Small Caps Fall Hardest, GM's No-Good-Very-Bad-Day, and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps to get Substack to share my newsletter***

“He who is quick to borrow is slow to pay”

-German proverb

“Wall Street is the only place that people ride to in a Rolls Royce to get advice from those who take the subway”

-Warren Buffett

Table of Contents

A.M. Allocations: Summaries of important news and investing events

The

BiggerSmaller They Are, the Harder They FallMeta's Update Status After Lawsuit: 'It's Complicated' with 42 States

Forecast Flubs: Dimon Dishes on Central Bank Missteps

Hot Headlines: Links to some of the top financial stories of the day

Market Movers

Notable Winners:

Logitech International (LOGI) [+12.9%]: FQ2 EPS and revenue surpassed expectations. Upped FY24 guidance.

Spotify Technology (SPOT) [+10.4%]: Q3 EPS and revenue exceeded forecasts, with a 26% y/y growth in Monthly Active Users (“MAU”). Positive operating income for the first time. Q4 MAU guidance was better than anticipated, although margins were slightly weaker due to decreasing cost-saving efficiencies and the introduction of Audiobooks.

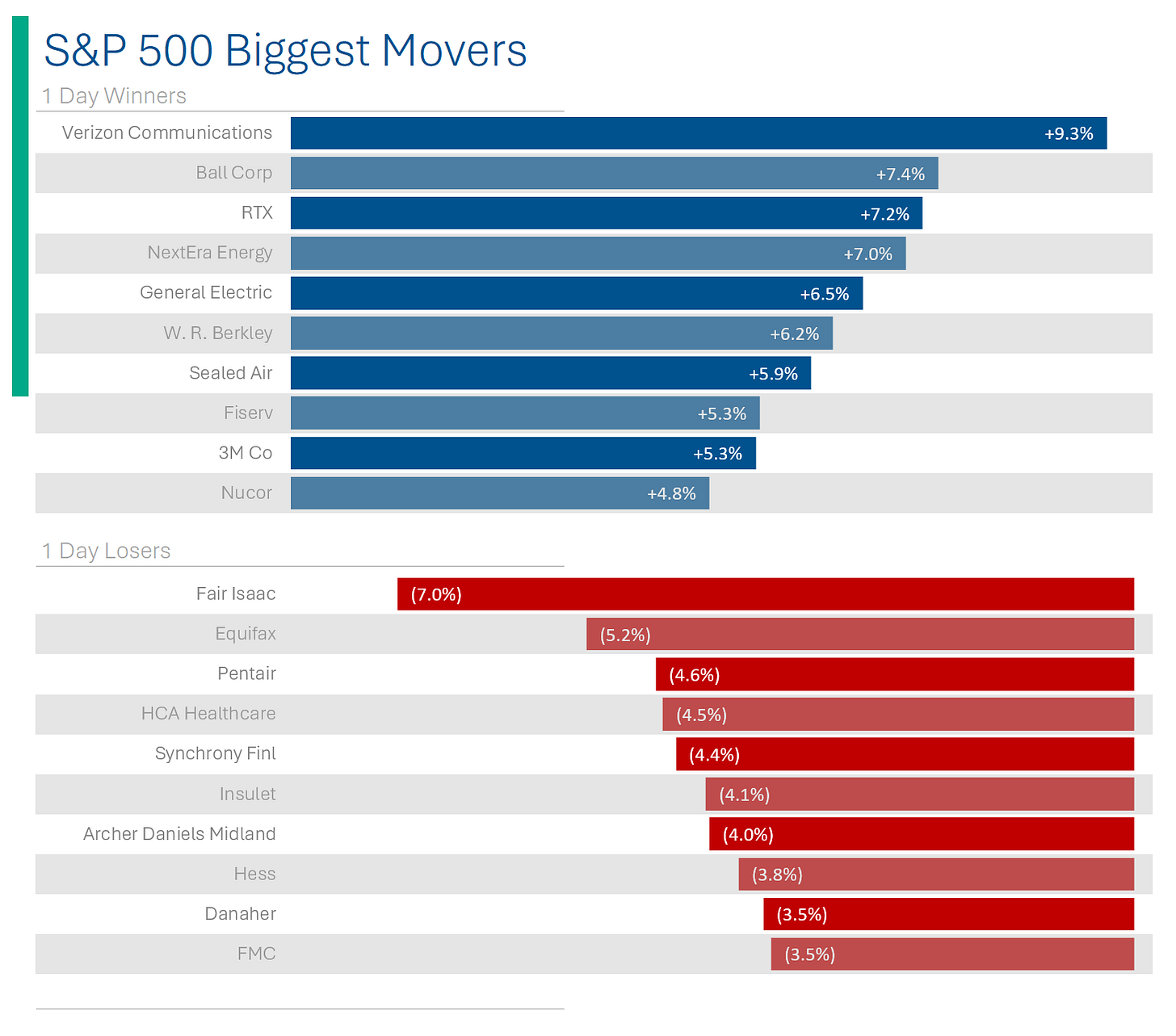

Verizon Communications (VZ) [+9.3%]: Q3 earnings were ahead of expectations, with revenue matching projections.

General Electric (GE) [+6.5%]: Q3 earnings and revenue surpassed forecasts, and free cash flow was way ahead of consensus.

3M (MMM) [+5.2%]: Notable Q3 segment EBIT performance with an updated FY guidance.

Coca-Cola (KO) [+2.9%]: Q3 organic revenue growth surpassed consensus by roughly 400 bp, with both volume and price/mix showing upside, resulting in an EPS beat. FY EPS growth guidance was increased despite a forecasted larger FX impact.

Notable Losers:

Barclays (BCS) [-6.9%]: Despite beating EPS and Net Income, revenue dropped due to weaker investment banking.

Halliburton (HAL) [-3.4%]: Strong margins led to a Q3 EPS beat, but revenue lagged because of D&E revenue shortfalls. The company expects steady oilfield services demand in 2024.

General Motors (GM) [-2.3%]: Q3 EPS, EBIT, and revenue all exceeded expectations. The company withdrew its FY23 financial predictions and its goal to produce 400K EVs from 2022 to mid-2024. Instead, GM aims to ramp up production to match demand rather than adhere to specific volume targets. Additionally, strike costs are pegged at $200M weekly, and California regulators suspended the Cruise autonomous testing permit.

A.M. Allocations

The Bigger Smaller They Are, the Harder They Fall

In this newsletter, I’ve harped quite a bit about the S&P 500 as a representative case for the ‘broader’ US economy - particularly in my tirade about how I think the Dow Jones is useless. However, my view still isn’t perfectly accurate. While the S&P 500 provides a solid, diversified representation of the US market it has one limitation: Size. Or rather, too much of it. Currently the smallest company in the S&P 500 is Sealed Air with market cap of $4.1 billion, but the median is around $29.5 billion. Not exactly mom-and-pop.

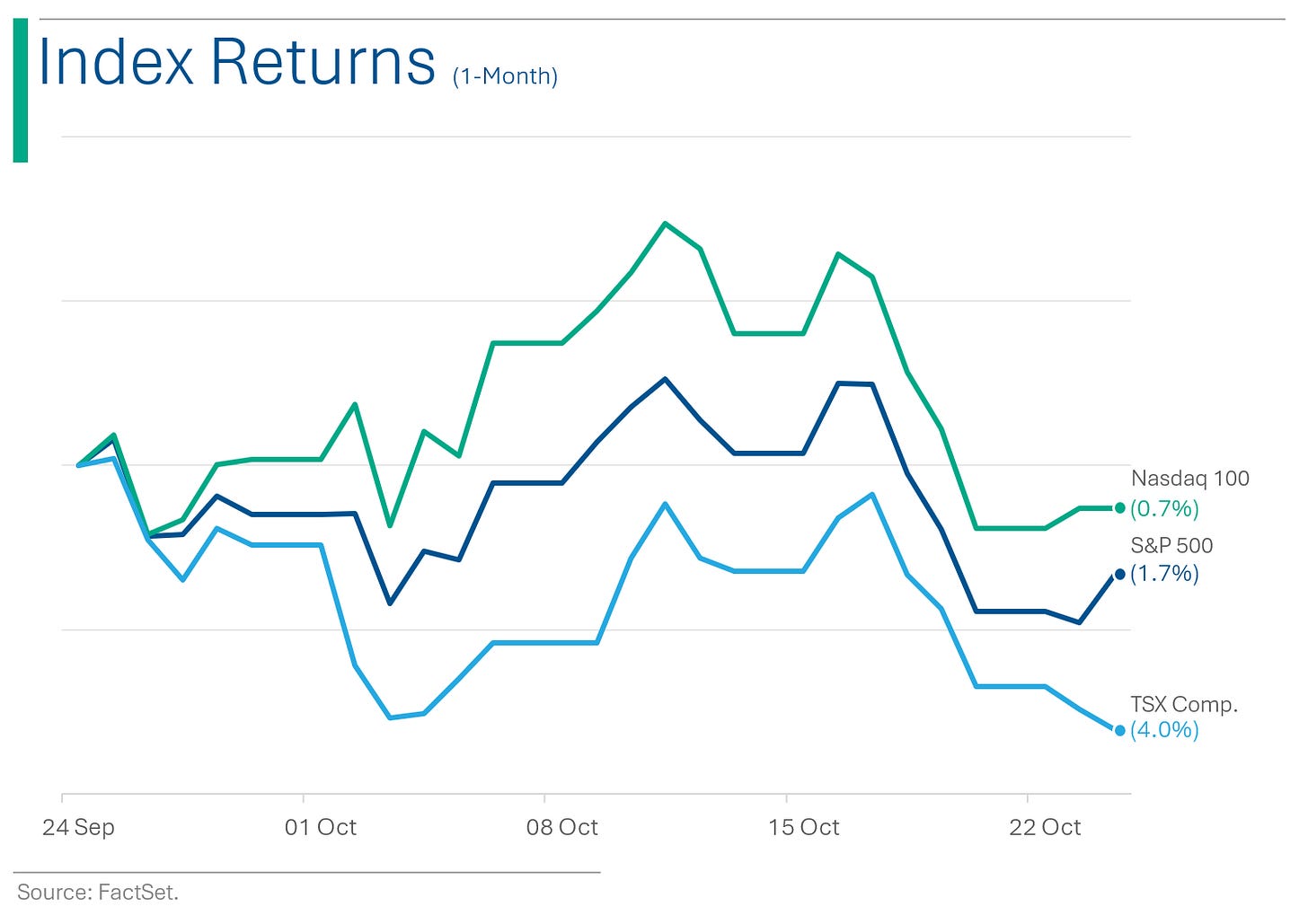

Above I show the S&P 500’s - labelled as ‘Large-Cap’ - performance since its 2023 high reached on July 31st. Since then the index is off nearly 8%. But as you can clearly see the Mid-Cap index (confusingly called the S&P 400) is down more (12%) and the Small-Cap Index (called the the S&P 600 no less) is down more still (14.4%).

Explainer: Now - the above chart isn’t a random occurrence. In fact, it’s a pretty well-known phenomenon. Technically speaking, smaller companies tend to get smoked during downturns. The rush to the exit is fueled by some of the more common risks associated with owning small-cap stocks, which include:

Liquidity Risk - small companies aren’t as actively traded and have fewer shares, so an investor’s ability to enter or exit a position is often trickier than it is with large caps. For larger investors, exiting a small-cap position quickly can move the price dramatically as finding buyers is more difficult. So if you smell a downturn coming, it behooves you to move on the weaklings first.

Recession Risk - there is evidence that smaller companies are more at risk during economic downturns. An example might be that if you have a massive contract with Tesla that represents most of your sales and they don’t pay you; well, you might give them some leniency since you need the business. Meanwhile, if a small owner-operating can’t pay, you will send her into bankruptcy and have her car repossessed.

Inflation Risk - smaller companies tend to have less dominant market positions. On the buying front, they tend to be ‘price takers’ vs. ‘price setters’. On the selling front, they tend to have more difficulty passing on price increases to customers as may not have large economies of scale to leverage to lower costs.

Credit Risk - typically, small companies have higher rates for raising capital - both debt (loans, bonds, etc.) and equity (shares) - due to their higher risk profiles (see 2 and 3).

Take-Aways: The chart above helps illustrate the situation: Small-cap stocks have a good chance of outperforming large-cap stocks when times are good (green column higher than blue column) but often do worse when times are bad. Often, monitoring the size-exposure of your portfolio is just as valuable as other factors such as industry or internal exposures.

If your view is that times may be rocky going forward, perhaps take a look at your portfolio for those little guys that might already be on the way to the wood shed.

Meta's Update Status After Lawsuit: 'It's Complicated' with 42 States

Bipartisan Effort: A substantial coalition of 42 state attorneys general, spanning both major political parties, have united to take legal action against Meta, asserting that its platforms, particularly Facebook and Instagram, deliberately employ addictive features targeting younger users.

Allegations and Accusations: The complaints focus on the platforms' design, from algorithm-driven content recommendations to infinite scroll functionalities, and their potential mental health implications, such as promoting body dysmorphia via "likes" and photo filters.

Past Legal Challenges: This isn't the tech giant's initial brush with legal controversies. In 2020, nearly as many states, along with the Federal Trade Commission, sued Meta on antitrust grounds, highlighting the company's contentious relationship with regulators.

A Larger Issue: While Meta is currently at the epicenter of this legal maelstrom, there are indications of an impending industry-wide investigation into social media practices. Other platforms like TikTok have also been under scrutiny, suggesting that the current lawsuits might be the tip of the iceberg for tech industry accountability. Anyway, I’m sure it's all just a misunderstanding around those totally innocent, not-at-all-manipulative algorithm designs, right?

Forecast Flubs: Dimon Dishes on Central Bank Missteps

JPMorgan Chase CEO Jamie Dimon criticized central banks for previous financial forecasting errors, urging caution regarding next year's economic outlook, especially given concerns about inflation and global growth slowdowns.

Dimon downplayed potential rate hikes' impact and drew parallels between today's economic conditions and the high spending of the 1970s.

He also criticized policymakers for their inefficient approach to addressing climate change, predicting delays in achieving necessary breakthroughs.

Joke Of The Day

Hot Headlines

(CNBC) UAW expands strike to crucial GM SUV plant in Texas hours after automaker reports earnings - The United Auto Workers union intensified its strike against General Motors by targeting its profitable SUV plant in Texas, shortly after GM reported robust third-quarter earnings. This move expands the ongoing strike that started on September 15, now involving over 45,000 UAW members. I feel like I talk about this strike everyday…

(Reuters) China to choose fiscal muscle over big reforms to revive economy - China plans to employ further fiscal stimulus, potentially exceeding its 2024 budget deficit target of 3% of GDP, to bolster its economic recovery amid concerns about diminishing private sector activity and a need for longer-term reforms. While the nation's post-pandemic growth has exposed structural constraints and ignited debates about sustainable reforms, immediate economic concerns and the political climate have prioritized short-term state spending over transformative change.

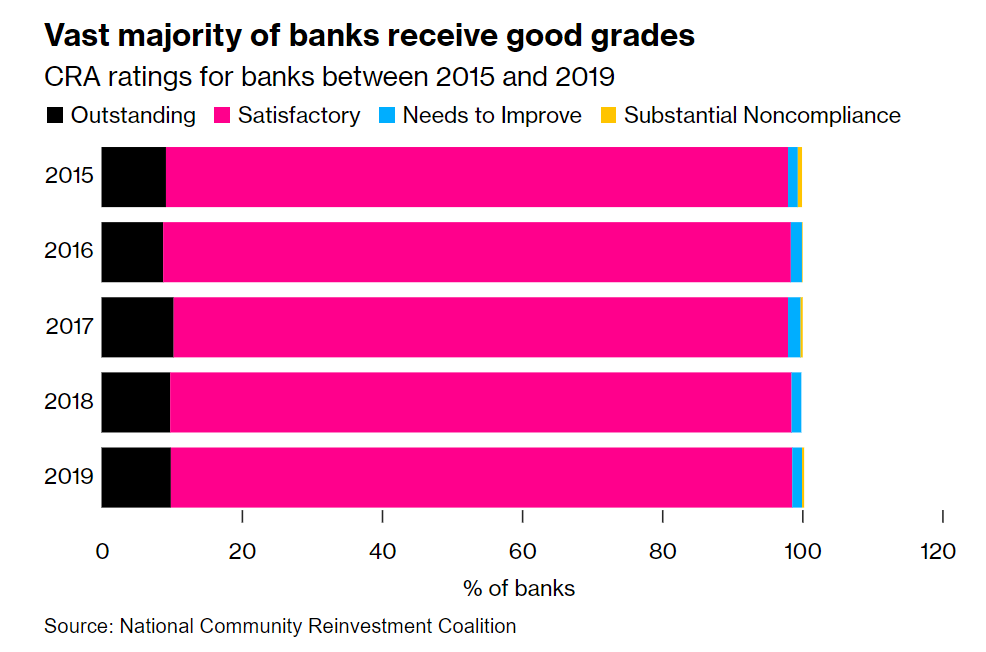

(Bloomberg) Big Banks Face Fresh Anti-Redlining Rules From Top US Regulators - U.S. banking regulators updated the 1977 Community Reinvestment Act (CRA) to now include online and mobile banking assessments. Amidst mixed feedback, the revised rule mandates large banks to disclose mortgage loan data by income, race, and ethnicity, shedding light on lending practices in diverse communities.

(WSJ) Pentagon Says Iran Ultimately Responsible for Attacks on U.S. Troops - The Pentagon attributes a series of drone attacks on U.S. bases in Iraq, Syria, and the Red Sea to Iranian-backed proxy forces, though without direct evidence of Tehran's orders, maintaining that Iran will be held accountable due to its support for these groups.

(Reuters) California sidelines GM Cruise's driverless cars, cites safety risk - New plant closures in the UAW strike; reported earnings (-2.3%) and pulled guidance; and now this. ALL IN ONE DAY! GM CEO Mary Barra probably had some a lot of wine last night.

Trivia

Barings Bank was the second older merchant bank in the UK until 1995 when it collapsed after a rogue trader lost £827 million punting futures contracts. Who was that trader?

Nick Leeson

Howie Hubler

Kweku Adoboli

Jérôme Kerviel

Bruno Iksil was a rogue trader at JP Morgan, that in 2012 lost the bank $6.2 billion from CDS trading. What was his nickname?

The London Whale

The Gorilla

Bruno the Badger

The Godfather

(answers at bottom)

Market Update

Trivia Answers

Nick Leeson. After a 4 year jail sentence, he apparently makes a killing on the lecture circuit.

The London Whale. Although, I’d just say he’s ‘husky’.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.