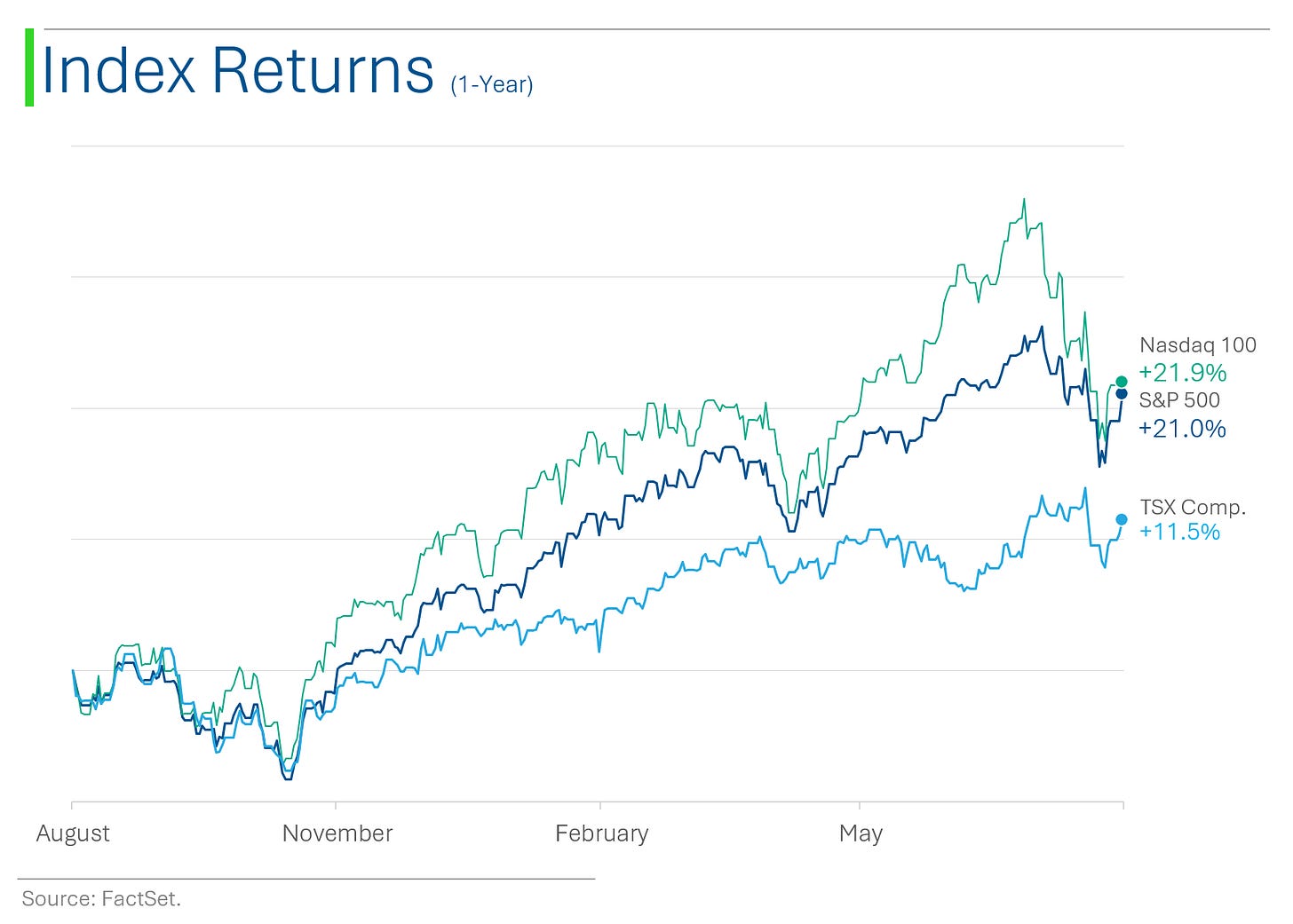

Strong day for the big US markets with the S&P 500 +1.7% and Nasdaq +2.4% following a positive inflation read. Even Small-Cap got back in on the action with the Russell 2000 +1.6%.

10 of 11 sectors closed higher, led by Tech (+3.0%). Energy was the only loser of the day, down -1.0%.

Inflation metric July headline Producer Price Index (PPI) was up +0.1% m/m, below Wall Street’s estimate for +0.2%. Core PPI was flat vs. +0.2% estimates, while June was revised to +0.3% from +0.4%. CPI comes out tomorrow so hopes are peaked.

Notable companies:

Dell Technologies (DELL) [+4.9%]: Upgraded to HOLD from SELL at Barclays; AI hype seen as washed out of share price; cautious outlook on enterprise server/storage and PC segments.

Viasat (VSAT) [-22.6%]: 11.2M share block reportedly being shopped through Morgan Stanley between $20.00-$20.50. Oooooffff.

Chipotle Mexican Grill (CMG) [-7.5%]: CEO Brian Niccol to depart for Starbucks CEO role; named COO Scott Boatwright as interim CEO.

Street Stories

Memory Lane (or the Road to PTSD)

The fact that my pant size is 6" bigger and I no longer have frosted tips is a good reminder that it’s not 2001. But with the current sell-off in Tech after a monumental winning streak, the parallels to the end of the Tech Bubble and today are perhaps a little too stark.

Let me give you a ‘for instance’…

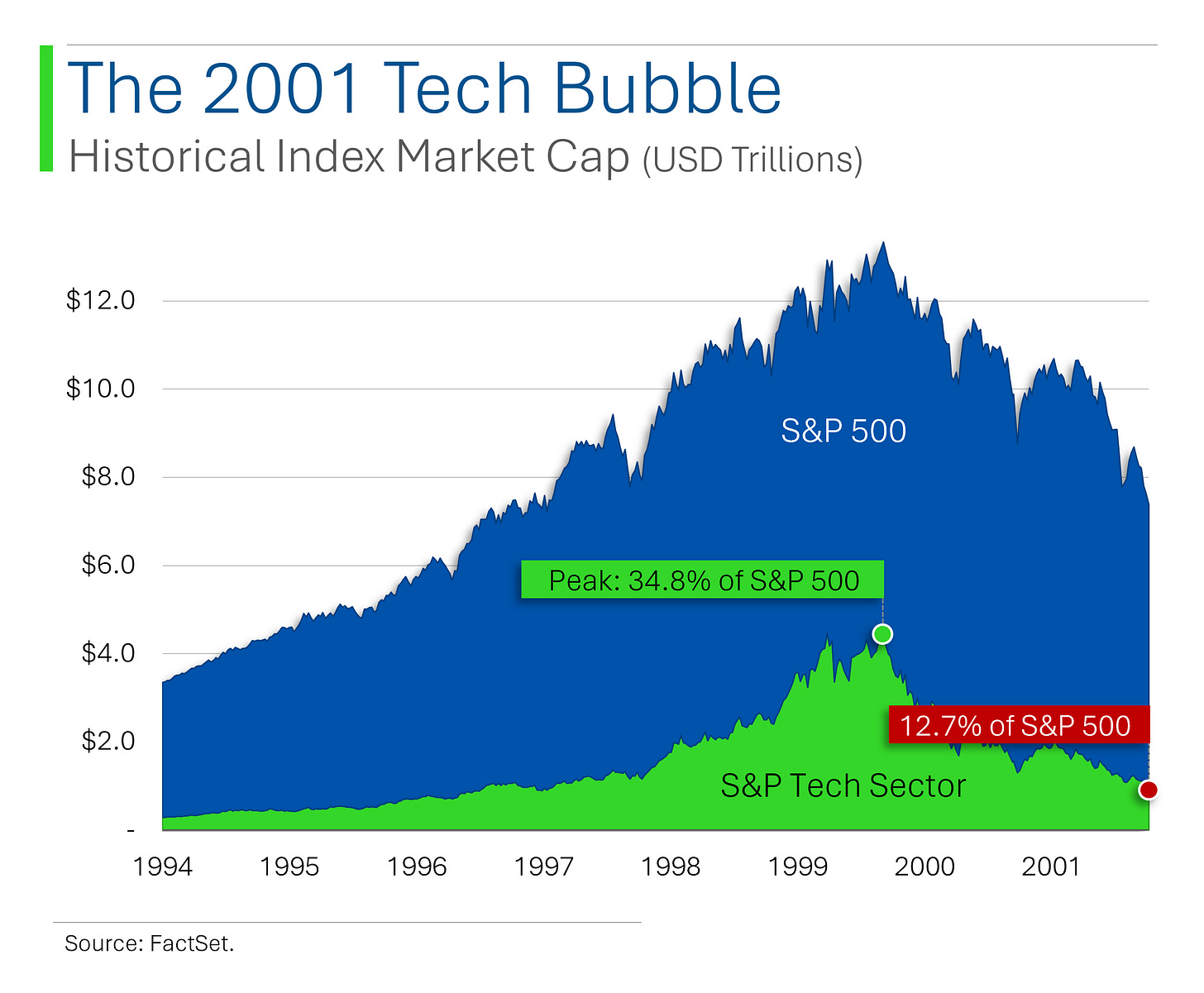

Before the Tech Bubble came into its own, the sector was kinda for nerds. But in March 2000, Tech peaked at a 35% weight in the S&P 500, only to fall back down to a 13% weight just two years later.

This time around, Tech hit a peak in July at 31% of the S&P 500. Where it goes from here is anyone’s guess at this point.

To those calling this another ‘Tech Bubble’ or whatever, there are some important considerations. For starters, before the Tech Bubble got rolling, the sector wasn’t of particular importance, sitting in the #5 spot with just a 10% weight in the Index. However, by the S&P 500’s peak in September 2000, Tech was up 10x, becoming the largest sector by a mile and sat at a ridiculous 35% weight in the S&P 500.

This of course got body slammed back to reality and into the #3 spot, losing nearly 80% of it’s market cap. Damnnnn.

(What a ride tho eh?)

This time around the leap hasn’t been as ridiculous. Five years before the recent Tech peak it was already in the #1 spot. And sure, it has nearly tripled, but its index weight is really only up around 50%.

Whatever the hell happens, I think it’s pretty reasonable to assume that Tech will remain the biggest sector - likely by a lot.

Additionally, so much of the earlier Tech Bubble was based on vaporware and companies that never went on to make a cent of profit. This time around the Tech sector is much healthier with consistent revenue growth and profitability.

But that’s not to say that every company will be ok. For example, the biggest success story of the year has been Nvidia. And remember, 1999 also had their own revolutionary chip company that was going to take over the world (see below). Didn’t really work out for everyone in the end.

Starbucked.

Starbucks has ousted CEO Laxman Narasimhan after just one year, replacing him with Chipotle's turnaround king, Brian Niccol. News of this shakeup sent shares flying more than 20%, the highest single day jump since the firm’s 1992 IPO.

While there are many factors driving this decision, two definitely stand out. The first of which was the declining sales in Starbucks’ flagship markets of China and the US during Narasimhan’s tenure…which led to a 21% drop in share price over the same period.

The more immediate pressure to make this change was driven by activist shareholder Elliot Management, which recently acquired a position worth close to $2B. Usually CEOs put up a bit of a fight, but I don’t think Narasimhan had a leg to stand on.

Joke Of The Day

"I don't need a gym membership - I get my heart rate up every time I check my crypto portfolio."

Hot Headlines

Bloomberg / Boeing’s July deliveries show slow recovery to pre-crisis output. The company delivered 43 commercial aircraft last month, which matched their pace from July 2023. Now on to the next crisis…

Yahoo Finance / Gold Fields to buy Canadian miner Osisko in $1.57 billion cash deal. The Johannesburg-based gold producer will pay C$4.90 per share, a 55% premium to Osisko's pre-announcement price.

Reuters / Paramount Global to lay off 15% of U.S. workforce and close TV studio. Paramount's co-CEOs stated that the company is at an "inflection point" where changes are necessary to strengthen the business. Recall they are merging with David Ellison's Skydance Media. Usually management waits 5min after the deal to start axing people.

Bloomberg / Goldman and JP Morgan say markets pricing in much higher recession odds.

Reuters / Fed's Bostic says a 'little more data' needed to support cutting rates. The Atlanta Fed President says he’s grown ‘more confident’ over inflation trajectory but isn’t yet supportive of cuts. In other news:

Trivia

Today’s Trivia is on the legendary Peter Lynch.

What is Peter Lynch best known for managing?

A) The Vanguard 500 Index Fund

B) The Magellan Fund

C) The Berkshire Hathaway Portfolio

D) The PIMCO Total Return FundWhat investment philosophy is Peter Lynch most famous for?

A) "Buy what you know"

B) "Sell in May and go away"

C) "Buy low, sell high"

D) "Value averaging"Which of the following books was written by Peter Lynch?

A) "The Intelligent Investor"

B) "One Up On Wall Street"

C) "A Random Walk Down Wall Street"

D) "The Little Book of Common Sense Investing"Under Peter Lynch's management, how much did the Magellan Fund grow in assets?

A) From $18 million to $14 billion

B) From $1 billion to $100 billion

C) From $500 million to $10 billion

D) From $5 billion to $50 billionWhat was Peter Lynch's famous approach to stock picking?

A) Momentum trading

B) Contrarian investing

C) Growth at a reasonable price (GARP)

D) Dividend growth investing

(answers at bottom)

Market Movers

Winners!

Starbucks (SBUX) [+24.5%]: Chipotle CEO Brian Niccol named CEO, effective 9-Sep; current CEO Laxman Narasimhan steps down immediately; leadership change follows activist investments by Elliott Management and Starboard Value.

PACS Group (PACS) [+18.8%]: Q2 adjusted EBITDA and revenue beat; management highlighted increased facility count, reimbursement rates, ~25% y/y rise in patient days; raised FY24 guidance; analysts positive on M&A momentum.

Penumbra (PEN) [+10.8%]: Announced $200M share repurchase authorization.

Rumble (RUM) [+5.4%]: Q2 EPS and revenue beat; global MAUs at 53M vs 50M in Q1; revenue up 27% Q/Q; new KPI Average Revenue Per User up 19% Q/Q; expects continued sequential revenue growth through 2024.

Dell Technologies (DELL) [+4.9%]: Upgraded to equal weight from underweight at Barclays; AI hype seen as washed out of share price; cautious outlook on enterprise server/storage and PC segments.

On Holding (ONON) [+4.3%]: Q2 EPS and GM light, but revenue, EBITDA, and margin beat; FY net sales growth forecast reiterated; analysts noted softer consumer backdrop but stronger-than-expected demand and product availability.

Hormel Foods (HRL) [+1.8%]: Upgraded to buy from neutral at Citi; improving retail sales trend and benign input cost environment; noted potential turkey price increases due to production declines.

Home Depot (HD) [+1.2%]: Q2 EPS beat expectations on margin upside, though comp decline was worse than expected; flagged higher rates and macro uncertainty as consumer demand headwinds; lowered FY guidance, though reset was more severe than expected.

Losers!

-22.6% VSAT (Viasat): 11.2M share block reportedly being shopped through Morgan Stanley between $20.00-$20.50.

-15.2% TME (Tencent Music Entertainment Group): Q2 earnings and GM better with revenue in line; mobile MAUs for Online Music and Social Entertainment below consensus; tabbed decline in Social Entertainment revenue to adjustments in certain livestream functions and more stringent compliance procedures.

-11.4% RILY (B. Riley Financial): Filed to delay filing its 10-Q for Q2 (third missed regulatory deadline this year); cited delays in finalizing valuations of certain loans and investments; comes after yesterday's negative preannouncement and headlines about SEC investigation (shares down ~52% on Monday).

-7.5% CMG (Chipotle Mexican Grill): CEO Brian Niccol to depart to take over CEO role at Starbucks; named COO Scott Boatwright as interim CEO.

-6.5% BAX (Baxter International): Announced definitive agreement to divest its Vantive Kidney CARE segment to Carlyle for $3.8B; transaction is expected to close in late 2024 or early 2025.

Market Update

Trivia Answers

B) Peter Lynch is best known for managing the Magellan Fund.

A) Peter Lynch is most famous for the investment philosophy "Buy what you know."

B) "One Up On Wall Street" was written by Peter Lynch.

A) Under Peter Lynch's management, the Magellan Fund grew from $18 million to $14 billion in assets.

C) Peter Lynch's famous approach to stock picking is Growth at a reasonable price (GARP).

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Missing some important stock moves in >$1bn market cap space such as $SPRY yesterday. It's a shame since that part of your daily is very useful