September - In Chart Form!, The 'Shutdown Can' Has Been Kicked, And Much More

Street Smarts Morning Note

“Time in the market, beats timing the market”

-Ken Fisher

“One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute”

-William Feather

Table of Contents

September In 5 Charts: Cruel (End Of) Summer)

U.S. Debt Is Ballooning

Fmr. Crypto King SBF’s Trial Starts Tuesday

Congress Averts Last Minute Shutdown

Japan Ceases Huge Used-Care Trade With Russia

UAW Strikes a Deal with Mack Trucks

Trivia

Joke Of The Day

Fun Fact

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

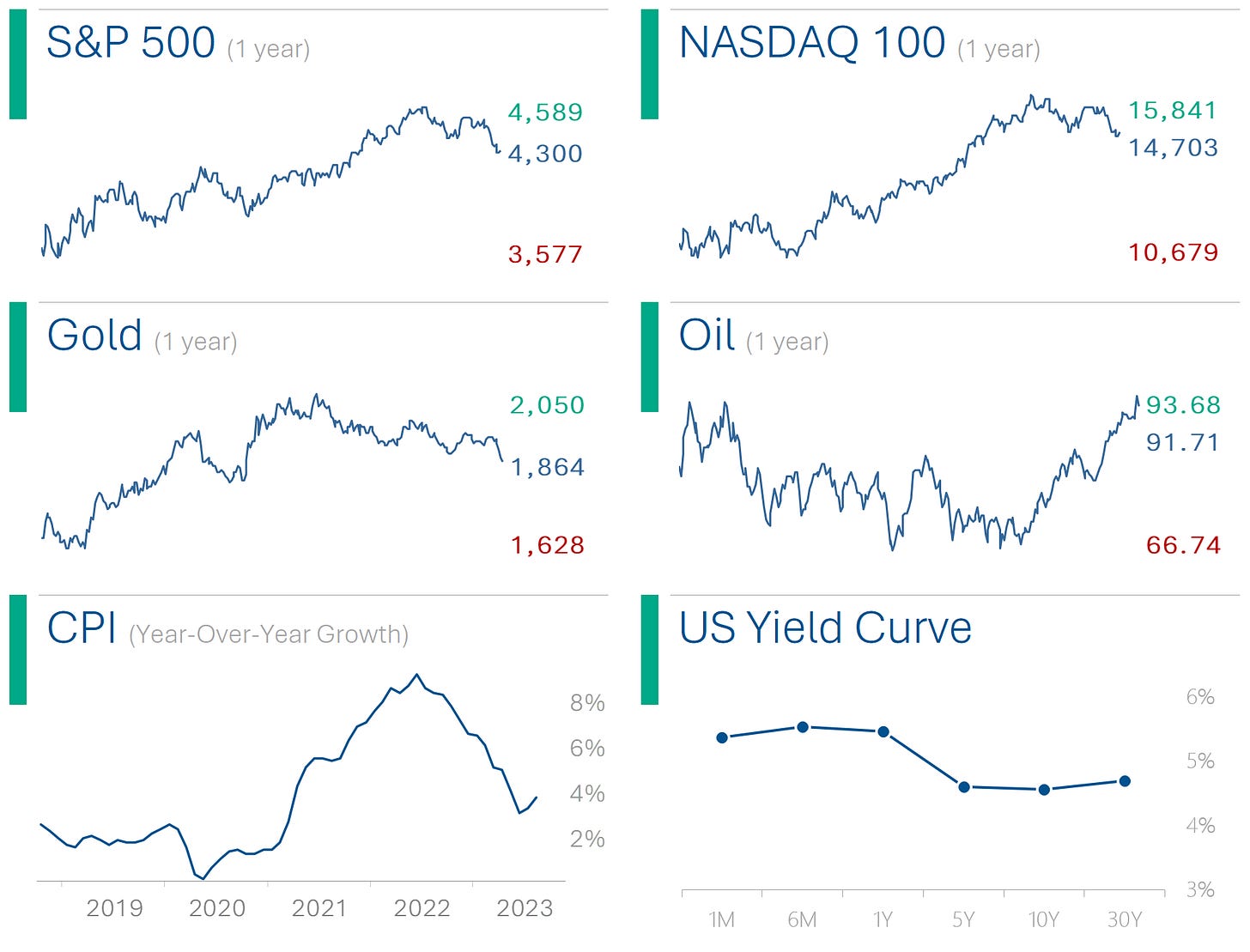

September In Charts

Cruel (End Of) Summer

September was an odd month for financial markets, with significant financial events dominating the headlines that overshadowed most of what was taking place at the company level (I mean, we kicked off Q3 reporting season and almost no one is talking about it.)

Below I summarize what I see as the big, market moving themes of this past month. Namely:

The weak stock market

The rally in oil prices

Inflation that doesn’t want to go away

The new expectation for interest rates

The opening of the market for Initial Public Offerings

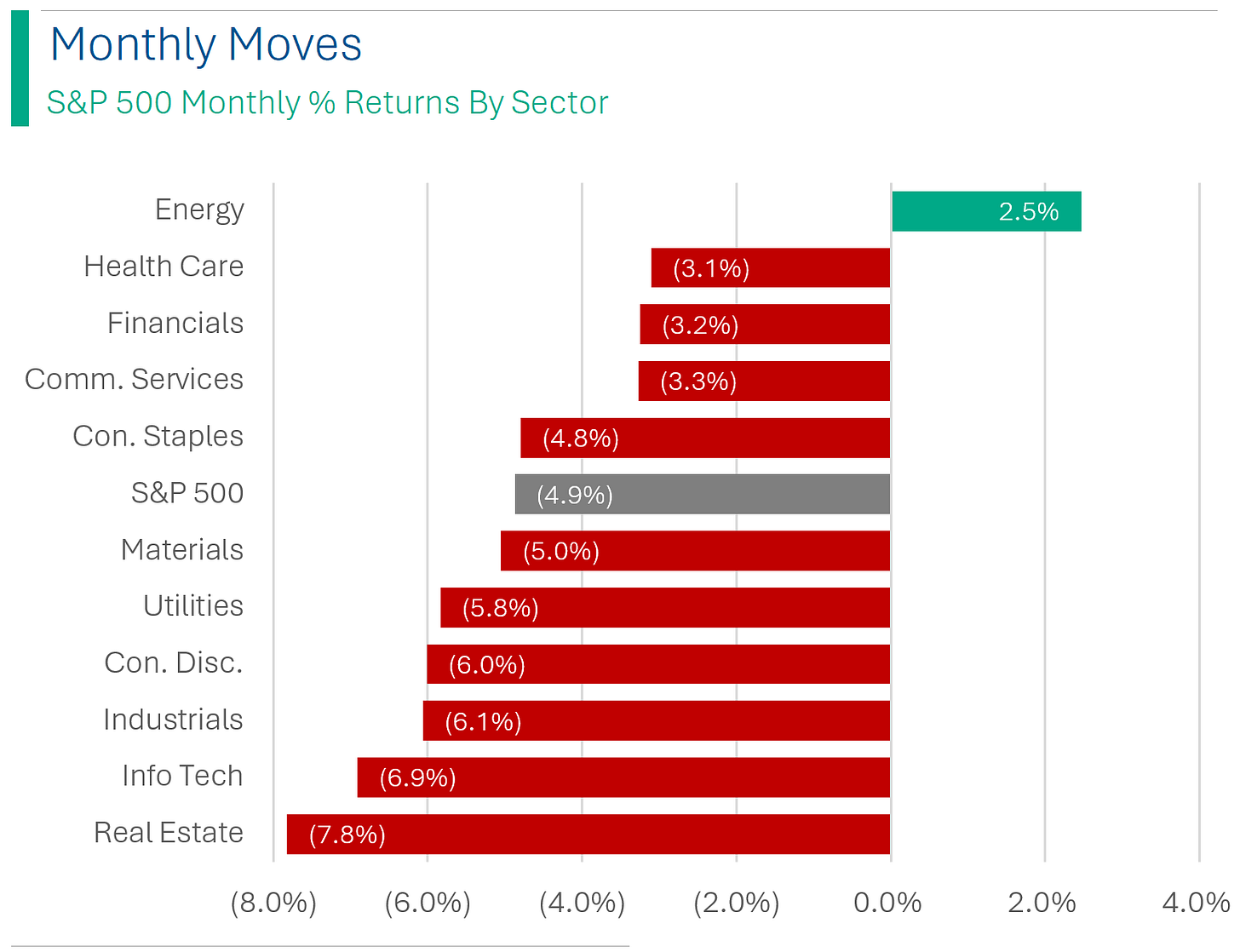

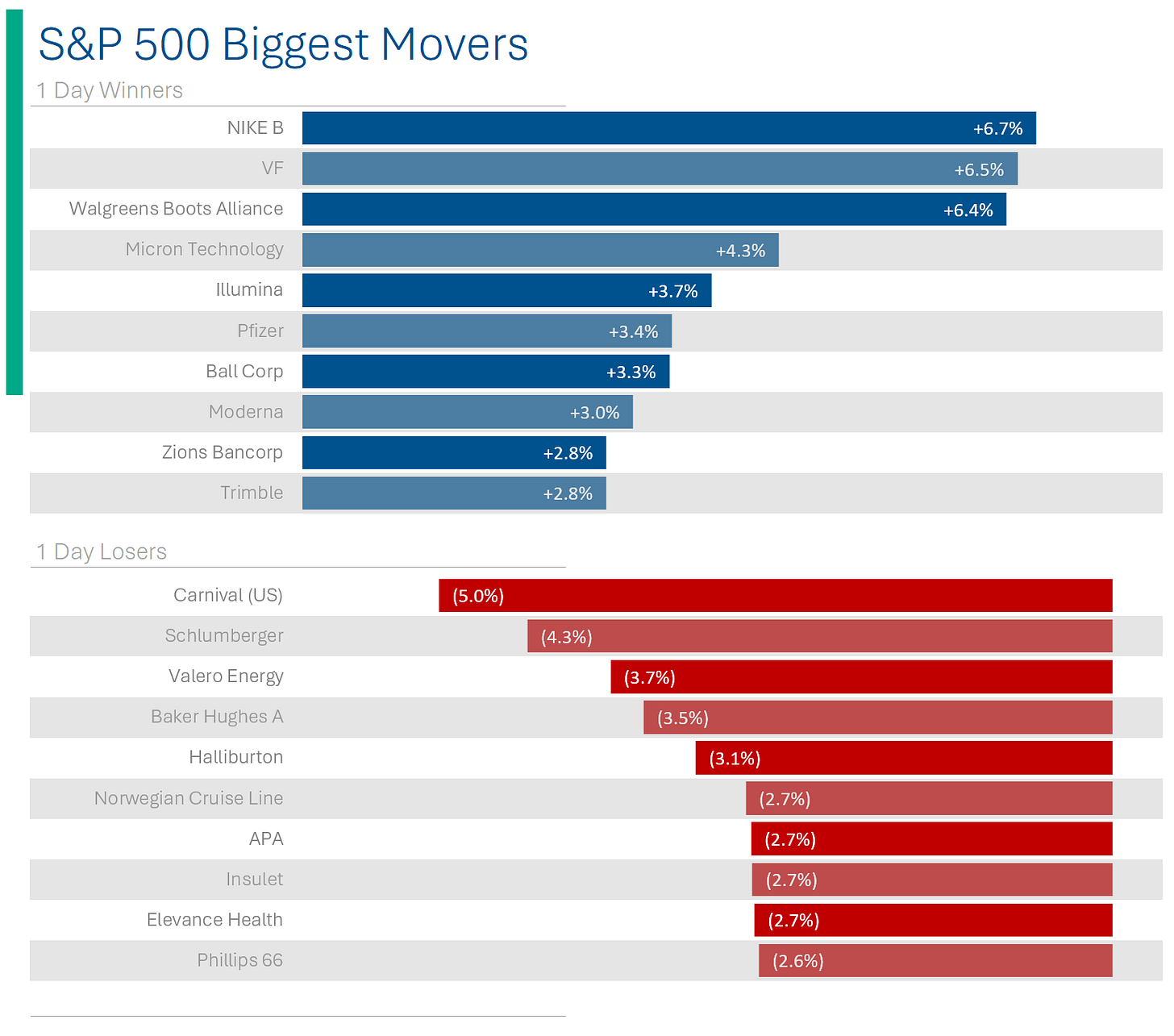

The Stock Market

The S&P 500 follows the 500 (or so) largest companies in the US and represents a good gauge for the stock market more broadly. September was the worst month of the year for the S&P 500, dropping 4.9%.

The only sector within the S&P 500 that was up last month was Energy (more on this under ‘Oil Price’ below) while ‘high flying sectors’ like Info Tech (+34% for the year) and Consumer Discretionary (+26% for the year) helped drag the sector down. There are many reasons behind these moves, but just to unpack a few of the more important ones:

Cyclical Stocks - Cyclicals are stocks that are impacted by macroeconomic events, primarily ones that impact people’s ability to consume (buy) products. Unemployed? You buy less stuff. Prices have gone up across the board? You buy less stuff. Your mortgage payment went up, your student loan payments resumed, and it costs you an extra $50 a month to fill up the tank? You buy less stuff. The economic environment appeared to weaken this month so stocks that are more exposed to weaker disposable income or capital goods spending were impacted.

Sensitivity to Interest Rates - Real Estate is obvious here: the average mortgage rate in the US is now +7%. That doesn’t help prospects for home builders and developers, nor the people that sell things to home-builders and developers. It also impacts companies that are highly levered (ie: borrow heavily) like Utilities. It is also bad for companies that are looked at as ‘income investments’ - specifically: if safe, steady bonds pay more interest, people are more inclined to sell their steady, predictable dividend paying stocks in favor of these bonds. It also affects stocks due to the ‘time value of money’ but we’ll save that for another day.

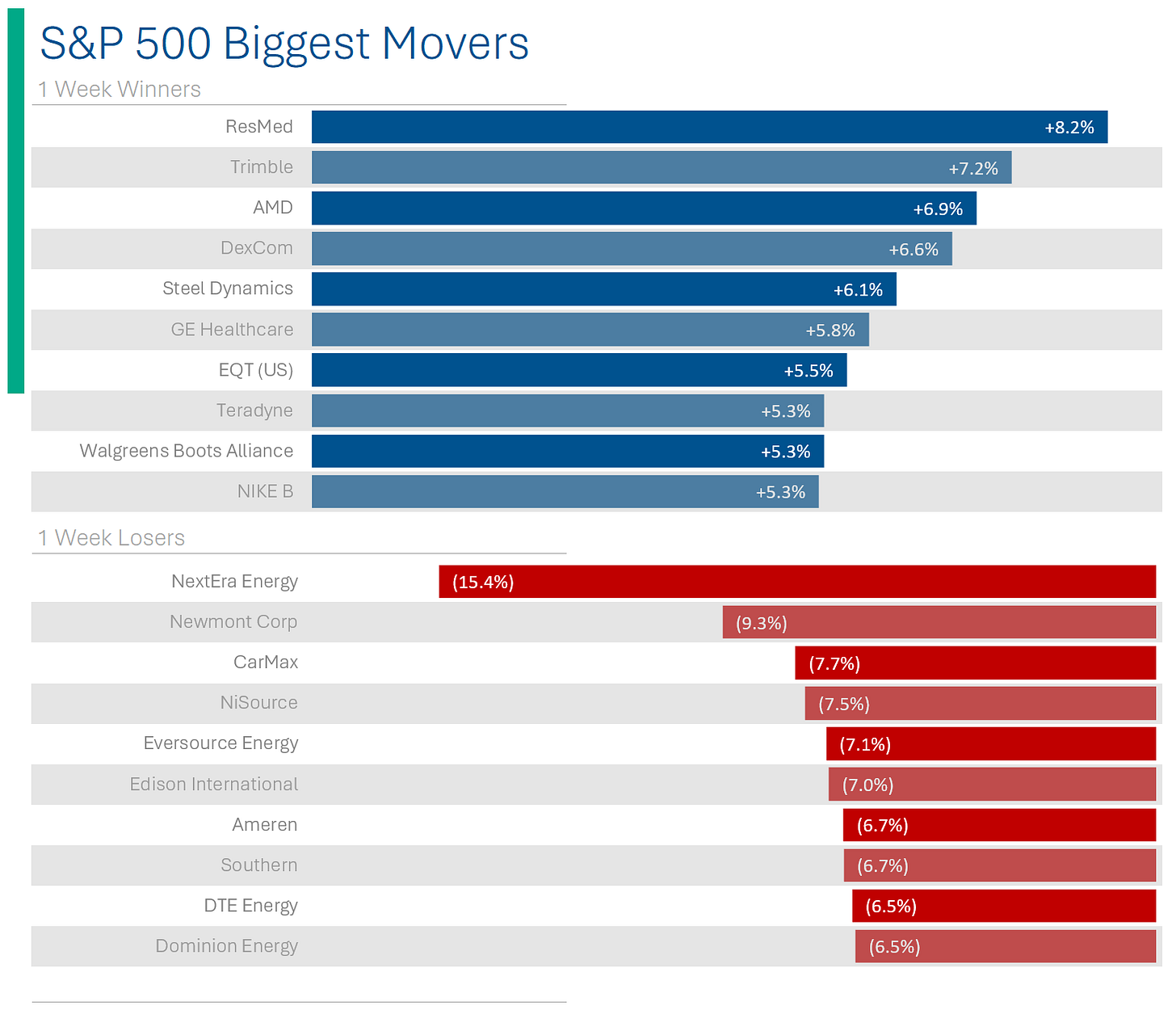

As mentioned above, an individual stock’s innate qualities seemed to be on the backburner this month, and stocks that fell the hardest were ones that were most exposed from a sector perspective (cyclical, exposed to interest rates, etc.) or have been on dramatic runs that some (including me) felt had grown long-in-the-tooth and were ripe for a bit of a correction. The stocks that outperformed were safe, non-cyclical companies…and energy (#$100Oil).

The Oil Price

Oil continued its rise from an ‘ok, that’s manageable’ price in June, to a ‘this could really start to mess things up’ price by the end of September. Oil impacts everything from travel and shipping, to manufacturing and consumer goods, so the effects here are only just beginning to be felt across the economy.

OPEC and Russia started the year off with previously announced production cuts which weren’t generally liked by anyone who doesn’t own a drilling well. The situation was exacerbated on September 5th, when the Saudis and Russians announced that these cuts would persist through the end of the year.

The only bright spot is watching the Saudis come up with increasingly hilarious reasons to justify these cuts, such as a ‘precautionary measure aimed at supporting the stability of the oil market’. Instead of just saying ‘we’re trying to jack the price up to buy more football stars (see: Naymar, Ronaldo, Firmino, Benzema, etc.) and sports leagues (see: LIV Golf The PGA Tour).

The Saudis have been more than committed to sacrificing global market share (now down to 13%) to improve profitability - but definitely aren’t making any new friends along the way (well, maybe Russia…)

Inflation

Inflation was going down, and now - for two months in a row - it’s heading back up. A significant proportion of this was based on the appreciation of oil, and this rightfully has people worried. Beyond not really liking it when things cost more (I bought two footlongs and a bottle of water at the Blue Jays’ game Sunday for $39), of real concern is that this seems to have reinvigorated the U.S. Federal Reserve (also known as 'the Fed’, or the ‘Economic Death Cult’) to try and fight inflation with ever so many more interest rate hikes. More on this below.

Rates

The US has led the world in combatting inflation through increases to their policy rate. And while other nations - such as Canada - appear to be taking their foot off the pedal to avoid any undesirable damage to their economies, 'Merica is not letting up (Shock And Awe, Baby!)

Following the most recent Fed meeting (Sept. 19-20), Fed Chairman Powell appeared to take an increasingly ‘hawkish’ tone - promising more rate increases this year - and potentially beyond - to fight inflation. Part of that zeal comes from the Fed’s belief that the US economy remains strong and can endure any damage that higher rates for longer may impose (fingers crossed). If you need a refresher on the Fed’s mandate and the state of monetary policy in the US, check out the primer I published last week.

Opinion: ^^^ Sometimes it’s nice to pause to think about the good ol’ days before my mortgage payment doubled.

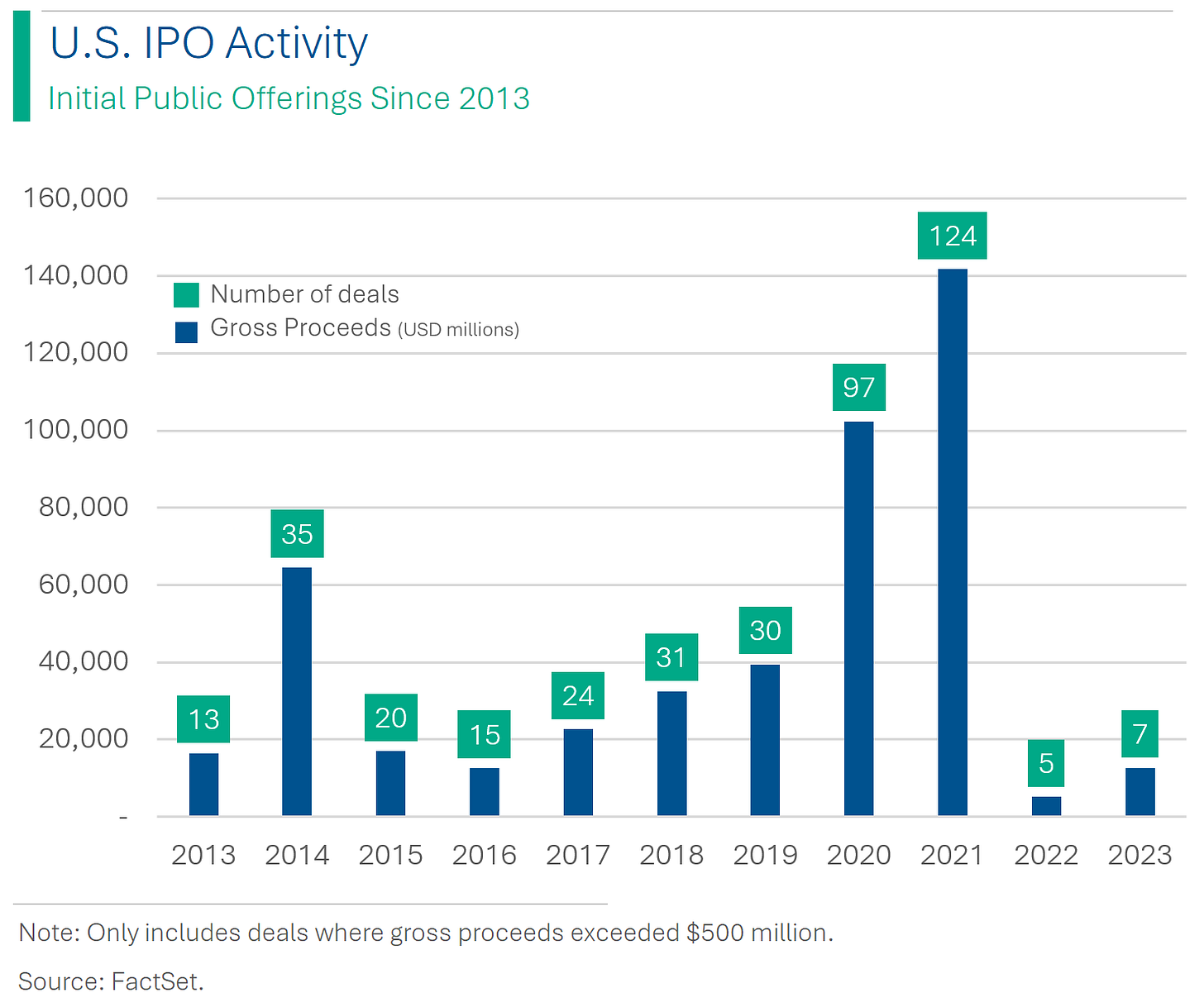

IPO Are Back (?)

While I highly suspect that all the ‘IPO hype’ last month stemmed from mischievous investment bankers trying to drum up business, the public market listing of three techy, billion dollar businesses gave the market some pause. ARM (~$55 billion), Instacart ($8 billion) and Klaviyo ($8 billion) brought some hope that us regular folks could get our hands on some new shiny toys the VC’s had been playing with. But I have my doubts.

The best time to IPO a company is when markets are strong and you can get a competitive price for listing your shares. The second best time is right before you think the window to list your shares is about to close because of rocky economic times ahead (raising money or cashing out is better at a high valuation, you see.)

Let’s look at the ARM transaction: Masayoshi Son’s Softbank bought the 25% stake in ARM that it didn’t already control directly from its Vision Fund in August at valuation of $65 billion (Softbank still controls around 90% of ARM). They hoped to IPO the company just one month later at a $70 billion valuation (they got $55 billion) and raise $8 - $10 billion (they ended up halving this to less than $5 billion, likely in part to support the valuation - ie: if they tried to raise more, the price would be lower). Part of the hurry to get to market certainly had to do with capturing some of the buzz around chip stocks (ARM develops and licenses intellectual property for the chip space), since stocks like NVIDIA were up +200% this year.

It is also possible that he wanted to get the deal done before the window closed. Now, it’s often hard to dig into the thinking behind Masayoshi Son’s decision-making abilities since they aren’t always rational (see: SoftBank values WeWork at $2.9 billion, down from $47 billion a year ago). But if you tell a banker you want to do something at X price and raise Y money, and they tell you numbers that are $15 billion and $5 billion lower respectively, you might take a few moments to re-think your strategy. But not if you think the first number will be $30 billion lower next time you try…

I think part of that rationale took over in 2020 and 2021. If you asked most investors at the start of the pandemic if they thought that in between lockdowns there would be two of the greatest years for issuing equity they probably would have laughed. If the market was open and you could raise money immediately, that was definitely a lot more desirable than taking a wait-and-see approach to raising cash amongst an opaque - and kinda spooky - economic outlook for the future.

Opinion: My bet is that for any significant IPO activity to resume, we need to be standing atop that interest rate mountain, looking at the green pastures below with not a hike to be seen for miles.

Speed Round

U.S. Debt Is Ballooning - The U.S. has been issuing trillions of additional bonds each year in order to cover budgetary short falls. Barron’s cites growing concern that the U.S. may be reaching a point where demand for those Treasuries declines enough that require them to pay much higher interest rates in order to induce demand. Barron’s Article.

Fmr. Crypto King SBF’s Trial Starts Tuesday - Just when you were starting to enjoy the fact that you haven’t had a conversation about crypto in weeks… bam! Sam Bankman-Fried faces a bevy of charges ranging from ol’ fashioned wire-fraud to stealing billions in customer tokens. Given that his two closest colleagues have already plead guilty and agreed to testify against SBF, I’d say he’s going away for a while. Reuters Article.

Congress Averts Last Minute Shutdown - President Biden signed the stopgap funding bill Saturday night that would avert a government shutdown. The US government will remain open through to November 17…and then we get to talk about this again! Yay! (Markets will still probably pop today on the news). CNN Article.

China Grows Commodity Demand - Demand for commodities in the Middle Kingdom is apparently much stronger than most of us predicted. Despite a spat of economic woes (unemployment, property market collapse), demand for Copper, Iron Ore and Oil are up +8%, +7% and +6% respectively - well ahead of Goldman’s full-year estimates. The caveat here is that a lot of this demand has come from government programs, many of which are aimed at Chinese green initiatives. Particularly, Chinese solar installations in 2023 which are greater than that of all the previous year. CNBC Article.

Japan Ceases Huge Used-Car Trade With Russia - In 2022, 25% of Japanese used cars set for export were shipped off for sale in Russia. While the fact that this market represented nearly $2 billion in trade is quite staggering, I think the fact that Russia imported +300 thousand used cars in the first eight months of the year is the most interesting fact. Especially considering that they only sold ~600 thousand new vehicles - mostly Russian and Chinese brands - over the same period. Guess they can also lean on the legendary Lada production at home to fill in some gaps while imports of new cars are still mostly sanctioned. I hear the new eco friendly model uses to 50% less wood. CNBC article.

UAW Strikes Deal (Just Not With Ford, GM or Stellantis) - The United Auto Works (UAW) union reached a deal with Mack Trucks, which is owned by Volvo Group, in a last minute deal to avoid a strike. Hopefully this is a sign that things are turning a page, and that UAW President Shawn Fain is capable of getting deals over the line for workers. Reuters Link

Grab Bag

Trivia:

How many stocks are listed in the Dow Jones Industrial Average?

100

1,000

75

30

Which act, created in 2002, seeks to cut down on insider trading by (among other things) banning all trades of a company's stock during certain "blackout windows"?

“Glass-Steagall” (Banking Act of 1933)

“Dodd-Frank” (Dodd–Frank Wall Street Reform and Consumer Protection Act)

“Sarbz” (Sarbanes–Oxley Act of 2002) (ok, no one calls it Sarbz but me)

“Volker Rule”

Joke Of The Day:

I purchased $1,000 in Bose stock today.

My accountant said it would be a sound investment.

Online trading isn’t all it’s cracked up to be:

Market Update

Main Indices

Global Market Indices

Global Commodity Prices

Global Exchange Rates

Interest Rates

Trivia Answers:

30. I hate the Dow. Like, with passion. I think I’m going to write about why I hate it tomorrow. Stay tuned!

Sarbanes–Oxley Act of 2002. Another one of those fun rules we get because someone did something stupid (sorta like how its illegal to use a catapult in Aspen). Sarbz traces its roots to the aftermath of Enron, where insider trading was the cool thing to do.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and Subscribe!