🔬Some Stock Market Records

Plus: The U.S. Consumer is a bit gloomy; and much more!

“The stock market is a device to transfer money from the impatient to the patient.”

-Warren Buffett

"I have an L shaped couch... Lower case."

- Demitri Martin

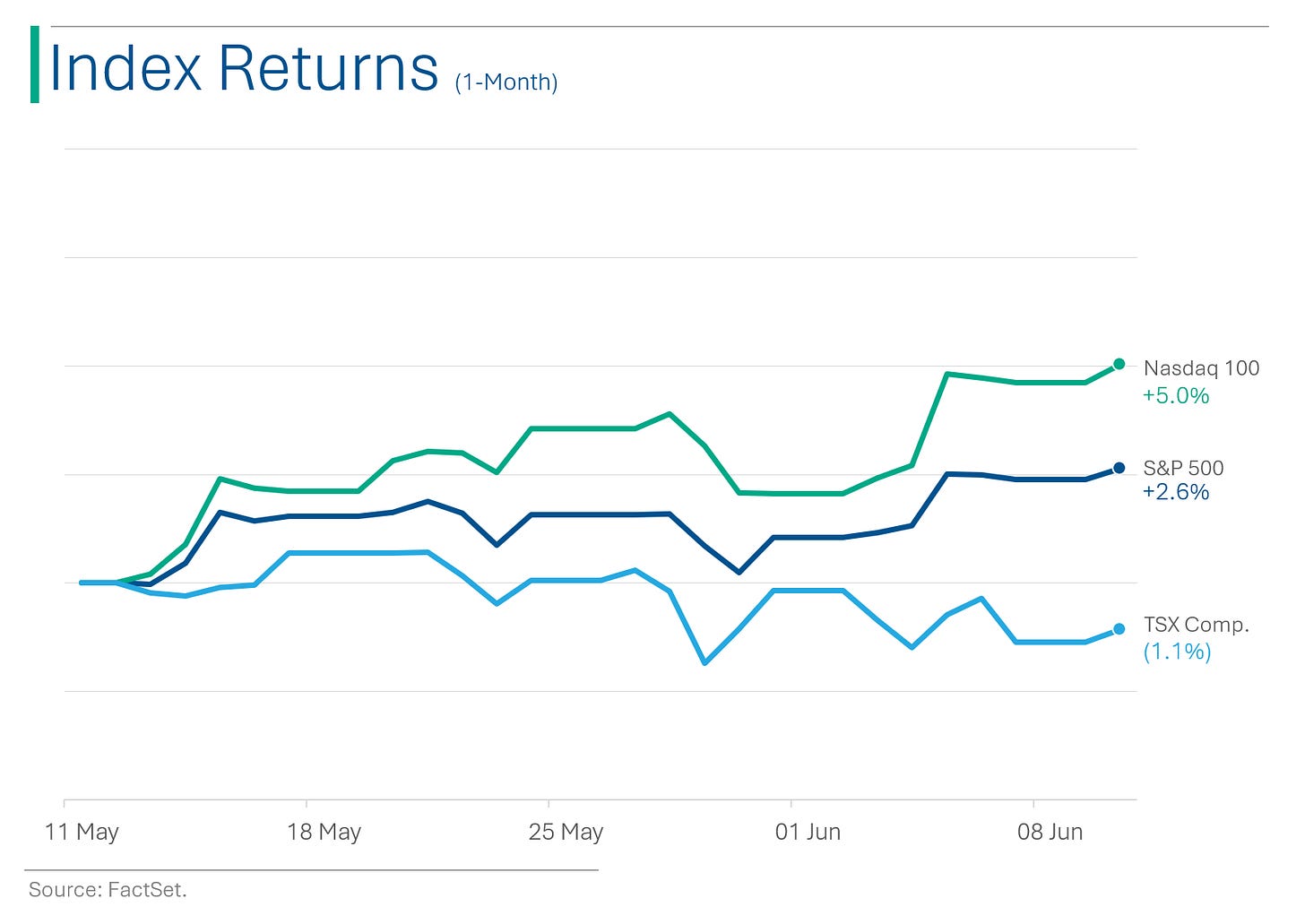

Decent day for the big US markets with the S&P 500 +0.3% and Nasdaq +0.4%.

8 of 11 sectors closed higher, led by Utilities (+1.3%) and Energy (+0.7%), with Financials fairing the worst (-0.4%).

Mostly a muted day in the markets as everyone is holding their breath for Wednesday’s CPI inflation print and Thursday’s Fed meeting press conference.

Oil was up +2.9% as it’s battles back from the last two week’s rout.

Notable companies:

KKR (KKR) [+11.2%] and CrowdStrike (CRWD) [+7.3%] had big days following the announcement they will join S&P 500 effective June 24th. GoDaddy (GDDY) [+1.9%], also joining, didn’t get so lucky.

Advanced Micro Devices (AMD) [-4.5%]: Downgraded to HOLD from BUY at Morgan Stanley.

Southwest Airlines (LUV) [+7.0%]: Activist hedge fund Elliott Management acquired nearly $2B stake; called for board enhancement, leadership upgrade, and comprehensive business review.

More below in ‘Market Movers’

Street Stories

Some Stock Market Records

Just to get this out of the way: Yes, I’ve mentioned Nvidia a lot lately. Yes, it’s probably annoying. And yes, after today I promise I won’t mention them for a while. Pinky swear!

Anyway, yesterday I wrote that so far in 2024 Nvidia has contributed a whopping $1.8 trillion out of the whole S&P 500’s $4.8 trillion gained this year, representing 36%. (Re-posting since it was a cool chart and took me a while.)

This got me thinking: What were the biggest company contributions to the S&P 500 in recent memory? Turns out what Nvidia’s done is indeed a record - by nearly 80%.

Moreover, other than Apple and Microsoft - the only two other companies to ever join Nvidia in the $3 Trillion Club - the biggest annual winner ever was General Electric way back in 2003 with $311 billion. Basically a rounding error.

Nvidia’s 36% index contribution is also a stand-out, with really only Apple’s 19% in 2020 even close to comparable.

(Caveat: In 2007 AT&T had a return of $114 billion when the S&P was up only $139 billion, representing 83%. Given that the market was barely up this is more of a statistical anomally imo.)

Something else I found interesting is the speed at which Nvidia was able to join the podium of biggest companies in the world. For example, seven U.S. companies have broken the $1 Trillion market but only three have been able to go from that to $3 Trillion.

Going from $1 trillion to $3 trillion, took Microsoft 1,732 days (4.7 years) and Apple a bit longer at 1,794 days (4.9 years). That feat only took Nvidia 359 days - less than a calendar year!

Not saying I’ve finally drank the AI-hypetrain Koolaid, but can certainly appreciate that this is something historic, the likes of which we may never see again.

Consumer Expectations

The latest edition of the New York Federal Reserve’s Survey of Consumer Expectations came out yesterday, and I’d say it showed a modest deterioration in general outlook of the average ‘Merican.

To start, expectations for home prices haven’t shown any sign of cooling off, despite +7% mortgage rates. With Shelter cost representing the bulk of persistently stick CPI inflation, this isn’t exactly an optimistic area of your average American.

Next, the general outlook for cooling inflation across a broad basket of important financial items has ticked back upwards, with everyone one of the above categories showing increased inflation expectations over the last six months, save for medical care costs.

Overall inflation expectations did tick down slightly from 3.3% to 3.2% but still nowhere near the Fed’s 2% target. Basically, the view from the ground right now doesn’t cast a particularly optimistic view of the economy.

Joke Of The Day

I asked my North Korean friend how it was there, he said he couldn't complain.

Hot Headlines

Reuters / Crypto miner Bitfarms to adopt 'poison pill' amid Riot’s hostile $950 million takeover attempt. Poison Pills are measures companies can adopt to fend off hostile take-over attempts; in this case if a company (ie: Riot) acquires more than 15% of Bitfarms after June 20th and up to September 10th, the company will issue fresh shares, diluting the attacker's stake in the company.

Market Watch / ‘AI bar remains high’ for AMD, says Morgan Stanley as it slashes rating. Cutting the stock to HOLD from BUY, MS said they see upward revision potential for AMD as “limited”. I didn’t think they’d be allowed to cast doubt on the AI boom? He must have tenure.

Coin Desk / Despite record flows into Bitcoin ETFs, the crypto’s price seems to have stalled out. Punchline: Hedge fund f***ery.

Reuters / After getting pummeled the last few weeks, Oil prices pop +3% on hopes of higher summer fuel demand. West Texas Intermediate oil finished the day at $77.74 after trading in the mid-/high-$80s the last few months.

Quartz / Trump Media stock slumps 6% after a new audit confirms the company lost $58 million last year. The company had to refile its financials after former auditor BF Borgers was barred by the SEC from being an accountants. Which is bad.

Reuters / ECB could wait several meetings between rate cuts says President Lagarde. After cutting rates for the first time since 2016 last week from 4.50% to 4.25%, ECB is talking down investor expectations for a drastic move which might destabilize markets.

Trivia

Today’ trivia is on stock markets.

Where's the oldest stock exchange in the world?

A. Lyon, France

B. Barcelona, Spain

C. Hamburg, Germany

D. Antwerp, BelgiumWhere was the first stock exchange in the United States?

A. Boston, Mass.B. New York, N.Y.

C. Philadelphia, Pa.

D. Washington, D.C.

What was the first listed company on the NYSE?

A. Nationwide InsuranceB. Prudential

C. Bank of New YorkD. Merrill Lynch

(answers at bottom)

Market Movers

Winners!

KKR (KKR) [+11.2%]: To join S&P 500 effective June 24th.

Diamond Offshore Drilling (DO) [+10.9%]: Agreed to be acquired by Noble (NE) in a stock and cash deal with ~11.4% premium to prior close.

CrowdStrike (CRWD) [+7.3%]: To join S&P 500 effective 24-Jun.

Southwest Airlines (LUV) [+7.0%]: Elliott acquired nearly $2B stake; called for board enhancement, leadership upgrade, and comprehensive business review.

Planet Fitness (PLNT) [+4.6%]: Upgraded to BUY from HOLD at Jefferies; expects franchise model adjustments and price increases to boost unit demand.

Mohawk Industries (MHK) [+4.1%]: Upgraded to strong buy from market perform at Raymond James; shares below floor valuation; positive on profitability, FCF, debt; noted restrained industry capacity adds.

DraftKings (DKNG) [+3.1%]: Added as Top Pick in North America Gaming & Lodging at Morgan Stanley.

Losers!

Huntington Bancshares (HBAN) [-6.1%]: Updated FY24 guidance; Average Loans +3-4% vs prior +3%-5%; Average Deposits +3-4% vs prior +2%-4%; Net Interest Income down 1-4% vs prior (2%) to +2%.

Advanced Micro Devices (AMD) [-4.5%]: Downgraded to equal weight from overweight at Morgan Stanley; noted valuation less attractive relative to peers; argued investor expectations for AI business are overly high.

Apple (AAPL) [-1.9%]: Lower as it makes keynote presentation at Worldwide Developers Conference; introducing "Apple Intelligence" combining Siri with OpenAI; widely previewed development.

Adobe (ADBE) [-1.2%]: Downgraded to hold from buy at Melius Research; said SAAS companies like Adobe may face challenges from AI, as new competitors threaten seat model and are emerging faster than expected.

Market Update

Trivia Answers

D. The Belgian ‘Antwerp Bourse’ is the oldest stock exchange, having opened its doors in 1460 and kept going until 1997.

C. New York is where all the action is today, of course, but the Philadelphia Stock Exchange, founded in 1790, predated it by two years.

C. Shares of the Bank of New York were traded under the fabled buttonwood tree on Wall Street in 1792 before being the first listed on NYSE.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.