🔬 Super Bowl Stats and Market Musings

Plus: the threats to Delaware as the incorporation Mecca; the forecast for Tesla is 'meh'; and much more

"It’s often easier to tell what will happen to the price of a stock than how much time will elapse before it happens"

- Philip Fisher

"A fool with a plan can outsmart a genius with no plan"

- T. Boone Pickens

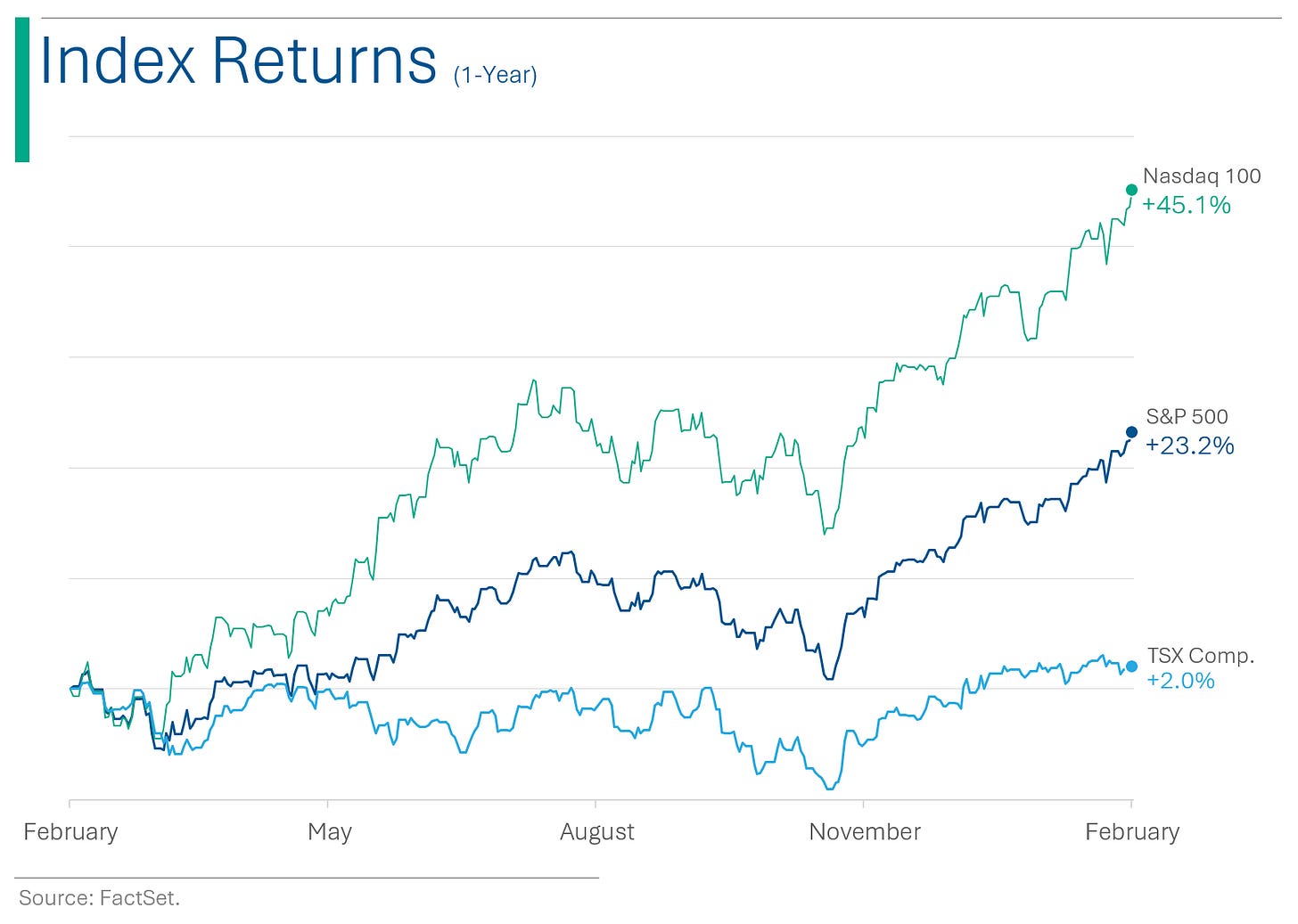

Solid day for the big US markets (S&P 500 +0.57%, Nasdaq +1.25%), particularly the S&P which closed above 5k for the first time ever.

8 of 11 sectors closed higher, led by Tech (+1.5%) and Consumer Discretionary (+1.0%). Energy (-1.6%) did that thing again where it closed lowest, desite oil closing up +0.8%.

Continued signs of a robust US economy as the Atlanta Fed’s estimate for Q1 GDP was increased to 3.4% from 3.0%. Legit.

Masonite announced it was being acquired by Owens Corning for $3.9 billion, a 38% spike from its Thursday close. While Expedia tanked 17.8% following a beat on EPS and Revs, but soft guidance and the surprise resignation of its CEO.

Street Stories

Super (Bowl) Stats

Viewership:

112.2 million people were expected to watch the game at home or at a friend’s home according to a recent survey. Another 16.2 million watched at a restaurant or bar.

Tickets:

Nearly 72k were expected at Allegiant Stadium in Las Vegas for the Super Bowl. After the conference final games, the average listed ticket price in the secondary market was $10,752 - well above the average for the last five Super Bowls of $6,680, according to Fast Company.

Spending:

$17.3 billion - roughly $86 per person - is expected to be spent on drinks, food and merch. According to the National Chicken Council - another thing I didn’t know was a thing - an estimated 1.45 billion chicken wings will be consumed.

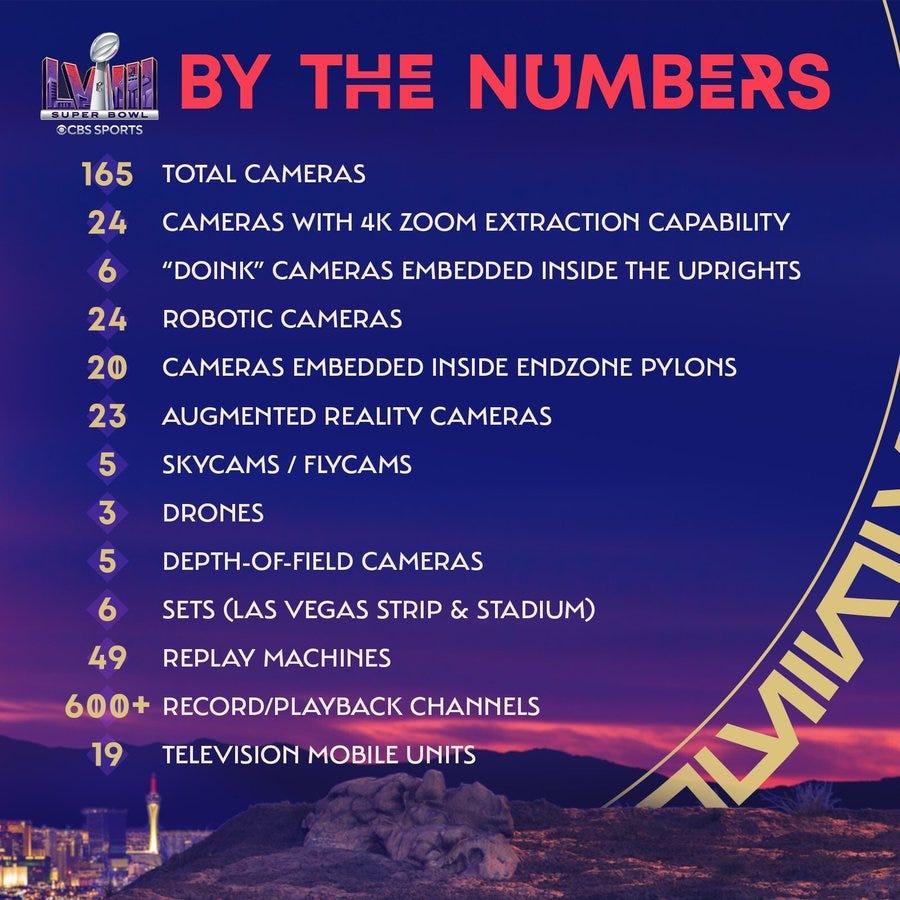

Cameras:

CBS Sports announced that it deployed 165 total cameras for the event.

Super Bowl Flu:

An estimated 16.2 million people will miss work on Monday.

Betting:

A record 68 million Americans were expected to wager $23.1 billion on Super Bowl bets. That’s 26% of America and a 35% increase over 2023.

Ad Spending:

A 30-second ad at this year’s Super Bowl costs $7 million (compares to $42.5k in 1967) - or $230k per second! Last year Fox made $600 million in ad revenue from the event and this year CBS is expected to have raked in $650 million.

Even outside of TV the costs are crazy. Advertising on the Sphere - the new Vegas event venue that doubles as the world’s biggest billboard - is apparently $1-2 million for a 90 second slot, with Adidas, FedEx, Nike, Verizon, AB InBev and Paramount included in the list running ads this week.

Vegas, Baby:

The real winner of the Super Bowl is Las Vegas, with an estimated $1.1b gross economic impact. That includes the projected 150k visitors forecast to spend $215 million just on food, drinks, merch, hotels, etc.

Delaware Dethroned?: The Corporate Migration

Delaware is a small state but is the legal home to over two-thirds of the Fortune 500 companies, with 80% of IPOs in 2022 registered there. However, there have been stirrings about companies leaving the state. Three influential figures, Greg Maffei of Tripadvisor, media heavyweight Barry Diller, and Elon Musk, are challenging Delaware's dominance in corporate law by considering or executing reincorporation of their companies to states like Nevada and Texas, seeking less stringent legal environments.

Nevada and Texas are enhancing their appeal to corporations through legal reforms aimed at reducing litigation costs and offering more protections for directors and executives. Musk has been the loudest of late, when he fumed over X to his 171 million followers ‘Never incorporate your company in the state of Delaware’, following the state’s cancellation of his $56 billion Tesla pay package.

Why are so many companies incorporated in Delaware? Delaware is known for having very business-friendly laws, especially when it comes to corporations. Some of the key ways that Delaware law differs from other states include:

1. Court of Chancery: Delaware has a specialized court, called the Court of Chancery, that hears corporate law cases. This court is made up of judges who are experts in corporate law and have a lot of experience dealing with corporate disputes. This means that corporate cases in Delaware are often resolved more quickly and with more expertise than in other states.

2. Flexibility: Delaware's corporate laws are very flexible, which makes it easy for businesses to set up and operate in the state. For example, Delaware allows corporations to have just one director and doesn't require them to hold annual meetings.

3. Shareholder rights: Delaware law gives shareholders more rights and protections than in some other states. For example, shareholders in Delaware have the right to vote on major corporate decisions, such as mergers and acquisitions.

4. Privacy: Delaware law allows corporations to keep certain information, such as the names of shareholders, private. This can be beneficial for companies that want to keep their ownership structure confidential.

Tesla Revenue Woes

I wrapped up last week by taking a look at the Magnificent 7 and noted that they have been responsible for >50% of the S&P 500’s performance this year. While Apples has been a wee bit of a laggard (+0.4% versus the S&P at +4.8%), the only name to really drag down the index has been Tesla, which is down 23.0% on the year.

For better or worse, Tesla has always been a hype stock; a rocket ship when times are good. And terrible when times are ‘meh’. This time, however, it hasn’t just been hype moving the stock, as EV expectations and threats from China’s BYD to Volkswagen have weighed on the revenue outlook of the company. Over the last six months, 2025 revenue estimates are down almost 18%. Not a good look/chart.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

I saw on the news that the CEOs of T-mobile and Sprint got married last weekend. Great wedding, terrible reception.

I just started a business where we specialize in weighing tiny objects. It’s a small-scale operation.

Hot Headlines

Billboard | Sony buys half stake in Michael Jackson’s music catalog, valuing it at $1.2 billion. Deal is comparable to the reported $1.2 billion the Queen catalog is being shopped at but that includes streaming rights and other kickers.

WSJ | What it takes to be a successful social-media influencer. Only about 4% of global creators pull in more than $100,000 a year but a survey last year said 57% of Gen Zers would like to be Influencers if given the chance.

Texas Monthly | His best friend was a 250-pound warthog. One day, it decided to kill him. I’m sticking to goldfish and wimpy dogs. Thx

WSJ | U.S.-China tensions have a new front: A naval base in Africa. After a decade of Chinese coercive investment in the continent (not aid, like the West provides), Gabon announced it has promised Beijing it could station forces on its atlanice coast.

Reuters | Nvidia pursues $30 billion custom chip opportunity with new unit. The company looks to offer chips tailored to specific demands of the largest customers - primarily the large cloud-computing companies doing specialized AI. Beyond the revenue, this could be another step to lock-in customers to their ecosystem and thwart the raft of competitors aiming for their GPU crown.

Trivia

This week’s trivia is on this week’s trivia is on famous corporate collapses. Today’s is on Lehman Brothers.

Before its collapse, Lehman Brothers was the fourth-largest investment bank in the U.S. It was also one of the oldest, having been founded in what year?

A) 1847

B) 1880

C) 1901

D) 1929

Which financial instrument played a significant role in the 2008 financial crisis, contributing to the collapse of several institutions?

A) Student loans

B) Mortgage-backed securities

C) Credit default swaps

D) Government bonds

Lehman Brothers' bankruptcy filing in 2008 was the largest in U.S. history, with assets totaling how much?

A) $912 billion

B) $639 billion

C) $107 billion

D) $55 billion

(answers at bottom)

Market Movers

Winners!

Masonite International (DOOR) [+35.1%]: Set to be acquired by Owens Corning for about $3.9B cash, a 38% premium over Thursday's close. The $133/share deal is expected to finalize in mid-2024.

Cloudflare (NET) [+19.5%]: Posted strong Q4 with a 32% year-over-year revenue increase and higher operating income. Upbeat guidance was given, noting conservative estimates, robust new deals, and momentum in SASE and security products.

Soho House & Co Inc. (SHCO) [+12.6%]: Announced a $50M share buyback and is exploring strategic options, including going private. How is this a public company again?

Central Garden & Pet (CENT) [+6.3%]: Exceeded FQ1 earnings and revenue forecasts, with noted progress in GM and early-season Garden strength. FY24 guidance was reaffirmed, considering geopolitical and commodity price pressures but expecting modest pricing actions.

Losers!

Newell Brands (NWL) [-18.9%]: Q4 earnings and revenue exceeded expectations despite a year-over-year sales drop in all segments. Q1 and FY24 forecasts fell short of analyst predictions, amid ongoing challenges in hard-goods and home sectors.

Expedia Group (EXPE) [-17.8%]: Surpassed Q4 EPS and revenue targets but fell short on bookings and Q1 growth projections. Announced CEO Peter Kern's unexpected departure and cited tough comparisons and a Vrbo ramp-up for slower Q1 growth.

Pinterest (PINS) [-9.5%]: Exceeded Q4 EBITDA and MAU forecasts but fell short on revenue and next-quarter guidance. Despite record MAUs and new ad products, concerns were raised about high expectations and a partnership with Google.

Take-Two Interactive (TTWO) [-8.7%]: Q3 EPS slightly missed, with bookings as expected. FY24 EPS and bookings guidance reduced due to weaker mobile ad revenue and NBA 2K24's performance, alongside a cost reduction plan and a delayed core title.

Owens Corning (OC) [-7.1%]: Announcing its $3.9B acquisition of DOOR at a 38% premium, aiming for a mid-2024 closure. The acquisition is seen as a growth opportunity, expected to enhance free cash flow by the end of 2025.

Magna International (MGA) [-6.8%]: Q4 EPS fell short due to margin issues, though revenue met expectations. FY24 guidance was slightly conservative, but its 2026 outlook is optimistic, especially in the Power/Vision segment.

Dexcom (DXCM) [-5.2%]: Surpassed Q4 earnings and revenue projections, maintaining FY24 forecasts. Gross margin declined year-over-year due to G7 sales, with some analysts noting slower international growth yet overall positive perspectives.

Market Update

Trivia Answers

A) Lehman Brothers was founded in 1847.

B) Mortgage-backed securities. Credit default swaps made several investors very rich better against the bonds.

B) Lehman had assets of $639 billion just prior to it bankruptcy.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.