🔬Should You Buy Palantir (or just be scared of it)?

Plus: Jerome Powell heads to Jackson Hole; and much more!

“Monopoly is the condition of every successful business.”

- Peter Thiel

"The only limit to our realization of tomorrow will be our doubts of today."

- Franklin D. Roosevelt

Strong day for the big US markets with the S&P 500 +1.0% and Nasdaq +1.4%. This takes the S&P and Nasdaq to +4.9% and +6.5% since last Monday. Small-Cap decided to start working again with the Russell 2000 +1.2%.

All 11 sectors closed higher led by Tech and Consumer Discretionary (both +1.4%).

Notable companies:

fuboTV (FUBO) [+17.7%]: Court granted a preliminary injunction in favor of fuboTV against sports streaming service Venu (backed by Disney, Warner Bros. Discovery, and Fox).

HP, Inc. (HPQ) [-3.7%]: Downgraded to equal-weight from overweight by Morgan Stanley, noting PC market recovery and improved print hardware already priced into the stock.

Sweetgreen (SG) [-6.9%]: Downgraded to neutral from overweight by Piper Sandler; recent rally (+36% in August) balanced risk/reward despite optimism about Infinite Kitchen.

More below in ‘Market Movers’.

Street Stories

Should You Buy Palantir (or just be scared of it)?

The book ‘Conspiracy: Peter Thiel, Hulk Hogan, Gawker, and the Anatomy of Intrigue’ is a tale about how the celebrity gossip website Gawker outed Peter Thiel as being gay so he went on a years-long vendetta that eventually led to Gawker’s bankruptcy1.

A better title might be ‘Peter Thiel is the scariest man on the planet’.

That same scariest man is also the founder and largest shareholder of Palantir, the largest AI defense and military intelligence platform in the world. This is likely the backstory plot of a future Bond film about world domination.

If you can get over the concerns about Peter Thiel using his AI supremacy to take over the world, the next logical question is ‘are they a good company?’ Let’s have a look-see!

1. There is a movie being made about this staring Ben Affleck as Hulk Hogan and Matt Damon as Peter Thiel. Can’t make this s*** up.

To start, Palantir is divided into two divisions: Government (basically defense and military) and Commercial. And both divisions have been rocket ships.

To over-simplify things, Palantir operates three key platforms: Gotham, Foundry, and AIP.

Gotham is primarily used by government and commercial customers to identify hidden patterns within complex datasets, helping users transition from data analysis to real-world operational responses.

Foundry serves as a central operating system for organizations' data, allowing users to easily integrate, analyze, and experiment with data in a way that streamlines the development and understanding of data pipelines.

AIP enhances both Gotham and Foundry by integrating AI and large language models (LLMs) into their frameworks. This allows organizations to incorporate AI into decision-making processes with comprehensive security, audit controls, and human oversight throughout their workflows.

Like most AI products, to most of us that just sounds like fluffy words that mean very little. So for some better context, below are some cool videos by the company that summarize the businesses. And in the case of the Defense one, hint at the rise of Skynet.

Defense Video:

Business Video:

Shares of Palantir have crushed it since the company went public in 2020. And in the last two years alone, the company is up +240% compared to the S&P 500 up just +30%.

The shares also have a habit of shooting up when the company reports (grey bars below) as they frequently increase their guidance or provide increasingly bullish narratives to the stock.

Strong bookings growth and near perfect customer retention has also meant that the company hasn’t reported negative quarter-on-quarter revenue growth since going public.

The Street expects revenue growth to cool down in the coming years but still remain consistently in the double-digits.

That plus some crafty management of Wall Street expectations has meant that company has only missed on earnings once - and even then it was by ~$100k so that doesn’t really count.

However, some overly optimistic expansionary expenses in 2021/2022 cut the profitability of the business massively. Having lapped these, the company has been a solid ever since.

Just like with Palantir’s operating expense oopsies (above), Wall Street expectations got a bit over their skis in late-2021 during the ‘Everything Bubble’. They have since slammed back to earth like one of Peter Theil’s future kinetic AI drone strikes on dissidents and former Gawker employees.

Since this reset, the Street has grown continually bullish with a series of upgrades, typically following quarterly reports.

This is probably a good place to stop for today. Tomorrow I’ll dive into the operations and valuation.

JPow Heads To JHole

As Jerome Powell heads to Jackson Hole, all eyes are on his Friday speech to see if the Fed will finally (ffs) start trimming rates.

With both inflation and the job market cooling down, the question on everyone’s mind is just how much rates will drop by; in anticipation, markets have portrayed this sentiment with a volatile yield curve over the last year.

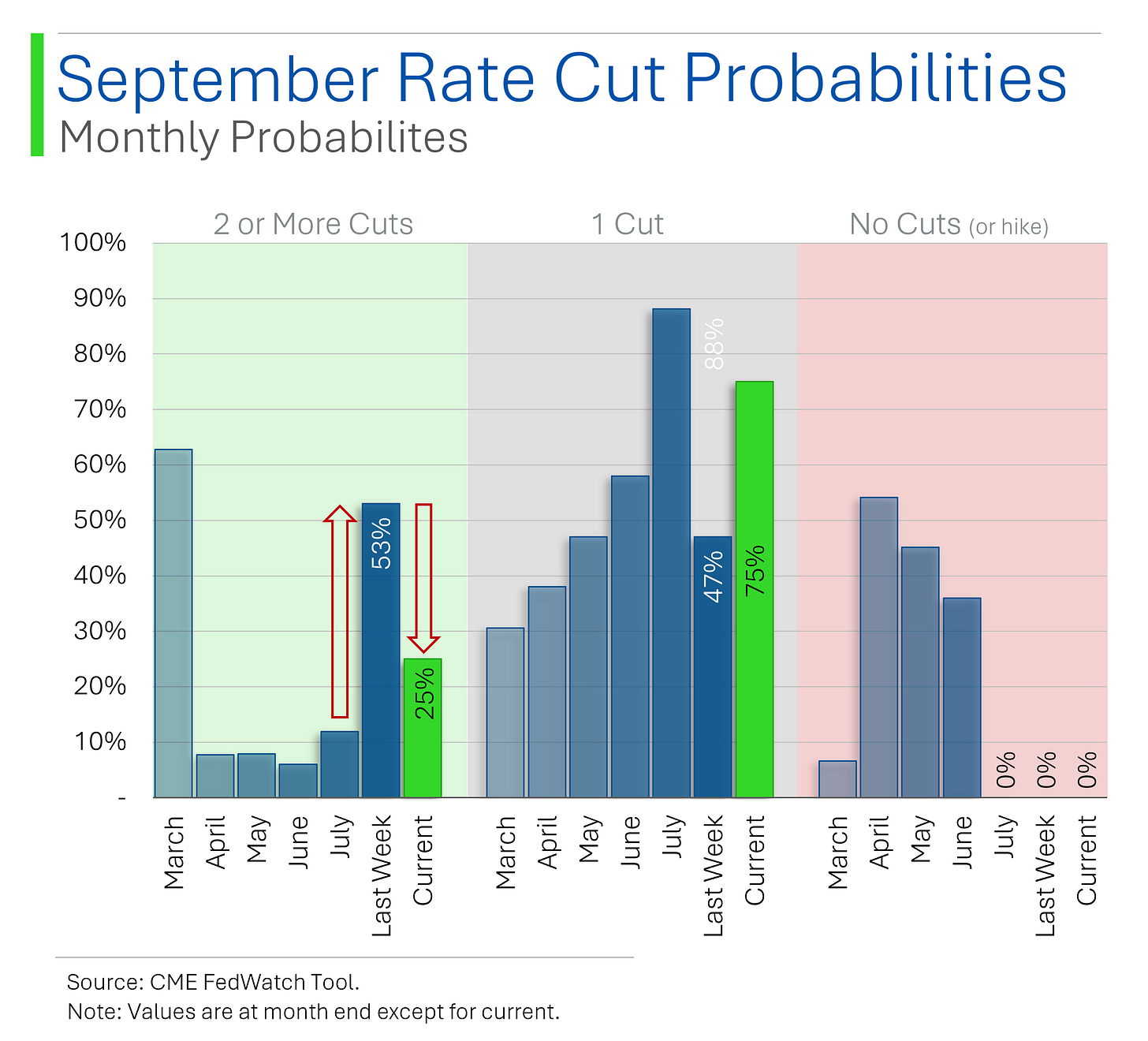

Historically, Powell’s Jackson Hole speeches have been market movers, and this year is no different. Investors are betting on a 75% chance of a quarter-point cut, a far cry from the 53% odds that were floating around just last week.

Joke Of The Day

I used to be a doctor but then I lost patients.

Hot Headlines

Nikkei Asia / Japan 7-Eleven parent to mull takeover offer from Canada's Couche-Tard. If successful, the proposed $31.5B deal would be the largest takeover by a foreign company the country has ever seen. For context Canadian M&A activity last year totaled just over $100 billion.

BNN Bloomberg / AMD to buy ZT Systems in $4.9 billion challenge to Nvidia. ZT Systems builds complex servers which are needed to house the massive arrays of GPUs needed in large scale AI.

CNBC / GM lays off more than 1,000 salaried software and services employees. Not a first for Detroit auto workers…

Yahoo Finance / Earnings call mentions of ‘recession’ dropped to 3 years low. Which means it won’t happen.

Yahoo Finance / Harris campaign says it would raise corporate tax rate to 28%. This represents a partial rollback of Trump's tax cut from 35% down to 21%, moreover, she maintained a pledge not to increase taxes on individuals earning under $400K.

Trivia

Today’s trivia is on Palantir Technologies

Palantir Technologies was co-founded by Peter Thiel in 2003. What was Thiel's primary vision for Palantir, which set it apart from other data analytics companies at the time?

A) To create a tool that could help intelligence agencies combat terrorism while preserving civil liberties

B) To develop a platform for financial institutions to optimize trading algorithms

C) To revolutionize the healthcare industry with advanced data analytics

D) To build a comprehensive social media data aggregation tool

Peter Thiel is a renowned entrepreneur and venture capitalist. Before co-founding Palantir Technologies, he achieved major success with another company that revolutionized online payments. Which company was that?

A) LinkedIn

B) SpaceX

C) PayPal

D) Stripe

Palantir Technologies was named after a mystical artifact from a popular fantasy series. What was the inspiration for the company’s name?

A) The Lord of the Rings

B) Dune

C) The Chronicles of Narnia

D) Game of Thrones

(answers at bottom)

Market Movers

Winners!

fuboTV (FUBO) [+17.7%]: Court granted a preliminary injunction in favor of fuboTV against sports streaming service Venu (backed by Disney, Warner Bros. Discovery, and Fox).

Zim Integrated Shipping Services (ZIM) [+16.7%]: Q2 earnings beat expectations; carried volume up 11% Y/Y. FY24 guidance raised due to strong H2 outlook driven by supply pressure from the Red Sea crisis and favorable demand.

United Therapeutics (UTHR) [+8.6%]: FDA gave tentative approval to LQDA's inhalation powder for pulmonary diseases but also granted UTHR three-year exclusivity for its dry-powder treprostinil.

Advanced Micro Devices (AMD) [+4.5%]: To acquire AI infrastructure provider ZT Systems for $4.9B in cash and stock; deal expected to close 1H-25.

Taylor Morrison Home (TMHC) [+3.1%]: Upgraded to buy from neutral by BTIG, citing confidence in long-term goals around construction, pricing, valuation, and balance sheet strength.

JB Hunt (JBHT) [+2.9%]: Announced a new $1B share buyback program.

Gates Industrial Corp. (GTES) [+2.2%]: Upgraded to outperform by RBC due to margin growth, personal mobility, China auto aftermarket, and India opportunities.

Losers!

Liquidia (LQDA) [-30.6%]: FDA delayed full approval of LQDA's treprostinil inhalation powder until UTHR's three-year exclusivity for its dry-powder formulation expires.

Sweetgreen (SG) [-6.9%]: Downgraded to neutral from overweight by Piper Sandler; recent rally (+36% in August) balanced risk/reward despite optimism about Infinite Kitchen.

Guess? (GES) [-4.8%]: Announced CFO transition; Markus Neubrand stepping down, Dennis Secor named interim CFO, effective Aug. 26.

Dutch Bros (BROS) [-3.9%]: Downgraded to neutral from overweight by Piper Sandler, citing balance sheet concerns and a tempered outlook for the fast-casual industry.

HP, Inc. (HPQ) [-3.7%]: Downgraded to equal-weight from overweight by Morgan Stanley, noting PC market recovery and improved print hardware already priced into the stock.

Shake Shack (SHAK) [-2.4%]: Downgraded to neutral from overweight by Piper Sandler, citing valuation and a tempered sentiment for the fast-casual sector.

Estée Lauder (EL) [-2.2%]: FQ4 EPS/revenue better than expected, but net sales down 2% Y/Y; CEO Freda to retire by FY25; weaker FQ1 and FY25 guidance due to softness in China and Asia travel retail.

Market Update

Trivia Answers

A) Peter Thiel's primary vision for Palantir was to create a tool that could help intelligence agencies combat terrorism while preserving civil liberties, distinguishing it from other data analytics companies.

C) Before co-founding Palantir Technologies, Peter Thiel achieved major success with PayPal, a company that revolutionized online payments.

A) Palantir Technologies was named after the "Palantíri," mystical seeing stones from J.R.R. Tolkien's The Lord of the Rings series.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

The fact analysts still expect relatively slower Revenue is a key reason why I am confident on my thesis.

The business momentum is real, everything is accelerating. ~30% Revenue CAGR is a real possibility.

Great post!