🔬Swooshing Downhill: The Nike Story

Plus: A look at how things worked out in the first half of the year; and much more!

"The only value of stock forecasters is to make fortune-tellers look good"

- Warren Buffett

“Business is the art of extracting money from another man’s pocket without resorting to violence”

- Max Amsterdam

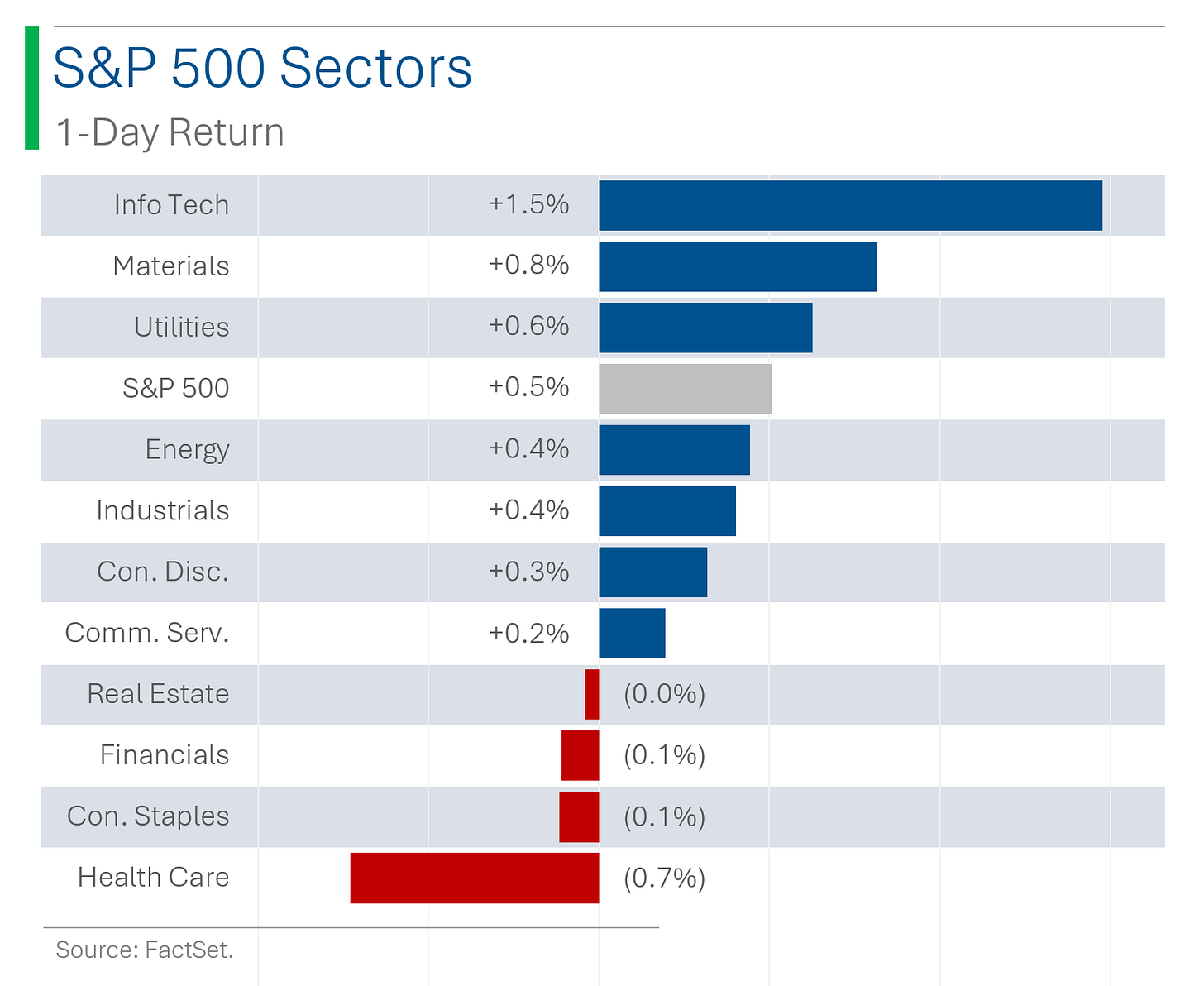

Another strong day for the big US markets despite the shortened trading day, with the S&P 500 +0.5% and Nasdaq +0.9%.

7 of 11 sectors closed higher, led by a big day for Tech (+1.5%). Health Care (-0.7%) and Staples (-0.1%) were sucky again.

June ISM Services PMI came in light at 48.8 vs. consensus for 52.5, meaning that it is now back in contraction territory.

Notable companies:

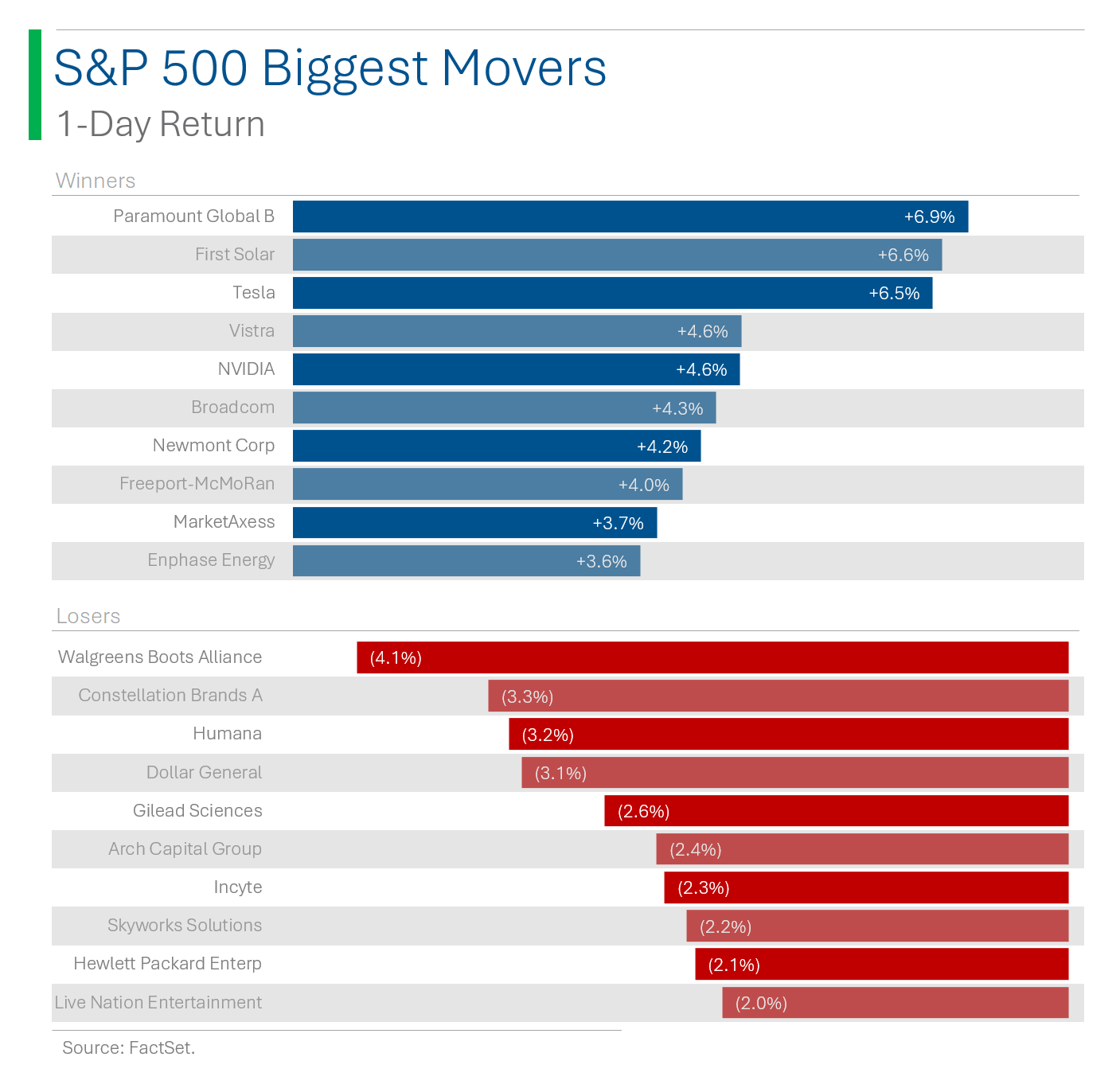

Tesla (TSLA) [+7.0%] Follow-on from Tuesday press release which showed the company beating Wall Street expectations for deliveries in Q2.

Paramount Global (PARA) [+6.9%] Sources report Shari Redstone's National Amusements has reached a preliminary deal to sell its controlling interest to Skydance Media.

Pacira BioSciences (PCRX) [-4.8%] Downgraded to equal weight from overweight at Barclays; FDA approved a generic version of Exparel; ongoing litigation keeps issue an overhang; stock dropped ~20% Tuesday.

Street Stories

Swooshing Downhill

With Tesla up 22.5% in the last three trading days, the biggest mainstream-dud-of-the-year torch is now passed to Nike.

Today I’ll dig into the situation and try to explain why the sporty stock has been benched. Let’s do it!

To start, the stock has been weak for a while but the latest round of pain came courtesy of their Q4 filing which was released on June 28th. The quarter was decidedly mixed with revenue missing analyst estimates and showing a year-over-year drop of 1.7%. EPS beat but it was a decidedly low bar from the Street, and the year-over-year increase of +53% came as a result of their Q4 2023 being a complete disaster. Like, Tiger Woods cheating scandal bad.

The biggest negative, however, was the company slashing its revenue growth expectations. Previously the company had guided towards a positive FY2025 but recanted on the earnings call, instead calling for a ‘mid-single digit’ decline. Youchy.

As a result, the Street set fire to their target prices, with analysts from JP Morgan, Morgan Stanley, Barclays, UBS, etc., all dumping their Buy ratings on the stock.

The results are quite anemic expectations for the company to grow revenues over the medium term. Since 2018 the company has managed a respectable +5.9% annual growth rate but the Street now sees this sinking to +2.5% over the next four years.

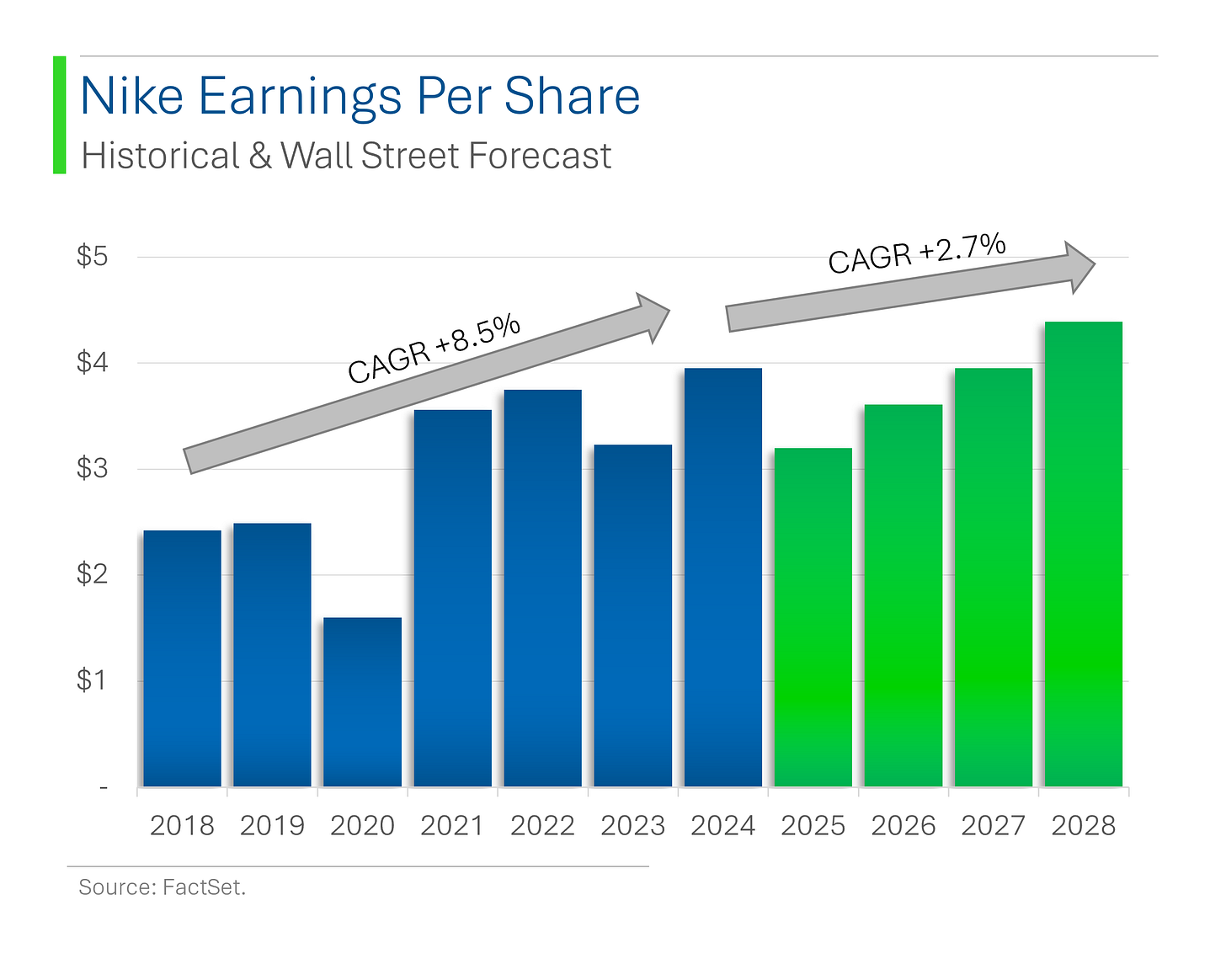

And earnings per share expectations moved in lockstep, with Wall Street now only banking on growth averaging a paltry +2.7%.

It’s also worth pointing out that this weakness isn’t a new phenomenon. While revenue was flat between fiscal 2023 and fiscal 2024, estimates for fiscal 2025 have been melting since as far back as 2021 - declining a staggering 33% over the last three years!

On a segment basis, it appears that the stagnation in Apparel, Converse, Equipment and Global Brand has finally spread to the vaunted footwear division.

With consumers feeling the pinch from inflation - and perhaps a bit of over spend during the pandemic - the market for +$200 shoes doesn’t seem so hot right now.

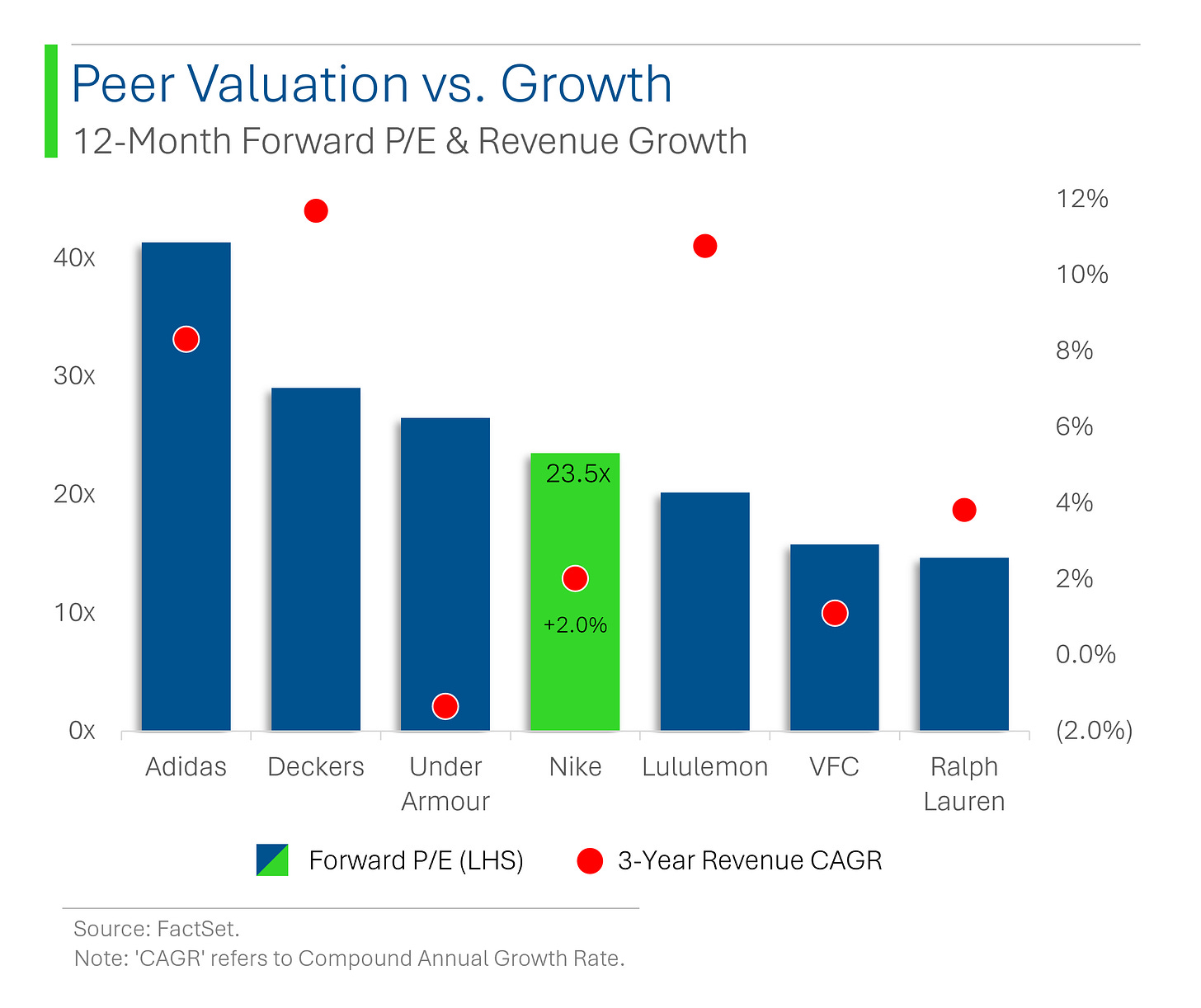

Lastly, Nike trades at a forward P/E of 23.5x, right around the middle of its footwear and athletics peers. Many of them (Lululemon, Deckers, Adidas and even Ralph Lauren) are expected to grow much faster than the Swoosh in the coming years.

And with the S&P 500 trading at around 21x forward P/E with growth forecasts in the 5-6% range over the next few years, Nike doesn’t seem like a screaming buy. Rather, despite its troubles, there still could be a lot of air beneath its valuation.

Maybe don’t just do it.

First Half Wrap-up

With the first half of the year now in the books, I thought I’d add a bit on how things are shaping up and how that compares with the past.

To start, we finished H1 with the S&P 500 up +14.5% which makes it the third best year this century. An interesting consideration is that every year where the S&P 500 has been up >10% in the first half, it has gone on to finish higher - with an average annual return of +27.2%. Not good news for the Bears out there…

Next, the U.S. has been dominating the stock markets around the world again this year. The ex-U.S. major markets have generally done ok (save for France) but still are a far ways off from the returns of the S&P 500 and the Nasdaq. That said, the Russel 2000 - the main U.S. small-cap index - has been a noticeable weak point this year (+1.0%).

Joke Of The Day

Why don't ants get sick? Because they have little antybodies.

Hot Headlines

The Verge / Zuckerberg says Meta’s Threads now has +175m monthly active users (up from 150m in April). The X/Twitter clone will hit its first birthday on July 5th.

Reuters / Jeff Bezos to sell Amazon shares worth about $5 billion after stock hits record high. Follows the $8.5 billion he sold in February with the stock up +30% this year. Mr. Kisses will still own 8.8% of Amazon following the sale.

CNBC / United Airlines is texting travelers live weather maps to explain flight delays. The move aims to keep customers for blaming them - prudent since 21.4% of flights arrived late so far this year.

Yahoo Finance / Cocoa’s extreme shortage is finally set to end. Commodities broker Marex expects cocoa output will top demand by 303,000 metric tons in the upcoming 2024-25 season that starts in October. That would mark the first year of surplus after three straight seasons of deficit.

Reuters / The UN reports that China is leading generative AI patents race. The organization stated that China is filing six times more patents than its closest rival the United States.

NY Times / President Biden has reportedly told allies he's considering whether to continue reelection bid. At this point I’m not sure he even knows he’s President.

Trivia

Today’s trivia is on Investing 101.

What does 'short selling' in the stock market mean?

A) Selling stocks quickly

B) Selling stocks of companies that are highly volatile

C) Selling borrowed stocks with the aim to buy back later at a lower price

D) Selling stocks below a certain priceThe 'Rule of 72' in finance is used to:

A) Calculate a country's GDP

B) Estimate how long an investment will take to double

C) Determine interest rates

D) Predict stock market crashes'Quantitative Easing' refers to:

A) Lowering interest rates in order to stimulate GDP growth (‘Dovish Policy’)

B) A monetary policy where the central bank buys securities to increase money supply

C) A move by the Treasury to sell shorter duration bonds which typically pay a lower rate of interest

D) Making exams easier

(answers at bottom)

Market Movers

Winners!

Paramount Global (PARA) [ +6.9% ] Sources report Shari Redstone's National Amusements has reached a preliminary deal to sell its controlling interest to Skydance Media.

Marketaxess Holdings (MKTX) [ +3.7% ] Noted June and Q2 average daily volume growth on strong total credit ADV and total rates ADV.

Losers!

Simulations Plus (SLP) [ -14.9% ] FQ3 earnings and revenue better; GM below consensus with Services weaker; cut FY EPS guidance (revised Pro-ficiency transaction costs); reaffirmed FY revenue guide; announced dividend discontinuation; analysts positive on demand commentary.

Pacira BioSciences (PCRX) [ -4.8% ] Downgraded to equal weight from overweight at Barclays; FDA approved a generic version of Exparel; ongoing litigation keeps issue an overhang; stock dropped ~20% Tuesday.

Constellation Brands (STZ) [ -3.3% ] FQ1 EPS, EBIT better but revenue light; operating income ahead in beer segment but missed in wine and spirits; FY25 EPS guidance midpoint in line; analysts positive on beer strength but noted softer depletions.

AZEK Co. (AZEK) [ -2.3% ] Downgraded to neutral from buy at DA Davidson; decking contractor survey showed decelerating activity; record proportion of contractors indicated below-normal backlogs.

Market Update

Trivia Answers

C) Short Selling is selling borrowed stocks with the aim to buy back later at a lower price.

B) The Rule of 72 is a way to estimate how long an investment will take to double. Just divide 72 by the expected annual return, and Bam!

B) Quantitative Easing is a monetary policy where the central bank buys securities to increase money supply.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Great writeup on NKE. I still think it’s a good buy here as there’s just too much “confluence” of negative sentiment. In other words, it’s too easy to be a bear here. But with the stock near its Covid lows, I’m willing to take a long-term stab at it and bet that its innovation engine (in the footwear division) is going to make a comeback