🔬Spinning Out: Peloton’s Financials Struggles Persist

Plus: U.S. Housing is hot despite stretched consumer; and much more!

"Given a 10% chance of a 100 times payoff, you should take that bet every time."

- Jeff Bezos

“Many of life’s failures are people who did not realize how close they were to success when they gave up.”

- Thomas A. Edison

Big day for the big US markets to end the week, with the S&P 500 +1.2% and Nasdaq +1.5%. Both indices finished the week +1.4%, which follows last week’s monster +3.9% and +5.3% for the S&P and Nasdaq respectively.

All 11 sectors finished higher Friday, led by Real Estate (+2.0%) and Discretionary (+1.7%). The defensives fared worst (Staples +0.2%, Utilities +0.3%).

The big news was the Fed’s JPow giving his Jackson Hole address where he flagged weakening labor conditions and literally said ‘the time has come for policy to adjust.’ So, yeah, September rate cut is officially locked in.

Notable companies:

CAVA (CAVA Group) [+19.6%]: Q2 results exceeded expectations across the board, leading to raised guidance and new restaurant openings forecast, driven by strong momentum from new grilled steak offerings and consumer trade-ups from lower-end QSRs.

WDAY (Workday) [+12.5%]: Despite a miss on billings and a cautious Q3 subscription outlook, upwardly revised operating margin targets offset a lowered FY27 revenue growth target.

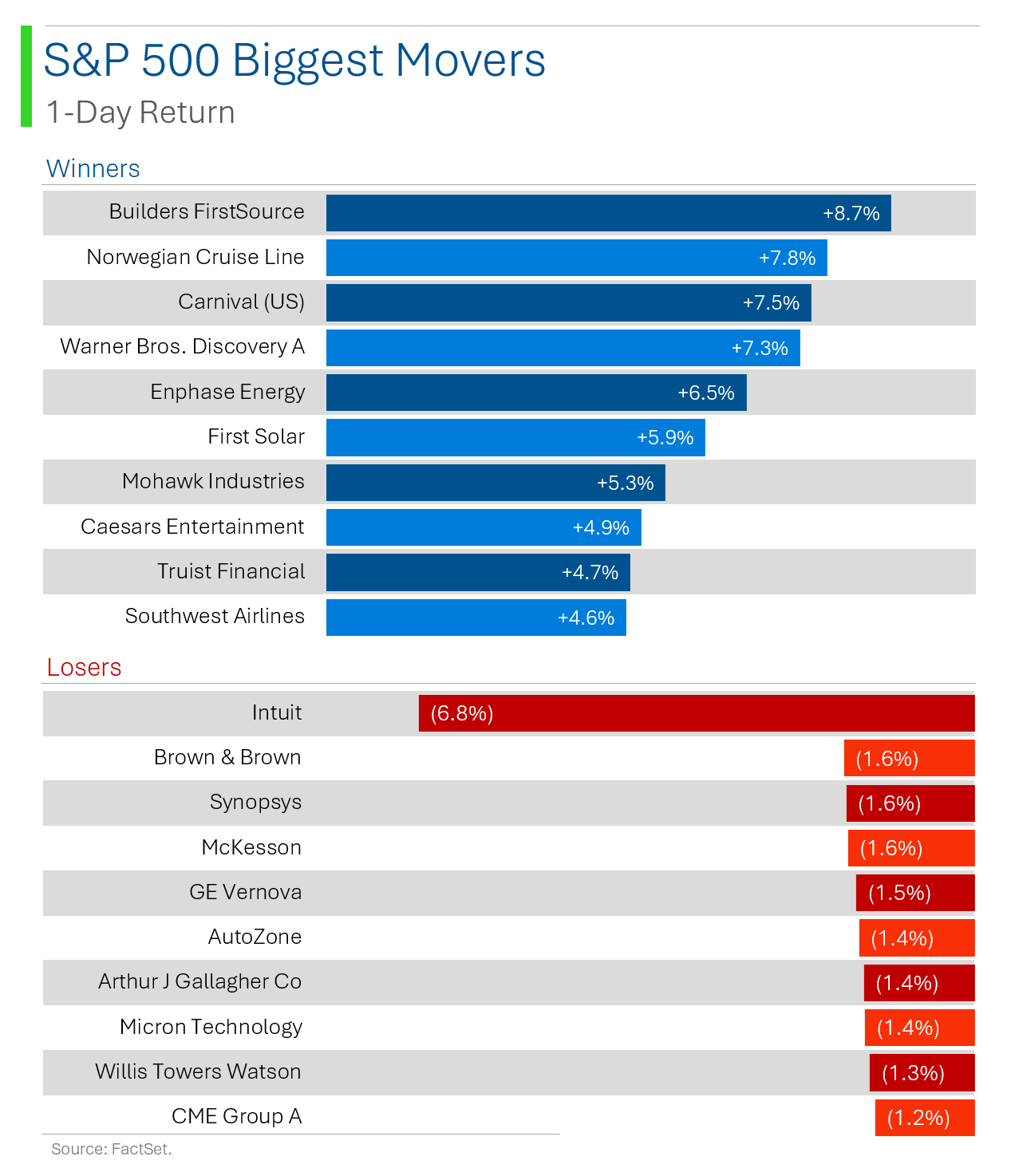

INTU (Intuit) [-6.8%]: Q4 EPS and revenue beat on strength from Credit Karma and Small Business segments but Q3 guidance fell short.

More below in ‘Market Movers’.

Street Stories

Spinning Out: Peloton’s Financials Struggles Persist

So, you hopped on a Peloton during the pandemic and thought, “This is the future of fitness!” Fast forward to today, and it looks like Peloton might be pedaling straight into a financial wall (and that Peloton is now just a fancy laundry rack).

The must-have quarantine purchase saw Peloton’s stock soar as everyone scrambled to bring the gym home and bikes were rarely in stock. But, the world reopened and that demand dried up just as fast as it came into existence.

With their share price down 45% this year alone, Peloton isn’t alone in post-pandemic world. The story is the same for other "COVID stocks" like Zoom, DocuSign, Etsy, etc.: A meteoric rise followed by an equally steep fall.

But even amongst the other damaged goods, Peloton stands out as the ‘worst of the worst’ share price collapse. And while some of these companies are pivoting to adapt, Peloton’s challenges are uniquely steep.

Their business model is heavily reliant on high-margin hardware sales and doesn’t have the flexibility others enjoy.

And then the debt started to pile.

It seemed like their pandemic strategy was pay now (and rack up debt mind you), and worry later.

By the numbers, in 2021, they issued $1 billion in zero-interest convertible notes, which seemed like a brilliant move at the time, however, fast forward to 2024, and it’s bitten them where it hurts, their balance sheet. And Peloton’s recent refinancing efforts have saddled it with much higher interest rates, leading to a hefty $55.5 million interest bill so far this year…

Their cash flow? Only just turned positive this quarter.

After the pandemic came changes and the hot new trend? Strength training.

Peloton’s trying to catch this wave with its new Peloton Strength+ app, aimed at the growing crowd of weightlifters and muscle enthusiasts.

It’s a smart pivot - strength training is gaining ground, especially among Gen Z and women who are flocking to gyms. But can Peloton muscle its way into this space this late in the game?

The Peloton of today is really two distinct businesses under one roof.

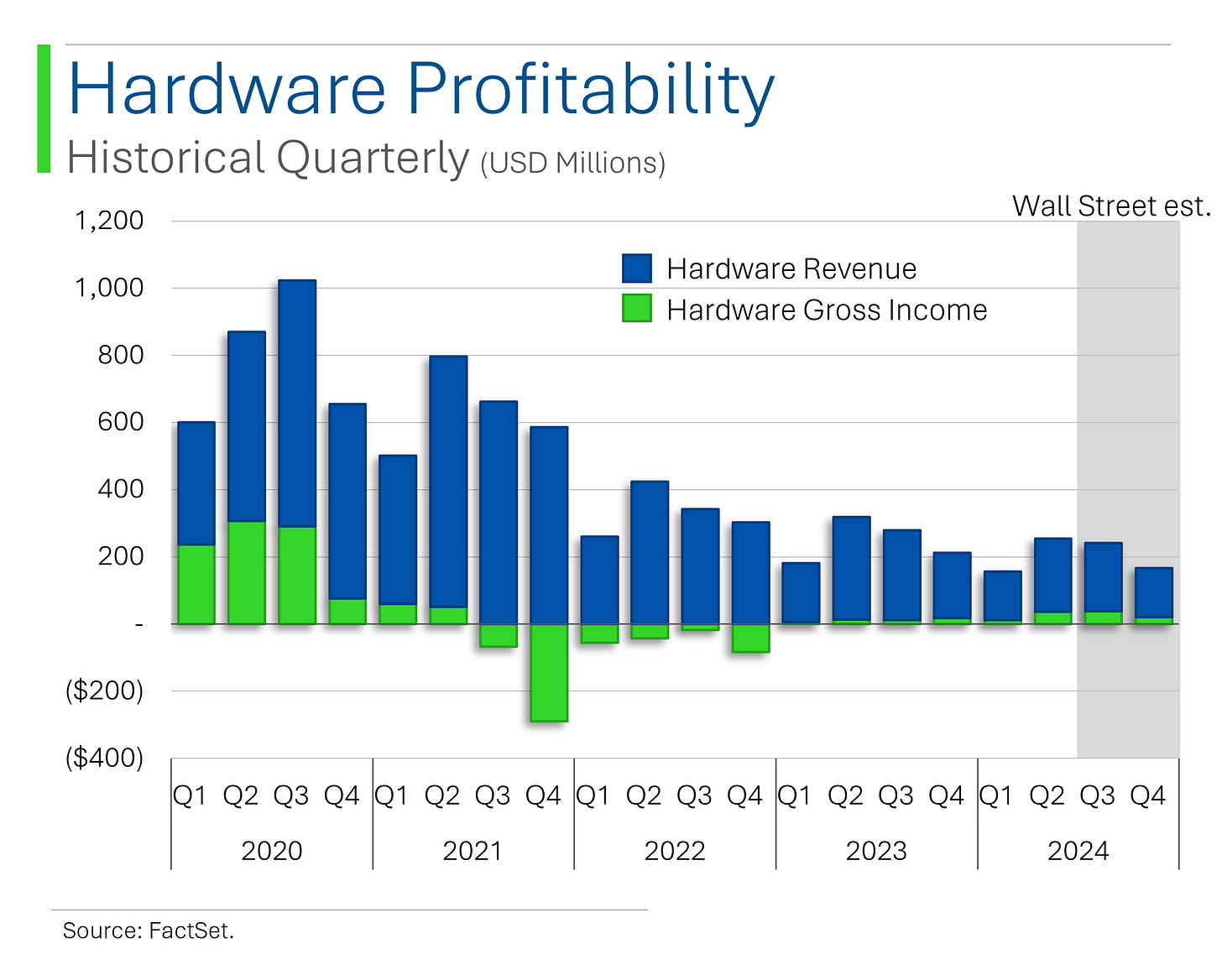

Breaking down Peloton’s financials reveals a stark reality: the company’s subscription business is doing the heavy lifting, while hardware sales are dragging things down.

Subscriptions are supposed to be the firm’s cash cow, but even here, growth is stalling. Just last Thursday when Peloton reported their fourth quarter earnings, we learned that their churn rate ticked up to 8.4% during the tailend of the 2024 fiscal year. Which is (very f*****) high.

Meanwhile, the cost of producing and selling those fancy bikes and treadmills is eating into any profits.

However, Peloton just inked a content licensing deal with Google’s Fitbit, aimed at providing Peloton content to Fitbit Premium subscribers. Bulls are seeing this as they’re big break.

In teaming up with Fitbit - which is admittedly like two former prom kings trying to relive the glory days - the company is hoping that combining forces will reignite some of the old magic, but it’s not like Fitbit is in peak physical condition itself.

That said, Peloton’s user base pales in comparison to Fitbit’s and it could be a good platform to serve as an introduction to new customers.

Financially, margins aren’t growing - their disappearing.

And Peloton’s market isn’t growing - it’s shrinking.

The pandemic surge in demand for home fitness equipment has fizzled, and the company’s core customers - those willing to spend thousands on home gym gear - are a finite group. And not exactly frequent buyers.

As cheaper alternatives flood the market and people tire of sweating in their basement, their next CEO [pending] will have some real heavy lifting.

U.S. Housing Comes in Hot

Despite a weakening consumer, housing continues to remain hot with July New Home Sales coming in at 739k vs. a Wall Street consensus for just 630k. June numbers were also upwardly revised to 668k from 617k.

While some remain on the sidelines in hopes for lower mortgage rates, urgent demand saw average sale price jump to $514,800. Which is a lot.

Joke Of The Day

We need to start investing more in solar energy. But it's not just going to happen overnight.

Hot Headlines

Reuters / Telegram messaging app CEO Durov arrested in France. Russian-born tech mogul detained over alleged abuses from the encrypted messaging app, while Moscow decries, “Freedom of speech is dead in Europe”…over state controlled media no less.

Bloomberg / Thoma Bravo’s RealPage sued by US in rental collusion case. The suit against RealPage Inc. alleges they are violating antitrust law by helping property managers collude to drive up rental prices on millions of units across the country.

Yahoo Finance / Bronfman's Paramount acquisition plans include partnerships with Amazon or Apple. Content meets distribution? Reminds me of Gojo and Waystar…

CNBC / Intel has hired Morgan Stanley, other advisers for activist defense. With a 60% stock plunge and Nvidia dominating the AI space, Intel braces for activist pressure while cutting 15,000 jobs in a $10 billion cost-reduction effort. Look’s like CEO Gelsinger’s days could be numbered.

CNBC / Boeing Starliner returning empty as NASA turns to SpaceX to bring astronauts back from ISS. After propulsion issues plagued the spacecraft, NASA shifts gears, relying on SpaceX’s Crew-9 mission to return its astronauts.

CNBC / Hezbollah launches missile barrage at Israel to avenge top commander. Over 320 rockets and drones strike military targets as Israel retaliates with 100 jet airstrikes, marking one of the most intense escalations in over 10 months of conflict.

Trivia

Today’s trivia is on the history of sports.

Which ancient civilization is credited with originating the Olympic Games?

A) Romans

B) Egyptians

C) Greeks

D) PersiansIn which year were women first allowed to compete in the modern Olympic Games?

A) 1896

B) 1900

C) 1920

D) 1936The concept of "a sound mind in a sound body" is attributed to which ancient philosopher?

A) Socrates

B) Plato

C) Aristotle

D) HippocratesWhich exercise technique, popularized in the early 20th century, was developed by a German physical trainer and focuses on controlled movements and core strength?

A) Calisthenics

B) Pilates

C) Aerobics

D) Yoga

(answers at bottom)

Market Movers

Winners!

CAVA (CAVA Group) [+19.6%]: Q2 results exceeded expectations across the board, leading to raised guidance and new restaurant openings forecast, driven by strong momentum from new grilled steak offerings and consumer trade-ups from lower-end QSRs.

WDAY (Workday) [+12.5%]: Despite a miss on billings and a cautious Q3 subscription outlook, upwardly revised operating margin targets offset a lowered FY27 revenue growth target, reflecting strength in key enterprise software trends.

WRBY (Warby Parker) [+11.9%]: Initiated at overweight by Piper Sandler, citing accelerating growth in the eyewear market and opportunities within its services segment.

ROKU (Roku) [+11.9%]: Upgraded to buy at Guggenheim Securities, with expectations that key initiatives will drive revenue acceleration and margin expansion.

ROST (Ross Stores) [+1.8%]: Q2 results beat expectations with increased traffic and basket size, though margin pressure is expected to rise in H2 amid macroeconomic uncertainty, particularly for low-to-moderate income consumers.

Losers!

INTU (Intuit) [-6.8%]: Q4 EPS and revenue beat on strength from Credit Karma and Small Business segments, though consumer slightly missed; Q3 guidance fell short, but FY25 guidance was strong, with analysts positive on the print despite concerns over long-term consumer and Credit Karma outlook.

BILL (Bill Holdings) [-6.7%]: FQ4 earnings, revenue, and margins exceeded expectations, driven by strong customer acquisition efforts, but FY25 EPS guidance disappointed, with analysts cautious on mixed guidance and upcoming investments; downgraded by Goldman Sachs.

GEV (GE Vernova) [-1.5%]: Turbine blade failure at the Dogger Bank offshore wind farm in England, following a similar incident near Nantucket, raised concerns.

LVS (Las Vegas Sands) [-1.1%]: Downgraded to neutral by UBS due to ongoing challenges in the recovery of the Macau segment.

Market Update

Trivia Answers

C) The Greeks are credited with originating the Olympic Games.

B) Women were first allowed to compete in the modern Olympic Games in 1900.

C) Aristotle is credited with the concept of "a sound mind in a sound body."

B) Pilates was developed by a German physical trainer and focuses on controlled movements and core strength.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

I once owned $PTON, I think the product is great but that was a painful experience

PTON really is the poster child for "what not to do." What a fall from grace.