🔬Rotation Alternatives (aka Roternatives)

Plus: Home sales hit worst level since the GFC; Tech earnings aren't enough to keep hype going; and much more!

"There is a giant difference between a good stock and a good company."

- Warren Buffett

"Remember, buy low, sell high. Fear? It’s the other guy’s problem."

- Louis Winthorpe III (Trading Places)

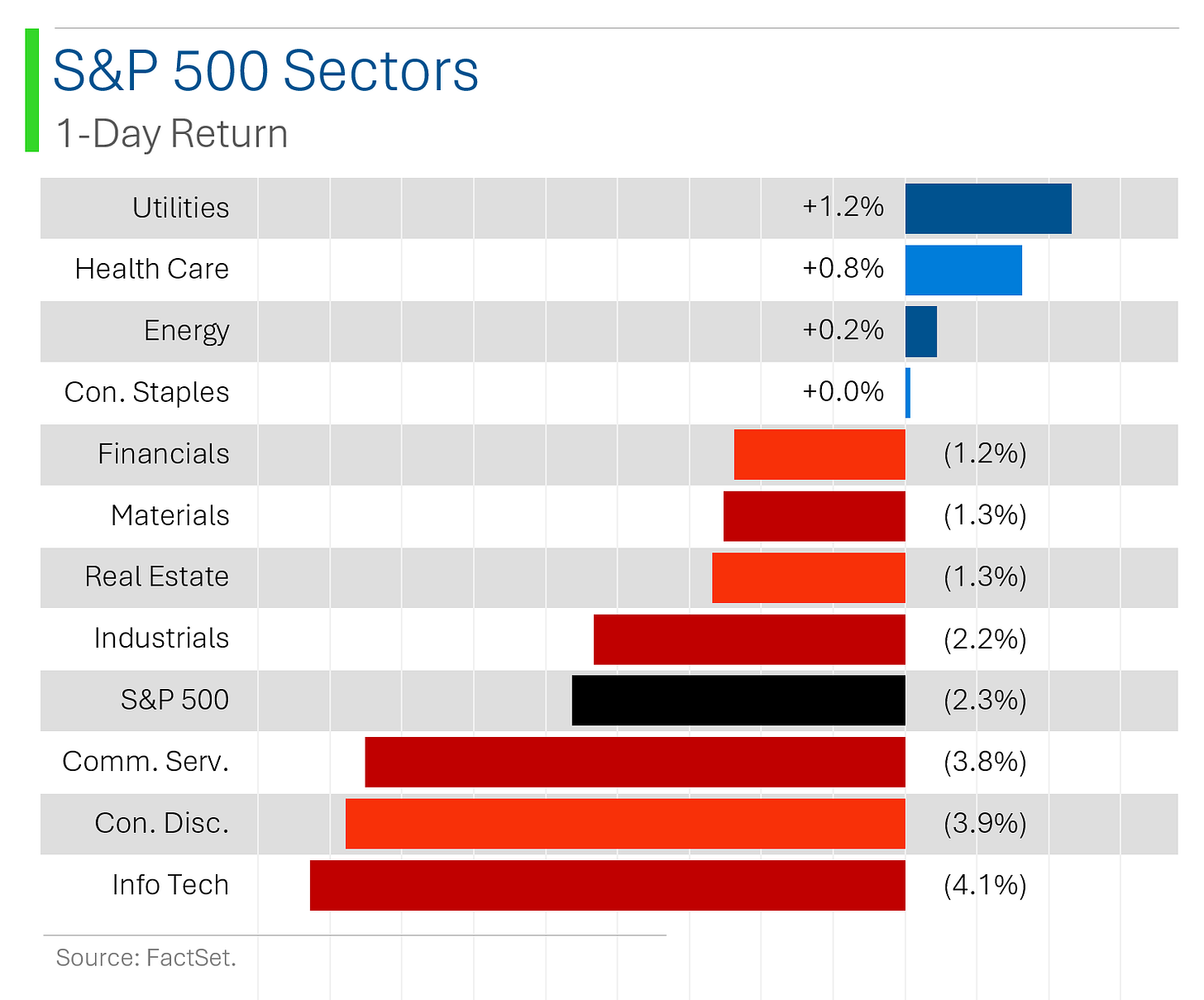

Terrible day for the big US markets with the S&P 500 -2.3% and Nasdaq -3.6%. Even small-cap imploded after recent strength, with the Russell 2000 -2.1%.

4 of 11 sectors closed higher and it was pretty textbook actually as the three biggest defensive sectors - Utilities (+1.2%), Healthcare (+0.8%) and Staples (+0.04%) - were in the green. Tech (-4.1%) got incinerated as soft earnings didn’t help matters.

Notable companies:

Tesla (TSLA) [-12.3%]: Q2 EPS and EBITDA missed; revenue ahead due to credits and energy segment strength; auto margins weaker as ASPs fall; announced Robotaxi event for 10-Oct; downgraded to neutral from overweight at Cantor Fitzgerald due to valuation after 70% rally over three months.

Alphabet (GOOGL) [-5.0%]: Q2 results mostly better; positive momentum in Search and Cloud from new AI features; cautious on YouTube miss, tougher 2H comps, margin headwinds from capex ramp and depreciation.

Ford (F) [-11.6% in pre-market trading]: Revenue in-line but EPS had a huge miss ($0.47 vs. estimates for $0.68). Reaffirmed EBIT guidance and upped free cash flow target.

More in ‘Market Movers’ below.

Street Stories

Rotation Alternatives (or roternatives, if you will)

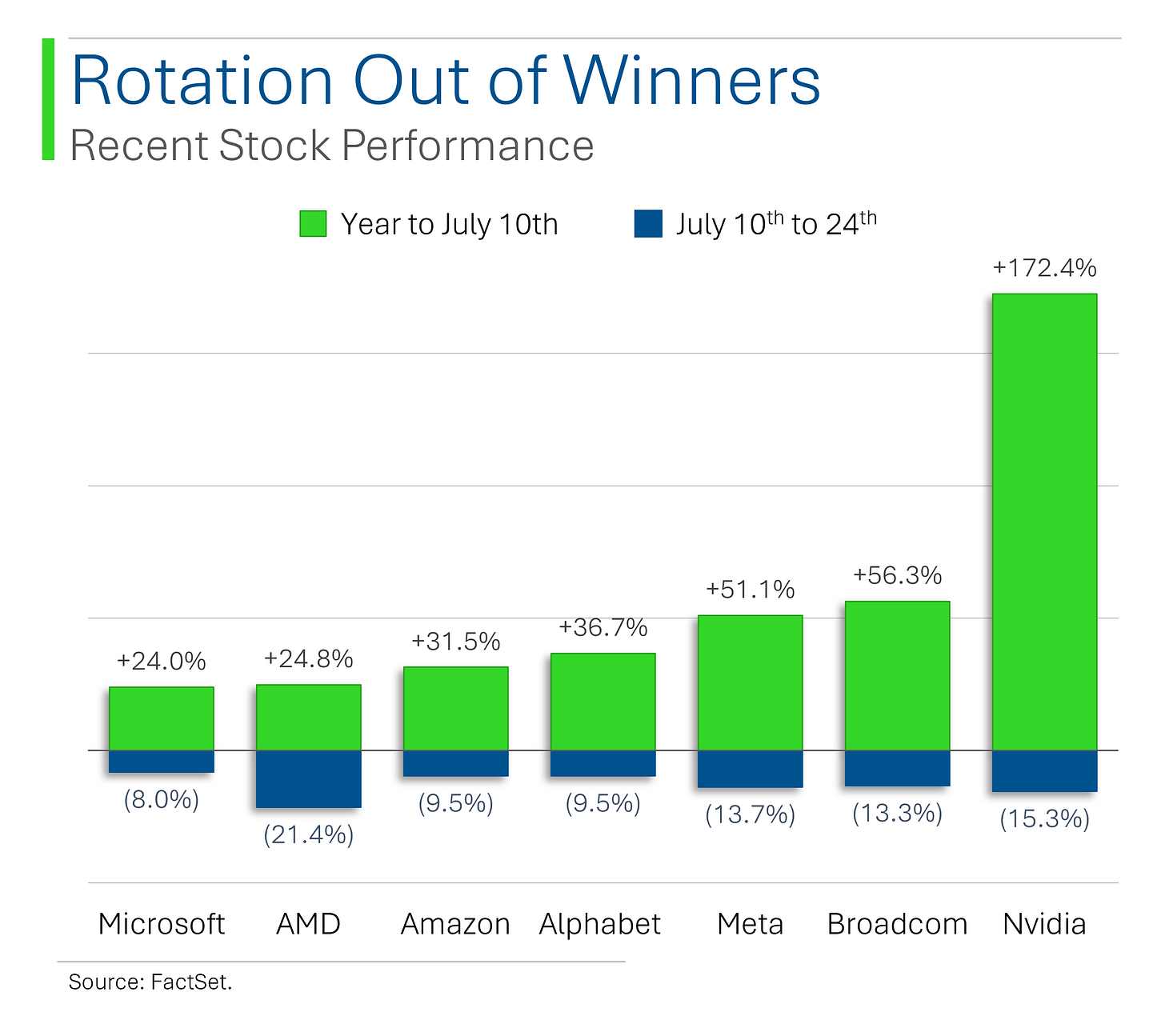

2024 thus far has been defined by a narrow selection of big winners. I’ve railed on this in pieces about market breadth, S&P concentration, etc. But now that it seems like things are rotating, it behooves investors to broaden their horizons and look for other quality investments that perhaps don’t have as much air under their valuation as the ones currently crumbling.

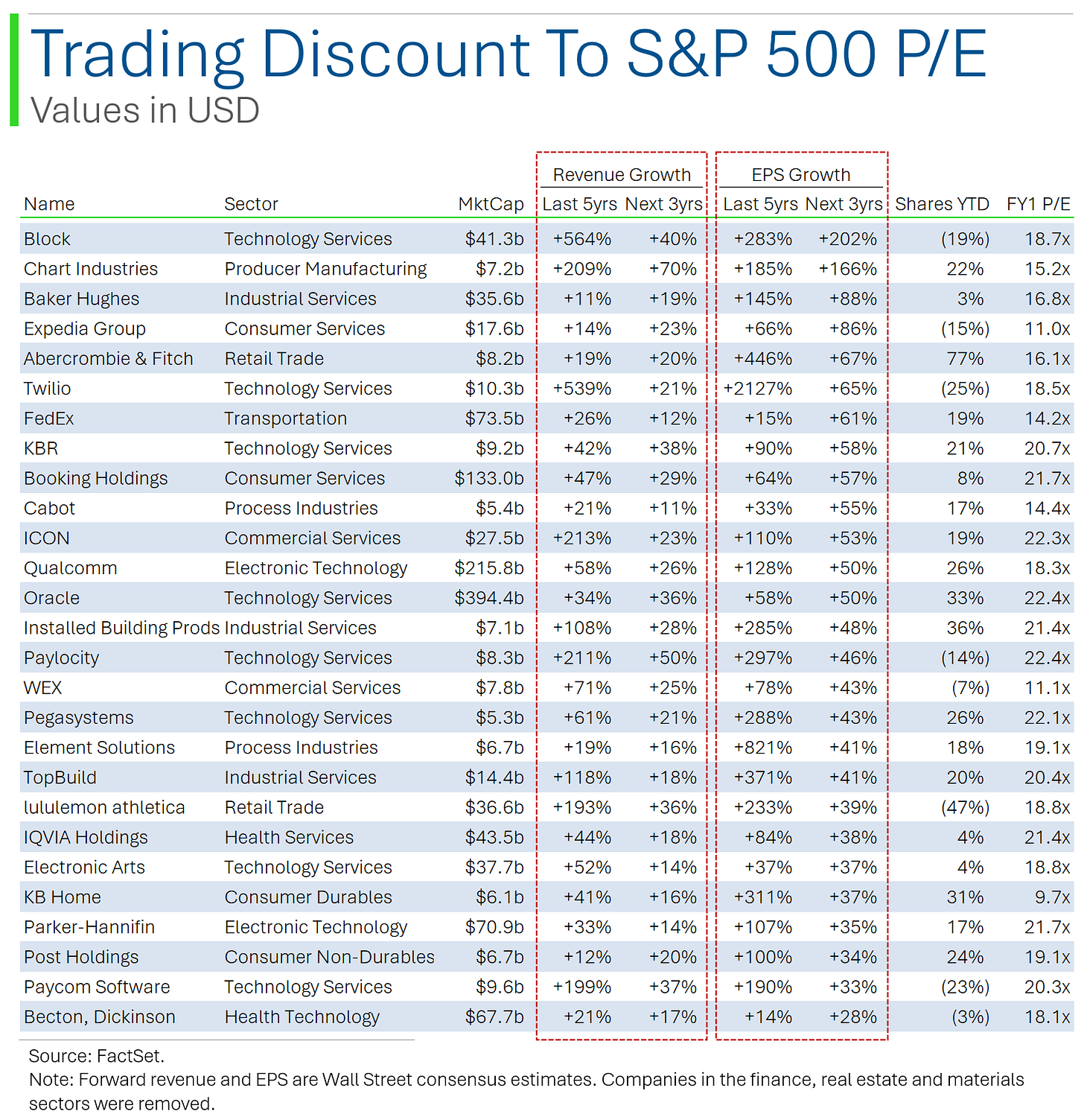

Presently, the S&P 500 trades at a calendar 2024 P/E of 22.6x. Tinkering a bit, I thought I’d check out what the best growing companies that trade at a discount to this are currently doing.

The results were pretty encouraging.

While the list above isn’t exhaustive (I removed a lot of duds), it does illustrate that there are still some solid companies out there trading at non-stupid valuations.

Highlighting just a few, Booking and Expedia got smoked during the pandemic but have returned to a nice glide path with Wall Street forecasting 23% and 16% compound annual growth rates for revenue over the next three years. And trading at 22x and 11x forward P/Es, they aren’t out in the stratosphere valuation-wise.

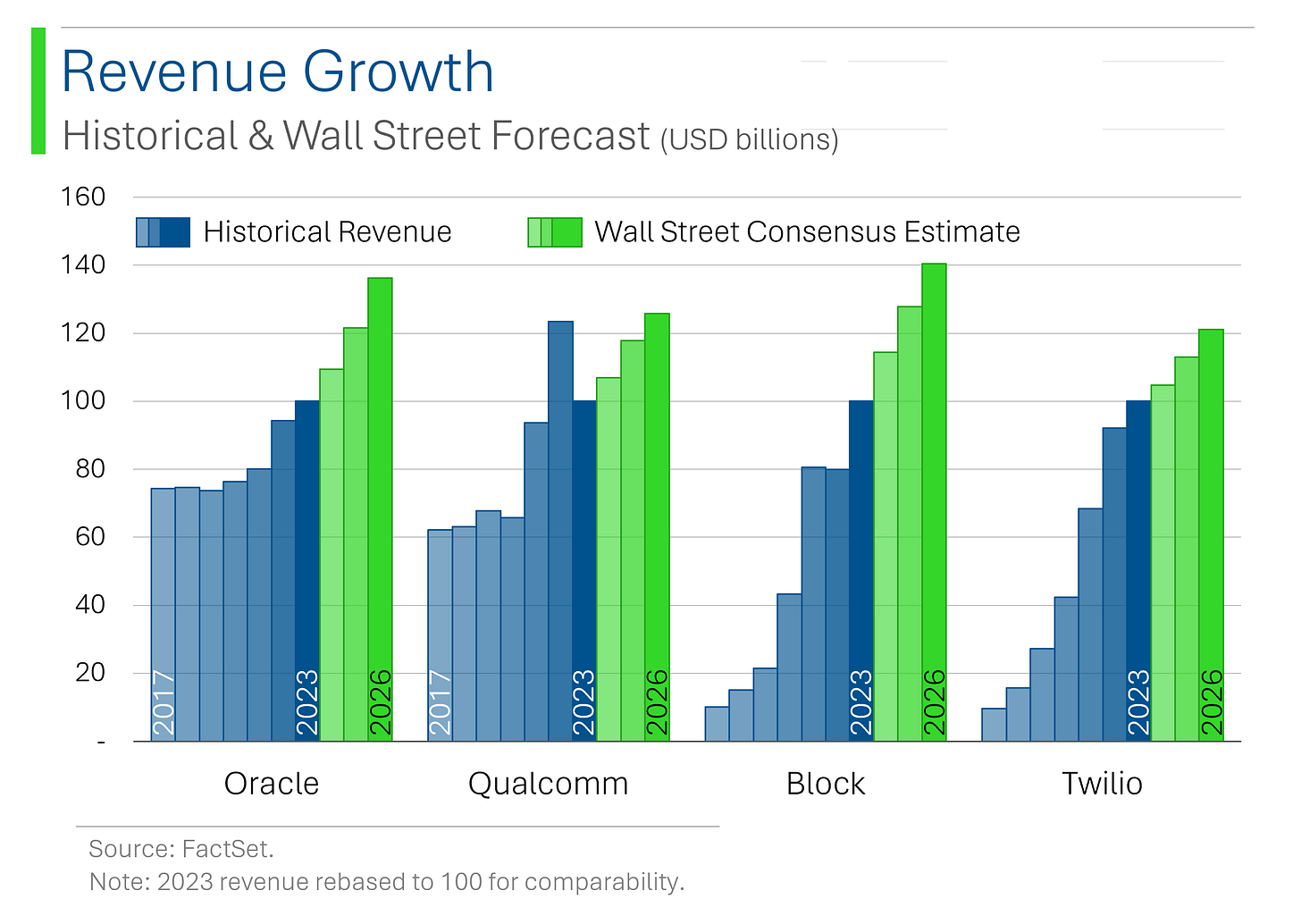

On a more techy front, Oracle and Block are expected to grow revs by double digits over the next few years, and Qualcomm and Twilio should continue their steady trudge upwards. All at P/Es below the market’s.

The point of StreetSmarts isn’t to be out pitching stocks, but I just wanted to point out that there are a lot of quality companies out there at non-record valuations.

Just in case you thought you had to start punting small-cap stocks just to stay in the game.

Market Flop Gets Floppier

The S&P 500 closed down 2.3% yesterday, compounding the recent sell-off and marking the worst trading day since December 15th, 2022. It was also the worst day for the Nasdaq in 18 months. At the time of publishing this newsletter (~7am EST July 25th), European and Asian semiconductor stocks are getting hammered as the US tech sell-off starts to go global.

So yeah, things are sucky atm.

Home Sales Are Collapsing

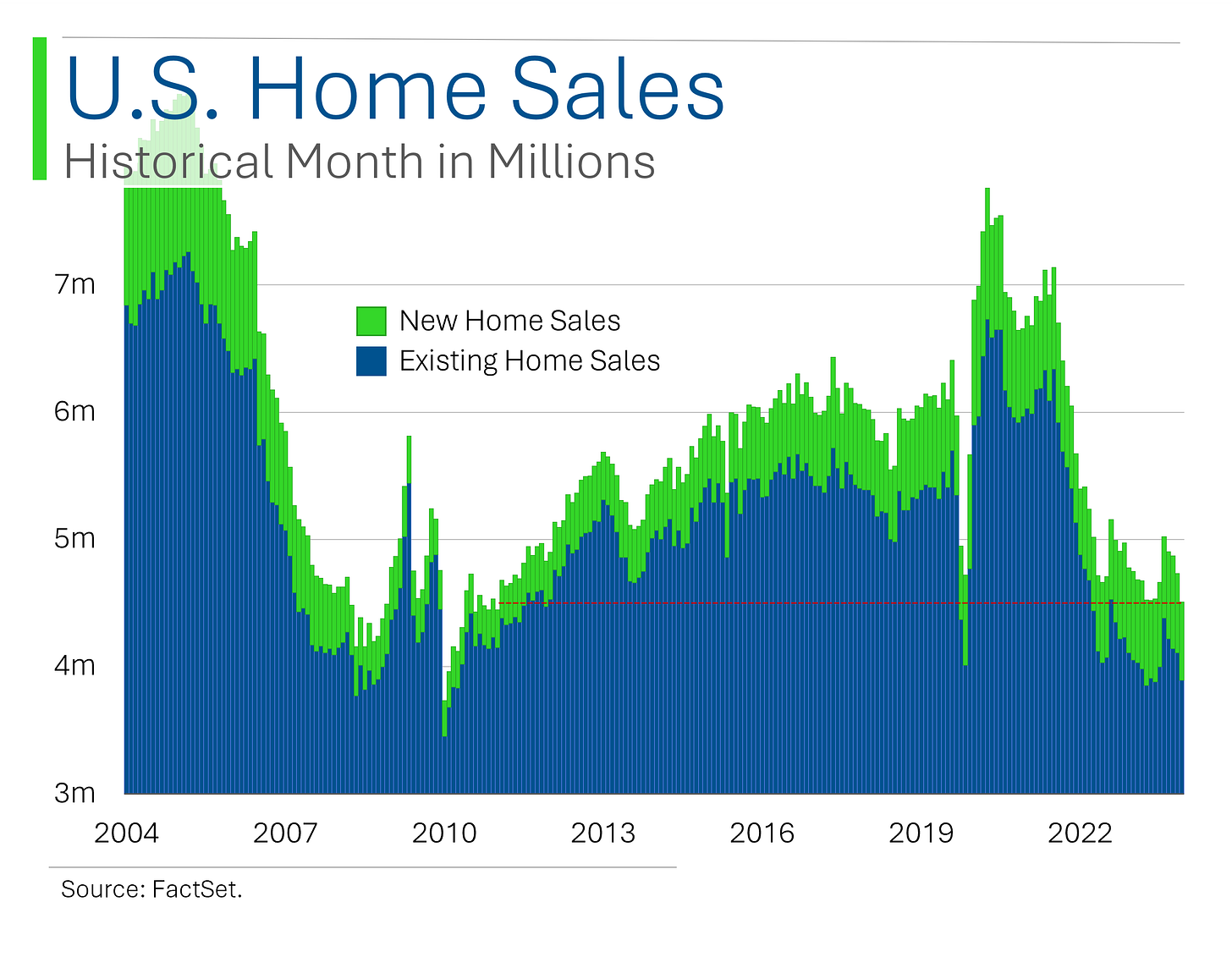

On Tuesday I flagged that June Existing Home Sales missed estimates (3.89m vs. economist estimates for 3.99m) and declined for the fourth straight month. Not wonderful.

Wednesday saw June New Home Sales come in at 617k - missing estimates for 640k by a mile. Also, not wonderful.

Being a bit curious, I thought I’d check out just how bad the situation is. Turns out June home sales hit their lowest combined level since July 2011 - you know, in the aftermath of the housing crash that triggered the Great Financial Crisis.

Cool….

Joke Of The Day

Today a man knocked on my door and asked for a small donation towards the local swimming pool. I gave him a glass of water. 😇

Hot Headlines

Reuters / Ferrari extends cryptocurrency payment system to Europe after US launch. A true HODLer’s dream…

Bloomberg / ~500 World of Warcraft workers vote to unionize which brings the total number of gaming nerds employees at Microsoft that have unionized to ~1,750. ‘Why would any Microsoft employee ever want to unionize?’ said nobody.

Reuters / Fortune 500 firms to see $5.4 bln in CrowdStrike losses, says insurer Parametrix. All good, I’m sure they’ll think of some way to make it up to their customers…

Tech Crunch / In probably the worst mea culpa in history, CrowdStrike offers $10 apology gift cards to disrupted partners. Apparently it even got flagged as fraud by Uber Eats and was cancelled. Can’t make this stuff up.

Newsweek / Putin needs '5 Years' to refill Russian Army as casualties reach 550K says UK Defense chief. CNN also reports that Russia is now offering a record $22k signing bonus to Moscow residents to fight in Ukraine.

Trivia

Today’s Trivia on great stock market crashes.

In the fallout from the Tech Bubble, what percentage did the NASDAQ Composite index lose from its peak in March 2000 to its trough in October 2002?

a) 35%b) 50%

c) 78%

d) 90%

Which Asian country experienced a major stock market crash known as the "Lost Decade"?

a) Japan

b) China

c) South Korea

d) India

Which event is often referred to as the start of the Great Depression?

a) The Tulip Mania

b) The Panic of 1907

c) The Stock Market Crash of 1929

d) The Dot-com Bubble

The Panic of 1907 was a financial crisis in the United States that led to the creation of what institution?

a) Federal Reserve System

b) Securities and Exchange Commission (SEC)

c) International Monetary Fund (IMF)

d) World Bank

(answers at bottom)

Market Movers

Winners!

Enphase Energy (ENPH) [+12.8%]: Q2 EPS and revenue slightly missed; no destocking expected in Q3; channel inventory normalized; Q3 booking strongest in a year; Q3 revenue guidance in line with consensus; Fed rate cuts expected to boost US solar market.

Mattel (MAT) [+9.8%]: Q2 earnings beat on better GMs; sales weaker; maintained FY24 guidance; analysts noted significant GM expansion and balance sheet improvements; solid 2H setup.

Flex (FLEX) [+6.9%]: FQ1 earnings and revenue beat; stronger demand in power and medical devices; strong FCF and inventory improvements; next-Q and FY guidance midpoints ahead of Street; announced CFO transition.

Check Point Software Technologies (CHKP) [+5.9%]: Q2 EPS and revenue beat; CFO light; ending deferred revenue and billings ahead; Q3 EPS and revenue midpoints in line with Street; reiterated FY guidance; Nadav Zafrir to become CEO in December.

AT&T (T) [+5.2%]: Q2 EPS in line; revenue slightly light; FCF well above consensus; growth in Mobility ARPU; postpaid net adds, churn, and upgrade rate ahead of expectations; reaffirmed FY guidance.

Tenet Healthcare (THC) [+4.8%]: Q2 earnings and revenue beat; authorized new $1.5B repurchase program; Q3 EPS and revenue guidance ahead of consensus; FY24 EBITDA and revenue guidance raised; increased 2024 volume outlook.

Thermo Fisher Scientific (TMO) [+4.1%]: Q2 earnings, revenue, and OM better; organic growth decline narrower than consensus; FY24 guidance midpoints raised; positive on Life Sciences demand stabilizing.

Seagate Technology (STX) [+4.0%]: Big FQ4 earnings beat; revenue and margins better; FCF ahead of consensus; next-Q guidance ahead of Street; analysts positive on strong cloud growth and stabilizing Enterprise; concerns about HAMR qualification push-out at GOOGL.

Lumen Technologies (LUMN) [+2.0%]: Partnership with Microsoft to expand network capacity for AI-driven datacenters.

Losers!

Lamb Weston Holdings (LW) [-28.2%]: FQ4 EPS and revenue missed; FY24 EPS and revenue guidance below consensus; noted market share losses and slowdown in US restaurant traffic; expects 2025 to be challenging; cited soft frozen potato demand, menu price inflation, slow restaurant traffic.

Tesla (TSLA) [-12.3%]: Q2 EPS and EBITDA missed; revenue ahead due to credits and energy segment strength; auto margins weaker as ASPs fall; announced Robotaxi event for 10-Oct; downgraded to neutral from overweight at Cantor Fitzgerald due to valuation after 70% rally over three months.

Wabash National (WNC) [-9.5%]: Q2 revenue light while EBITDA and EPS ahead; backlog down 28% q/q; flagged slowdown in new order activity; lowered FY revenue and EPS guidance; noted weakened demand environment.

Deutsche Bank (DB) [-9.4%]: Q2 mixed; higher provisions flagged as a concern; CFO comments highlighted no second buyback this year following quarterly loss.

AMC Entertainment (AMC) [-7.7%]: Preannounced Q2 EBITDA ahead, revenue in line, though EPS weak; blamed writers' strike for Q2 weakness compared to last year; noted strong July results; expects stronger movie revenues in 2H, 2025, and 2026.

Otis Worldwide (OTIS) [-7.1%]: Q2 sales missed while EPS better on margin upside; lowered FY sales guidance but EPS higher; softer NE orders/backlog; implied 2H EPS guide below consensus.

Ulta Beauty (ULTA) [-5.1%]: Downgraded to neutral from overweight at Piper Sandler; cited increased competition and lack of upside catalysts.

Alphabet (GOOGL) [-5.0%]: Q2 results mostly better; positive momentum in Search and Cloud from new AI features; cautious on YouTube miss, tougher 2H comps, margin headwinds from capex ramp and depreciation.

Lennox International (LII) [-4.9%]: Q2 earnings better though revenue light; Home Comfort sales below consensus; industry destocking concluded midway through the quarter; reaffirmed FY revenue and FCF guidance; cautious on repair vs replace trends.

Visa (V) [-4.0%]: Fiscal Q3 revenue light while EPS in line; reiterated FY guidance; noted slowdown in July spending growth; comments on moderation in low-end customer spending; focus on softer cross-border trends.

General Dynamics (GD) [-3.3%]: Q2 EPS light, but revenue ahead; OM light on Aerospace underperformance; margin weakness likely due to mix; cautious on Aerospace deliveries, offset by better Marine and Combat segment performance.

Market Update

Trivia Answers

c) The Nasdaq lost 78% in the Tech Bubble.

a) Japan experienced the lost decade. The Nikkei index only caught up to those levels after more than 30 years in 2024.

c) The Stock Market Crash of 1929 is considered the start of the Great Depression.

a) Federal Reserve System came about after the Panic of 1907.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.