🔬Sequel Fatigue: Paramount's Acquisition Saga, Part 100

Plus: Surprise Employment Revision Increases Odds of Double Rate Cut; and Much More!

"A market is the combined behavior of thousands of people responding to information, misinformation, and whim."

- Kenneth Chang

"The only way to make sense out of change is to plunge into it, move with it, and join the dance."

- Alan Watts

Solid day for the big US markets with the S&P 500 +0.4% and Nasdaq +0.6%. Weak employment revisions sent the market lower but the Fed’s July Meeting Minutes flipped that, all but confirmed a September rate cut.

9 of 11 sectors closed higher, led by Consumer Discretionary and Materials (both +1.2%).

Notable companies:

Target (TGT) [+11.2%] Q2 comp growth, GMs, and EPS exceeded forecasts, with strong traffic and improving discretionary sales trends, particularly in apparel.

Macy's (M) [-12.9%] Q2 EPS beat but revenue missed; merchandise inventories up 6% y/y, with FY25 EPS reaffirmed but revenue and comp guidance cut due to a more cautious consumer and heightened promotions

JD.com (JD) [-4.2%] Bloomberg reported that Walmart sold 144.5M shares of JD.com at $24.95 a share, raising $3.6B, with the sale price representing an 11% discount to the prior close.

More below in ‘Market Movers’.

Street Stories

Sequel Fatigue: Paramount's Acquisition Saga, Part 100

Just when it seemed like Skydance Media had Paramount Global in the bag, plot twist!

Edgar Bronfman Jr. has swooped in with a $4.3 billion counteroffer. Skydance, backed by RedBird Capital and led by David Ellison, had inked a deal to acquire Shari Redstone’s controlling stake in National Amusements, giving them the keys to Paramount.

The Skydance deal, valued at $28 billion, promised sweet premiums to Paramount’s Class B shareholders and would see Ellison and former NBCUniversal CEO Jeff Shell running the show.

…But the deal included a 45-day window for better offers, and Bronfman didn’t miss his chance. His bid includes $2.4 billion for National Amusements, $1.5 billion to ease Paramount’s debt, and a $400 million breakup fee if Skydance is left in the dust.

Since the situation is a bit weird (like why does some National Amusements company matter when buying Paramount, a public company?) I thought I would lay out the particulars above.

In essence, only 11.9% of Paramount’s market cap is from it’s Class A shares but they control 100% of the voting rights. Shari Redstone’s National Amusements owns 77.4% of said Class A shares, meaning she has complete control over Paramount’s fate and no deal can go through without her consent.

And she plays hardball…

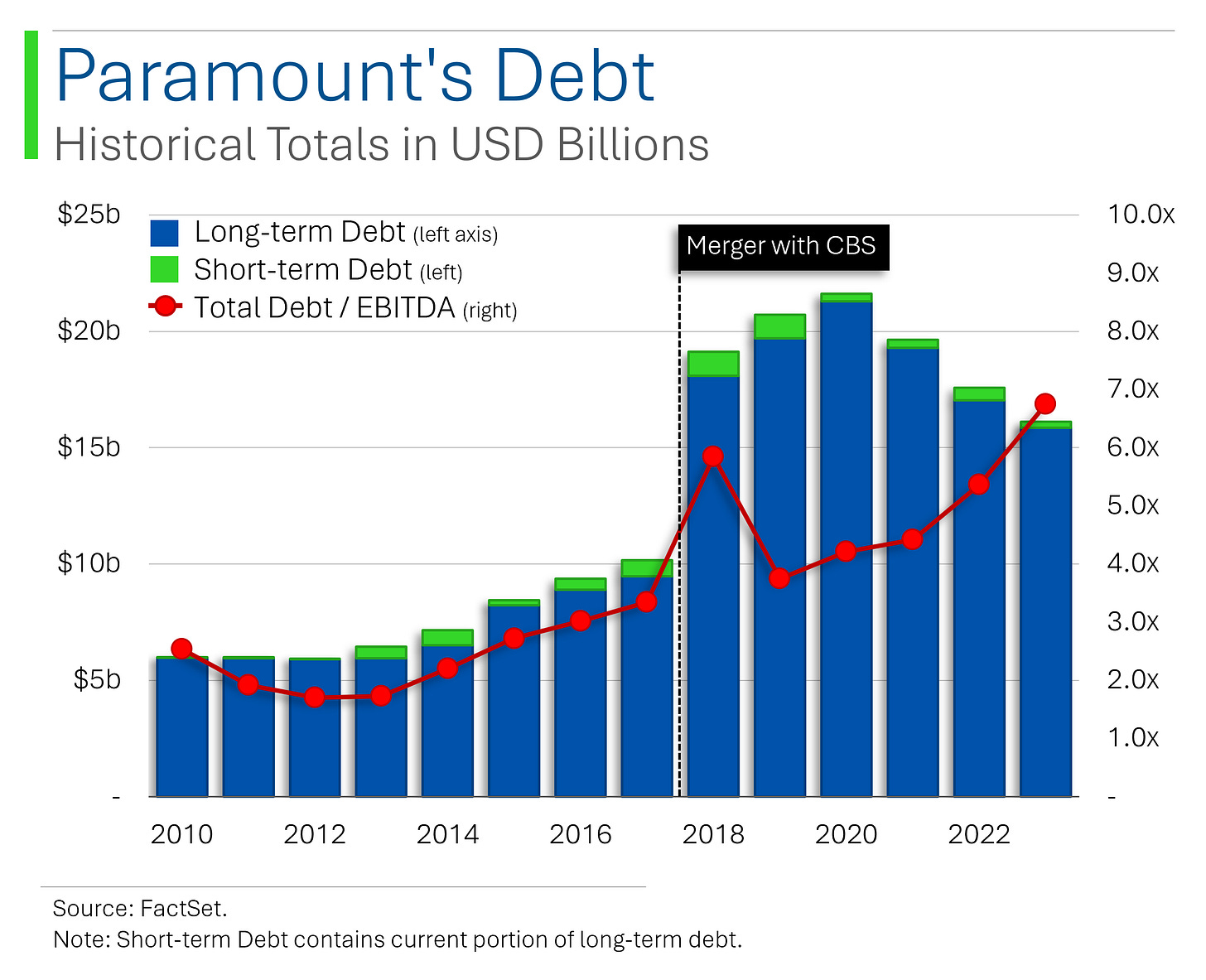

Of paramount concern (tehehe) is the buyer kicking in funds to lower the company’s massive debt load. That debt has been shrinking nicely these last few years but profitability has shrunk even faster, meaning that their Total Debt to EBITDA ratio (a common measure of financial health) has now moved into the stratosphere.

The dumbest part of the deal is that if Bronfman is successful he’ll be on the hook to Skydance for the $400 million breakup-fee for scuttling their deal. Imagine being in discussions with Paramount since 2023 (like Bronfman was); passing on making an offer (like Bronfman did); only to wait just long enough so you’d be on the hook for a massive breakup-fee to make your move (like Bronfman did).

Sons of billionaires often do s*** like this.

The Great Employment Revision

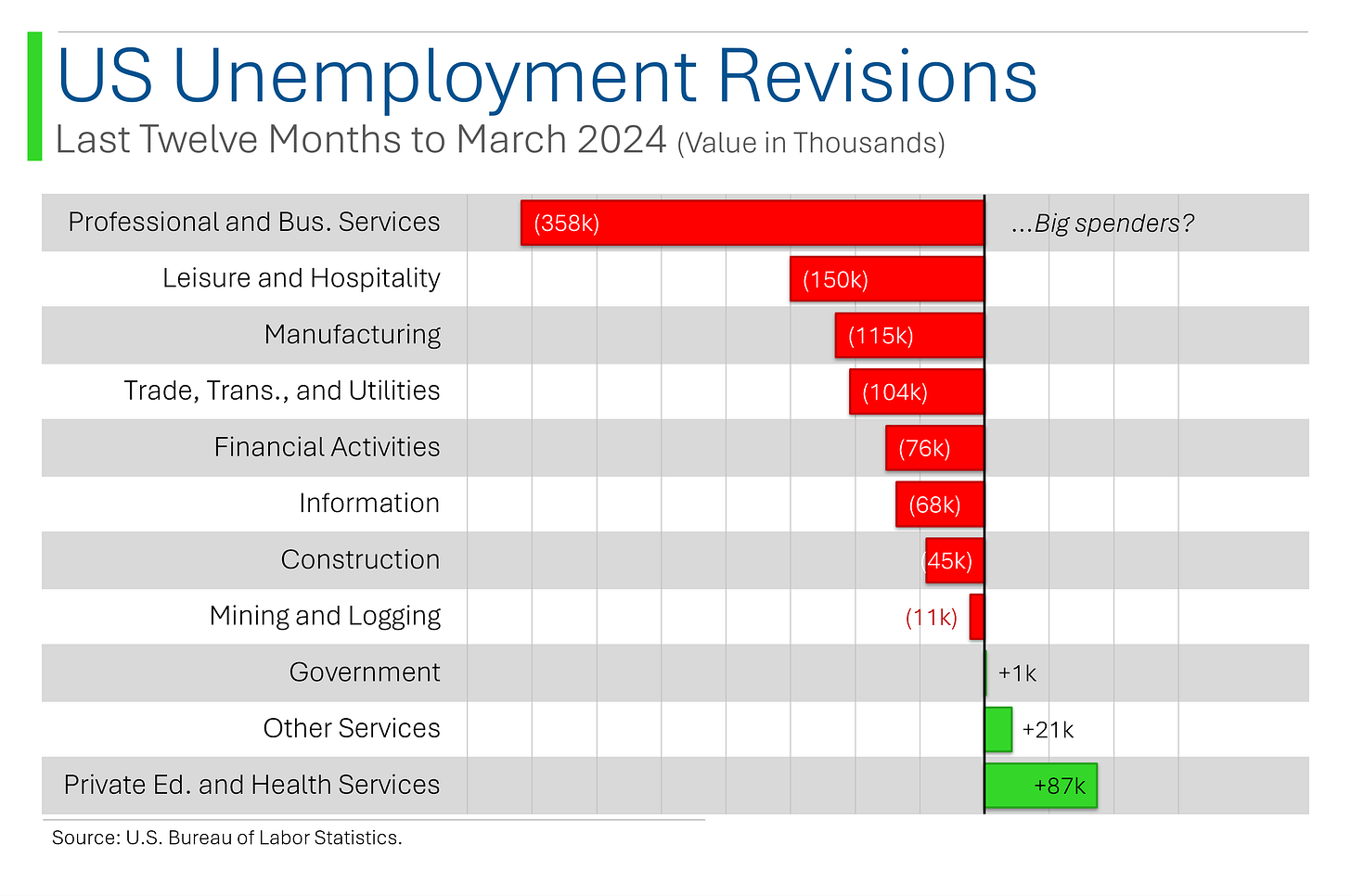

New data from the Bureau of Labor Statistics reveals that the U.S. economy added 818,000 fewer jobs than initially reported between April 2023 and March 2024.

The once-celebrated 2.9 million new jobs have now been scaled down to a more modest 173,500 per month, with the majority coming from professional services (generally a high salaried bunch of folks to boot).

I guess we can’t bank on lifestyle-creep saving the economy eh?

This unexpected revision complicates things for the Federal Reserve, which might need to pay closer attention to labour market conditions alongside inflation.

Specifically, that while the market is still pricing in a 25 basis-point rate cut, these revisions were the likely culprit in pushing the probability of a 50 basis-point cut up significantly over the last 24 hours.

With that said, JPow and friends will be watching the August employment figures like a hawk and based on the measly 114,000 jobs that were added in July, we’ll be walking a fine line to say the least.

Joke Of The Day

Humpty Dumpty had a great fall. He said his summer was pretty good too.

Hot Headlines

CNBC / Ford delays new EV plant, cancels electric three-row SUV as it shifts strategy. Ford's Tennessee plant was set to start vehicle production next year, but that's been delayed. Battery cell production is still on for 2025, with CFO John Lawler aiming for a more efficient, profitable electric future.

CNBC / Five bodies recovered in wreckage of superyacht that sank off Sicily. Quite a few of the ultra-wealthy were on this boat such as tech billionaire, Mike Lynch and Morgan Stanley International Chair Jonathan Bloomer. However, authorities have not released the names of the bodies recovered.

NY Times / Consumers are bargain shopping, Macy’s and Target Q2 reports show. Department store chain Macy’s had a rough Q2 but discounters Target and T.J. Maxx saw strong growth as increasingly stretched consumers navigate down channel. Target was +11% yesterday while Macy’s was -13%.

Business Insider / See inside the NYC-sized area of Russia that Ukraine seized in its lightning offensive. Ukraine launched a surprise offensive into Russia's Kursk region, seizing 488 square miles and catching enemy forces off guard. Despite the chaos, Ukraine is focusing on aiding civilians in the newly occupied territories.

Washington Post / Democrats use oversize text of Project 2025 to warn of Trump, GOP agenda. At the DNC, Rep. Malcolm Kenyatta hoisted a massive book, calling Project 2025 a blueprint for economic chaos. Democrats are making sure everyone knows it’s Trump’s not-so-secret playbook.

Trivia

Today’s trivia is on the U.S. Military.

The U.S. military is composed of multiple branches. Which branch is the oldest, having been established before the United States was officially a country?

A) U.S. Army

B) U.S. Navy

C) U.S. Marine Corps

D) U.S. Air ForceMilitary spending is a significant part of the U.S. federal budget. As of recent years, what percentage of the federal budget is allocated to defense spending?

A) 10%

B) 15%

C) 20%

D) 25%The U.S. military has bases around the world. Which country hosts the largest number of U.S. military personnel outside of the United States?

A) Germany

B) Japan

C) South Korea

D) ItalyThe U.S. military is known for its advanced technology. Which branch is responsible for operating the U.S. military’s nuclear triad, which includes land-based missiles, submarine-launched missiles, and strategic bombers?

A) U.S. Navy

B) U.S. Army

C) U.S. Air Force

D) U.S. Marine Corps

(answers at bottom)

Market Movers

Winners!

B. Riley Financial (RILY) [+45.7%] Oaktree Capital is in talks to acquire majority stakes in two of B. Riley's businesses, valuing the units at around $380M.

BigBear.ai Holdings (BBAI) [+27.1%] Announced a 10-year $2.4B contract, alongside Concept Solutions, to provide IT solutions and emerging tech to the FAA.

Keysight Technologies (KEYS) [+13.9%] FQ3 EPS and revenue beat expectations, with solid FQ4 guidance and strong H2 order growth, particularly in AI-driven communications and geopolitical defense spending.

Target (TGT) [+11.2%] Q2 comp growth, GMs, and EPS exceeded forecasts, with strong traffic and improving discretionary sales trends, particularly in apparel.

Vector Group (VGR) [+8.2%] To be acquired by JT Group for $15 per share, representing a $2.4B total equity value and a 7% premium to Tuesday’s close.

TJX Cos. (TJX) [+6.1%] Q2 EPS, revenue, and comps beat expectations, with raised FY25 EPS and momentum into Q3, particularly in HomeGoods.

Toll Brothers (TOL) [+5.6%] Fiscal Q3 EPS beat expectations despite missed orders, with the company raising FY EPS guidance and noting strong July and August trends.

Corning (GLW) [+3.3%] Upgraded to outperform by Mizuho Securities due to valuation after a recent pullback.

Woodward (WWD) [+3.2%] Upgraded to buy by Truist, citing growth re-acceleration in Defense OEM revenues after five years of decline.

Texas Instruments (TXN) [+2.9%] Upgraded to buy by Citi, citing lower capex and signals that GMs are bottoming.

Losers!

Macy's (M) [-12.9%] Q2 EPS beat but revenue missed; merchandise inventories up 6% y/y, with FY25 EPS reaffirmed but revenue and comp guidance cut due to a more cautious consumer and heightened promotions.

Franklin Resources (BEN) [-12.6%] Bloomberg reported that federal prosecutors are investigating "cherry-picking" accounts during the trade allocation process at its Western Asset Management subsidiary.

Dycom Industries (DY) [-7.6%] Q2 EPS beat with revenue in line, though Q3 contract revenue guidance fell short; acquisition of Black & Veatch's public carrier wireless business was announced, with analysts bullish on data center commentary.

JD.com (JD) [-4.2%] Bloomberg reported that Walmart sold 144.5M shares of JD.com at $24.95 a share, raising $3.6B, with the sale price representing an 11% discount to the prior close.

American Express (AXP) [-2.7%] Downgraded to neutral by BofA, citing limited upside due to subdued billings volume growth, challenges in the travel sector, and its current premium valuation.

Market Update

Trivia Answers

A) The U.S. Army is the oldest branch, established in 1775.

C) About 20% of the federal budget is allocated to defense spending.

B) Japan hosts the largest number of U.S. military personnel outside of the United States at around 55k across 15 bases.

C) The U.S. Air Force is responsible for operating the nuclear triad.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.