🔬SPACs Are Still Lame, S&P 500 Bear to Peak, Housing Is Ok Again, And Much More

"Not everything that is faced can be changed, but nothing can be changed until it is faced"

- Howard Marks

“You know, Kevin, you're what the French call ‘les incompetents’".

- Linnie McCallister, Home Alone

Another up day, adding to Monday’s gains with the S&P 500 +0.59% and Nasdaq +0.66%. The S&P is now 0.6% off its all-time high reached in January 2022.

All 11 sectors ended things in the green today. Energy (+1.2%) led the way as the situation south of the Suez Canal continues to weigh on oil markets. Consumer Staples lagged, up a measly 0.2%.

As mentioned, oil was strong again today with WTI Crude up 1.5%, an increase of almost $4 since last week to $73.58.

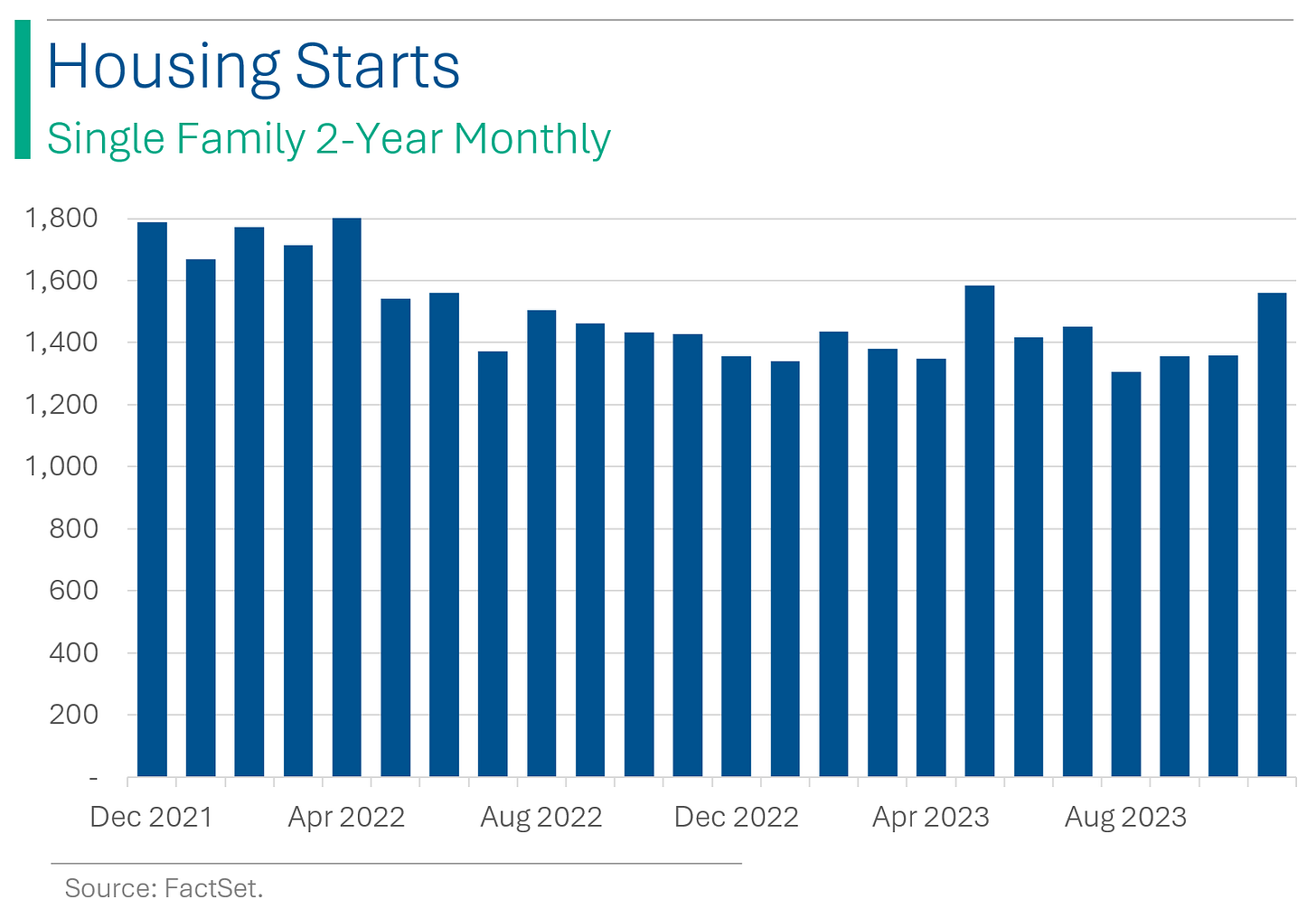

November Housing Starts came in well above consensus (+1.56m) as improved economic prospects and lower interest rates are taking hold.

***Note: there will be no newsletter tomorrow. I’m pretty sick atm with a mixture of daycare and school-aged kids’ colds***

Street Stories

REMEMBER SPACS? - In yesterday’s note I mentioned that A-Rod’s terribly named SPAC, Slam Corp., announced it was merging with mobile internet company Lynk Global in an $800 million dollar deal. This got me thinking: What the hell happened to all those SPACs from the pandemic?

SPAC Refresher: Back in the heady days of 2020 and 2021, one of the oddest and most greed-laden events in the history of capital markets took place: The SPAC Boom. For those unfamiliar or forgetful, a SPAC - or Special Purpose Acquisition Company - is a pool of capital raised by a (famous) investor or celebrity with the aim of buying a company. The money raised from dupes and rubes is put into a trust that cannot be used other than for the purpose of completing a single acquisition of a private company, which is then IPO’d onto public markets. The benefits to the parties involved are as follows:

Arranger/Sponsor - The individuals that set-up the SPAC typically receive a 20% interest in the value of the company purchased for their troubles (there can also be additional fees charged in the process). This is probably the best example of moral hazard available since it’s in the financial interest of the arranger to hammer through any ole deal possible. Even buying a terrible company that tanks after IPO is still worth it for the sponsor, compared to just handing the money back to investors. At least hedge funds and PE shops have to show a positive return in order to get paid (above the 1-2% management fee, that is).

The Company - Most ‘legit’ companies avoid going down this road since it can tarnish their name and add unnecessary dilution. For them, it’s better to wait things out for a proper IPO down the road. But if you are a struggling company that can’t find capital elsewhere, or if your business is a borderline fraud/real fraud (see below) then this is the best route for you to turn your equity into liquid shares. The rules for promotion of a SPAC are also very... let’s say ‘loose’ (more like ‘suggestions’ really)…so management can make outrageous claims about future profitability that would get them thrown in jail in a typical IPO S1 prospectus. Although, as the sentencing of former Nikola CEO, Trevor Milton, proved yesterday, even this can be pushed too far.

The

SuckersInvestors - People bought into SPACs to get a piece of the action in what was pitched as a ‘new revolution’ in investing. One that allowed the little guy to be investing in the hot private growth plays typically only reserved for the big Wall Street firms. Sprinkle in some fancy big name investors, like Chamath Palihapitiya or Bill Ackman, or celebrities, like Shaq and Donald Trump, and who could say no? (note: Trump’s SPAC to list Truth Social never ended up closing).

As you might have guessed, the performance of SPACs launched in the bubble has been pretty abysmal. Notable ones include cash incinerators BuzzFeed, Nikola and Virgin Galactic. But thankfully, as the hype waned, investors have wised up and exercised their right not to approve sketchy transactions pitched by management. While it’s the sponsor’s duty to find a suitable (read as: any) transaction, ultimately the investors do get a vote and many have exercised their displeasure by cancelling deals before consummation. Moreover, typical SPAC structures only allow for a 2-Year window for a transaction to be approved, and as such the number of SPACs that have gone into liquidation without ever finding a home for their capital has expanded since the end of the bubble.

Take-Aways: Wall Street isn’t a charity. If it’s hot and hyped, you’re not co-investing; you are a profit center.

TESLA DRIVERS HAVE HIGHEST CRASH RATE - Tesla drivers, in their pursuit of futuristic driving experiences, have distinguished themselves as the most accident-prone among 30 car brands, boasting a crash rate of 23.5 accidents per 1,000 drivers. This impressive statistic eclipses the adventurous Ram drivers at 22.8 and Subaru at 20.9 - the only other two brands with crash rates north of 20 per 1,000 drivers. Despite this, Tesla's latest recall of 2 million vehicles - the biggest in the company’s 20 year history - highlights the realization that reading novels or daydreaming while the car does the work might not yet be a seamless reality. As the National Highway Traffic Safety Administration raises an eyebrow over Autopilot's potential for misuse, Tesla's response, infused with a touch of irony, focuses on enhancing warnings to remind drivers that Autopilot is more co-pilot than magic wand. [CNBC has more on this]

S&P 500 APPROACHES ALL-TIME HIGH - After closing up 0.6% yesterday, the S&P 500 is now only 0.6% shy of its all-time high reached on January 3rd, 2022 record close. Everyone start crossing your fingers.

An interesting thing about this go-around, is that it (again, fingers crossed) could mean a much shorter time frame going from peak to bear market to fresh all-time highs. After the Tech Bubble popped, it took over seven years to breach those levels, and we only got to experience that for five months before the bottom fell out during the Great Financial Crisis. From there, it took another five and half years to reach a new all-time high. And sure, it only took 181 days following the start of COVID to reach a new all-time high, but I think we all agree those were weird times and it doesn’t count.

As for the Nasdaq, it still has a ways to go to get back to its Pandemic Peak (+7%). Hopefully it doesn’t end up taking as long as it did after the Tech Bubble, when the Nasdaq didn’t reach a new all-time high until April 23rd, 2015. Yeh, it took over 15 years. Yeesh.

HOUSING STARTS - Housing starts for November came in at a seasonally adjusted annual rate of 1,560,000, surpassing expectations with a 14.8% percent increase compared to the revised October estimate of 1,359,000. Permits for future single-family homes also rose to the highest since May 2022, indicating potential further growth in the housing market. Economists are optimistic that this uptick in housing activity, along with declining long-term interest rates, will contribute to economic growth and could help avoid a recession next year. [Reuters has more on this]

Joke Of The Day

Did you hear about the cannibal CPA? She charges an arm and a leg.

Hot Headlines

Space.com | China's space plane apparently deployed 6 'mysterious wingmen' in orbit.

NY Post | Over 170 people with Jeffrey Epstein links likely to be named in court docs set to be unsealed in coming weeks. Burn them. Burn them all.

Bloomberg | Apple races to tweak software ahead of looming US watch ban on December 25th. Algorithms that track blood oxygen levels found to infringe on Masimo’s patents.

CNN | CNN’s 17 most transformative media moments of 2023. The launch of MarketLab’s StreetSmarts was shunned for political reasons.

Reuters | Trump barred from Colorado ballot for role in attack on US Capitol following Colorado Supreme Court ruling 4-3 in favor of the move. The rarely used provision of the U.S. Constitution bars officials that have engaged in ‘insurrection or rebellion’ from holding office, and the ruling will likely be appealed at the Supreme Court.

Trivia

This week’s trivia is on ‘first year economics’.

The 'Efficient Market Hypothesis' suggests that:

A) All markets are inherently efficient

B) Stock prices fully reflect all available information

C) Only financial markets can reach efficiency

D) Market efficiency is impossibleThe 'Big Mac Index' is an informal measure of:

A) The profitability of fast food chains

B) Purchasing power parity between currencies

C) Global obesity rates

D) Consumer preference for fast foodWhat is the primary aim of 'Supply-Side Economics'?

A) To increase government revenue

B) To reduce inflation

C) To boost production and lower the cost of goods and services

D) To increase consumer spending

(answers at bottom)

Market Movers

Winners!

Affirm Holdings (AFRM) [+15.5%]: Expanded services with Walmart to offer BNPL options at self-checkout kiosks across the US. Just what the world needs! 😕

Chewy, Inc. (CHWY) [+9.3%]: Received a buy initiation from Jefferies, highlighting its high-income customer base's resilience to inflation and potential revenue growth from pet health, sponsored ads, in-house brands, and new markets.

Enphase Energy (ENPH) [+9.1%]: Announced a restructuring plan to reduce the workforce by about 10% and close some manufacturing facilities, aiming to cut operating expenses by $75-80M quarterly by 2024, with most actions completed in H1'24.

UBS Group (UBS) [+5.2%]: Saw a 1.3% stake acquired by activist investor Cevian Capital, who views UBS as undervalued given its status as a leading global wealth manager.

Losers!

CureVac (CVAC) [-29.6%]: German patent office invalidated the company's patent involved in litigation with BioNTech, as reported by Reuters. Ouchy.

Market Update

Trivia Answers

B) The Efficient Market Hypothesis states that stock prices fully reflect all available information.

B) The Big Mac Index measures the purchasing power parity between currencies.

C) Supply-Side Economics aims to boost production and lower the cost of goods and services in the effort of increasing GDP growth and maximizing employment.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

Nice SPAC overview and recap!

Rising and falling SPAC issuance is also a good way to track risk sentiment and liquidity.