Research Analysts are Chicken, Earnings Season Doesn't Suck (*yet*), and Much More

StreetSmarts Morning Note

***Friendly reminder to hit the ‘Like’ button above, it really helps get Substack to share my newsletter***

“The four most dangerous words in investing are: ‘This time it’s different.’”

-Sir John Templeton

"Know what you own, and know why you own it."

-Peter Lynch

Table of Contents

A.M. Allocations: Summaries of important news and investing events

Big 3 Sales Estimates: Analysts on Strike

Green October: Earnings Season Scorecard

Pay to Play: X's Dollar Defense Against the Bot Invasion

Hot Headlines: Links to some of the top financial stories of the day

A.M. Allocations

Big 3 Sales Estimates: Analysts on Strike

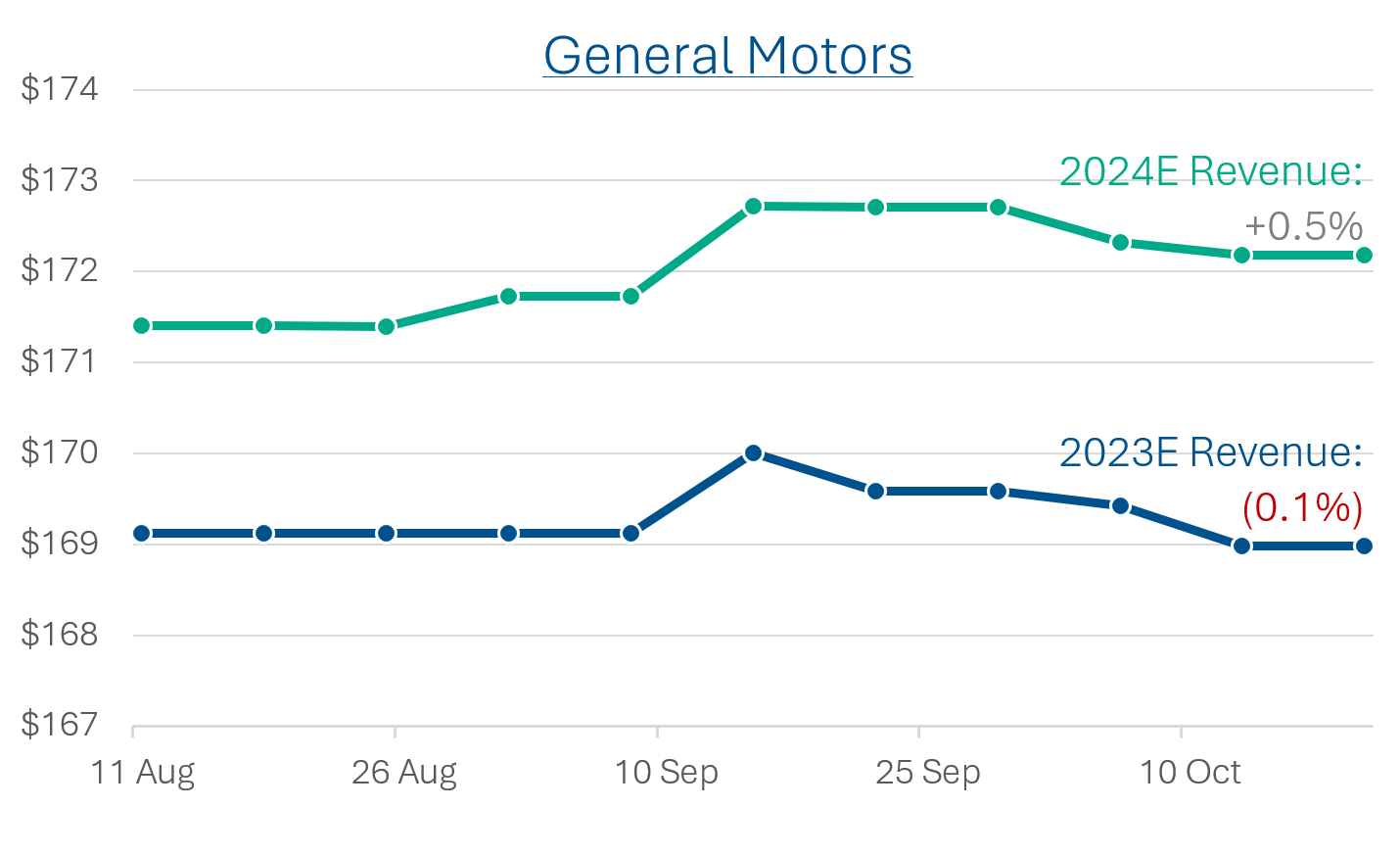

I’ve written quite a bit about the UAW-led strike at the Big 3 Automakers, including my coverage of current wages on Monday. What I am curious about is ‘how much have sales estimates actually decreased?’ I mean, at this point this is looking like an multi-generational affair, which, presumably, is bad for production. You’d think…

It turns out estimates for sales haven’t really come down by too much. Wall Street revenue estimates for Ford and GM have only been trimmed by 0.5% and 0.1%, respectively, for their current fiscal years (both December year ends).

Granted that until recently the strikes have been limited to select plants, but I’m pretty surprised at the modesty of the trims. I mean, Ford’s 2024E is actually up. Right now around +36k employees at the Big 3 are on strike or furloughed because of the strike, out of a total workforce of 146k.

Take-Aways: I think this oddity is driven by one of two things: Either, I don’t understand the automotive industry (fine, I don’t) or Wall Street analysts are too chicken to slash estimates. For context, Lehman Brother’s had an ‘A’ credit rating six days before it went bust.

A shady relic of the past is the ‘relationship’ companies have had with their coverage at the banks. Too hard on management? We aren’t speaking at your conference. Trash talked our quarter? You just lost our investment banking business. Also, a very real thing is the way CEOs, CFOs and Investor Relations teams ‘manage the Street’: Effectively you get a nudge if your estimates are too punchy or bearish (they want a modest beat on the quarter, after all).

Now - Stellantis’ numbers have come down, but it’s hard to say how much is operational and how much is their European research coverage not ‘playing ball’. Anyway, maybe I’m wrong, and the expected-value of having a quarter of your workforce (and growing) engaged in a negotiation stalemate poses effectively zero risk to fiscal 2023 or 2024 at GM and Ford . Or maybe we shouldn’t trust Wall Street (lol)

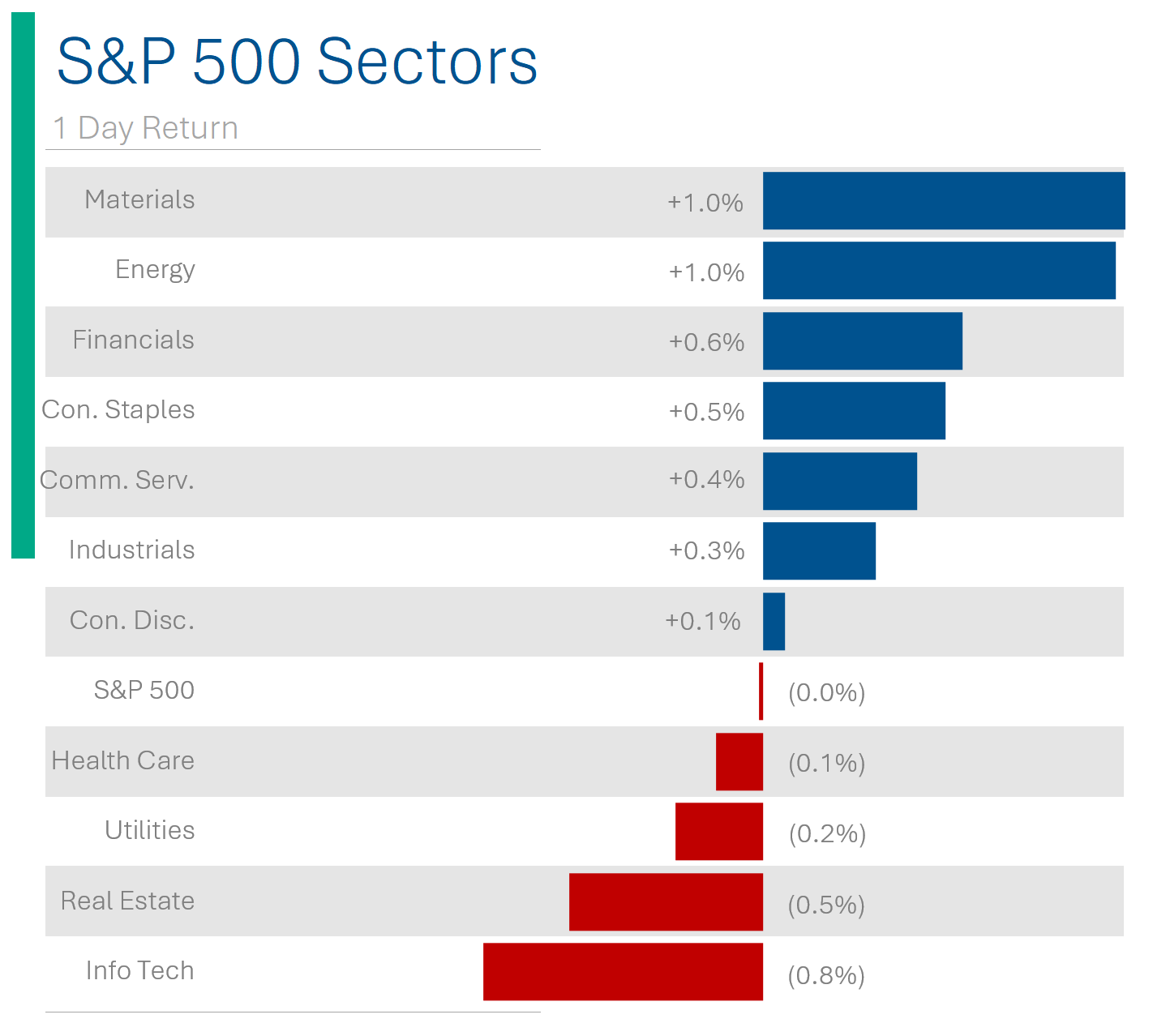

Green October: Earnings Season Scorecard

Earnings season has kicked-off in earnest and it is off to a good start. Of the 23 companies that have reported so far in October, 78% have beat on Earnings Per Share, with only 1 miss (4%).

Revenue has been a bit more of a mixed bag, but still with most companies (83%) in the ‘good’ column (Beat or In-line).

On the sector front, most of the reporting has been from Financials (35% of companies), Consumer Staples (26%) and Industrials (17%), and we haven’t really seen any of the big tech names as of yet.

Take-Aways: It’s a bit too early to draw any big conclusions across the board, but with several of the big banks having already reported, it looks like the financial sector has done a decent job of managing the rate raising cycle effectively.

Explainer: If you don’t own any of the companies that have reported, why should you care? Well, there are a few reasons. The first is what are sometimes called ‘read-throughs’ or ‘read-across’. You might not care how Pepsi did when they reported last Tuesday, but you might if you owned Coke shares. Do to operational and competitive factors, their earnings will look different but some of the macro economic factors that influenced Pepsi’s performance can be used as a hint for Coke. For example, if ‘Small Regional US Bank #1’ reported record profits and massive loan growth, you might infer that ‘Small Regional US Bank #2’ is probably going to have an ok quarter as well.

Another consideration is market sentiment. It’s complex, opaque and hardly worth building an investment strategy around, but if a broad mix of companies is having a good quarter, that helps to set a positive tone for the market. Conversely, if every company is out there reporting disastrous earnings, you might want to have a look into your market exposure.

Notes on calculations:

1. Determining what constitutes a ‘Beat’ or a ‘Miss’ is also subjective. For myself, I consider a figure that exceeds the estimate by greater than 1% as a ‘Beat’ and a figure that falls short by greater than 1% as a miss.

2. I am only using companies that have reported since October 1st to align with my subjective view of what constitutes ‘earnings season’. For example, Nike reported its Q1 earnings on September 29th because it has a May fiscal year end. Weirdos.

Pay to Play: X's Dollar Defense Against the Bot Invasion

X (formerly Twitter) is testing a new program called “Not a Bot,” requiring new users in New Zealand and the Philippines to pay a $1 annual subscription to post and interact on the platform. This initiative allegedly aims to reduce spam and bot activity, but critics see this as a test to see if people will pay for X. Existing users are not affected, and the fee is waived for those opting for the $3.99 monthly premium service.

The move follows Elon Musk’s suggestion to introduce a small payment system for using X to combat bot activity. Despite this, concerns arise as bad actors could still pay for inauthentic accounts. X is also facing scrutiny from the European Commission over the spread of false and misleading information during the Israel-Hamas conflict.

Joke Of The Day

A client asks his adviser, “is all my money really gone?”

"No, of course not," the adviser says.

"It's just with somebody else!"

Stockbroker: What is a million years like to you?

God: Like one second.

Stockbroker: What is a million dollars like to you?

God: Like one penny.

Stockbroker: Can I have a penny?

God: Just a second...

Hot Headlines

(Axios) WFH rates lowest since pandemic, federal data finds - currently only 26% of households have someone who will WFH at least one day a week, down from early 2021 peak of 37%. I WFH. It gets lonely. Msg if you wanna hang-out IRL

(Reuters) GM delays EV truck production at Michigan plant by year - ie: they don’t think anyone will buy them now (but what about later?…TBD).

(Axios) Amazon reaches 10,000 Rivian electric delivery vans in U.S. - if you caught my Monday newsletter you’d know Rivian loses $90k per vehicle. So, that cost them about $900 million (yes, I know it doesn’t work that way).

(Reuters) Putin visits 'dear friend' Xi in show of no-limits partnership - with friends like that, who needs leprosy?

(CNN) CVS, Walgreens and Rite Aid are closing thousands of stores - decreased profits from prescription sales and increased competition from Amazon and big-box retailers have led to gaps in communities for accessing medicines and essentials. Rite Aid has filed for bankruptcy amidst these struggles, and ongoing walkouts by Walgreens and CVS staff over low pay and understaffing exacerbate the issue.

(Yahoo) Equity Bears Resurface in BofA Poll as Recession Risks Linger

Trivia

What was the informal nickname to a group of Blue Chip stocks that was considered responsible for the bull market of the 1960’s and early-1970s?

The Sweet 16

The Dow Dreamers

Magnificent 7

The Nifty 50

The 1970s bull market ended with the 1973-1974 bear market, one of the worst on record. What event compounded the bear market?

Black Friday

US Savings and Loan Crisis

The Oil Crisis

Rock and roll music

(answers at bottom)

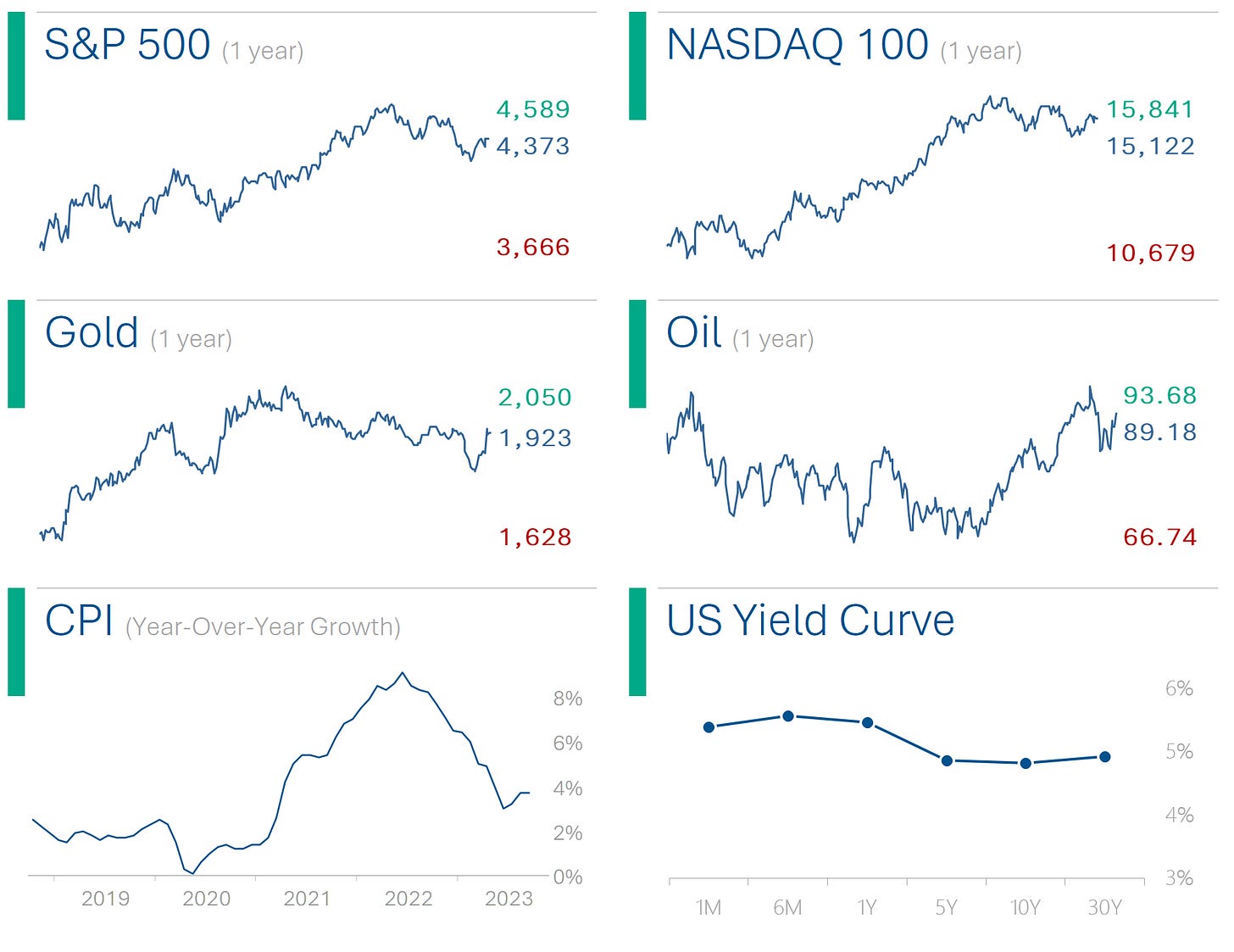

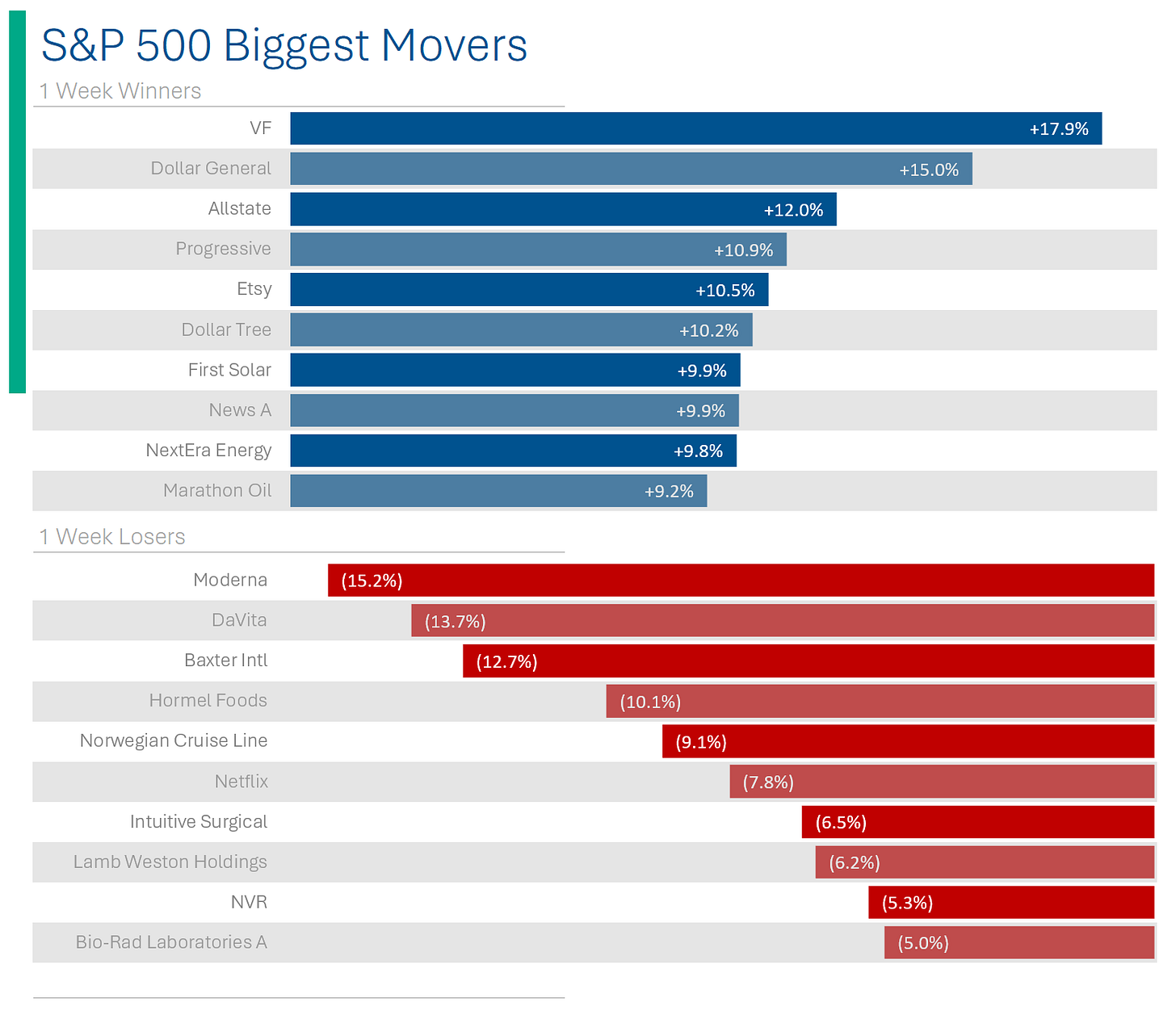

Market Update

Trivia Answers

The Nifty 50. Some of them are still household names, like McDonald’s, Walmart and Disney. Some aged as well as a tomato: Polaroid, Sears, Eastman Kodak, Xerox…

The Oil Crisis.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could Share and give us a ‘Like’ below.