🔬Remember When Covid Companies Were A Thing?

Plus: Disney's proxy fight comes to an end (for now); Intel's Foundry business gets zero love from the Street; *Insert pun about weed stocks going higher*; and much more.

"It’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong"

- David Einhorn

“If you're going through hell, keep going”

- Winston Churchill

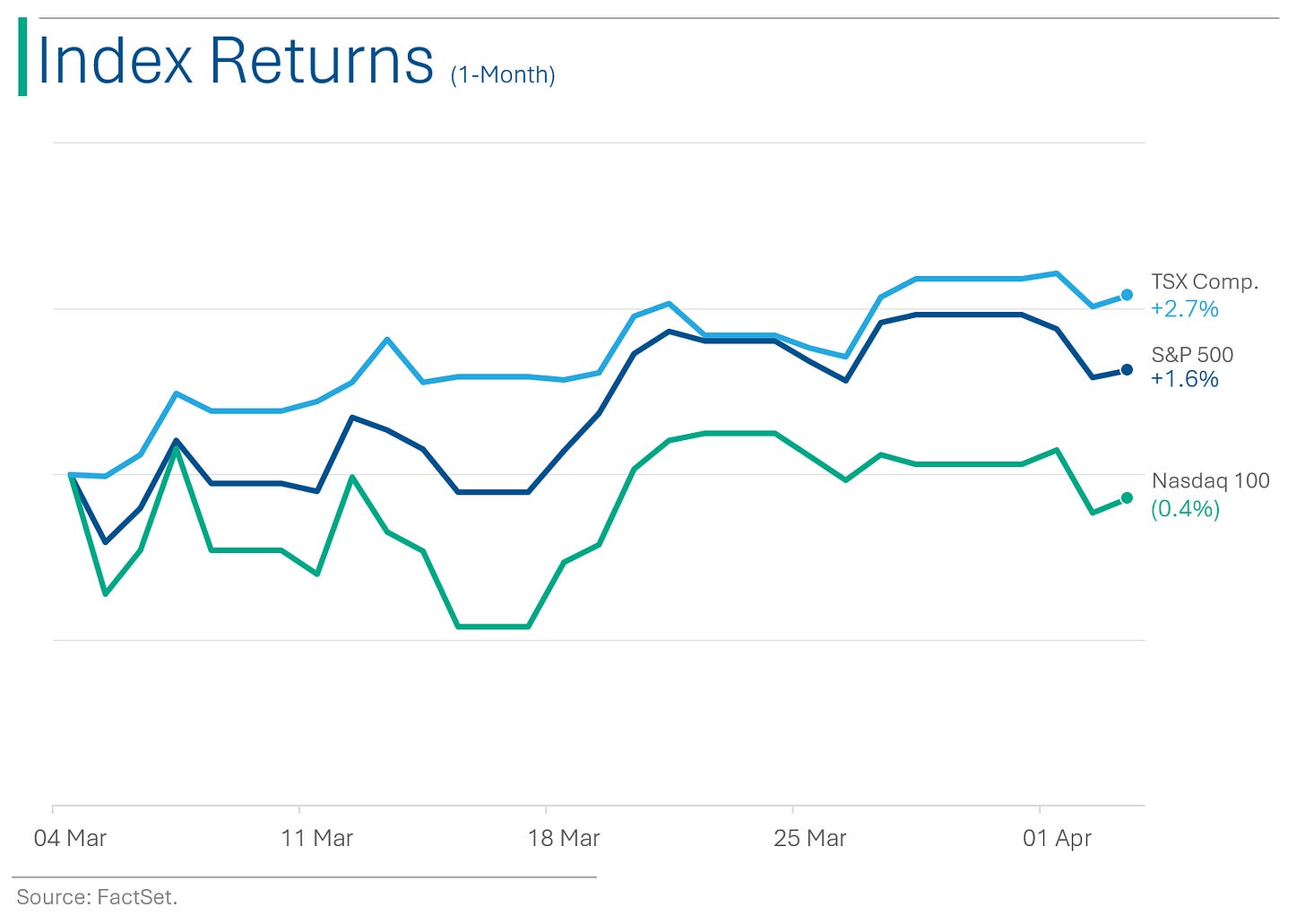

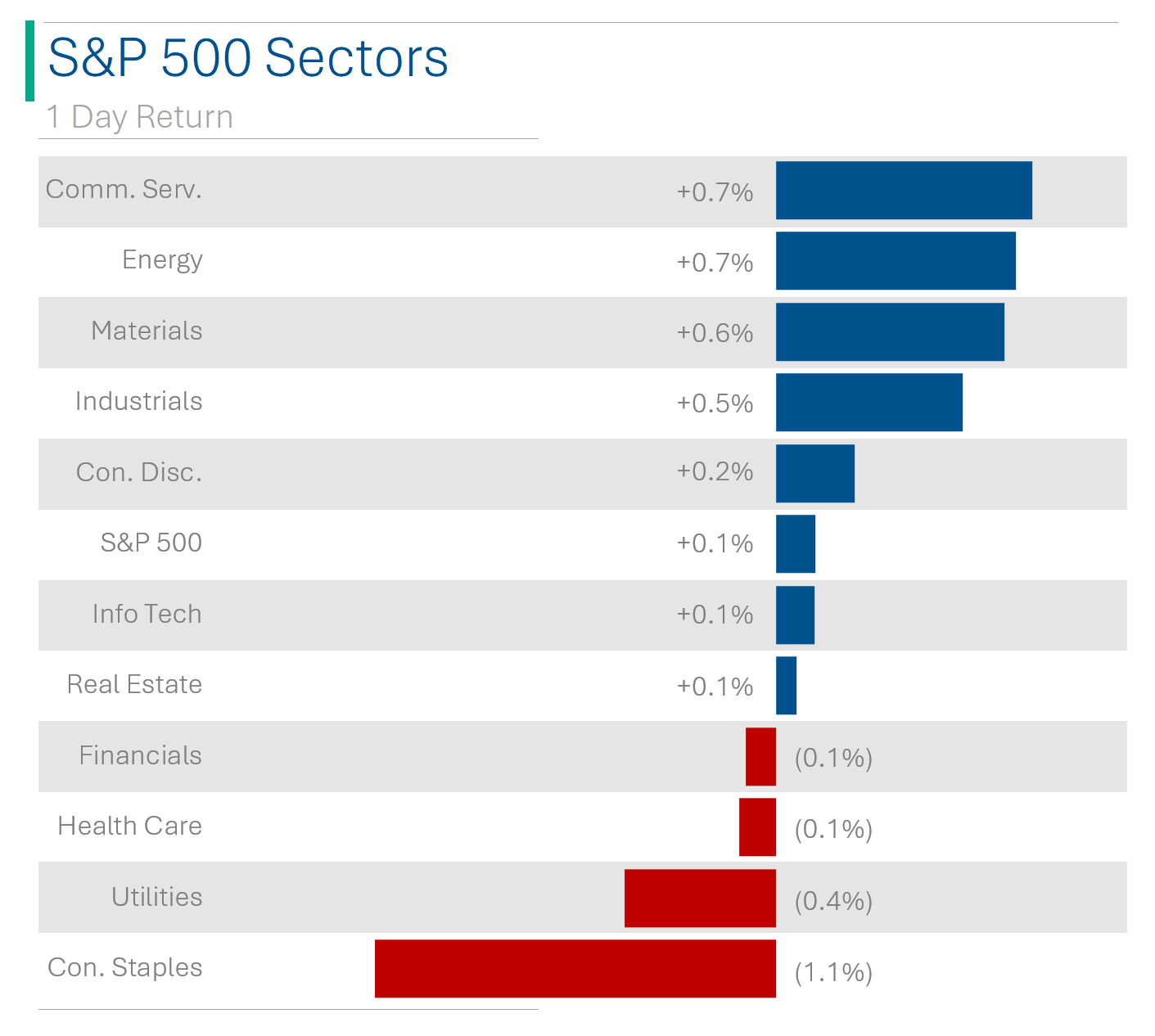

The big US markets snapped a two day losing streak the week with the S&P 500 +0.1% and Nasdaq +0.2%.

7 of 11 sectors closed higher, led by Communication Services and Energy (both +0.7%). Defensives were the worst, with Consumer Staples (-1.1%), Utilities (-0.4%) and Healthcare (-0.1%) at the bottom of the pile.

ISM Services for March came in below Wall Street estimates (51.4 vs. 52.7 consensus). The Prices Index dropped 5.2 points to 53.4 - its lowest since March 2020 (which was a bad month if you recall).

March ADP private payrolls came in at 184k, which was a nice beat over the Street’s 150k estimate. (Jobs = Good)

Street Stories

Remember When Covid Companies Were A Thing?

It seems like a separate reality now that for two years the world felt frozen in place. Some of us had it worse, losing loved ones and friends, but everyone’s world was turned on its head. Now I’m not going to get into the personal side of the pandemic (that necessitates having feelings), but rather I wanted to look into the companies whose names we seemed to hear every 5 minutes back then. And, really haven’t heard from since…

To start, I’m not going to dive into the 50 or so approved vaccines, but will only focus on the Pfizer-BioNTech and Moderna vaccines, as they had dominant market shares. If you’d like to learn more about Sputnik V or Ivermectin you’ve come to the wrong place.

To start, Moderna’s share price went parabolic after it started showing strong clinical trial data for its RNA vaccine. While still up nicely, around +430% since pre-pandemic, the stock topped out up nearly 25x from where it started. I covered Moderna in my past life as a mutual fund guy focused on healthcare (actually met Moderna 2x in their pre-IPO roadshows), which makes it extra shameful that I in no way profited from its pop.

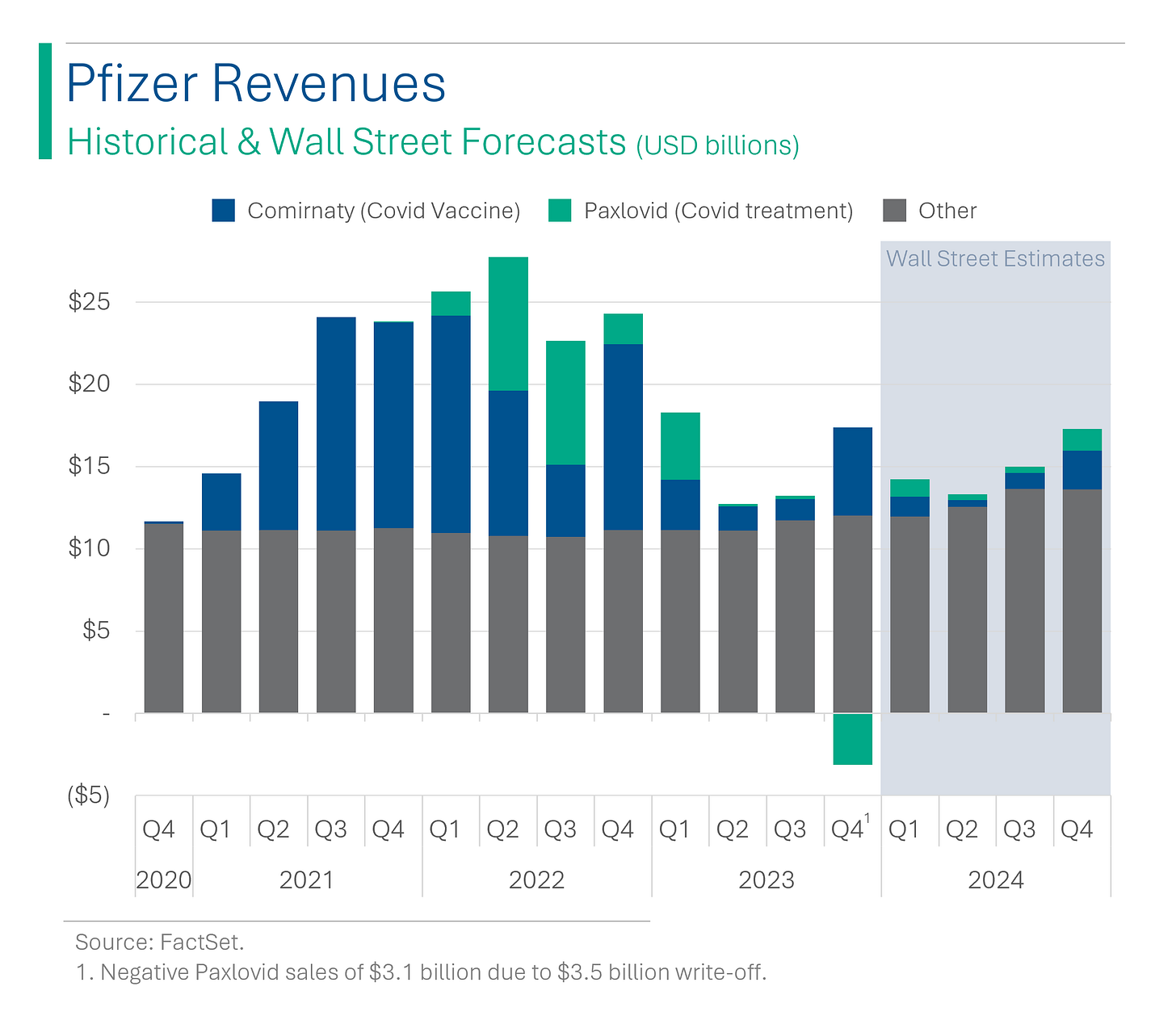

Pfizer, however, is just a sad story. Sure, the stock was up +51% at one point, but once the pandemic cooled off, so did the shares. Currently the shares are down 32% from whence they started. So what the hell happened?

On the revenue front, Pfizer had literally one of the most miraculous growth stories in corporate history, as they went from (essentially) zero Covid sales in 2020 to $37 billion in 2021 and $57 billion in 2022. For context, Nvidia added $50 billion in 2023 and the Street is forecasting ~$24 billion for this year. Surely Pfizer must have put some of this money to good use?

I mean, it’s not like Pfizer suddenly became a charity, either: earnings per share doubled during the pandemic. The company also spent around $70 billion on acquisitions, including $43 billion for Seagen and $12 billion for Biohaven.

So yeah, Pfizer booked $106 billion in high margin Covid revenue, spent $70 billion on acquisitions, and somehow finds itself three years later with lower earnings per share. Up north here, we call that a bag of hammers.

Anyway, I think this is a good place to stop. I’ll finish this up tomorrow with a look into Moderna and some other things, like valuation.

Disney CEO Wins Proxy Fight

Disney CEO Bob Iger successfully repelled an onslaught by activist investors led by Nelson Peltz, ensuring the board remained in friendly hands. Despite facing criticism over Disney's sagging share prices, unprofitable streaming ventures, and the perceived dilution of the Marvel and Star Wars franchises, Iger's leadership received backing from industry giants and major shareholders. Shares slumped 3.1% on the news (guess not everyone was on Team Iger).

Intel Finds Its Chips Down

Intel tanked 8.2% yesterday following the release of their historical financials under their new reporting structure (link). What’s with all the hype if they are just shuffling numbers around? Well, their newly separate ‘Foundry’ unit - aimed at competing with TSMC - reported a loss of $7 billion in 2023, up from $5 billion in 2022. Moreover, they don’t forecast making a profit until 2027. Basically the Street thought they were doing (wayyyyyyy) better than they actually are in this new division, which is the main growth story for the company.

The processor giant is banking on a major deal with Microsoft and the rollout of its advanced 18A manufacturing process but faces hurdles due to earlier decisions against adopting cutting-edge chipmaking technology, now rectified, yet still trailing behind the competition like TSMC.

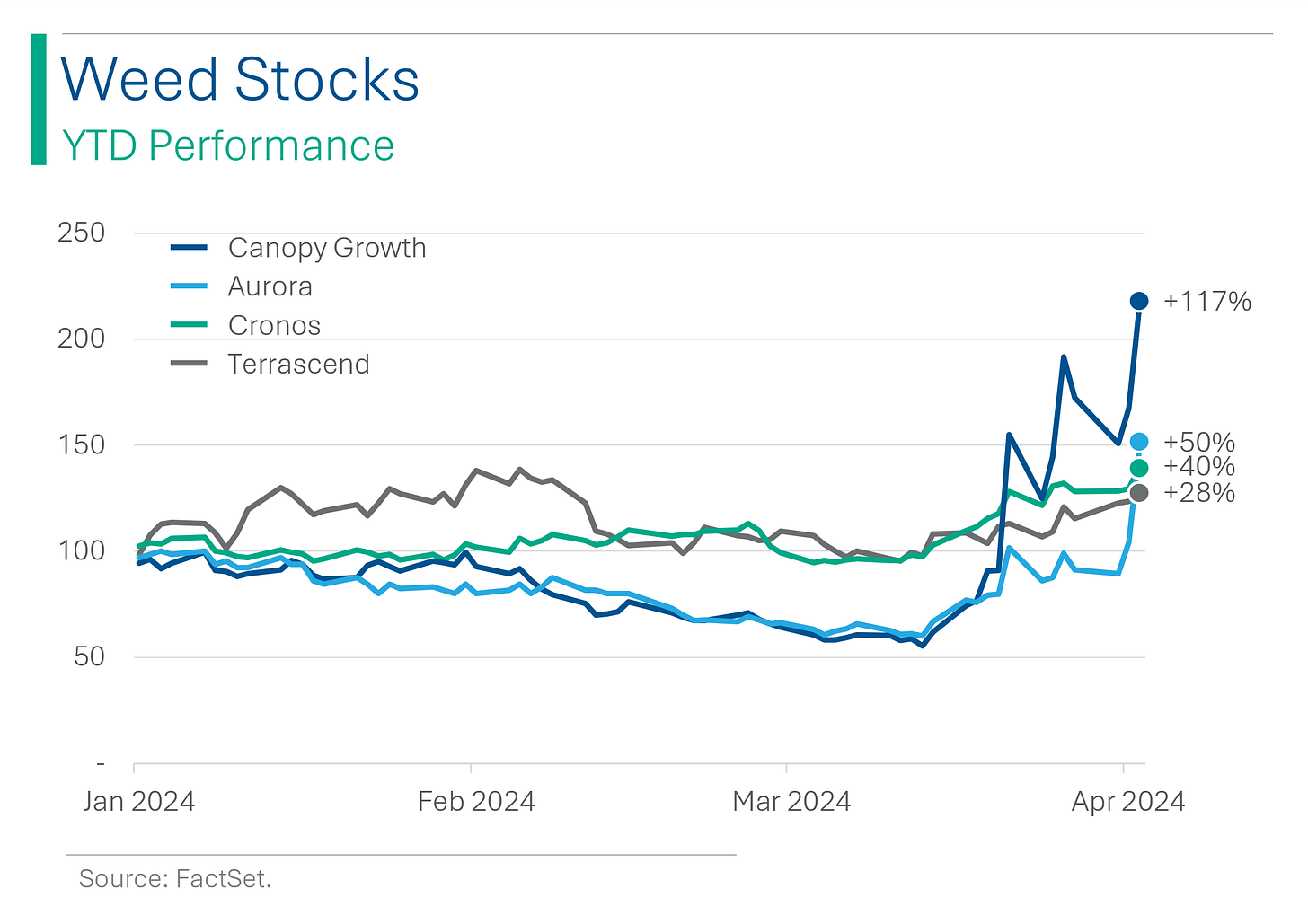

Weed Stocks Keep Getting Higher

Weed stocks keep pushing higher following Florida’s Supreme Court ruling Monday to allow a legalization initiative to appear on the State’s ballot in November. Essentially if approved by 60% of voters, ‘non-medical’ marijuana would be legal within the State. The news follows increased exuberance in the space following legalization efforts in Germany.

Joke Of The Day

To err is human. To blame it on someone else shows management potential.

Hot Headlines

Bloomberg / Spotify jacks up its prices for the second time this year as it focusing on profitability. Prices will go up by $1-$2 a month in the different regions effected by the gouge increase, as the company blames audiobooks. Shares popped 8.2% on the news.

OilPrice.com / Oil market set to tighten as OPEC+ sticks with production cuts. The move was generally expected, as the cartel plans to maintain restricted levels until the middle of 2024, with OPEC’s deciding panel not set to meet again until June 1st.

Engadget / The FCC will vote to restore net neutrality later this month. Democrats finally have a majority at the Federal Communications Commission to fulfill Biden’s executive order from 2021 after the Obama-era rules were repealed by President Trump back in 2017.

Axios / Taiwan earthquake misses the world's biggest chip hub. The epicenter of the 7.4-magnitude earthquake was on the eastern side of Taiwan, about 90 miles south of the capital Taipei, where Taiwan Semiconductor Manufacturing's main facilities are located nearby.

Page Six / Jeff Bezos drops $90 million on Billionaire Bunker estate - and his neighbor is Tom Brady. Must be f***** nice…

Trivia

In recognition of GE completing it’s split into three companies (GE HealthCare, GE Vernova, and GE Aerospace) here’s some trivia on the original company.

When was General Electric (GE) founded?

A) 1871

B) 1892

C) 1908

D) 1931Who was one of the founding figures of GE?

A) Andrew Carnegie

B) Thomas Edison

C) Alexander Graham Bell

D) Henry FordGE was one of the original 12 companies listed on which stock exchange?

A) NASDAQ

B) NYSE

C) Dow Jones Industrial Average

D) S&P 500GE played a crucial role in the development of the first U.S. Jet engine during which event?

A) World War I

B) World War II

C) Korean War

D) Vietnam War

(answers at bottom)

Market Movers

Winners!

Paramount Global (PARA) [+15.0%]: Media outlets report the company entered exclusive discussions with Skydance, sidelining a $26B offer from APO.

Dave & Buster's Entertainment (PLAY) [+10.3%]: Q4 EPS fell short, with revenues meeting expectations. Effective cost control boosted margins and EBITDA, maintaining confidence in reaching a $1B EBITDA goal. An additional $100M share repurchase was authorized, anticipating traffic improvements.

Signet Jewelers (SIG) [+9.9%]: Repurchased ~50% of convertible preferred shares, using ~$1.4B cash, expected to lower the diluted share count by ~7.6%. This led to an increased diluted EPS forecast for FY25.

Spotify Technology (SPOT) [+8.2%]: Bloomberg reported the company is hiking prices in key markets again, with potential U.S. price increases later. Higher prices aim to offset costs from new audiobook features.

Losers!

Ulta Beauty (ULTA) [-15.3%]: Reported at the JPMorgan Retail Conference a quicker than anticipated deceleration in overall category growth.

Intel (INTC) [-8.2%]: Revealed Intel Foundry's ~$7B operating loss in 2023, worse than 2022's $5.2B loss, with negative gross margins and doubts on meeting long-term targets, including concerns over AI engagement.

Walt Disney (DIS) [-3.1%]: Confirmed the reelection of its full director slate over Blackwells and Nelson Peltz's Trian nominees, aligning with previous reports.

Market Update

Trivia Answers

B) GE was founded in 1892.

B) Thomas Edison was a founder of GE.

C) GE was an original member of the Dow Jones Industrial Average.

B) GE was a leader in jet engine development during World War II.

Thank you for reading StreetSmarts. We’re just starting out so it would be great if you could share StreetSmarts with a friend that might be interested.

I think it is possible that the benefits of the $70B will take a little longer. I have supported biotech projects for almost two decades and it is probably one of the longest life cycles from innovation to profits. Even acquisitions can only cut that by so much. Covid was unusual and there will be consequences for a long time due to the haste.

Interesting chart on the 1 month Nasdaq 100 Ryan