Stock Market Parabola

"What the wise do in the beginning, fools do in the end"

- Warren Buffett

"How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case"

- Robert G. Allen

Hey Readers!

Another short one today as I’ve got a lot going on at the moment. Back to regular programming next week!

Have a good weekend,

- Ryan

Street Stories

Stock Market Parabola

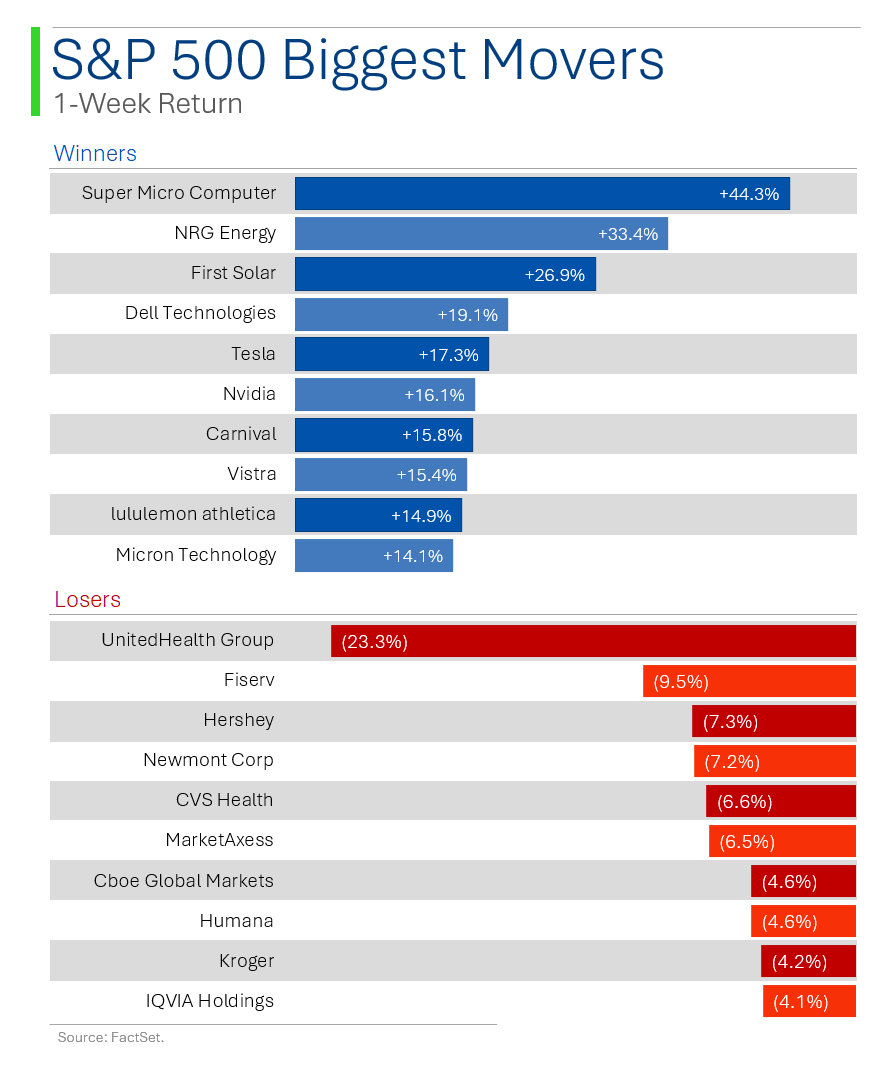

Five weeks ago, the S&P 500 was down 15% in 2025. Yesterday it closed up 1.3% on the year.

And no, markets aren’t efficient.

The wild run over the last few weeks has meant that 7 of 11 sectors are now in the green for the year.

Of the four sectors in the red, only Healthcare is trading near its lows for the year.

Healthcare’s plight can almost singlehandedly be blamed on UnitedHealth - the beleaguered health insurance giant.

Having its market cap cut by 55% since the murder of Brian Thompson, the CEO of the insurance division, the company used to represent ~10% of the healthcare index but now only makes up ~5%.

Considering that healthcare is down 5%, it’s basically all UNH’s fault.

As for the Magnificent 7, all are now miles away from their lows for the year but still net down in 2025.

Nvidia’s bounce has probably been the most surprising considering the question marks around competition and AI bubbles still linger, but the stock is officially back in the green for 2025 - however, this is admittedly a bit less impressive than its +171% performance in 2024.

The rally has also meant that the forward P/E multiple for the S&P 500 is now back above 21x - where the air is quite thin. Ooof.

And while the market may have turned positive, the same can’t be said about Wall Street’s analysts, which have only grown increasingly sour in their outlook for S&P 500 constituents.

But ‘sour’ doesn’t necessarilly mean negative, as the Wall Street consensus is for the S&P 500 to continue to post strong Revenue and EPS growth in 2025 - recession fears be damned!

In fact, the Street is calling for double-digit EPS growth in each of the next three years, which I have to admit seems pretty punchy!

I’m definitely more optimistic about things since President Trump’s de-escalation of tariff diplomacy, but I have to admit that my outlook for the global economy likely falls some degree below the exuberance on display in this market.

Expensive markets and high levels of forecast growth don’t tend to mix well with uncertainty. Lots and lots of uncertainty.

Joke Of The Day

My hotel tried to charge me ten dollars extra for air conditioning. That wasn’t cool.

Trivia

Today’s trivia is on the history of Wall Street.

What year was the Buttonwood Agreement, which laid the foundation for the New York Stock Exchange, signed?

A) 1689

B) 1792

C) 1834

D) 1901What is the origin of the name "Wall Street"?

A) It was named after a Dutch-built wall meant to defend against attacks

B) It was named after a famous banker, John Wall

C) It was an early nickname for the financial district in London

D) It was the first street paved in ManhattanWhat major event occurred on Wall Street on October 28, 1929?

A) The opening of the NYSE

B) The worst single-day stock market crash in U.S. history at the time

C) The signing of the Securities Act

D) The Dow Jones hit an all-time highIn what year was the Dow Jones Industrial Average (DJIA) first introduced?

A) 1856

B) 1896

C) 1914

D) 1933Which company was the first to reach a $2 trillion market capitalization?

A) Amazon

B) Tesla

C) Microsoft

D) Apple

(answers at bottom)

Market Update

Please consider giving this post a Like, it really helps get Substack to share my work with others.

Trivia Answers

B) The Buttonwood Agreement was signed in 1792.

A) Wall Street is named after a defensive wall the Dutch built before New York was acquired by the British.

B) October 28, 1929 was worst single-day stock market crash in U.S. history at the time and ushered in the Great Depression.

B) The Dow-Jones was created in 1896.

D) Apple was the first company to reach a $1 trillion market cap.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.