🔬 Stocks only go up (errrr...)

Plus: Boeing delivery delays are impacting airline estimates; crude oil headed to the moon; and much more

"Experience is what you got when you didn’t get what you wanted"

- Howard Marks

“A clear conscience is a sure sign of a bad memory.”

- Mark Twain

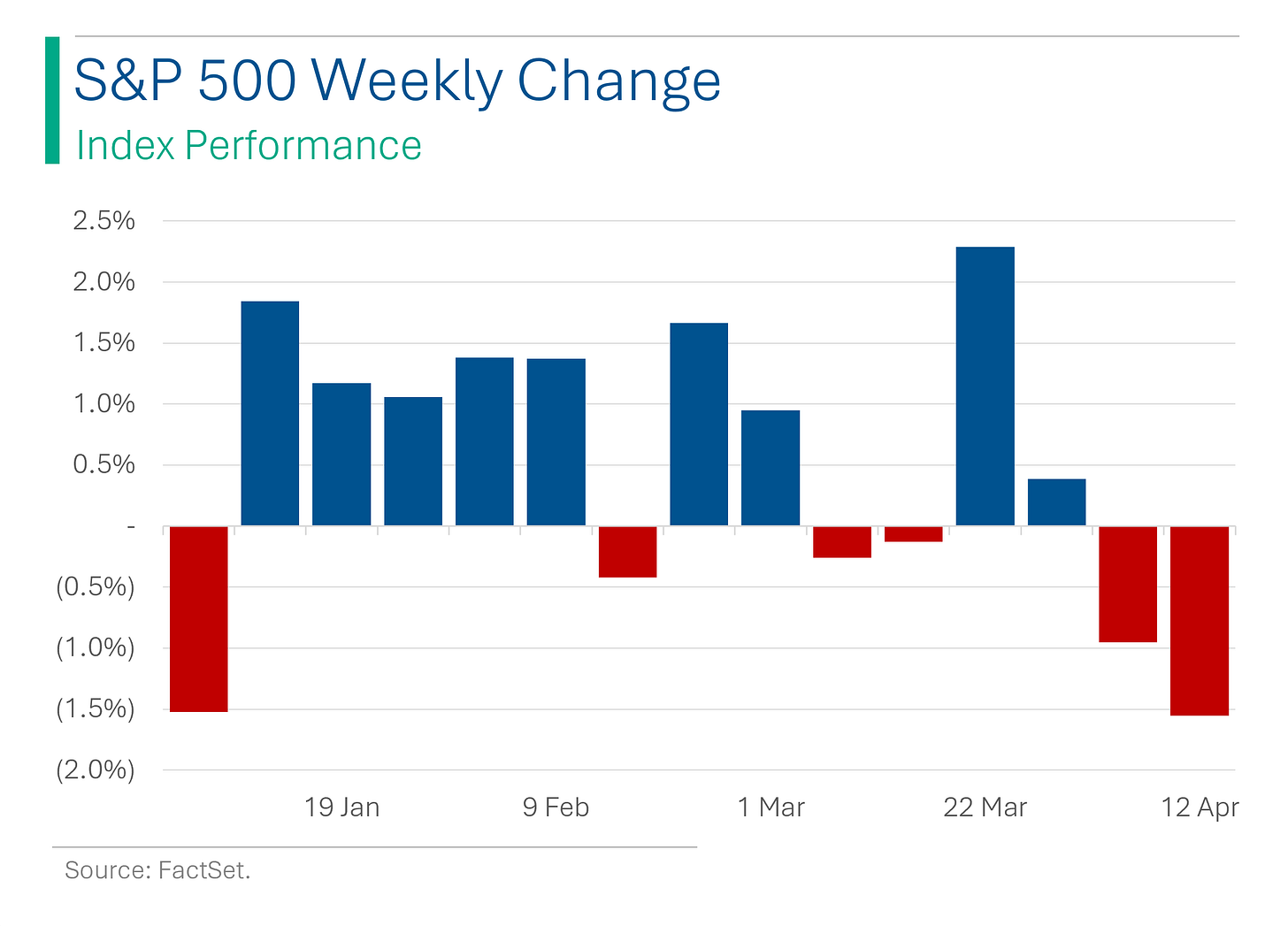

Ugly end of the week for the big US markets (S&P 500 -1.5% and Nasdaq -1.6%) as geopolitical tensions soured the market’s mood and triggered a flight to quality and treasuries. The S&P and Nasdaq finished the week -1.6% and -0.5%, respectively.

None of the 11 eleven sectors closed higher Friday or for the week. Tech did the best, finishing the week down -0.2%. Financials finished the week -3.6%, the worst of its peers.

Iran’s eventual retaliation on Israel was the main story into the weekend, as fear for an expanded conflict in the Middle East weighs on markets.

Street Stories

Weekly Review

I’m going to try and start Monday’s off with a brief wrap-up of some of the market moves over the previous week. If you don’t like it, let me know in the comments. Or just say hi. No one ever just says hi.

To start, the S&P 500 was down for the second week in a row, making it four out of the last six weeks. When we had the first double down week back in March, this was the first time that had happened in 19 weeks: Not since October before the ‘Peak Fed’ narrative kicked-off, which was one of the longest stretches in decades.

Back then it felt like the market could only go up. Right now, sentiment seems to be building in the opposite direction as there doesn’t seem to be many positive catalysts out there. The economic data out of the US has been quite positive, but the ‘goldilocks’ scenario of strong economic growth and with receding inflation seems to be at an end.

Inflation stepping up coupled with an economy that can linger on well enough with high interest rates means that Fed rate cuts have gotten pushed further into the year. Removing a key catalyst for stocks to move higher.

I’ve written a lot about the fact that the market has been pulled upward by the efforts of a few stocks this year; notably that ~72% of the positive return of the market this year has come from just Nvidia and Microsoft.

While the moves upward were due to a few strong performers, the move downwards this week has been pretty broad-based. In fact, the few bright spots in the market this week (Tesla, Nike, Apple) were more akin to relief rallies, as all those stocks have been crushed this year.

Basically, the strong growth (ok, fine ‘momentum’) names seem to have disappeared and what remains is a general absense of positive stories.

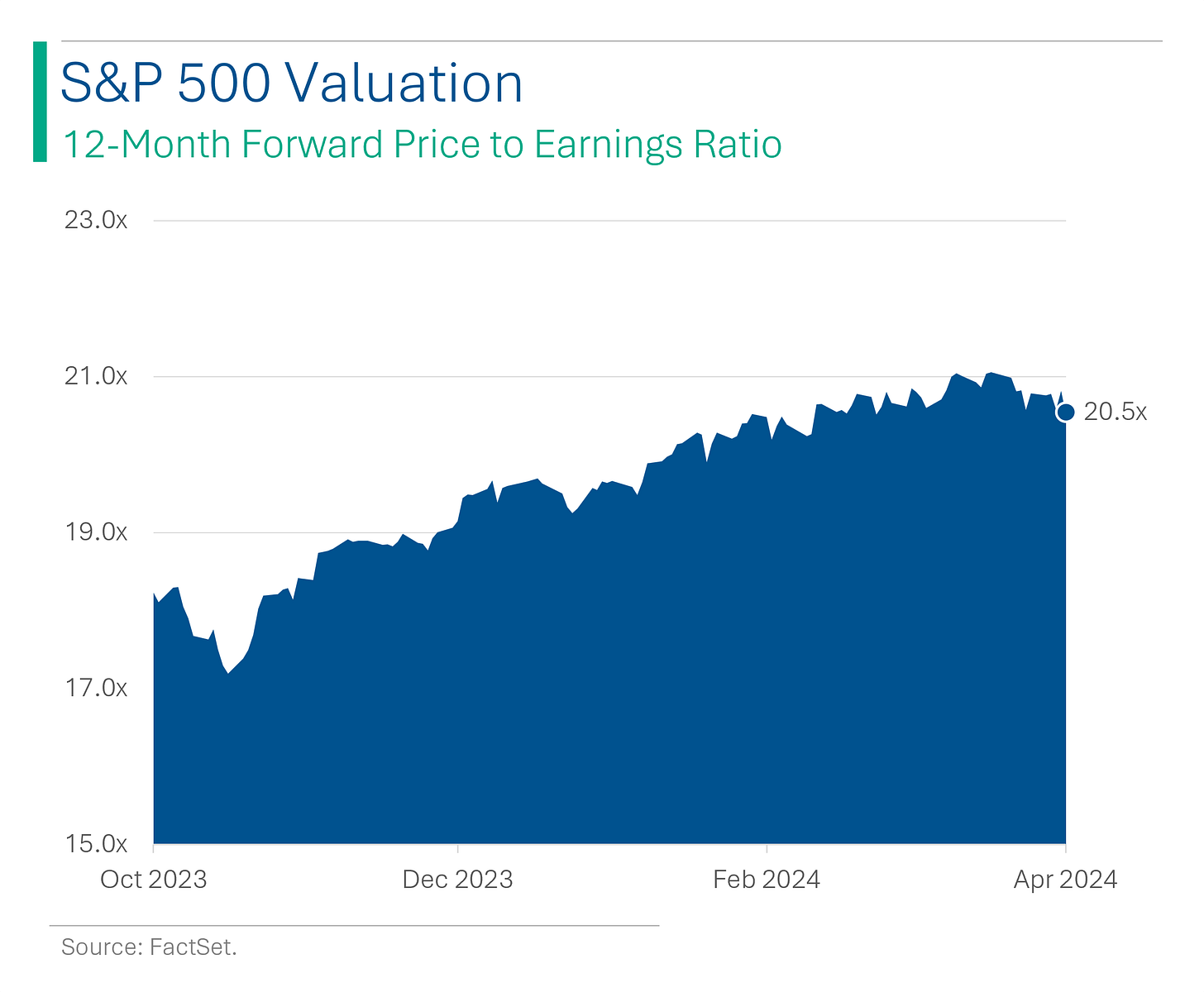

So while there isn’t much to cheer for right now, importantly there is also a decent amount of air under the market’s current valuation. While down modestly, at 20.5x forward P/E the market is still at multi decade highs (excluding that Covid blip).

A bit of bright spot is that when looked at on an ‘equal weight’ basis, the market’s P/E is much more manageable. There’s lots of good companies out there that may prove more defensive than the big names that pulled the market up (and got expensive on the way).

Lastly, the big story of the week was CPI inflation coming in hot for the third month in a row. The odds of one or more rates cuts by the July Fed meeting now sits at just 58% and, for the first time this year, odds of a potential rate increase are now starting to be priced in.

For context, on December 31st the odds of one of more rate cuts by July was 100% with the odds of two or more sitting at 89%. What a long way we’ve fallen.

To conclude, there’s not a lot to be excited for at the moment and there aren’t too many positive catalysts, beyond a potential cooling of inflation. Earnings season is just kicking off so this is going to be extra scrutinized this time around to see if corporate growth stories are still in tact. This is going to be a very interesting month.

Airlines Chop Estimates Due To Boeing Production Delays

Southwest Airlines, which operates an all-Boeing fleet, now expects to receive only about 20 Boeing MAX jets this year. This represents a decline from 46 jets forecast in March and their original plan for 85 jets this year.

These issues stem from heightened quality checks and regulatory audits after a safety incident involving a Boeing 737 MAX in January, which has led Boeing to cut its production rates significantly. As a result, airlines, including Southwest, have had to adjust growth plans, halt pilot hiring and spend more on maintaining older aircraft while trying to control costs.

Not a good way to build customer loyalty.

Oil Rally Continues

OPEC’s master plan of propping up oil prices by supply cuts may have had mixed results (donating market share is typically not the best long-term strategy) but expanded hostilities in the Middle East are certainly playing their part.

The base-case for the markets seems to be increased conflict, rather than a the cease-fire being pushed by the international community. So maybe don’t short oil at the moment.

Explainer - Oil benchmarks: There is no actual ‘oil price’, in fact much of the world’s physical oil is settled through pre-negotiated contracts at various prices. Oil is used everywhere, produced across the world and comes in various qualities that require different levels of refinement - from light, sweet (low sulfur) West Texas Intermediate, to heavy, sour (high sulfur) Arab Heavy out of Saudi Arabia. All with different prices.

The two most commonly cited ‘oil prices’ are West Texas Intermediate (WTI) and Brent Crude. The Brent oilfield actually no longer produces any oil but the benchmark price lives on, representing the market price of other North Atlantic crude. Brent is typically used to infer the price of oil being paid in Europe.

West Texas Intermediate is generally considered the benchmark price for the US, and doesn’t refer to a product from a region but a general classification of oil grade, in this case ‘Texas light sweet’. The WTI price is the result of York Mercantile Exchange (NYMEX) futures contracts on supply available at the Cushing, Oklahoma trading hub.

Historically, WTI traded at a premium to Brent Crude prior to 2011. After the US shale oil boom started, WTI tends to trade at a material discount to Brent.

Joke Of The Day

I had to fire my acupuncturist. It turned out they were a back-stabber.

Hot Headlines

NT Times / How Tech Giants cut corners to harvest data for A.I. Detailed look at how AI crazed companies are bending/breaking the rules in order to find better data to train their algorithms.

WSJ / Rents are still rising and pumping up inflation. Despite cooling off from double digit levels, the shelter component of CPI was up 5.7% YoY in March.

Vanity Fair / Russia has a hidden prison system in Crimea for Ukrainian prisoners of war. Human rights monitors claim that occupation forces engage in torture and prolonged captivity in a sprawling penal network.

WSJ / U.S. Steel Shareholders approve sale to Japan’s Nippon Steel. The $14.1 billion deal still faces regulatory reviews, opposition from United Steelworkers union, members of Congress.

Coindesk / Bitcoin plunges to $65k while Altcoins tumble 10-15% on bad Friday for crypto. The ‘halving’ - the event whereby new blocks mined will pay only half as many Bitcoins - is expected later in the month but the typical rally into the event seems to have petered out earlier than expected, as crypto euphoria has slowed for the time being.

Trivia

Today’s trivia is on Intel.

What year was Intel founded?

A) 1959

B) 1971

C) 1968

D) 1979Intel’s first processor, the 4004, was originally developed for which kind of device?

A) Personal computers

B) Military technology

C) Calculators

D) Video game consolesOne of Intel’s co-founders, Gordon Moore, is perhaps best known for this technological insight?

A) That the number of transistors in an integrated circuit doubles about every two years.

B) A test of a machine's ability to exhibit intelligent behavior equivalent to, or indistinguishable from, that of a human.

C) That ‘software is eating the world’.

D) That artificial intelligence will lead to ‘Skynet’ which will create machines to take over the world.What year did Intel's revenue first surpass $1 billion?

A) 1983

B) 1987

C) 1992

D) 1999

(answers at bottom)

Market Movers

Winners!

Globe Life (GL) [+20.2%]: Post-close Thursday, issued a statement addressing a short report from Fuzzy Panda Research as self-serving and "wildly misleading." The stock fell ~53% a day earlier following allegations of insurance fraud and executive misconduct.

Coupang (CPNG) [+11.5%]: Increased its Wow paid membership fee to $5.74 per month, marking a 58% rise.

Losers!

Arista Networks (ANET) [-8.6%]: Downgraded to sell from buy at Rosenblatt Securities. Shares had risen on AI tailwinds; however, the company's AI market potential is likely smaller than current prices suggest.

Zoetis (ZTS) [-7.8%]: Trading lower following a report on unexpected pet deaths linked to arthritis medications. Zoetis contends side effects are rare and notes continued success reported by vets and pet owners.

VF Corp (VFC) [-7.8%]: Downgraded to neutral from outperform at BNP Paribas Exane. FY25 estimates seen as optimistic, raising the risk of downward revisions. Challenges noted with brands like Vans and Timberland, and potential debt refinancing issues.

JPMorgan Chase (JPM) [-6.5%]: Reported a strong Q1 EPS with beneficial fees and credit tailwinds. FY net interest income (NII) guidance remains unchanged, slightly below expectations, amidst less aggressive Fed easing predictions.

Intel (INTC) [-5.2%]: Reports surfaced earlier this year that Chinese authorities have directed major telecoms to plan the replacement of non-Chinese chips in their networks by 2027.

Market Update

Trivia Answers

C) Intel was founded in 1968.

C) Their first processor was used in calculators.

A) Moore’s Law is that the number of transistors in an integrated circuit doubles about every two years. B is Alan Turing’s Turing Test. C is Mark Andresson. D is Terminator.

A) Intel’s revenue hit $1.1 billion in 1983.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.