🔬Spotify… in Charts!

Plus: The job market takes a nosedive; Trump's Truth Social sees platform exodus; and much more!

"Change is the investor’s only certainty"

- Thomas Rowe Price Jr.

“My formula for success is rise early, work late and strike oil”

- J.P. Getty

Another small up day for the big US markets, with the S&P 500 +0.2% and Nasdaq +0.2% on a pretty quiet day on the news front.

6 of 11 sectors closed higher, with Real Estate and Staples (both +0.9%) in the lead. While Materials (-1.2%) and Energy (-1.0%) fared the worst.

Energy weakness attributed to continued weakness in oil prices following OPEC+’s announced trimming of it’s production cuts which has led the oil price down 3.5% so far this week.

Notable companies:

Carnival (CCL): [+5.8%] Announced it will sunset P&O Cruises Australia brand and fold into Carnival Australia brand in March 2025, adding 8 new ships to the fleet.

Harley-Davidson (HOG): [-5.3%] Mentioned cautiously at UBS; dealer conversations suggest weaker sales in May; company could lower shipment guidance.

Gitlab (GTLB): [-4.9%] Q1 earnings, revenue, and OM better; billings and deferred revenue below consensus; raised FY guidance but Q2 revenue guide in line; analysts positive on execution and growth.

More in ‘Market Movers’ below.

Street Stories

Spotify… in Charts!

On Monday, Spotify announced that it would be raising the prices of its premium plans, with US individual plans going up $1 to $11.99; ‘Duo’ plans by $2 to $16.99; and Family plans moving up $3 to $19.99.

The Street reacted strongly to the news, sending shares +10% in the last two trading sessions. Why? Well, with their dominant market position, investors are betting that the price increase won’t cause attrition to their user-base.

Also, that this might mean Spotify will (finally) be able to turn a profit. Let’s get into it!

To start, shares of Spotify have been on a roller coaster since their 2018 IPO but after this week’s showing, are roughly in line with the market. Not that a few analysts haven’t been reamed out by their PMs along the way for promising that ‘they’ll be profitable next quarter’ for many a year.

Despite the rocky ride, Spotify has dealt with competition from some of the top names in Tech superbly. Not too many firms can say they went tête-à-tête with the likes of Apple, Amazon, Tencent and Alphabet (they own YouTube after all), and lived to tell about it. Usually that results in a fire sale and a couple fewer CEOs.

Since 2017 Spotify has managed to grow its paid subscriber base by an average of +22.5% per annum. And the Street still sees significant growth yet to come, averaging around +9.2% over the next four years.

Revenue has kept pace as well, roughly matching subscriber growth since 2017 but with the Street expecting it to outpace it going forward.

This is mostly attributable to Spotify’s ability to take price on its premium plans as well as additional revenue from new and recently added content libraries, such as audiobooks.

So that’s the good stuff.

The bad stuff is that the company - founded 18 years ago - has yet to produce a profitable fiscal year.

One of my biggest red flags as an investor is when I see years of negative profitability but that, for some reason, Wall Street believes the company is going to turn that around immediately, and that going forward its all - as Churchill put it - ‘broad, sunlit uplands’.

Having said that, there are certainly a lot of things to be positive about as an investor. For example, while unfortunate, Spotify had massive layoffs in 2023, resulting in around 1,500 job cuts or around 17% of its workforce. That’s not great, but that has had a material improvement on their fixed cost base.

Next, their move into audiobooks within the last year has been incredible. As someone who has used Amazon’s Audible for +12 years to the tune of probably $45 per month after additional token purchases, I love the product and the selection is amazing1.

1. The audiobooks are capped at at 15 hours per month (booo) but 10 hour top-ups are only $10.99. Considering the average audiobook is around 8-12 hours that compares nicely to the ~$20 per book I was paying for on Audible.

Lastly, a big headwind to their profitability has been their loss making podcast business. The company has spent well over a billion to attract artists - like the reported $250 million deal for Joe Rogan - but has remained subscale historically. That has changed recently, and the podcast business is now a nice net addition to Spotify’s gross margin.

The result is that the company has shown solid earnings growth recently and their Q1 was a standout beat on the bottom line.

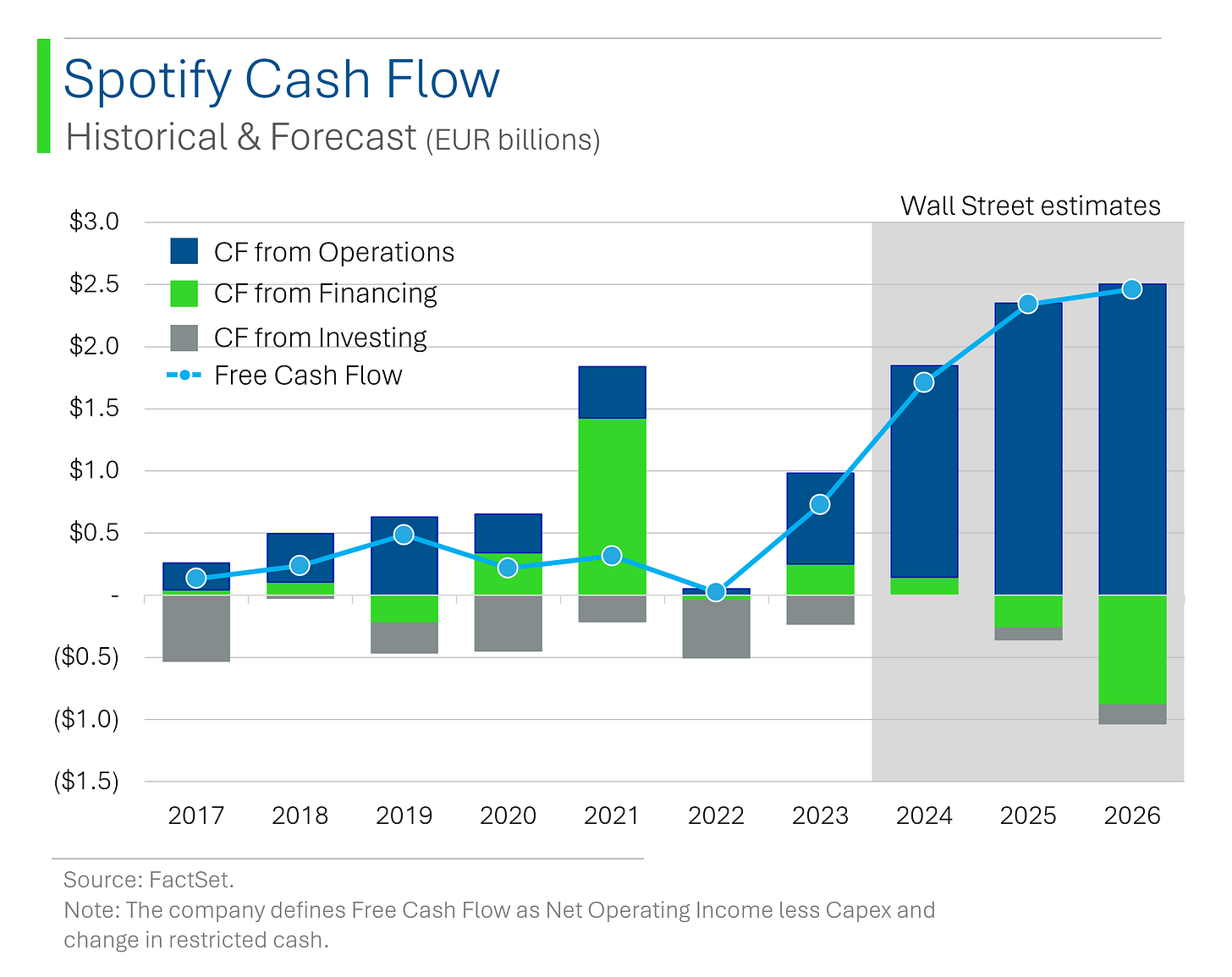

Additionally, while the business has played earnings peekaboo for nearly two decades, on a cash flow basis they have generally been positive with several years of positive Operating Cash Flow. Yeah, accounting is weird.

To conclude, the company has made big strides in the past 12 months to give investors hope that - this time - profitability isn’t just ‘a few quarters away’. That said, at a $61 billion valuation, it better be.

Oh, and I almost forgot - part of that profitability comes from paying artists the bare-ist of minimums.

Truth Social Usage Collapses

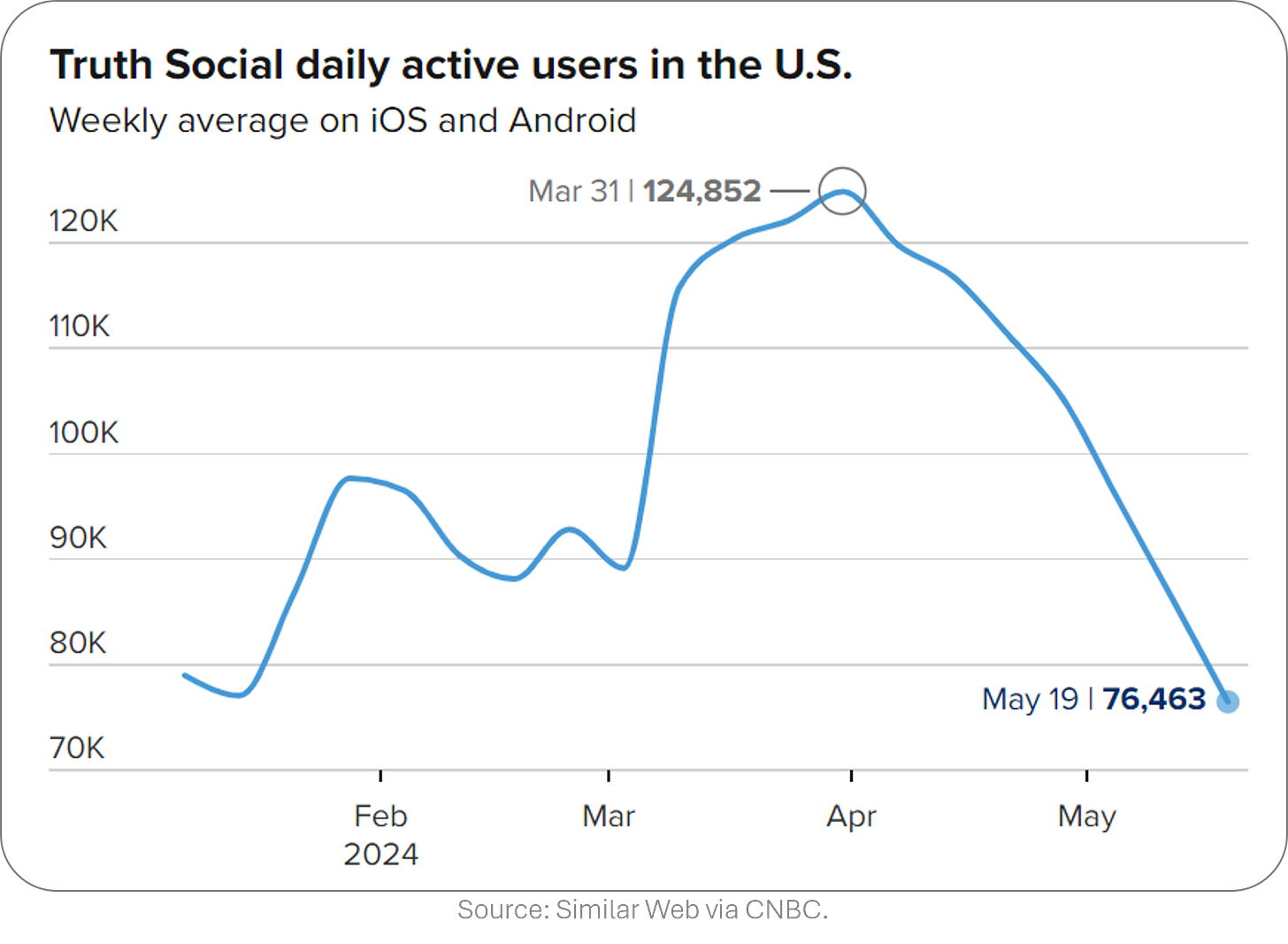

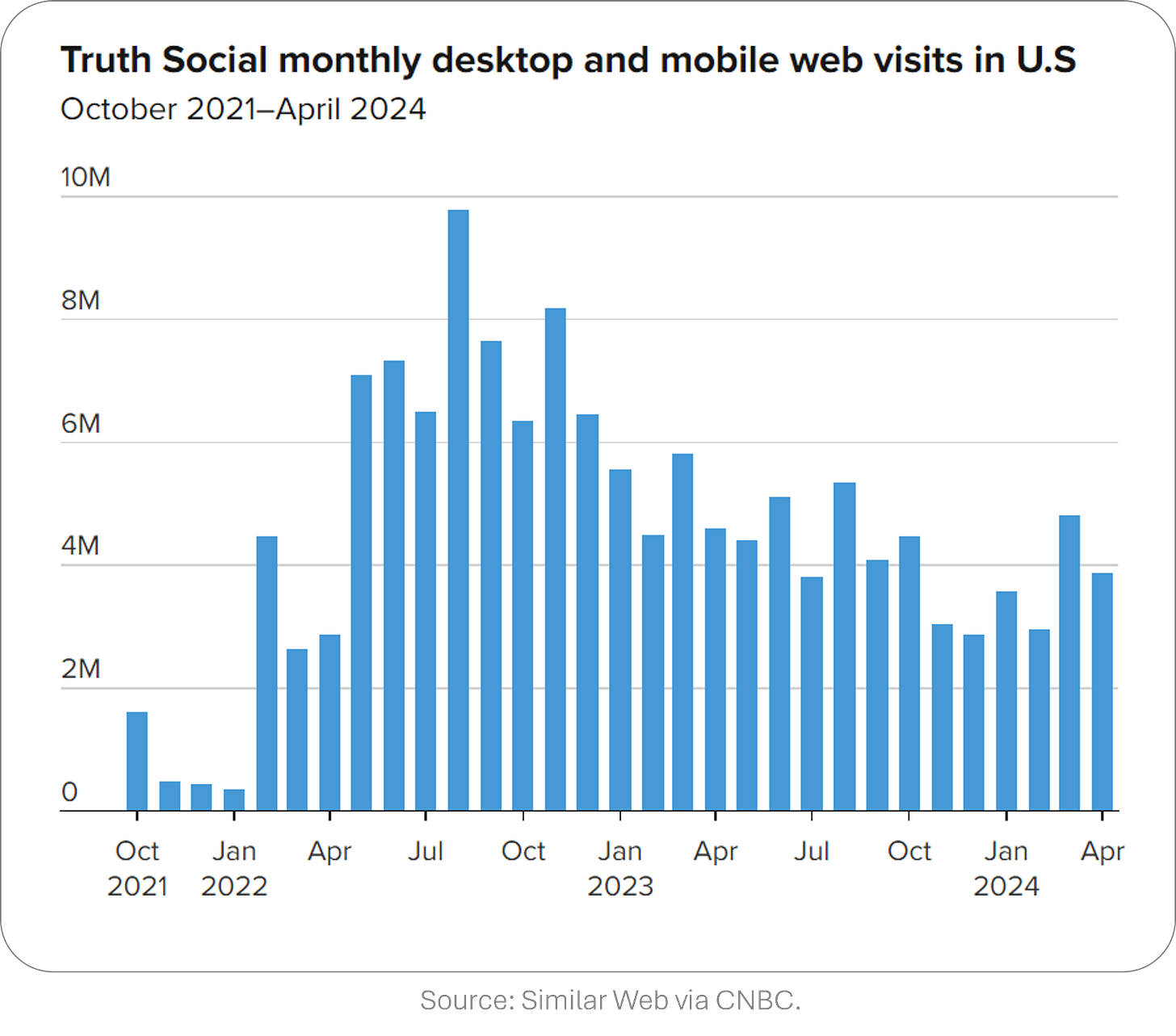

According to data compiled by Similar Web, usage of the app peaked at 125k in daily active users four days after its parent company, Trump Media & Technology Group, listed via SPAC on May 26th. Since then, usage has nearly halved across its user-base.

While the SPAC listing did provide a small bump in users, the trend for Truth Social has been quite negative over the last two years.

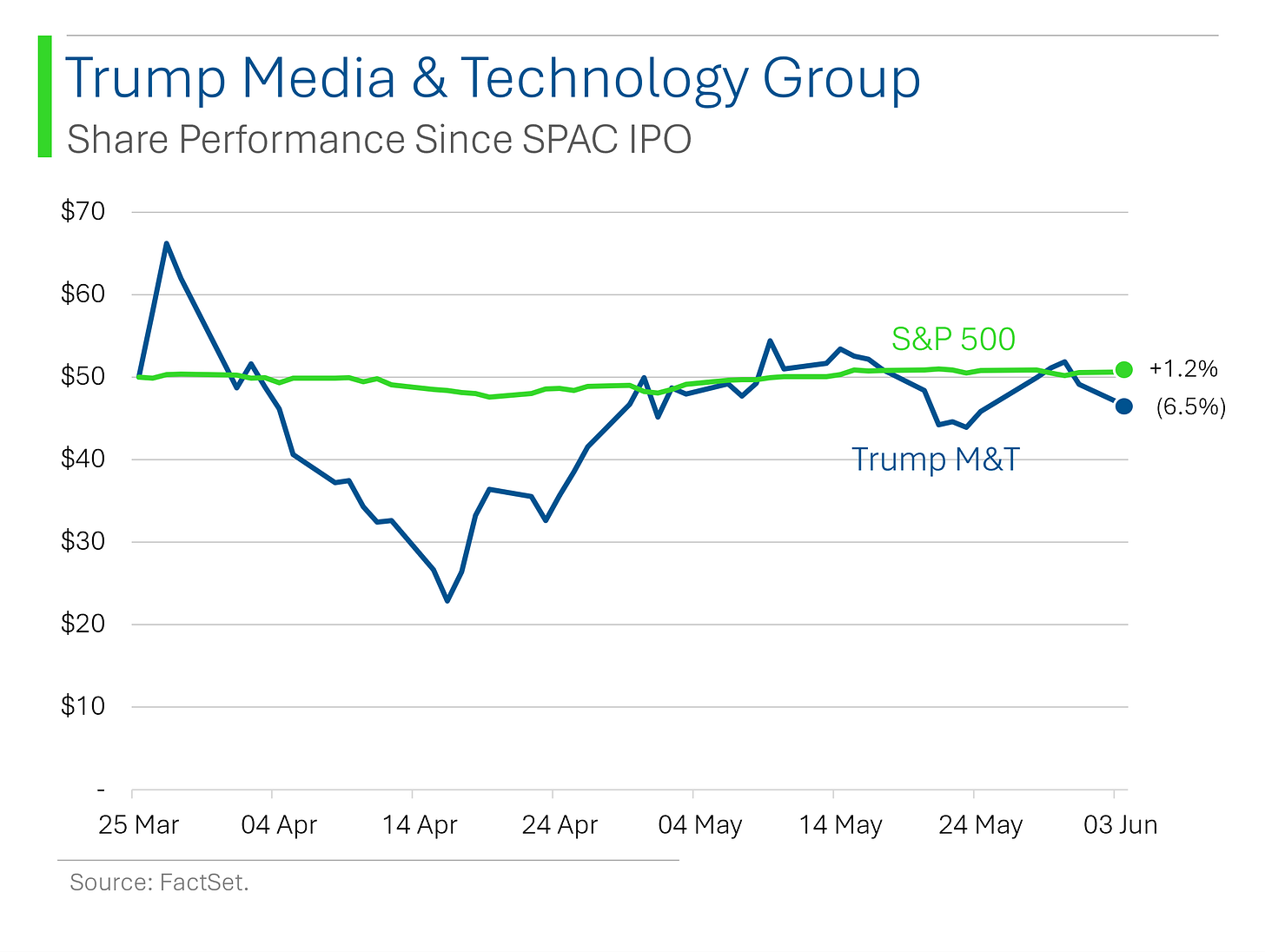

This has helped foster an negative investor outlook on the company, whose shares have been on a roller coaster since the listing but appear to have stabilized in the $40-$50 range.

Number of investors shorting the stock has also improved, as the short interest has declined from +15% to just over 10% of the float. However, this is still nearly 4x the average of the S&P 500.

Job Openings Go On Summer Holiday

U.S. job openings took a nosedive in April, hitting their lowest since February 2021, as the labor market decided to take a chill pill, much to the Federal Reserve's delight in their inflation battle (tight labor markets lead to wage increases which has a material impact on price levels).

The Job Openings and Labor Turnover Survey (or JOLTS report if you’re cool) showed openings dipped to 8.059 million, well below the Street’s estimate for 8.360 million, while the number of people quitting their jobs stayed impressively stable, showing just how thrilled everyone is with their current gigs. 🫠

Joke Of The Day

What do you call a Swiss Banker? Frank.

My broker and I are working on a retirement plan. Unfortunately, it's his.

Hot Headlines

CNBC / Elon Musk ordered Nvidia to ship thousands of AI chips reserved for Tesla to X and xAI. Elon has stated that the chips aren’t yet needed at Tesla’s Texas facility and would have sat idle otherwise, but many have seen this as mismanagement and poor fiduciary duty towards Tesla. Elon has recently said that Tesla will spend $10 billion this year “in combined training and inference AI.”

Yahoo Finance / Massachusetts regulator probes 'Roaring Kitty's' GameStop trades as potential market manipulation. I mean, if you buy options and then do something that makes the price go up, sure. But everyone talks about their investments (except Congress officials) and he hasn’t misrepresented any information. Soooo… 🤘😗

New York Times / OpenAI Insiders warn of a ‘reckless’ race for dominance. The biggest concerns from the whistleblower group hinge on their belief the company is taking insufficient steps to prevent AI systems from becoming dangerous.

Bloomberg / ETFs are getting more concentrated in their bets which presents potential risks to investors. ETF popularity is increasing but the focus of new launches has been ever more concentrated portfolios. The average number of holdings in new equity ETFs has shrunk to the least since 2010, at around 136 this year, with 88 ETFs launched last year containing less than 50 holdings.

Reuters / United Airlines cuts hiring plans for 2024 due to Boeing delays.

Tech Crunch / AI-powered virtual physical therapy start-up Sword Health raises $130M and its valuation soars to $3B. Yep, that’s really a thing.

Trivia

This week’s trivia is on famous investors.

Which investor is famous for pioneering the use of high-frequency trading

A) Renaissance Technologies (James Simons)

B) Citadel LLC (Kenneth Griffin)

C) Bridgewater Associates (Ray Dalio)

D) Soros Fund Management (George Soros)Who is known as the 'father of value investing'?

A) Warren Buffett

B) Benjamin Graham

C) Philip Fisher

D) John TempletonWho is the founder of the private equity firm Blackstone Group?

A) Carl Icahn

B) Stephen Schwarzman

C) David Einhorn

D) Ray Dalio

(answers at bottom)

Market Movers

Winners!

Saia Inc (SAIA): [+6.7%] Released LTL (less than truckload) operating data for first two months of Q2; saw solid increases in LTL shipments and tonnage per workday in April with slight acceleration in May.

Carnival (CCL): [+5.8%] Announced it will sunset P&O Cruises Australia brand and fold into Carnival Australia brand in March 2025, adding 8 new ships to the fleet.

Boot Barn Holdings (BOOT): [+4.4%] Announced preliminary Q1 SSS up 1.4%; noted increase in SSS for first nine weeks of Q1; continued improvement in both store and e-commerce channels.

Losers!

Core & Main (CNM): [-14.4%] Q1 adjusted EBITDA and revenue better; highlighted end market improvements but noted pricing headwinds, especially in steel pipe; raised low end of FY guidance on positive acquisitions impact; analysts noted release against high expectations.

Bath & Body Works (BBWI): [-12.6%] Q1 revenue and EPS ahead; raised low end of FY guidance; however, Q2 EPS guide light; stock up over 20% YTD with talk of elevated expectations into the print.

SiteOne Landscape Supply (SITE): [-10.3%] Cautious Q2 update; noted organic daily sales down 4-5% QTD; flagged general slowing across products and geographies, and persistent commodity deflation.

Harley-Davidson (HOG): [-5.3%] Mentioned cautiously at UBS; dealer conversations suggest weaker sales in May; company could lower shipment guidance.

Gitlab (GTLB): [-4.9%] Q1 earnings, revenue, and OM better; billings and deferred revenue below consensus; raised FY guidance but Q2 revenue guide in line; analysts positive on execution and growth, noted smaller-than-expected beat and softer cRPO growth.

Market Update

Trivia Answers

A) Renaissance Technologies (James Simons) is considered the first great quantitative hedge fund.

B) Benjamin Graham, Warren Buffett’s mentor, is considered the Father of Value Investing.

B) Stephen Schwarzman founded P/E firm Blackstone.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Life After Stratton Oakmont - Still Making Money https://open.substack.com/pub/michael880/p/life-after-stratton-making-money?r=3b6pw1&utm_campaign=post&utm_medium=web