🔬S&P 500 Valuation Has Bright Spots

Plus: Expectations for interest rates get kicked back even further; 60 years worth of market corrections; and much more

"You don't have to be right all the time. You just have to be right occasionally when it really counts"

- Julian Robertson

“Who’s the more foolish: the fool or the fool who follows him?”

- Obi-Wan Kenobi

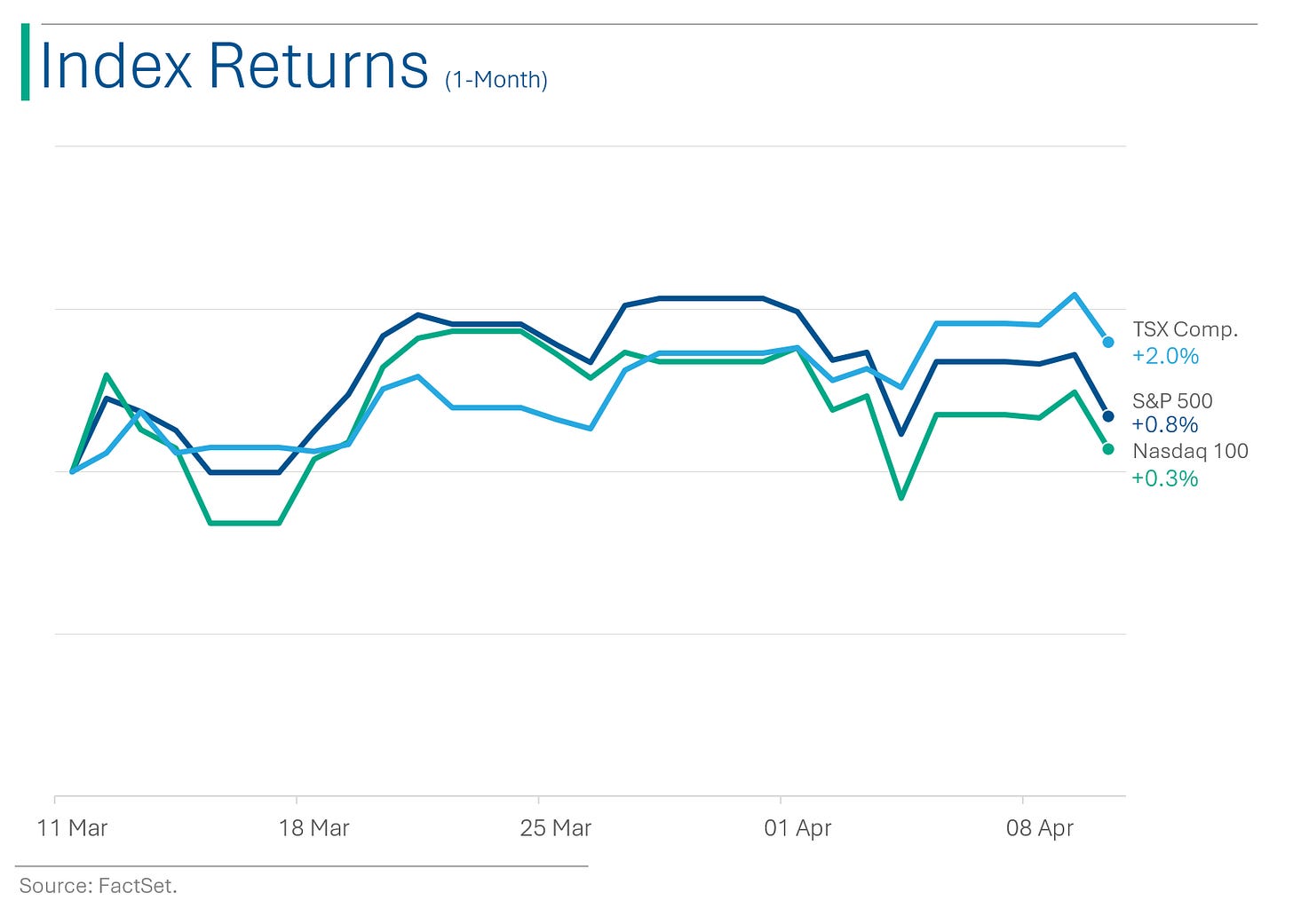

Bad day for the big US markets (S&P 500 -0.9%, Nasdaq -0.8%) as the CPI inflation print rocked markets with a higher than expected readout.

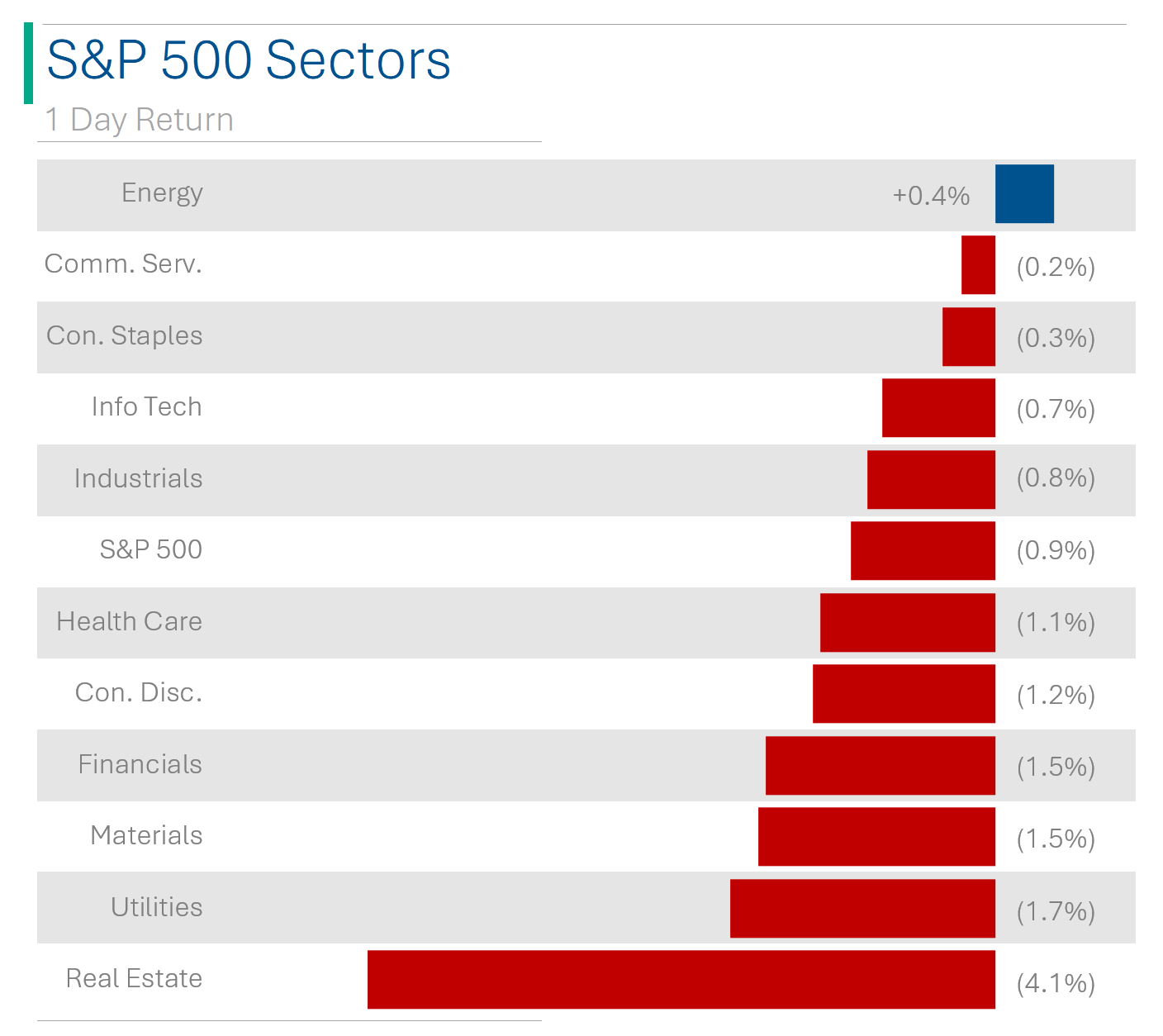

Only 1 of 11 sectors closed higher, and figures it was Energy (+0.4%) as the oil rally continued. Worst off was Real Estate (+4.1%) as interest rates/mortgages are now expected to be higher for longer after the inflation report (more below).

Crude oil (+1.2%) popped after a report that US and allies believe Iranian retaliatory attack on Israel is imminent.

Street Stories

S&P 500 Valuation

I’ve mentioned before that, if you excuse that little blip during Covid (when valuations went stupid), then the S&P 500 is currently trading at its highest level since the end of the Dot-Com bubble. Not really inspiring stuff.

Well, something that is a bit more palatable is the fact that the median company in the S&P 500 is actually trading at a lower multiple than it was in January 2023 (back when the S&P was 26% lower). In fact, the distribution of the middle 50% of companies doesn’t seem to have moved much either. So while the index overall have become ‘more expensive’, that has more to do with the performance of the index heavy weights, like Nvidia and the former Mag7.

So while it might be a bit harder to find quality companies at reasonable valuation, there are still a few left it seems.

Inflation Reflates

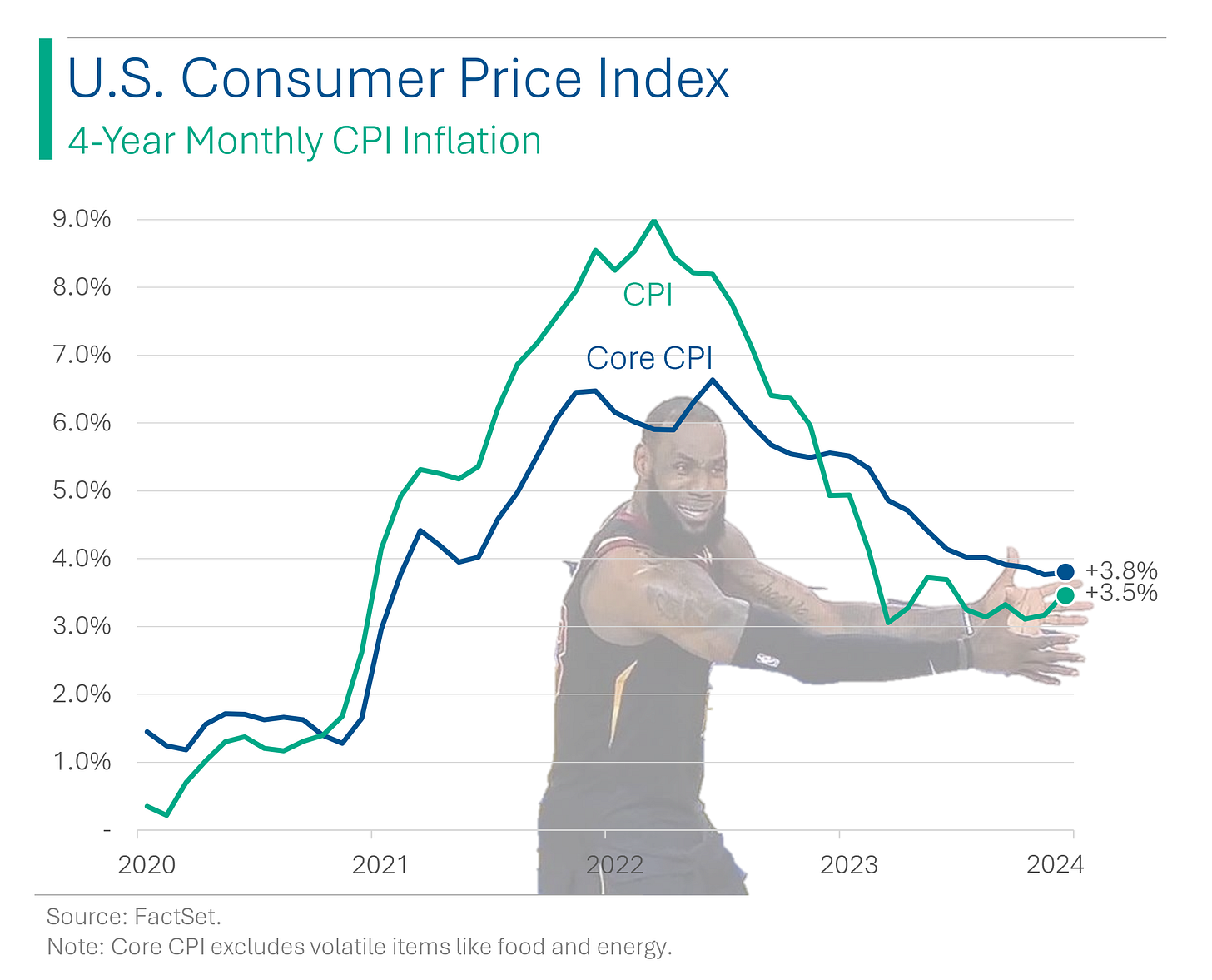

March CPI Inflation came in hot, rising to +3.5% YoY from +3.2% last month, and missing economist estimates for +3.4%. Core CPI (ex-food and energy) came in at 3.8% against an expected decline to 3.7%.

For those new to markets, the hope is that inflation eventually starts to, you know, go down.

The big impact of today’s news is that it has sent the probability of a June rate cut/cuts from 57% to only 19%. What a difference a day makes…

What Broke The Market?

Piper Sandler did a cool report (link) on the causes of all the market corrections over the past 60 years.

The report is particularly well timed as everyone seems to be waiting around for this next correction to happen…

Joke Of The Day

Q: How many telemarketers does it take to change a light bulb?

A: Only one, but he has to do it while you are eating dinner.

Hot Headlines

Yahoo Finance / OpenAI and Meta are on the verge of releasing AI models capable of reasoning like humans. I’ll eat my hat if, after hundreds of Meta business failures (see: Facebook Wall of Shame), the one thing they get right is the trillion dollar AI market.

Bloomberg / Tesla's supercharging network set to rake in piles of cash. A new analysis projects that by 2030, the charging industry is on track to generate $127 billion in revenue globally by 2030 with Tesla estimated to make around $7.4 billion (or 6%) of that income.

Barron’s / Real Estate stocks got crushed after high inflation report indicates higher mortgage rates are on the horizon. (Which is bad.)

CNBC / Apple doubles India iPhone production to $14 billion as it shifts from China. The company now makes around 14% of its iPhones in India, which is double the amount it produced there last year.

WSJ / Four Paramount Directors to step down as company discusses Skydance merger. Hurry up and do a deal while you still have a company left.

Trivia

This week’s trivia is on the big financial indices. Today’s is on the UK’s FTSE 100 Index.

When was the FTSE 100 Index first introduced?

A) 1980

B) 1984

C) 1988

D) 1992What does FTSE stand for?

A) Financial Times Stock Exchange

B) Financial Transaction Stock Exchange

C) Federal Trading Stock Enterprise

D) Financial Trading Systems EuropeThe FTSE 100 is made up of the 100 companies listed on the London Stock Exchange with the:

A) Highest profitability

B) Largest sales

C) Largest market capitalization

D) Longest trading historyThe biggest company listed in the FTSE 100 is:

A) Shell

B) BP

C) Diageo

D) Tesco

(answers at bottom)

Market Movers

Winners!

GoodRx Holdings (GDRX) [+3.9%] Upgraded by KeyBanc to overweight, praises customer growth and subscription strength, sees digital ad potential.

Alibaba Group (BABA) [+2.2%] Jack Ma backs restructuring, highlights AI era's arrival, lifting sentiment.

NVIDIA (NVDA) [+2%] Morgan Stanley reaffirms overweight, price target up to $1000; BofA continues buy rating despite recent pullbacks.

Losers!

WD-40 Company (WDFC) [-8.6%] Q2 EPS exceeds expectations, revenue slightly misses; FY24 EPS guidance up due to higher margins; reaffirms long-term targets but notes ERP challenges in Americas, strong growth in EMEA; plans to sell US and UK cleaning businesses.

monday.com (MNDY) [-7.3%] Citi downgrades to neutral, pointing to slowing demand and minimal impact from recent price hikes.

Deckers Outdoor (DECK) [-6.7%] Truist downgrades to hold, noting slowed HOKA Direct-to-Consumer growth since mid-February.

Delta Air Lines (DAL) [-2.3%] Q1 EPS outperforms by nearly 30%, Q2 revenue growth and operating margin outlooks beat expectations; maintains FY24 forecast; highlights strength in corporate and domestic travel but mentions challenges from travel credits and weaker Latin America performance.

Market Update

Trivia Answers

B) The FTSE 100 was founded in 1984.

A) FTSE stands for Financial Times Stock Exchange.

C) The index contains the largest market capitalization companies.

A) Shell is the biggest company in the FTSE 100 with a market cap around $230 billion.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.