🔬S&P 500 Valuation Update, Baseball Meets Tax Evasion, and Much More

"An investment in knowledge pays the best interest."

- Benjamin Franklin

“I don’t want yes-men around me. I want everyone to tell the truth. Even if it costs them their jobs”

- Samuel Goldwyn

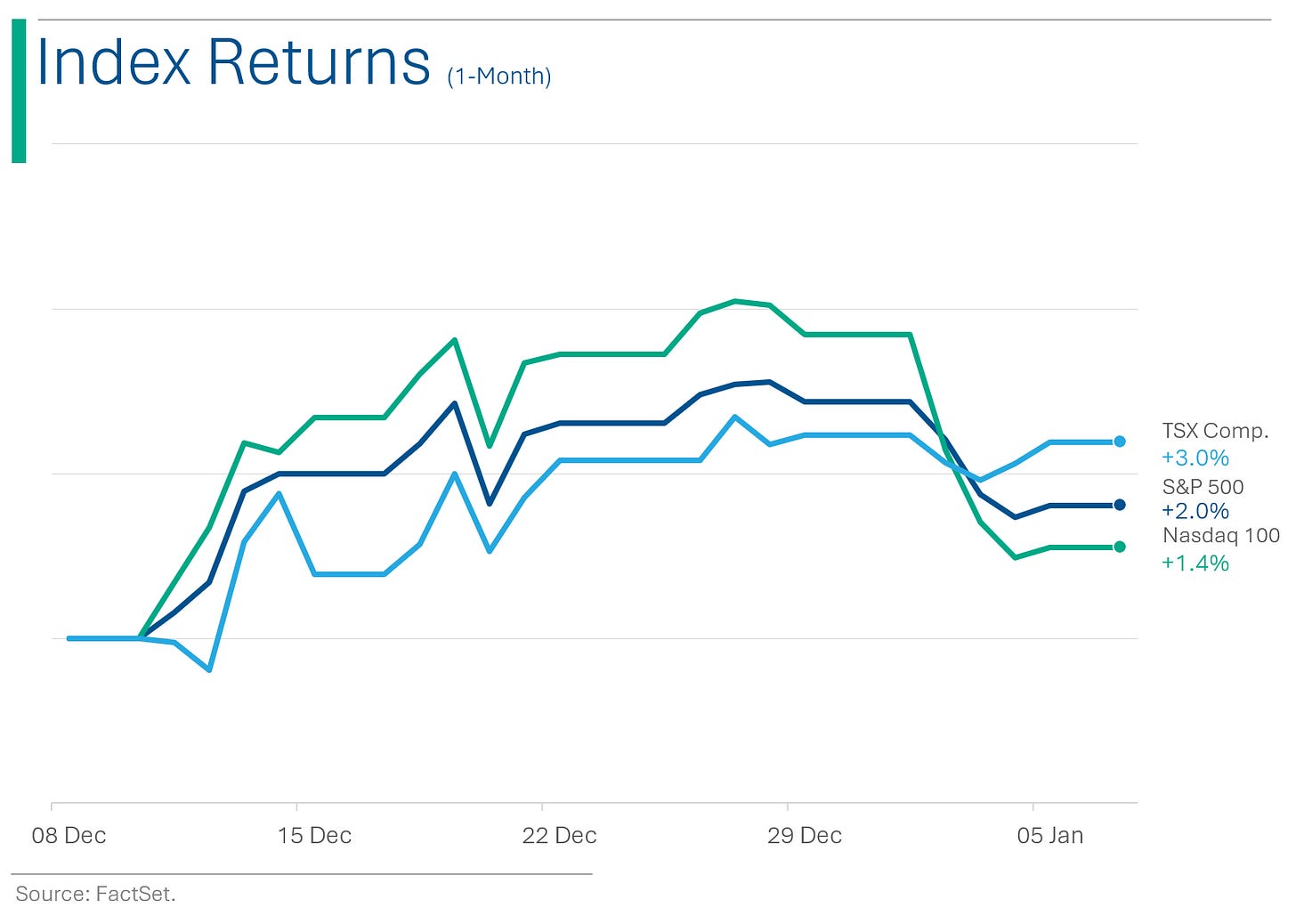

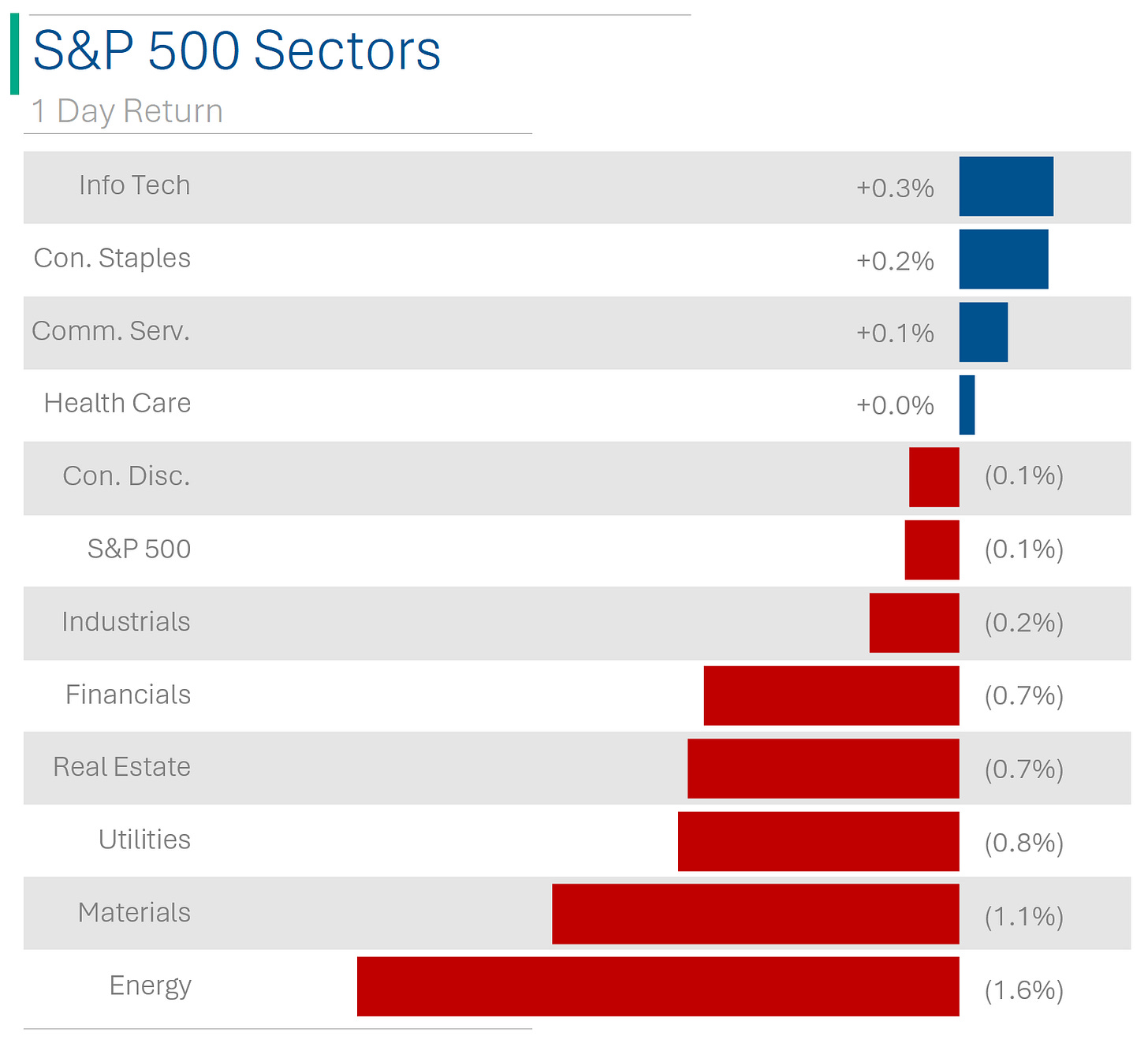

After a big day on Monday, the big US markets were mixed and close to flat on Tuesday with the S&P 500 down -0.15% and Nasdaq +0.09%.

4 of 11 sectors closed higher, led by Info Tech (+0.3%) and Consumer Discretionary (+0.2%).

Oil settled up +2.1% after a big sell-off Monday (-4.1%) but that wasn’t enough to help the Energy sector which fared worse (-1.6% after -1.2% on Monday).

Juniper Networks was up big (+22.8%) after rumors of a take-over by HP circulated.

Street Stories

Valuation Update

So far this year I’ve dug into the relative outperformance of defensive stocks since the ‘Peak Fed’ rally cooled (Cyclical vs. Defensive) and cast a critical eye over the the high valuations baked into the market (Market Update), but something I’ve failed to address is how sector valuations have evolved over the course of the year. Spoiler: They’re a lot more expensive.

As you can see above, only Consumer Staples and Utilities have actually seen their forward Price to Earnings multiples contract over the last twelve months. Whereas Info Tech (+30%), Comm. Services (+22%) and Consumer Discretionary (+17%) have seen their P/E multiples expand materially. On average, P/Es across the sectors increased by around 10.9% over the course of the year.

Ryan’s Thoughts: As I’ve stated before, I don’t think we are at some crisis point but we do currently sit at multi-decade high valuations, so investors need to be a bit more discerning around valuation. That said, ex-Materials (which doesn’t typically work well with P/E multiples due to commodity prices/reserve values) the sectors that have seen the greatest multiple expansion are the ones with the highest expected revenue growth. Sure valuations in Info Tech and Consumer Discretionary might be a bit stretched, but unless you think the economy is going to fall off a cliff, the growth outlook is as strong as it’s been in a long time.

And even with the multiple contraction, it’s not exactly like defensive Consumer Staples and Utilities are screaming buys. If anything, they might have been artificially high at the start of 2023 back when it looked like the world was going to hell in a handbasket (40yr high inflation, the mini-banking crisis, China still locked-down, etc.)

To me, buying quality companies with strong growth at fair valuations is a much easier way to make a buck, than trying to time the market or jumping around between hype stocks and the value bucket.

Baseball Deal Triggers Cali Tax Reform

When the deal for All Star two-way player Shohei Ohtani to join the LA Dodgers was announced last month, it made the news because of its massive scale: $700 million over 10-years. Yeesh. But now it’s getting press for a less than awesome reason: tax avoidance. See the contract is EXTREMELY back-end loaded, and instead of clipping $70 million a season over the life of the deal, Shohei is taking a measly $2 million per annum until getting a balloon payment of $680 million in 2034.

Beyond simply deferring taxes to a future date, should Shohei find himself living outside of California ten years from now he wouldn’t be liable for any of the $98.2 million in 2034 taxes owed (current income and payroll taxes sit at 14.4% in California). Anywhoo, California State Controller Malia Cohen doesn’t like this much and has just filed with Congress to close the deferred income loophole. I’m no Commie, but it’s not cool for a near billionaire to pay $288k in taxes this year*.

* The exact particulars of his contract aren’t fully known, and he does receive millions from endorsement deals that are presumably taxed appropriately.

Buy the Rumor, Sell the Bitcoin ETF?

Bitcoin's flirtation with $46,000, buoyed by the buzz of potential U.S. approval for Bitcoin ETFs, might be a classic case of "buy the rumor, sell the news." Market watchers are side-eyeing the digital currency, with speculation that post-approval, Bitcoin could do a dramatic about-face, potentially leaving speculators and Johnny-come-latelies ruing their FOMO-induced investments. While the SEC mulls over the fate of these ETFs amidst crypto's roller-coaster reputation, Bitcoin's recent +160% surge could be walking a tightrope between optimism and fad.

Explainer: ‘Buy the rumor, sell the news’ sounds like some hokey investing thing, like ‘Sell in May and go away’ that a 5 minute backtest immediately proves false. But as someone who covered biotech for a decade and has seen countless stocks crash on the day their hot new drug got FDA approval, I have to say there is some merit to it (at least imho).

While the Coca-Cola’s and McDonald’s of the world can just plod along nicely, hype stocks (and, I guess, crypto) often need catalysts to keep the party going. Without any event, metric, psychological barrier or eccentric billionaire memeing, the story can fail to attract the next set of FOMO buyers. Now, I’m not saying that after the ETF approval Bitcoin has no catalysts - I actually did a piece on this recently (the next ‘Halving’ event expected in April and institutional buying of Bitcoin ETFs is expected to be worth billions). Just that sometimes it’s better to de-risk and take some money off the table. Perhaps even more so with something that’s increased over 2x of late.

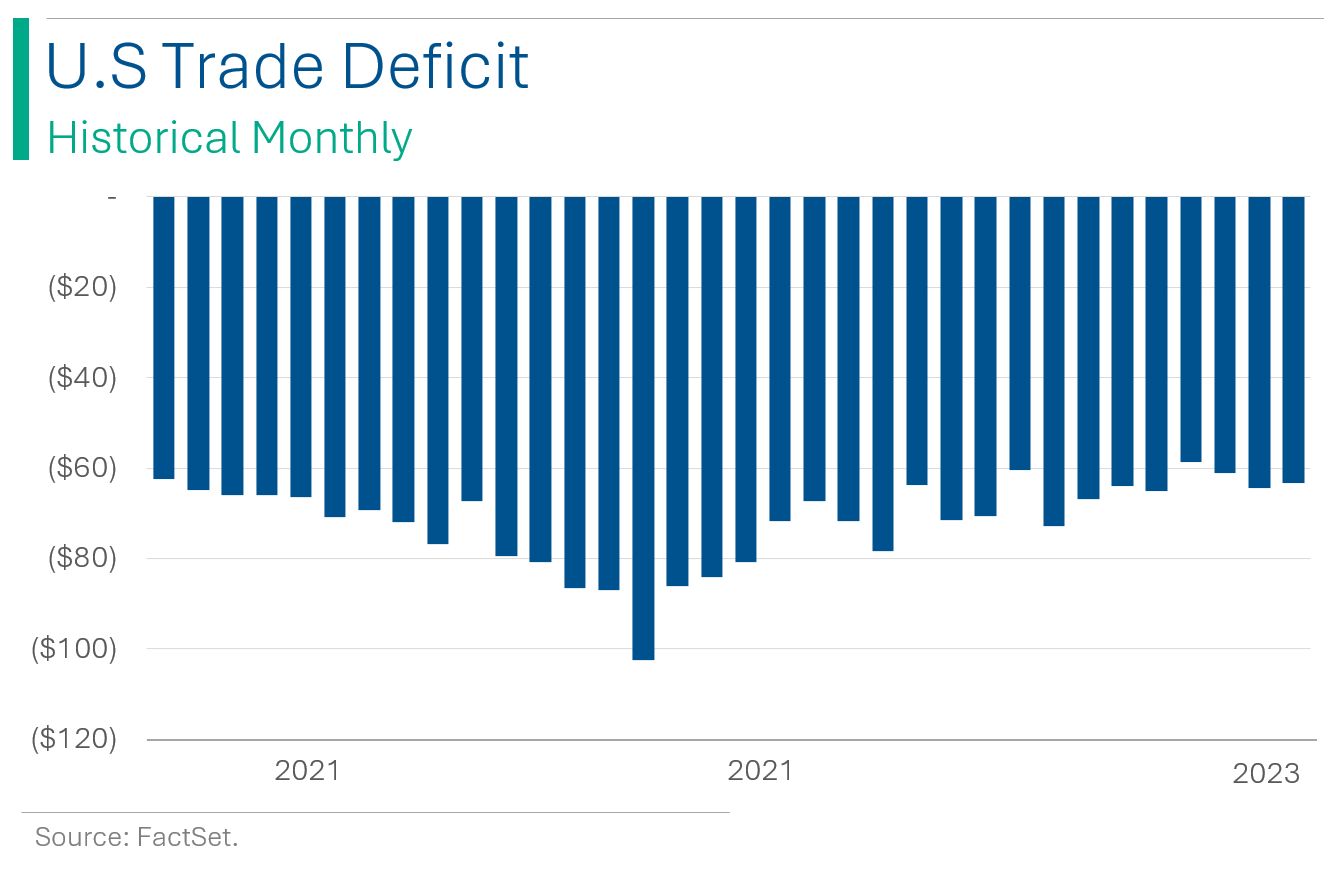

Retail Therapy on a Break: U.S. Trade Deficit Sheds Some Pounds

The U.S. trade deficit narrowed unexpectedly in November, dropping to $63.2 billion as imports, particularly of consumer goods, hit a one-year low due to slowing domestic demand. This trend, coupled with a decrease in exports amid global demand slowdown and central banks' interest rate hikes, could mean trade has a neutral impact on Q4 economic growth. While imports fell across various sectors, including a notable decrease in cell phones and household goods, there was an increase in crude oil imports, indicating continued business spending in certain areas.

Joke Of The Day

A stockbroker is someone who will invest your money until it's all gone.

Hot Headlines

Reuters | World Bank forecasts 2024 global growth to slow for third consecutive year. 2024 GDP growth expected to be 2.6% with the report stating that the first half of the 2020s now looks like it will be the worst half-decade for GDP growth performance in 30 years.

Axios | Fox Corp. announces new blockchain protocol to track how its content is being used across the internet. Fox + Blockchain. WTF?

Bloomberg | BlackRock cuts 3% of global workforce, citing dramatic industry shifts. “We see our industry changing faster than at any time since the founding of BlackRock,” Chief Executive Officer Larry Fink and President Rob Kapito wrote Tuesday in a memo to staff.

CNBC | Meta says it will restrict content for teens, as complaints mount about harmful effects on youth. I have a feeling Zuck fought this pretty hard.

CNBC | Elon Musk’s X to launch peer-to-peer payments this year. I’m having deja vu. Pre-hair transplant deja vu.

Trivia

This week’s trivia is on the great financial dynasties. Today’s is on the Waltons of Walmart fame.

Who founded Walmart, the source of the Walton family's wealth?

A) Sam Walton

B) John Walton

C) Jim Walton

D) Alice WaltonIn what year was Walmart founded?

A) 1945

B) 1950

C) 1962

D) 1972As of 2023, approximately what is the combined net worth of the Walton family?

A) $150 billion

B) $215 billion

C) $175 billion

D) $200 billionWhat state is the headquarters of Walmart located in?

A) Texas

B) Arkansas

C) Missouri

D) Oklahoma

(answers at bottom)

Market Movers

Winners!

Juniper Networks (JNPR) [+21.8%]: In advanced talks to be acquired by HP for about $13B. See HP below.

Sarepta Therapeutics (SRPT) [+16.7%]: Reported preliminary Q4 net product revenue for Elevidys significantly above consensus. Analysts see potential for early FDA label expansion.

Acuity Brands (AYI) [+11.5%]: Q1 earnings exceeded expectations with revenue meeting forecasts. Noted strong Retail channel performance and growth in ISG; analysts commend solid cash flow.

Urban Outfitters (URBN) [+7.7%]: Positive holiday sales update with November and December revenue up 10% against a 5% consensus for Q4. Strong performance in Free People and Anthropologie segments.

Losers!

Grifols (GRFS) [-21.8%]: Gotham City Research alleges the company manipulates debt and EBITDA figures, making shares uninvestable.

JetBlue Airways (JBLU) [-10.2%]: CEO Hayes to step down for health reasons, President/COO Geraghty to take over.

Hewlett-Packard Enterprise (HPE) [-8.9%]: Reported by Reuters as in advanced talks to acquire Juniper. Deal announcement possible this week; analysts see strategic fit but note HP shareholders might have preferred dividends or buybacks.

Market Update

Trivia Answers

A) Sam Walton founded Walmart.

C) Walmart was founded in 1962.

B) The Walton family is worth around $215 billion.

B) Walmart is headquartered in Arkansas.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.