🔬Stocks + Elections.

Plus: Super Micro drops faster than it goes up, low income households feeling the pinch; and much more

"Not everything that can be counted counts, and not everything that counts can be counted."

- Albert Einstein

"The alien mothership! If we hit that bullseye, the rest of the dominoes will fall like a house of cards. Checkmate."

- Zapp Brannigan, Futurama

Bounce back day for the big US markets with the S&P 500 +0.9% and Nasdaq +1.1% after a bloodbath last week.

All 11 sectors closed higher, with Tech (+1.3%) in front after leading the way down last week. Materials (+0.1%) were the worst.

Gold was down 2.8% for its biggest one day loss in over a year (risk on!?)

Tesla and Visa report today after close, which will have ripples across the market.

Street Stories

Stocks in Election Years

As I mentally prepare myself for yet another election to fully deluge the media cycle, I thought I’d take a quick look at how the stock market does during election years. Here we go! Whoooosh.

To start, election years haven’t been particularly kind to investors: the average return for the S&P over the last 11 election years has been a paltry 5.8% versus the 11.8% the S&P has banged out in non-election years since 1979.

However, to be fair, 2008 - which had very little to do with the election (re: Financial Crisis) - is something of an outlier and really pulled the data downward. Excluding ‘08, this average is a respectable 10.2%.

Moreover, since the 1980 election, the market has only declined in two election years; the above mentioned 2008 and 2000 - also not really the fault of the election (re: DotCom bubble burst).

However, election years have tended to not really be huge years for outperformance. For example, in only 3 election years (27% of the time) did the S&P finish the years up 15% or more. For non-election years this figure is 44%.

Next, it might be worth noting that while the average increase in the market during election years is 5.8%, the S&P is currently up 5.0%.

On the sector front, the underperformance in election years is pretty broad-based. Utilities is the only sector has actually outperformed in election years versus non-election years. Although, I would add the caveat that S&P only started mapping out sector data at the end of 1994, so this isn’t a particularly robust data set.

Tech has been the worst performer relative to non-election years; underperforming by 18.4%. Although I would add that 2000 was a particularly bad year for Tech stemming from the DotCom bubble, so this is perhaps a bit unfair.

To wrap this up, election years aren’t great for stocks but excluding the DotCom meltdown (2000) and Great Financial Crisis (2008) they have held in ok. At this moment, I think investors have bigger things to fret over.

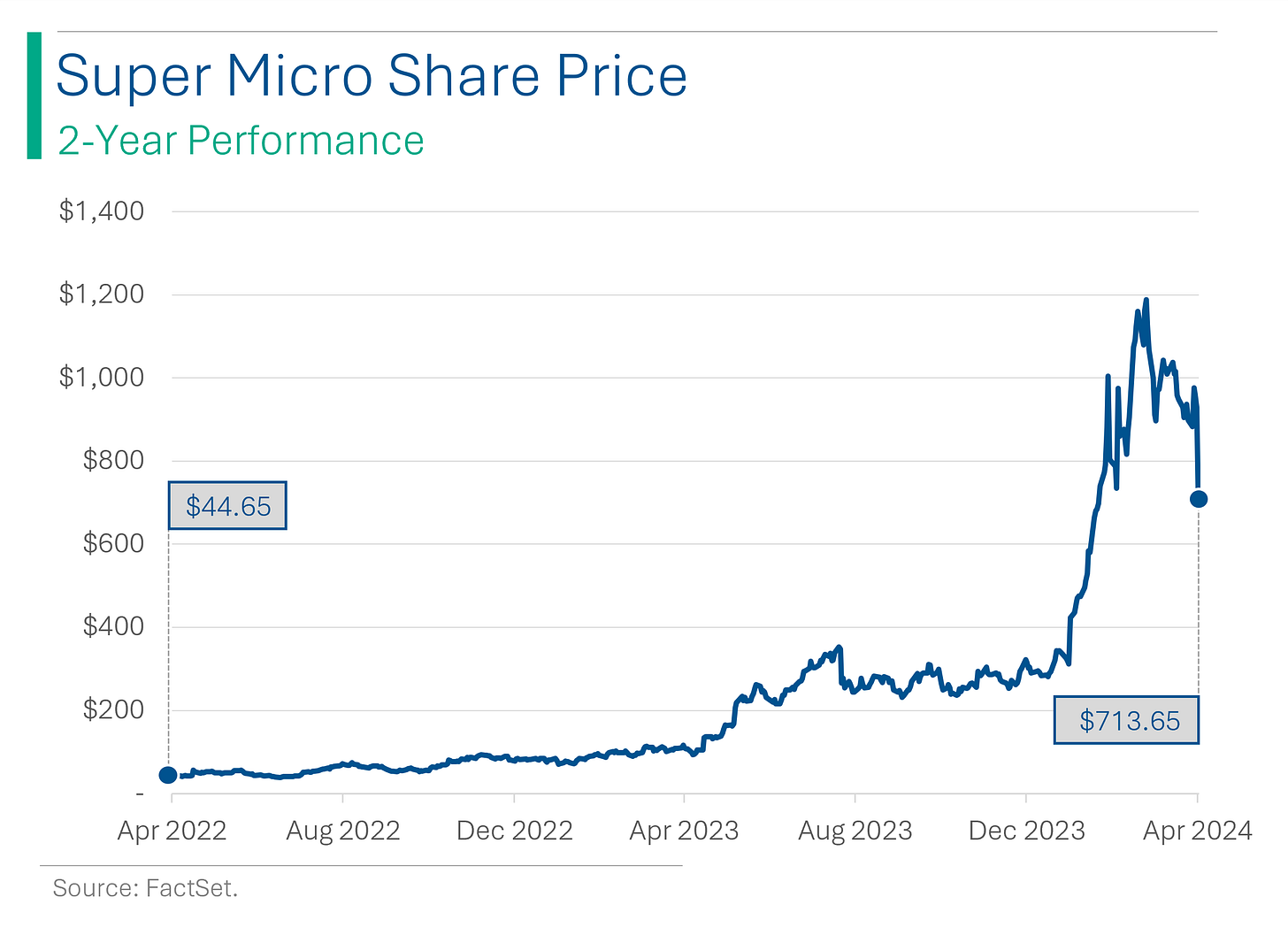

Super Micro's Silent Treatment Sends Stocks Spiraling

Investors value consistency, often above returns. And they punish inconsistency.

For example, ahead of their quarterly reports, Super Micro Computer typically pre-announces their earnings and offers forward guidance on their prospects. On Friday this didn’t happen, with the company merely announcing the date of their next earnings release (April 30th)

The result? A 22% cliff dive for the shares.

Were they being lazy? Did KPMG f*** up the books? Or (what the Street has presumed) are they sticking their heads in the sand hoping to avoid talking about a weak quarter and/or weak outlook? Pro tip: That never works out well.

Shares are still up 2.6 bagillion percent over the past 12 months so plz don’t feel too bad for them.

Chinese Real Estate Growth

Ok this isn’t about stocks. Or, really any type of analysis at all. Last weekend China played host to the latest round of the Formula 1 World Championship at the Shanghai International Circuit (and Lance Stroll is the devil).

Anything stand out in this picture?

Low Income Defaults Slowing Bank Lending

U.S. borrowers on the lower end of the income scale are having a tougher time keeping up with their loans, inspiring banks to suddenly remember the virtue of prudence, particularly when it comes to handing out credit cards and car loans.

Bank of America and JPMorgan Chase are seeing their charge-offs balloon, as more folks default on their credit card debt - seems like high interest rates and inflation don't mix well with budgeting.

Joke Of The Day

Knock, knock. Who’s there? Control freak. Now you say, “Control freak who?”

Hot Headlines

Business Insider / New York Stock Exchange mulls 24-hour trading as it reportedly polled market participants of its merit. Currently stocks trade between 9:30AM and 4:00PM, but things like stocks futures, Treasury bonds and crypto trades perpetually.

INC. / OpenAI CEO Same Altman joins Andreessen-Horowitz and Atomic in $20 million funding round for solar start-up Exowatt. The start-up anticipates its modular, portable solution could cut the cost of electricity down to $0.01 per kilowatt-hour once it hits scale. With energy usage for AI-running data centers starting to explode, clean energy tech is getting a lot of attention.

Bloomberg / UBS cuts view on ‘Big 6’ tech stocks as earnings growth slows. Their rating for the group that includes Apple, Alphabet, Amazon, Meta, Microsoft and Nvidia was cut to Neutral (Hold) from Overweight (Buy). So Mag7 is now Big 6? How come I never get a vote.

Washington Post / As Meta flees politics, campaigns rely on new tricks to reach voters.

Barron’s / Luxury fashion brand Tapestry (Coach, Kate Spade) has had their $8.5 billion acquisition of rival Capri (Michael Kors, Jimmy Choo) cancelled by the FTC. The US agency argued that the acquisition would lower competition in the market for moderately priced luxury handbags. HOW IS THIS WORTH THEIR TIME?

Trivia

Today’s trivia is on the US Federal Reserve.

When was the Federal Reserve System established?

A) 1979

B) 1913

C) 1929

D) 1945What was the primary reason for the creation of the Federal Reserve?

A) To fund World War I

B) To stabilize the banking system

C) To end the Great Depression

D) To collect income taxesThe Federal Reserve is composed of how many regional Banks?

A) 5

B) 8

C) 12

D) 15In a rare Saturday night press conference, Fed Chairman Paul Volcker announced a sudden increase to the Fed Funds Rate from 11% to 12%, in what later became known as ‘The Saturday Night Massacre’ due to its impact on bond prices. What year was this?

A) 1961

B) 1985

C) 1955

D) 1979

(answers at bottom)

Market Movers

Winners!

Matterport (MTTR) [+175.9%]: Set to be acquired by CoStar in a cash and stock deal valued at $5.50 per share, marking a ~216% premium to its last close; transaction worth ~$1.6B, expected to close this year.

Wolfspeed (WOLF) [+7.9%]: Reuters reported that JANA Partners is urging Wolfspeed to explore a sale or other strategic options.

Vista Outdoor (VSTO) [+6.5%]: In talks with MNC Capital following an unsolicited interest indication on March 25; expects a proposal exceeding the initial $37.50/sh bid, which it views as inferior to Czechoslovak Group a.s.'s offer.

Losers!

Informatica (INFA) [-10.5%]: Reuters reported CRM withdrew from its takeover bid after failing to agree on terms with Informatica.

Cardinal Health (CAH) [-4.9%]: Announced it will not renew its distribution contract with PBM OptumRx, which accounted for over 15% of 2023 revenue; plans to mitigate the impact with new customer wins and growth in specialty pharma; reaffirmed 2024 EPS guidance and long-term goals.

Tesla (TSLA) [-3.4%]: Reduced prices across key markets including China and Germany, and lowered its Full Self-Driving software price in the US to $8K from $12K; CEO Musk stated on X that Tesla's pricing strategy must be flexible to align production with demand.

Market Update

Trivia Answers

B) The Fed was established in 1913. The Panic of 1907, where several notable Wall Street banks nearly collapsed, led to an impetus to put the US financial system on a more stable footing.

B) The Fed was created to stabilize the banking system.

C) The Fed consists of 12 regional banks.

D) The Saturday Night Massacre was in 1979.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.