🔬 S&P 500 Growth Outlook (if Wall Street can be trusted (it can't))

Plus: Uber's buy-back more than delivers; global inflation cools off; Zuckerberg pretends his VR doesn't suck; and much more

"The investor's chief problem – and even his worst enemy – is likely to be himself"

- Benjamin Graham

"A nickel ain't worth a dime anymore"

- Yogi Berra

Rebound day for the big US markets (S&P 500 +0.96%, Nasdaq +1.30%) after yesterday’s inflation panic (markets are too sensitive).

9 of 11 sectors closed higher with Industrials (+1.7%) and techy Communication Services (+1.4%) in the lead. Consumer Staples and Energy (both -0.4%) gave back some of their big gains yesterday.

Uber announced a $7 billion share buy-back and the stock popped ~15%, while MGM (-6.3%) and Kraft (-5.5%) took it on the chin after earnings misses.

Crude oil slumped 1.5%, while Bitcoin rebounded 4.9% to get back above $50k.

Street Stories

S&P 500 Growth Forecasts

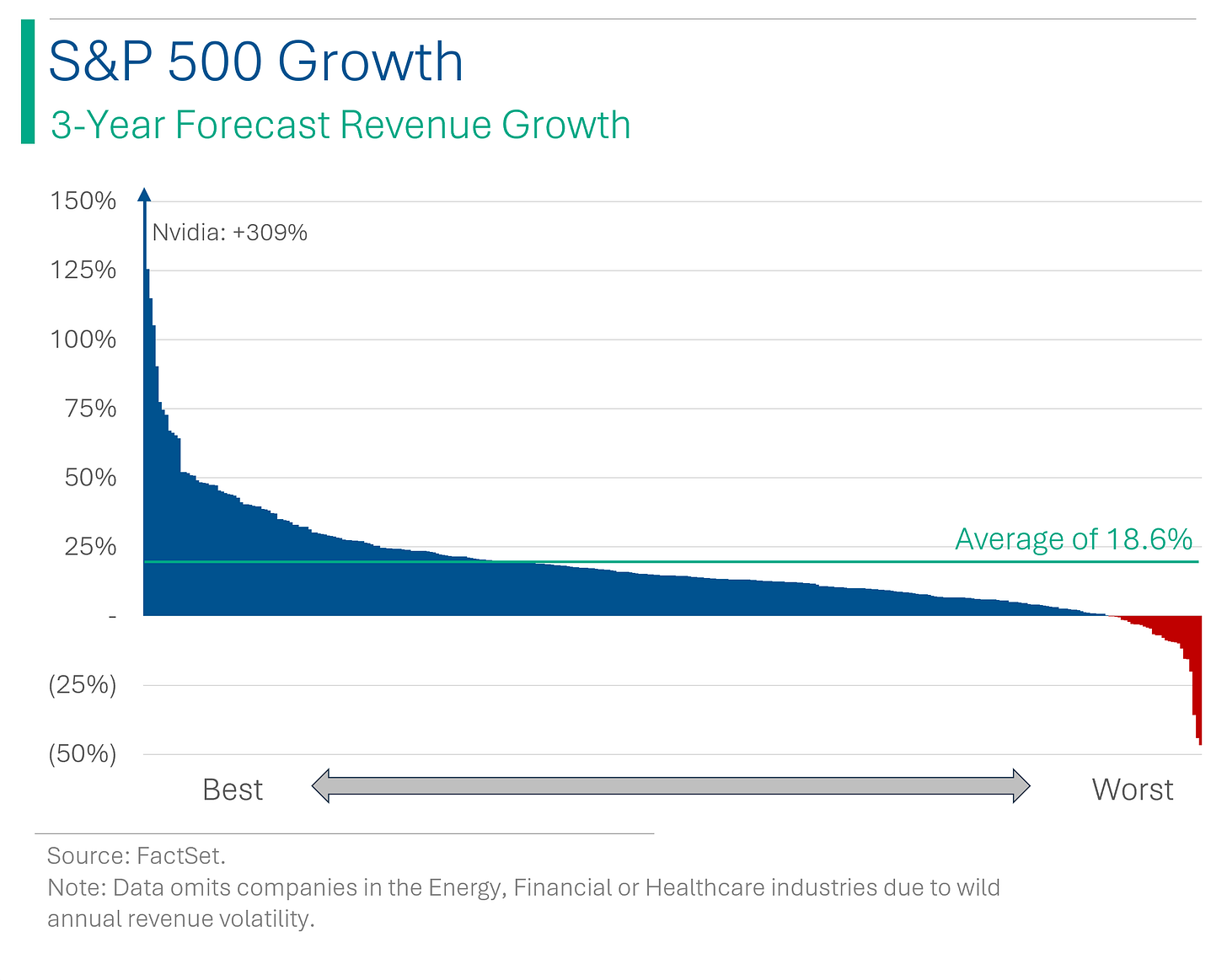

After digging a bit into Nvidia earlier this week and noting their outrageous growth outlook, I decided to check to see how that stacks up with the rest of the S&P 500. Turns out, it does very well (the best actually).

Looking at the 340 companies in the S&P that don’t fall into the Energy/Financials/Healthcare bucket (their revenues are too wonky), the average company is expected to grow Revs by +18.6% over the next three years, based on Wall Street consensus estimates. 30 of them are expected to show negative revenue growth, while only 17 fall into the ‘extreme’ growth category of +50%.

A couple things stand-out when looking at the 20 fastest growing companies (see below):

Most are in InfoTech or the techy end of Consumer Discretionary (kinda figured).

Most are actually pretty big. The median company size in this restricted S&P 500 universe (340 companies) is $29.9 billion but in the Top 20 the median is $49.9 billion, and only six (30%) are below the universe median. The idea that 'big companies grow slow, and small companies grow fast’ doesn’t seem to really hold up here.

Next - and this is likely related to the above - is that growth is pretty sticky. While there are some weirdos on the list, like recovery story Norwegian Cruise lines or Micron, which got banged-up in the chip surplus of 2023, most of the other companies’ revenue growth over the last three years is comparable to what their forecast to put out over the next three years. I say this is related to point two because successful growth stories tend to persist for years, or decades. If a company finds itself punching out top tier growth, it’s obviously built a better mousetrap, and size (or scale) can usually just help them to grow even faster.

Ryan’s Thoughts: My final point about ‘sticky’ growth reminds me of something that I’ve referred to in the past as the ‘DCF Fallacy’. The idea that those building financial models always forecast growth to taper-off dramatically towards the end of the 5, 7 or 10 year model forecast period.

At my last gig, I gave a presentation on this and used a research report from (I think) Merrill Lynch on Facebook when it IPO’d to illustrate my point. It showed Facebook continuing to grow revenue at ~50% in 2013 (like it did the year previous) and then something like 30%, then 20%, 15%, 10%, 5%. That would have meant Facebook would have revenue of ~$16 billion in 2018. The actual number was $56 billion. Only off by ~250%.

I bring this up because I think a lot of investors get scared-off of companies because they see a high valuation and worry about, say, that P/E multiple getting cut in half in a few years. I’m not saying valuation isn’t important, only that if you find a truly transformational company - a Facebook, Nvidia, Amazon, Tesla, etc. - that that multiple sticks around a lot longer than you expect, and that high valuation was a bargain.

A good growth investor I know use to say ‘Most people want to buy stocks at low P/E multiples and sell them at high P/E multiples. Me, I want to buy them at high P/E’s and sell them at low P/E’s. I just want the ‘E’ to grow a few thousand percent first.’

Free Money: Uber’s First Share Buy-Back

In a press release ahead of their Investor Day yesterday morning, Uber announced a $7 billion share repurchase program. Now, I’m sure the Investor Day was fine and all (here’s the link in case you want to flip through the deck), but it’s not like they had too much new to talk about (they reported last week after all) so most of the share price reaction is attributable to the buy-back. The first in the company’s history I should add.

Ryan’s Thoughts: Investors like buy-backs. It increases the ownership position of their shares and is also a great indication that a company has excess cashflow and is operating with enough confidence to spend the cash. The fun side is that often the share reaction is quite disproportionate to the nominal impact on ownership.

For example, that $7 billion buy-back represented ~4.9% of Uber’s market cap at yesterday’s close. So, to extremely oversimplify things, that might warrant a +4.9% movement in the shares, since everyone’s ownership stake will increase by around that much (dependent on the repurchase price, of course). Instead, the shares popped a whopping 14.6%. Or looked at another way, that $7 billion buy-back just added $20.9 billion in market cap. Gotta love Bull Markets, eh?

Global Inflation

While the US may have led the way, it seems the other developed economies have seen inflation come down as well. Currently, most Western peers have seen inflation contract significantly, almost all (sorry UK) to below the 3.5% level where things get spicy.

The US was the leader - sorry, Canada but no one really follows you (I can say that, I’m a Canuck) - in the rate hike game, but it seems no one has really had the ba***/central bank support to start the rate move downwards. It’ll be curious to see how fast the rest of the developed world follows Uncle Sam once they start slashing rates in March May June (?)

Robozuck Throws Shade At Apple

Mark Zuckerberg, Meta's CEO, has publicly stated that he believes Meta's Quest 3 headset is superior to Apple's new Vision Pro, not just in terms of value but as a product overall (that’s why it’s selling so well and Zuck didn’t lay off 10k people from his VR division). He cites the Quest 3's lighter weight, lack of a wired battery pack, wider field of view, and its immersive content library as key advantages over the Vision Pro. However, he acknowledges Apple's potential in hardware and developer ecosystem, indicating that while Meta leads now, the competition with Apple in the VR headset market is set to intensify. When the king wants to eat, the food is there.

I really hope you are enjoying StreetSmarts. If you are, please consider helping me continue to grow it by sharing it with your friends (or enemies, I’m not picky).

Joke Of The Day

After telling a joke, the manager looks around to see everybody laughing. However, one guy sits in the corner without even a smile.

‘Didn’t you get it?’

‘I got it, but I resigned yesterday’

Hot Headlines

Bloomberg | PE shop Roark Capital weighs IPO of Dunkin’, Arby’s owner Inspire Brands. Street indicates potential value of around $20 billion. The portfolio of Arby’s, Baskin-Robbins, Buffalo Wild Wing, Dunkin’, Jimmy John’s, and SONIC reads like a list of ‘s*** drunk Ryan did in his 20s and has no plans to revisit’. $20 billion, you say? Good luck.

Yahoo | Nvidia replaces Alphabet as Wall St's third most valuable company. I thought I just talked about this with them being number 4 after passing Amazon? Bull markets, man.

Fox Business | Imported luxury cars such as Audi, Porsche and Bentley held by US over banned part linked to forced labor in China. To refresh: forced labor = bad.

Reuters | Reports indicate in process of Biden slashing F-35 jet order 18% in 2025 budget request. 11k lobbyists are currently updating their LinkedIn.

ABC | Blasts hit a natural gas pipeline in Iran and an official says it was an act of sabotage.

Trivia

This week’s trivia is on the great corporate collapses.

What large US automaker DIDN’T declare bankruptcy as part of the 2008 financial crisis?

A) General Motors

B) Chrysler

C) Ford

The Dutch Tulip Mania bubble took place in what century?

A) 1500s

B) 1600s

C) 1700s

D) 1800s

The collapse of which airline, formerly controlled by Howard Hughes, in 2001 was one of the largest airline bankruptcies in U.S. history at the time?

A) Pan American World Airways

B) TWA (Trans World Airlines)

C) Eastern Air Lines

D) Continental Airlines

(answers at bottom)

Market Movers

Way to much earnings…

Winners!

Lyft (LYFT) [+35.1%]: Q4 adj. EBITDA and bookings exceeded expectations with stable revenue. Analysts noted continued rides growth and controlled expenses, leading to margin expansion. Q1 outlook surpasses consensus, with mid-teens rides growth expected in 2024 despite concerns over insurance cost inflation.

Kratos Defense & Security Solutions (KTOS) [+17%]: Beat Q4 EPS and revenue, with FY23 outlook aligning closely. Weak FCF expected due to higher capex for growth investments. Analysts are optimistic about the pipeline, record backlog, and Kratos' role as a cost-effective provider of jet drones.

Uber Technologies (UBER) [+14.7%]: Forecasts mid to high teens growth in gross bookings over the next 3 years. Announced a $7B share repurchase authorization, marking a significant company milestone.

Allison Transmission Holdings (ALSN) [+13.9%]: Surpassed Q4 revenue and EBITDA estimates, driven by strong demand across various markets. Volume and pricing tailwinds are expected to enhance margins, with future on-highway contract renegotiations seen as potentially advantageous.

IQVIA Holdings (IQV) [+13.1%]: Q4 earnings and revenue slightly above forecasts. Strength in Technology & Analytics and Research & Development Solutions noted, despite ongoing client caution. FY24 guidance aligns with consensus expectations.

Robinhood Markets (HOOD) [+13%]: Q4 EPS exceeded forecasts with unexpected profit; revenue beat driven by crypto and options trading. Expenses for the quarter were lower than expected, with optimistic 2024 expense guidance. Highlighted significant inflows from competitors and growth in Gold subscribers.

Topgolf Callaway Brands (MODG) [+11.6%]: Q4 EBITDA beat expectations due to robust Topgolf sales and golf equipment demand. Q1 guidance reflects weather impacts, but 2024 outlook remains positive, underlining a long-term growth trajectory.

Avantor (AVTR) [+10.2%]: Q4 performance surpassed expectations across all metrics, with strong results in all regions. Education/service platforms maintained momentum; FY24 revenue growth guidance encircles consensus. Market conditions seen as stable.

DaVita (DVA) [+8.6%]: Exceeded Q4 earnings and revenue predictions. Early revenue recognition from certain arrangements and revenue-cycle management improvements noted. FY24 EPS guidance exceeds analyst expectations, aided by anticipated rate increases.

Zillow Group (ZG) [+7.6%]: Q4 EBITDA and revenue outperformed, with an improved EBITDA margin. Analysts positive on Residential segment's growth and super app rollout, despite concerns over interest rates post-January CPI report.

Losers!

QuidelOrtho (QDEL) [-32.2%]: Significant Q4 earnings and margin miss with weaker revenue, focusing on an overestimated Covid/Flu season impact but more positive on non-respiratory segments, especially labs business. FY24 guidance significantly below expectations, leading to multiple downgrades.

MGM Resorts (MGM) [-6.3%]: Missed Q4 EBITDAR but revenue exceeded forecasts, with Las Vegas and Macau outperforming despite regional setbacks from labor strikes and tough comparisons. Analysts remain optimistic about Macau and Vegas, driven by events like F1 and Super Bowl.

Kraft Heinz (KHC) [-5.5%]: Q4 adjusted EBITDA and revenue fell short, with sales affected by lower volume/mix despite better pricing. FY24 EPS guidance matches consensus, expecting flat or slightly higher organic net sales year-over-year. Noted FX and debt refinancing challenges, with no further buybacks in 2024.

Market Update

Trivia Answers

C) Ford never declared bankruptcy while GM and Chrysler did.

B) Dutch Tulip Mania took place in the 1600s.

B) TWA went bankrupt in 2001 (for the third time I might add), and it’s pieces acquired by American Airlines.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.