🔬Shopaholics: The Kroger-Albertsons Merger

Plus: Microsoft tries to save face after CrowdStrike; Nvidia is great but not good enough; and much more!

"Don’t let yesterday take up too much of today."

- Will Rogers

"The most valuable commodity I know of is information."

- Gordon Gekko, Wall Street

Sucky day for the big US markets on a light day of trading, with the S&P 500 -0.6% and Nasdaq -1.1%.

Only 2 of 11 sectors closed higher, and even those weren’t standouts (Financials: +0.3%; Health Care +0.1%). Tech (-1.3%) and Discretionary (-1.0%) got hit the hardest.

Biggest news was Nvidia’s Q2 reporting after close which came in hot but to bearish reactions over the guidance (more below).

Notable companies:

Super Micro Computer (SMCI) [-19.1%]: Delayed FY24 form 10-K filing to complete assessment of internal financial controls, following Hindenburg Research's allegations of accounting violations.

Abercrombie & Fitch (ANF) [-17.0%]: Q2 earnings beat expectations with raised FY25 guidance, but analysts noted concerns over a high bar and uncertain operating environment in the second half.

Chewy, Inc. (CHWY) [+11.1%]: Q2 earnings beat expectations with revenue in line, raised FY24 margin outlook, and positive analyst reaction to growth in active customers and significant capital returns.

More below in ‘Market Movers’.

Street Stories

Shopaholics: The Kroger-Albertsons Merger

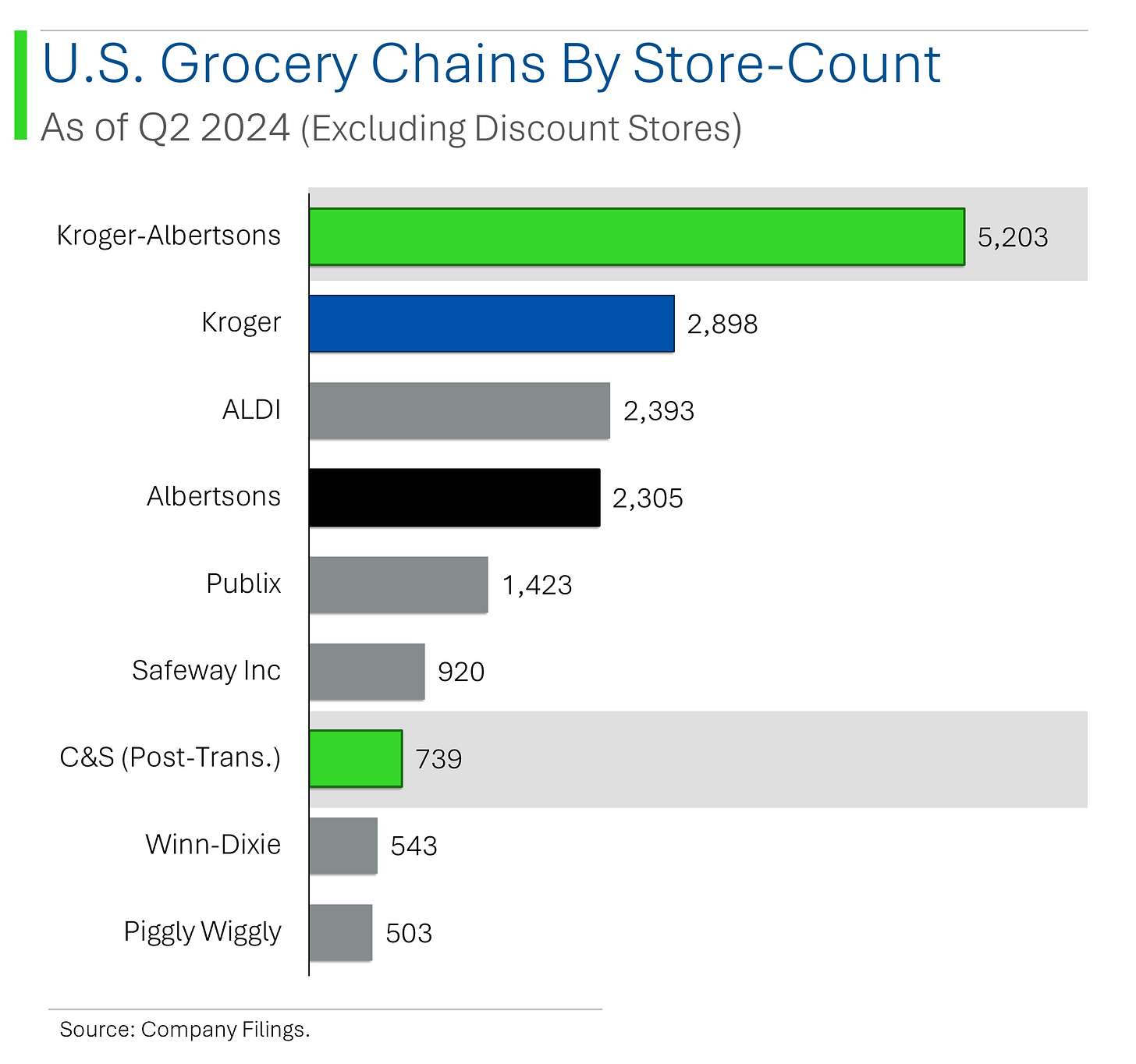

In the world of grocery giants, there’s a new player getting ready to shake things up. As Kroger's $20 billion bid to acquire Albertsons heads to the antitrust battlefield, the spotlight’s turning toward a lesser-known contender: C&S Wholesale Grocers.

The company, with more than a century of history under its belt, is gearing up to snag 579 stores from the Kroger-Albertsons deal for a cool $3 billion. This is a huge deal for them as they wouldn’t even make the top 25 today given their measly 160 stores.

The move? It’s all about easing those pesky competition concerns.

If C&S pulls this off, it’s set to leap into the grocery big leagues, ranking as the eighth-largest grocer in the U.S. However, it also puts the combined Kroger-Albertsons entity in the undisputed first spot.

However, the Federal Trade Commission is skeptical.

Kroger’s track record as an acquirer is under scrutiny, particularly after struggles in past acquisitions. With the trial beginning in Oregon, the fate of this mega-merger hinges in the balance…all I know is that prices will continue to go up for the rest of us. 💁

Microsoft’s Cybersecurity Summit: Addressing the Fallout…

Microsoft is hosting a cybersecurity summit on September 10th at its Redmond campus, and it’s not just a routine gathering. The summit follows a major fiasco in July, when CrowdStrike’s software update went disastrously wrong, crashing over eight million computers worldwide.

Delta Air Lines alone is still suffering a $550 million loss due to the chaos (but then again, maybe that was on them and the ‘quality’ of their leadership.)

At this summit, industry leaders will dive into how to prevent such digital disasters in the future.

A key focus will be on moving away from Windows’ vulnerable kernel mode, which played a big role in the meltdown, and shifting towards more secure options like user mode. Despite the massive disruption, analysts remain optimistic about CrowdStrike, projecting quarterly revenue to still hit around $960 million. However, there’s an expectation that new subscription bookings might slow down as confidence takes time to rebuild.

CrowdStrike’s stock dropped from $380 to $271 after the outage, but many see the dip as a buying opportunity, especially for long-term investors.

CEO George Kurtz will address the incident further during the company’s upcoming earnings call, as the industry seeks to prevent similar issues in the future.

My question is whether this is just a show. Or just straight from the PR Playbook.

Nvidia Slips After Earnings Despite Smashing Expectations

Nvidia just reported blockbuster earnings, with revenue surging 122% year-over-year and adjusted earnings per share (EPS) hitting $0.68, beating Wall Street’s expectations.

They also provided an impressive forecast for the next quarter, projecting $32.5 billion in revenue, well above analysts’ $31.9 billion estimate.

Yet, despite this stellar performance and the announcement of a massive $50 billion share buyback, Nvidia’s stock took a hit, dropping over 3.5% in after-hours trading.

So, what’s the deal? The market may be reacting to the sheer height Nvidia’s stock has climbed - up 150% this year alone. Even with “incredible” demand for its upcoming Blackwell chip, investors seem cautious, perhaps thinking the stock’s spectacular rise might have reached its peak.

Nvidia’s data center business, which brought in $26.3 billion this quarter (up 154% year-over-year), continues to dominate, but even that wasn’t enough to calm jittery traders. In a nutshell, Nvidia is firing on all cylinders, but in the world of high expectations, even a flawless quarter can spark some nerves.

And maybe there’s not enough money left on the sidelines to buy the stock? As you can see below, the buyside is fully invested.

Joke Of The Day

I had a nightmare of a day, the computers went down and everything had to be done manually. It took me ten minutes just to shuffle the cards for solitaire.

Hot Headlines

Business Insider / Former billionaire John Foley says he lost all his money and had to sell 'almost everything' after losing the Peloton CEO job. Apparently, Mr. Foley is selling off assets like Michael Jackson after the stock’s fall from grace…Now, what was that about taxing unrealized gains?

Yahoo Finance / US 30-year mortgage rate falls to lowest since April 2023. U.S. 30-year mortgage rates have dipped to 6.44%. The drop, spurred by hints of future Fed rate cuts, has homeowners rushing to refinance, while potential buyers still wait on the sidelines.

Yahoo Finance / Google and Meta employees are apparently getting jealous of their wealthy Nvidia peers. Nvidia’s stock surge, in conjunction with a generous ESOP has turned its employees into tech’s new rich kids on the block, and it’s making Google and Meta workers a bit green. In an industry where talent is everything, this could have real effects on the on the silicon valley labour force.

Barron’s / Call it the Mag8 as Berkshire Hathaway joins the $1 Trillion Club. Berkshire Hathaway crossed the $1 trillion market cap for the first time, making it the eighth U.S. company to achieve this milestone. The company's Class B shares rose 0.9% on Wednesday, bringing its year-to-date gain to 30.3%, the best since 2013. Berkshire's market value increase of $224.1 billion this year is more than the entire market cap of major companies like American Express and McDonald’s.

Yahoo Finance / Super Micro stock plunges 19% after company delays annual report following short-seller report. Super Micro’s stock nosedived 19% after delaying its annual report, thanks to Hindenburg’s claims of shady accounting. The AI darling’s once sky-high shares are now down over 60% from their peak, leaving short-sellers grinning all the way to the bank.

CNBC / OpenAI in talks to raise funding that would value it at more than $100 billion. OpenAI is looking to raise more cash, aiming for a whopping $100 billion valuation. Thrive Capital is ready to drop $1 billion into the pot, with Microsoft also in the mix. This investment is already looking pretty great on Microsoft’s balance sheet…that said, didn’t Altman tell Congress they were a non-profit?

Trivia

Today’s trivia is on the history of computers!

Who is often referred to as the "father of the computer" for designing the first mechanical computer, known as the Analytical Engine, in the 19th century?

A) Alan Turing

B) Charles Babbage

C) John von Neumann

D) Ada LovelaceWhich programming language, created in the 1970s by Dennis Ritchie at Bell Labs, became one of the most widely used languages in the world, especially for system and application software?

A) BASIC

B) Python

C) C

D) JavaWhich company introduced the first personal computer (PC) with a graphical user interface (GUI) that became widely popular in 1984?

A) IBM

B) Microsoft

C) Apple

D) XeroxThe first commercially successful portable computer, introduced in 1981, was called the Osborne 1. What was its weight?

A) 5 pounds

B) 12 pounds

C) 24 pounds

D) 32 pounds

(answers at bottom)

Market Movers

Winners!

Chewy, Inc. (CHWY) [+11.1%]: Q2 earnings beat expectations with revenue in line, raised FY24 margin outlook, and positive analyst reaction to growth in active customers and significant capital returns.

Box, Inc. (BOX) [+10.8%]: Q2 EPS and revenue beat, with raised FY25 EPS guidance and slight revenue midpoint increase; management noted stability in seat growth, AI tailwinds, and product upgrades.

Ambarella (AMBA) [+10.6%]: Q2 results exceeded expectations, with Q3 revenue guidance ~15% above consensus driven by double-digit growth in IoT and Auto segments.

AeroVironment (AVAV) [+9.1%]: Awarded a $990M hybrid contract by the U.S. Army to provide dismounted infantry with stand-off capabilities to destroy tanks, vehicles, and personnel.

Nordstrom (JWN) [+4.2%]: Q2 EPS beat with revenue slightly ahead, driven by a strong Anniversary Sale and digital momentum, leading to raised FY24 guidance despite higher expenses.

e.l.f. Beauty (ELF) [+1.4%]: Announced a $500M share repurchase program.

Losers!

Super Micro Computer (SMCI) [-19.1%]: Delayed FY24 form 10-K filing to complete assessment of internal financial controls, following Hindenburg Research's allegations of accounting violations.

Neurocrine Biosciences (NBIX) [-18.9%]: Phase 2 study for Schizophrenia met primary endpoint, but higher doses were less effective, with benefits below expectations and competition.

Abercrombie & Fitch (ANF) [-17.0%]: Q2 earnings beat expectations with raised FY25 guidance, but analysts noted concerns over a high bar and uncertain operating environment in the second half.

Polestar Automotive (PSNY) [-16.4%]: CEO Thomas Ingenlath resigned, effective 1-Oct, with Michael Lohscheller set to replace him.

Patterson Cos. (PDCO) [-12.5%]: Fiscal Q1 revenue and EPS missed expectations due to cybersecurity impact and lower sales in the companion animal business, but FY EPS guidance remained unchanged.

Foot Locker (FL) [-10.2%]: Q2 earnings beat with FY24 guidance reaffirmed, but analysts expressed disappointment over guidance amid elevated expectations.

Bath & Body Works (BBWI) [-7%]: Q2 earnings in line, but Q3 guidance missed, with lowered FY24 revenue growth expectations and concerns over a choppy macro environment.

PVH Corp (PVH) [-6.4%]: Q2 revenue slightly better with a big EPS beat, but Q3 guidance below expectations, raising concerns over slowdowns in China and the US.

J. M. Smucker (SJM) [-5%]: Q1 earnings beat with revenue in line, but FY25 forecasts were cut due to inflationary pressures and weaker consumer spending in certain categories.

Shake Shack (SHAK) [-2.6%]: Announced the closure of 9 underperforming stores with significant pretax charges in Q3, while reaffirming Q3/FY guidance.

Market Update

Trivia Answers

Charles Babbage is often referred to as the "father of the computer" for his design of the Analytical Engine.

The programming language created by Dennis Ritchie in the 1970s is C.

Apple introduced the first widely popular PC with a GUI, the Macintosh, in 1984.

The Osborne 1, the first commercially successful portable computer, weighed 24 pounds.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

great work! Greetings from germany