🔬Saudi Mega Projects, Fed Meeting Looms, and Much More

"If you don’t find a way to make money while you sleep, you will work until you die"

- Warren Buffett

“If one does not know to which port one is sailing, no wind is favourable”

- Seneca the Younger

The big US markets closed down yesterday, with the S&P 500 -0.1% and the Nasdaq -0.8%.

6 of 11 sectors closed up, lead by Financials (+1.2%) and Energy (+1.0%). Real Estate (-0.9%) and Tech (-0.7%) were the worst .

January Consumer Confidence came in at 114.8, beating consensus of 113.3. While the December Job Openings and Labor Turnover Survey (JOLTS) report came in at 9.03 million vs. consensus of 8.71 million.

Street Stories

Fed Day Today

The Federal Reserve is expected to keep interest rates stable at their current 23-year high during today’s meeting, marking the fourth consecutive meeting without a change. Investors and analysts are closely monitoring for any indications of a potential rate cut, possibly in March, although current economic conditions such as a robust job market and inflation above the Fed's 2% target have left the Fed leaning towards a ‘what’s the rush?’ position.

Financial markets have been speculating about a spring rate cut, but Fed officials, through recent statements, have significantly tempered expectations, emphasizing a cautious approach to any future rate adjustments. For example, for the next Fed meeting in March, markets were pricing in a probability of one or more rate cuts at 89% back in December. This has now dropped down to around 47%. Fed Governor Christopher Waller and San Francisco Fed President Mary Daly have both highlighted the need for methodical policy changes, considering the current state of the economy and gradual progress towards inflation targets.

Saudi Super Projects

I read a cool article in Forbes about Saudi Arabia’s plans to convert its oil economy (oil accounts for around 40% of GDP and 75% of Government revenue) into a tourist economy (lol), and so far the Kingdom has reportedly doled out over $1 trillion in programs linked to it’s Vision 2030. While visiting isn’t exactly on the top of my list - and I hold suspicions that it’s not really on too many other people’s lists either - I do find the scale and scope of these initiatives to be pretty outrageous. So, below I outline a few of the plethora of developments the Kingdoms is investing in to make it the Disneyland of the desert.

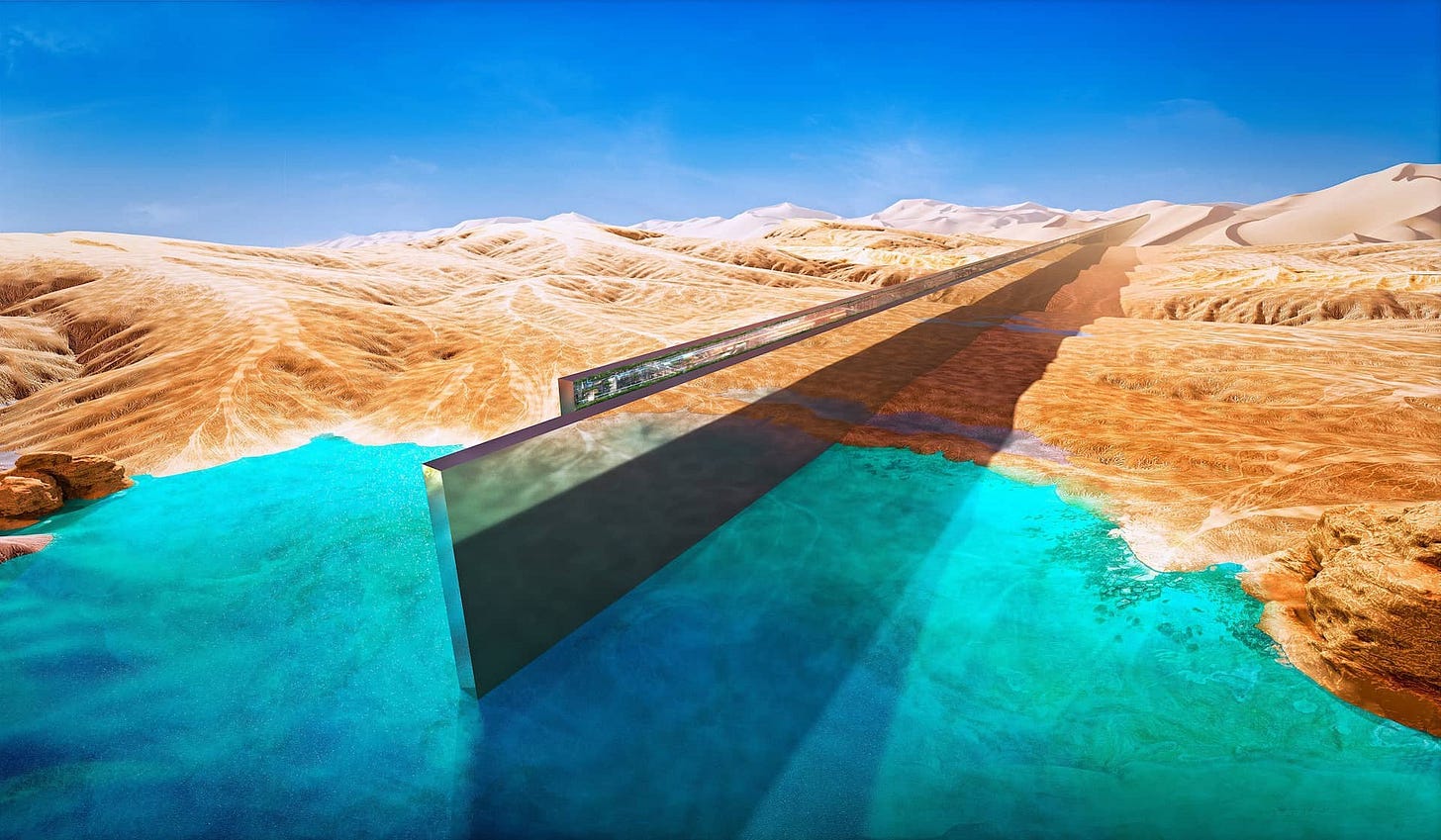

The Line

A 110 mile long vertical city with no cars or streets. The Kingdom estimates the cost will be $100 to $200 billion but some estimates have it coming it at ~$1 trillion. Construction started in 2022 and the Saudis believe it will add $48 billion to GDP by 2030. Sure!

Qiddiya

A master planned city dedicated to… ‘play’. The city is to hold stadiums, a Formula 1/MotoGP race track, golf courses and a Six Flags amusement park with the world’s biggest/fastest/longest rollercoaster. The city was actually supposed to host the 2021 Formula 1 Saudi Arabian Grand Prix but development delays have pushed this to 2027. A region of the city is dedicated to creating the Mecca for eSports. Whatever that means.

The Rig

A 300k square meter floating resort/amusement park…on an oil rig. Why?

Trojena

A ski resort…in Saudi Arabia. In another case of ‘definitely not bribery’ (see: Qatar World Cup), this, as yet unbuilt resort, is set to host the 2029 Asian Winter Games.

Oxagon

Essentially an industrial city built on water. Because that is cost effective/safe.

Sindalah

Another resort island off the coast. Worth noting that Dubai - a place where some people actually want to go - shuttered their island ambitions after weak demand and the fact that they kept melting into the sea. Google Maps shows that the 9 hole golf course is already built. Why build that first?

Leyja

‘Ultra luxury’ resort built into a mountain. Looks more like a hideout for a Marvel supervillain.

Ctrl+Alt+Think: Musk’s Neuralink Implanted In First Human

Elon Musk announced that his brain-science startup Neuralink successfully implanted a device, named Telepathy, in a human, aiming to enable control of external devices through thought. The device, intended primarily for individuals with severe paralysis, promises enhanced communication abilities, with the first patient apparently already showing positive initial results. Amidst this breakthrough, Neuralink faces scrutiny over past animal testing practices, and awaits FDA approval for wider consumer use.

Inflation Eases, World Economy Picks Up Speed, Says IMF

The International Monetary Fund (IMF) has raised its global economic growth forecast for 2024 to 3.1% (from 2.9% in October), partly due to a faster-than-anticipated decrease in inflation, particularly in the United States and China. Chief Economist Pierre-Olivier Gourinchas highlighted the possibility of a "soft landing" for the global economy, despite growth and trade figures remaining below historical averages. The IMF's optimistic outlook is supported by factors like stronger spending, increased labor force participation, and lower energy prices, although risks persist due to geopolitical tensions and potential inflationary pressures from global elections. Inflation forecasts have been adjusted, with a decline expected in advanced economies by 2025, while emerging markets will experience higher rates. (Link to the full report)

Judge Decides Musk's $56 Billion Pay Is Not 'Rocket Science', But Excessive

More Musk (sorry!) but this one is pretty wild: A Delaware judge has nullified Elon Musk's $56 billion Tesla pay package, calling it "an unfathomable sum" and unfair to shareholders, leading to a 3% drop in Tesla shares in extended trade. The ruling, which can be appealed, reflects concerns about the Tesla board's oversight and Musk's significant influence, amidst Tesla's preparation for new compensation negotiations with Musk and a call for more independent board members. Best part is that an Exec pay researcher estimated that his 2022 comp was ~6x… the combined pay of the 200 highest-paid executives in 2021. WOW. (Reuters has more)

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

He gave a great 10-minute business speech yesterday. The only problem was it took him an hour to deliver it.

My new colleagues are so much fun, they write names on all the food. Yesterday, I ate a yogurt named ‘Susan’; how cute is that?

Hot Headlines

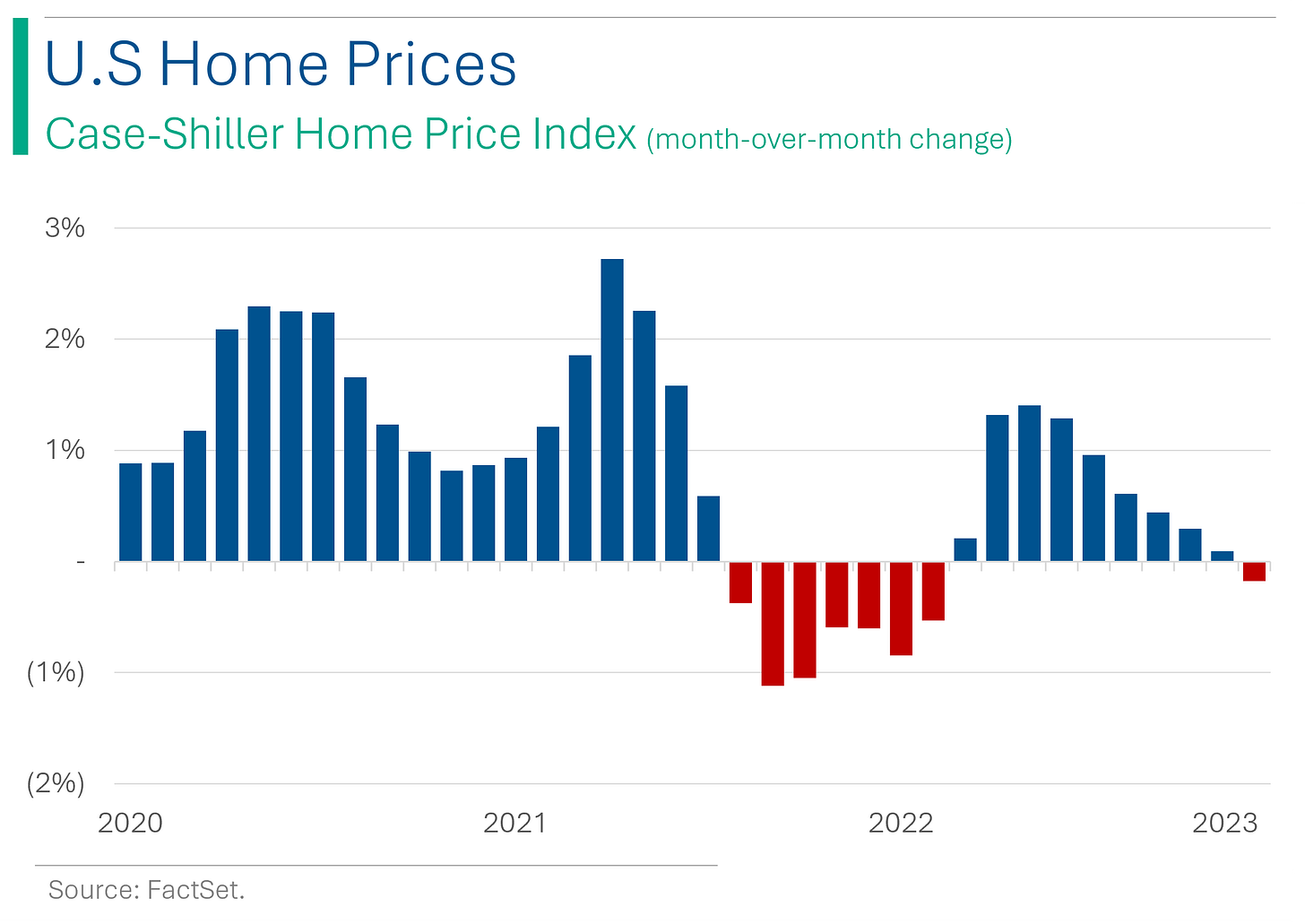

Bankrate | U.S. home prices drop after nine months of steady increases. Granted the drop was only 0.2% but definitely looks like things are cooling.

Bloomberg | Crypto’s billion-dollar ‘Restaking’ bet comes with some layered risks.

Reuters | Industry pain abounds as electric car demand hits slowdown. Article does a good job outlining battery and lithium demand weakness as leading indicators.

CNBC | Apple iPhone shipments may see ‘significant decline’ in 2024, analyst says. Based on Apple’s semiconductor orders dropping by 200 million, which represents a drop of 15% YoY. China shipments already down 30-40% this year.

BNN | Iran urges diplomacy as US weighs response to deadly attack. Oh cool, now they want diplomacy.

Trivia

This week’s trivia is on companies and war.

Skunkworks, the creator of the SR-71 Blackbird and F-117 Nighthawk (the ‘Stealth Fighter’), is a division of what major aircraft producer?

A. BoeingB. McDonnell Douglas

C. Northrop Grumman

D. Lockheed MartinWhich company, famous for its motorcycles, also produced aircraft engines for the Axis powers during World War II?

A. Harley-Davidson

B. Ducati

C. BMW

D. HondaDuring World War II, which Swedish company provided ball bearings crucial for both Allied and Axis powers?

A. SKF

B. Saab

C. Volvo

D. Scania

(answers at bottom)

Market Movers

Winners!

Helmerich & Payne (HP) [+12.0%] Q4 EPS and Revs exceeded expectations, driven by higher US land results. Announced a significant international contract for 7 super-spec rigs, but acknowledged ongoing churn issues from weaker commodity prices.

MSCI Inc. (MSCI) [+9.3%] Beat Q4 earnings and revenue with strong Index and Analytics performance, though ESG was weaker. Free cashflow guidance was better than expected, despite some non-recurring Index revenue concerns.

General Motors (GM) [+7.8%] Q4 results were in line, with 2024 EBIT and EPS guidance exceeding expectations, benefiting from no UAW strike impact, lower EV inventory adjustments, a new LG battery agreement, reduced Cruise expenses, and fixed cost reductions.

Cleveland-Cliffs (CLF) [+6.6%] Q4 EPS matched forecasts, EBITDA was slightly better, but revenue fell short. Expects significant EBITDA growth in FY24 and cost reductions of about $30 a ton.

Citigroup (C) [+5.5%] Upgraded to overweight by Morgan Stanley, with a larger price target for US banks. Anticipates softened Basel III rules, especially CET1 ratios, leading to increased buybacks due to record high excess capital levels.

Losers!

United Parcel Service (UPS) [-8.2%] Q4 EBIT was slightly lower, but EPS was above expectations. The 2024 outlook disappointed, with EBIT ~10% under estimates, highlighting elevated costs and domestic segment underperformance.

Schlumberger (SLB) [-7.2%] Shares fell after news that Saudi Aramco is pausing its crude production capacity expansion, affecting multiple oil-services companies.

Whirlpool Corp. (WHR) [-6.6%] Q4 EPS and revenue exceeded forecasts, but guidance for FY24 EP, FCF, and revenue was below expectations. Despite predicting modest growth in all regions, North America margins were weaker in Q4, with a slightly positive industry outlook noted.

Market Update

Trivia Answers

D. Skunkworks is part of Lockheed Martin.

C. BMW made engines for Axis powers. Infact, their logo is meant to be a spinning airplane propeller.

B. Saab made ball bearings for both sides in WWII.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.