🔬Revenue Growth Is Sticky

Plus: Tesla shares do180 on self-driving hype; yield curve is less inverted; Japan goes to battle with Yen sellers; and much more

“Heroes are heroes because they are heroic in behavior, not because they won or lost.”

- Nassim Taleb, Fooled by Randomness

"My iPhone has 2 million times the storage of the 1969 Apollo 11 computer. They went to the moon. I throw birds at pig houses"

- Bill Murray, famous Angry Birds player

Solid day for the big US market with the S&P 500 and Nasdaq both +0.3%.

9 of 11 sectors closed higher led by Consumer Discretionary (+2.0%) while Communication Services (-2.1%) was worst.

The extreme rise in Cocoa prices seems to be waning as futures crashed 17% for their worst single day decline in history as speculators unwind positions.

Way too many earnings yesterday (see ‘Market Movers’ below) including AMC Entertainment dropping 11.3% on mixed results and soft Q2 outlook due to linger impact of last year’s Hollywood strike.

Tesla popped 15.3% on approval for full self-driving in China.

Street Stories

Growth is Sticky

I don’t have many investment maxims but I do have a few, such as invest in scarcity (see my write-up on if you should buy a sports team for an example) or my spin on the 80/20 rule, the 90/3 rule, where 90% of what happens to a stock can be attributed to 3 factors. Retail investors don’t have time to know everything about a company, but will fare better if they find and understand those three things.

Another one of these maxims I have is that ‘Growth is Sticky’ - essentially that winners keep on winning, and losers suck.

Above is a list of companies in the S&P 500 that had strong revenue growth rates not just over the last five years, but the previous five as well. While growth may have tempered, in most cases it has remained strong. Winners keep winning.

Above, you can see the average revenue growth for companies in the S&P 5001: Green is for the last 5 fiscal years (FY -5 to FY 0), Blue for the previous 5 fiscal years (FY -10 to FY -5). As you can see, fast growing companies 10 to 5 years ago typically have had strong growth over the last 5 years. And vice versa.

1. Note that I excluded companies without a full 10 years of publicly available revenue data. As well as smaller companies with <$5 billion in revenue in the last fiscal year.

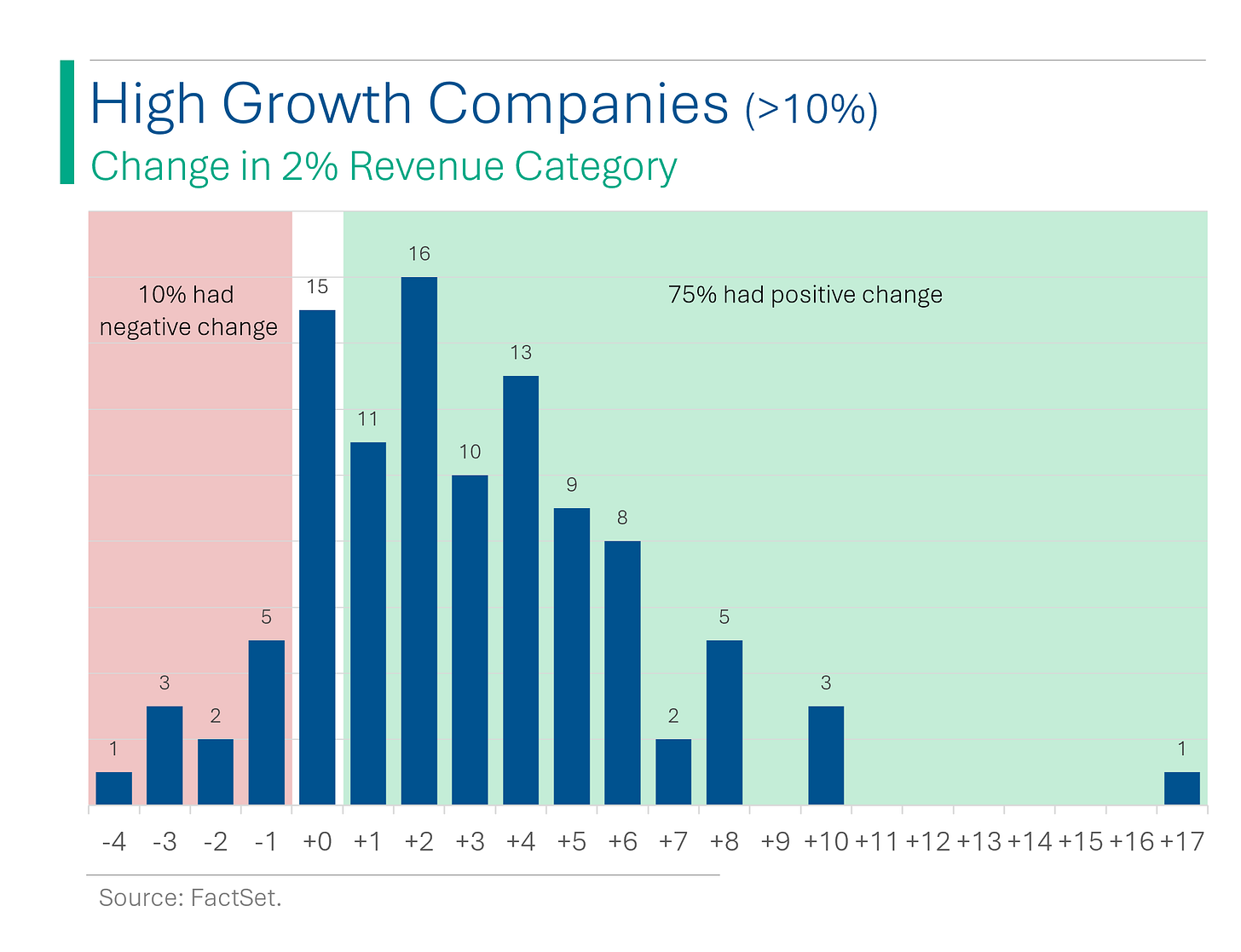

To dig in a bit more, I put companies into buckets based on their revenue growth in the 10 to 5 years period with each bucket representing a 2% change in revenue (>20% for bucket 1, 18-20% for bucket 2, all the way to <20% for bucket 22). I then compared that to each company’s bucket over the last 5 years.

The result aligns with my thinking that, generally speaking, revenue growth is sticky. But this isn’t super convincing, is it?

What is more convincing is just including companies that had strong (>10% annual average) between the 10 to 5 years period. Of these companies, 85% grew at the same growth rate or better over the last 5 years.

Moreover, only three had negative growth: chip maker Micron1, biotech Biogen2, and orthopedic device maker Zimmer Biomet3.

1. Mostly because FY -5 was a banner year.

2. Thanks to a slowing Multiple Sclerosis portfolio which was well forecast.

3. Well telegraphed loss of market share in hip and knee surgeries due to better competition.

Ryan’s Thoughts: So who cares? I bring this up because I think a lot of investors get scared-off of great companies because they think they’ve missed the boat and that growth will cool; the multiple will get cut in half; and they’ll lose their shirt.

I’m not saying valuation isn’t important, only that if you find a truly transformational company - a Facebook, Nvidia, Amazon, Tesla, etc. - that that growth tends to stick around a lot longer than you expect, and that high valuation was a bargain.

This relates to something I’ve referred to in the past as the ‘DCF Fallacy’: The idea that those building financial models always forecast growth to taper-off dramatically towards the end of the 5, 7 or 10 year model forecast period.

At my last gig, I gave a presentation on this and used a research report from (I think) Merrill Lynch on Facebook when it IPO’d to illustrate my point. It showed Facebook continuing to grow revenue at ~50% in 2013 (like it did the year previous) and then something like 30%, then 20%, 15%, 10%, 5%. That would have meant Facebook would have revenue of ~$16 billion in 2018. The actual number was $56 billion. Only off by ~250%.

A good growth investor I know used to say ‘Most people want to buy stocks at low P/E multiples and sell them at high P/E multiples. Me, I want to buy them at high P/E’s and sell them at low P/E’s. I just want the ‘E’ to grow a few thousand percent first.’

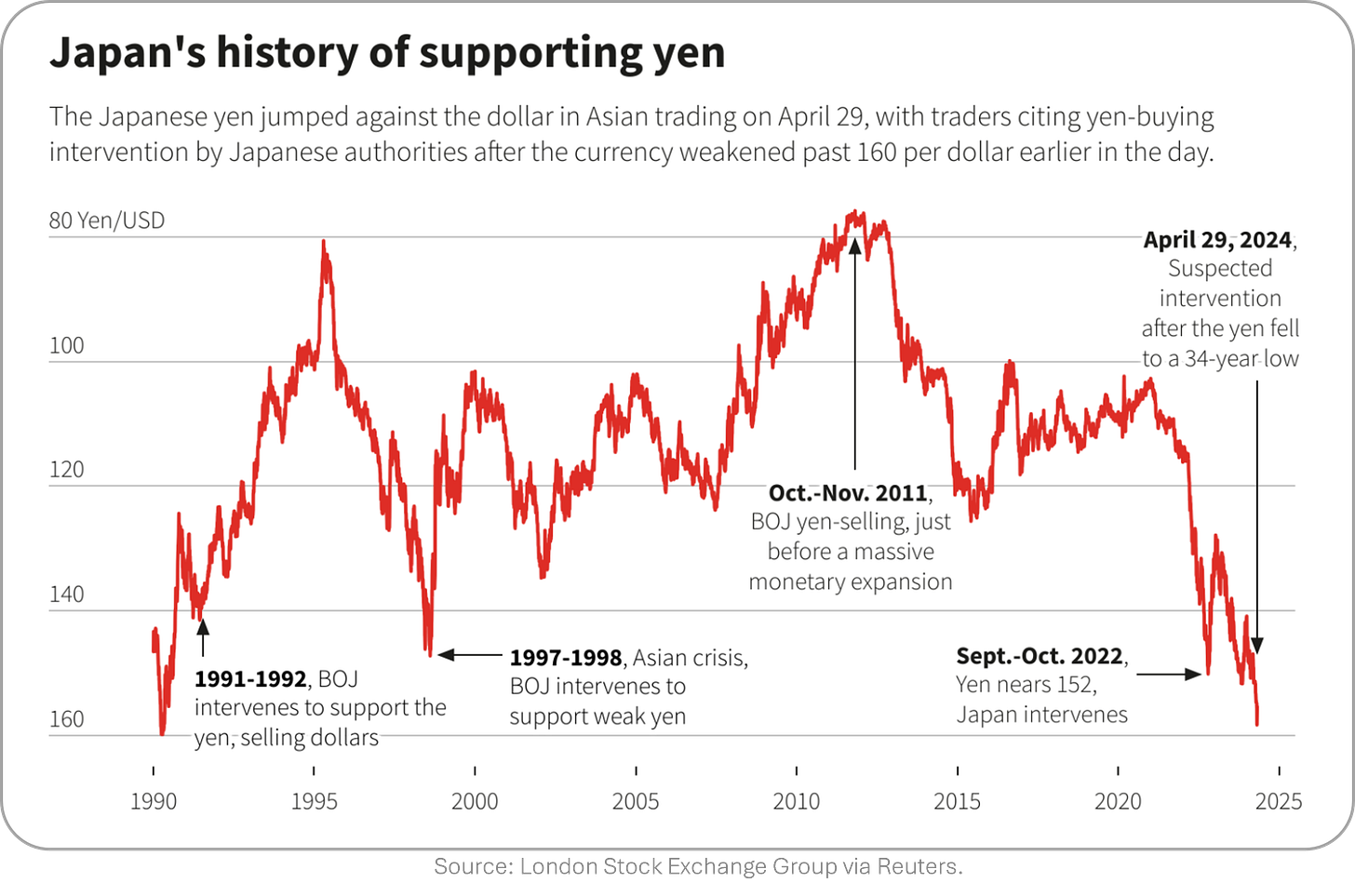

Japan Intervenes to Stop Yen Tanking

The Japanese yen has been a disaster this year, dropping 10% against the USD (massive for FX land) to a 34-year low Monday. Decades of ultra low (or negative) interest rates, and now an economy in recession has weighed heavily on the currency. The Bank of Japan has (apparently) said enough is enough, and taken action to support the currency by buying yen.

Yield Curve’s Bearish Steepening

One of the most reliable indicators of a future recession is an inverted yield curve, meaning that short-term government securities (T-Bills) hold a higher interest rate than longer term ones (T-Notes, T-Bonds). Right now it’s looking like we might lose the invertedness - but be worse off for it.

While a US recession isn’t on anyone’s radar at the moment, the back-end of the yield curve has been picking up steam, with the 10-Year Bond yield headed up towards the ominous 5% level it closed in on last October. Sticky inflation and a perpetually increasing timeline for the Fed to cut rates has fueled this bond selloff, with individuals and businesses set to endure increasing interest costs as a result.

Tesla Surges on China EV Ruling

Elon Musk's stealthy weekend trip to China miraculously secured a preliminary nod for Tesla's driver-assistance system, catapulting Tesla's stock up 15% in a single day. The quick turnaround from his meeting with Premier Li Qiang led to the regulatory thumbs-up, despite Tesla's dwindling market share in the face of fierce local competition.

This approval, contingent upon Tesla’s deals over mapping with Baidu and data privacy, might just be the lifeline Tesla needs to reclaim its fading star in the world’s biggest auto market, provided the systems work as smoothly as planned.

Good thing Elon doesn’t have a history of over promising.

Joke Of The Day

🤦♂️I got an email asking me to invest in Egyptian architecture. Sounds like a pyramid scheme.

Hot Headlines

The Verge / National Highway Traffic Safety Administration (NHTSA) opens investigation into Ford’s BlueCruise after software linked to fatal crashes. It includes two 2024 incidents - one in San Antonio and another in Philadelphia. News comes a few days after they launched an investigation to determine if Tesla’s Autopilot driver-assistant software recall did enough to increase driver engagement and protect lives.

Reuters / Apple’s latest iOS for iPad given 6 months to comply with new regulations. The operating system for iPads has been designated as a gatekeeper under the bloc's landmark tech rules by EU antitrust regulators because of its importance to business users, the European Commission said on Monday.

Hawaii Tribune / How athletes and entertainers like Shohei Ohtani get financially duped by those they trust. Builds on the recent illegal gambling probe that resulted in his interpreter, Ippei Mizuhara, being charged with bank fraud for stealing $16 million from Ohtani’s bank account to pay gambling debts.

Reuters / Apple shares rise after Bernstein analyst takes bullish stance. The analyst argued that China weakness is "more cyclical than structural" and that its business there has "exhibited much higher volatility" than Apple's overall business. Shares closed up +2.5% but are still down 9.9% in 2024.

Axios / Major mobile carriers fined nearly $200 million for sharing customer location data. T-Mobile, AT&T, Sprint and Verizon violated the Communications Act when they sold customers' location data without their consent and continued the practice without sufficient safeguards after being informed of the violations, the FCC said.

Trivia

Today’s trivia is on the sexy and exciting mutual fund industry.

When was the first mutual fund created?

A) 1893

B) 1924

C) 1945

D) 1924What is considered the primary advantage of investing in mutual funds?

A) Guaranteed returns

B) High-risk investments

C) Fixed income

D) DiversificationWhich mutual fund company is known for pioneering the first retail index fund?

A) Vanguard

B) Fidelity

C) Schwab

D) BlackRockWhat is a mutual fund that primarily invests in short-term debt instruments known as?

A) Equity fund

B) Balanced fund

C) Money market fund

D) Bond fund

(answers at bottom)

Market Movers

Winners!

Tesla (TSLA) [+15.3%]: Received approval in China for its FSD technology and will collaborate with Baidu for mapping and navigation.

Baidu (BIDU) [+5.6%]: Reached a deal with Tesla to provide mapping licenses for data collection on China's roads.

Domino's Pizza (DPZ) [+5.6%]: Q1 EPS exceeded expectations with steady revenue; US same-store sales rose 5.5%, surpassing forecasts. Opened 164 new stores in Q1 and confirmed long-term growth targets, including a minimum of 7% annual global retail sales growth. The Uber Eats partnership initiated in Q1 accounted for 3% of sales.

Liberty Media Formula One (LSXMA) [+5.3%]: Rating upgraded to buy from neutral by Seaport Research due to the stock's dip ahead of its June merger with SIRI, eliminating the NAV discount.

Sirius XM Holdings (SIRI) [+5%]: Rating upgraded to buy from neutral at Seaport Research, noting the recent price dip ahead of its June merger with LSXMA, which has removed the NAV discount; highlighted the potential for share repurchases due to strong free cash flow.

Losers!

AMC Entertainment (AMC) [-11.3%]: Reported a preliminary Q1 revenue that surpassed expectations by 10%, although EBITDA was slightly worse; expects continued challenges in Q2 box office due to last year's Hollywood strike.

SoFi Technologies (SOFI) [-10.5%]: Beat Q1 earnings and revenue forecasts, but provided Q2 adjusted EBITDA and net revenue guidance below consensus. Raised FY24 adjusted EBITDA and net revenue guidance, now anticipates an increase in tangible book value between $800M and $1B, up from previous $300-500M; still plans to add at least 2.3M new members in 2024.

Deutsche Bank (DB) [-8.4%]: Exploring settlement options in litigation over its Postbank takeover, with potential financial impacts from legal provisions expected to reduce Q2 and FY profitability by approximately €1.3B; also uncertain about applying for another share buyback this year.

UMB Financial (UMBF) [-6.5%]: Reported Q1 net interest income and margin above expectations, noted double-digit fee income growth and stable credit metrics. Announced acquisition of HTLF in an all-stock deal valued at $2.0B, with per-share consideration of $45.74, about a 28% premium; deal expected to close in Q1'25.

Franklin Resources (BEN) [-6.4%]: FQ2 earnings fell short with revenue matching forecasts; operating income was below consensus and expenses were higher than anticipated, although positive net inflows were a highlight.

Market Update

Trivia Answers

D) The first mutual fund launched in 1924. The oldest mutual fund still in existence is MFS' Massachusetts Investors Trust (MITTX), also established in 1924. Currently it manages ~$6 billion.

D) Diversification is typically considered the main draw for investing in mutual funds.

A) Vanguard pioneered the index fund. Shout out to the Bogle-heads.

C) Money market fund invests primarily in short-term debt instruments.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

I can't wait for someone to master self driving.