🔬Starboard Takes Position In Value Trap...I mean, Pfizer

“A lot of success in life and business comes from knowing what you want to avoid: early death, a bad marriage etc.”

-Charlie Munger

“As I learned from growing up, you don’t mess with your grandmother.”

-Prince William

US equities rallied Tuesday, reversing Monday's losses. Gains were led by big tech, cruise lines, airlines, and software, while energy, chemicals, and industrial metals lagged. Treasuries were firmer, gold was down 1.2%, and WTI crude fell 4.6%.

Fed commentary remained focused on inflation control and rate decisions. Fed officials stressed the importance of continuing the inflation fight, with some advocating patience to avoid easing too soon. Treasury auctions saw weaker demand, with 10- and 30-year note sales scheduled for later this week.

Corporate updates were light, with Nvidia and Honeywell making headlines. Nvidia (+4%) saw gains as Foxconn announced a new factory to meet demand for AI servers, while Honeywell plans to spin off its advanced-materials business. Roblox was hit by a short report, and DocuSign will join the S&P MidCap 400.

Notable companies:

Alibaba Group (BABA) [-6.7%] dropped after China's latest stimulus update didn't deliver any big surprises, leaving investors disappointed.

Palo Alto Networks (PANW) [+5.1%] got a nod from Goldman Sachs and BNP Paribas Exane for strong growth potential and market share gains.

Sphere Entertainment (SPHR) [-2.8%] slipped as their CFO announced plans to leave the company, although they’ll stick around during the search for a replacement.

Move below in ‘Market Movers’.

Street Stories

Starboard To Give Pfizer Painful Shot in The Arm

Pfizer became a household name in 1998 with Viagra. Then faded into obscurity after hype waned. They rebecame a household name again in 2020 with their Covid vaccine. And, yeah, same thing.

And now management has more problems: Activist investor Starboard just bought a $1 billion stake and is ready to bang heads together. Cue the fireworks.

Despite making over $100 billion from Covid sales in the past few years, the company finds itself with serious revenue growth challenges due to patent expirations, competitive pressures and some terribly performing M&A.

What started as a buying spree to bolster the portfolio - including the monster $41 billion deal for Seagen in 2023 - has now turned into a massive cost cutting program to shore up their finances. Pfizer bought Global Blood Therapeutics for $5.4 billion in 2022, and had to pull their main product from the market over safety issues. A $6.7 billion deal for Arena Pharmaceuticals has suffered a similar fate with two of their three lead products also shelved.

Hell, even their me-too Ozempic/Mounjaro competitor flubbed on safety issues. I swear, you can’t make this stuff up…

As added insult to impending injury, Starboard actually tapped former Pfizer CEO Ian Read and CFO Frank D’Amelio to help them with their strategy, with current CEO Albert Bourla reportedly scheduled to meet the gang soonish.

Usually a big name activist jumping into a company garners a pretty serious share reaction but the stock is only up +2% from when the news broke.

Almost like the Street thinks it’s a hopeless cause…

Ubisoft: Worst Side Quest Ever

Tencent and the founding Guillemot family are reportedly exploring a potential buyout of Ubisoft following a sharp drop in the French game developer’s stock price.

‘Drop’ with the caveat that it followed after the shares already tanked 40% YTD, which has shrunk the market cap down to just $2 billion.

Personally, I value Assassin’s Creed at more than $2 billion in childhood memories alone.

The Guillemot family holds a 20.5% stake, while Tencent owns 9.2% of net voting rights and the duo has been in talks with advisors about “stabilizing” Ubisoft, which has been struggling with production delays and weak sales forecasts.

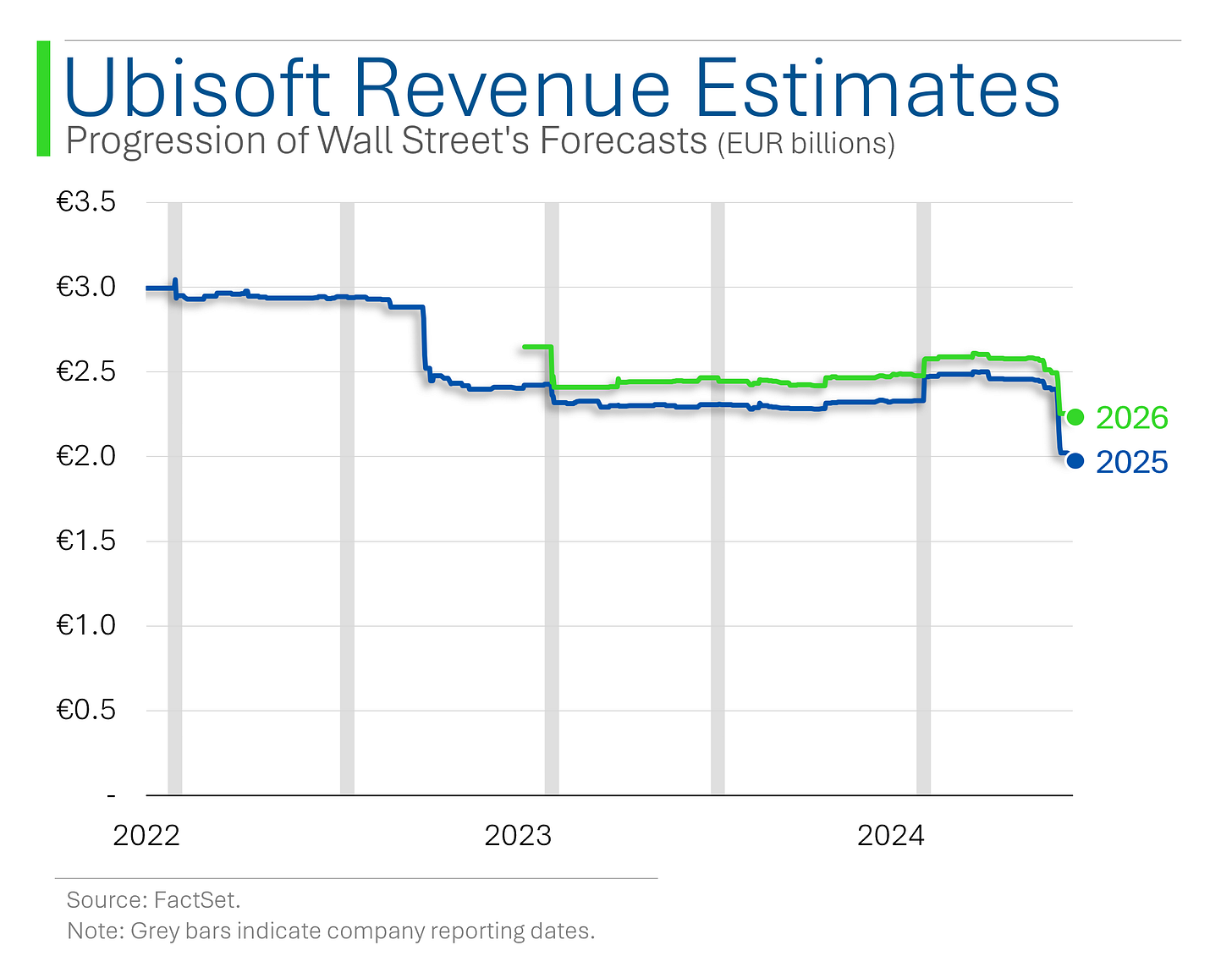

Analysts have basically dismantled their revenue models at this point.

A possible solution on the table? Taking Ubisoft private, which sent the stock soaring +33% on Friday - the biggest jump since its IPO in 1996.

Lemme know how French labor and Chinese management works out. 🫠

Joke Of The Day

What's the difference between an oral and a rectal thermometer?

The taste. 🤦♂️

Hot Headlines

Yahoo Finance / PepsiCo 'took it too far' with 'shrinkflation'. When the analyst making $500k+ per year says shrinkflation is pissing him off, you know you f***** up.

Yahoo Finance / Bill Gates-backed company is redesigning the wind turbine. Are these ones going to be even better at killing birds? I mean, the US DoD is involved in the project.

Yahoo Finance / Foreign mutual funds and ETFs sold $5 billion in Canadian energy stocks amid oil volatility. Apparently this decision was largely driven by their outlook on Canadian policy and their opinions on Canadian energy’s relative valuations to global peers.

Bloomberg / Couche-Tard suggested higher price of $47 billion for Seven & I. This figure is 20% higher than their original offer, however, JPY/CAD has fallen about 5% from its peak about a month ago.

Bloomberg / Boeing at risk of junk rating with S&P amid strike.

Bloomberg / Ukraine’s allies see Kyiv getting more flexible over war endgame. …and this is aligning with the US election which might mean a closing of the US faucet?

CNBC / Harris is borrowing from ‘Republican playbook’ as she leads Trump in new national poll. This is the most sincere form of flattery in my opinion.

CNBC / SpaceX may receive FAA license for next Starship launch in time for Sunday attempt. Elon just can’t wait to get to Mars and abandon this dumpster-fire eh?

Reuters / Israel says it has killed slain Hezbollah leader's successors.

CNBC / GM expects 2025 earnings to be similar to this year’s despite industry headwinds. Tesla should take a page out of their book.

Trivia

Today’s trivia is on America’s northern neighbor, Canada.

Which year did Canada officially become a country through Confederation?

A) 1791

B) 1867

C) 1905

D) 1931Who was Canada's first Prime Minister?

A) Alexander Mackenzie

B) John A. Macdonald

C) Wilfrid Laurier

D) Robert BordenWhich war led to the construction of the Halifax Citadel?

A) The War of 1812

B) The Crimean War

C) The Seven Years' War

D) The Napoleonic WarsWhen did Canada gain full control over its constitution?

A) 1867

B) 1931

C) 1949

D) 1982What was the last province to join Canada?

A) Alberta

B) British Columbia

C) Newfoundland

D) Manitoba

(answers at bottom)

Market Movers

Winners!

PTC Therapeutics (PTCT) [+16.5%] announced positive study results for their treatment of Friedreich ataxia and are gearing up for a big FDA submission.

Affirm Holdings (AFRM) [+6.6%] got a boost after being upgraded to a buy rating, with optimism around profitability and increased merchant engagement.

DocuSign (DOCU) [+6.6%] is set to join the S&P MidCap 400 next week.

Palo Alto Networks (PANW) [+5.1%] got a nod from Goldman Sachs and BNP Paribas Exane for strong growth potential and market share gains.

Nvidia (NVDA) [+4.0%] is riding high on news that Foxconn is building a huge factory to meet crazy demand for their AI servers.

Humana (HUM) [+2.9%] was upgraded after analysts saw a good entry point following a price drop and a better outlook for the business.

Waters (WAT) [+2.6%] got an upgrade as analysts believe a new replacement cycle is kicking off for their products.

Honeywell International (HON) [+1.8%] announced plans to spin off their advanced materials business into its own company by 2025 or 2026.

Losers!

Alibaba Group (BABA) [-6.7%] dropped after China's latest stimulus update didn't deliver any big surprises, leaving investors disappointed.

Sphere Entertainment (SPHR) [-2.8%] slipped as their CFO announced plans to leave the company, although they’ll stick around during the search for a replacement.

Otis Worldwide (OTIS) [-2.8%] was downgraded due to concerns about valuation and possible margin compression after a rally driven by China stimulus news.

Roblox (RBLX) [-2.1%] took a hit after Hindenburg Research published a short report claiming inflated metrics and safety concerns for kids on the platform.

American Express (AXP) [-1.7%] fell following multiple downgrades, with analysts citing slowing revenue growth, credit trends, and trouble hitting their 10% growth target.

Market Update

Trivia Answers

B) 1867 – Canada became a country on July 1, 1867, through the British North America Act.

B) John A. Macdonald – He was the first Prime Minister of Canada, serving from 1867 to 1873 and again from 1878 to 1891.

C) The Seven Years' War – The Halifax Citadel was built during this conflict to defend the city from a French invasion.

D) 1982 – Canada gained full control over its constitution with the Canada Act of 1982.

C) Newfoundland – Newfoundland joined Confederation in 1949

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Clever title! :)